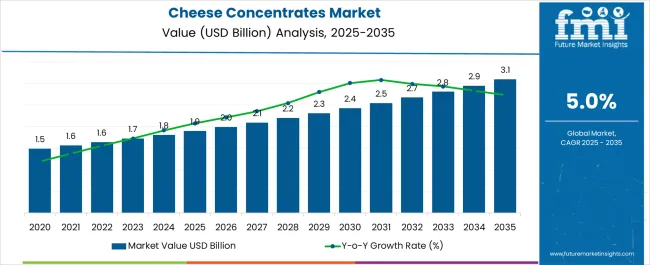

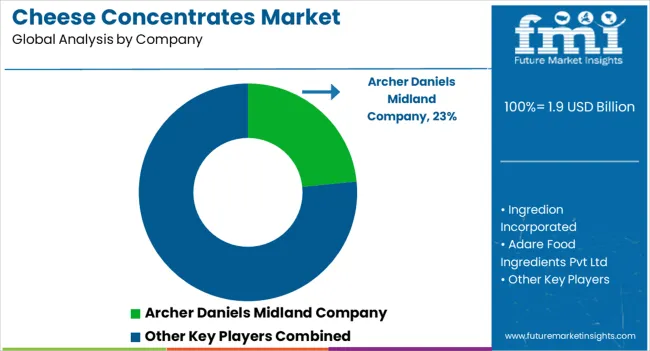

The global cheese concentrates market is valued at USD 1.9 billion in 2025 and is expected to reach USD 3.1 billion by 2035, reflecting a CAGR of 5.0%.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 1.9 billion |

| Projected Value (2035F) | USD 3.1 billion |

| CAGR (2025 to 2035) | 5.0% |

Factors driving this growth include rising demand for clean-label, low-fat cheese options, growing application of cheese concentrates in ready meals and snacks, and increasing interest in dairy-free cheese substitutes. Moreover, product versatility and strong flavor profiles up to 20x stronger than natural cheese are enhancing their adoption.

By 2030, the market is forecasted to reach around USD 2.5 billion, reflecting steady growth throughout the first half of the period. The absolute dollar growth between 2025 and 2035 is expected to be USD 1.2 billion, indicating steady and reliable market expansion. Growth is expected to accelerate in the latter half of the timeline, driven by increased adoption of cheese concentrates in convenience foods, processed snacks, sauces, and quick-service restaurant menus.

Key companies such as Kraft Heinz, Lactal is Ingredients, and Archer Daniels Midland are strengthening their positions by expanding production capacities and investing in advanced processing technologies like spray drying and microfiltration. Their innovation efforts focus on low-fat, lactose-free, and fortified cheese concentrate products to capture health-conscious and premium market segments. Market performance will continue to depend on quality control, dairy sourcing standards, and regulatory compliance, which will influence competitive dynamics and expansion opportunities across different regions within the cheese concentrates market.

The market accounts for nearly 39% of the global cheese ingredients market, driven by its ability to deliver authentic taste, longer shelf stability, and reduced storage costs. It represents about 27% of the dairy-based flavoring market, owing to rising use in snacks, sauces, soups, and ready meals. The market holds close to 21% share in functional dairy ingredients and around 18% of clean-label flavorings, supported by growing consumer preference for natural, nutrient-rich, and versatile ingredient solutions in packaged food processing.

The market is witnessing structural changes as technological advancements such as spray drying, enzymatic concentration, and fermentation enhance flavor intensity, stability, and adaptability. Rising demand for clean-label, authentic, and nutritionally transparent ingredients is driving adoption across sauces, dips, bakery fillings, frozen meals, and foodservice applications. Manufacturers are developing organic, vegan-compatible, and reduced-fat concentrates aligned with evolving dietary preferences. Strategic collaborations between concentrate producers, food manufacturers, and flavor houses are accelerating innovation, market penetration, and global reach.

The market is expanding due to increasing demand for convenient and processed food products worldwide. Consumers are seeking ready-to-eat meals and snacks that offer rich cheese flavors, and cheese concentrates provide an efficient way to deliver this with enhanced shelf life and reduced storage requirements. The rise in fast food and quick-service restaurants fuels the need for concentrated cheese ingredients that are easy to use and cost-effective.

Additionally, technological advancements in processing methods like spray drying enhance product quality and consistency, attracting more manufacturers. The growing middle-class population in emerging economies, coupled with changing eating habits and increased dairy consumption, further drives market expansion. Innovations in cheese concentrates, including lactose-free and low-fat variants, cater to health-conscious consumers, widening the market appeal. These factors collectively contribute to a strong projected growth rate, making cheese concentrates a key ingredient in modern food processing and fast-growing packaged foods sectors. This market is expected to witness significant growth through the forecast period.

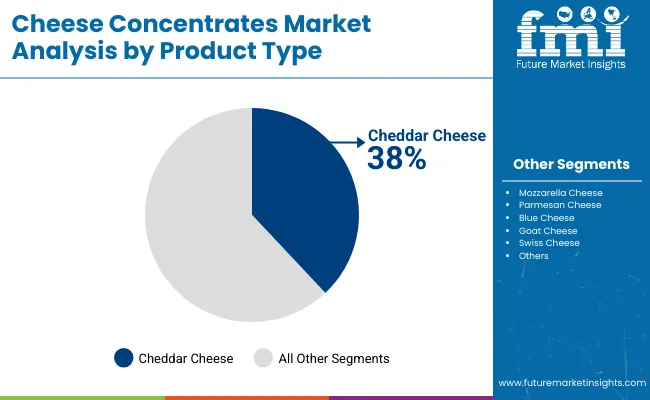

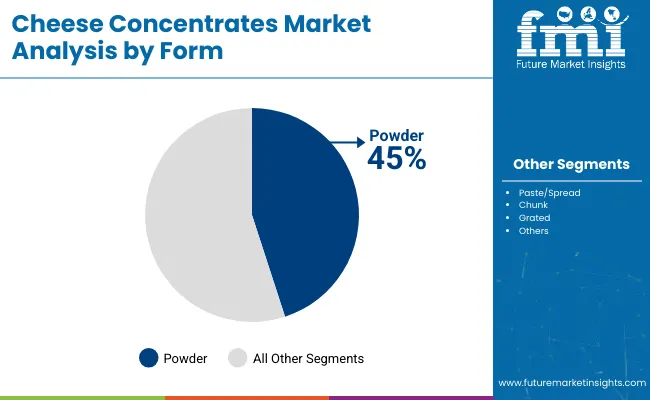

The market is segmented by product, form, buyer, application, sales channel, and region. By product, the market is categorized into mozzarella, cheddar, parmesan, swiss, goat, blue, and others (cream cheese and vegan cheese). Based on form, the market is segmented into powder, paste/spread, chunk, grated, and others (liquid and sliced forms). By buyer, the market is divided into commercial bakers, artisan bakers, retail buyers, and food service providers. In terms of application, the market is segmented into bakery & confectionery, processed cheese, sauces/dressings/dips & condiments, dairy & desserts, snacks & savory items, ready meal production, and others (seasonings and instant mixes).

By sales channel, the market is bifurcated into B2B/HoReCa and B2C (hypermarkets/supermarkets, convenience stores, mom and pop stores, discount stores, food specialty stores, independent small groceries, online retail, and others such as direct-to-consumer).Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and Middle East & Africa.

Cheddar cheese concentrates are expected to dominate the product type segment, holding a significant 38% market share in 2025. This leadership is driven by Cheddar’s distinct sharp flavor, which appeals to a wide range of consumers and blends well with various cuisines. Its versatility is evident in its extensive use across multiple food applications, including sauces, snacks, and baked goods. Increasing consumer preference for rich, aged cheese flavors further boosts demand for Cheddar concentrates. Additionally, Cheddar concentrates are popular in low-fat food formulations as they maintain the bold taste without adding extra fat, attracting health-conscious buyers.

The sharp flavor of Cheddar makes it particularly suitable for quick-service restaurants (QSR) and processed snack foods, where strong taste profiles are valued. Its compatibility with powdered and paste formulations further enhances its usability in food manufacturing. Cheddar concentrates also benefit from a long shelf life, improving logistics and storage efficiency. Demand for these concentrates is notably high in North America and Europe, regions with mature processed food markets.

Powder cheese concentrates are expected to dominate the market in 2025 with a 45% share due to their extended shelf life, easy storage, and flexible applications. These concentrates are widely used in sauces, seasonings, bakery products, and snacks because they can be easily incorporated and provide consistent flavor. Manufacturers favor the powder form for its stable flavor delivery and simplified packaging, which supports large-scale food production. The dry nature of powder concentrates also reduces shipping and handling costs, making them ideal for global trade and distribution.

Advancements in spray-drying technology have enhanced powder production, improving quality and scalability. This form is preferred for industrial use, particularly in bulk processing, where efficiency and consistency are crucial. The long shelf life of up to 24 months further boosts its appeal, especially in dry snacks and seasoning blends, where freshness and flavor stability are vital. Overall, powder cheese concentrates offer significant advantages that drive their strong market presence.

From 2025 to 2035, growing consumer demand for convenient, flavorful, and health-conscious food products is driving significant growth in the cheese concentrates market. Increasing preference for processed foods that offer rich cheese taste with extended shelf life has positioned manufacturers investing in advanced concentration and drying technologies as leaders in meeting evolving culinary needs and expanding applications across snacks, sauces, and ready-to-eat meals.

Health Awareness Boosts Demand for Innovative Cheese Concentrates

Rising health awareness among consumers is driving demand for low-fat, lactose-free, and clean-label cheese concentrates. This trend encourages manufacturers to innovate by developing enhanced formulations that offer better flavor, improved nutritional value, and greater compatibility with diverse cuisines. In response, producers are expected to adopt advanced processing techniques such as spray drying and microfiltration by 2025. These technologies help deliver higher quality, improved consistency, and longer shelf life to meet evolving consumer expectations. Overall, health-conscious choices and technological advancements are key factors shaping the future growth and product development in the cheese concentrates market.

Technological Advancements and Sustainability Expand Market Opportunities

Technological innovations and sustainable sourcing are expanding the cheese concentrates market, especially in North America and Europe. Companies prioritizing sustainability and quality certifications gain a competitive edge by appealing to environmentally conscious consumers. This trend drives long-term growth as consumers increasingly demand eco-friendly, ethically produced products. By adopting advanced processing technologies and focusing on sustainable practices, these companies improve product quality and reduce environmental impact. Aligning with regulatory standards and consumer values, they strengthen market presence and foster loyalty. Overall, sustainability and innovation are key drivers shaping the future expansion of the cheese concentrates market in developed regions.

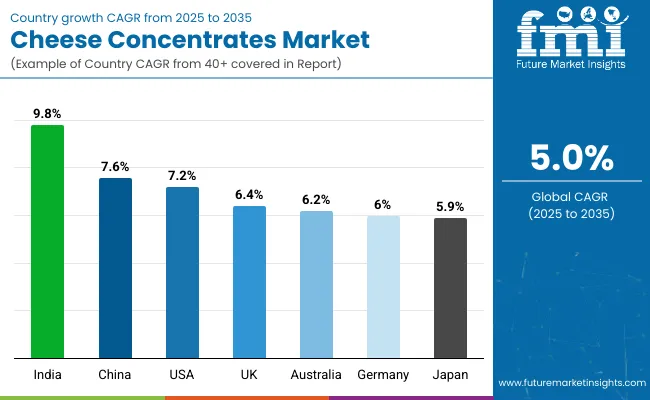

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 9.8% |

| China | 7.6% |

| USA | 7.2% |

| UK | 6.4% |

| Australia | 6.2% |

| Germany | 6.0% |

| Japan | 5.9% |

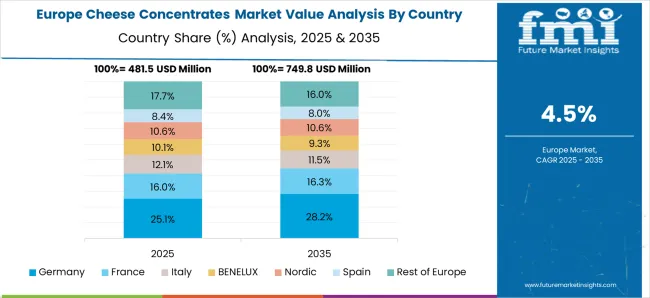

The market is set to experience varied growth rates across key countries from 2025 to 2035, reflecting differing market dynamics and consumer trends. India leads with the highest CAGR of 9.8%, driven by rapid urbanization, rising disposable incomes, and increasing demand for processed and lactose-free cheese products in both urban and rural areas. China follows at 7.6%, propelled by Western food adoption, technological advancements, and government support for modern dairy practices. The USA grows at 7.2%, fueled by innovation in low-fat and organic concentrates and strong foodservice demand. The UK and Australia report steady growth at 6.4% and 6.2%, respectively, focusing on premium, clean-label products and export-driven expansion. Germany progresses at 6.0%, benefiting from advanced processing and health-conscious trends, while Japan shows the slowest growth at 5.9%, emphasizing premium convenience products tailored to local tastes.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Demand for cheese concentrates in India is set to register an impressive 9.8% CAGR from 2025 to 2035. Rapid urbanization, a booming fast-food sector, and higher disposable incomes are fueling the growth for cheese concentrates nationally. Westernization of food habits, combined with health and protein awareness, boosts consumption in both urban and emerging rural areas. Organized foodservice, retail expansion into tier-2 and tier-3 cities, and government initiatives in dairy modernization are strengthening distribution networks. There is surging demand for lactose-free, fortified, and value-added cheese products, supporting market diversification. Manufacturers are introducing innovative flavors to cater to changing palates, while premium positioning stimulates consumer interest. The trend towards convenience and packaged foods, alongside growing youth demographics, further accelerates market momentum.

Revenue from cheese concentrates in China is projected with a CAGR of 7.6%, China demonstrates robust expansion in production capacities for cheese concentrates from 2025 to 2035. Urbanization, increased disposable income, and the influence of Western cuisine have propelled consumption and domestic cheese production. Investments in advanced processing, technology upgrades, and cold chain logistics are improving quality and shelf-life. The market is further stimulated by government support for modern dairying, catering to both local and export demand. Major players are promoting processed and packaged cheese options to fit shifting consumer lifestyles. Chinese companies are strengthening partnerships with global dairy leaders, enriching offerings. Growing nutritional awareness and popularity of international food chains fuel continuous market uplift.

Demand for cheese concentrates in the USA projected at a 7.2% CAGR, is marked by dynamic innovation and steady demand in processed, convenience, and specialty foods. Strong food tech infrastructure aids in launching low-fat, lactose-free, and organic concentrates. The robust food service sector, especially QSRs and snacks, shapes new product development. Continuous R&D enables consistent flavor and texture for bulk and retail markets. Export growth, fueled by consumer trust in US dairy quality, enhances global presence. Health-oriented product launches address rising wellness trends. The USA is a hub for flavor innovation, microfiltration, and distribution. Efficient supply and logistics networks drive product reach to all states and export destinations.

Sales of cheese concentrates in the UK are projected with a 6.4% CAGR, the market is shaped by the premiumization trend and focus on clean-label, natural products. Strong demand for gourmet, artisan, and vegan cheese ranges defines market innovation. Retailers and producers are prioritizing traceability, sustainable sourcing, and eco-friendly packaging. Convenience, meal kits, and premium snacking options drive category expansion. Health-conscious consumers seek additives-free, organic, and specialty blends, while diversified product ranges appeal to foodservice operators. The UK market is marked by strategic collaborations for product launches and distribution. Consumers’ appetite for global flavors reflects in evolving cheese concentrate portfolios, fueling incremental value growth.

Demand for cheese concentrates in Australia is forecast to grow at 6.2% CAGR, leveraging its strong dairy export foundation and premium natural image. Demand is driven by Asia-Pacific and Middle East exports, backed by highly efficient production facilities and quality assurance. Local consumers prefer minimally processed, high-protein, and natural flavor ingredients. Sustainable practices and traceability are core to market expansion. Technological upgrades increase volume and consistency, supporting bulk supply to global and domestic brands. Government support and geographical advantages further bolster export logistics. Australia’s market is increasingly characterized by premium positioning in food processing and snack segments.

Revenue from cheese concentrates in Germany will advance at a 6.0% CAGR, benefiting from premier processing standards and strict food safety regulations. The country leads in technological adoption, exporting innovative solutions across Europe and globally. Health-forward consumer trends increase demand for reduced-fat, high-protein, and functional cheese ingredients. Partnerships between research institutions and industry drive ongoing R&D and product improvement. The foodservice sector leverages German cheese concentrates for quality and consistency, fueling applications in sauces, bakery, and processed snacks. Sustainability and eco-certification initiatives underpin market presence. Germany remains a benchmark for quality, with a well-diversified portfolio of cheese concentrates.

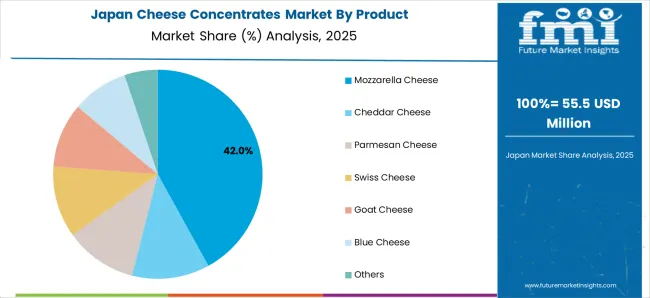

Demand for cheese concentrates in Japan, with a 5.9% CAGR, focuses on premium convenience and tailored formulations for local consumers. Interest in Western cuisine and unique dairy flavors is rising consumers prefer mild, functional, and easy-to-use cheese products. Innovations target the needs of bakery, snack, and ready-to-eat meal markets, with significant retail concentration. Packaging and shelf-life improvements cater to space and freshness concerns. Product launches often emphasize nutrition, flavor variety, and compact storage. Strong import presence complements domestic production. Collaborative efforts with international brands bring new trends to Japanese consumers.

The market is moderately consolidated, with several regional and global players contributing to competition. Companies such as Archer Daniels Midland Company, Land O’ Lakes Inc., Dairy Farmers of America, and Ingredion Incorporated are key leaders, leveraging innovation, price competitiveness, and robust distribution networks to sustain their market presence. These players focus heavily on clean-label solutions, flavor customization, and cost-effective dairy alternatives to meet evolving consumer preferences across the food processing industry.

Leading firms are prioritizing strategic partnerships, flavor research, and geographic expansion to cater to rising demand across the USA, Europe, and Asia. ADM and Ingredion have enhanced their plant-based portfolios to serve flexitarian markets, while companies like First Choice Ingredients and Butter Buds Inc. have strengthened their B2B networks, targeting bakery, snacks, and ready-to-eat sectors. Notably, the integration of enzymatic and natural cheese flavors has been a critical differentiator in retaining large-scale food service contracts. Meanwhile, M&A activity continues, especially among mid-tier suppliers aiming to expand their footprint in developing economies.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1.9 billion |

| Form | Powder, Paste /Spread, Chunk, Grated, Others (Liquid and Sliced) |

| Application | Bakery & Confectionery, Processed Cheese, Sauces, Dressings, Dips & Condiments, Dairy & Desserts, Snacks & Savory Items, Ready Meal Production, and Others (Seasoning and Instant Mixes) |

| Product | Cheddar Cheese, Mozzarella Cheese, Parmesan Cheese, Blue Cheese, Goat Cheese, Swiss Cheese, Others (Cream Cheese and Vegan Cheese) |

| Buyer | Commercial Bakers, Artisan Bakers, Retail Buyers, Food Service Providers |

| Sales Channel | B2B/ HoReCa, B2C (Hypermarkets/Supermarkets, Convenience Stores, Mom and Pop Stores, Discount Stores, Food Specialty Stores, Independent Small Groceries, Online Retail, and Others) |

| Regions Covered | North America, Latin America, Europe, the Middle East and Africa, East Asia, South Asia, and Oceania |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, and 40+ countries |

| Key Players | Archer Daniels Midland Company, Ingredion Incorporated, Adare Food Ingredients Pvt Ltd, Dale Farm Ltd, C.P. Ingredients Ltd, Land O’ Lakes Inc., Dairy Farmers of America, Inc., First Choice Ingredients (DSM), Butter Buds Inc., GoBia Ltd, Puramio India Pvt Ltd, and Jeneil Bioproducts GmbH |

| Additional Attributes | Dollar sales and growth by product, form, buyer, application, and sales channel; segment-wise market share analysis; country-wise market analysis; evolving consumer preferences for natural and clean-label cheese concentrates; innovations in formulation and flavor delivery; and focus on sustainability, traceability, and quality consistency |

The global cheese concentrates market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the cheese concentrates market is projected to reach USD 3.1 billion by 2035.

The cheese concentrates market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in cheese concentrates market are mozzarella cheese, cheddar cheese, parmesan cheese, swiss cheese, goat cheese, blue cheese and others.

In terms of form, powder segment to command 36.2% share in the cheese concentrates market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cheese Packaging Market Forecast and Outlook 2025 to 2035

Cheese Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Cheese Color Market Size and Share Forecast Outlook 2025 to 2035

Cheese Market Size and Share Forecast Outlook 2025 to 2035

Cheese Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Cheese Flavor Market Size, Growth, and Forecast for 2025 to 2035

Cheese Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cheese Powder Market Size, Growth, and Forecast for 2025 to 2035

Cheese Alternatives Market Analysis - Size, Share, and Forecast 2025 to 2035

Cheese Analogue Market Insights - Growth & Demand Analysis 2025 to 2035

Cheese Liners Market

Vegan Cheese Market Size and Share Forecast Outlook 2025 to 2035

Cream Cheese Market Analysis – Size, Share, and Forecast 2025 to 2035

Vegan Cheese Sauce Market Size and Share Forecast Outlook 2025 to 2035

Nacho Cheese Warmers Market – Hot & Fresh Cheese Dispensing 2025 to 2035

Spray Cheese Market Analysis by Flavours, Distribution Channel and Region through 2035

Analysis and Growth Projections for Halal Cheese Market

Color Concentrates Market

Frozen Cheese Market Size and Share Forecast Outlook 2025 to 2035

Understanding Market Share Trends in String Cheese Production

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA