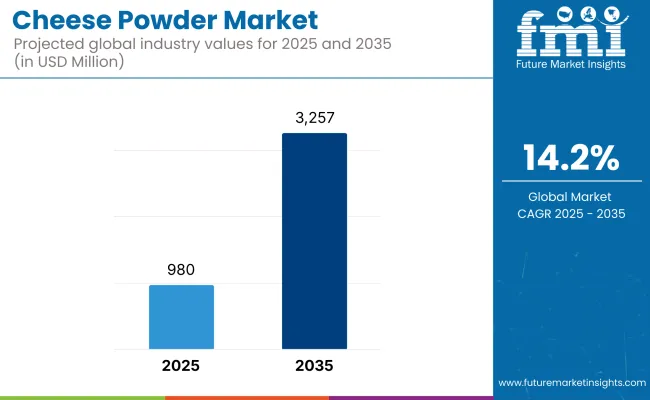

The cheese powder market is set to demonstrate exponential expansion, growing from a baseline valuation of USD 980 million in 2025 to reach an impressive USD 3,257 million by 2035.

This growth trajectory reflects a compelling CAGR of 14.2% over the assessment period. Among various geographies, North America is positioned as the most lucrative market in 2025, owing to the entrenched consumption of cheese-infused snacks and sauces. Meanwhile, the Asia Pacific region is forecasted to be the fastest-growing market during the same period, propelled by rising westernization of diets, increased snacking behaviors, and growing demand for dairy-based convenience foods.

Strong momentum in the cheese powder market has been catalyzed by a shift toward shelf-stable dairy alternatives, particularly for applications in ready-to-eat meals, bakery, dry snacks, and sauces. Increasing urbanization and fast-paced consumer lifestyles have encouraged demand for powdered ingredients that deliver authentic cheese flavor without requiring refrigeration. However, market expansion is somewhat restrained by formulation challenges, such as flavor volatility during spray drying and textural concerns in processed foods.

Additionally, the rising preference for clean-label and allergen-free products has added pressure on manufacturers to reformulate without compromising taste. Key trends influencing the landscape include the use of novel cheese blends (e.g., smoked, truffle, blue cheese powders), organic and non-GMO claims, and application-specific innovation targeting plant-based snacks and gluten-free baking mixes.

Market participants are seen investing in functional formulation technologies, improving solubility and emulsification properties of cheese powders, and exploring lactose-free or vegan alternatives for niche segments.

Looking ahead from 2025 to 2035, cheese powder demand is expected to be significantly shaped by the convergence of functional food trends and convenience. The market will likely witness increased cross-category adoption-from baby food and meal kits to gourmet seasoning blends. Sustainable sourcing of cheese inputs, alongside innovations in drying technologies to improve nutrient retention, will become critical differentiators.

Product development aligned with consumer expectations for intense taste, low sodium, and fortified nutrition is projected to influence both premium and mainstream segments. With digital retail and D2C formats gaining traction, the market is anticipated to expand beyond industrial foodservice into high-end culinary and at-home preparation formats, offering long-term value creation opportunities.

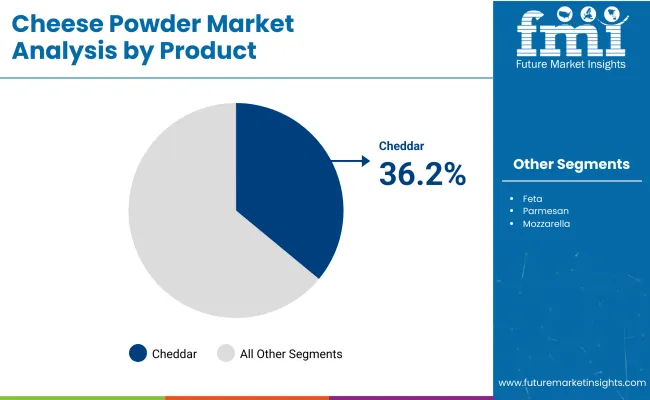

Cheddar cheese powder holds the largest share of the global cheese powder market at 36.2% in 2025. This dominant position reflects its deep integration across both industrial and consumer-facing food categories, amid a broader market growing at a 14.2% CAGR through 2035.

Cheddar’s appeal has been consistently reinforced by its sharp yet adaptable flavor profile and cost-efficient processing advantages. It has been favored by food technologists for delivering consistent sensory impact across dry and wet matrices-critical in snack seasonings, sauces, and dehydrated meals. In the coming decade, the segment is expected to maintain its leadership not only through volume but also through formulation versatility, particularly as the line between indulgent and better-for-you snacking continues to blur.

The segment is also poised to benefit from rising clean-label adaptations, such as non-GMO and organic cheddar powder formats, as well as regional innovations like aged or smoked cheddar profiles tailored to gourmet consumer preferences.

Strategically, cheddar cheese powder will continue serving as the baseline for hybrid cheese blends and functional seasoning systems. As application formats diversify and demand for high-impact yet shelf-stable dairy solutions grows globally, cheddar powder’s technical reliability and broad consumer familiarity will position it as the most scalable vector of cheese flavor delivery in the decade ahead.

The Asia Pacific region is forecasted to register the fastest CAGR of 16.5% between 2025 and 2035 in the global cheese powder market. While North America leads in absolute market value, Asia Pacific’s growth trajectory reflects transformative shifts in dietary patterns, foodservice formats, and processed food consumption across emerging economies.

This growth has been driven by the accelerating westernization of diets in countries such as China, India, Indonesia, and Vietnam, where cheese-once a niche or unfamiliar ingredient-is now increasingly embedded in everyday meals, QSR menus, and fusion cuisines.

The rapid expansion of middle-income populations, urban living, and dual-income households has fueled consumer demand for indulgent yet convenient foods, making cheese powder an attractive format for snack, instant meal, and ready-to-cook categories. Moreover, low ambient storage requirements and cost-effective reconstitution give cheese powder a logistical edge in regions with limited cold chain infrastructure.

Looking ahead, Asia Pacific is likely to evolve from a consumption-driven region to one of production and innovation. Local manufacturers are already seen investing in dairy processing infrastructure, regional flavor profiling, and clean-label adaptations to suit local palates and regulatory frameworks. As multinational and regional players intensify competition, the region will define the next wave of application-driven growth in cheese powders.

Challenges

Regulatory Compliance and Health Concerns

Entrenched among the dominant imperfections in the cheese powder market is the stringent regulatory standards and health concerns surrounding processed as well as powdered dairy products. Regulatory agencies around the world are working to create tighter guidelines around food additives, preservatives and labelling practices, making manufacturers more transparent and focused on natural ingredient lists.

Moreover, consumers have become health-conscious which is anticipated to spur the demand for low-sodium, reduced-fat, and clean-label cheese powders. Retooling products to meet these changing expectations without sacrificing taste and texture is no small challenge.

To overcome this, companies need to invest in R&D to explore alternative processing techniques such as spray-drying that retains flavor without the negative nutritional implications. In addition, in order to meet regulatory approval and maintain consumer trust, complying with food safety standards in the supply chain is ensured by further quality control investments and compliance management across global supply chain networks.

Opportunities

Rising Demand for Convenience Foods and Plant-Based Alternatives

Cheese powder market is witnessing a huge opportunity from the growing demand for convenience foods and plant-based cheese alternatives. Cheese powders are taking off in snack foods, ready-to-eat meals and seasoning applications as consumers look for convenient and shelf-stable cheese products.

Furthermore, the rising population of vegan and lactose-intolerant consumers is fuelling the demand for plant-based cheese powders produced from nuts, soy, and other dairy alternatives. Instead of cash, companies are using cutting-edge food tech including microbial fermentation and enzyme modification, to develop dairy-free cheese powders that closely match conventional cheese flavours.

As e-commerce and foodservice industries continue to grow, opportunities for creative cheese powder applications like gourmet popcorn toppings, flavored pasta seasonings, and savory meal kit enhancers also expand. This unique spin on breakfast informs recipes and products, allowing factory producers to capitalize on consumer desires for ease of access and dietary involvement, all while leveraging new revenue opportunities and market expansion.

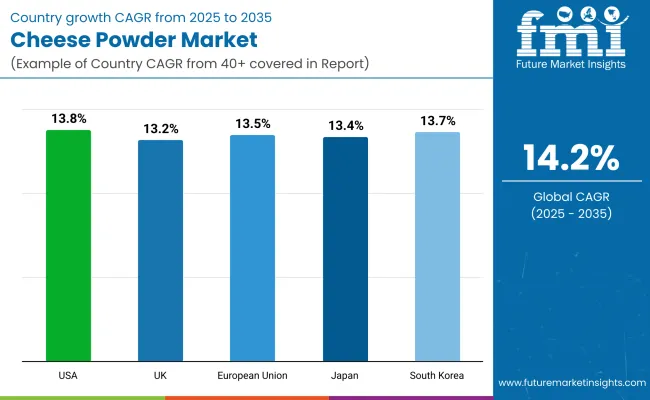

Increasing consumer demand for convenient long shelf-life dairy and dairy products catalyses the growth of the cheese powder market in the United States. Growing use of cheese-containing snacks, ready-to-eat foods, and seasoning in food service and retail sectors greatly supports the growth of the market.

Moreover, the demand for natural cheese powders with reduced-fat products is instigating manufacturers to offer clean-label and organic cheese powder, Induced by health aware consumers. Innovations in drying and flavor-enhancing technologies enhance cheese powder, which is used in a variety of processed food applications, supporting market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 13.8% |

In the UK, the cheese powder market is growing due to the changing consumer behaviour preferences towards convenience products and gourmet snack products. The use of cheese powder in a variety of ready-to-eat meals, bakery products, and savory snacks has steadily increased. Looking further, the rising demand for plant-based cheese powders with the growing category of the vegan and vegetarian population is also changing the game for the cheese powder industry.

In addition, stringent food safety standards and a growing preference for natural and clean-label cheese powders catalyse manufacturers to innovate and improve product quality, thereby sustaining steady market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 13.2% |

The cheese powder in the European Union accounts for a significant fraction, led by France, Germany, and Italy. Growth is primarily driven by the strong dairy production industry, along with the wide use of cheese powder in processed foods, sauces, and seasonings.

The popularity of premium, organic, and plant-based cheese powders is another driving force for the market, as consumer preferences shift prompted by climate change and evolving diets. Furthermore, cheese-flavored snacks and convenience food products are gaining a lot of popularity, which is encouraging manufacturers to expand their product portfolios thus driving the ever-advancing growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 13.5% |

The cheese powder market is booming in Japan as cheese flavors are being incorporated into instant ramen, chips, and bakery products as it adds flavors to food.

Western-style fast foods, and cheese-flavored snacks have helped the expansion of that market. Japanese consumers favour mild, umami rich cheese powders, drawing the necessity for new and local formulations. Moreover, technology improvements in food processing allow manufacturers to improve the taste, texture and application versatility of cheese powders, which propel the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 13.4% |

Instant foods, snacks and ready-made seasonings while drive the cheese powder mystery in South Korea as well. Rising trends towards Western diet and the growing fast food sector have propelled the demand for cheese powders and their applications across food. The influence of social media and K-food trends is also behind the cheese-flavored phenomena.

Moreover, with the increasing health-conscious consumer segment, there is a demand for natural, and organic, and low-fat cheese powder options that will continue to fuel market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 13.7% |

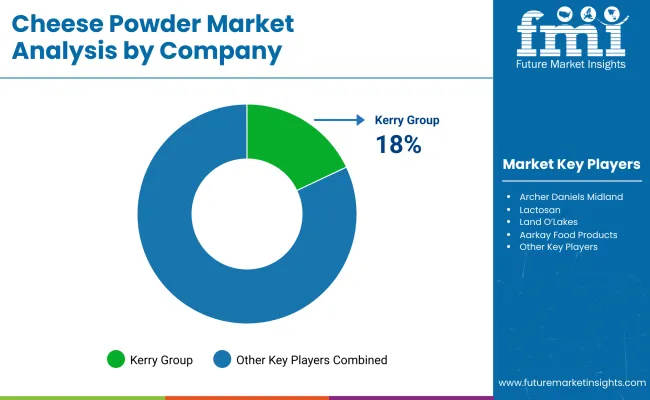

Kerry Group (18-22%)

Kerry Group is a major player in cheese powder solutions for snacks, soups, and bakery, with competencies in customized applications. The company's emphasis on clean-label and plant-based cheese powder formulations serves the needs of health-conscious consumer trends.

Archer Daniels Midland (ADM) (15-20%)

ADM's extensive portfolio of both dairy-based and plant-based cheese powders is meeting evolving consumer preferences. The firm places resources into sustainable bounce sourcing and flavor advancement to reinforce its economic position.

Lactosan (10-15%)

Lactosan specializes in enzyme-modified cheese powders, which provide excellent opportunities of gaining authentic cheese flavor in your food application, while maximizing the utilization of the cheese. The business's focus is that of extending its collection along with natural and natural cheese powder offerings.

Land O’Lakes (8-12%)

Land O’Lakes, a producer of high-end dairy-based cheese powders, and other products that find their way into snack foods, seasonings and sauces. In pursuit of superior product quality, the company utilizes advanced drying and flavor enhancing technologies.

Aarkay Food Products (5-10%)

Aarkay Food Products focuses on natural cheese powders, which suit different regional taste profiles. To keep pace with the increasing demand for vegan-friendly food, the plant-based cheese powder company has decided to expand its range of products.

Other Key Players (30-40% Combined)

Market growth is driven by new entrants as well as established players, each of whom has their own lenses on innovation and sustainability. Notable companies include:

The overall market size for the cheese powder market was USD 980 million in 2025.

The cheese powder market is expected to reach USD 3,257 million in 2035.

The cheese powder market is expected to grow at a CAGR of 14.2% during the forecast period.

The demand for the cheese powder market will be driven by increasing consumer preference for convenience foods, rising demand for dairy-based flavoring ingredients, expanding applications in the snack and ready-to-eat meal industries, growing interest in natural and organic food products, and advancements in food processing technologies.

The top five countries driving the development of the cheese powder market are the USA, Germany, France, China, and the UK.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cheese Packaging Market Forecast and Outlook 2025 to 2035

Cheese Concentrates Market Size and Share Forecast Outlook 2025 to 2035

Cheese Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Cheese Color Market Size and Share Forecast Outlook 2025 to 2035

Cheese Market Size and Share Forecast Outlook 2025 to 2035

Cheese Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Cheese Flavor Market Size, Growth, and Forecast for 2025 to 2035

Cheese Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cheese Alternatives Market Analysis - Size, Share, and Forecast 2025 to 2035

Cheese Analogue Market Insights - Growth & Demand Analysis 2025 to 2035

Cheese Liners Market

Vegan Cheese Market Size and Share Forecast Outlook 2025 to 2035

Cream Cheese Market Analysis – Size, Share, and Forecast 2025 to 2035

Vegan Cheese Sauce Market Size and Share Forecast Outlook 2025 to 2035

Nacho Cheese Warmers Market – Hot & Fresh Cheese Dispensing 2025 to 2035

Spray Cheese Market Analysis by Flavours, Distribution Channel and Region through 2035

Analysis and Growth Projections for Halal Cheese Market

Frozen Cheese Market Size and Share Forecast Outlook 2025 to 2035

Understanding Market Share Trends in String Cheese Production

Smoked Cheese Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA