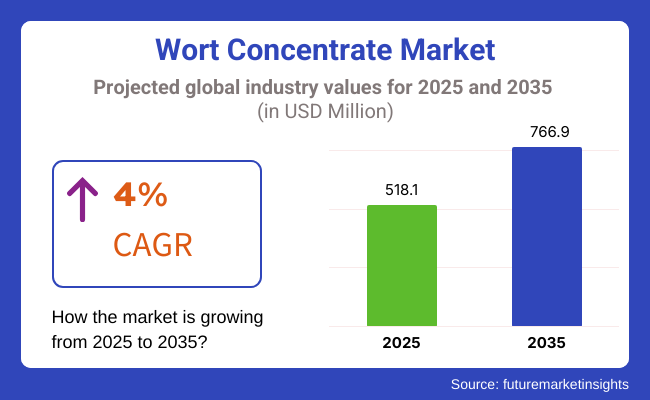

The wort concentrate market is anticipated to be valued at USD 518.1 million in 2025 and is projected to reach USD 766.9 million by 2035, growing at a CAGR of 4% over the assessment period of 2025 to 2035. The industry is seeing continuous development due to the augmented requirements from the brewing, food, and beverage industries.

It is a malt-derived liquid, is extensively used in the production of beer, non-alcoholic malt beverages, and functional food applications because of its taste, ferment ability, and nutritional advantages. The increasing interest in craft brewing and home brewing is additionally driving the industry's rise.

Breweries that are using more and more wort concentrate for their production process simplification, precision, and time optimization. Moreover, the non-alcoholic beverage industry growth that is malt drink based and is becoming a trend among health-conscious consumers who seek natural and nutritious beverage alternatives is driving. The demand for clean-label and organic malt ingredients is also affecting industry trends, alongside the customers' preference for products with no additives and those that are processed naturally.

Improved malt extraction and concentration technology have brought about the enhancement of the concentrate, not only in the area of quality but also in terms of stability and shelf life. As a result, it has become the most popular option for manufacturers.

The latest developments enable the brewing industry to operate in a more energy-efficient way, with better fermentation control, and with a greater consistency of taste. Furthermore, the increasing requirement for specialty and premium malt ingredients by craft breweries is resulting in the mushrooming of the use of it as a dependable and high-quality brewing option.

On the other hand, the industry is faced with several challenges. These include the fluctuation of raw material prices and the unpredictable weather effect on barley production. The availability and expense of high-quality malting can be a major factor in determining pricing and production of the product.

Except for that, the competition among the soft drink manufacturers, who are using other sweeteners and flavorants might cost the industry some of its gross. The food additives and labeling standards imposed by each region also create hurdles for the industry which requires manufacturers to maintain stricter quality and safety regulations.

Nevertheless, a good number of opportunities are there for the growth of the industry. The growing demand for premium and specialty malt ingredients in the craft brewing sector, as well as innovations in the functional malt beverages, will be the main forces driving this development.

The ongoing lifestyle changes, focused on health benefits and plant-based diets, is creating entirely new pathways for the use of the product in sports drinks and meal replacement products. As buyers' preferences keep modifying, the industry will go under continuous growth during the next years.

The industry is growing steadily driven by the factors such as rising demand for fermentable sources of sugar in brewing, bakery, and functional beverage uses. Wort concentrate, which is produced from malted grains, is high in maltose and nutrients, and it is a highly sought-after ingredient in many industries.

In the brewing industry, the product is a key ingredient in beer production, aiding in flavor, color, and efficiency of fermentation. It is utilized as a natural sweetener and flavoring agent by the bakery and confectionery industry, contributing to bakery products' texture and storage life. Functional beverages, like energy drinks and nutritional supplements, use the product for its content of complex carbohydrates and natural malt flavors.

Moreover, animal feed producers are also looking into the industry for its energy value and digestive health virtues. With consumer trends favoring natural, non-GMO, and clean-label ingredients, producers are shifting towards sustainable sourcing and new product formulation to address industry demands.

The table below provides a comparative analysis of the change in CAGR among the base year (2024) and the current year (2025) in the global industry. The review highlights significant transformations in the industry, and trends in revenue realization, thus offering stakeholders guidance on growth patterns. H1 is January &- June and H2 is July - December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 4.9% |

| H2 (2024 to 2034) | 5.5% |

| H1 (2025 to 2035) | 5.1% |

| H2 (2025 to 2035) | 5.6% |

From 2024 to H1 2034, the industry continued to rise at a fairly consistent CAGR of 4.9%, only slightly higher of 5.5% during H2. It would continue to display ongoing growth during the entire H1 2025- H2 2035 period with 5.1% rate of growth for first half of a decade and it's 5.6% for the second half. The industry had a 20 BPS growth in the first half and then 10 BPS coming in the second half indicating steady growth in the industry.

The industry saw significant growth between 2020 and 2024 due to the growing demand for craft beer and non-alcoholic drinks. It is one of the most important ingredients in brewing, became more popular because it is convenient and can offer consistent quality and taste in beer brewing.

Greater popularity for home brewing and growth of microbreweries also contributed to fueling industry expansion. Brewers also adopted the utilization of it in order to shorten production time and ensure consistent flavor profiles. Furthermore, the health craze reached its peak with greater production of lower-alcohol and non-alcoholic beers utilizing it. Supply chain disruptions and volatilities in prices of raw materials such as barley and hops posed challenges to producers.

Looking forward to 2025 to 2035, the industry will develop as fermentation technology progresses and demand rises for new styles of beer. Growing demand for low-calorie and low-alcohol beers and functional products will bring new opportunities for the producers.

Environment-friendly raw material sourcing and eco-friendly production technologies that do not harm the environment will become the differentiation factors in the industry. Improved concentration and preservation techniques will enhance shelf life and quality of the product.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Demand growth for craft beer and microbreweries. | Growing interest in low-alcohol and functional drinks. |

| Used to reduce production time and maintain consistency of flavor. | Improved fermentation processes to maximize taste portfolios. |

| Raw material price volatility and supply chain disruptions. | Growing need for sustainable sourcing and green manufacturing. |

| Growing popularity of home brewing. | Increased demand for gluten-free and organic brewery markets. |

| Health trends forcing demand for low-alcohol and non-alcoholic beers. | New taste innovation and enhanced product shelf life. |

The industry greatly owes its use of raw materials towards the manufacture of beer, baking, and production of functional beverages. However, food safety regulations and labelling requirements are two significant issues that provide compliance uncertainty to organizations. Adjustment in conformity to evolving industry standards, acquiring certificates as necessary, and the assurance of total openness are the means of establishing consumer trust and industry goodwill.

Supply chain disruptions create instability and add costs because of the conditional availability of malt and barley, transport constraints, and price volatility. Climate change in combination with farm issues and geopolitical tensions that influence the grain trade lead to uncertainties. The firms should diversify grain sources, invest in sustainable sources, and identify substitute types of grain in order to counteract the risks.

The shift in preferences of consumers to products with low-alcohol or without alcohol raises the challenges before the beneficial of traditional wort concentrate. The expansion of health-conscious customers and the trends of functional drinks is the source of the desire for the formation of new products. Industries must change with the time by developing less-sugar, enriched, or fortified foods that are in conformity with the industry trend.

The growing rivalry from synthetic and plant-based malt substitutes holds back the development of the two processes of pricing and placement in the industry. In order to keep their competitive edge, the concerned companies need to fund research and development, try to improve the quality of the product, and look for chances in sports diseases, bakery, and non-alcoholic drinks.

Industry developments are influenced by economic variations, trade regulations, and the choice of the customer's lifestyle. In the interest of staying in business for long, companies must operate their supply chain efficiently, venture into the markets that are just emerging, and join with beverage and food manufacturers to create innovative solutions on the manufacturing of the product to be suitable for different industries.

Unhopped Wort Concentrate Dominates the Market with High Demand

| Segment | Unhopped (By Type) |

|---|---|

| Value Share (2025) | 45.2% |

The industry can be segmented as unhopped, hopped, and gluten-free. The market for unhopped wort concentrate is leading with a 45.2% share due to its versatility in home-brewing, craft beer, and non-alcoholic malt beverages. This type enables brewers to design the hop profile to fit a variety of taste preferences. Large manufacturers such as Briess Malt & Ingredients and Muntons and Coopers Brewery offer unhopped products for use in commercial breweries, artisan fermentation projects, and malt-based soft drinks. Another is the growing practice of home-brewing and customizing the formulation of beer.

And hopped wort concentrates, which represent 38% of the percent of the industry, are preferred for reasons of their convenience and consistency in the hop flavor profile. Its ease of use makes it ideal for either small-scale breweries or even home-brewers who require something to boost their efficiency without the complication of commonly used hops, adding pre-determined hop bitterness and aroma examples to the brewing process allowing for similar functionality as the traditional hops but without the complications.

Liquid Malt Extract Co. and Northern Brewer - among others - also sell hopped products that are performed with different types of beer in mind, from pale ales to lagers. Advancements such as hops concentrates, which allow the consumer to create brewed craft beers with minimal investment in space and equipment, have rapidly increased the industry for hopped concentrates.

Demand for gluten-free and specialty beers is increasing, and gluten-free wort concentrate will be a key segment driving this exponential growth. In a bid to cater to health-conscious and gluten-intolerant consumers, breweries are also using alternative grains such as sorghum and millet. Other aspects like craft brewing expansion trends, development of non-alcoholic beer, and home-brewing culture are also directing the industry dynamics for the industry.

Industrial Brewers Drive the Highest Demand for Wort Concentrates

| Segment | Industrial Brewers (By End Use) |

|---|---|

| Value Share (2025) | 55.8% |

The end user leads the Industry in 2025. Industrial brewers dominate the industry with a 55.8% share with beer, malt-based beverages, and non-alcoholic malt drinks contributing towards the mass production of the product. Top beer producers including Anheuser-Busch InBev, Heineken, and Carlsberg use wort concentrates for cost-effective, efficient brewing to achieve consistent flavor and output. The need for inexpensive, high-volume brewing options remains a key reason industrial brewers are turning to these products, especially in developing markets with growing beer consumption.

Breweries increasingly use wort concentrates (30%) to also retain quality funds, save time for brewing, and experiment with novel beer styles. The movement toward craft beer - particularly strong in North America and Europe has also fueled the demand for customizable, high-quality products. Companies such as Briess Malt & Components, Muntons, and Coopers Brewery provide microbreweries with specialty products to create seasonal and small-batch craft beers using atypical malt profiles.

As consumer tastes continue to move toward craft and specialty beers, we see microbreweries increasing their industry share in the wort concentrate space. Furthermore, the increasing popularity of non-alcoholic and gluten-free beer segments is driving industrial and micro-brewers to develop new wort formulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.5% |

| Germany | 3.2% |

| China | 4% |

| UK | 3% |

| Australia | 3.8% |

| France | 3.1% |

| Italy | 2.9% |

| South Korea | 3.6% |

| Japan | 3.3% |

| New Zealand | 3.4% |

The USA will dominate the global industry due to a strong craft brewing industry and increased interest in home-brewing. As more and more consumers want variety and innovation in beer tastes, the demand for higher quality products has seen a significant boost.

The trend is also driven by increasing health-oriented consumption, which has spurred increased interest in low-alcohol and non-alcoholic beers. Sophisticated brewing technologies serve to play an important role in improving the quality and efficiency of the product, with a proper distribution system enabling commercial breweries as well as domestic brewers to have access to the required ingredients.

The existence of leading industry players creates a competitive industry that drives ongoing product enhancement and innovation. With changing consumer preferences, there is a growing trend towards sustainability and natural ingredients, which are in line with overall health trends. Together, the sum of these factors puts the USA in favor of strong growth in the industry, with a forecasted CAGR that captures its dynamic nature.

Germany's rich tradition in brewing is a testament to its status as a prominent industry player. Germany's strict adherence to the Reinheitsgebot, or Beer Purity Law, ensures the utilization of traditional ingredients, ensuring a steady demand for high-quality products. Germany's growing craft beer culture inspires breweries to innovate and create new types and flavors, which translates to a higher demand for specialty products that can facilitate brewing creativity.

Further, the growing popularity of alcohol-free beers tracks health and wellbeing trends, leading to industry expansion as consumers become more interested in high-quality products that fit into their lifestyles. German breweries are also more interested in innovation, experimenting with novel flavor profiles and environmentally friendly manufacturing methods to reach discerning consumers.

This fusion of tradition and innovation in the brewing process ensures that Germany will continue to be an important industry. Since both established and emerging breweries are investing in quality ingredients, the competitive industry drives growth and innovation, expressed as the industry's projected CAGR.

China's industry is growing at a very high rate, driven by growth in its brewing sector. Urbanization and rising disposable incomes are causing beer consumption to increase and subsequently drive demand for the products. The Chinese government strongly supports domestic craft breweries, stimulating innovation and diversification of beer products. Such support stimulates local brewers to innovate in terms of styles and flavors, and this requires a variety of products to accommodate different consumer tastes.

Also on the increase is an image of health benefits from moderate consumption of beer, prompting consumers to look for premium beers rather than mass-produced ones. As the industry changes, the focus on improved ingredients and specialty taste becomes even stronger, consistent with trends internationally among beverage markets. Synergy together brings China to a vibrant industry, with huge potential for future development, as represented by its projected CAGR.

The UK is witnessing constant growth in the industry with the revival of traditional brewing styles and the increase in demand for craft beer. With a robust beer culture and an increasing number of microbreweries, the industry has accelerated to high gear. Consumers are seeking local products, which has prompted breweries to adopt high-quality products.

Moreover, the low-alcohol and non-alcoholic beer trend is also going strong in the industry, with health-conscious consumers looking for alternatives without compromising on taste. British breweries like Camden Town Brewery and BrewDog are utilizing products to create new flavors and evolve with changing consumer demands. Focus on sustainability and eco-friendly manufacturing processes also continues to fuel industry growth, making the UK the leading player in the industry.

Australia's industry is growing with the popularity of craft beers. The increase in popularity of craft breweries and home-brewing across Australia has boosted demand for improved brewing material. The growth of new varieties of beer, with indigenous Australian ingredients, for example, has driven the trend.

In addition, Australia's robust beer export industry expands opportunities for growth, with domestic breweries striving for premium quality to fulfill international orders. Companies such as Coopers Brewery and Stone & Wood Brewing Co. have been at the forefront of spearheading innovation and making the nation a competitive force in the industry. The rising trend towards organic and sustainable ingredients is consistent with global developments, guaranteeing continuous growth within the industry.

The French industry will increase at a CAGR of 3.1% due to the country's growing craft beer industry. French breweries are emphasizing the use of high-quality ingredients, following the country's strong gastronomic tradition. The growth of artisanal brewing, especially in areas such as Alsace and Brittany, has provided new opportunities for the suppliers.

Also, consumer demand for locally and organically grown ingredients is influencing industry trends. Companies like Brasserie de Vézelay promote sustainable brewing, giving credibility to consumers' trend of premium beer consumption. Greater international collaboration with French breweries is fueling innovation as it assists in providing sustainable long-term industry growth.

The Italian industry will grow at a 2.9% CAGR due to an increasing trend for craft beer. Italy, being a country with a history of wine culture, has experienced a boom in microbreweries in recent years, particularly in the northern parts of the country. Chestnuts and local herbs are the ingredients Italian brewers emphasize, and they are ingredients that need tailor-made products.

Furthermore, companies such as Birra Baladin are also innovating the industry, further promoting demand for premium-quality products. Beer-food pairing, especially with fine dining, is also taking off and further pushing the industry ahead, ensuring steady growth.

The South Korean industry will grow at 3.6% due to a thriving craft beer industry. The younger generation, seeking a variety of beer offerings, has made local breweries the rage. Organizations like The Hand and Malt Brewing Company are at the forefront, focusing on quality ingredients and proficiency in brewing techniques.

In addition, the expansion of home-brewing culture through facilitation by the availability of homebrew kits and ingredients has further boosted demand for products. Western-style beers combined with local flavorings in Korea are still fueling industry development.

The Japanese industry will grow with a CAGR of 3.3% as a result of the nation's long history of beer culture. Japanese breweries emphasize quality and precision greatly, which guarantees a growing demand for premium wort concentrates. The global popularity of premium breweries such as Hitachino Nest Beer is offering better prospects for the industry.

The increasing health-oriented trend also boosted demand for low-alcohol and non-alcoholic beer. Japan's innovation and sustainability focus means that the industry should increase steadily over the next two to three years.

New Zealand's industry will grow by 3.4% due to its robust brewing culture. The nation's direct access to clean water and good hops constructs the nation's brewing sector reputation. Craft breweries like Garage Project are challenging creative boundaries, creating more demand for high-end products.

In addition, New Zealand's emphasis on organic brewing practices and sustainability will appeal to global consumer attitudes. The blend of innovation and quality manufacturing ensures long-term growth for the industry.

The industry is edging towards growth with the continual demand for craft-and-specialty beers, home brewing, and specialty beverages. Increasingly, consumers are gravitating toward natural, organic, and premium ingredients for brewing, thus putting pressure on manufacturers to innovate and respond with new offerings.

Industry players like Döhler Natural Food and Beverage Ingredients, Black Rock, Patagonia Malt, Briess Malt & Ingredients, and Thomas Fawcett and Sons are now investing in product development, sustainable sourcing, as well as modern malt extraction technologies. Briess Malt & Ingredients is geared toward green production, whereas Black Rock is increasing its industry of high-quality products for homebrew enthusiasts and breweries.

The industry is, therefore, moving toward custom malt blends, high-ferment ability concentrates, and organic formulations. Companies are fortifying their distribution networks and entering smart partnerships with breweries while also utilizing direct consumer sales. Competitive strategies include expanding their global landscape and optimizing supply chain operations while adopting digital marketing techniques to differentiate their brands and build customer loyalty in a saturated industry.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Döhler Natural Food and Beverage Ingredients | 18-22% |

| Black Rock | 14-18% |

| Patagonia Malt | 10-14% |

| Briess Malt & Ingredients | 8-12% |

| Thomas Fawcett and Sons | 6-10% |

| Other Players (Combined) | 25-35% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Döhler Natural Food and Beverage Ingredients | A global leader in natural beverage ingredients, providing high-quality malt extracts for brewing and non-alcoholic applications. |

| Black Rock | Specializes in premium liquid wort concentrates for homebrewing and craft beer production, focusing on easy-to-use formulations. |

| Patagonia Malt | Offers organic and specialty malt concentrates, emphasizing sustainable and regionally sourced ingredients. |

| Briess Malt & Ingredients | A key player in all-natural malt extract production, catering to craft breweries and homebrewers with a diverse malt portfolio. |

| Thomas Fawcett and Sons | It focuses on traditional malt processing methods, supplying premium wort concentrates for artisanal and heritage beer styles. |

Key Company Insights

Döhler (18-22%)

Industry leader with a wide spectrum of malt extracts and wort concentrates directed towards both beer and non-alcoholic beverage industries.

Black Rock (14-18%)

Reverberated throughout the house-brewing and craft beer markets for easy-to-brew wort concentrates of high quality.

Patagonia Malt (10-14%)

Strong presence in organic and eco-friendly malt concentrates, which appeal to environmentally conscious breweries.

Briess Malt & Ingredients (8-12%)

These are the main suppliers to craft breweries, and they are recognized for their outstanding quality and range of malt extract solutions.

Thomas Fawcett and Sons (6-10%)

Traditional malt producer for premium and heritage beer brands.

Other Key Players

The industry is segmented into organic and conventional wort concentrates.

The industry is categorized as unhopped, hopped, and gluten-free.

The primary ingredients include barley, wheat, and others such as sorghum and blends of rye and corn.

The industry is segmented into home brewers, micro-brewers, and industrial brewers.

The industry is analyzed across North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic countries, Russia and Belarus, and the Middle East & Africa.

The industry is expected to generate USD 518.1 million in revenue by 2025.

The industry is projected to reach USD 766.9 million by 2035, growing at a CAGR of 4%.

Key players include Döhler Natural Food and Beverage Ingredients, Black Rock, Patagonia Malt, Briess Malt & Ingredients, Thomas Fawcett and Sons, Muntons, Weyermann Malting, Castle Malting, Crisp Malt, and Dingemans.

North America and Europe, driven by the growing popularity of craft beer, rising home-brewing trends, and the expansion of small-scale breweries.

Barley-based wort concentrate dominates due to its rich malt profile, versatility in brewing, and strong preference among craft brewers and home-brewers.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Concentrate Containers Market Size and Share Forecast Outlook 2025 to 2035

Concentrated Solar Power Market Size and Share Forecast Outlook 2025 to 2035

Concentrate Pods Market Analysis Size and Share Forecast Outlook 2025 to 2035

Concentrated Milk Fat Market – Growth, Demand & Forecast 2025 to 2035

Concentrated Whey Market

Unconcentrated Orange Juice Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Beef Concentrate Market Size, Growth, and Forecast for 2025 to 2035

Cake Concentrate Market

Dairy Concentrate Market Forecast and Outlook 2025 to 2035

Juice Concentrate Market Analysis - Trends & Consumer Insights 2025 to 2035

Fruit Concentrate Puree Market Growth - Trends & Forecast 2025 to 2035

Color Concentrates Market

Cheese Concentrates Market Size and Share Forecast Outlook 2025 to 2035

Coffee Concentrate Market - Size, Share, and Forecast Outlook 2025 to 2035

Butter Concentrate Market

Omega-3 Concentrates Market Size and Share Forecast Outlook 2025 to 2035

Ketchup Concentrates Market Analysis by Nature, Product Type, Distribution Channel and Region through 2035

Poultry Concentrate Market

Cannabis Concentrate Market Analysis - Size, Share, and Forecast 2025 to 2035

Analyzing Not From Concentrated (NFC) Puree Market Share & Industry Leaders

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA