The Men's Grooming Product Market is estimated to be valued at USD 6.8 billion in 2025 and is projected to reach USD 14.9 billion by 2035, registering a compound annual growth rate (CAGR) of 8.2% over the forecast period.

| Metric | Value |

|---|---|

| Men's Grooming Product Market Estimated Value in (2025 E) | USD 6.8 billion |

| Men's Grooming Product Market Forecast Value in (2035 F) | USD 14.9 billion |

| Forecast CAGR (2025 to 2035) | 8.2% |

The men’s grooming product market is expanding steadily with rising awareness of personal care, evolving lifestyle patterns, and increasing influence of digital media on consumer preferences. Current dynamics are defined by higher adoption of multifunctional grooming products, continuous innovation in formulations, and the introduction of natural and premium-grade ingredients that align with changing consumer expectations. Demand is being shaped by urbanization, improved disposable incomes, and a growing cultural shift toward self-care among male consumers.

Distribution has been enhanced through strong penetration of online platforms and omnichannel strategies, enabling wider accessibility across both developed and emerging economies. The future outlook reflects sustained growth as premiumization trends intensify, product lines diversify, and regional brands strengthen market competition.

Growth rationale is supported by brand investments in targeted marketing campaigns, endorsement by influencers, and technological innovation in product delivery formats These developments are expected to reinforce market expansion, increase brand loyalty, and drive consistent revenue growth across multiple consumer demographics.

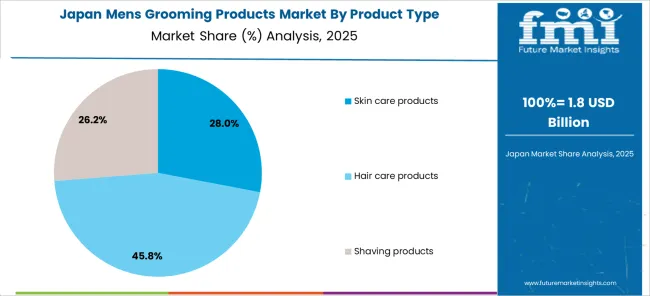

The skin care segment, holding 27.4% of the product type category, has emerged as the leading product type due to growing demand for facial cleansers, moisturizers, and anti-aging solutions specifically tailored for men. Its share has been supported by rising awareness of dermatological health and the integration of preventive care products into daily grooming routines.

Innovation in lightweight, fast-absorbing, and natural ingredient-based formulations has strengthened consumer acceptance. Market expansion has also been influenced by the adoption of premium and dermatologist-recommended skincare lines, which appeal to health-conscious consumers.

Strong retail visibility and digital campaigns have enhanced awareness, while the proliferation of subscription-based services and personalized skincare recommendations is expected to further drive growth The segment’s sustained leadership is supported by continuous product innovation and alignment with consumer preferences for holistic personal care.

The premium segment, representing 38.6% of the price range category, has maintained dominance due to rising disposable incomes and the shift toward aspirational purchasing behaviors among men. Premium grooming products are being perceived as offering superior quality, advanced formulations, and brand prestige, which have strengthened demand across both urban and semi-urban markets.

The segment has benefited from increased brand positioning in wellness and lifestyle categories, appealing to consumers seeking exclusivity and authenticity. Premiumization has also been supported by luxury packaging, limited edition product lines, and strong distribution across high-end retail outlets and online specialty platforms.

With growing emphasis on self-image and personal grooming, the segment is expected to witness further growth as consumers increasingly associate premium products with performance, safety, and lifestyle enhancement.

The e-commerce and online segment, accounting for 32.1% of the distribution channel category, has become the leading channel due to rising internet penetration, rapid adoption of smartphones, and consumer preference for convenience-driven shopping experiences. Online platforms have enabled direct-to-consumer strategies, expanded product variety, and facilitated personalized recommendations through AI-driven analytics.

The segment’s dominance has been reinforced by aggressive digital marketing campaigns, influencer endorsements, and the popularity of subscription-based grooming kits. Competitive pricing, bundled offers, and seamless delivery systems have further accelerated adoption.

Trust in online transactions has been strengthened by secure payment systems and easy return policies, making e-commerce a preferred channel The segment is expected to sustain its leadership as digital ecosystems expand, with omnichannel integration and direct brand-to-consumer engagement further enhancing growth prospects in both mature and emerging markets.

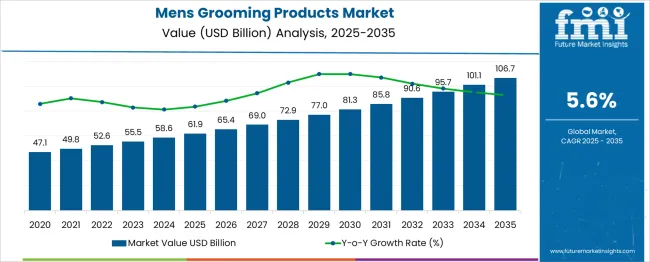

The demand for men's grooming products grew during the historical period from 2020 to 2025, propelled by the emergence of niche grooming companies and rising awareness of personal grooming. This trend of product diversification, including eco-friendly options and technologically advanced inventions like smart razors, is expected to continue until 2035.

Sustainable ingredients and packaging ought to be a key concern in 2025. With individualized grooming products and a focus on mental wellness incorporated into grooming practices, the men's grooming product market is expected to become mainstream by 2035. There is a rising demand for men’s grooming products in the market.

The section shows the market analysis of men's grooming products divided into categories. The thorough research shows that the mid-range segment leads the price range category, and the shave care segment dominates the product type category.

The shave care segment leads the sales of men’s grooming products since it plays a crucial part in men's everyday grooming routines. A well-groomed appearance is mostly dependent on shaving goods, including lotions, razors, and aftershaves. This product line is in demand because men of all ages and demographics utilize it daily.

| Top Product | Shave Care |

|---|---|

| Market Share in 2025 | 41.6% |

A diverse array of high-quality and innovative products that cater to varying consumer preferences characterize the shaving products sector. The shave care segment is dominant in the men's cosmetics market because of its availability in a wide range of alternatives and the universal demand for shaving among the male population.

Since it offers a mix of quality and price, the mid-range sector dominates the men's grooming product market. Mid-range products are accessible to a broader population since they are positioned between premium and low-priced options and appeal to a wider consumer base.

| Top Price Range | Mid |

|---|---|

| Market Share in 2025 | 51.5% |

Customers in the mid-range category typically look for products that offer decent quality and are good value for their money. Seeking an ideal middle ground between the luxury of high-end goods and the affordability of low-cost ones, the mid-range segment draws a sizeable share and boosts men's grooming product sales.

The following section focuses on the top economies in Asia Pacific, North America, and Europe, displaying the market for male grooming and personal care products. Based on a comprehensive review, Asia Pacific is an important region because of the presence of major men's grooming product manufacturers.

Evolving Market Trends in Men's Grooming Products in Japan

Popularity of Anti-aging Products in China

China's growing urban middle class is boosting the men's cosmetics market's rapid expansion via increasing disposable income.

| Countries | CAGR (2025 to 2035) |

|---|---|

| Japan | 12.3% |

| China | 9.4% |

| India | 8.8% |

Grooming Revolution in India Instigated by Ayurveda, Tier 2 Cities, and Online Sales

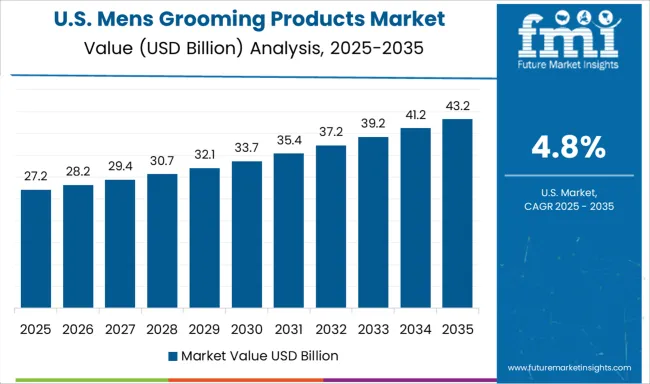

Changing Trends for Men's Grooming Products in the United States

| Countries | CAGR (2025 to 2035) |

|---|---|

| Canada | 8.8% |

| United States | 6.2% |

Men's Grooming Products Gain Ground in Canada

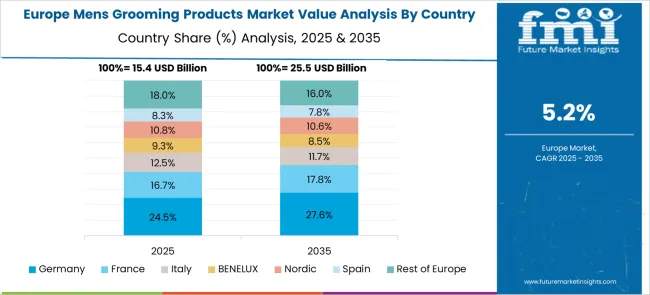

Italy Men's Grooming Industry Embraces Premium Personal Care

France's Growing Male-Specific Grooming and Skincare Market

Men's Grooming Market in Germany Reflects the Love for Facial Hair

| Countries | CAGR (2025 to 2035) |

|---|---|

| Spain | 7.7% |

| Italy | 5.6% |

| France | 4.6% |

| United Kingdom | 3.9% |

| Germany | 3.6% |

The United Kingdom Emerges as a Hub for Anti-Aging and Personalized Grooming

Minimalistic and Eco-Conscious Trends in Spain

Men's grooming products are a somewhat competitive business, with numerous manufacturers vying for market dominance. The men's grooming industry competitors have employed various expansion strategies, including partnerships, acquisitions, and mergers.

Men's grooming product manufacturers are using sustainability as a tactic to increase their market share. Marketing and branding strategies are expected to shift in favor of eco-friendly items as more customers prefer companies with green labels and charity endeavors, increasing men's grooming product sales.

Cutting-Edge Breakthroughs

| Company | Details |

|---|---|

| L'Oréal S.A | To expand its ethical product offerings in the very competitive male grooming product industry, L'Oréal purchased the superfood skincare expert Youth to the People in the United States in January 2025. |

| Beiersdorf AG | Beiersdorf AG's Nivea Men brand introduced a skincare moisturizer of recycled carbon dioxide in April 2025. The product was obtained through the carbon capture and utilization (CCU) method. The climate care moisturizer gives the skin a revitalizing moisture boost and a calming effect. |

| Michael Strahan | In September 2025, Michael Strahan unveiled a line of men's skincare products that included a face and beard wash that hydrates, a beard oil that nourishes, a clear shave lotion, a moisturizer for the face and neck, and a soothing post-shave balm. |

| Gillette | Gillette introduced King C. Gillette, a whole line of male grooming and beard care products, in May 2024. Three categories, including shave and edge, trim, and care, were used to group the range. |

The global men's grooming product market is estimated to be valued at USD 6.8 billion in 2025.

The market size for the men's grooming product market is projected to reach USD 14.9 billion by 2035.

The men's grooming product market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in men's grooming product market are skin care, shave care, hAIr care, toiletries, fragrances and others.

In terms of price range, premium segment to command 38.6% share in the men's grooming product market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Men's Intimate Care Products Market - Trends, Growth & Forecast 2025 to 2035

Men's Intimate Hygiene Products Market Size and Share Forecast Outlook 2025 to 2035

Women's Intimate Care Product Market Size and Share Forecast Outlook 2025 to 2035

Pet Grooming Market Trends - Size, Share & Forecast 2025 to 2035

Beard Grooming Products Market Size and Share Forecast Outlook 2025 to 2035

Men’s Grooming Products Market Size and Share Forecast Outlook 2025 to 2035

Cattle Grooming Chute Market Size and Share Forecast Outlook 2025 to 2035

Mobile Grooming Services Market Size and Share Forecast Outlook 2025 to 2035

UK Pet Grooming Market Analysis - Size, Demand & Forecast 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

In Motion Dimensioning Systems Market Analysis Size and Share Forecast Outlook 2025 to 2035

Menstrual Care Market - Size, Share, and Forecast Outlook 2025-2035

Menstrual Cups Market Growth - Trends & Forecast 2025 to 2035

Menstrual Cup Foam Wash Market Trends - Growth & Demand From 2025 to 2035

Product Tour Software for SaaS Market Size and Share Forecast Outlook 2025 to 2035

Product Life-Cycle Management (PLM) IT Market Size and Share Forecast Outlook 2025 to 2035

Product Analytics Software Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Production Logistics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA