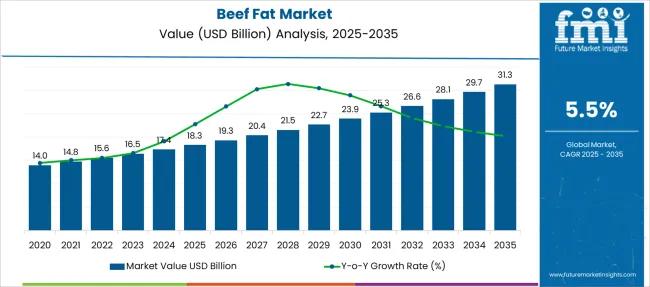

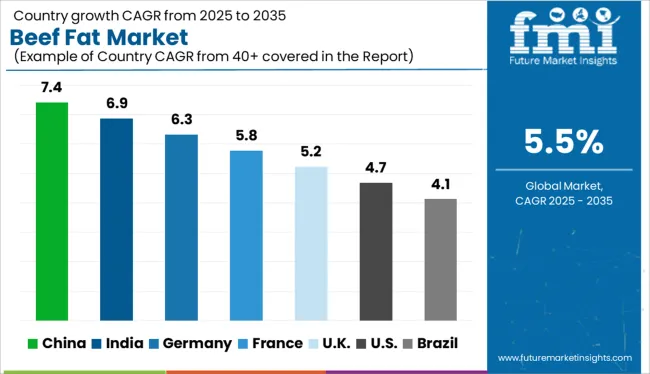

The Beef Fat Market is estimated to be valued at USD 18.3 billion in 2025 and is projected to reach USD 31.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Beef Fat Market Estimated Value in (2025 E) | USD 18.3 billion |

| Beef Fat Market Forecast Value in (2035 F) | USD 31.3 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The beef fat market is experiencing steady growth, fueled by rising demand for animal-based fats in both culinary and industrial applications. Shifts in consumer preference toward traditional cooking fats, especially in emerging economies, are revitalizing the use of beef tallow in food processing, bakery, and frying applications.

Regulatory acceptance of beef fat in cosmetic and biodiesel formulations is opening new non-food avenues, while a resurgence in high-fat diets like keto and paleo has supported its reintroduction into health-conscious segments. Additionally, improvements in rendering technology, enhanced traceability in meat processing, and a greater focus on reducing food waste have reinforced the integration of beef fat within closed-loop supply chains.

Ongoing innovations in fat purification and blending processes are expected to further elevate product value and expand its commercial utility across diverse sectors.

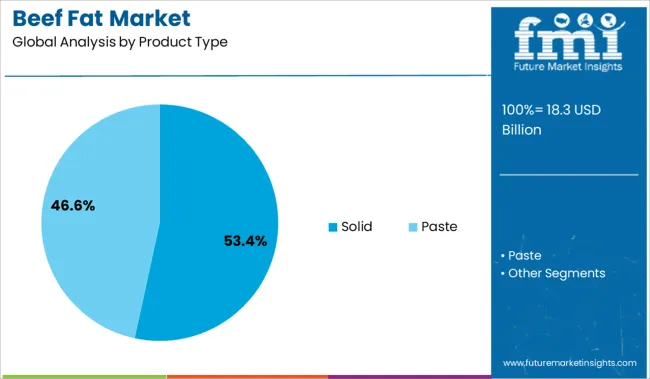

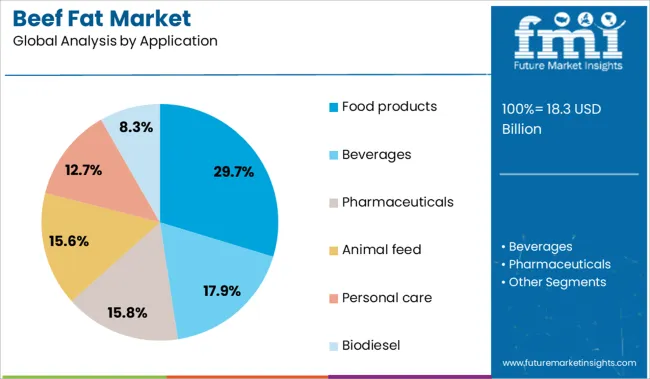

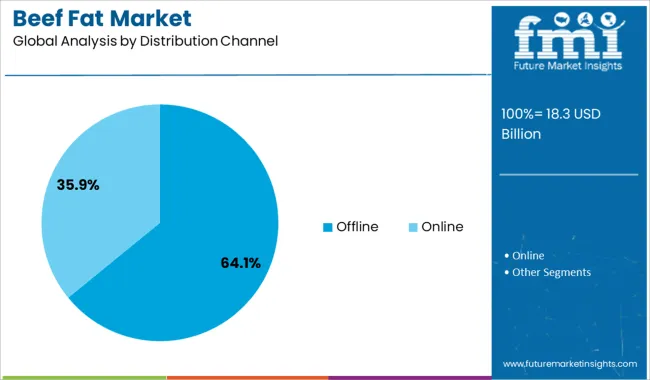

The market is segmented by Product Type, Application, and Distribution Channel and region. By Product Type, the market is divided into Solid and Paste. In terms of Application, the market is classified into Food products, Beverages, Pharmaceuticals, Animal feed, Personal care, and Biodiesel. Based on Distribution Channel, the market is segmented into Offline and Online. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Solid beef fat is projected to account for 53.4% of the total market revenue in 2025, establishing it as the dominant product type. Its widespread use in foodservice, processed food manufacturing, and traditional cooking methods is attributed to its stable consistency and shelf-life advantages.

Solid tallow has maintained favor in both industrial and culinary settings due to its high smoke point, flavor retention, and suitability for high-temperature applications. Moreover, the ability to mold, portion, and store solid fat products efficiently has reinforced their adoption among institutional buyers.

As food processors seek consistent input materials for scaling production, the structural advantages of solid beef fat have solidified its lead in the market.

Food products are expected to represent 29.7% of the overall revenue share in 2025, making this the leading application area for beef fat. This growth has been driven by renewed acceptance of animal fats in baking, frying, and ready-to-eat meal preparation.

Beef fat imparts flavor, moisture retention, and textural benefits that are difficult to replicate with synthetic or plant-based alternatives. Food processors and artisanal producers alike are reintroducing beef fat into heritage recipes and premium offerings, particularly in high-fat and protein-rich diets.

Additionally, foodservice operations in emerging markets are increasing their reliance on beef fat as a cost-effective and flavor-enhancing input. The enduring appeal of traditional fat-based cooking is contributing to its continued usage in both domestic and commercial kitchens.

Offline distribution channels are projected to account for 64.1% of total revenue by 2025, making them the most utilized route for beef fat procurement. This dominance is being driven by bulk buying behaviors, institutional supply relationships, and longstanding trust in physical distribution networks, especially in developing regions.

Butcher shops, specialty fat processors, and wholesale markets remain preferred points of purchase, offering buyers immediate access to verified quality and large quantities. Regulatory oversight in offline channels also ensures compliance with food safety standards, which is critical for commercial and foodservice applications.

While digital sales are emerging, logistical challenges and perishability concerns continue to favor traditional retail and business-to-business supply chains in this segment.

The market for beef fat was valued at USD 14.0 Billion in 2020, and since then, it has grown quickly, with a CAGR of 3.7% from 2020 to 2024. The market for milk components was worth USD 17.4 Billion in 2024.

The food and beverage industry, biodiesel, the personal care industry, the animal feed sector, and many more all use beef fat in a number of ways. It is primarily utilized in the production of soap in the personal care industry, and as more soap-making businesses emerge, the demand for beef fat will rise.

It is utilized as a cooking fat and a substitute for butter in the food and beverage industry. Because beef fat is relatively inexpensive compared to other cooking oils on the market, the increasing number of food industries around the world will increase demand for it.

The USA produces the most beef in the world and dominates the market for beef fat. The nation's beef fat has a high nutritional value and is used in dietary supplements and fortified foods.

During the projected period, the USA beef fat market is anticipated to expand at a CAGR of 5%. (2020 to 2025). The market is expanding as a result of rising consumer demand for wholesome foods and growing knowledge of the advantages of beef fat.

Another important element fueling the expansion of the USA beef fat market is the rising demand for fortified foods and nutritional supplements. Rich in nutrients, fortified foods, and dietary supplements have been shown to improve heart health and lower cholesterol levels.

On the international market, the United Kingdom is a significant producer and consumer of beef fat. Beef fat gives food a taste and serves as a lubricant. More beef fat is produced and consumed in the United Kingdom than anywhere else in the world.

The United Kingdom produces high-quality beef fat, which accounts for a portion of the global market for beef fat. Beef fat has been produced and consumed in the United Kingdom for a very long time, and the country's producers have a wealth of knowledge when it comes to creating high-quality beef fat. Beef fat with good oxidative stability can be produced in the United Kingdom and stored for extended periods of time without going rancid.

Producers in the United Kingdom combine soybean oil with cow fat to generate a product that is used in most industries.

Manufacturers have a huge chance to meet the expanding demand for beef fat on the international market. The increase in demand for biofuel and the use of beef fat as a lubricant in industrial products are both found to have a favorable impact on the market share growth in the anticipated period.

Due to its stability, several biodiesel producers add beef fat to soybean oil to increase the stability of the latter. Improved stability in different oils is facilitated by beef fat's strong oxidative stability. Due to this quality, beef fat is more in demand in the biodiesel sector, which presents a chance for suppliers to meet the rising demand in other sectors.

The personal care industry is responsible for the growth of the beef fat market. The main use of beef fat is in the production of soaps. The demand for soap is constantly increasing due to the growing population. The increase in demand has led to an increase in the price of beef fat.

beef fat is used as a cooking fat and a substitute for butter in the food and beverage sector. Because beef fat is relatively inexpensive compared to other cooking oils on the market, the increasing number of food industries around the world will increase demand for it.

Companies in the beef fat sector are continually releasing new types of ingredients to fulfill the shifting needs of consumers and to seize the largest market feasible. In order to reach new markets, firms are also focusing on growing their distribution networks.

In a recently published Research, FMI in-depth explored the pricing points of beef fat manufacturers positioned across geographies, sales growth, production capacity, and speculative production expansion.

The full report includes recent alterations that beef fat suppliers have been impacted by and that the FMI team has been tracking.

| Attribute | Details |

|---|---|

| Forecast period | 2025 to 2035 |

| Historical data available for | 2020 to 2025 |

| Market analysis | USD million in value |

| Key regions covered |

|

| Key countries covered |

|

| Key segments covered |

|

| Key companies profiled |

|

| Report Coverage |

|

| Customization and Pricing | Available upon request |

The global beef fat market is estimated to be valued at USD 18.3 billion in 2025.

The market size for the beef fat market is projected to reach USD 31.3 billion by 2035.

The beef fat market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in beef fat market are solid and paste.

In terms of application, food products segment to command 29.7% share in the beef fat market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beef Grower Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beef Concentrate Market Size, Growth, and Forecast for 2025 to 2035

Beef Flavors Market Insights - Trends & Forecast 2025 to 2035

Beef Bouillon Market

Wagyu Beef Market Analysis by Type, End-use, Region and Others Through 2035

Global Organic Beef Meat Market Size, Growth, and Forecast for 2025 to 2035

Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

Grass Fed Beef Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Breakdown of Processed Beef Market Share

Plant-Based Beef Market Size and Share Forecast Outlook 2025 to 2035

UK Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

Analysis of the USA Processed Beef Market by Product Type, Processing Method, Distribution Channel, Packaging Type and Region through 2035

Analysis of the Europe Processed Beef Market by Product Type, Processing Method, Distribution Channel, Packaging Type and Region through 2035

Asia Pacific Processed Beef Market Outlook - Size, Share & Industry Trends 2025 to 2035

Fatigue Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Fats And Oils Market Size and Share Forecast Outlook 2025 to 2035

Fatty Methyl Ester Sulfonate Market Size and Share Forecast Outlook 2025 to 2035

Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Fat Replacers, Salt Reducers and Replacers Market Size and Share Forecast Outlook 2025 to 2035

Fatty Acid Supplements Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA