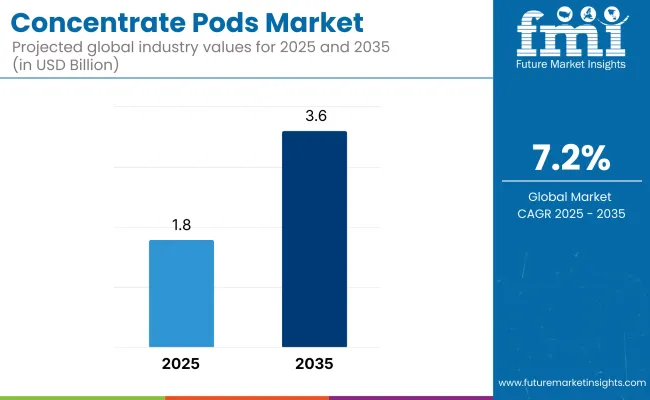

The concentrate pods market is forecast to expand from USD 1.8 billion in 2025 to USD 3.6 billion by 2035, resulting in a total gain of USD 1.8 billion over the decade. This reflects a 100.0% overall growth, with the market doubling in size and achieving a compound annual growth rate (CAGR) of 7.2% over the ten-year period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.8 billion |

| Industry Value (2035F) | USD 3.6 billion |

| CAGR (2025 to 2035) | 7.2% |

The market scales by a 2.0 multiple, indicating rising demand for concentrated, single-serve delivery formats. In the first five years (2025-2030), the market rises from USD 1.8 billion to USD 2.6 billion, contributing USD 0.8 billion, or 44.4% of the total decade’s growth. Growth in this phase is driven by surging adoption in household cleaning, personal care, and laundry care categories, where sustainability concerns and consumer convenience encourage the shift to waterless, lightweight formats. E-commerce and subscription-based sales channels boost early-phase market visibility and trial.

From 2030 to 2035, the market further accelerates from USD 2.6 billion to USD 3.6 billion, generating USD 1.0 billion, or 55.6% of the total growth. Demand in this phase is driven by food & beverage applications, pet care, and nutraceuticals, as brands invest in functional pod systems compatible with smart dispensers and IoT-connected devices. Compostable pod films, active ingredient encapsulation, and precision-dosing technology become key innovation areas, enhancing both value and sustainability.

From 2020 to 2024, the concentrate pods market grew from USD 1.2 billion to USD 1.6 billion, driven by hardware-centric adoption across home care, personal care, and institutional cleaning applications, where compact, pre-dosed formats enable sustainability and convenience. During this period, the competitive landscape was dominated by pod packaging specialists and fast-moving consumer goods (FMCG) firms, with companies such asS.C. Johnson & Son Inc., and Auhentic Daily Chemical Co., Ltd. controlling nearly 70% of total revenue.

Competitive differentiation relied on solubility precision, pod strength, and compatibility with dispensers, while digital enablement such as usage tracking or smart refill integration was bundled within broader appliance ecosystems rather than as direct revenue drivers. Service-based models had minimal traction, contributing less than 10% of total market value, with most consumer brands prioritizing high-volume single-purchase models.

Demand for concentrate pods will expand to USD 3.6 billion in 2035, and the revenue mix will shift as refill subscription models, sustainable packaging innovation, and IoT-linked dispensers grow to over 40% share. Traditional FMCG and contract packagers face rising competition from sustainability-first players offering biodegradable pod shells, waterless cleaning systems, and customized refill solutions.

The shift toward portion-controlled, mess-free, and portable product formats is driving the growth of the concentrate pods market. These pods are pre-measured units of concentrated liquids or gels commonly used in home care, personal care, food & beverage, and nutraceuticals designed to dissolve or dilute during use. Consumers increasingly prefer these formats for their convenience, sustainability benefits, and reduction in product overuse or waste.

Single-use and multi-use concentrate pods have gained popularity due to their compatibility with refillable dispensers, smart appliances, or direct-application packaging. Their compact size, lightweight profile, and reduced transportation footprint support circular economy goals and appeal to eco-conscious consumers. The rise in e-commerce and subscription-based delivery models has further propelled the demand for concentrated, ship-friendly product formats.

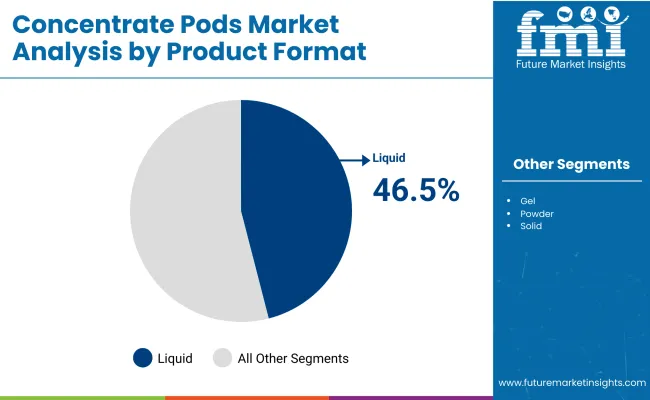

The market is segmented by product format, solubility type, pod material, activation method, application, end-use channel, and region. Product format includes liquid pods, gel pods, powder pods, and solid pods, offering diverse delivery systems tailored to product texture, shelf life, and activation requirements. Solubility type segmentation comprises water-soluble, oil-soluble, and dual-phase variants, supporting compatibility across a range of aqueous and lipid-based formulations. Pod material includes PVOH film, PLA film, starch-based film, and biodegradable barrier materials, emphasizing sustainability, biodegradability, and product integrity.

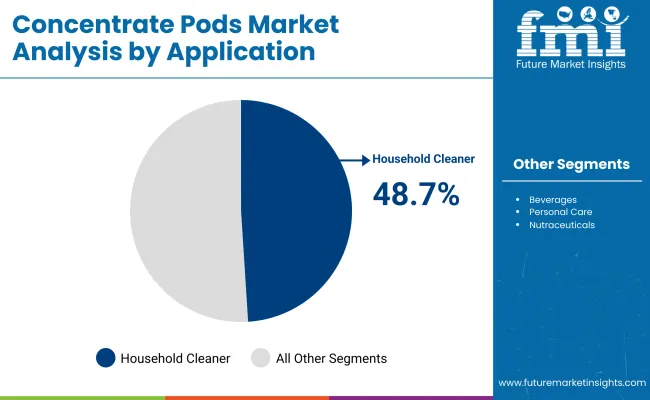

Activation method includes snap-to-use, twist-to-release, and dissolve-in-use, designed for user convenience, safety, and precision dispensing. Application areas span beverages, household cleaners, personal care, and nutraceuticals, reflecting rising demand for compact, single-dose, and mess-free solutions. End-use channels include retail, institutional, e-commerce, and foodservice, addressing varied distribution pathways for both consumer and commercial environments. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

The liquid pods segment is projected to secure the largest market share of 46.5% in the concentrate pods market by 2025. This leadership stems from their ability to offer precise dosing, spill prevention, and easy storage, which enhances both consumer convenience and product effectiveness. Their compatibility with a wide range of applications from laundry detergents to surface cleaners makes liquid pods a preferred choice for brands targeting consistent performance and reduced product wastage. The segment’s growth is further fueled by consumer preference for ready-to-use, pre-measured solutions that eliminate guesswork in mixing.

Manufacturers are investing in barrier-protected, multi-layer pod designs to extend shelf life and protect sensitive ingredients from moisture or contamination. Liquid pod formulations are also being upgraded with eco-friendly and biodegradable components to align with sustainability targets.

The household cleaners segment is expected to hold a commanding 48.7% share of the concentrate pods market in 2025, driven by the growing adoption of single-dose cleaning solutions that combine convenience with reduced environmental impact. These pods enable consumers to prepare cleaning solutions on demand, minimizing packaging waste and storage needs. Their ease of use has made them especially popular among busy households seeking effective cleaning with minimal preparation time.

Leading cleaning brands are expanding their pod-based offerings with targeted formulations for kitchens, bathrooms, and multi-surface use, supported by marketing campaigns focused on hygiene and sustainability. The shift toward refillable spray bottles paired with concentrate pods supports zero-waste initiatives, while child-resistant and water-soluble designs enhance user safety.

The water-soluble segment is forecast to lead the concentrate pods market with a 62.2% share in 2025, driven by rising consumer demand for effortless, mess-free solutions that eliminate the need for manual measuring or mixing. Water-soluble pods dissolve completely upon contact with water, ensuring precise dosing and uniform product consistency across applications such as household cleaning, laundry care, and personal hygiene. Their ability to simplify usage without compromising performance has made them a preferred choice for both domestic and commercial settings.

Manufacturers are leveraging advanced film technologies and barrier coatings to enhance pod stability, preventing premature dissolution during storage while maintaining rapid solubility at the point of use. The segment’s growth is further reinforced by its alignment with eco-friendly goals, as water-soluble films significantly reduce secondary packaging waste and are compatible with biodegradable materials.

The PVOH (polyvinyl alcohol) film segment is projected to dominate the pod material category with a 54.2% market share in 2025, driven by its rapid solubility, non-toxic profile, and compatibility with a variety of active ingredients. Its ability to completely dissolve in water without leaving residue has made it the preferred choice for manufacturers aiming to deliver a premium, mess-free consumer experience. PVOH films also act as a protective barrier, ensuring product stability during storage and transportation.

With regulatory bodies and consumers increasingly prioritizing biodegradable and compostable materials, PVOH film is gaining traction as a sustainable alternative to conventional plastics. Manufacturers are enhancing these films with moisture resistance and higher tensile strength to improve shelf life and packaging durability.

Dissolve-in-use pods are anticipated to capture 49.1% of the market share in 2025, supported by growing consumer demand for instant, pre-measured solutions that minimize preparation time. These pods dissolve entirely in the end-use container, such as a spray bottle or mixing jug, ensuring there is no product waste or leftover residue. Their convenience appeals strongly to on-the-go consumers and commercial users seeking efficiency without compromising on performance.

Producers are increasingly offering dissolve-in-use pods in both liquid and powder formats, allowing cross-segment adoption in household care, institutional cleaning, and even specialty food preparation. The format aligns well with refillable packaging systems, promoting sustainability by reducing the need for single-use bottles and extra packaging layers.

The retail channel is expected to account for 42.1% of the Concentrate Pods Market in 2025, reflecting its role in driving mass-market adoption through supermarkets, hypermarkets, and specialty stores. Retail availability allows consumers to easily compare brands, formats, and prices, facilitating faster uptake of pod-based products. Promotions, product demos, and in-store education are also helping to familiarize shoppers with the convenience and sustainability benefits of concentrate pods.

Major retailers are partnering with leading manufacturers to expand private-label offerings, while also introducing eco-displays highlighting refillable and dissolvable pod systems. The retail channel benefits from impulse purchases, seasonal product rotations, and premium shelf placements that boost visibility.

Single-use plastic concerns and compatibility limitations challenge scalability, even as demand grows across beverages, cleaning products, and personal care for pre-measured, mess-free, and compact concentrate pods that support convenience, portion control, and sustainability.

Convenience-driven Adoption in Homecare, Beverage, and Personal Care Segments

Concentrate pods are witnessing strong uptake in categories such as liquid detergents, concentrated juices, health supplements, and personal care due to their compactness, pre-measured dosing, and ease of use. These pods enable consumers to dilute a concentrated formula on demand, eliminating guesswork, overuse, or waste. Their small size supports lightweight logistics, e-commerce delivery, and on-the-go use.

In homecare and cleaning products, concentrate pods reduce plastic usage by encouraging reusable bottles. In beverages and nutraceuticals, pods appeal to health-conscious consumers seeking portability and freshness.

Material Waste, Compatibility Barriers, and Regulatory Concerns

Despite their utility, concentrate pods face several barriers to mass-market penetration. Most pods use water-soluble films like PVA or encapsulating polymers, which may not be universally biodegradable or safe across all chemical formulations. These films can present disposal and microplastic issues in wastewater treatment when not properly managed. Compatibility challenges also exist certain formulas degrade the film or require specific environmental conditions for stable encapsulation. In some markets, regulatory scrutiny around child safety and accidental ingestion (especially for cleaning pods) is tightening.

Growth of Refill Ecosystems and Biodegradable Pod Technologies

A leading trend in the concentrate pods market is the evolution of closed-loop refill systems and environmentally responsible pod designs. Brands are developing pod-compatible reusable bottles, dispensing devices, and starter kits that reduce packaging waste and boost customer loyalty through subscription models.

At the same time, innovations in water-soluble films using plant-based polymers or marine-safe biodegradables are helping overcome concerns around plastic pollution. Formulators are also experimenting with dual-chamber or multi-phase pods for advanced use cases like skincare layering or vitamin boosts in beverages.

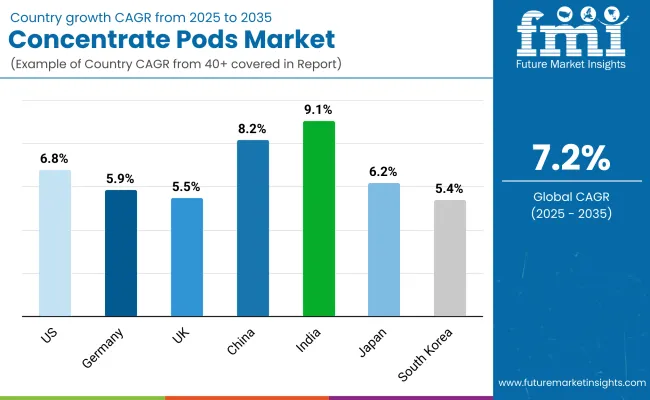

The global concentrate pods market is witnessing robust expansion, driven by rising demand for single-dose convenience, hygienic dispensing, and precise formulation across household care, personal care, nutraceuticals, and food sectors. Asia-Pacific leads growth momentum, with India and China accelerating due to growing middle-class awareness and e-commerce penetration.

In developed countries like the USA and Germany eco-conscious consumption and space-efficient product packaging are central to market traction. Concentrate pods are gaining relevance across FMCG and pharma applications due to measured usage, tamper resistance, and compact logistics.

The USA market for concentrate pods is projected to grow at a CAGR of 6.8%, supported by consumer preference for pre-measured units in laundry, dishwasher detergents, and functional beverages. FMCG brands are emphasizing pod-based solutions that ensure reduced spillage, controlled dosing, and eco-conscious packaging. With smart dispensers gaining traction in connected homes, pod-format products are becoming part of subscription-based refill ecosystems.

Germany’s concentrate pods market is growing at a CAGR of 5.9%, propelled by demand in green cleaning, homecare, and nutrition sectors. Regulatory focus on packaging waste and recyclability is leading brands to adopt pod formats made from water-soluble films and biodegradable capsules. German consumers favor refillable and precision-based usage, especially for laundry, oral hygiene, and health supplements.

The UK concentrate pods market is projected to grow at a CAGR of 5.5%, led by growing adoption across oral care, OTC drugs, and sustainable cleaning. Cost-of-living pressures have prompted demand for accurate dosing and extended product shelf life. Subscription models are being built around pods for toothpaste, hand soap, and nutraceuticals, driving repeat usage.

China’s concentrate pods market is forecast to expand at a CAGR of 8.2%, driven by growing e-commerce formats, rapid urbanization, and premiumization in household care. Single-dose pods for cleaning and skincare are widely adopted by Gen Z and millennial consumers, who prioritize convenience, hygiene, and minimalist design. Domestic brands are also innovating with herbal formulations in pod formats.

India is witnessing the fastest growth in the concentrate pods market with a projected CAGR of 9.1%. MSMEs and urban households are adopting pods for precise usage in cleaning, beauty, and nutraceutical applications. Tier-2 and Tier-3 cities are seeing demand for compact, travel-friendly, and water-activated products. Eco-conscious start-ups are using pods to promote zero-waste packaging.

Japan’s concentrate pods market is projected to grow at a CAGR of 6.2%, led by innovation in compact homecare, elder-friendly personal care, and precision medication formats. Japanese consumers value form factor efficiency and aesthetic integration with minimalist homes. Pharmaceutical and OTC categories are also exploring pods for accurate dosage, particularly in geriatric populations.

South Korea’s market is forecast to grow at a CAGR of 5.4%, supported by beauty, wellness, and premium FMCG segments. Pods are increasingly used in K-beauty rituals, including cleansing oils, serums, and hair masks. Precision formulation and airtight pod storage help preserve active ingredients. The tech-savvy Korean market is also aligning pods with app-controlled home dispensers.

The concentrate pods market is moderately fragmented, with contract manufacturers, sustainability-driven innovators, and multinational CPG players competing across household cleaning, personal care, and foodservice concentrate categories. Global leaders such as S.C. Johnson & Son Inc. and Pod Pack International, LLC hold significant market share, driven by proprietary pod-based formulations, compatibility with refillable systems, and strategic alignment with waste-reduction goals. Their strategies increasingly emphasize dissolvable film technologies, single-dose accuracy, and retail-ready solutions for cleaning, beverage, and flavoring applications.

Established mid-sized players, including Unimasses Group, Auhentic Daily Chemical Co., Ltd., and UnikPods, are accelerating adoption through private-label offerings, dual-compartment innovations, and customizable shapes designed for e-commerce and subscription-based delivery formats. These firms are particularly relevant for DTC (direct-to-consumer) brands in laundry care, multi-surface sprays, and waterless concentrates.

Key Development of Concentrate Pods Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| By Product Format | Liquid Pods, Gel Pods, Powder Pods, and Solid Pods |

| By Solubility Type | Water-soluble, Oil-soluble, and Dual-phase |

| By Pod Material | PVOH Film, PLA Film, Starch-based Film, and Biodegradable Barrier |

| By Activation Method | Snap-to-Use, Twist-to-Release, and Dissolve-in-Use |

| By Application | Beverages, Household Cleaners, Personal Care, and Nutraceuticals |

| By End-Use Channel | Retail, Institutional, E-commerce, and Foodservice |

| Key Companies Profiled | Auhentic Daily Chemical Co., Ltd., S.C. Johnson & Son Inc., UnikPods, EcoZone, Green Sustainable Packaging, Inc., and GoodFibers |

| Additional Attributes | Expanding adoption of single-dose pod formats in beverage and personal care segments, water-soluble PVOH films gaining prominence for eco-friendly disposal, innovation in dual-phase pods for multi-component delivery, increasing use in concentrated household cleaner refills, biodegradable pod materials aligning with circular economy initiatives, growth in e-commerce sales for DIY pod refills, rising institutional demand for bulk pack pods in foodservice and healthcare, child-resistant and tamper-evident pod formats improving safety, integration of oil-soluble pods in nutraceutical and wellness products, and strong market growth across North America, Europe, and Asia-Pacific |

The global concentrate pods market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the concentrate pods market is projected to reach USD 3.6 billion by 2035.

The concentrate pods market is expected to grow at a CAGR of 7.2% between 2025 and 2035.

The key product types in the concentrate pods market include liquid pods, powder pods, and gel-based pods.

In terms of product type, the liquid pods segment is expected to account for the highest share of 46.5% in the concentrate pods market in 2025

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Concentrate Containers Market Size and Share Forecast Outlook 2025 to 2035

Concentrated Solar Power Market Size and Share Forecast Outlook 2025 to 2035

Concentrated Milk Fat Market – Growth, Demand & Forecast 2025 to 2035

Concentrated Whey Market

Unconcentrated Orange Juice Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Beef Concentrate Market Size, Growth, and Forecast for 2025 to 2035

Wort Concentrate Market Analysis by Nature, Type, Ingredient, End Use and Region through 2025 to 2035

Cake Concentrate Market

Dairy Concentrate Market Forecast and Outlook 2025 to 2035

Juice Concentrate Market Analysis - Trends & Consumer Insights 2025 to 2035

Fruit Concentrate Puree Market Growth - Trends & Forecast 2025 to 2035

Color Concentrates Market

Cheese Concentrates Market Size and Share Forecast Outlook 2025 to 2035

Coffee Concentrate Market - Size, Share, and Forecast Outlook 2025 to 2035

Butter Concentrate Market

Omega-3 Concentrates Market Size and Share Forecast Outlook 2025 to 2035

Ketchup Concentrates Market Analysis by Nature, Product Type, Distribution Channel and Region through 2035

Poultry Concentrate Market

Cannabis Concentrate Market Analysis - Size, Share, and Forecast 2025 to 2035

Analyzing Not From Concentrated (NFC) Puree Market Share & Industry Leaders

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA