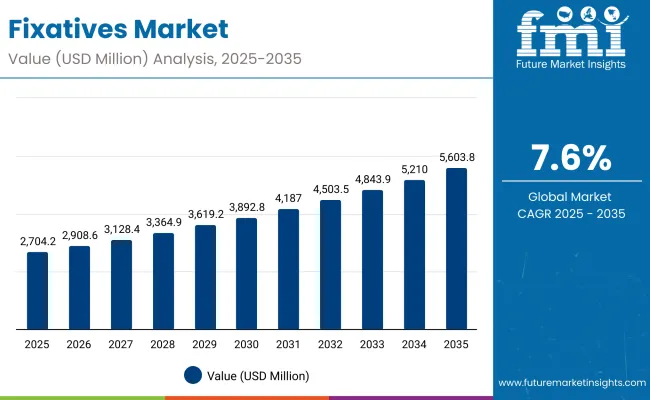

A valuation of USD 2,704.20 million was recorded by the global Fixatives Market in 2025, and projections indicate that it will reach USD 5,603.80 million by 2035. The growth represents an incremental gain of nearly USD 2,899.60 million across the decade, equivalent to a CAGR of 7.60%. This trajectory suggests that the market will more than double in value, supported by rising demand for long-lasting performance in hair styling, fragrance retention, and color cosmetic adhesion.

Fixatives Market Key Takeaways

| Metric | Value |

|---|---|

| Fixatives Market Estimated Value in (2025E) | USD 2,704.20 million |

| Fixatives Market Forecast Value in (2035F) | USD 5,603.80 million |

| Forecast CAGR (2025 to 2035) | 7.60% |

During the first phase of 2025 to 2030, the market is forecast to advance from USD 2,704.20 million to USD 3,892.80 million, adding USD 1,188.60 million. This stage accounts for nearly 41% of the total decade growth, driven by premiumization in hair sprays, gels, and primers, as well as tightening sustainability requirements that are accelerating reformulation.

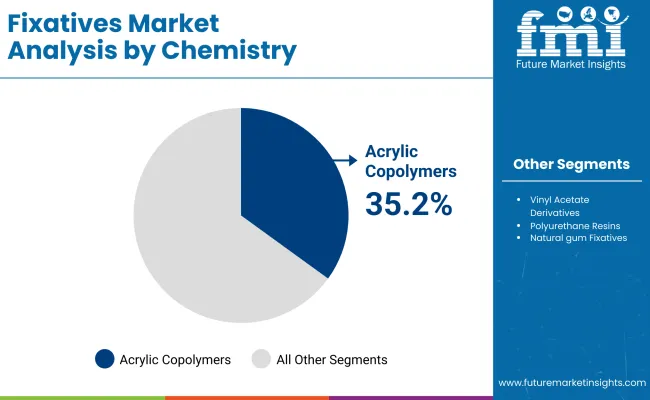

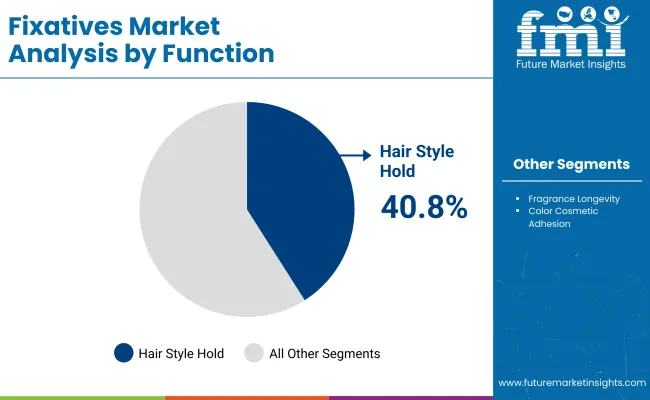

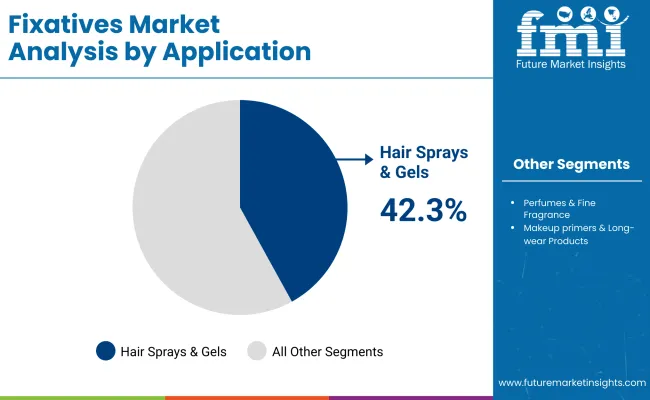

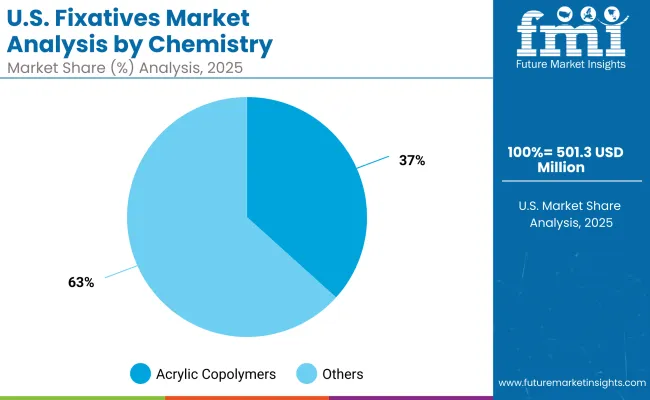

Hair sprays & gels are expected to dominate, supported by a 42.30% share in 2025, as styling innovations continue to emphasize strong hold, humidity resistance, and re-style flexibility. Acrylic copolymers are projected to anchor the chemistry segment with a 35.20% share, given their versatility and broad processing compatibility.

In the subsequent five years from 2030 to 2035, the market is projected to expand from USD 3,892.80 million to USD 5,603.80 million, contributing 59% of the total decade growth. This acceleration is anticipated to be underpinned by advanced formulations meeting microplastic transition pathways, regulatory-driven clean-label demand, and regional growth led by China and India. By the end of the forecast period, stronger adoption in fragrance longevity and hybrid applications is expected to further diversify usage, reinforcing fixatives as indispensable formulation ingredients.

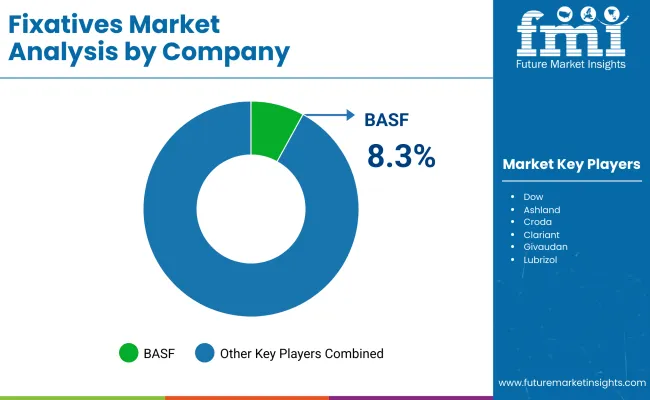

From 2020 to 2024, steady uptake of film-forming agents in hair styling, fragrance retention, and color cosmetics created a foundation for accelerated growth. By 2025, demand is projected to reach USD 2,704.20 million, with innovation in polymers and bio-based dispersions shaping competitive positioning. Market leadership is expected to remain fragmented, with BASF commanding 8.30% of global value, while a wide spectrum of specialty ingredient players share the remaining 91.70%.

Through the forecast decade, expansion toward USD 5,603.80 million is anticipated, powered by rising demand in Asia and regulatory-driven reformulations in mature markets. Competitive differentiation is projected to shift from product performance alone to sustainability credentials, microplastic compliance, and technical service capabilities.

Regional players in China and India are expected to capture incremental growth, while global incumbents strengthen portfolios through bio-lean innovations and multifunctional systems. Suppliers emphasizing ecosystem strength, scalability, and claim-substantiated formulations are likely to secure long-term procurement partnerships and sustain relevance in a rapidly evolving fixatives landscape.

Growth in the Fixatives Market is being fueled by increasing consumer demand for long-lasting performance in hair styling, fragrance retention, and color cosmetics. Rising awareness of durability and humidity resistance in styling products has created sustained reliance on advanced polymer systems. Expansion in hybrid formulations, where hold and conditioning benefits are combined, is accelerating adoption across premium and mass-market categories.

Regulatory pressures around microplastics and clean-label expectations are encouraging reformulation, driving suppliers to innovate with bio-based and eco-conscious fixatives. Demand growth is also being supported by emerging economies, where rising disposable incomes and beauty consumption trends are boosting product uptake.

Applications in hair sprays and gels remain central, while long-wear makeup and fragrance extensions are diversifying usage. With greater emphasis on performance-driven claims and regulatory compliance, fixatives are expected to remain indispensable to formulation strategies, ensuring consistent growth throughout the forecast period.

The Fixatives Market has been segmented on the basis of chemistry, function, and application, with each category shaping demand differently across the value chain. Market behavior is being influenced by evolving consumer needs, regulatory pressures, and brand focus on high-performance and sustainable formulations. Acrylic copolymers are anticipated to dominate chemistry due to their versatile film-forming properties and compatibility with multiple formulations.

Within function, hair style hold is emerging as the leading category, driven by consumer preference for durability and restyle flexibility. On the application side, hair sprays & gels are expected to lead, supported by consistent product innovation and premiumization trends. Each of these dominating segments reflects broader industry priorities centered on performance, sensory quality, and long-lasting appeal.

| Chemistry | Market Value Share, 2025 |

|---|---|

| Acrylic copolymers | 35.2% |

| Others | 64.8% |

Acrylic copolymers accounted for 35.20% of the global fixatives market in 2025, representing USD 951.88 million in value. This dominance is expected to be maintained as these materials continue to deliver consistent film-forming properties, flexibility under humidity, and superior adhesion across diverse formulations. Their ability to balance clarity, strength, and compatibility with water-based and solvent-based systems ensures long-term preference among formulators.

Demand is projected to rise further as microplastic regulations and clean-label pressures push suppliers to introduce next-generation grades with reduced residual monomers and better biodegradability. The chemistry landscape is expected to remain shaped by acrylic copolymers, while other alternatives compete in niche areas requiring specialized performance.

| Function | Market Value Share, 2025 |

|---|---|

| Hair style hold | 40.8% |

| Others | 59.2% |

Hair style hold was the leading function in the fixatives market in 2025, with a 40.80% share valued at USD 1,103.31 million. This segment is anticipated to maintain its dominance as long-lasting styling effects remain a primary consumer expectation. The rise of multifunctional styling products that combine conditioning with hold is projected to reinforce the segment’s importance.

Technical advantages such as humidity resistance, re-style capability, and compatibility with new delivery systems continue to enhance acrylic-based fixatives in this area. Global growth in premium hair sprays, gels, and hybrid products is expected to accelerate adoption, particularly in emerging economies. Hair style hold will remain central to innovation pipelines as brands compete on performance-driven claims.

| Application | Market Value Share, 2025 |

|---|---|

| Hair sprays & gels | 42.3% |

| Others | 57.7% |

Hair sprays & gels represented the dominant application in 2025 with 42.30% of total market share, equivalent to USD 1,143.88 million in value. This leadership is expected to persist as styling products remain widely used across both premium and mass-market channels. Performance requirements such as fast-drying, flake-free finish, and high humidity resistance are expected to drive continued investment in fixative innovation.

Expansion in aerosol-free sprays and clean-label gels is projected to contribute further to growth. Consumer demand for strong, durable hold with flexibility to re-style is ensuring ongoing preference for these formats. Hair sprays & gels are anticipated to remain the anchor application of the fixatives market throughout the forecast horizon.

The Fixatives Market is being shaped by evolving formulation requirements, stringent regulatory frameworks, and heightened performance expectations, with opportunities unlocked through innovation while structural challenges in sustainability, compliance, and cost efficiency continue to influence procurement and product development strategies.

Regulatory Push for Microplastic-Free Formulations

A major driver for the Fixatives Market is the accelerating regulatory momentum against microplastic content in cosmetic and personal care formulations. This shift is compelling global suppliers to innovate with biodegradable polymers and bio-based dispersions that meet both environmental and performance criteria.

Investments in compliant alternatives are expected to create strong differentiation, as early adopters secure long-term procurement contracts with multinational beauty brands facing stringent compliance deadlines. Technical service capabilities are increasingly required to help formulators transition without compromising film clarity, humidity resistance, or sensory performance. This driver not only aligns with sustainability imperatives but also opens significant market opportunity for suppliers delivering scalable, compliant innovations supported by robust regulatory dossiers.

Cost Intensification from Specialty Polymer Supply Chains

A critical restraint is the rising cost of specialty raw materials required for advanced fixative formulations. Supply chain vulnerabilities in acrylic monomers, bio-based feedstocks, and specialty dispersions are pushing up formulation costs, creating pressure on margins across the value chain. Smaller regional formulators are especially challenged, as volatility in feedstock pricing and logistics adds unpredictability to production planning.

Procurement teams are forced to prioritize security of supply over price competitiveness, creating limited flexibility for innovation budgets. While premium end-use markets may absorb part of the cost, mass-market segments face a significant risk of margin compression. This dynamic is expected to limit adoption speed of next-generation fixatives unless efficiency gains or scaled sourcing strategies are implemented.

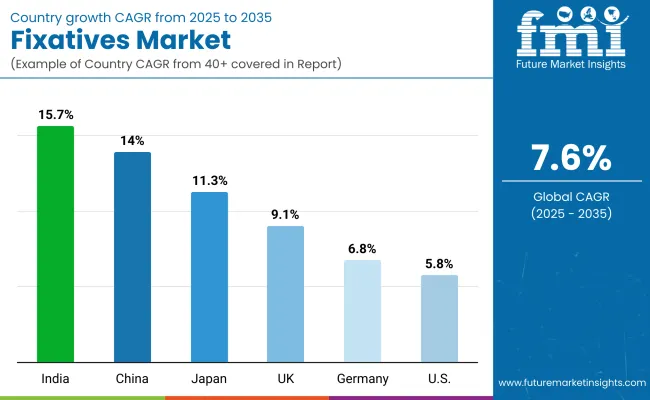

| Country | CAGR |

|---|---|

| China | 14.0% |

| USA | 5.8% |

| India | 15.7% |

| UK | 9.1% |

| Germany | 6.8% |

| Japan | 11.3% |

The global Fixatives Market is anticipated to expand unevenly across key geographies, shaped by divergent consumer behavior, regulatory imperatives, and innovation priorities. Asia is positioned as the most dynamic region, with India leading at a CAGR of 15.70% and China close behind at 14.00% over 2025 to 2035.

This momentum is expected to be supported by rapid urbanization, surging beauty consumption, and the fast adoption of long-wear cosmetics. India’s trajectory is being reinforced by the expansion of domestic haircare and personal grooming brands, while China’s growth reflects strong penetration of e-commerce-driven beauty formats and accelerated preference for high-performance styling products.

Japan, with an 11.30% CAGR, is projected to benefit from premiumization and early adoption of clean-label fixatives, particularly in long-lasting fragrance and hybrid categories. Europe is expected to expand steadily at 8.40%, with the UK (9.10%) and Germany (6.80%) anchoring growth, driven by stringent regulatory mandates, sustainability compliance, and consumer demand for eco-conscious formulations.

The USA, at 5.80%, demonstrates a mature yet stable profile, supported by established brands emphasizing performance validation and premium claims. Collectively, regional variations suggest that while emerging markets are expected to drive volume acceleration, developed markets are likely to shape innovation pathways and regulatory benchmarks for the decade ahead.

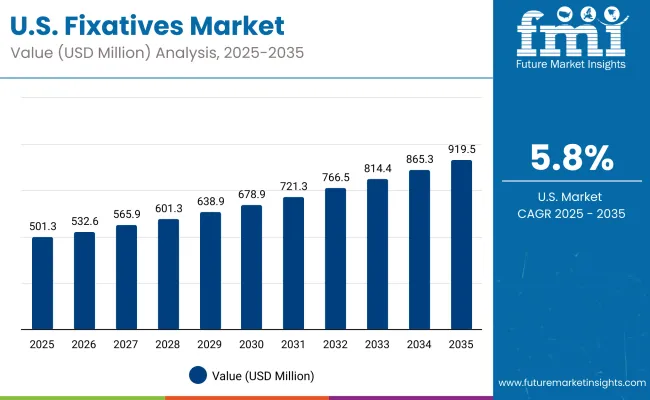

| Year | USA Fixatives Market (USD Million) |

|---|---|

| 2025 | 501.30 |

| 2026 | 532.65 |

| 2027 | 565.96 |

| 2028 | 601.36 |

| 2029 | 638.97 |

| 2030 | 678.93 |

| 2031 | 721.39 |

| 2032 | 766.51 |

| 2033 | 814.45 |

| 2034 | 865.39 |

| 2035 | 919.51 |

The Fixatives Market in the United States is projected to expand at a CAGR of 5.80% during 2025 to 2035, reflecting steady growth in a mature but innovation-driven landscape. Hair sprays and gels remain the anchor category, supported by strong consumer loyalty to styling products and innovation in humidity-resistant hold systems.

Premium color cosmetics, including primers and long-wear foundations, are expected to further increase fixative adoption, particularly in prestige and masstige channels. Clean-label positioning and regulatory compliance with evolving microplastic guidelines are anticipated to influence procurement and product development strategies.

The Fixatives Market in the United Kingdom is projected to grow at a CAGR of 9.10% between 2025 and 2035, driven by regulatory compliance pressures and the premiumization of beauty and grooming categories. The market is expected to gain momentum through increasing investments in sustainable formulations and advanced styling products that meet eco-conscious consumer expectations. The demand outlook indicates steady adoption across both mass-market and prestige channels, reinforcing the UK’s position as a leading European hub for innovation.

The Fixatives Market in India is anticipated to register the fastest growth globally at a CAGR of 15.70% from 2025 to 2035. This trajectory is expected to be fueled by rising disposable incomes, accelerated urbanization, and expanding penetration of beauty and personal care products in Tier II and Tier III cities. Local and international brands are projected to benefit from the growing emphasis on premium grooming and hair styling, alongside increasing adoption of long-wear cosmetics.

The Fixatives Market in China is projected to expand at a CAGR of 14.00% during 2025 to 2035, supported by rapid beauty consumption growth and strong e-commerce penetration. Market expansion is being driven by high demand for premium hair styling products, long-wear color cosmetics, and fragrance extensions tailored to local consumer preferences. Domestic innovation and regulatory adaptation are expected to further accelerate uptake, making China a critical engine of global demand.

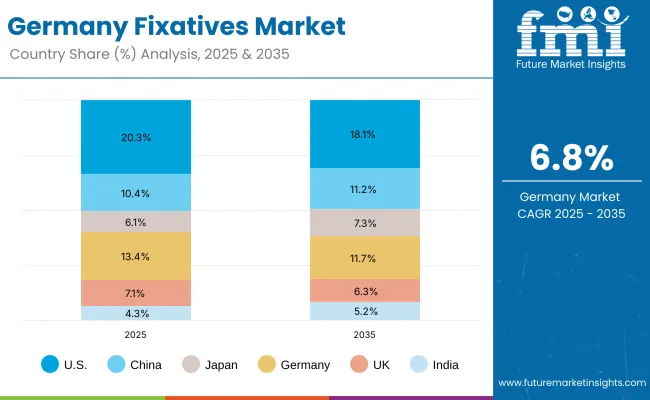

| Country | 2025 |

|---|---|

| USA | 20.3% |

| China | 10.4% |

| Japan | 6.1% |

| Germany | 13.4% |

| UK | 7.1% |

| India | 4.3% |

| Country | 2035 |

|---|---|

| USA | 18.1% |

| China | 11.2% |

| Japan | 7.3% |

| Germany | 11.7% |

| UK | 6.3% |

| India | 5.2% |

The Fixatives Market in Germany is expected to grow at a CAGR of 6.80% between 2025 and 2035, reflecting steady expansion anchored in regulatory rigor and consumer emphasis on product safety and sustainability. The market is anticipated to benefit from high penetration of premium cosmetics and a strong presence of global formulation leaders.

| USA By Chemistry | Market Value Share, 2025 |

|---|---|

| Acrylic copolymers | 36.7% |

| Others | 63.3% |

The Fixatives Market in the United States is projected at USD 501.30 million in 2025. Acrylic copolymers contribute 36.70%, while other chemistries hold 63.30%, underscoring a stronger presence of diversified solutions beyond traditional polymers. The share of acrylic copolymers reflects their consistent use in film-forming and humidity-resistant applications, valued for their reliability across styling and long-wear formulations.

However, the larger share held by other chemistries highlights an ongoing shift toward customized blends and advanced alternatives tailored to meet regulatory compliance and consumer-driven sustainability demands. This composition signals a gradual broadening of the USA fixatives portfolio, with increasing attention to bio-lean and multifunctional solutions.

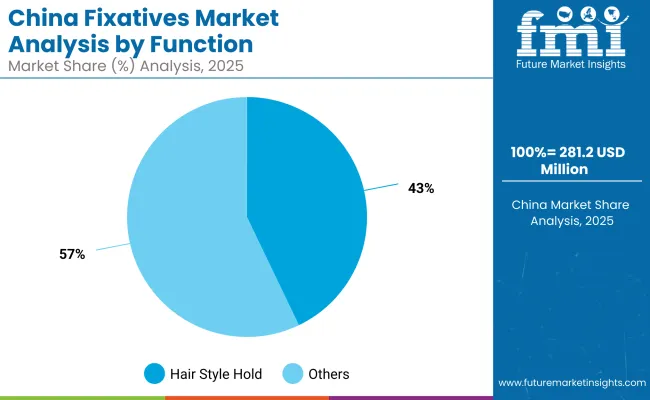

| China By Function | Market Value Share, 2025 |

|---|---|

| Hair style hold | 42.9% |

| Others | 57.1% |

The Fixatives Market in China is valued at USD 281.25 million in 2025. Hair style hold contributes 42.90%, while other functions account for 57.10%, reflecting a balanced mix of performance-driven styling and diversified long-wear applications. The strong share of hair style hold indicates that Chinese consumers prioritize durability, re-style flexibility, and humidity resistance in everyday grooming products, particularly in urban centers.

The wider share of other functions highlights the rising adoption of fixatives in long-wear makeup and fragrance categories, where demand for transfer resistance and sensorial performance is expanding. This composition underscores China’s evolving beauty market, where both traditional styling and emerging multifunctional applications are driving forward growth.

| Company | Global Value Share 2025 |

|---|---|

| BASF | 8.3% |

| Others | 91.7% |

The Fixatives Market is moderately fragmented, with global leaders, mid-sized ingredient suppliers, and specialized innovators competing across diverse formulation needs. BASF held the largest global value share at 8.3% in 2025, reflecting its strong presence in polymers and fixative chemistries. This leadership is anchored in its ability to supply scalable, regulatory-compliant solutions with robust technical service support, positioning it as a preferred partner for multinational cosmetic and personal care brands.

Other multinational suppliers, including Dow, Ashland, Croda, Clariant, Givaudan, Symrise, Eastman, Evonik, and Lubrizol, are shaping the market through differentiated offerings in acrylic copolymers, bio-based fixatives, and fragrance-compatible systems. These companies are advancing adoption by investing in clean-label solutions, multifunctional chemistries, and regional R&D centers tailored to local market dynamics.

Smaller and niche-focused players are strengthening positions through specialization in bio-lean dispersions, high-performance adhesion systems, and region-specific formulations. Their adaptability and ability to respond quickly to evolving sustainability demands are enabling deeper integration with emerging-market brands.

Competitive differentiation is shifting away from simple film-forming performance toward comprehensive ecosystems. Key growth is being driven by suppliers offering sustainability credentials, microplastic-free pathways, and regulatory support, alongside innovations that enable multifunctionality and consumer-preferred sensorial outcomes.

Key Developments in Fixatives Market

| Item | Value |

|---|---|

| Quantitative Units | USD 2,704.20 million (2025) - USD 5,603.80 million (2035) |

| Chemistry | Acrylic copolymers, Vinyl acetate derivatives, Polyurethane resins, Natural gum fixatives |

| Function | Hair style hold, Fragrance longevity, Color cosmetic adhesion |

| Application | Hair sprays & gels, Perfumes & fine fragrance, Makeup primers & long-wear products |

| Form | Liquid, Powder, Resin dispersion |

| End-use Industry | Haircare brands, Fragrance houses, Color cosmetics manufacturers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF, Dow, Ashland, Croda, Clariant, Givaudan, Symrise, Eastman, Evonik, Lubrizol |

| Additional Attributes | Dollar sales by chemistry, function, and application; growth driven by sustainability compliance, bio-based innovations, and regulatory shifts on microplastics; diversification into hybrid formulations; strong regional growth in China and India; performance validation as a procurement priority; fragmentation of global competition with BASF leading at 8.3% share (2025). |

The global Fixatives Market is estimated to be valued at USD 2,704.20 million in 2025.

The market size for the Fixatives Market is projected to reach USD 5,603.80 million by 2035.

The Fixatives Market is expected to grow at a CAGR of 7.60% between 2025 and 2035.

The key product types in the Fixatives Market are acrylic copolymers, vinyl acetate derivatives, polyurethane resins, and natural gum fixatives.

In terms of application, hair sprays & gels are projected to command 42.30% share of the Fixatives Market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA