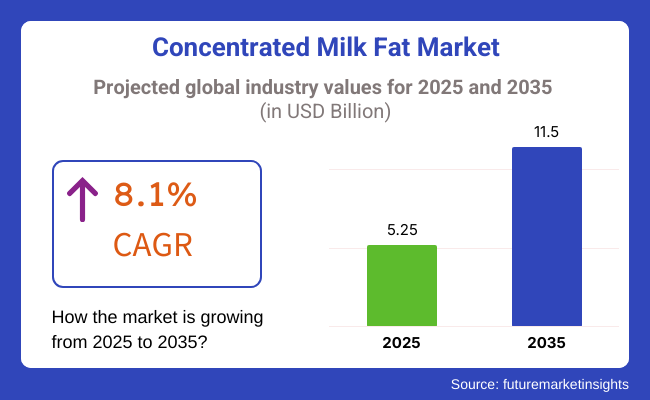

The global concentrated milk fat market is estimated to be worth USD 5.25 billion in 2025. It is projected to reach USD 11.5 billion by 2035, growing at a CAGR of 8.1% over the 2025 -2035 assessment period. The concentrated milk fat sector is performing consistently well, driven by the increasing demand for high-quality dairy raw materials in the food and beverage industry.

Concentrated milk fat, also known as anhydrous milk fat or butter oil, is primarily used in bakery, confectionery, dairy, and cooking applications due to its rich taste, improved texture, and extended shelf life. Furthermore, the shift towards the use of natural and top-grade dairy fats is underway, as market development is on the rise.

The market growth is primarily driven by the increasing consumption of bakery and confectionery products, where concentrated milk fat stands out in enhancing both the flavor and mouthfeel. The growing use of milk fat as a functional ingredient in the production of premium chocolates, pastries, and dairy spreads has been the main reason for the issuing of more butter oils. Furthermore, the growing popularity of keto and high-fat diets is a factor that increases consumer demand for concentrated dairy fats.

Innovations include fractionation and improved quality of milk fat; thus, it is now a go-to choice for various food producers. The development of both dairy re-exporting and free trade agreements has also driven market growth, mainly in regions with high dairy consumption, such as North America, Europe, and Asia-Pacific.

However, players face challenges such as dynamic commodity prices of raw materials and supply chain disruptions due to climate change and regulatory issues affecting dairy production. There is increasing competition from alternatives based on plant sources, and consumers are also inclined to consume non-dairy fats, which results in hindrances to industry growth.

Through the use of plant-based ingredients, manufacturing companies are taking proactive steps to align their operations with sustainability, refine their process methods, and develop new products that cater to the evolving market.

The rising demand for organic and grass-fed dairy products actualizes a whole new avenue for the premium milk fat sector. Equally, the trend for functional and fortified dairy ingredients, which embrace those with omega-3 fatty acids and probiotics, is likely to induce more experimentation. As food manufacturers carry out their strategy of prioritizing high quality, good taste, and environmental sustainability, the sector is slated for significant, prolonged expansion.

The market for concentrated milk fat experienced steady growth between 2020 and 2024, driven by increasing demand for premium dairy ingredients and functional food products in the food industry. Growing consumer aspiration towards intense, full-bodied texture and genuine dairy flavor underlaid the consumption of milk fat concentrate in processed dairy, bakery, and confectionery.

The growing demand from consumers for health-related consumption patterns has triggered businesses to deliver products that incorporate clean-label ingredients and enhanced nutritional content. The increased processing of milk, including improved separation and purification processes, enabled the production of finer-quality and more uniform milk fat.

Greater overseas trading and demand by the Third World for Western-style bread further accelerated market development. Stability within the market, nonetheless, was secured through milk price volatility as well as supply interruptions. Sustainability, technological innovations, and changing consumer values will shape the industry from 2025 through 2035.

Precision fermentation and other lactation technologies will enable the production of substitutes with similar flavor and textural profiles but with reduced environmental impacts. AI-managed manufacturing processes will maximize yield and consistency with reduced waste. Organic and grass milk fat products will become increasingly popular as consumers drive higher demands for transparency and ethical origins.

Concentrated milk-fat foods with functional significance, enriched with omega-3s, probiotics, and vitamins, will appeal to health-conscious consumers who want to capitalize on the benefits of milk fat. Blockchain technology will support traceability and authenticity, further reinforcing consumer confidence. Additionally, regulatory requirements for reducing saturated fat content and improving nutritional labeling will drive reformulation activity across the industry.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased demand for premium and authentic dairy flavors. | Precision fermentation for environmentally friendly milk fat production. |

| Improvements in dairy processing and purification methods. | AI-based optimization of manufacturing processes. |

| Growing applications in the bakery and confectionery industries. | There is a growing demand in the market for grass and organic milk fat ingredients. |

| Disruption of supply chains and volatile prices of milk. | Blockchain traceability and authenticity. |

| Clean labeling is driven by health-conscious consumers. | Functional milk fat ingredients with probiotics and omega-3 added. |

The industry is growing consistently, and the demand for premium dairy ingredients in various food processing and bakery applications contributes to this growth. For both consumers and manufacturers, the most important products are high-purity, long-shelf-life dairy fats, which, according to their claims, enhance products by making them better, more textured, and creamier.

In the dairy sector, milk fat is used to fortify butter, cheese, and cream-based products, where the issues of purity and clean-label sourcing are of primary importance. The bakery and confectionery industries regard it as the best solution due to its added butter aroma, soft and full-bodied mouthfeel, and emulsion stability, particularly in chocolate bars and pastries.

Cost-effectiveness, without compromising quality, is the priority for the processed food and food service segments; however, the retail sector has seen an increase in requests for organic and minimally processed products. As demand for clean labels and the trend toward natural ingredients increase, the market is transitioning toward non-GMO products. On top of that, the technological steps forward in fractionation and lipid structuring are permitting these dairy fats to find their way in a wider range of industries.

There is a surge in sales, primarily due to the upswing in demand from sectors such as dairy, bakery, and confectionery. However, the compliance issues are mainly due to the rigorous food safety regulations, quality standards, and package labeling requirements. The companies must be primarily aware of changes in laws, obtain the necessary certificates, and maintain transparency to ensure their trust and approval.

Moreover, the issue of supply chain interruptions, such as the inconsistency of raw milk and long-haul transport routes added to the volatility of product prices, generates negative consequences to production stability and costs. Climate alteration, pandemics in the livestock population, and trade restrictions resulting from political conflicts can pose a substantial risk. Diversified sourcing strategies should be established, and local production investment should be the first step in mitigating these threats.

The increasing shift of consumers to plant-based and lactose-free alternatives inherently creates problems for the concentrated milk fat produced by traditional dairy farmers. The primary cause of this competitive situation is the rise in vegan and health-oriented lifestyles, which leads to the increased use of more plant-based fats and oils. Companies need to come up with innovative ideas, such as new products and processes, that respect the sustainability principle if they are to maintain a proper position in the industry.

The growing competition from plant oils, such as margarine and vegetable-based oils, which have adverse effects on pricing and industry positioning, is a driving force behind product improvement and research and development. The path to success lies in companies investing in product functionality, R&D, and identifying niche applications in high-end food and beverage sectors to address competition challenges.

Industry growth is subject to economic volatility, shifts in trade policy, and changes in consumer food choices. In their endeavor to have a competitive advantage, companies ought to refashion their supply chains for maximum efficiency, explore fledgling segments, and cooperate with other food producers in creating innovative dairy fat products adhering to shifting consumer demands.

| Countries | CAGR (2025 to 2035) |

|---|---|

| The USA | 5.8% |

| China | 5.5% |

| Germany | 5.0% |

| Japan | 4.5% |

| The UK | 4.8% |

| France | 4.7% |

| Italy | 4.6% |

| South Korea | 4.9% |

| Australia | 4.3% |

| New Zealand | 4.2% |

The United States is expected to lead, with a 5.8% compound annual growth rate (CAGR) from 2025 to 2035. It is primarily driven by the increasing demand for premium dairy ingredients in the food processing and food service industries, particularly for these high-end products.

Concentrated milk fat is a premium ingredient with superior taste and functionality, making it a perfect solution for numerous applications, including bakery, confectionery, and culinary uses. The clean-label and natural trend is also driving the consumption of milk fat concentrate among health-conscious consumers. As more consumers look for high-quality, full-flavored foods in their diets, demand for milk fat concentrate should rise as part of a broader premium dairy trend in the USA.

Major dairy players such as Land O'Lakes and Dairy Farmers of America are driving this growth. Such customers are investing in more premium dairy processing machinery in an effort to achieve product uniformity and create a functional advantage through concentrated milk fat.

Furthermore, the ever-increasing demand for digital infrastructure used in online trade to deliver milk drives growth, as improved-quality dairy constituents become more accessible to both companies and ultimate consumers.

China is expected to expand at a compound annual growth rate (CAGR) of 5.5% over the next ten years. The incredible expansion is primarily attributed to the rapid growth of the dairy processing industry and the growth in consumption by clients of dairy and dairy products. Urbanization and increasing disposable incomes are transforming the emerging demand for bakery and confectionery products, where concentrated milk fat is increasingly becoming a critical ingredient.

In addition to this, government interventions, such as policies that benefit the dairy sector and quality enhancements, are compelling businesses to utilize high-quality ingredients like concentrated milk fat in their products.

With the increasing growth of the Chinese industry, concentrated milk fat is likely to be consumed more due to shifts in consumer demand and the growing demand for diversified dairy products. Large players in the dairy industry, such as Yili Group and Mengniu Dairy, are broadening their product offerings to include high-quality dairy fats.

The players emphasize R&D towards providing improved nutritional functionality to dairy ingredients for premium dairy-based food products that meet consumer expectations. China's growing bakery industry, driven by Western dietary trends, is increasing milk fat concentration in various applications, thereby propelling growth.

Germany is expected to grow at a 5.0% compound annual growth rate (CAGR) until 2035. The high demand for food quality and sustainability in the nation has strongly boosted the demand for densified milk fat, especially among upscale confectioneries and baked goods.

Increasing German consumer demand for natural foods that are less processed strongly propels the use of concentrated milk fat, driving growth. Additionally, the presence of well-established dairy cooperatives and advanced processing units ensures a consistent supply of high-quality concentrated milk fat, which in turn encourages innovation in the sector.

As consumers prioritize premium quality and sustainability in food, Germany follows a sustained growth pattern, demonstrating its commitment to high-quality dairy products. Structured brands such as DMK Group and Hochland specialize in the production of high-quality dairy fats.

The company's focus is on green processing and sustainable sourcing, enabling it to capitalize on the demand for ethically sourced and organic dairy products. Moreover, Germany's vibrant dairy ingredient export industry makes concentrated milk fat a leading force in Germany's food market.

Japan is expected to experience a compound annual growth rate (CAGR) of 4.5% from 2025 to 2035. Growth is spurred by growing demand for dairy ingredients with enhanced functionality, including concentrated milk fat. Japanese consumers consider food texture and quality extremely important, and concentrated milk fat is a key ingredient in Japan's confectionery, bakery, and premium dessert industries. Along with this, more and more Western-type coffee houses and

Japanese bakeries have also contributed to the growing use of dairy fat in chocolates, cakes, and pastries. Japanese dairy companies such as Meiji Holdings and Morinaga Milk Industry expand product portfolios to capture evolving consumer preferences.

These companies invest in R&D to develop superior shelf life and texture-dairy products. Additionally, Japan's stringent food safety protocols ensure the manufacture of high-quality condensed milk fat, making it a highly sought-after ingredient both domestically and internationally.

Italy is expected to grow at a compound annual growth rate (CAGR) of 4.6% through 2035. The country's strong food culture and centuries-long dairy heritage are firm demand drivers for concentrated milk fat. Italian consumers place a very high value on authentic taste and high-quality dairy ingredients, which are the focus of traditional pastry, bakery, and gelato production. The country's emphasis on artisan foods also underpins the demand for natural dairy fats.

Leaders such as Granarolo and Parmalat continue to invest in innovation to process dairy better and to make better quality concentrate milk fat supply. The increased popularity of Italian pastries globally also assisted in creating export-led industries.

South Korea is expected to grow at a compound annual growth rate (CAGR) of 4.9% between 2025 and 2035. The popularity of the Western diet is driving demand for bakery and confectionery items that feature dairy. South Koreans demand high-quality dairy ingredients to enhance the taste and texture of their products.

Seoul Milk and Namyang Dairy Products are targeting the production of superior-quality dairy fats. The rising café culture of the country, with rising demand for specialty bakery foodstuffs and sweets, provides growth momentum.

The Australian market is expected to achieve a compound annual growth rate (CAGR) of 4.3% until 2035. The highly developed dairy export base and manufacturing of high-quality pure milk drive the demand in the country at a global level. Leading companies, such as Devondale and Bega Cheese, maintain sustainable dairy processing operations. Australia's image of producing high-quality dairy products contributes to its dominance in the industry.

New Zealand is expected to grow at a 4.2% CAGR between 2025 to 2035. New Zealand's dairy industry is highly developed, with innovation and quality being the top priority. Fonterra, the global leader in the dairy industry, is a key driver of growth. Global demand for high-quality dairy fats is fueling New Zealand's leading export-oriented dairy industry

| Segment | Value Share (2025) |

|---|---|

| Conventional (By Nature) | 78.5% |

Based on nature, the entire industry can be segmented into conventional and organic. Standard milk fat accounts for the largest share, approximately 78.5%. This has made it the preferred choice for large food manufacturers and dairy product processors due to its cost-effective and well-established supply chains. The leading companies in this industry, such as Fonterra, Arla Foods, and Lactalis, provide conventional fats for use in bakery, confectionery, and dairy products with consistent quality and availability.

In contrast, organic concentrated milk fat holds a 21.5% share, demonstrating significant growth as consumers shift toward clean-label and sustainable products. The organic dairy transition is being spearheaded by health-conscious consumers who want products free of synthetic additives, antibiotics, and pesticides.

Anticipating the growing trend, Organic Valley and Friesland Campina, for example, have developed their organic dairy range. Furthermore, regulatory support for organic farming practices in regions such as North America and Europe also boosts growth.

| Segment | Value Share (2025) |

|---|---|

| Bakery & Confectionery (By Application) | 46.2% |

By application, the bakery & confectionery segment accounted for 46.2% of the share in 2025. This dominance is driven by the widespread use of milk fat in bakery items such as croissants, pastries, cookies, and chocolates. Premium bakery brands also use it for its capabilities to improve texture.

Top players, such as Barry Callebaut, Cargill, and Puratos, utilize concentrated milk fat to enhance the richness of chocolate coatings and fillings, thereby catering to the increasing consumer demand for indulgent and high-quality confectionery products.

The Soups & Sauces dominate segment share at 20.0% and is motivated by the surging demand for creamy and a variety of flavor formulations. Dairy-based sauces, gravies, or soups, such as Alfredo and cheese sauces, contain concentrated milk fat that alters the viscosity or texture of the dish, adding a smooth and rich flavor that complements the other ingredients.

Major food manufacturers, such as Nestlé, Campbell's, and Unilever, are utilizing concentrated milk fat to enhance the characteristics of their soup and sauce ranges. The opening of this segment is driven by growing interest in ready-to-eat and convenience foods, particularly in North America and Europe.

Soups & Sauces are developing into a new growth segment as food companies test out more dairy-based formulations in response to shifting consumer tastes. At the same time, Bakery & Confectionery remains the primary application due to its functional benefits in premium products.

There has been steady growth due to increased demand for premium-quality dairy ingredients, clean-label formulations, and functional food applications in the processing industry. Companies invest in innovative new products and sustainable sourcing, while strengthening their networks to improve distribution and gain a share of the growing industry.

The top players of this industry are Fonterra, FrieslandCampina, Lactalis Ingredients, Arla Foods, and Darigold, known for formulating best-in-class butterfat solutions for use in bakery, confectionery, and dairy applications. Fonterra, for instance, has developed tailor-made milk fat products to enhance both texture and shelf life in food formulations. At the same time, FrieslandCampina is now embraced as an advocate of sustainable dairy fat solutions that respond to changing consumer needs.

Industry evolution is propelled by the extent to which dairy-based fat substitutes are being adopted, advancements in milk fractionation technologies, and the shift from conventional to organic, as well as non-GMO dairy ingredients. Companies have increased production units, such as Arla Foods' investment in safe dairy processing plants for sustainable marketing growth.

Strategic drivers influencing competition also include cost-effective production, regulatory compliance, and partnerships with food manufacturers. The force of competition involves improving global supply chain networks while adopting environmentally friendly processing techniques and utilizing digital platforms to optimize sales and consumer engagement.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Fonterra Co-operative Group Limited | 20-24% |

| FrieslandCampina N.V. | 14-18% |

| Lactalis Ingredients | 12-16% |

| Arla Foods | 8-12% |

| Darigold, Inc. | 6-10% |

| Other Players (Combined) | 25-35% |

| Company Name | Key Offerings & Focus |

|---|---|

| Fonterra Co-operative Group Limited | A global leader in premium concentrated milk fats, focusing on sustainable dairy farming, high-quality anhydrous milk fat (AMF), and butter oil solutions. |

| FrieslandCampina N.V. | Specializes in functional milk fat ingredients for bakery and confectionery applications, with an emphasis on European dairy quality and sustainability efforts. |

| Lactalis Ingredients | Offers high-purity milk fat solutions for food processing and dairy manufacturing, thereby expanding its global presence in the dairy supply chain. |

| Arla Foods | Focuses on organic and clean-label dairy fat products, investing in innovative butterfat solutions for high-end food applications. |

| Darigold, Inc. | A key player in North American dairy exports, providing customized milk fat blends for industrial food applications. |

Key Company Insights

Fonterra (20-24%)

A key leader in the premium milk fat segment advocates sustainable dairy farming and offers high-quality AMF solutions for global applications.

FrieslandCampina (14-18%)

A strong contender in Europe, it's using high-quality dairy sources and innovative development in milk fat formulations.

Lactalis Ingredients (12-16%)

Widening its global dairy supply chain with investments in functional and highly pure milk fat solutions.

Arla Foods (8-12%)

Most renowned organic and clean-label milk fats serving the premium and specialty markets.

Darigold, Inc. (6-10%)An

American giant dairy focused on milk fat solutions for exports with specific ingredient provisions.

Other Key Players

The segmentation is into conventional and organic types.

The segmentation is into soups & sauces, bakery & confectionery, dairy products, and others.

The segmentation is into liquid and dry forms.

The segmentation is into direct sales (B2B) and indirect sales (B2C).

The market is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and the Middle East & Africa.

The global concentrated milk fat market is expected to grow at a compound annual growth rate (CAGR) of approximately 8.1% from 2025 to 2035.

The market is projected to reach a value of approximately USD 11.5 billion by 2035.

The bakery & confectionery segment is anticipated to grow the fastest, driven by increasing demand for premium baked goods and confections that utilize concentrated milk fat for enhanced flavor and texture.

Key growth drivers include rising consumer preference for natural and clean-label ingredients, increasing applications in bakery and confectionery products, and expanding demand in emerging markets due to urbanization and changing dietary habits.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 34: Western Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: Western Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 38: Western Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Western Europe Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 44: Eastern Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: Eastern Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 48: Eastern Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 50: Eastern Europe Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (MT) Forecast by Application, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (MT) Forecast by Form, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 64: East Asia Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 66: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 68: East Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 70: East Asia Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 74: Middle East and Africa Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 76: Middle East and Africa Market Volume (MT) Forecast by Application, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 78: Middle East and Africa Market Volume (MT) Forecast by Form, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 80: Middle East and Africa Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 11: Global Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 15: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 19: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 23: Global Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Nature, 2023 to 2033

Figure 27: Global Market Attractiveness by Application, 2023 to 2033

Figure 28: Global Market Attractiveness by Form, 2023 to 2033

Figure 29: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 41: North America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 45: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 49: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 53: North America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Nature, 2023 to 2033

Figure 57: North America Market Attractiveness by Application, 2023 to 2033

Figure 58: North America Market Attractiveness by Form, 2023 to 2033

Figure 59: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 101: Western Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 105: Western Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 109: Western Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 113: Western Europe Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Nature, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Form, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 131: Eastern Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 135: Eastern Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 139: Eastern Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 143: Eastern Europe Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Nature, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Form, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Nature, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Form, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Nature, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Form, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Nature, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 191: East Asia Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 195: East Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 199: East Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 203: East Asia Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Nature, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Nature, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Form, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Nature, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Form, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Concentrated Solar Power Market Size and Share Forecast Outlook 2025 to 2035

Concentrated Whey Market

Unconcentrated Orange Juice Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Analyzing Not From Concentrated (NFC) Puree Market Share & Industry Leaders

Milk Carton Market Size and Share Forecast Outlook 2025 to 2035

Milking Automation Market Size and Share Forecast Outlook 2025 to 2035

Milking Robots Market Size and Share Forecast Outlook 2025 to 2035

Milk Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Clarifier Market Size and Share Forecast Outlook 2025 to 2035

Milk Homogenizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Milk Pasteurization Machines Market Size and Share Forecast Outlook 2025 to 2035

Milk Sterilizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Milk Protein Market - Size, Share, and Forecast 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Milk Mineral Concentrate Market Trends-Demand, Innovations & Forecast 2025 to 2035

Milk Thistle Market Analysis by Form, Distribution Channel and Region through 2035

Milk Powder Market Analysis by Type, Distribution Channel, Region and Other Applications Through 2035

Milk Tank Cooling System Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA