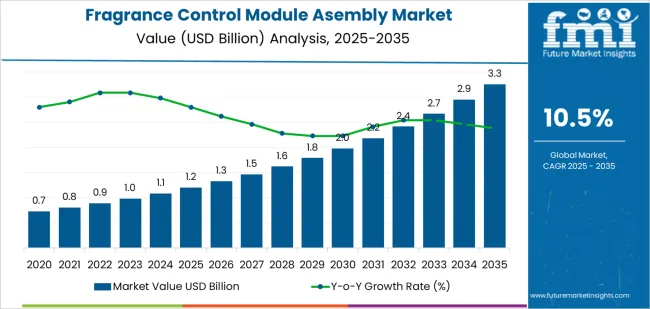

The global fragrance control module assembly market is valued at USD 1.2 billion in 2025 and is projected to reach USD 3.2 billion by 2035, registering a CAGR of 10.5%. Early growth is driven by rising integration of scent-dispersion systems across home appliances, automotive cabins, commercial HVAC units, and smart-environment devices. Manufacturers refine module design to improve dosing accuracy, extend cartridge life, and stabilize diffusion performance under varying temperature and airflow conditions. Advancements in compact actuator mechanisms and sensor-linked control logic support broader applications in premium consumer electronics and automated building-management systems.

Toward 2035, demand continues to expand as more products incorporate programmable ambient-scent features and adjustable odor-neutralization functions. Module assemblies gain traction in hospitality, retail interiors, and transport fleets seeking consistent, low-maintenance fragrance delivery. Product development emphasizes quieter operation, tighter emission control, and improved compatibility with diverse fragrance formulations. As installation volumes rise across both consumer and commercial segments, long-term market growth is sustained by ongoing upgrades to module durability, embedded circuitry, and precision control components.

Between 2025 and 2030, the Fragrance Control Module Assembly Market expands from USD 1.2 billion to USD 1.9 billion, showing a pronounced peak-to-trough pattern tied to consumer-electronics refresh cycles, automotive interior-system upgrades, and growth in smart-home diffusers. The trough emerges in the early years (2025–2027), with annual increases of about USD 0.1 billion each year as adoption grows steadily but moderately. Mid-cycle acceleration becomes clearer between 2028 and 2030, when annual gains rise to USD 0.2–0.3 billion. This first peak aligns with rising integration of programmable scent modules in premium vehicles, hospitality environments, and connected-home ecosystems.

From 2030 to 2035, the market advances from USD 1.9 billion to USD 3.2 billion, forming a second, more pronounced peak-to-trough sequence. The trough occurs between 2030–2031 with a gain of roughly USD 0.1–0.2 billion, followed by an escalation in annual additions as fragrance modules evolve with improved micro-diffusion systems, cartridge-recognition technology, and energy-efficient control boards. By 2034–2035, the market reaches its peak with growth above USD 0.3 billion in a single year, supported by expanding adoption in luxury vehicles, retail-environment scent management, and smart-building automation platforms. The decade displays consistent upward peak-to-trough movement powered by both product innovation and widening multi-industry penetration.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.2 billion |

| Market Forecast Value (2035) | USD 3.2 billion |

| Forecast CAGR (2025–2035) | 10.5% |

Demand for fragrance control module assemblies is rising as manufacturers of home appliances, HVAC systems, and automotive interiors integrate controlled scent-dispersion features to improve user comfort. These modules combine reservoirs, micro-pumps, airflow channels, and electronic timers to release measured fragrance doses without residue or oversaturation. Appliance makers adopt these assemblies in air purifiers, robotic cleaners, and dehumidifiers to differentiate product lines while maintaining safety and consistent diffusion rates. Automotive suppliers integrate compact scent cartridges with climate-control ducts, using temperature-stable housings and calibrated valves to ensure uniform fragrance intensity in varying cabin conditions. Manufacturers refine leak-resistant seals, low-noise actuators, and long-life cartridges to support predictable operation and reduce service requirements across consumer and vehicle applications.

Market expansion is also supported by growing interest in personalized environment control and premium in-cabin or in-home experiences. Electronics producers enhance connectivity options, enabling users to adjust fragrance timing through mobile apps or integrated device panels. HVAC and smart-home systems adopt fragrance modules fitted with particle filters and quick-change reservoirs to maintain hygiene and comply with indoor-air-quality guidelines. Automotive platforms incorporate multi-scent switching and synchronization with driving modes, requiring precise electronic control and robust thermal resistance. Although challenges include cartridge-refill logistics and compatibility with varied volatile compounds, improvements in plastic formulations, micro-pumping efficiency, and sealed-pod designs strengthen reliability. These developments ensure steady adoption of fragrance control module assemblies across global consumer appliance and automotive interior markets.

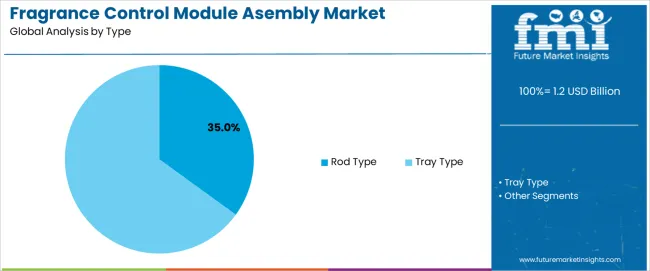

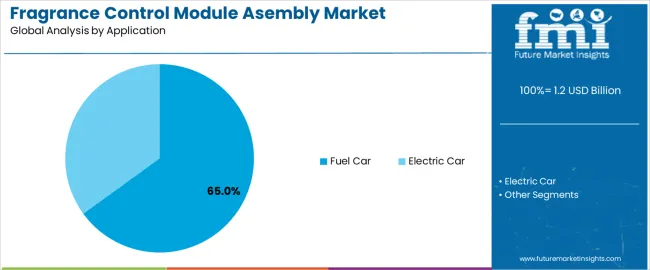

The fragrance control module assembly market is segmented by type, application, and region. By type, the market is divided into rod type and tray type assemblies. Based on application, it is categorized into fuel cars and electric cars. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions reflect differing vehicle-interior designs, control-system layouts, and regional automotive production trends influencing fragrance-module integration.

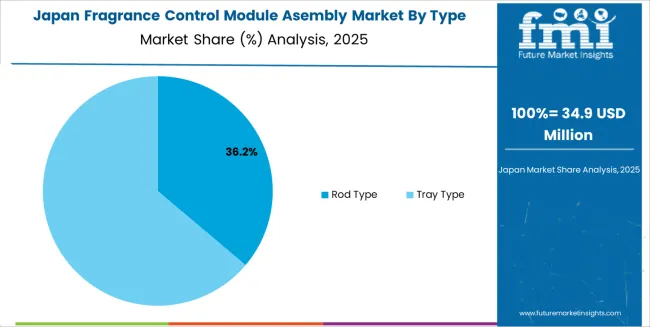

The rod type segment accounts for approximately 35.0% of the global fragrance control module assembly market in 2025, making it the leading type category. This position reflects its compatibility with existing HVAC duct formats used in many internal-combustion vehicle platforms. Rod-type assemblies are designed to fit compact air-channel spaces, enabling direct placement within airflow paths without requiring significant structural modification. Their narrow form supports stable fragrance diffusion and predictable airflow interaction, making them practical for mid-range and high-volume vehicle models.

Manufacturers develop rod-type units with heat-resistant casings, controlled-release materials, and standardized mounting fixtures to align with varied dashboard configurations. Adoption is notable in East Asia and Europe, where large automotive producers continue to manufacture fuel-based vehicles equipped with conventional HVAC layouts. These assemblies also support routine replacement cycles, creating recurring demand within service networks. Rod-type modules maintain their leading position because they integrate efficiently into established ventilation designs, accommodate consistent production workflows, and offer predictable fragrance distribution performance suited to traditional passenger-vehicle interiors.

The fuel car segment represents about 65.0% of the total fragrance control module assembly market in 2025, making it the dominant application category. This position is linked to the global vehicle fleet composition, where fuel-powered cars still account for a substantial share of active passenger vehicles. These vehicles generally retain HVAC configurations suited to mechanical fragrance-module assemblies, supporting straightforward integration during manufacturing and aftermarket servicing.

Manufacturers install fragrance systems in mid-range and premium fuel-car models to enhance cabin comfort and maintain consistency with interior personalization features increasingly offered across vehicle trims. Adoption is strong in regions with large fuel-vehicle markets, including East Asia, North America, and parts of Europe. Fuel-car HVAC systems provide steady airflow patterns that facilitate controlled fragrance dispersion, reinforcing compatibility with standard module designs. The fuel car segment holds its leading share because its established platform architecture, widespread availability, and stable production volumes continue to generate consistent demand for fragrance control modules across both factory-installed and service-replacement channels.

The fragrance control module assembly market is expanding as consumer-goods manufacturers and appliance brands integrate controlled scent-dispersion mechanisms into air-care devices, HVAC-linked systems and premium home appliances. These modules regulate scent release through programmable electronics, pumps or diffusion elements. Growth is supported by rising demand for automated home-fragrance products, increasing focus on indoor ambience and expansion of smart-home ecosystems. Adoption is limited by cost pressures, component-integration challenges and varying regional preferences in scent usage. Manufacturers are improving compactness, durability and electronic precision to support stable, repeatable fragrance delivery across household and commercial applications.

Demand grows as households adopt plug-in diffusers, smart air-care devices and HVAC-connected scent systems. Automated fragrance modules allow consistent release cycles, intensity adjustments and multi-scent programming, supporting personalised ambience preferences. Appliance makers incorporate these modules into air purifiers, dehumidifiers and fans to enhance product value. Commercial spaces such as hotels and retail stores also rely on controlled scenting to standardise guest experience. As users prefer low-maintenance and predictable scent output, demand for reliable, electronically managed fragrance modules continues to rise.

Adoption is restrained by higher production and integration costs, especially in appliances or devices positioned for mass-market consumers. Regional differences in scent acceptance and sensitivity influence manufacturer decisions, reducing global uniformity in product design. Complexity in maintaining stable output over the lifespan of cartridges or gels adds reliability concerns. Some users avoid scented products due to allergies or fragrance fatigue, lowering adoption in certain demographics. These constraints slow integration in cost-sensitive markets and limit fragrance modules to mid- and premium-tier product categories.

Trends include development of compact modules with improved micro-pumps, electronically controlled diffusion elements and replaceable scent cartridges designed for longer service life. Manufacturers are incorporating smart controls that sync with mobile apps, occupancy sensors or environmental data such as airflow and humidity. Interest is rising in eco-friendly fragrance media and low-energy diffusion methods. Commercial users seek modules that support uniform scenting across large rooms with minimal maintenance. As smart-home ecosystems expand, fragrance control assemblies continue shifting toward higher precision, better system integration and diversified scent-format compatibility.

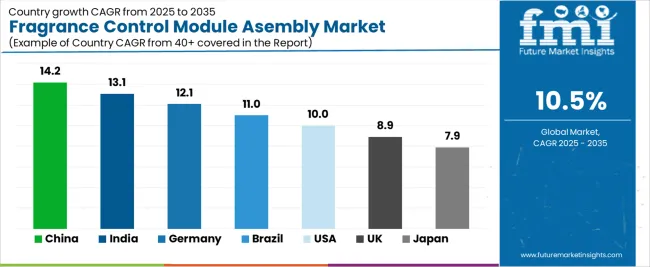

| Country | CAGR (%) |

|---|---|

| China | 14.2% |

| India | 13.1% |

| Germany | 12.1% |

| Brazil | 11.0% |

| USA | 10.0% |

| UK | 8.9% |

| Japan | 7.9% |

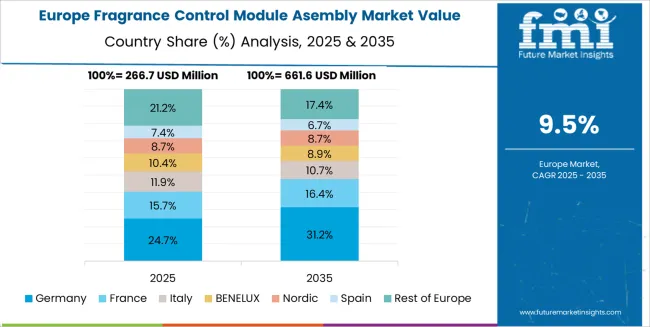

The Fragrance Control Module Assembly Market is expanding rapidly worldwide, with China leading at a 14.2% CAGR through 2035, driven by rising demand for smart home fragrance devices, large-scale electronics manufacturing, and increased integration of scent-control modules in consumer products. India follows at 13.1%, supported by growth in consumer electronics, expanding middle-class adoption of smart lifestyle devices, and rising interest in automated home ambience solutions. Germany records 12.1%, reflecting strong engineering standards, advancements in HVAC-integrated fragrance systems, and high uptake in premium consumer products. Brazil grows at 11.0%, fueled by expanding household electronics consumption and increasing use of ambient scent technologies in retail environments. The USA, at 10.0%, remains an innovation-focused market emphasizing IoT-enabled fragrance delivery, while the UK (8.9%) and Japan (7.9%) prioritize compact, energy-efficient, and precision-controlled module designs aligned with premium consumer expectations.

China is projected to grow at a CAGR of 14.2% through 2035 in the fragrance control module assembly market. Rapid expansion of commercial fragrance deployment across retail, hospitality, and transport hubs increases demand for assembled control modules. Manufacturers focus on compact actuator designs, precise dispensing timers, and modular scent cartridges to support varied application profiles. Integration with building automation systems and IoT sensor inputs enables usage-based release scheduling. Service providers emphasise ease of maintenance, cartridge swap workflows, and certified emission controls. Procurement by facility managers for consistent ambience management drives repeat orders and scale production nationwide.

India is projected to grow at a CAGR of 13.1% through 2035 in the fragrance control module assembly market. Expansion of hospitality chains, shopping centres, and corporate campuses increases demand for assembled scent-dispensing modules. Local assemblers prioritise robust pump mechanisms, humidity tolerant materials, and simplified calibration routines for tropical environments. Integration with building management and occupancy sensors supports targeted scenting and reduced consumable use. Service networks offer cartridge distribution, technical support, and scheduled maintenance contracts. Procurement favours scalable module platforms compatible with regional power standards. Market growth aligns with commercial real estate expansion and rising focus on in-store experience nationwide.

Germany is projected to grow at a CAGR of 12.1% through 2035 in the fragrance control module assembly market. Demand from premium retail, hospitality, and corporate headquarters increases need for precision assembly and certified materials. Manufacturers emphasise low-noise actuators, accurate microdosing pumps, and recyclable module components meeting regional environmental standards. Integration with building automation and central control platforms enables synchronized multi-zone scenting. Service providers supply documented maintenance routines, spare-part kits, and qualified installation teams. Procurement prioritises modules with compliance certification and clear lifecycle documentation. Market growth reflects investment in refined in-store ambience and regulated material handling across commercial sectors nationwide.

Brazil is projected to grow at a CAGR of 11.0% through 2035 in the fragrance control module assembly market. Demand from hotels, retail malls, and transport hubs drives procurement of assembled scent modules tuned to tropical climates. Manufacturers adapt corrosion-resistant casings, higher-capacity cartridges, and robust sealing to manage humidity and salt exposure. Integration with HVAC and facility management systems supports zoned scenting and timed release. Service networks provide cartridge supply chains, technical maintenance, and local installation. Procurement criteria emphasise durability under environmental stress and simple field-repair procedures. Market expansion aligns with tourism growth and renovation of coastal commercial properties.

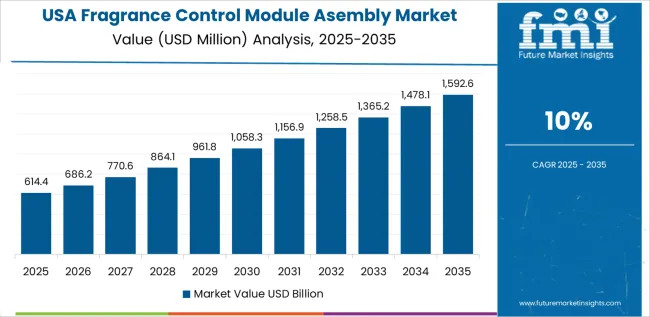

USA is projected to grow at a CAGR of 10.0% through 2035 in the fragrance control module assembly market. Retail chains, hospitality groups, and transportation providers invest in assembled scent modules to enhance occupant experience and brand presence. Manufacturers prioritise FDA compliant materials for indoor air contact, low-noise motors, and precise metering pumps for stable delivery. Integration with digital building platforms enables scheduling, telemetry, and usage reporting. Service contracts bundle cartridge logistics, remote diagnostics, and preventive maintenance. Procurement preferences include modular upgrade paths and lifecycle cost estimates. Market growth corresponds with experiential retail strategies and investment in public travel hubs.

UK is projected to grow at a CAGR of 8.9% through 2035 in the fragrance control module assembly market. Demand from boutique retail, hospitality venues, and corporate offices increases need for compact assembled scent modules. Manufacturers design units with low-energy fans, discreet housings, and certified replacement cartridges to meet urban aesthetics. Integration with building management systems and scheduling apps supports timed ambience control and tenant billing. Service providers administer cartridge distribution, waste handling, and compliance with local environmental guidance. Procurement emphasises modularity, quiet operation, and vendor response times. Market growth aligns with refurbishment projects supporting consistent occupant experience across spaces.

Japan is projected to grow at a CAGR of 7.9% through 2035 in the fragrance control module assembly market. Demand from compact retail outlets, high density hotels, and public transport spaces increases interest in space efficient assembled scent modules. Manufacturers design slim enclosures, precise microdosing pumps, and low-energy control electronics suited to limited installation clearances. Integration with occupancy sensors and station management systems enables timed release and zone prioritisation. Service networks deliver cartridge replenishment, rapid field repairs, and disposal handling. Procurement criteria emphasise compact footprint, quiet operation, and certified low-emission consumables. Market growth follows urban redevelopment and improved passenger experience.

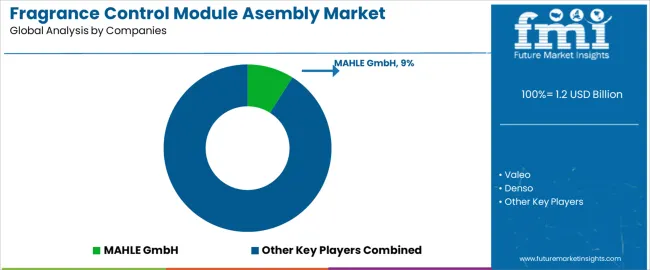

The global fragrance control module assembly market is moderately fragmented, shaped by suppliers developing in-cabin scent-dispersion and air-quality enhancement systems for automotive manufacturers. MAHLE GmbH, Valeo, and Denso hold strong positions through integrated HVAC components that incorporate scent cartridges, controlled diffusion, and sensor-driven air-management functions. Their systems align with OEM requirements for occupant-comfort features and compatibility with existing climate-control architectures. BYD strengthens the market from the OEM side through in-house module development for electric vehicles, where cabin differentiation plays a growing role. Cubic Sensor and Instrument and Huizhou Foryou Group contribute to mid-tier competition by supplying sensors, dosing valves, and compact fragrance units tailored for mass-market vehicle platforms. Across these suppliers, competition is shaped by control precision, cartridge compatibility, and system durability under continuous cabin-temperature cycling.

SAILING TECHNOLOGY, Xiamen Maxmac Air Technology, and Guangdong Car House Electronic Commerce Technology expand regional production capacity with cost-efficient modules aimed at both OEM integration and aftermarket distribution. Zhengzhou Jinfei Automotive Electric System, Suzhou Handlink Auto-Tech, and Dongguan Huaze Electronic Technology support broader supply with units designed for airflow consistency, minimal noise, and easy cartridge replacement. AUTOSEC adds niche capability through compact assemblies suited for smart-cabin electronics. Strategic differentiation across this market relies on odor-dispersion uniformity, electronically controlled dosing accuracy, and safe integration with vehicle air pathways. As automakers continue to enhance cabin personalization and wellness features, suppliers offering reliable electronics, low-power operation, and compatibility with digital cabin-control systems are positioned to strengthen long-term competitiveness.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type | Rod Type, Tray Type |

| Application | Fuel Car, Electric Car, Home Appliances, Commercial HVAC, Smart-Home Devices |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ additional countries |

| Key Companies Profiled | MAHLE GmbH, Valeo, Denso, BYD, Cubic Sensor And Instrument, Huizhou Foryou Group, SAILING TECHNOLOGY, Xiamen Maxmac Air Technology, Guangdong Car House Electronic Commerce Technology, Zhengzhou Jinfei Automotive Electric System, Suzhou Handlink Auto-Tech, Dongguan Huaze Electronic Technology, AUTOSEC |

| Additional Attributes | Dollar sales by type and application, OEM vs aftermarket split, module counts and cartridge-replacement cycles, compatibility with HVAC duct formats and vehicle CAN/BMS systems, dosing accuracy metrics, noise & power ratings, sensor integration (odor, humidity, occupancy), regulatory/indoor-air-quality conformance, regional distribution channels, installation & service requirements, product roadmaps for smart/connected diffusion features. |

The global fragrance control module assembly market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the fragrance control module assembly market is projected to reach USD 3.3 billion by 2035.

The fragrance control module assembly market is expected to grow at a 10.5% CAGR between 2025 and 2035.

The key product types in fragrance control module assembly market are rod type and tray type.

In terms of application, fuel car segment to command 65.0% share in the fragrance control module assembly market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fragrance Diffuser Market Size and Share Forecast Outlook 2025 to 2035

Fragrance Product Market Size and Share Forecast Outlook 2025 to 2035

Fragranced Personal Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fragrance Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Fragrance Fixatives Market Size and Share Forecast Outlook 2025 to 2035

Fragrance Jewellery Pods Market Analysis Size and Share Forecast Outlook 2025 to 2035

Fragrance Concentrates Market Size and Share Forecast Outlook 2025 to 2035

Fragrance-free Serum Market Report – Growth & Trends 2024-2034

Fragrance Oil Market

Smart Fragrance Box Market Analysis – Growth & Forecast 2025 to 2035

Herbal Fragrance Ingredients Market Analysis by Application, Ingredients, and Region Through 2035

Natural Fragrance Chemicals Market

Gourmand Fragrance Market Analysis - Size, Share, and Forecast 2025 to 2035

Flavors and Fragrances Market Analysis by Type, Nature, Application, and Region through 2035

Encapsulated Flavors and Fragrances Market Analysis by Product Type, Technology, Wall Material, End-use, Encapsulated Form, Process, and Region through 2035

Controllable Shunt Reactor for UHV Market Size and Share Forecast Outlook 2025 to 2035

Control Room Solution Market Size and Share Forecast Outlook 2025 to 2035

Control Knobs for Panel Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Controlled-Release Drug Delivery Technology Market Size and Share Forecast Outlook 2025 to 2035

Controlled Environment Agriculture (CEA) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA