The Fragrance Fixatives Market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 3.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period. During the early adoption phase from 2020 to 2024, the market progressed from USD 1.8 billion to USD 2.2 billion. This period was characterized by experimental use in premium perfumes, personal care, and niche applications, where formulators tested novel fixative blends for enhanced fragrance longevity. Key breakpoints included initial regulatory approvals, pilot launches, and the gradual recognition of fixatives’ value in extending scent profiles, helping build consumer and industry awareness.

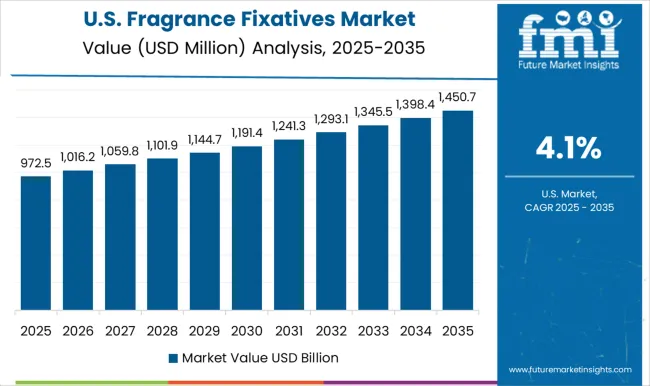

From 2025 to 2030, the market entered a scaling phase, expanding from USD 2.3 billion to USD 2.9 billion. Adoption accelerated as leading brands integrated fixatives across multiple product lines and optimized formulations for cost and performance. Between 2030 and 2035, the market transitioned to consolidation, reaching USD 3.7 billion. Milestones in this phase included the dominance of established players, streamlined supply chains, and wider penetration into mass-market personal care and home fragrance products. Growth became more stable, reflecting mature distribution networks, standardized product formulations, and consistent demand, marking the market as a well-established segment in the fragrance industry.

| Metric | Value |

|---|---|

| Fragrance Fixatives Market Estimated Value in (2025 E) | USD 2.3 billion |

| Fragrance Fixatives Market Forecast Value in (2035 F) | USD 3.7 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The fragrance fixatives market is experiencing sustained growth as the industry increasingly prioritizes scent longevity, formulation stability, and multisensory appeal in both personal care and home fragrance applications. Fixatives play a crucial role in enhancing the performance of perfumes by slowing down the evaporation of volatile components and stabilizing aroma compounds over time. This market momentum is supported by a surge in demand for high-end fine fragrances, grooming products, and specialty cosmetics where consistent scent profiles are essential.

Manufacturers are focusing on innovation in fixative chemistry to align with regulatory requirements and consumer expectations regarding ingredient safety and environmental impact. The shift toward synthetic molecules with controlled olfactory release and compatibility across complex formulations has opened new pathways for scalable and cost-effective production.

Additionally, consumer interest in layered and bespoke scents is encouraging R&D investments in functional fixative systems The integration of advanced encapsulation technologies and solvent-free solutions is anticipated to further propel the market's evolution across premium and mass-market product categories.

The fragrance fixatives market is segmented by type, product, application, and geographic regions. By type, fragrance fixatives market is divided into Synthetic and Natural. In terms of product, fragrance fixatives market is classified into Galaxolide, Sclareolide, ISO E Super, Sucrose acetate isobutyrate, Ambergris, and Civet. Based on application, fragrance fixatives market is segmented into Fine Fragrances, Homecare Fragrance, Color Cosmetics, Skincare Products, and Haircare Products. Regionally, the fragrance fixatives industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The synthetic type segment is projected to hold 55.6% of the total revenue share in the fragrance fixatives market in 2025, establishing itself as the dominant formulation approach. This leadership has been supported by the ability of synthetic fixatives to offer consistent quality, enhanced longevity, and stability across diverse fragrance profiles.

Unlike natural alternatives, synthetic variants are engineered for precision in volatility and fixative strength, which improves their performance in complex formulations. The segment’s growth has also been influenced by lower production costs and scalability, making it a preferred choice for mass-market and premium applications alike.

In addition, the adaptability of synthetic compounds to comply with evolving safety and allergen regulations has further enhanced their acceptance among formulators and global brands. Continuous advancements in olfactory chemistry and molecule engineering have enabled the creation of highly effective synthetic fixatives with minimal environmental footprint, which is expected to reinforce further their adoption across both personal care and industrial scenting solutions.

The Galaxolide product segment is expected to account for 39.5% of the overall revenue share in the fragrance fixatives market in 2025. Its strong market presence is attributed to its established performance as a cost-effective and versatile synthetic musk with excellent fixative properties.

Galaxolide has been widely incorporated into various personal care products, home fragrances, and detergents due to its clean, musky odor and ability to enhance scent longevity. Its stability under diverse pH conditions and compatibility with a broad range of aromatic ingredients have positioned it as a workhorse fixative in large-scale formulations.

Despite ongoing scrutiny related to environmental persistence, reformulation efforts and usage level adjustments have enabled continued adoption in compliance with regional regulations The ability of Galaxolide to perform effectively in both oil- and water-based systems has also contributed to its widespread use, particularly in cost-sensitive segments where olfactory consistency and formulation efficiency are critical.

The fine fragrances application segment is forecast to capture 47.3% of the fragrance fixatives market revenue share in 2025, making it the leading area of application. This dominance is being driven by the increasing global appetite for luxury perfumes and artisanal scent products that demand superior olfactory performance and wear time. Fixatives in fine fragrances play a pivotal role in anchoring volatile top and middle notes, thereby enhancing the overall composition and sensory experience.

The segment’s expansion has been supported by rising disposable income, urbanization, and the aspirational appeal of niche and premium fragrance lines. Brands are leveraging advanced fixative technologies to achieve differentiated scent structures and long-lasting impressions, aligning with consumer expectations for value and exclusivity.

The use of controlled-release and microencapsulation delivery systems in fine fragrance formulations has further elevated the role of fixatives as performance enablers. As the market continues to move toward personalization and gender-neutral scent profiles, the importance of tailored fixative solutions in this segment is expected to grow.

The fragrance fixatives market is expanding due to rising demand for long-lasting, high-quality perfumes, personal care products, and home fragrances. Fixatives stabilize volatile compounds, enhancing scent longevity and intensity in perfumes, lotions, candles, and air fresheners. Growth is driven by increasing disposable income, premiumization in personal care, and emerging markets in Asia-Pacific. Manufacturers are focusing on natural, sustainable, and allergen-free fixatives. Technological innovations in macrocyclic musks, botanical extracts, and synthetic molecules enable high-performance, customized fragrance profiles across multiple applications.

Consumers increasingly prefer perfumes, body sprays, and personal care products that retain fragrance over extended periods. Fragrance fixatives enhance scent retention, prevent rapid evaporation, and stabilize complex aromatic compositions. Luxury and premium product segments especially rely on high-performance fixatives to deliver consistent olfactory experiences. Manufacturers invest in high-purity natural resins, synthetic fixatives, and microencapsulation technologies to achieve longer-lasting fragrances. Until universal standards for scent retention measurement are adopted, product differentiation and consumer satisfaction depend on innovation in fixative chemistry and formulation expertise.

Growing environmental awareness and consumer demand for clean-label products are driving the use of natural, eco-friendly, and biodegradable fragrance fixatives. Botanical resins, essential oils, and plant-derived compounds are increasingly replacing petroleum-based fixatives. Sustainability initiatives, such as traceable sourcing and reduced chemical footprint, are important for brand perception and regulatory compliance. Companies developing high-performing natural fixatives that maintain scent longevity and intensity gain competitive advantage. Until scalable, cost-effective, and high-quality natural fixatives are widely available, manufacturers must balance performance, sustainability, and pricing to meet market demand.

Technological innovations in microencapsulation, nanoparticles, and polymer-based delivery systems are transforming the fragrance fixatives market. These technologies allow controlled release of aromatic molecules, improving longevity and intensity while reducing formulation volatility. Controlled-release fixatives are increasingly used in air fresheners, laundry products, and home care items. Integration of fixatives with encapsulation ensures stability during storage and application. Companies investing in R&D to optimize release kinetics and scent profiles can create unique consumer experiences. Until these advanced technologies become standardized, innovation remains a key differentiator for premium and functional fragrance products.

Emerging economies in Asia-Pacific, Latin America, and the Middle East present high growth potential due to increasing urbanization, disposable income, and demand for luxury personal care products. Niche applications, including scented candles, aromatherapy oils, and functional fragrances, are driving adoption of specialized fixatives. Cultural preferences and regional scent trends require customized formulations. Manufacturers investing in regional market insights, localized production, and application-specific solutions can capture new segments. Until global consumer trends converge, market growth will depend on the ability to combine performance, customization, and affordability for diverse fragrance applications.

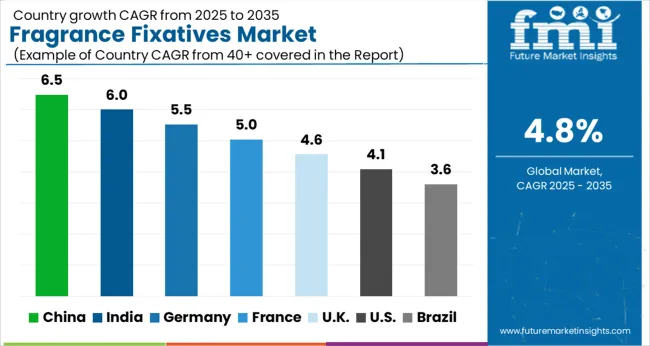

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

The global Fragrance Fixatives Market is projected to grow at a CAGR of 4.8% through 2035, supported by increasing demand across perfumes, personal care, and cosmetic applications. Among BRICS nations, China has been recorded with 6.5% growth, driven by large-scale production and deployment in fragrance and personal care products, while India has been observed at 6.0%, supported by rising utilization in cosmetics and perfumery. In the OECD region, Germany has been measured at 5.5%, where production and adoption for perfumes, personal care, and cosmetic applications have been steadily maintained. The United Kingdom has been noted at 4.6%, reflecting consistent use in cosmetic and fragrance products, while the USA has been recorded at 4.1%, with production and utilization across personal care, perfumes, and cosmetic sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The fragrance fixatives market in China is expanding at a CAGR of 6.5%, driven by growth in the personal care, cosmetics, and household products sectors. Increasing demand for long-lasting perfumes, scented toiletries, and premium cosmetic formulations is fueling market adoption. Cosmetic and personal care brands are incorporating fragrance fixatives to enhance scent longevity and improve overall product performance. Rising disposable income and changing consumer preferences toward premium and long-lasting fragrances further support market growth. Industrial applications, including scented cleaning products and air fresheners, contribute to steady demand. Manufacturers are investing in research and development to produce environmentally friendly and sustainable fixatives. Additionally, government regulations on chemical safety and quality standards ensure high-quality production, reinforcing market stability. China’s expanding cosmetics industry and rapid urbanization create a favorable environment for fragrance fixative adoption, positioning the market for consistent growth over the forecast period.

The fragrance fixatives market in India is growing at a CAGR of 6.0%, supported by the rising personal care and cosmetics industry. Increasing awareness of long-lasting perfumes and scented toiletries is driving adoption of fragrance fixatives among consumers. Urbanization and growing disposable income encourage the purchase of premium and mid-range personal care products. Cosmetic and household product manufacturers are incorporating fixatives to improve fragrance stability, durability, and user experience. Growth in scented air fresheners, detergents, and cleaning products also contributes to market expansion. Government regulations on chemical safety and quality standards ensure consumer protection and product compliance. Indian manufacturers are investing in research to develop natural and synthetic fixatives with minimal environmental impact. Overall, the combination of rising consumer demand, industrial applications, and regulatory support creates a positive outlook for the fragrance fixatives market in India.

The fragrance fixatives market in Germany is expanding at a CAGR of 5.5%, driven by the personal care, cosmetic, and household product sectors. High consumer expectations for long-lasting, high-quality fragrances encourage the use of advanced fixatives. The cosmetics industry relies on fixatives to maintain scent stability and enhance overall product performance. Household cleaning products and scented air fresheners also utilize fragrance fixatives to improve consumer satisfaction. Germany’s strong focus on sustainability and environmental regulations ensures the adoption of eco-friendly fixative solutions. Manufacturers invest in research and development to create innovative products that comply with chemical safety standards and environmental requirements. Export opportunities within Europe further support market growth. The combination of technological innovation, regulatory compliance, and demand from cosmetics and household sectors ensures steady expansion of the fragrance fixatives market in Germany.

The fragrance fixatives market in the United Kingdom is growing at a CAGR of 4.6%, with demand driven by personal care, cosmetics, and home fragrance products. Consumers increasingly seek long-lasting perfumes, scented toiletries, and high-performance cosmetic products. Manufacturers incorporate fixatives to improve scent stability, durability, and user experience. Household products such as air fresheners and cleaning agents also benefit from fragrance fixatives. Government regulations on chemical safety, product labeling, and environmental compliance promote high-quality production. Innovation in natural and synthetic fixatives supports the development of sustainable and eco-friendly solutions. The UK market also benefits from increasing urbanization, disposable income, and rising consumer awareness about premium fragrances. Combined with ongoing R&D investments and industry collaborations, these factors ensure continued growth and a positive outlook for the fragrance fixatives market in the United Kingdom.

The fragrance fixatives market in the United States is expanding at a CAGR of 4.1%, driven by demand from personal care, cosmetics, and home fragrance industries. Consumers prefer long-lasting perfumes, scented toiletries, and high-quality cosmetic products, creating opportunities for fixative adoption. Household products such as air fresheners, detergents, and cleaning agents increasingly incorporate fragrance fixatives to enhance scent stability and performance. Manufacturers invest in research to develop natural, sustainable, and eco-friendly fixatives that comply with regulatory requirements. Government policies on chemical safety and environmental compliance ensure product quality and consumer protection. Technological innovation, industry collaborations, and growing consumer awareness about premium fragrances further support market growth. Overall, the combination of increasing product applications, urbanization, and regulatory support positions the fragrance fixatives market in the United States for steady expansion over the forecast period.

The fragrance fixatives market is a critical segment within the global fragrance and personal care industry. Fragrance fixatives are compounds used to stabilize and prolong the scent of perfumes, cosmetics, and personal care products, ensuring that the fragrance maintains its intended profile over time. These additives are essential for maintaining product consistency, enhancing consumer experience, and improving the longevity of scents in various applications, including perfumes, soaps, lotions, and household products.

Key players in the market include Eastman Chemical Company, a global leader providing high-performance ingredients and chemical solutions for fragrance stabilization. Givaudan, a renowned fragrance and flavor company, offers a range of natural and synthetic fixatives designed to enhance scent longevity and quality. Alpha Aromatics focuses on innovative fragrance fixatives that cater to both industrial and personal care applications, offering tailored solutions for complex fragrance formulations.

Other prominent suppliers include BMV Fragrances Private Limited, which specializes in custom fragrance fixatives for diverse consumer products; Tokos, known for high-quality fixatives that ensure scent stability and intensity; and Landmark Perfumes & Aromatics, which provides functional and aromatic fixatives for the perfume and personal care industries. Dadia Chemicals Industries and Lotioncarfter also contribute significantly, offering specialty fixatives for both natural and synthetic fragrance applications. The market is growing due to increasing demand for premium and long-lasting fragrances, rising consumer awareness of product quality, and expansion of the personal care and household product segments globally. Continuous innovation and development of eco-friendly and sustainable fixatives are driving competitive advantage among leading suppliers, making fragrance fixatives an indispensable component in modern scent formulation.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.3 Billion |

| Type | Synthetic and Natural |

| Product | Galaxolide, Sclareolide, ISO E Super, Sucrose acetate isobutyrate, Ambergris, and Civet |

| Application | Fine Fragrances, Homecare Fragrance, Color Cosmetics, Skincare Products, and Haircare Products |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | EastmanChemicalCompany, Givaudan, AlphaAromatics, BMVFragrancesPrivateLimited, Tokos, LandmarkPerfumes&Aromatics, DadiaChemicalsIndustries, and Lotioncarfter |

| Additional Attributes | Dollar sales vary by type, including natural fixatives, synthetic fixatives, and resin-based fixatives; by application, such as perfumes, personal care products, household products, and aromatherapy; by end-use industry, spanning cosmetics, toiletries, and home care; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for long-lasting fragrances, premium personal care products, and innovative scent formulations. |

The global fragrance fixatives market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the fragrance fixatives market is projected to reach USD 3.7 billion by 2035.

The fragrance fixatives market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in fragrance fixatives market are synthetic and natural.

In terms of product, galaxolide segment to command 39.5% share in the fragrance fixatives market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fragrance Product Market Size and Share Forecast Outlook 2025 to 2035

Fragranced Personal Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fragrance Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Fragrance Jewellery Pods Market Analysis Size and Share Forecast Outlook 2025 to 2035

Fragrance Concentrates Market Size and Share Forecast Outlook 2025 to 2035

Fragrance-free Serum Market Report – Growth & Trends 2024-2034

Fragrance Diffuser Market Growth – Trends & Forecast 2024-2034

Fragrance Oil Market

Smart Fragrance Box Market Analysis – Growth & Forecast 2025 to 2035

Herbal Fragrance Ingredients Market Analysis by Application, Ingredients, and Region Through 2035

Natural Fragrance Chemicals Market

Gourmand Fragrance Market Analysis - Size, Share, and Forecast 2025 to 2035

Flavors and Fragrances Market Analysis by Type, Nature, Application, and Region through 2035

Encapsulated Flavors and Fragrances Market Analysis by Product Type, Technology, Wall Material, End-use, Encapsulated Form, Process, and Region through 2035

Fixatives Market Size and Share Forecast Outlook 2025 to 2035

Cytology Fixatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA