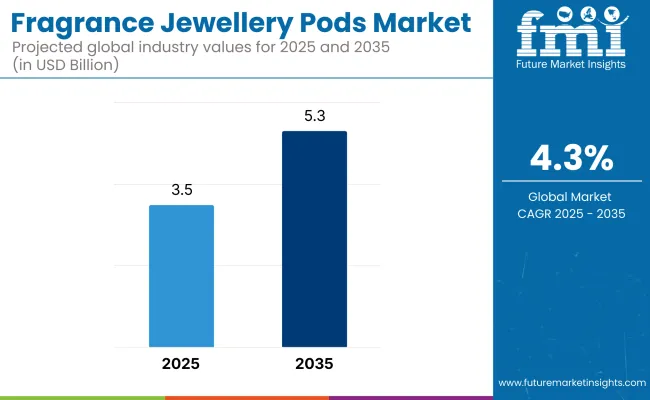

The fragrance jewelry pods market is expected to grow from USD 3.5 billion in 2025 to USD 5.3 billion by 2035, resulting in a total increase of USD 1.8 billion over the forecast decade. This represents a 51.4% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 4.3%. Over ten years, the market grows by a 1.5 multiple.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3.5 billion |

| Industry Value (2035F) | USD 5.3 billion |

| CAGR (2025 to 2035) | 4.3% |

In the first five years (2025-2030), the market progresses from USD 3.5 billion to USD 4.2 billion, contributing USD 0.7 billion, or 38.9% of total decade growth. This phase is shaped by steady adoption among fashion-conscious consumers seeking personalized fragrance experiences. Growth is reinforced by the gifting sector, with innovative designs and refillable pod systems enhancing product appeal in key markets.

In the second half (2030-2035), the market grows from USD 4.2 billion to USD 5.3 billion, adding USD 1.1 billion, or 61.1% of the total growth. This acceleration is supported by integration of smart-scent diffusion technologies, biodegradable pod materials, and designer-brand collaborations. Expanding distribution through luxury retail and e-commerce platforms solidifies the category’s position in the premium accessories market.

From 2020 to 2024, the fragrance jewellery pods market grew from USD 3.1 billion to USD 3.4 billion, driven by luxury gifting trends, customization in wearable fragrances, and premium jewellery collaborations. Leading brands and fragrance houses held over 65% market share, integrating refillable pods into high-end accessories. Companies such as Pandora, Cartier, and Swarovski emphasized scent longevity, hypoallergenic materials, and secure locking mechanisms.

Technological differentiation centered on micro-encapsulation, leak-proof sealing, and adjustable diffusion systems, while smart app-controlled scent variation remained secondary. Subscription refill services contributed less than 15% of market value as most consumers opted for occasional replacements over recurring models.

By 2035, the fragrance jewellery pods market will reach USD 5.3 billion, growing at a CAGR of 4.3%, with connected, tech-integrated designs capturing over 40% of value. Competition will intensify as new entrants offer modular pod systems, AI-powered scent personalization, and wearable devices with real-time fragrance monitoring. Established players are pivoting toward hybrid luxury-tech models using AR for virtual scent trials and digital fragrance libraries.

Emerging brands such as Scentinvent Technologies, OUIA Fragrances, and My Aroma Jewellery are expanding with biodegradable pods, multi-scent switching features, and sustainable gemstone alternatives to appeal to eco-conscious and tech-savvy buyers.

The rising consumer interest in multifunctional products that combine fashion with wellness is fueling growth in the fragrance Jewellery pods market. These accessories offer a discreet way to enjoy long-lasting scents, appealing to fragrance enthusiasts seeking portability and style. Growing gifting trends, customization options, and premiumization in personal accessories are further supporting market expansion across global retail channels.

Pods featuring refillable scent capsules, hypoallergenic materials, and precision-engineered aroma release systems are gaining popularity for their ability to maintain fragrance intensity without direct skin contact. Compact designs with interchangeable scents enhance versatility, while durable, sustainable materials align with eco-conscious consumer preferences. The blend of aesthetics, technology, and sustainability is driving adoption in both luxury and mass-market segments.

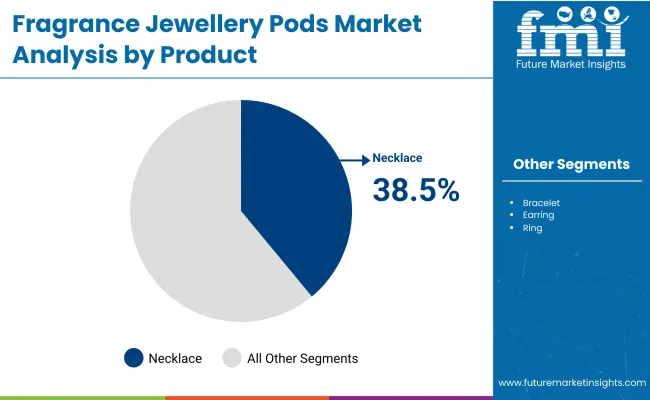

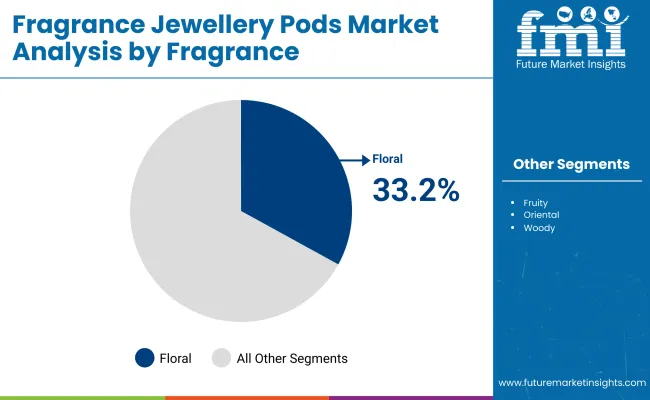

The market is segmented by product type, fragrance type, end user, distribution channel, and region. Product type segmentation includes necklaces, bracelets, earrings, and rings, each serving as both decorative accessories and discreet fragrance carriers. Fragrance type covers floral, fruity, oriental, woody, and blended scents, providing diverse olfactory profiles to suit consumer preferences and seasonal trends.

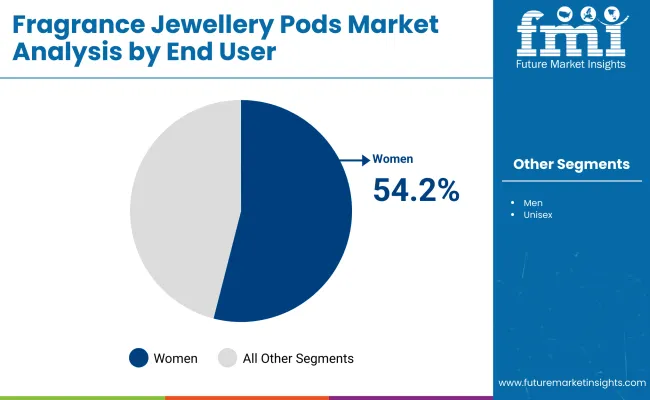

End user segmentation includes women, men, and unisex, addressing varied style choices and gifting occasions. Distribution channel covers offline and online platforms, enabling accessibility through retail stores, boutiques, e-commerce marketplaces, and brand-owned websites. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

The necklaces segment is forecast to command a 38.5% share in 2025, driven by their dual function as decorative accessories and discreet fragrance diffusers. Incorporating scent pods into pendants enables continuous aroma release without direct skin contact, reducing irritation risks. Durable metal, resin, and glass designs extend product life, while interchangeable pendants support seasonal and personal customization trends.

These products cater to consumers seeking style and sensory appeal in a single purchase. Luxury and artisanal brands leverage fine materials, gemstone embellishments, and limited-edition scents to elevate perceived value. Necklaces’ portability enhances daily wear and travel convenience, making them an attractive gifting option. Collaborations with fashion designers and fragrance houses further position them as premium lifestyle accessories.

Floral fragrances are expected to account for 33.2% of the market in 2025, supported by their universal familiarity and ability to evoke positive emotions. Popular notes like rose, jasmine, and lavender align with consumer associations of freshness, romance, and wellness. Encapsulation technology ensures fragrance pods maintain aroma intensity over extended periods, supporting repeat use and customer loyalty.

The segment benefits from growing demand for nature-inspired products that promote relaxation and mood enhancement. Seasonal collections introduce new floral blends, keeping the product line fresh and appealing. Marketing often emphasizes botanical sourcing and natural ingredients, aligning with clean beauty trends. Premium positioning is reinforced through collaborations with renowned perfumers and luxury packaging designs.

Women are projected to account for 54.2% of market demand in 2025, reflecting their strong affinity for jewellery and fragrance as personal style statements. Designs feature elegant finishes, delicate chains, and customizable scent options to match diverse wardrobes. Sustainability is addressed through refillable pods and recyclable packaging, appealing to eco-conscious buyers.

This segment thrives on gifting occasions such as birthdays, anniversaries, and holidays, where personalization enhances emotional value. Social media campaigns showcasing influencer endorsements drive aspirational appeal. Luxury brands expand reach by offering limited-edition collections and exclusive retail experiences. The fusion of fashion trends and fragrance innovation ensures continued relevance for female consumers.

Offline sales are set to hold a 59.6% share in 2025, as consumers seek the sensory reassurance of smelling fragrances before purchase. Retail environments such as department stores, jewellery boutiques, and pop-up events enable tactile interaction with products, enhancing purchase confidence. Store staff demonstrations educate buyers on scent pod replacement and care, improving customer experience.

These channels are particularly effective for premium and gift-oriented products, where presentation and packaging influence buying decisions. In-store exclusives and bundled gift sets drive seasonal foot traffic. Strategic retail partnerships expand market reach into luxury and lifestyle segments. Visual merchandising and live sampling create immersive brand encounters that online platforms struggle to match.

The market is growing as consumers increasingly seek personalized, portable fragrance solutions that merge fashion with functionality. These products cater to demand for luxury accessories that double as lifestyle enhancers, offering both style and sensory appeal. Rising interest in personalized gifting, luxury wellness, and travel-friendly formats supports adoption.

However, high product development costs, technical challenges in scent preservation, and niche appeal currently limit mass-market expansion. Innovations in refillable pods, sustainable materials, and advanced scent diffusion technologies are expected to drive future growth and market penetration.

Personalized Luxury Appeal and Functional Convenience Driving Adoption

Fragrance jewellery pods are gaining momentum among consumers who value both elegance and practicality. These wearable scent diffusers allow discreet fragrance application without carrying traditional perfume bottles, making them perfect for on-the-go lifestyles, travel, and professional environments. The ability to customize designs, pair scents with specific occasions, or choose limited-edition releases enhances their exclusivity and gifting appeal.

Luxury brands are leveraging this category to attract younger, experience-driven consumers, while wellness-focused players integrate aromatherapy benefits. In high-end retail, fragrance jewellery pods are positioned as a fusion of fashion, personal care, and emotional well-being, driving interest in premium price segments.

High Development Costs, Limited Consumer Awareness, and Market Concentration

Despite rising demand, several barriers limit rapid market growth. The miniaturization of scent capsules within jewellery pieces requires precision engineering, durable materials, and advanced microencapsulation techniques to ensure fragrance stability over time. These processes significantly increase R&D expenses, impacting scalability and affordability.

Consumer awareness remains low outside luxury retail channels, with many still unfamiliar with the product category’s benefits. Distribution is concentrated among niche brands with limited marketing budgets, restricting global reach. Additionally, counterfeit risks in the luxury sector discourage wider adoption, as authenticity and scent performance are critical to brand trust.

Sustainable Materials, Refillable Pods, and Smart Diffusion Trends Emerging

Sustainability is becoming a defining theme in this market, with brands adopting recycled metals, ethically sourced gemstones, and biodegradable pod casings. Refillable fragrance capsules are gaining popularity, enabling consumers to switch scents easily while reducing environmental waste. Technological advancements in scent-release mechanisms now allow for controlled, long-lasting diffusion that adapts to body heat and movement.

Some innovators are exploring Bluetooth-enabled pods that sync with wearable devices to adjust fragrance intensity based on time or activity. The growing popularity of subscription-based scent refills, combined with the appeal of limited-edition designs, is positioning fragrance jewellery pods as a recurring revenue stream for premium and lifestyle brands.

The global fragrance Jewellery pods market is experiencing steady growth, fueled by rising consumer interest in personalization, luxury self-expression, and eco-friendly refillable formats. Asia-Pacific is emerging as a highly lucrative region, with India and China leading expansion due to strong Jewellery manufacturing capabilities, growing disposable incomes, and tech-enabled fashion adoption.

Developed markets such as the USA, Germany, and Japan are focusing on advanced miniaturized scent diffusion systems, hypoallergenic materials, and smart authentication solutions, aligning with safety, quality, and sustainability standards to meet evolving consumer expectations across premium and mid-tier segments.

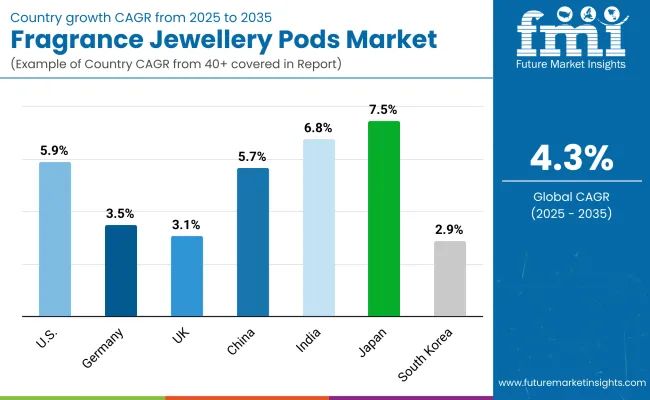

The USA market is projected to grow at a CAGR of 5.9% from 2025 to 2035, driven by premiumization in wearable accessories, demand for refillable fragrance pods, and the popularity of unique gifting experiences. Luxury brands are introducing NFC-enabled capsules that ensure secure refills and deliver consistent scent diffusion over time. Premium retailers are pairing fragrance Jewellery with subscription-based scent programs for recurring engagement.

Germany’s market is anticipated to grow at a CAGR of 3.5%, supported by the country’s engineering precision in airtight sealing and micro-encapsulation technologies. Strong cultural traditions in premium gifting and a preference for skin-safe, hypoallergenic materials are boosting demand. Luxury watch and Jewellery brands are partnering with perfumers to create pods that maintain fragrance integrity for extended periods.

Expansion Outlook for Fragrance Jewellery Pods United Kingdom

The UK market is expected to expand at a CAGR of 3.1%, driven by hybrid fashion-accessory trends and growing adoption of travel-friendly scent formats. Independent designers are developing modular pendants with interchangeable pods that reflect seasonal fragrance profiles. Sustainability is a key focus, with recyclable capsules and brand-led take-back programs gaining popularity.

China’s market is projected to grow at a CAGR of 5.7%, fuelled by luxury lifestyle trends, influencer-driven marketing, and strong online retail penetration. Domestic manufacturers are scaling gemstone-embedded and gold-plated capsules, integrating anti-counterfeit features like QR codes. Younger consumers prefer customizable charms that can be paired with mobile app-controlled scent release functions.

India is forecast to record the fastest growth at a CAGR of 6.8%, supported by a rising culture of luxury gifting during weddings and festivals. Local artisans are blending traditional craftsmanship with modern scent-diffusion technology, while premium buyers in urban areas favour compact, refill-ready designs. Ayurveda-inspired fragrance profiles are also gaining traction in this segment.

Japan’s market is expected to grow at a CAGR of 7.5%, driven by demand for minimalist designs, precision engineering, and discreet luxury wear. Brands are launching pods with precision nozzles that enable controlled micro-dosing, meeting consumer preferences for subtle, long-lasting scents. Seasonal and cultural limited editions remain a cornerstone of the market.

South Korea’s market is projected to expand at a CAGR of 2.9%, led by K-fashion collaborations and the merging of beauty-tech innovations with accessories. Compact pods are positioned as high-fashion status symbols for younger demographics. Partnerships with K-pop influencers and beauty brands create strong consumer engagement and limited-edition sales spikes.

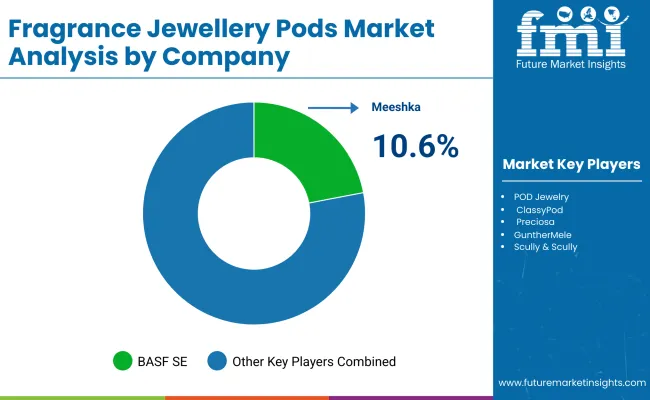

The fragrance jewellery pods market is moderately fragmented, with artisanal pod makers, luxury jewellery houses, and specialty packaging firms competing across fine fragrance, aromatherapy, and personalized gifting applications. Global leaders such as Meeshka, POD Jewelry, and ClassyPod hold notable market share, driven by intricate pod designs, precision scent encapsulation, and premium materials meeting IFRA and ISO fragrance safety standards. Their strategies increasingly emphasize customization, refillable systems, and integration of sustainable metals, glass, and biodegradable inserts.

Established mid-sized players including Preciosa, GuntherMele, and Scully & Scully are supporting adoption of decorative pod formats featuring hand-crafted settings, magnetic closures, and controlled-release scent technology. These companies are especially active in premium gifting, wedding favors, and boutique fragrance collections, offering heritage-inspired craftsmanship, limited-edition runs, and collaborations with niche perfumers.

Specialized packaging and display providers such as Taylor Box Company, Brimar Packaging, Cedar Box Company, and Allure Box & Display focus on tailored solutions for independent jewelers and fragrance brands. Their strengths lie in bespoke box engineering, eco-friendly substrate sourcing, and integration with retail-ready display systems for enhanced point-of-sale presentation and brand storytelling.

Key Development of Fragrance Jewellery Pods Market

| Item | Value |

|---|---|

| Quantitative Units | USD 3.5 Billion |

| By Product Type | Necklaces, Bracelets, Earrings, Rings |

| By Fragrance Type | Floral, Fruity, Oriental, Woody, Blended Scents |

| By End User | Women, Men, Unisex |

| By Distribution Channel | Offline, Online |

| Key Companies Profiled | Meeshka, POD Jewelry, ClassyPod, Preciosa, GuntherMele, Scully & Scully, Taylor Box Company, Brimar Packaging, Cedar Box Company, Allure Box & Display |

| Additional Attributes | Growing demand for personalized jewellery integrating fragrance delivery for fashion-conscious consumers, expansion of refillable fragrance pod designs to reduce waste, increased adoption of customizable scent combinations targeting both gender-specific and unisex preferences, rising presence of luxury and artisan brands offering limited-edition scent- jewellery collections, and growing online retail platforms enhancing accessibility through immersive product visuals and influencer-driven marketing campaigns. |

The global fragrance jewellery pods market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the fragrance jewellery pods market is projected to reach USD 5.3 billion by 2035.

The fragrance jewellery pods market is expected to grow at a CAGR of 4.3% between 2025 and 2035.

The key product types in the fragrance jewellery pods market include necklaces, bracelets, earrings, and rings.

The necklaces segment is expected to account for the highest share of 38.5% in the fragrance jewellery pods market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fragrance Control Module Assembly Market Size and Share Forecast Outlook 2025 to 2035

Fragrance Diffuser Market Size and Share Forecast Outlook 2025 to 2035

Fragrance Product Market Size and Share Forecast Outlook 2025 to 2035

Fragranced Personal Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fragrance Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Fragrance Fixatives Market Size and Share Forecast Outlook 2025 to 2035

Fragrance Concentrates Market Size and Share Forecast Outlook 2025 to 2035

Fragrance-free Serum Market Report – Growth & Trends 2024-2034

Fragrance Oil Market

Smart Fragrance Box Market Analysis – Growth & Forecast 2025 to 2035

Herbal Fragrance Ingredients Market Analysis by Application, Ingredients, and Region Through 2035

Natural Fragrance Chemicals Market

Gourmand Fragrance Market Analysis - Size, Share, and Forecast 2025 to 2035

Flavors and Fragrances Market Analysis by Type, Nature, Application, and Region through 2035

Encapsulated Flavors and Fragrances Market Analysis by Product Type, Technology, Wall Material, End-use, Encapsulated Form, Process, and Region through 2035

Jewellery Box Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in the Jewellery Box Market

Leather Jewellery Box Market Size and Share Forecast Outlook 2025 to 2035

Paperboard Jewellery Box Market Growth & Trends Forecast 2024-2034

Luxury Fine Jewellery Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA