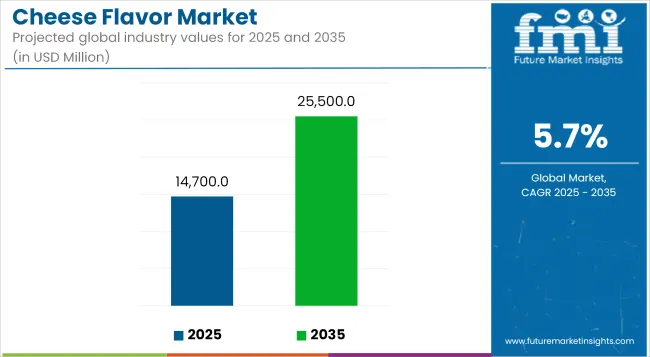

In 2025, the global cheese flavor market size is assessed at USD 14,700 million and is forecasted to witness robust growth, reaching USD 25,500 million by 2035, reflecting a CAGR of 5.7%. This consistent expansion trajectory is anchored in the intensifying consumer preference for indulgent flavors and the expanding footprint of processed foods across the globe. Technological advances in flavor encapsulation and natural cheese extraction have been instrumental in enhancing product stability and taste profiles, further solidifying demand across multiple food formats.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 14,700 million |

| Industry Value (2035F) | USD 25,500 million |

| CAGR (2025 to 2035) | 5.7% |

The global cheese flavor market is witnessing accelerated adoption across packaged snacks, bakery products, and sauces, driven by the growing need for rich, umami notes in processed foods. Consumer shifts toward convenience meals and shelf-stable gourmet offerings are sustaining this trend. The proliferation of plant-based and allergen-free cheese flavors is also gaining prominence, catering to evolving dietary preferences.

However, price fluctuations in raw cheese inputs and the regulatory scrutiny on artificial flavor compounds remain key challenges for manufacturers. Nevertheless, the rising penetration of e-commerce and D2C models is enabling manufacturers to launch new formats and tailor flavor innovations to regional palates more efficiently.

Between 2025 and 2035, the cheese flavor sector is expected to be reshaped by clean-label innovation, hybrid-dairy formulations, and cross-cultural flavor fusions. By 2025, cheddar and parmesan variants will continue holding significant ground, particularly in snack seasoning and instant meal applications. By 2035, a noticeable shift toward vegan cheese flavor analogs is anticipated as alternative proteins gain traction.

The functional use of cheese flavors as both sensory enhancers and masking agents in health-positioned foods is projected to expand, reinforcing their role across nutraceuticals and fortified formulations. Technological differentiation in flavor delivery systems, particularly microencapsulation and spray-drying, will be critical in defining market competitiveness over the decade.

Cheese flavors positioned under clean-label claims are expected to hold approximately 21.6% of market share in 2025. This segment’s expansion is largely underpinned by the rising demand for transparency in food labeling and minimal ingredient processing. Regulatory shifts across North America and the European Union have encouraged brands to reformulate offerings without artificial enhancers, aligning with EFSA and FDA guidelines on permitted natural flavor constituents.

Companies such as Synergy Flavors and Gold Coast Ingredients have introduced natural cheese flavor solutions using enzyme-modified cheese and fermentation-based approaches to meet clean-label standards. These innovations not only deliver enhanced flavor intensity at lower dosages but also align with plant-based and allergen-free positioning strategies.

Clean-label cheese flavors are also finding traction in organic snack categories and health-positioned bakery items, where additive-conscious consumers influence product innovation. Challenges remain in maintaining stability and shelf life, especially under high-heat processing conditions; however, spray-dried and microencapsulated formats are addressing these concerns. The clean-label segment is expected to evolve further as brands increasingly integrate AI-based flavor development tools and fermentation-derived flavor libraries.

Functional cheese flavors are projected to account for 12.3% of market share in 2025, marking their emergence as multifunctional agents beyond conventional taste enhancement. These flavors are increasingly incorporated into fortified products such as high-protein snacks, reduced-fat sauces, and nutraceutical beverages, particularly in Western Europe and East Asia.

Functional cheese flavors act as masking agents for bitterness in protein-enriched and fiber-fortified formulations, enabling manufacturers to balance nutritional value with sensory appeal. Players like DSM-Firmenich and Kerry Group are actively deploying cheese flavor platforms that integrate with micronutrients, vitamins, and botanical extracts to elevate both flavor and health positioning.

This segment is gaining regulatory validation, with recent guidelines from the European Food Safety Authority (EFSA) permitting multifunctional natural flavors in functional food matrices. The versatility of functional cheese flavors is also being explored in meal replacement applications and pediatric nutrition where taste fatigue presents a major barrier. Continued advancements in biotransformation and thermal-resistant delivery systems will define the segment’s scalability across ambient and chilled product categories.

Stringent Regulatory Standards and Clean Label Demand

The growing regulatory scrutiny over food additives, flavoring agents, and labelling requirements is one of the major challenges in the cheese flavor market. The growing trend among consumers to know what goes into the products they consume is driving a shift toward clean label and natural alternatives.

Regulatory authorities in several countries have introduced stringent limits on artificial flavoring and preservatives, prompting manufacturers to reformulate products to meet changing safety requirements. Such transition has complicated production processes, and often when it comes to sourcing natural and organic ingredients, it has led to rising costs.

Producers also face the challenge of maintaining consistency in flavor profiles whilst making the shift away from synthetic additives, as natural flavour replacements can differ in taste and stability. Innovation in the area of natural fermentation techniques to create mature flavor profiles, developing enzyme-modified cheese, and creating plant-based flavoring solutions is critical, and companies need to focus their research and development portfolio in line with the regulatory and consumer mandates to compete.

Growing Demand for Plant-Based and Specialty Cheese Flavors

The success of specialty and plant-based cheese alternatives can also present a lucrative opportunity for the cheese flavor market. With an increasing number of consumers turning towards vegan, lactose-free, and health-aware diets, there is a growing appetite for genuine cheese flavours sourced from dairy-alternatives.

Other companies are using fermentation technology, microbes and plant-derived compounds to mimic the flavors in traditional cheese without employing any dairy ingredients. The growing trend toward gourmet and artisanal cheeses has also provided opportunities for distinctive, regionally inspired flavors that align with diverse culinary preferences.

Food producers and restaurants are adding specialty cheese flavors to snack foods, sauces, and ready-to-eat meals and premium grocery dairy products, increasing market potential even more.

The incorporation of states-of-the-art flavor enhancers, including enzyme-modified cheese and encapsulated flavors is also enabling manufacturers to provide deeper, more authentic tasting experiences, making plant-based cheese flavour profiles more attractive to mass-market customers.

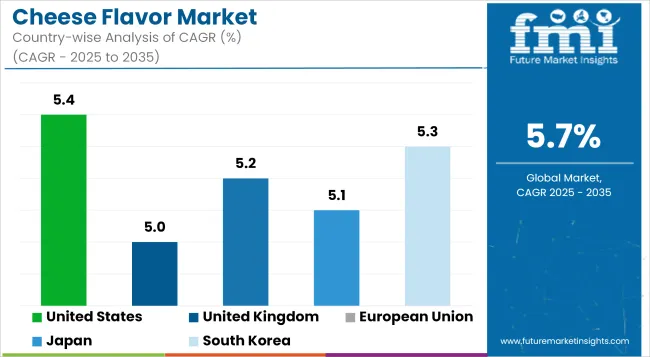

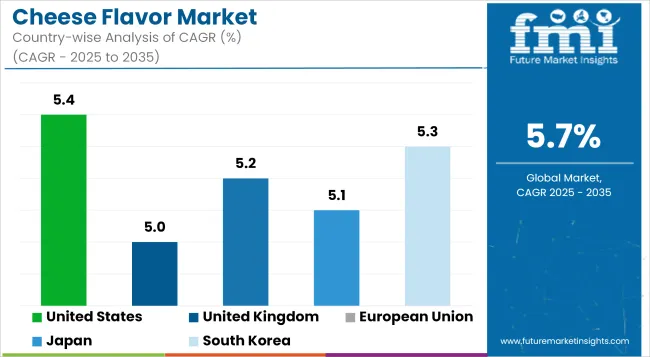

As processed and flavored cheese product consumption continues to rise, the United States cheese flavor market is anticipated to continue growing at a stable rate. The industries of fast food and snacks are important contributors, with cheese-flavored snacks, sauces, and ready-to-eat meals showing increased demand.

The growing demand for natural and organic cheese flavors has propelled manufacturers to explore clean-label and plant-based options. The prevalence of large-scale food processing companies and the constant launches of new cheese flavor profiles are further driving the demand in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.4% |

United Kingdom's thriving bakery and snack and ready-meal industries are driving the demand for cheese flavor. The British consumer is searching for gourmet and artisanal cheese flavors, which in turn has encouraged manufacturers to diversify their product portfolios by introducing novel flavor variants.

There is also an increased interest in flavors for vegan and dairy-free cheeses that are growing in popularity which is creating an opportunity for innovation within the plant-based options. Furthermore, trending government regulations regarding food additives and flavoring agents is also propelling demand, promoting the evolution of natural and clean-label cheese flavoring solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.0% |

France, Italy, and Germany continue to be the leading European producers and consumers of cheese flavors. To a significant extent, the expansion of the market is due to the region's formidable dairy industry and cultural inclination towards cheese. Trends towards health-conscious consumers are further boosting demand for reduced-fat and natural cheese flavouring solutions, whereas consumers are increasingly seeking out premium and gourmet cheese flavours.

The popularity of cheese flavors for use in processed foods, sauces and snacks remains on a trajectory of growth which is underpinning developments in flavor extraction and formulation technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.2% |

The cheese profile of the country is prompted by the growing interest from consumers in Western style dairy and fusion food. The rise in the consumption of cheese-flavored snacks, instant noodles and baked products is stimulating market growth. Furthermore, Japanese honey, which is milder, and corn syrup, which offers umami-rich flavors, have become flavor variants catered to regional tastes.

The increasing consumption of convenience food coupled with the ongoing innovation in cheese-based seasonings is likely to boost market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

The cheese-flavor industry in South Korea is also growing as the country's diet becomes more westernized, and cheese-filled fast food and snacks become popular. Its popularity in products such as cheese-flavored ramen, chips, and baked goods is driving market growth.

Moreover, health-conscious consumers are increasingly looking for natural and premium cheese flavors. As new trends in cheese, such as Korean-themed cheese-dipped street eats and fusion cuisine, continue to dominate the landscape, steady expansion is anticipated for the market through coming years.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.3% |

Growing consumer preference towards processed food and convenience foods, increasing trend for gourmet and artisan cheese, and development in the flavoring technologies are the key factors for the growth of cheese flavor market. Due to a growing demand for cheesiness in the form of cheese flavors in snacks, sauces, seasonings, and ready-to-eat meals, cheese flavors are used extensively for taste and aroma enhancement.

Rise in plant-based and dairy-free cheese alternatives are also driving the innovation of natural & synthetic cheese flavor formulations market. The growth in the food processing industry and the establishment of quick-service restaurants (QSRs) are among other factors that are expected to drive the growth of the market.

By Functionality:

The overall market size for the cheese flavor market was USD 14,700 million in 2025.

The cheese flavor market is expected to reach USD 25,500 million in 2035.

The cheese flavor market is expected to grow at a CAGR of 5.7% during the forecast period.

The demand for the cheese flavor market will be driven by the growing popularity of processed and convenience foods, increasing consumer preference for dairy-based flavors, rising demand for natural and organic flavoring agents, expanding applications in the snack and bakery industries, and technological advancements in flavor formulation.

The top five countries driving the development of the cheese flavor market are the USA, France, Germany, China, and the UK.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Cheese Flavor in Japan Size and Share Forecast Outlook 2025 to 2035

Cheese Packaging Market Forecast and Outlook 2025 to 2035

Flavor Modulator Market Size and Share Forecast Outlook 2025 to 2035

Flavor Emulsions Market Size and Share Forecast Outlook 2025 to 2035

Flavor Masking Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavor Modulators Market Size and Share Forecast Outlook 2025 to 2035

Cheese Concentrates Market Size and Share Forecast Outlook 2025 to 2035

Flavor Compounds Market Size and Share Forecast Outlook 2025 to 2035

Cheese Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Cosmetic Formulation Agents Market Size and Share Forecast Outlook 2025 to 2035

Cheese Color Market Size and Share Forecast Outlook 2025 to 2035

Flavored Whiskey Market Size and Share Forecast Outlook 2025 to 2035

Flavored Butter And Oils Market Size and Share Forecast Outlook 2025 to 2035

Cheese Market Size and Share Forecast Outlook 2025 to 2035

Cheese Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Oils Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavors for Pharmaceutical & Healthcare Applications Market Size and Share Forecast Outlook 2025 to 2035

Flavor Capsule Cigarette Market Analysis - Size, Share, and Forecast 2025 to 2035

Flavored Syrup Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA