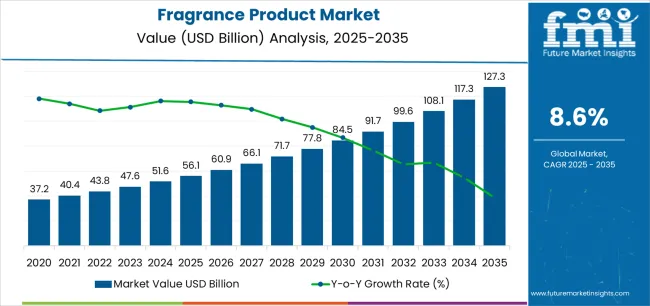

The Fragrance Product Market is estimated to be valued at USD 56.1 billion in 2025 and is projected to reach USD 127.3 billion by 2035, registering a compound annual growth rate (CAGR) of 8.6% over the forecast period.

The fragrance product market is experiencing steady expansion driven by rising consumer demand for personal care and lifestyle enhancement products. Market performance is being supported by growing disposable incomes, urbanization, and the global influence of fashion and grooming trends. Product innovation, combined with the introduction of new scent profiles and advanced formulation technologies, is enhancing product differentiation and broadening consumer appeal.

Regulatory compliance related to safety and environmental standards is shaping production strategies and ingredient sourcing. The increasing use of digital platforms and e-commerce channels has further strengthened product accessibility and market penetration across regions.

Over the forecast period, market growth is expected to be reinforced by heightened brand investments in sustainability, customization, and long-lasting formulations The ongoing shift toward high-performance fragrances and premium segments, along with continued development of diverse scent portfolios, will contribute to consistent market expansion and value creation across both mature and emerging economies.

| Metric | Value |

|---|---|

| Fragrance Product Market Estimated Value in (2025 E) | USD 56.1 billion |

| Fragrance Product Market Forecast Value in (2035 F) | USD 127.3 billion |

| Forecast CAGR (2025 to 2035) | 8.6% |

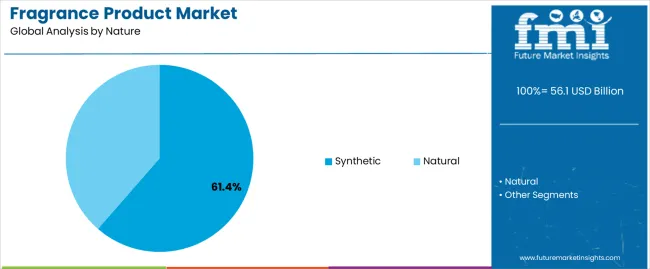

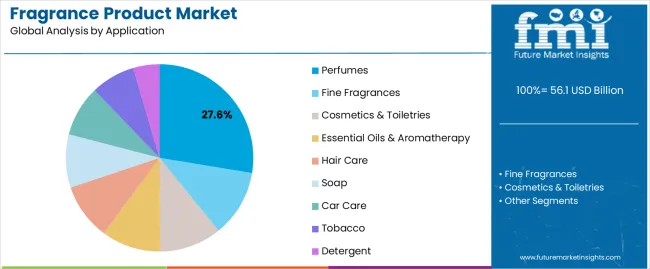

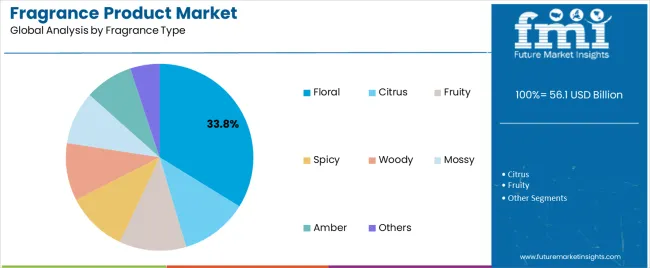

The market is segmented by Nature, Application, and Fragrance Type and region. By Nature, the market is divided into Synthetic and Natural. In terms of Application, the market is classified into Perfumes, Fine Fragrances, Cosmetics & Toiletries, Essential Oils & Aromatherapy, Hair Care, Soap, Car Care, Tobacco, and Detergent. Based on Fragrance Type, the market is segmented into Floral, Citrus, Fruity, Spicy, Woody, Mossy, Amber, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The synthetic segment, accounting for 61.40% of the nature category, is leading the market due to its cost efficiency, stability, and scalability in production. Synthetic fragrance compounds enable consistent quality and wide olfactory diversity, which has supported their dominance in mass-market and luxury formulations alike.

Manufacturers prefer synthetic ingredients for their reliability under varying environmental conditions and compatibility with multiple product types, including perfumes, cosmetics, and personal care items. Continuous innovation in aroma chemistry has improved safety and environmental profiles, addressing earlier concerns associated with synthetic origins.

The segment’s growth is also being driven by increased demand for complex and long-lasting scents that natural ingredients alone cannot achieve The ability to replicate rare or endangered natural notes without ecological impact has further strengthened its position in the global fragrance landscape.

The perfumes segment, representing 27.60% of the application category, has maintained leadership through sustained consumer preference for premium and signature scents. High adoption rates are being supported by lifestyle trends emphasizing personal grooming and self-expression. The segment benefits from robust brand marketing, celebrity endorsements, and strong retail visibility across both online and offline channels.

Product diversification into niche, gender-neutral, and artisanal categories has created additional growth momentum. Manufacturers are focusing on improving fragrance concentration, longevity, and skin compatibility to meet evolving customer expectations.

Technological innovations in encapsulation and controlled-release mechanisms are further enhancing performance As consumer purchasing power and aspirational consumption rise globally, the perfumes segment is expected to maintain its growth trajectory and continue driving overall market demand.

The floral segment, holding 33.80% of the fragrance type category, continues to dominate owing to its broad appeal and versatility across demographics. Floral notes remain foundational in fragrance development, offering familiarity and emotional resonance that align with both traditional and modern formulations.

The segment’s stability is supported by its integration in a wide range of products including perfumes, lotions, and air fresheners. Manufacturers are expanding floral blends by combining natural extracts with synthetic enhancements to achieve unique and long-lasting profiles.

Seasonal launches and limited-edition variants featuring exotic floral accords have further stimulated consumer engagement The enduring popularity of floral scents across cultures and product categories ensures continued leadership of this segment, reinforced by consistent innovation and consumer loyalty within the global fragrance market.

From 2020 to 2025, the fragrance product market experienced a CAGR of 7.9%. This growth was primarily driven by increasing disposable incomes, evolving consumer preferences towards premium and niche fragrances, and introducing innovative product offerings.

Market players capitalized on the rising demand for natural and organic fragrances, personalized scent solutions, and sustainable practices to maintain their competitive edge. During this period, the market faced intense competition, fluctuating raw material prices, and regulatory pressures regarding ingredient safety and environmental impact.

Looking ahead to the forecasted period from 2025 to 2035, the fragrance product market is expected to sustain its growth momentum with a projected CAGR of 9%. Several factors, including continued economic development in emerging markets, further advancements in fragrance technology, and the growing influence of digital platforms in marketing and distribution channels fuel this optimistic outlook.

Shifting consumer preferences towards wellness-oriented and experiential fragrance products are anticipated to drive market expansion. Market participants will need to navigate evolving consumer trends, regulatory landscapes, and competitive dynamics to capitalize on emerging opportunities and sustain growth in the forecasted period. Top of Form

| Historical CAGR from 2020 to 2025 | 7.9% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 9% |

The provided table illustrates the top five countries in terms of revenue, with India holding a prominent position in the market.

Fragrances play a significant role in Indian customs, rituals, and daily life, making them an integral part of the cultural fabric. This cultural affinity towards fragrances fuels a strong demand for fragrance products across various segments, including perfumes, incense sticks, aromatic oils, and scented personal care items.

The diverse consumer base, growing disposable incomes, and evolving consumer preferences contribute to the market growth and leadership position in the fragrance industry.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 6.3% |

| Canada | 7.3% |

| Italy | 6.1% |

| China | 7.6% |

| India | 8% |

In the United States, the fragrance product market finds extensive usage across various sectors. It is prominently utilized in the cosmetics and personal care industry, where fragrances are incorporated into products such as perfumes, colognes, body sprays, and scented lotions.

The home fragrance segment is significant, with consumers frequently using fragrance products such as candles, reed diffusers, and room sprays to create pleasant indoor environments. Fragrances are also utilized in household cleaning products, air fresheners, and laundry detergents, catering to consumer preferences for pleasant scents in their daily lives.

Similar to the United States, fragrance products in Canada are widely used across multiple sectors. In the personal care industry, fragrances are integral components of perfumes, body mists, and skin care products, appealing to consumers' desire for enhanced grooming and self-expression.

The home fragrance market is growing steadily, driven by the demand for ambient scenting solutions such as diffusers, scented candles, and room sprays to create cozy and inviting living spaces. Fragrances are also utilized in household cleaning products and air care solutions to impart freshness and cleanliness.

Italy has a rich tradition in the fragrance industry, with fragrances deeply embedded in various aspects of life. In Italy, fragrance products are extensively used in the luxury cosmetics and perfumery sector, where Italian brands are renowned for their craftsmanship and artistry in creating exquisite fragrances. Perfumes, colognes, and scented skincare products are highly sought after by Italian consumers, reflecting their appreciation for quality and sophistication.

Fragrances play a significant role in Italian culture, with scented candles and home fragrances commonly used to enhance the ambiance of homes and public spaces, especially during social gatherings and festivities.

The fragrance product market in China is experiencing rapid growth, driven by increasing urbanization, rising disposable incomes, and evolving consumer lifestyles.

Fragrances are primarily utilized in the personal care sector, with perfumes, body sprays, and scented skincare products gaining popularity among Chinese consumers seeking self-expression and luxury experiences.

The home fragrance market is expanding, fueled by the growing trend of home decor and wellness, with consumers incorporating diffusers, scented candles, and room sprays to create tranquil and harmonious living environments. Fragrances are also used in air care products and luxury household items, catering to consumers' desire for premium and functional products.

In India, the fragrance product market is diverse and multifaceted, with fragrances deeply ingrained in the cultural and religious traditions of the country. Fragrances are extensively used in the personal care industry, with perfumes, deodorants, and scented body lotions popular among Indian consumers, especially the youth segment.

Fragrances play a significant role in spiritual and religious practices, with incense sticks, aromatic oils, and floral waters commonly used in rituals and ceremonies across different communities. The home fragrance market is growing steadily, with consumers adopting diffusers, scented candles, and air fresheners to create pleasant and inviting home environments.

The below section shows the leading segment. Based on nature, the synthetic segment is accounted to hold a market share of 32.6% in 2025. Based on the distribution channel, the offline segment is anticipated to hold a market share of 79.4% in 2025.

Synthetic fragrances can be produced at a lower cost compared to natural alternatives, making them more accessible to a wider range of consumers. The offline distribution channel has continued its dominance and is driven by the unique sensory experiences and personalized services it offers consumers.

| Category | Market Share in 2025 |

|---|---|

| Synthetic | 32.6% |

| Offline | 79.4% |

Based on nature, the synthetic segment holds a significant market share of 32.6%. This indicates that a considerable portion of fragrance products available in the market are synthesized rather than derived from natural sources. Synthetic fragrances are created through chemical processes to mimic natural scents or develop new fragrances.

The substantial share suggests a strong demand for synthetic fragrances due to cost-effectiveness, consistency in scent, and versatility in creating a wide range of fragrance options to cater to diverse consumer preferences.

Based on distribution channels, the offline segment is projected to dominate, with a market share of 79.4% in 2025. Offline distribution channels include brick-and-mortar stores such as specialty fragrance shops, department stores, supermarkets, and pharmacies.

The dominance highlights the continued significance of traditional retail channels in the fragrance industry despite the growing influence of e-commerce. Consumers often prefer offline channels for fragrance purchases as they provide opportunities for sensory experiences, such as sampling and testing fragrances before making a purchase. Offline channels offer personalized assistance from sales representatives, fostering consumer trust and satisfaction.

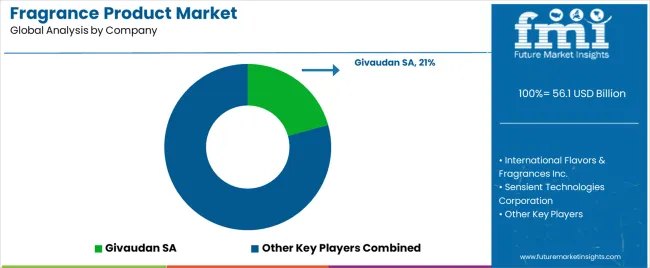

The competitive landscape of the fragrance product market is characterized by a diverse array of players ranging from global fragrance houses to niche artisanal brands.

Smaller players are gaining traction by offering unique and innovative fragrance formulations tailored to specific consumer preferences. The market is also witnessing increased competition from direct-to-consumer brands leveraging digital platforms for marketing and distribution.

Some of the key developments

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 56.1 billion |

| Projected Market Valuation in 2035 | USD 127.3 billion |

| Value-based CAGR 2025 to 2035 | 8.6% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered |

North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East and Africa |

| Key Market Segments Covered |

Nature, Application, Fragrance Type, Region |

| Key Countries Profiled |

The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled |

International Flavors & Fragrances Inc.; Sensient Technologies Corporation; Givaudan SA; Symrise AG; Firmenich International SA; Takasago International Corporation; Avon Products, Inc.; CavinKare Pvt. Ltd; Henkel AG & Co.; Lion Corporation |

The global fragrance product market is estimated to be valued at USD 56.1 billion in 2025.

The market size for the fragrance product market is projected to reach USD 127.3 billion by 2035.

The fragrance product market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in fragrance product market are synthetic and natural.

In terms of application, perfumes segment to command 27.6% share in the fragrance product market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fragranced Personal Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fragrance Diffuser Market Size and Share Forecast Outlook 2025 to 2035

Fragrance Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Fragrance Fixatives Market Size and Share Forecast Outlook 2025 to 2035

Fragrance Jewellery Pods Market Analysis Size and Share Forecast Outlook 2025 to 2035

Fragrance Concentrates Market Size and Share Forecast Outlook 2025 to 2035

Fragrance-free Serum Market Report – Growth & Trends 2024-2034

Fragrance Oil Market

Smart Fragrance Box Market Analysis – Growth & Forecast 2025 to 2035

Herbal Fragrance Ingredients Market Analysis by Application, Ingredients, and Region Through 2035

Natural Fragrance Chemicals Market

Gourmand Fragrance Market Analysis - Size, Share, and Forecast 2025 to 2035

Flavors and Fragrances Market Analysis by Type, Nature, Application, and Region through 2035

Encapsulated Flavors and Fragrances Market Analysis by Product Type, Technology, Wall Material, End-use, Encapsulated Form, Process, and Region through 2035

Product Life-Cycle Management (PLM) IT Market Size and Share Forecast Outlook 2025 to 2035

Product Analytics Software Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Production Logistics Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA