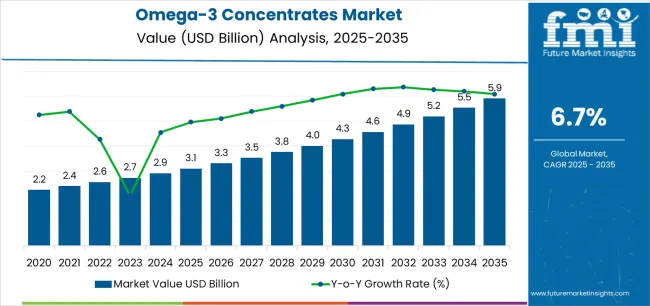

The Omega-3 Concentrates Market is estimated to be valued at USD 3.1 billion in 2025 and is projected to reach USD 5.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period.

The Omega-3 Concentrates market is experiencing robust growth driven by increasing consumer awareness regarding the health benefits of omega-3 fatty acids, particularly in cardiovascular, cognitive, and inflammatory health management. The future outlook for this market is influenced by rising demand from both developed and emerging economies due to lifestyle-related health concerns and growing preventive healthcare adoption. Continuous advancements in extraction and concentration technologies are enhancing the bioavailability and purity of omega-3 products, further supporting market expansion.

Increasing investment in nutraceuticals, functional foods, and dietary supplements is fueling demand across multiple regions. Additionally, the shift towards personalized nutrition and health-oriented consumption patterns is creating new opportunities for product differentiation and premium formulations.

Regulatory support and approvals for omega-3 usage in food, beverages, and supplements are further facilitating market adoption As consumer preference for sustainable and high-quality ingredients rises, the Omega-3 Concentrates market is expected to witness steady growth, with sustained opportunities across multiple end-use applications and product formats.

| Metric | Value |

|---|---|

| Omega-3 Concentrates Market Estimated Value in (2025 E) | USD 3.1 billion |

| Omega-3 Concentrates Market Forecast Value in (2035 F) | USD 5.9 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

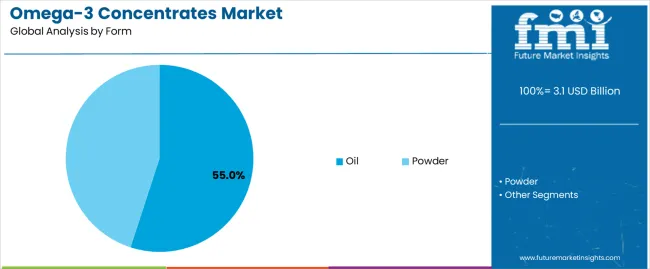

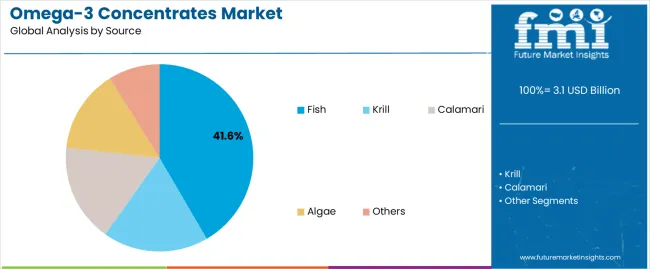

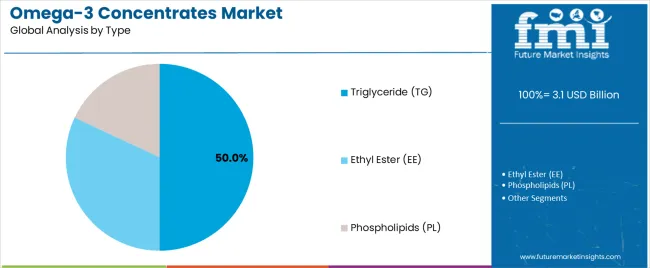

The market is segmented by Form, Source, Type, Concentration, End Use, and Packaging and region. By Form, the market is divided into Oil and Powder. In terms of Source, the market is classified into Fish, Krill, Calamari, Algae, and Others. Based on Type, the market is segmented into Triglyceride (TG), Ethyl Ester (EE), and Phospholipids (PL). By Concentration, the market is divided into High EPA, High DHA, and Balanced EPA: DHA. By End Use, the market is segmented into Food And Beverages, Dietary Supplements, Pharmaceuticals, Nutraceuticals, Infant Formula, Personal Care And Cosmetics, and Pet Food. By Packaging, the market is segmented into Drums and Totes. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The oil form is projected to hold 55.0% of the Omega-3 Concentrates market revenue share in 2025, establishing it as the leading form segment. This dominance is attributed to the ease of consumption, high bioavailability, and flexibility in incorporation into functional foods, beverages, and supplements. Oils allow precise dosing and are highly preferred by consumers seeking direct nutritional supplementation.

The segment has benefited from technological advancements in encapsulation and flavor masking, which enhance palatability and shelf stability. The widespread acceptance of omega-3 oils in nutraceutical and pharmaceutical formulations has further reinforced its market position.

Additionally, the increasing focus on preventive healthcare and wellness trends is driving the demand for convenient and effective oil-based omega-3 supplements The robust presence of oil forms in both consumer retail and professional health channels continues to sustain its leading revenue share.

The fish source segment is expected to capture 41.6% of the Omega-3 Concentrates market revenue share in 2025, positioning it as the leading source segment. Growth in this segment is driven by the high concentration of EPA and DHA in fish oils, which are recognized for their superior health benefits.

The availability of high-quality fish oil concentrates, along with advancements in purification and deodorization processes, has enhanced product appeal. Increasing consumer preference for natural and marine-derived ingredients over synthetic alternatives has further reinforced the segment’s market position.

The segment has also benefited from improved supply chain management and sustainable sourcing practices, which ensure product quality and traceability These factors collectively support the adoption of fish-based omega-3 concentrates across dietary supplement and functional food applications, sustaining its revenue dominance.

The triglyceride (TG) type segment is anticipated to account for 50.0% of the Omega-3 Concentrates market revenue in 2025, making it the leading type segment. This segment’s growth is attributed to higher bioavailability and superior absorption rates compared to ethyl ester and other forms.

TG-based omega-3 concentrates are increasingly preferred in nutraceutical formulations due to their compatibility with existing dietary fats and enhanced stability. The segment has benefited from technological improvements in concentration and refinement, which maintain the structural integrity of fatty acids and improve consumer efficacy.

Rising awareness about the health advantages of triglyceride-form omega-3s, including cardiovascular and cognitive benefits, has further driven adoption Additionally, the segment’s acceptance in both functional food and supplement markets ensures sustained growth and continued dominance in revenue share.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2025) and current year (2025) for global omega-3 concentrate market.

This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision about the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 5.4% (2025 to 2035) |

| H2 | 5.7% (2025 to 2035) |

| H1 | 6.3% (2025 to 2035) |

| H2 | 6.8% (2025 to 2035) |

The above table presents the expected CAGR for the global omega-3 concentrate demand space over semi-annual period spanning from 2025 to 2035. In the first half (H1) of the year 2025, the business is predicted to surge at a CAGR of 5.4%, followed by a slightly higher growth rate of 5.7% in the second half (H2) of the same year.

Moving into year 2025, the CAGR is projected to increase slightly to 6.3% in the first half and remain relatively moderate at 6.8% in the second half. In the first half (H1 2025) the market witnessed a decrease of 19 BPS while in the second half (H2 2025), the market witnessed an increase of 32 BPS.

Omega-3 Fortification in Infant Formula is Gaining Momentum

Growing awareness of DHA's vital role in infant brain and visual development is considerably driving the inclusion of omega-3 concentrates in infant formula. DHA, a key omega-3 fatty acid, is essential for proper neurological and visual functioning in infants. Parents and healthcare specialist are progressively recognizing its importance, which is leading to a higher demand for fortified infant formulas.

Due to which, manufacturers are producing products with enhanced omega-3 concentrates to meet this growing demand, and ensuring infants receive optimal nutrition for healthy development during the crucial early stages of life.

Expanding Use of Omega-3 Concentrates in Personal Care and Cosmetics

The use of omega-3 concentrates in personal care and cosmetic products is expanding due to their proven skin health and anti-inflammatory properties. Omega-3 fatty acids help maintain skin hydration, improve elasticity, and reduce signs of aging by tackling inflammation and promoting cell membrane health.

As consumers become more health-conscious and are seeking natural ingredients, the demand for skincare and cosmetic products enriched with omega-3s is growing. This encourages manufacturers to innovate and include these beneficial concentrates in a wider range of beauty and personal care products.

Rise of Algae-Based Omega-3s: Meeting Sustainability Demands

There is a distinct shift towards sustainably sourced omega-3 fatty acids, particularly from algae-based products, driven by increasing environmental awareness among consumers. Algae-based omega-3 sources are considered as more eco-friendly compared to traditional fish-derived sources, which helps reduce concerns over marine ecosystem depletion.

This drift reflects a broader consumer preference for products that minimize environmental impact and promote sustainable practices. As awareness grows about the benefits of algae-based omega-3s, such as reduced environmental footprint and potential purity advantages, more consumers are opting for these sustainable alternatives for their dietary supplements and functional foods.

Global Omega-3 Concentrates sales increased at a CAGR of 5.9% from 2020 to 2025. For the next ten years (2025 to 2035), projections are that expenditure on Omega- 3 Concentrates will rise at 7.0% CAGR

The rising popularity of dietary supplements as a means to enhance overall health and wellness has been a major stimulant for the growth of the omega-3 concentrate market.

Consumers are increasingly switching to supplements to complement their diets and address specific health concerns, including cardiovascular health, cognitive function, and inflammation reduction, domains where omega-3 fatty acids are well known to provide major benefits.

This shift is driven by growing health consciousness and the desire for preventive healthcare measures, pushing manufacturers to innovate and expand their offerings of omega-3 concentrates in various forms to meet the increasing demand in the supplement market.

Increasing awareness of pet health and nutrition is prompting the inlusion of omega-3 concentrates into pet food formulations. Omega-3 fatty acids, such as DHA and EPA, offer benefits for pets similar to those for humans, including support for joint health, coat condition, and overall immune system function.

As pet owners are searching to provide optimal nutrition for their animals, omega-3 enrichment in pet foods is becoming a essential attribute in meeting these health-conscious demands.

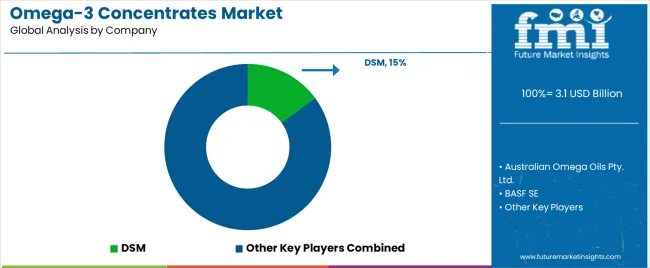

Tier 1 companies comprise industry leaders with market revenue of above USD 50 million capturing significant sales domain share of 45% to 55% in the global sphere. These business leaders are characterized by high production capacity and a wide product portfolio.

These trade leaders are distinguished by their extensive expertise in manufacturing and reconditioning across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base. Prominent companies within tier 1 include BASF SE, Nordic Naturals, DSM, ADM, and Corbion

Tier 2 companies include mid-size players with revenue of USD 10 to 50 million having presence in specific regions and highly influencing the local retail space. These are characterized by a strong presence overseas and strong consumer base knowledge.

These industry players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include Epax, GC Rieber (VivoMega), AlaskOmega, Norwegian Fish Oil, Golden Omega, KD Pharma Group, Orkla Health, and Olvea Omega Solutions

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche demand space having revenue below USD 10 million. These companies are notably oriented towards fulfilling local marketplace demands and are consequently classified within the tier 3 share segment.

They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized field, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The table below highlights revenue from product sales in key countries. The China and Japan are predicted to remain top consumers, with estimated trade valuations of USD 5.9 million and USD 598.9 million, respectively, by 2035.

| Countries | Market Value (2035) |

|---|---|

| China | USD 5.9 million |

| Japan | USD 598.9 million |

| India | USD 519.4 million |

| USA | USD 164.3 million |

| Australia | USD 127.2 million |

The following table shows the estimated growth rates of the top five sales domain. India and China are set to exhibit high Omega- 3 Concentrates consumption, recording CAGRs of 5.9% and 5.5%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| China | 5.5% |

| Japan | 5.3% |

| India | 5.9% |

| USA | 4.9% |

| Australia | 4.6% |

The demand space for Omega- 3 Concentrates in the Japan is projected to exhibit a CAGR of 5.3% during the assessment period. By 2035, revenue from the sales of Omega- 3 Concentrates in the country is expected to reach USD 598.9 Million.

Japan's aging population is one of the world's most prominent, has increased the requirement for health supplements aimed at reducing age-related issues. Omega-3 fatty acids, popular for their anti-inflammatory properties and contributions to heart and brain health, are especially appealing to older adults pursuing to maintain cognitive sharpness and cardiovascular well-being.

This demographics’ amplified health consciousness and proactive approach to aging, linked with widespread scientific endorsement of omega-3 benefits, drive strong market interest in Japan. As a result, products enriched with omega-3 concentrates are consequently featured in the country's healthcare and wellness strategies aimed at supporting longevity and quality of life.

Omega- 3 Concentrates demand in India is calculated to rise at a value CAGR of 5.9% during the forecast period (2025 to 2035). By 2035, India is expected to account for 32.6% of Omega- 3 Concentrates sales in East Asia.

Most of the Indians experience dietary deficiencies in essential nutrients like omega-3 fatty acids, determined by traditional diets that often lack adequate fish consumption. This deficiency has boosted interest in omega-3 supplements as a convenient solution to bridge nutritional gaps and support overall health.

Simultaneously, the rising frequency of lifestyle-related diseases such as cardiovascular conditions, diabetes, and cognitive decline has pointed out the importance of preventive healthcare strategies.

Omega-3 supplements are incrementally getting recognized as a proactive measure to reduce these health risks, promoting their adoption among individuals looking to maintain or improve their long-term health issues in India's evolving healthcare environment.

Consumption of Omega- 3 Concentrates in USA is projected to increase at a value CAGR of 4.9% over the next ten years. By 2035, the business size is forecasted to reach USD 164.3 Million, with China expected to account for a domain share of 78.3% in East Asia.

Omega-3s has gained popularity among athletes and fitness enthusiasts in the USA because of their perceived benefits for joint health, reducing inflammation, and enhancing overall physical performance. These fatty acids are considered to support recovery and reduce exercise-induced muscle soreness, which makes them a preferred supplement in the fitness community.

While, ongoing product innovation has further boosted their appeal. Advances such as higher concentrations and improved food attributes in omega-3 supplements cater to consumer preferences for effectiveness and palatability, further driving greater acceptance and integration of these products into daily health routines among active individuals in the country.

| Segment | Fish (Source) |

|---|---|

| Value Share (2025) | 41.6% |

Sales of fish sourced Omega- 3 Concentrates are projected to register a CAGR of 5.7% from 2025 to 2035. Fish-sourced omega-3s, especially in the form of triglycerides, are often more bioavailable and easily absorbed by the body compared to plant-based or other sources, which ensures more efficient utilization of these essential fatty acids.

Extensive research and clinical studies have shown the health benefits of fish-derived omega-3 fatty acids, specifically EPA (eicosapentaenoic acid) and DHA (docosahexaenoic acid).

These benefits include improved heart health, cognitive function, and anti-inflammatory properties, making them highly sought after. Furthermore, fish oil concentrates typically contain higher levels of EPA and DHA compared to plant-based omega-3 sources. This higher concentration means that consumers can achieve therapeutic benefits with smaller doses, enhancing the appeal and effectiveness of fish-sourced omega-3 supplements.

| Segment | Food & Beverages (End Use) |

|---|---|

| Value Share (2025) | 38.2% |

The Food & Beverages segment is anticipated to advance at 6.2% CAGR during the projection period.

Food and beverage companies are determined to differentiate their products in a competitive marketplace by adding omega-3 concentrates. This addition allows them to trade their offerings as health-enhancing, appealing to the growing segment of health-conscious consumers pursuing functional benefits from their food and beverages.

Moreover, many consumers suffer from nutritional deficiencies, particularly in omega-3 fatty acids, due to insufficient dietary intake of fish and other sources. Fortifying foods and beverages with omega-3s provides a convenient solution for increasing omega-3 intake without requiring crucial change in eating habits.

This fortification benefits consumers to meet their nutritional needs easily, supporting overall health and wellness, and further driving the demand for omega-3-enriched products in the market.

The Omega- 3 Concentrates market encompasses a diverse and dynamic competitive landscape. Leading Omega- 3 Concentrates manufacturing companies are focusing on research and development, sustainable sourcing, and new formulations. They are also emphasizing environment-friendly practices and product certifications to satisfy the increasing demand for natural and sustainable ingredients.

For instance

As per form, the market has been categorized into powder and oil

This segment is further categorized into krill, fish, calamari, algae, and others

As per type, the market has been categorized into triglyceride (TG), ethyl ester (EE), and phospholipids (PL)

This segment is further categorized into High DHA, High EPA, and Balanced EPA: DHA

As per end use, the market has been categorized into food and beverages, dietary supplements, pharmaceuticals, nutraceuticals, infant formula, personal care and cosmetics, and pet food

This segment is further categorized into drums and totes

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The global omega-3 concentrates market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the omega-3 concentrates market is projected to reach USD 5.9 billion by 2035.

The omega-3 concentrates market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in omega-3 concentrates market are oil and powder.

In terms of source, fish segment to command 41.6% share in the omega-3 concentrates market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Omega-3 Concentrates Market Report – Trends, Demand & Outlook 2025-2035

Europe Omega-3 Concentrates Market Insights – Growth, Demand & Forecast 2025-2035

Color Concentrates Market

Cheese Concentrates Market Size and Share Forecast Outlook 2025 to 2035

Ketchup Concentrates Market Analysis by Nature, Product Type, Distribution Channel and Region through 2035

Fragrance Concentrates Market Size and Share Forecast Outlook 2025 to 2035

Vegetable Concentrates Market Growth - Nutrient-Dense Foods & Industry Demand 2025 to 2035

Soft Drinks Concentrates Market Trends - Growth & Forecast

Emulsifiable Concentrates Market Size, Growth, and Forecast 2025 to 2035

Dialysis Device and Concentrates Market Growth - Trends & Forecast 2025 to 2035

Prothrombin Complex Concentrates Market Trends and Forecast 2025 to 2035

Enzyme-Enabled Cold-Brew Concentrates Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dialyzer Reprocessing Machines and Concentrates Market and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA