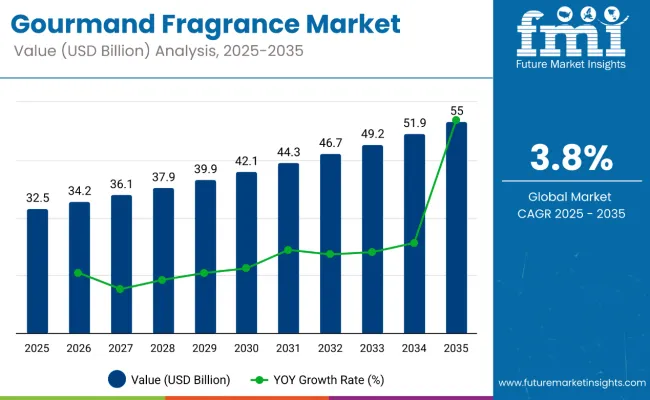

The global gourmand fragrance market has reached an estimated value of USD 32.55 billion in 2025, reflecting growing interest in sweet, edible-inspired scents across various consumer segments. A steady CAGR of 3.8% is projected through 2035, at which point the market is expected to reach USD 55.0 billion. In 2024, high consumer demand was recorded in both personal care and home care applications, especially in urban markets where self-care and scent-based indulgence have become increasingly important.

The year 2025 has seen a greater push toward olfactory innovation. A growing number of luxury and niche fragrance houses have expanded their gourmand portfolios by blending vanilla, praline, tonka bean, caramel, and fruity accords with smoky, spicy, or floral notes. One such development was the 2025 launch of a multi-sensory perfume capsule by a leading French brand that infused edible elements into limited-release scents for enhanced consumer engagement.

Compared to 2024, there has been a measurable rise in demand for fragrances that evoke emotion and nostalgia. Consumers have increasingly gravitated toward fragrances that mimic desserts and baked goods, driven by social media trends and the growing influence of sensory marketing. Natural and synthetic notes are being blended to achieve authenticity while maintaining performance and longevity. Synthetic materials such as ethyl maltol, coumarin, and vanillin continue to gain traction for their ability to create complex sweet profiles without allergenic risks or batch-to-batch inconsistencies.

The industry has also responded to growing clean-label preferences. In 2025, several brands introduced allergen-free synthetic gourmand blends that comply with evolving cosmetic regulations in the EU and North America. Innovation in microencapsulation and water-based formulation is also being adopted to extend wearability and reduce skin sensitivity.

Fragrance layering has emerged as a key trend, with consumers pairing multiple products across categories to achieve consistent and long-lasting olfactory signatures. As demand for comfort-driven, emotion-evoking products increases, the gourmand fragrance segment is expected to evolve further into both mass and prestige product lines.

Fragrance regulations aim to protect consumer health, promote transparency, and ensure environmental responsibility. These rules vary across regions but generally focus on ingredient safety, labeling, and adherence to standards. Regulatory bodies and industry best practices together help maintain quality and trust in the global fragrance industry.

The trade landscape of the gourmand fragrance market is shaped by shifting consumer preferences, regulatory compliance, and growing demand for premium, sensory-rich products. As the category gains traction for its edible-inspired notes like vanilla, caramel, chocolate, and spices, both export and import dynamics have evolved to support global expansion.

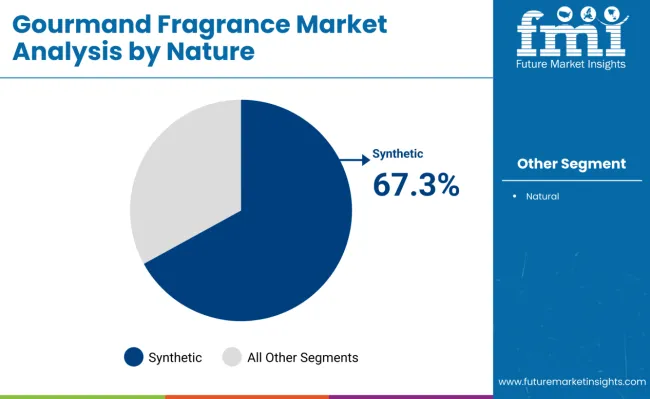

In 2025, synthetic fragrances are expected to account for 67.3% of the gourmand fragrance market, supported by their consistency, performance, and creative range. These formulations allow perfumers to mimic natural ingredients while enhancing them with lasting sweetness and warmth. Key molecules such as vanillin and ethyl maltol are widely used to construct gourmand scents that replicate caramel, cotton candy, and toasted sugar notes.

Unlike natural extracts, synthetics offer stability across large batches and are less affected by environmental conditions. This ensures uniform scent quality for mass-market applications like body mists, deodorants, and home sprays. For example, a global personal care brand launched a cocoa-inspired fragrance in 2024 using synthetic chocolate accords, achieving long-lasting scent diffusion while keeping the formula cost-effective.

Synthetics also help reduce dependence on limited natural resources, aligning with sustainability goals. Rare notes such as tonka bean or benzoin can now be recreated with lab-developed molecules, ensuring accessibility without environmental depletion. Additionally, synthetic ingredients pose fewer allergenic risks, making them suitable for sensitive skin applications and regulatory compliance. With brands aiming for wider reach and allergen-free claims, synthetic gourmand fragrances are expected to lead in both innovation and volume over the next decade.

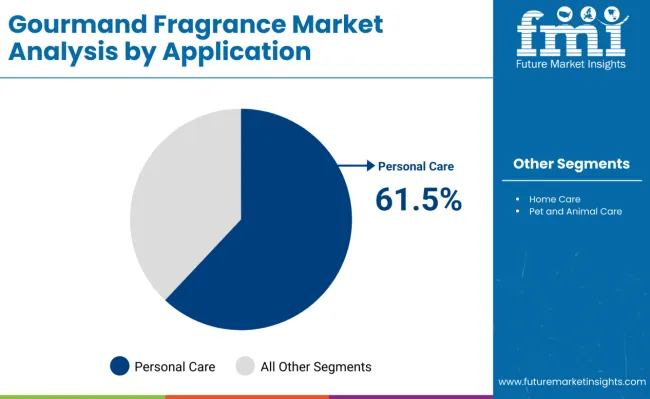

The personal care segment is projected to capture 61.5% of the gourmand fragrance market in 2025. These fragrances are increasingly favored in body lotions, shower gels, and perfumes due to their ability to evoke comfort, indulgence, and familiarity. Vanilla, honey, caramel, and almond notes are widely used to create an emotional connection between the product and the consumer.

Consumers in 2024 showed a strong preference for daily-use products that delivered both skincare benefits and a mood-enhancing olfactory experience. Brands responded by integrating dessert-inspired fragrances into body creams and mists, often positioning them as part of wellness or self-care routines.

These fragrances are particularly popular among younger demographics seeking playful, nostalgic, or emotionally charged scents. TikTok trends and influencer campaigns have propelled the popularity of fragrances that mimic baked goods or sweet treats. A 2025 launch of a marshmallow-scented face mist by a Korean beauty brand gained viral traction for its unique combination of scent and hydration.

With increasing demand for layered routines and sensorial skincare, the personal care application of gourmand fragrances is expected to retain dominance, with more cross-category blends and limited-edition launches in the years ahead.

Today, customers want their gourmand fragrances to be more personalized according to their taste and mood. Brands are using AI and machine learning to develop a customized scent profile according to individual tastes and moods. Subscription-based fragrance services and bespoke perfume experiences become popular as they offer exclusive, made-to-order gourmand scents for consumers to try.

Shoppers are now becoming attuned to sustainability such as eco-friendly packaging, responsible use of ingredients, and carbon-neutral production. The vegan and cruelty-free gourmands exemplify the rise of the ethical consumer. These companies are investing in biodegradable packaging and refillable perfume bottles to diminish environmental consequences while still being luxurious.

Once feminine fragrances, gourmand perfumes are no longer the exclusive domain of women. Bold, dark chocolate, coffee, tobacco, and whiskey gourmand fragrances are being developed for men and unisex use. This reflects a new trend of consumers looking for more diverse, inclusive, and boundary-pushing fragrance compositions.

E-commerce and digital scent technology redefine the purchase of fragrance. With the power of augmented reality and artificial intelligence-driven scent matching, consumers are now confident when buying gourmand fragrances online. Building brand loyalty is also helped through virtual fragrances, unique social media campaign experiences, and collaborations with influencers.

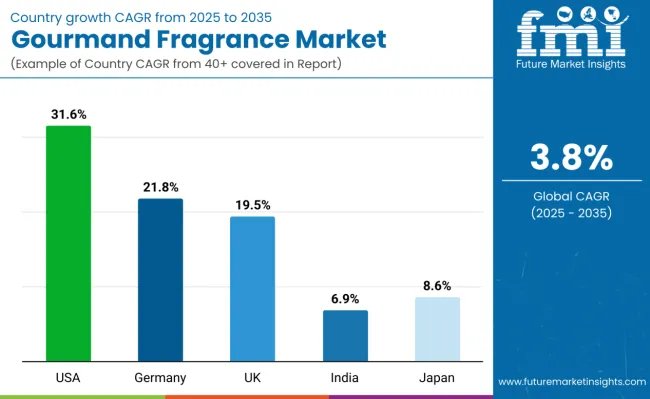

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 31.6% |

| Germany | 21.8% |

| UK | 19.5% |

| India | 6.9% |

| Japan | 8.6% |

The USA is expected to continue holding a large share of the gourmand fragrance market as consumers continue to show a taste for rich and indulgent scents. A stable economy and high demand for luxury personal care products are expected to drive steady growth in the market.

The men's grooming industry is growing immensely, with high growth in the usage of fragrances. Companies are bringing out campaigns that focus on male consumers, incorporating gourmand notes in men's fragrances to respond to changing tastes.

A niche consumer interest for distinctive and handmade fragrances has emerged. Specialist fragrance brands are pushing the boundaries of gourmand perfumes with novel usage of unexpected food notes like nutmeg, butter, and honey, which attracts consumers who prefer unusual olfactory experiences.

They all combine together to fuel growing USA gourmand fragrance market share, as there is a widespread trend toward individuated and affective scent experience.

The gourmand fragrance market in Germany is supposed to grow steadily. This market, along with a quality focus of the country, is being driven by premium and new fragrances. This, along with growing product innovations by top companies is leading to market growth.

The gourmand fragrance market in the UK is expected to grow steadily, driven by a growing interest in niche and personalized fragrances. Consumers' willingness to explore unique scent profiles supports the development and adoption of gourmand fragrances in the region.

Chinese domestic fragrance brands are gaining momentum, especially in the mass market segment. The brands are launching different fragrance forms and textures, such as gourmand fragrances, to suit different consumer tastes. This diversification is driving momentum in the fragrance market through the launch of products that appeal to local preferences.

With an increase in disposable incomes and a greater affinity toward luxury and premium personal care products, India's market will grow considerably. The growing middle class and urbanization are some of the factors contributing to the heightened demand for gourmand fragrances in the country.

There is probably going to be moderate growth in the Japanese market as consumers tend to prefer scents that are relatively discreet and mature. The growth also comes from the steady economy of Japan and their rich culture embracing premium, class products.

The market is concentrated, with three primary players dominating the global market - Chanel, Dior, and Guerlain. These giants are leading brands due to heritage, innovation, and strong distribution networks.

The main market concentrators are the European countries, especially France, with its strong fragrance houses and perfumery expertise. Italy and the UK also add value by manufacturing quality ingredients and supporting niche brands, which helps Europe maintain a leading position in the global market.

There exist both established brands and niche players in the USA market. Luxury brands have a ready market of spenders, whereas indie fragrance houses are gaining popularity through digital marketing and social media. The dynamic market ensures that innovation is never stagnant and consumers keep growing for gourmand fragrances.

International brands are spreading their wings across Asia Pacific, including India and Japan, thereby increasing market concentration. Rising disposable incomes and evolving consumer preferences are also driving demand for premium fragrances. Local brands are entering the market as well, thus making the competition scenario blend traditional ingredients with modern gourmand fragrance trends.

The market is competitive, which includes the age-old and growing companies battling for leadership. Strategic investment in the areas of R&D facilitates the innovation of some companies, while other companies introduce their innovative goods as based on changing consumer demand. In new markets with novel distribution systems, these organizations have heightened access to diversified consumers.

Companies implementing such strategies can include product innovation, mergers and acquisitions, and aggressive marketing campaigns. Big brands may go for limited editions of gourmand collections or partner with niche perfumers to suit shifting consumer tastes. Newcomer brands can look for unique differentiations through the development of novel product formulations where gourmand scents meet wellness attributes.

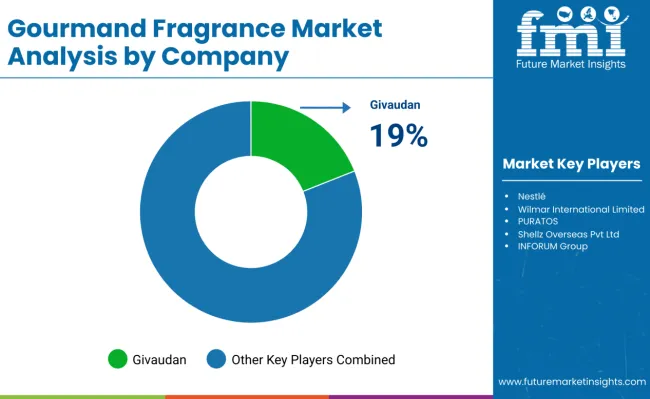

As per FMI analysis, major gourmand flavors and fragrances market players are Firmenich, Givaudan, Symrise, IFF, and Takasago. Other significant participants in the market for gourmand fragrances include INITIO Parfums Prives Perfumes and Colognes, Yves Saint Laurent Beauté, Dior, Lancome, MUGLER, and Guerlain. Other companies that are part of the market mainly through sourcing the ingredients and flavoring include Unigrà S.r.l., Blommer Chocolate Company, CEMOI, Cargill, Incorporated, and Nestlé.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 32.55 billion |

| Projected Market Size (2035) | USD 55.0 billion |

| CAGR (2025 to 2035) | 3.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand tons for volume |

| Nature Analyzed (Segment 1) | Natural, Synthetic |

| Applications Analyzed (Segment 2) | Personal Care Fragrance, Home Care Fragrance, Pet and Animal Care Fragrance |

| Sources Analyzed (Segment 3) | Honey, Chocolate, Vanilla, Almond, Others |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Gourmand Fragrance Market | Clover Hill Food Ingredients Ltd, Cargill, Incorporated, ADM WILD Europe GmbH & Co.KG, Nestlé, Wilmar International Limited, PURATOS, Shellz Overseas Pvt. Ltd., INFORUM Group, Buhler AG, Barry Callebaut, Unigrà S.r.l., Blommer Chocolate Company, CEMOI, HERZA Schokolade GmbH & Co. KG. |

| Additional Attributes | Growth in natural fragrance extraction technologies, Regional trends in personal and home care fragrance demand, Increasing use of gourmand scents in pet care products, Emergence of synthetic fragrance blends for longevity and aroma strength |

| Customization and Pricing | Customization and Pricing Available on Request |

With respect to nature, the market is classified into natural and synthetic.

In terms of application, the market is segmented into personal care fragrance, home care fragrance, and pet and animal care fragrance.

In terms of source, the market is divided into honey, chocolate, vanilla, almond, and others

In terms of region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The market is anticipated to reach USD 32.55 billion in 2025.

The market is predicted to reach a size of USD 55.0 billion by 2035.

Prominent players include HERZA Schokolade GmbH & Co. KG., Barry Callebaut, and others.

The USA is a prominent hub for product suppliers.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fragrance Control Module Assembly Market Size and Share Forecast Outlook 2025 to 2035

Fragrance Diffuser Market Size and Share Forecast Outlook 2025 to 2035

Fragrance Product Market Size and Share Forecast Outlook 2025 to 2035

Fragranced Personal Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fragrance Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Fragrance Fixatives Market Size and Share Forecast Outlook 2025 to 2035

Fragrance Jewellery Pods Market Analysis Size and Share Forecast Outlook 2025 to 2035

Fragrance Concentrates Market Size and Share Forecast Outlook 2025 to 2035

Fragrance-free Serum Market Report – Growth & Trends 2024-2034

Fragrance Oil Market

Smart Fragrance Box Market Analysis – Growth & Forecast 2025 to 2035

Herbal Fragrance Ingredients Market Analysis by Application, Ingredients, and Region Through 2035

Natural Fragrance Chemicals Market

Flavors and Fragrances Market Analysis by Type, Nature, Application, and Region through 2035

Encapsulated Flavors and Fragrances Market Analysis by Product Type, Technology, Wall Material, End-use, Encapsulated Form, Process, and Region through 2035

Demand for Encapsulated Flavors and Fragrances in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Encapsulated Flavors and Fragrances in USA Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA