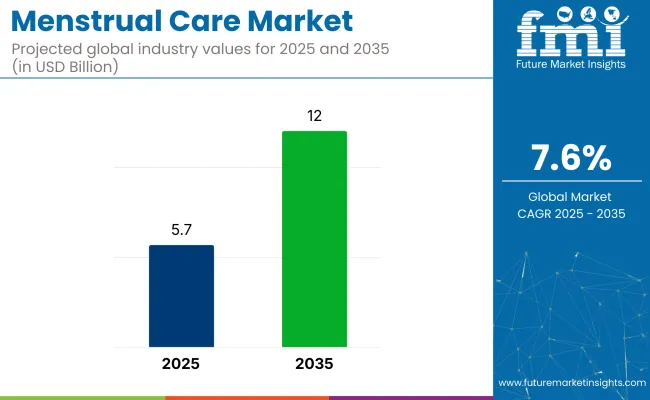

The global menstrual care market is valued at USD 5.7 billion in 2025 and is slated to reach USD 12 billion by 2035, reflecting a CAGR of 7.6%.

| Metric | Value |

|---|---|

| 2025 Market Value | USD 5.7 billion |

| 2035 Market Value | USD 12 billion |

| CAGR (2025 to 2035) | 7.6% |

Growth has been driven by the increasing demand for nutritional support, functional foods, and dietary supplements to manage menstrual health effectively. Innovations in carbohydrate-infused beverages, adaptogen blends, and vitamins tailored for hormonal balance are being prioritized.

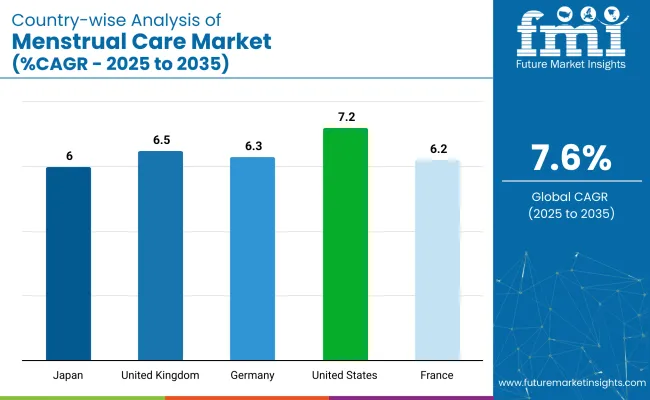

The USA remains the largest market, projected to grow at a CAGR of 7.2% from 2025 to 2035, driven by high consumer awareness, strong demand for hormonal supplements, and innovations in functional foods and beverages. The UK ranks second with a CAGR of 6.5%, supported by rising preference for plant-based, clean-label products.

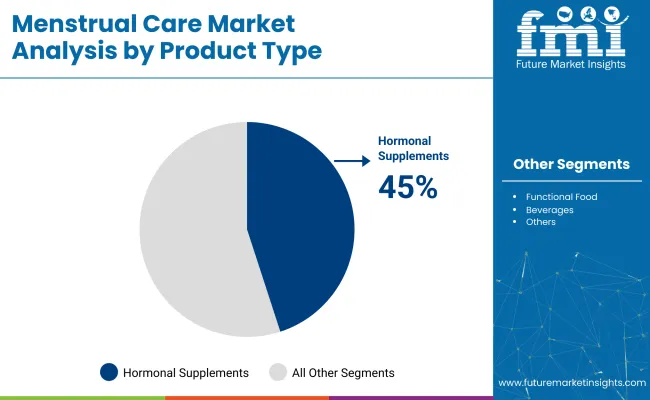

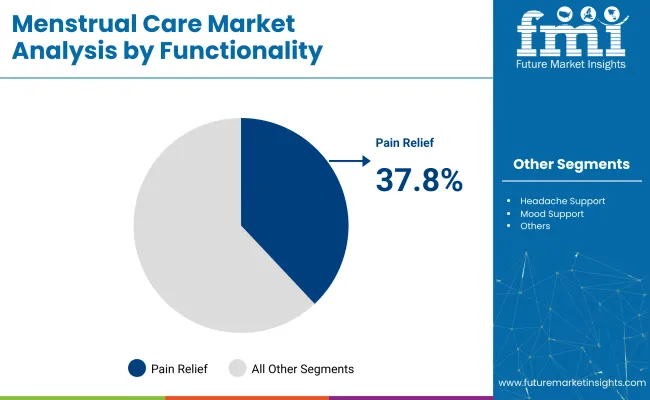

Germany holds the third spot with a CAGR of 6.3%, driven by demand for natural remedies and strong pharmacy distribution. Hormonal supplements lead the market with a 45% share, while pain relief is expected to lead the functionality segment and is likely to hold a 37.8% share in 2025.

The menstrual care market holds varying percentages across its parent markets. Within the global women’s health market, it accounts for approximately 6-8%, driven by a rising focus on menstrual wellness. In the personal care sector, menstrual care contributes around 3-4%, primarily from sanitary products, supplements, and wellness beverages.

Within nutraceuticals, it holds roughly 2-3%, as menstrual supplements remain a niche but growing category. In functional foods and drinks, the share is under 2%, reflecting its emerging status. Overall, while menstrual care remains a smaller segment, its growth potential is significant due to increasing awareness, personalized formulations, and global wellness trends.

The menstrual care market is segmented by product type, flavour type, form, functionality, sales channel, and region. By product type, the market includes functional food (fortified snacks and beverages, specialized foods such as protein bars with added nutrients and dark chocolate), beverages (probiotic drinks, herbal teas, smoothies), supplements (hormonal supplements, non-hormonal supplements, nutritional supplements), and others (including menstrual relief patches, heating pads, and topical creams). Based on flavour type, it is segmented into apple, spearmint, cinnamon, ginger, raspberry, and others (including lemon, chamomile, hibiscus, and mixed berry blends).

By form, the market includes gummies, tablets, capsules, powders, and soft gels. Based on functionality, it is categorized into headache support, mood support, energy support, hormonal support, pain relief, hydration balance, and pre-menstrual syndrome support.

By sales channel, it is segmented into store-based retail (hypermarket/supermarket, convenience store, specialty store, pharmacies) and online retail (company website, third-party website, social media selling). Regionally, the market is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Russia & Belarus, and the Middle East & Africa.

Hormonal supplements are identified as the most lucrative segment overall, capturing 45% of the market share.

Ginger is identified as the most lucrative flavour type in the market, capturing approximately 28% of the overall flavour segment share.

Tablets are identified as the most lucrative form in the market, holding around 26.4% of the total form segment share.

Pain relief leads functionality segments with a 37.8% market share.

Pharmacies are identified as the most lucrative sales channel in the market, holding 32% of the total sales channel share.

The global menstrual care market is growing steadily, driven by increasing awareness of menstrual health, rising demand for targeted hormonal and pain relief solutions, and advancements in functional food, beverage, and supplement formulations.

Recent Trends in the Menstrual Care Market

Challenges in the Menstrual Care Market

Among the top five countries in the menstrual care market, the USA leads with the highest projected CAGR of 7.2% from 2025 to 2035, driven by strong consumer awareness and innovative supplement launches. The UK follows with a CAGR of 6.5%, supported by rising demand for plant-based and eco-friendly products.

Germany is projected to grow at a CAGR of 6.3%, with a focus on clean-label and organic solutions. France shows a CAGR of 6.2%, driven by herbal teas and hormonal supplements, while Japan records the lowest among these at 6.0%, driven by probiotics, gummies, and e-commerce expansion.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA menstrual care products market is projected to grow at a CAGR of 7.2% from 2025 to 2035.

Sales of menstrual care products in the UK are projected to grow at a CAGR of 6.5% from 2025 to 2035.

The revenue from menstrual care products in Germany is forecasted to grow at a CAGR of 6.3% from 2025 to 2035.

The sales of menstrual care products in France are projected to grow at a CAGR of 6.2% from 2025 to 2035.

Sales of menstrual care products in Japan are projected to grow at a CAGR of 6.0% from 2025 to 2035.

The menstrual care market is moderately consolidated, with a mix of established players and emerging brands. Leading companies, such as Happy Mammoth, NOW Foods, and Bayer AG, dominate the market due to their extensive product portfolios and global reach.

Happy Mammoth is an Australian company that offers natural supplements to support hormonal balance and gut health. Customers have given positive reviews for their main product, Hormone Harmony™, because it helps alleviate menopause symptoms and enhances overall well-being.

Recent Menstrual Care Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 5.7 billion |

| Projected Market Size (2035) | USD 12 billion |

| CAGR (2025 to 2035) | 7.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion/Volume (Units) |

| By Product Type | Functional Food (Fortified Snacks and Beverages, Specialized Foods [Protein Bars with Added Nutrients, Dark Chocolate]), Beverages (Probiotic Drinks, Herbal Teas, Smoothies), Supplements (Hormonal Supplements, Non-Hormonal Supplements, Nutritional Supplements), Others (Menstrual Relief Patches, Heating Pads, Topical Creams) |

| By Flavour Type | Apple, Spearmint, Cinnamon, Ginger, Raspberry, Others (Lemon, Chamomile, Hibiscus, Mixed Berry Blends) |

| By Form | Gummies, Tablets, Capsules, Powders, Soft Gels |

| By Functionality | Headache Support, Mood Support, Energy Support, Hormonal Support, Pain Relief, Hydration Balance, Pre-Menstrual Syndrome Support |

| By Sales Channel | Store-Based Retail (Hypermarket/Supermarket, Convenience Store, Specialty Store, Pharmacies), Online Retail (Company Website, Third-Party Website, Social Media Selling) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Happy Mammoth, NOW Foods, Nature's Way, Garden of Life, Procter & Gamble (New Chapter), Thorne Health Tech, Inc., Life Extension, FLO Vitamins, Olly, Gaia Herbs, Herbalife Nutrition, Pfizer, Bayer AG, Pharmavite LLC (Nature Made, MegaFood), Pure Encapsulations, Swisse, Solgar, GNC, Vitabiotics, Herbaland, MyOva . |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

As per product type, the industry has been categorized into Functional Food (Fruits, Vegetables, Nuts, and Others), Beverages (Probiotic drinks, Herbal Teas, and Smoothies), Supplements (Hormonal Supplements, Non-hormonal Supplements, Nutritional Supplements), and Others.

As per ingredient type, the industry has been categorized into Apple, Spearmint, Cinnamon, Ginger, Raspberry, and Others.

This segment is further categorized into Gummies, Tablets, Capsules, Powders, and Soft gels.

As per the sales channel, the industry has been categorized into Store-based Retail (Hypermarket/Supermarket, Convenience Store, Specialty Store, and Pharmacies), Online Retail (Company Website, 3rd party website, and Social Media Selling).

This segment is further categorized into Headache support, Mood Support, Energy support, Hormonal Support, Pain Relief, Hydration Balance, and Pre-Menstrual Syndrome support.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The market is valued at USD 5.7 billion in 2025.

It is projected to reach USD 12 billion by 2035.

The market is expected to grow at a CAGR of 7.6% during this period.

Hormonal supplements lead with approximately 45% market share.

Ginger leads with a 28% share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Menstrual Cups Market Growth - Trends & Forecast 2025 to 2035

Menstrual Cup Foam Wash Market Trends - Growth & Demand From 2025 to 2035

Suncare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Lip Care Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Haircare Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Lip Care Packaging Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sun Care Products Market Analysis – Growth, Applications & Outlook 2025–2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Pet Care Market Analysis – Demand, Trends & Forecast 2025–2035

Car Care Products Market Trends - Growth, Demand & Analysis 2025 to 2035

Pet Care Packaging Market Insights - Growth & Forecast 2025 to 2035

Eye Care Supplement Analysis by Ingredients, Dosage Form, Route of Administration, Indication, Distribution channel and Region 2025 to 2035

Homecare Medical Devices Market Outlook – Industry Growth & Forecast 2025 to 2035

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Global Skincare Treatment Market Analysis – Size, Share & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA