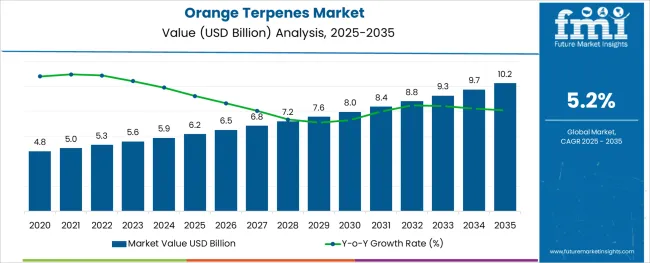

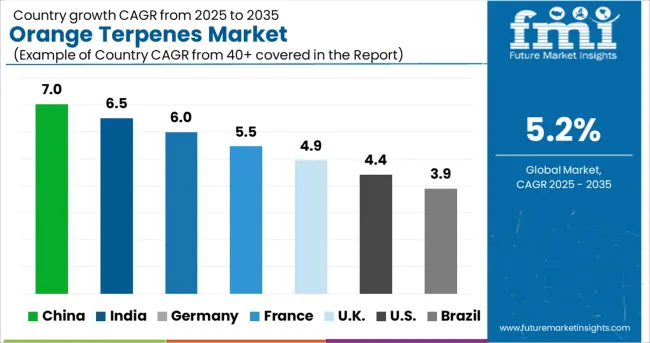

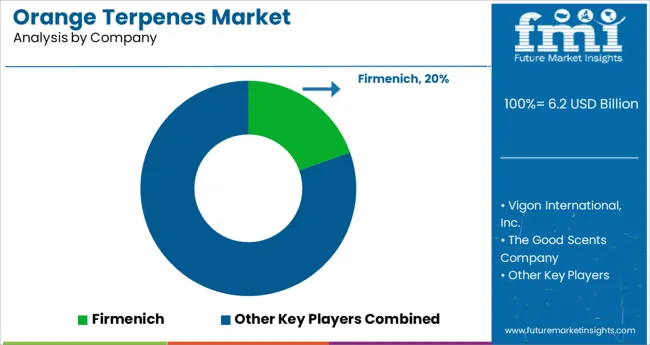

The Orange Terpenes Market is estimated to be valued at USD 6.2 billion in 2025 and is projected to reach USD 10.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

The orange terpenes market is experiencing significant growth, fueled by increasing demand for natural solvents and eco-friendly cleaning agents across various industries. The rising consumer preference for sustainable and biodegradable products has led to broader adoption of orange terpenes as an alternative to traditional petroleum-based solvents. Advancements in extraction and purification technologies have improved product quality and consistency, encouraging their use in applications ranging from cleaning to fragrances and agrochemicals.

Environmental regulations aimed at reducing volatile organic compounds have further accelerated market expansion. The growth is also supported by the versatility of orange terpenes in both industrial and consumer applications.

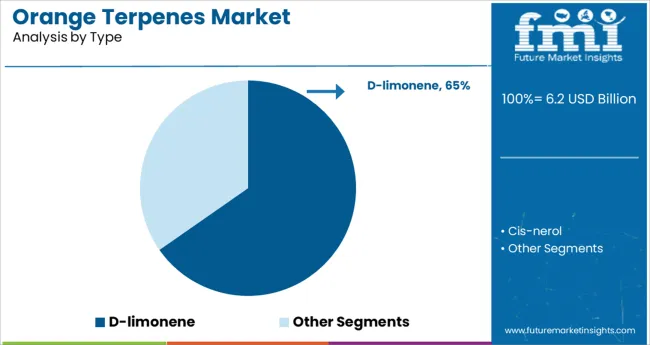

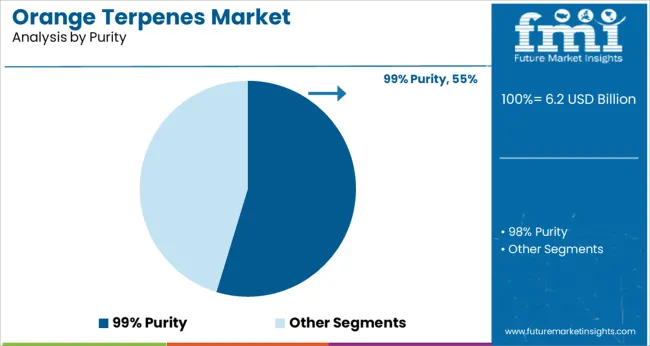

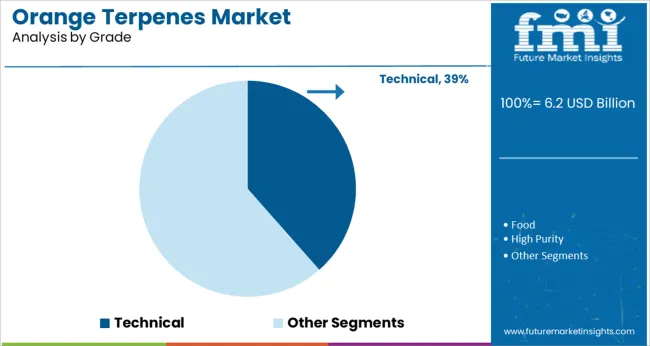

Looking ahead, the market is expected to benefit from ongoing innovations in terpene extraction and formulation as well as increased adoption in emerging markets. Segmental growth is projected to be driven by the D-limonene type, 99% purity products, and the technical grade category, reflecting demand for high-quality and industrial-use terpenes.

The market is segmented by Type, Purity, Grade, Application, and End Use and region. By Type, the market is divided into D-limonene and Cis-nerol. In terms of Purity, the market is classified into 99% Purity and 98% Purity. Based on Grade, the market is segmented into Technical, Food, High Purity, Ultra-High, Fragrance, and Other Grades.

By Application, the market is divided into Cleaning & Sterilization, Degreaser, Flavoring Agent, Fragrance, and Direct Solvent Replacement. By End Use, the market is segmented into Household/Institutional, Automotive, Cosmetics, Food & Beverages, Medical & Pharmaceutical, Textiles, Marine, and Oil & Gas. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The D-limonene segment is projected to hold 65.3% of the orange terpenes market revenue in 2025, leading the market by a significant margin. This dominance is due to D-limonene’s widespread application as a natural solvent with excellent degreasing properties and a pleasant citrus aroma. Its biodegradability and low toxicity have made it the preferred choice in industrial cleaning, adhesives, and coatings formulations.

Production efficiencies and improvements in extraction methods have also contributed to its availability and affordability.

The broad functional utility of D-limonene has ensured its steady demand across various sectors, sustaining its market leadership.

The 99% purity segment is expected to account for 54.7% of the market revenue in 2025, establishing itself as the most sought-after product specification. High purity is essential for applications requiring consistent performance and minimal impurities, such as in fragrances, food additives, and pharmaceutical formulations.

Refinement processes have advanced, enabling manufacturers to achieve and maintain this purity level reliably.

Customers prioritize 99% purity orange terpenes due to their effectiveness and regulatory compliance, which supports their use in sensitive applications. This segment’s growth is driven by the increasing demand for high-grade natural ingredients in quality-conscious markets.

The Technical grade segment is projected to represent 38.5% of the orange terpenes market revenue in 2025, positioning it as the leading grade category. This segment is characterized by orange terpenes designed for industrial applications such as solvents, cleaners, and degreasers where ultra-high purity is less critical.

Technical grade products offer a cost-effective solution for large-scale usage without compromising essential performance characteristics. The growth in this segment reflects expanding industrial usage and the substitution of hazardous chemicals with safer alternatives.

As industries continue to seek sustainable materials, the Technical grade orange terpenes segment is expected to maintain robust demand.

The increase in demand for the product from end user industries such as cosmetics and personal care, as well as their global expansion, are the major factors driving the orange Terpenes market.

Increased awareness about the environmental impact of non-biodegradable products, as well as the growing popularity of orange terpenes due to their sustainability, drive the orange Terpenes market forward.

The government's increased investment and funds, as well as technological advancements in the fragrance and flavor sectors, all have an impact on the orange Terpenes market.

Furthermore, the rise in demand for organic and natural cosmetics and personal care products, as well as restrictions on the use of synthetic materials in some regions, benefit the orange Terpenes market.

Furthermore, millennials' preference for organic products and the demand for clean labels create profitable opportunities for orange Terpenes market players during the forecast period.

The implementation of stringent regulatory norms and standards for personal care ingredients and personal care chemicals in both developed and developing countries is expected to stymie the orange Terpenes market.

In the forecast period, the market for orange Terpenes is expected to be challenged by the adoption of synthetic materials as alternatives.

It is important to note that the Asia Pacific (APAC) region will lead in terms of production over the forecast period. Large areas of arable land and increased production are factors supporting this lead. However, in terms of demand, Asia Pacific comes in second to North America.

Because Europe and North America consume large amounts of orange Terpenes, exports will be noted in Asia Pacific, creating opportunities for market growth.

Some of the key participants present in the global Orange Terpenes market include Firmenich, Florida Chemical Company, Citrosuco North America, Inc., Cutrale Citrus Juices USA, Inc., Florachem Corporation, Citrus and Allied Essences, Ltd., Ventos, Citrus Oleo, Givaudan Flavors Corporation, Flotek Industries, Inc., Southern Gardens Citrus, Takasago International Corp., De Monchy Aromatics, Tropicana Products, Inc. and Vigon International among others.

Attributed to the presence of such high number of participants, the market is highly competitive.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 8% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and CAGR from 2025-2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Application, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; Asia Pacific; Middle East & Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | Firmenich; Florida Chemical Company; Citrosuco North America, Inc.; Cutrale Citrus Juices USA, Inc.; Florachem Corporation; Citrus and Allied Essences, Ltd.; Ventos; Citrus Oleo; Givaudan Flavors Corporation; Flotek Industries, Inc.; Southern Gardens Citrus; Takasago International Corp.; De Monchy Aromatics; Tropicana Products, Inc.; Vigon International |

| Customization | Available Upon Request |

The global orange terpenes market is estimated to be valued at USD 6.2 billion in 2025.

It is projected to reach USD 10.2 billion by 2035.

The market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types are d-limonene and cis-nerol.

99% purity segment is expected to dominate with a 54.7% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Orange Compound Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Orange Juice Market Share

Market Share Insights for Orange Extract Suppliers

Acid Orange Market

Unconcentrated Orange Juice Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA