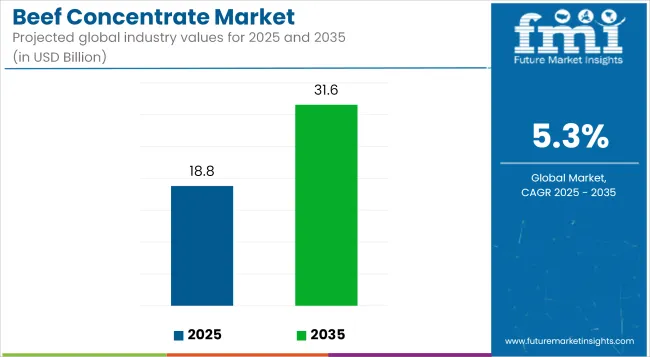

Surging demand is expected to elevate the global beef concentrate market from USD 18.82 billion in 2025 to approximately USD 31.56 billion by 2035, translating to a CAGR of 5.3% over the decade. The market’s ascent is shaped by the rising utilization of beef concentrates in foodservice and industrial meal production, where they offer a consistent, shelf-stable flavor solution. Consumer preference for protein-rich, umami-flavored foods has further intensified the uptake of beef-based flavoring systems in processed culinary applications.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 18.82 billion |

| Industry Value (2035F) | USD 31.56 billion |

| CAGR (2025 to 2035) | 5.3% |

The industry’s current dynamics are characterized by a growing shift toward liquid and paste formulations that offer high solubility and concentrated flavor profiles. Demand is being propelled by industrial users seeking standardized taste and extended shelf life in meal kits, instant noodles, bouillons, and gravies.

However, restraints persist in the form of increasing consumer skepticism toward animal-derived products and fluctuating raw material prices, which challenge long-term sourcing stability. Key trends such as clean-label claims, sodium reduction, and hybrid blends (meat-plant concentrates) are shaping innovation pipelines. Manufacturers are actively optimizing formulation performance for better sensory output, especially in frozen and ambient meal solutions.

Over the coming years, a clear trajectory of growth is expected as manufacturers emphasize product versatility and customized formulations to align with foodservice, retail, and B2B channel needs. By 2025, liquid beef concentrate will solidify its dominant position as the most preferred format, driven by ease of use and consistent reconstitution.

By 2035, as convenience foods evolve with premium flavoring standards, the market is projected to benefit from robust penetration across global markets, particularly in Asia-Pacific and North America. Technological enhancements in enzymatic hydrolysis and vacuum concentration processes are expected to further elevate product quality and broaden usage across gourmet and mass-market segments.

Retail sales of beef concentrate are estimated to hold a market share of 32.1% in 2025, with projections to exceed 35% by 2030 as shelf-stable, umami-rich condiments gain traction in premium grocery channels. The expansion of ready-to-cook products and culinary bases in retail formats is supporting growth, particularly in North America and Western Europe.

Regulatory frameworks such as the USDA’s FSIS labeling guidelines and EFSA’s clean-label harmonization efforts have prompted innovation in preservative-free and reduced-sodium beef concentrates for household use. Companies like More Than Gourmet and Better Than Bouillon have successfully positioned concentrated beef reductions and pastes as pantry essentials, offering authentic culinary flavor in minimal quantities.

These products are increasingly tailored for home chefs seeking convenience without compromising on quality. Transparent sourcing and simplified ingredient lists are now core differentiators as discerning consumers scrutinize label content.

The retail category is also benefitting from rising demand for premium private-label offerings, with supermarkets launching in-house branded beef stocks and concentrates in glass jars and pouches. This trend is being supported by enhanced in-store merchandising and recipe integration campaigns. While price sensitivity exists, consumers are showing willingness to pay for premium flavoring systems that mirror professional kitchen outcomes.

Exports of beef concentrate for industrial use are projected to account for 29.7% of total market volume in 2025, led by demand from food manufacturers in Asia, the Middle East, and parts of Latin America. The trade flow is dominated by paste and spray-dried forms with extended shelf stability and high bulk density, which optimize logistics and storage.

Beef concentrate is widely used in instant noodles, bouillon cubes, canned soups, and seasoning blends. Global processors such as Essentia Protein Solutions and Proliant Biologicals are scaling operations in Brazil and the United States to meet regional B2B contract demands.

Regulatory authorities such as the European Commission’s DG SANTE and Brazil’s MAPA maintain stringent guidelines on animal origin traceability and processing hygiene, thereby influencing product acceptability in cross-border transactions. Additionally, Halal and Kosher certifications are critical for expanding reach into markets across the Middle East and Southeast Asia. Industrial buyers prioritize functional consistency, cost per yield, and regional formulation adaptability, which continues to favor enzymatically hydrolyzed beef extracts with tailored flavor release.

Emerging trade corridors and relaxed import regulations in ASEAN and African nations are likely to support future volume scalability. Strategic collaboration between extract manufacturers and local contract formulators is expected to accelerate regional adoption of Western-style savory bases.

Supply Chain Volatility and Rising Production Costs

Thus far, supply chain disruptions caused by the pandemic which are already raising cattle feed prices along with rising production costs have negatively impacted the Beef Concentrate Industry.

Elements like climate change, feed shortages, and worldwide trade limitations influence the accessibility and cost of hamburger concentrate. There are also complexities around food safety and sustainability regulations that are an increasing threat to industry growth and operational stability.

Growing Demand for High-Protein and Nutrient-Dense Products

As consumers become more and more aware of protein-rich diets, the need for beef concentrate as a core element in nutritional supplements is increasing, alongside that of processed meat products and pet food. New opportunities are driven by innovations in protein extraction, sustainable sourcing and functional food applications.

Additionally, growing consumer demand for transparency and quality is driving more investment in clean-label and organic beef concentrate production.

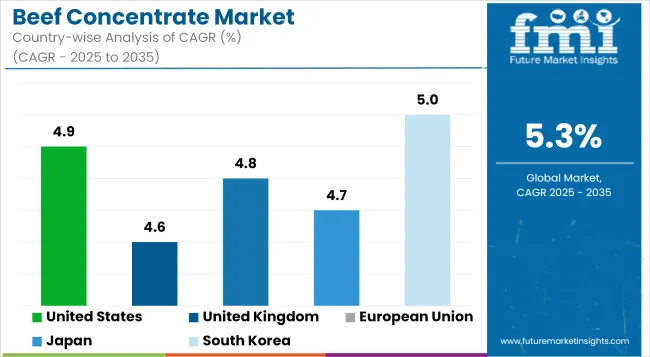

The consistent and upward growth of the beef concentrate market in the United States can be attributed to the increasing demand for nutrient-dense and high-protein food products. As consumers, driven by the preference towards protein-rich diets are increasingly gaining an array of application in processed food, convenience meals, and sports nutrition products, the beef concentrates market is maturing.

The increasing trend of clean-label and organic meat products has supported the development of premium beef concentrate products that are not only premium but are also free from any type of artificial additives and preservatives.

In addition, foodservice sectors such as quick-service restaurants and gourmet meal delivery services have also contributed to the growth of market by adding beef concentrates in soups, in sauces, and in broths to enrich flavors.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.9% |

Moderate growth in the United Kingdom's beef concentrate sector is bolstered by a trend toward convenient, high-protein foods. So it was a natural response to rising consumer interest in traditional British cuisine - which places an emphasis on stock and broth from beef to give the retail and foodservice sectors what they want.

Moreover, increasing adoption of ketogenic and paleo diets that promote high-protein intake has bolstered the demand for beef concentrates as a nutritious and savoury ingredient. Sustainability is for sure of concern, just like with ethical sources, for a swarm of health-centered consumers, and there is a movement towards grass-fed and organic beef focuses.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.6% |

Culinary traditions and demand for premium meat-based flavouring ingredients are the major driving factors for the European beef concentrate industry. Countries such as France, Germany, and Italy, which have a rich gastronomy with an emphasis on stocks, sauces, and reductions made from beef concentrates, all exhibit particularly strong market potential.

This has driven up demand in the region, driven by higher acceptance of processed and convenience foods. But regulatory policies impacting meat processing and sustainability concerns over cattle farming also create challenges and opportunities for manufacturers looking to innovate with ethically sourced, clean-label beef concentrates.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.8% |

Japan’s beef concentrate industry is cashing in on the country’s time-honoured culinary traditions, in which meat bases packed with umami are a vital component of dishes such as ramen and sukiyaki. Rising demand for convenience in home cooking and an increasing appetite for high-protein diets have bolstered the market’s growth.

In the upscale food sector, Wagyu beef concentrates made from premium grade meat are also in demand. The industrial transformation of meat and the proliferation of functional foods, such as collagen-infused beef concentrates aimed at health-oriented consumers, have also fuelled the rise of the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

In South Korea, there is a strong cultural preference for meat-based broths, particularly in traditional dishes such as seolleongtang (ox bone soup) and galbitang (short rib soup), driving the beef concentrate market. With growing demand for convenience food, many manufacturers have started to provide ready to use beef concentrates.

Increasing demand for beef concentrate products has been driven by increasing consumer interest in high-protein diets, along with a growing foodservice market. Moreover, the rise of K-food in the world market has opened doors for the export of Korean version beef concentrates.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

The beef concentrate market industry is expected to grow widely with increasing demand for protein-rich diet, growing consumer awareness regarding functional food ingredients, and limited application in various culinary sources and processed food products.

As companies leverage advances in food preservation, flavour enhancement, and nutritional fortification, the market is characterised by quality offerings, sustainable sources and innovative processing technologies. The strong consumer demand for high-protein, low-fat meat products is also contributing to the industry growth; the food service and packaged food sectors are particularly interested in the market.

The overall market size for the beef concentrate industry was USD 18.82 billion in 2025.

The beef concentrate industry is expected to reach USD 31.56 billion in 2035.

The beef concentrate industry is expected to grow at a CAGR of 5.3% during the forecast period.

The demand for the beef concentrate industry will be driven by increasing consumer preference for protein-rich diets, growing demand for processed and convenience foods, rising popularity of beef-based broths and soups, expansion of the foodservice industry, and advancements in food processing technology.

The top five countries driving the development of the beef concentrate industry are the USA, Brazil, Argentina, China, and Australia.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beef Fat Market Size and Share Forecast Outlook 2025 to 2035

Beef Flavors Market Insights - Trends & Forecast 2025 to 2035

Beef Bouillon Market

Wagyu Beef Market Analysis by Type, End-use, Region and Others Through 2035

Global Organic Beef Meat Market Size, Growth, and Forecast for 2025 to 2035

Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

Grass Fed Beef Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Breakdown of Processed Beef Market Share

Plant-Based Beef Market Size and Share Forecast Outlook 2025 to 2035

UK Processed Beef Market Analysis

Analysis of the USA Processed Beef Market by Product Type, Processing Method, Distribution Channel, Packaging Type and Region through 2035

Analysis of the Europe Processed Beef Market by Product Type, Processing Method, Distribution Channel, Packaging Type and Region through 2035

Asia Pacific Processed Beef Market Outlook - Size, Share & Industry Trends 2025 to 2035

Concentrate Containers Market Size and Share Forecast Outlook 2025 to 2035

Concentrated Solar Power Market Size and Share Forecast Outlook 2025 to 2035

Concentrate Pods Market Analysis Size and Share Forecast Outlook 2025 to 2035

Concentrated Milk Fat Market – Growth, Demand & Forecast 2025 to 2035

Concentrated Whey Market

Unconcentrated Orange Juice Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Wort Concentrate Market Analysis by Nature, Type, Ingredient, End Use and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA