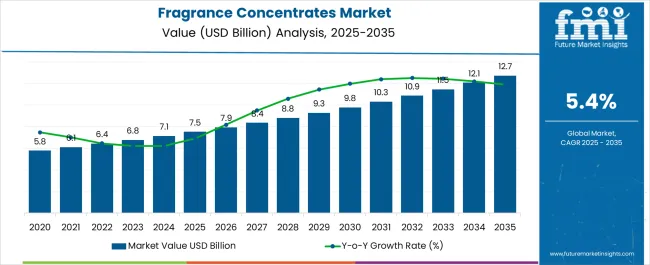

The Fragrance Concentrates Market is estimated to be valued at USD 7.5 billion in 2025 and is projected to reach USD 12.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

| Metric | Value |

|---|---|

| Fragrance Concentrates Market Estimated Value in (2025 E) | USD 7.5 billion |

| Fragrance Concentrates Market Forecast Value in (2035 F) | USD 12.7 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The fragrance concentrates market is experiencing steady growth due to rising demand for long-lasting, customizable scents in personal care, home care, and industrial applications. Manufacturers are prioritizing concentrated formulas to reduce transport volume and improve shelf life, while meeting performance expectations in compact packaging.

Technological innovations in solubility enhancement, encapsulation, and delivery mechanisms have enabled improved fragrance stability and intensity across oil- and water-based systems. Growing consumer interest in cleaner label ingredients, regionally tailored aromas, and wellness-enhancing fragrances is pushing producers to focus on versatile concentrate formats.

Strategic investments in modular formulation facilities and bio-based solvents are also contributing to reduced production cost and sustainability compliance. The market is poised for further expansion as regulatory standards drive the need for traceable, compliant ingredients in export-focused fragrance solutions.

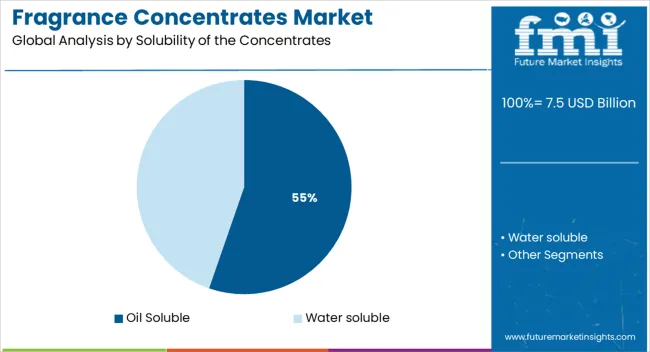

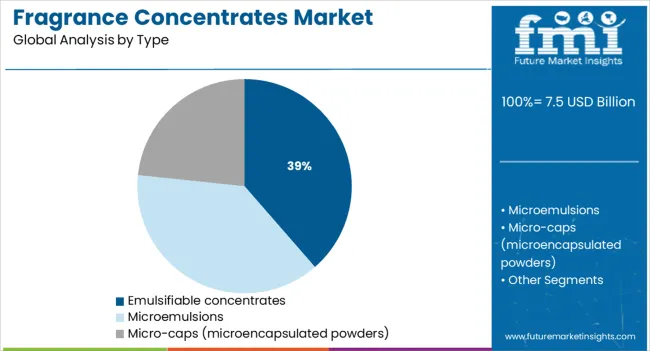

The market is segmented by Solubility of the Concentrates, Type, Structure/form, and End User and region. By Solubility of the Concentrates, the market is divided into Oil Soluble and Water soluble. In terms of Type, the market is classified into Emulsifiable concentrates, Microemulsions, and Micro-caps (microencapsulated powders). Based on Structure/form, the market is segmented into Liquid, Powder, and Emulsion. By End User, the market is divided into Personal care, Household, Cosmetics, Aromatherapeutic, Candles, and Essence sticks. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Oil soluble fragrance concentrates are projected to hold 55.3% of the total market revenue in 2025, making this the leading solubility category. This dominance is driven by their superior compatibility with a wide variety of cosmetic, personal care, and oil-based formulations.

These concentrates exhibit higher longevity and fragrance load retention, which has increased their use in products requiring extended wear and reduced volatility. Enhanced lipophilic solubility makes them particularly useful in skin-contact products where stability and slow release are critical.

Additionally, oil soluble systems facilitate better blending with carrier oils, improving formulation performance across body oils, perfumes, and creams. As manufacturers seek solubility options that support both functionality and sensorial quality, oil soluble variants continue to be preferred for their formulation efficiency and consistent olfactory delivery.

Emulsifiable fragrance concentrates are anticipated to contribute 38.6% of overall revenue in 2025, emerging as the dominant product type. Their popularity stems from their ability to form stable emulsions when blended with water, making them ideal for multifunctional formulations in air fresheners, household cleaners, and personal care products.

These concentrates eliminate the need for additional solubilizers or surfactants, simplifying formulation design and reducing ingredient load. Advancements in microemulsion technology and biodegradable emulsifiers have further strengthened their applicability across environmentally sensitive categories.

As demand for high-performance water-compatible fragrance systems grows, emulsifiable concentrates have become a strategic choice for manufacturers targeting clarity, consistency, and faster production cycles in water-based applications.

Liquid fragrance concentrates are expected to account for 49.1% of the total market share in 2025, leading the structure/form category. Their flexibility, ease of dosing, and compatibility with both automated and manual filling systems have positioned liquid formats as the preferred choice for scalable production.

Liquids offer rapid dispersion and uniform distribution in various end-use bases, including lotions, diffusers, and sprays. This structural format also supports efficient blending with other ingredients during manufacturing, reducing batch variability and enhancing throughput.

As the industry continues to prioritize precision dosing, real-time customization, and sustainability in packaging, liquid concentrates remain central to optimizing production agility and sensory consistency in fragrance applications.

The fragrance concentrates market was valued at USD 5,539.27 Million in 2020, and was growing steadily at a CAGR of 3% from 2020 to 2024.

According to FMI fragrance concentrates market is expected to grow during its forecasted period that is from 2025 to 2035 at a rapid growth rate.

Due to the growing use of fragrance concentrations to treat various physiological disorders, including stress, poor sleep, and others, the market for fragrance concentrates is booming. Aromatherapy has gained widespread public acceptance during the past few decades, having a significant impact on the scent concentrates market.

The fragrance serves as one of the main therapeutic elements, just like in aromatherapy. In addition, rising urbanization has boosted living standards in emerging countries, encouraging the usage of fragrance concentrates to provide perfume to the air. The demand for scented candles, which contain fragrance concentrate and cause a continual release of smell with a candle burning, has recently been on the rise.

The United States of America is known as the land of opportunity, and that’s especially true for businesses. Many big brands like Q-perfumes, INeKE perfumes, and Alpha aromatic got their start in the USA.

There are a few reasons why the USA is such a good place for businesses. First, the economy is strong and stable. This provides a good environment for businesses to grow and thrive. Second, there’s a lot of competition in the USA market. This forces businesses to continuously innovate and improve their products and services.

Finally, American consumers are some of the most loyal in the world. Once they find a brand they trust, they stick with it. This loyalty can help businesses succeed even in tough economic times.

The USA became one of the biggest markets for fragrance concentrates brands because of liking people have luxury preferences and fragrances.

Alone USA has a value of 28% in the global fragrance concentrates market and is growing rapidly.

The United Kingdom (UK) was the leading country in the production and consumption of fragrance concentrates globally. The United Kingdom's share of global production was 22 percent, while its share of global consumption was 20 percent.

The United Kingdom's position as a leading producer and consumer of fragrance concentrates is due to several factors. First, the United Kingdom has a large and mature fragrance industry, with many established companies producing high-quality products. Second, the United Kingdom's proximity to Europe gives it easy access to raw materials and finished products from other countries in the region. Finally, the United Kingdom's strong economy means that there is high demand for luxury goods, including fragrance concentrates.

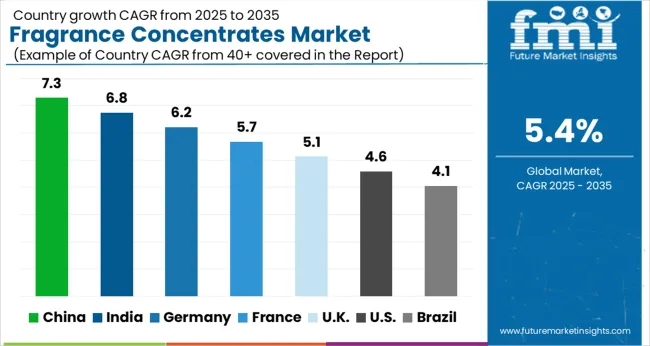

The United Kingdom has a forecasted CAGR of 6.3% for the growth of the fragrance concentrates market from 2025 to 2035, and growing strongly due to the increasing income of middle-class people in the United Kingdom

Due to the vast population and rising standard of living in the region, Asia-Pacific is the region with the fastest-growing market for fragrance concentrates.

The substantial populace of the area Given that over 60% of the world's population lives in Asia-Pacific, there is a sizable market for scent concentrates.

increased disposable incomes: More people may now buy luxury goods like perfume as the region's salaries continue to rise.

Western culture's acceptance: Asia-Pacific has recently seen a rise in the popularity of Western culture, including the use of fragrances.

In Asia- pacific region China and India have the highest growth rate as the countries are moving towards the premiumization of cosmetics and perfumes.

The foundation of the fragrance concentrate market is the cosmetics and personal care sector, which has propelled its expansion in response to shifting consumer perceptions as well as the needs of a rapidly changing society.

The personal care and cosmetics industries are seeing an increase in demand for fragrance concentrates. The scent is one of the primary determinants of the product's net sale in the worldwide personal care and cosmetics market. For instance, a product with a high scent value has a greater potential of making enormous profits than a product with a lower fragrance value.

Due to the growing use of fragrance concentrations to treat various physiological disorders, including stress, poor sleep, and others, the market for fragrance concentrates is booming. Aromatherapy has gained widespread public acceptance during the past few decades, having a significant impact on the fragrance concentrates market.

The fragrance serves as one of the main therapeutic elements, just like in aromatherapy. In addition, rising urbanization has boosted living standards in emerging countries, encouraging the usage of fragrance concentrates to provide perfume to the air. The demand for scented candles, which contain fragrance concentrate and cause a continual release of smell with a candle burning, has recently been on the rise.

The market for scent concentrates is flourishing as a result of the expanding use of fragrance concentrations to treat a variety of physiological diseases, including stress, poor sleep, and others. In recent decades, aromatherapy has become widely accepted by the general public, which has had a big impact on the market for scent concentrates.

One of the key trends driving the fragrance concentrate industry over the years is customization and personalization. A tailored product has a better probability of reaching the proper buyer in the current era. Additionally, there has been a sharp increase in products that may be customized to meet consumer desires.

The demand for scent concentrates is rising in the personal care and cosmetics sectors. In the global market for personal care products and cosmetics, scent is one of the key factors affecting the product's net sales. A product with a high smell value, for instance, has a greater chance of generating tremendous profits than one with a lower fragrance value.

The global fragrance concentrate market is made up of many rivals throughout the world, and these companies are continuously willing to create new product lines to cater to consumers' tastes. They are focused on providing customers with innovative product offerings.

Market leaders in fragrance concentrates are growing by concentrating on things like technological developments and concepts that can ease the work of customers and help them attract more clients.

These are some of the major companies in the fragrance concentrates market

The pricing points of fragrance concentrate manufacturers positioned across geographies, sales growth, production capacity, and speculative production expansion were all thoroughly covered by FMI in a recently released Research.

The complete report contains recent changes that have affected companies that offer fragrance concentrates that the FMI team has been tracking.

| Attributes | Details |

|---|---|

| Forecast period | 2025 to 2035 |

| Historical data available for | 2020 to 2025 |

| Key regions covered |

|

| Key countries covered |

|

| Key segments covered |

|

| Key companies profiled |

|

| Report Coverage |

|

| Customization and Pricing | Available upon request |

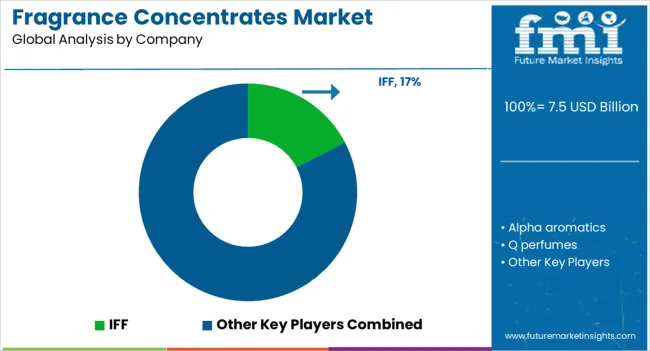

The global fragrance concentrates market is estimated to be valued at USD 7.5 billion in 2025.

The market size for the fragrance concentrates market is projected to reach USD 12.7 billion by 2035.

The fragrance concentrates market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in fragrance concentrates market are oil soluble and water soluble.

In terms of type, emulsifiable concentrates segment to command 38.6% share in the fragrance concentrates market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fragrance Diffuser Market Size and Share Forecast Outlook 2025 to 2035

Fragrance Product Market Size and Share Forecast Outlook 2025 to 2035

Fragranced Personal Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fragrance Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Fragrance Fixatives Market Size and Share Forecast Outlook 2025 to 2035

Fragrance Jewellery Pods Market Analysis Size and Share Forecast Outlook 2025 to 2035

Fragrance-free Serum Market Report – Growth & Trends 2024-2034

Fragrance Oil Market

Smart Fragrance Box Market Analysis – Growth & Forecast 2025 to 2035

Herbal Fragrance Ingredients Market Analysis by Application, Ingredients, and Region Through 2035

Natural Fragrance Chemicals Market

Gourmand Fragrance Market Analysis - Size, Share, and Forecast 2025 to 2035

Flavors and Fragrances Market Analysis by Type, Nature, Application, and Region through 2035

Encapsulated Flavors and Fragrances Market Analysis by Product Type, Technology, Wall Material, End-use, Encapsulated Form, Process, and Region through 2035

Color Concentrates Market

Cheese Concentrates Market Size and Share Forecast Outlook 2025 to 2035

Omega-3 Concentrates Market Size and Share Forecast Outlook 2025 to 2035

Ketchup Concentrates Market Analysis by Nature, Product Type, Distribution Channel and Region through 2035

Vegetable Concentrates Market Growth - Nutrient-Dense Foods & Industry Demand 2025 to 2035

USA Omega-3 Concentrates Market Report – Trends, Demand & Outlook 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA