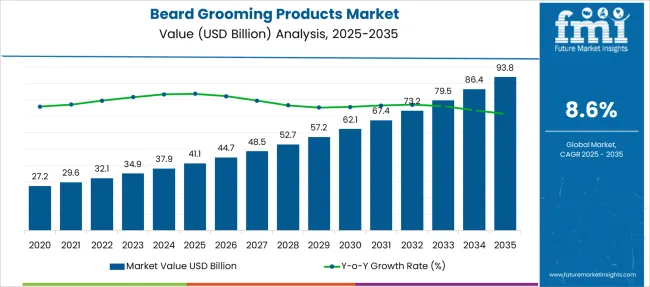

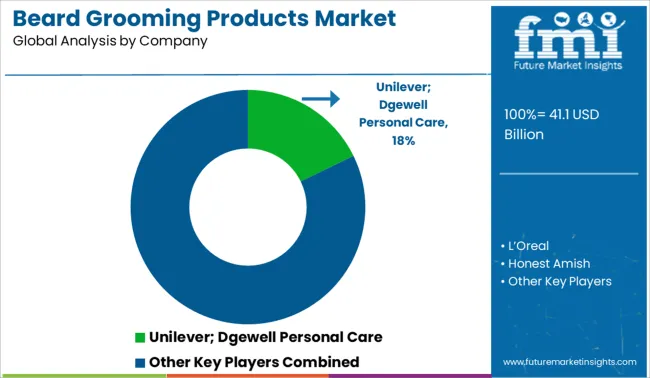

The Beard Grooming Products Market is estimated to be valued at USD 41.1 billion in 2025 and is projected to reach USD 93.8 billion by 2035, registering a compound annual growth rate (CAGR) of 8.6% over the forecast period.

| Metric | Value |

|---|---|

| Beard Grooming Products Market Estimated Value in (2025 E) | USD 41.1 billion |

| Beard Grooming Products Market Forecast Value in (2035 F) | USD 93.8 billion |

| Forecast CAGR (2025 to 2035) | 8.6% |

The beard grooming products market is witnessing steady expansion, fueled by the rising global popularity of facial hair styling and increasing awareness regarding personal grooming among male consumers. Shifts in cultural norms, social media influence, and a growing preference for premium grooming routines have elevated the demand for specialized beard care solutions.

Manufacturers are responding with clean-label formulations, natural ingredients, and packaging innovations that cater to modern aesthetic and sustainability preferences. In urban markets, the grooming category is benefiting from a wider retail footprint and growing online visibility, while emerging markets are seeing uptake driven by aspirational trends and expanding middle-class populations.

Continued investment in influencer-led brand positioning, along with the proliferation of subscription-based grooming services, is expected to strengthen consumer loyalty and category penetration across household segments.

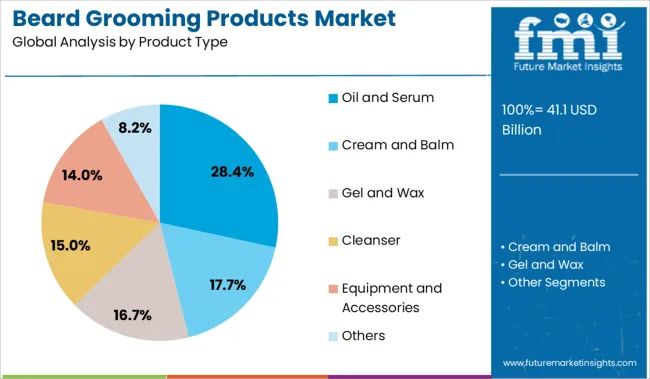

The market is segmented by Product Type, Product Function, End User, Price Range, and Distribution Channel and region. By Product Type, the market is divided into Oil and Serum, Cream and Balm, Gel and Wax, Cleanser, Equipment and Accessories, and Others. In terms of Product Function, the market is classified into General Purpose and Medicated. Based on End User, the market is segmented into Household and Commercial. By Price Range, the market is divided into Economic and Premium. By Distribution Channel, the market is segmented into Online Store, Hypermarket/Supermarket, Specialty Stores, Independent Stores, Official Websites, and Direct Sales. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Oil and serum products are expected to lead the market with a 28.4% share in 2025, establishing them as the preferred product type in the beard grooming category. This leadership is being driven by their multifunctional benefits in conditioning, moisturizing, and promoting healthier beard growth.

Consumer preference has shifted toward lightweight, non-greasy formulations that offer both nourishment and aesthetic shine, especially in daily routines. Oils and serums have also gained traction due to their compatibility with natural ingredients such as argan, jojoba, and essential oils, which appeal to users seeking clean and organic grooming solutions.

Their ease of application and quick absorption make them ideal for busy consumers, while the versatility of usage across beard lengths and textures supports widespread adoption.

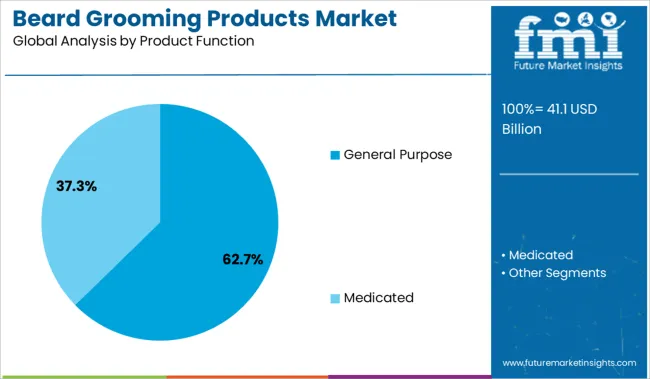

General purpose products are projected to account for 62.7% of market revenue in 2025, making them the dominant function type within the category. This segment's strength lies in its ability to address multiple grooming concerns through single formulations, including cleansing, moisturizing, detangling, and conditioning.

Time-conscious consumers are increasingly opting for all-in-one solutions that reduce complexity in personal care routines. The demand is also being fueled by the availability of multifunctional beard balms, oils, and washes that deliver comprehensive care with fewer SKUs.

As cost-efficiency and convenience remain key purchase drivers, brands offering value-oriented, general-purpose grooming lines are seeing sustained uptake across diverse consumer groups.

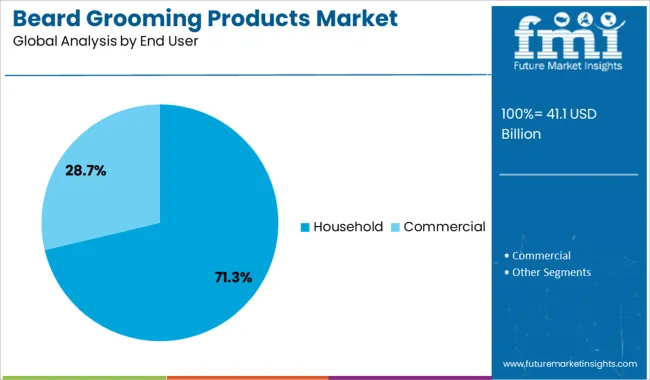

Household users are anticipated to contribute 71.3% of the overall revenue in 2025, making this the leading end-user segment in the beard grooming products market. This segment's growth is being fueled by the mainstreaming of beard care as a part of daily grooming habits among men across various age groups.

The COVID-19 era accelerated the normalization of at-home grooming, leading to long-term behavioral shifts toward self-care and personal maintenance. Increased accessibility through e-commerce, retail chains, and D2C platforms has enabled household consumers to explore and invest in quality grooming solutions.

Additionally, rising disposable incomes and greater awareness about grooming regimens have supported continued purchases of customized and routine-specific products within the household segment.

Beard is becoming a fashion statement for men all over the world. To maintain and keep beards neat, customers are regularly using beard grooming products. Increased awareness about these products and accessories among consumers is helping in market expansion.

Manufacturers are actively trying to attract customers by giving them offers and loyalty points on purchases. Effective advertisement, brand endorsement by celebrities, and marketing through social media and influencers are proving effective in increasing the market value.

Many manufacturers and brands have dedicated websites for product sales. These products are also available in online market stores, making ordering and receiving them easy, even in remote areas.

As these products are available everywhere and easily, and the customers from urban areas have high disposable income, they are willing to spend money on premium products. Also, an increase in shopping habits and the development of public malls and specialty stores are responsible for the market boost.

The main restraint to the beard grooming products market is the counterfeit products and premium price range of products.

Counterfeit manufacturers use low-quality raw ingredients, affecting the overall effectiveness of the product. Sometimes, these products can cause skin issues and injuries. Such problems can directly affect genuine brands, reducing sales and customer preference. These counterfeit products also have low prices compared to original products, which attracts customers and ultimately, affects the market.

As many brands use natural ingredients in their products, they are quite expensive. These products are sometimes considered premium. People having high disposable income can purchase and use these products regularly to get maximum results. People on strict budgets can’t purchase these products regularly, resulting in the loss of a big chunk of customers.

European countries are observing a rise in beard grooming products, as men all around Europe are wearing beards. Spanish men started transplanting beards in 2020. Facial hair became a trend and is considered as a sex symbol and women found men with facial hair attractive. Also, abundant men’s salons are responsible for the increase in sales of beard grooming products in Spain.

India is becoming a growing market for beard grooming products. India had the traditional importance of keeping a beard, and post-COVID effects on beard-wearing habits are responsible for the rise of beard grooming products in India. Men in urban areas are willing to spend money to look good and spend a considerable amount of money on grooming products.

Some key players in the Beard Grooming Products market are Unilever, Dgewell Personal Care, L’Oreal, Honest Amish, Badass Beard Care, Herbivore Botanicals, Beiersdorf, Anthony Brands, Beardbrand, Harry’s Inc., Tweezerman International, Newport Apothecary Inc., Walker & Company Brands, Kiehl's, Clarisonic, Prospector Co., BAXTER OF CALIFORNIA, Procter & Gamble, Koninklijke Philips N.V., ZILBERHAAR and Conde Nast and others. These are popular and well-known brands all over the world.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 8.6% from 2025 to 2035 |

| The base year for estimation | 2024 |

| Historical Data Available for | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative units | Revenue in USD Billion, volume in Units, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, pricing analysis |

| Segments Covered | Product Type, Product Function, End User, Price Range, Distribution Channel, Region |

| Country scope | USA, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, Russia, India, Thailand, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, United Arab Emirates, South Africa |

| Key Companies Profiled | Unilever; Dgewell Personal Care; L’Oreal; Honest Amish; Badass Beard Care; Herbivore Botanicals; Beiersdorf; Anthony Brands; Beardbrand; Harry’s Inc.; Tweezerman International; Newport Apothecary Inc.; Walker & Company Brands; Kiehl's; Clarisonic; Prospector Co.; BAXTER OF CALIFORNIA; Procter & Gamble; Koninklijke Philips N.V.; ZILBERHAAR; Conde Nast; Others |

| Customization scope | Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global beard grooming products market is estimated to be valued at USD 41.1 billion in 2025.

The market size for the beard grooming products market is projected to reach USD 93.8 billion by 2035.

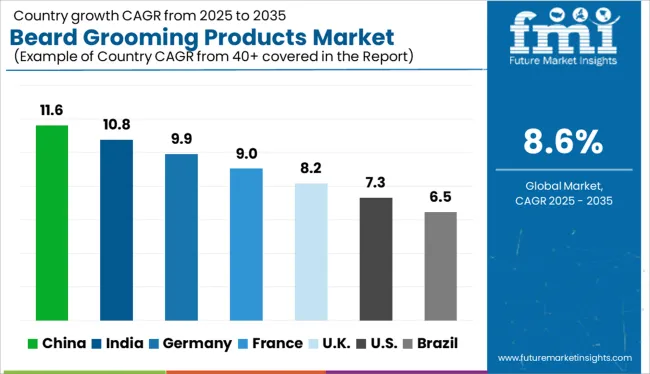

The beard grooming products market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in beard grooming products market are oil and serum, cream and balm, gel and wax, cleanser, equipment and accessories and others.

In terms of product function, general purpose segment to command 62.7% share in the beard grooming products market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beard Straightener Market

Beard Oil Market Trends – Growth & Forecast 2019-2029

Men Beard Care Market Analysis – Demand & Growth 2024-2034

Market Share Insights of Men's Beard Care Product Providers

Pet Grooming Market Trends - Size, Share & Forecast 2025 to 2035

Men's Grooming Product Market Size and Share Forecast Outlook 2025 to 2035

Men’s Grooming Products Market Size and Share Forecast Outlook 2025 to 2035

Cattle Grooming Chute Market Size and Share Forecast Outlook 2025 to 2035

Mobile Grooming Services Market Size and Share Forecast Outlook 2025 to 2035

UK Pet Grooming Market Analysis - Size, Demand & Forecast 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

Teff Products Market

Detox Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Algae Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pulse Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Products Market Analysis by Product Type, End Use, Distribution Channel and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA