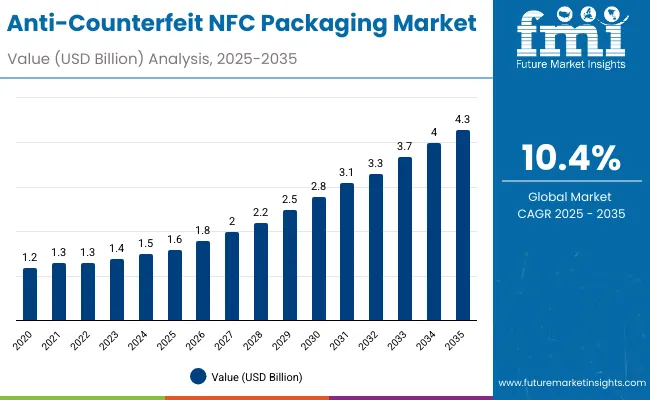

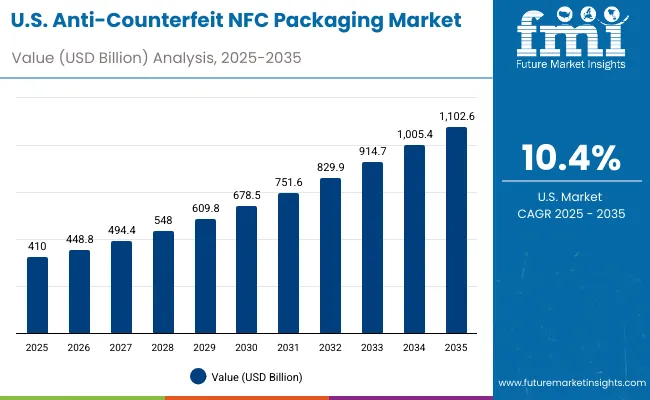

The anti-counterfeit NFC packaging market is expected to grow from USD 1.6 billion in 2025 to USD 4.3 billion by 2035, resulting in a total increase of USD 2.7 billion over the forecast decade. This represents a 168.8% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 10.4%. Over ten years, the market grows by 2.7 times.

| Metric | Value |

|---|---|

| Anti-Counterfeit NFC Packaging Market Estimated Value in (2025 E) | USD 1.6 billion |

| Anti-Counterfeit NFC Packaging Market Forecast Value in (2035 F) | USD 4.3 billion |

| Forecast CAGR (2025 to 2035) | 10.4% |

In the first half (2025-2030), the market progresses from USD 1.6 billion to USD 2.6 billion, contributing USD 1.0 billion, or 37.0% of total decade growth. This phase is shaped by adoption in pharmaceuticals and luxury goods, driven by rising concerns over counterfeiting. The need for product authentication and supply chain transparency fuels early demand.

In the second half (2030-2035), the market grows from USD 2.6 billion to USD 4.3 billion, adding USD 1.7 billion, or 63.0% of the total growth. This acceleration is supported by blockchain integration, cloud-enabled verification, and consumer engagement through smartphones. Increasing regulatory mandates on serialization and traceability further solidify NFC-enabled packaging as a cornerstone of secure and interactive product packaging.

From 2020 to 2024, the anti-counterfeit NFC packaging market grew from USD 1.1 billion to USD 1.5 billion, driven by rising concerns over product authenticity in pharmaceuticals, luxury goods, and food & beverages. Nearly 70% of revenue was led by packaging and electronics majors integrating NFC-enabled tags, labels, and chips into secure packaging formats.

Leaders such as Avery Dennison, Smartrac, and Thinfilm Electronics emphasized tamper resistance, authentication reliability, and consumer interaction features. Differentiation centered on chip durability, encryption security, and integration with supply chain systems, while blockchain-enabled traceability remained secondary. Service-based models such as authentication audits accounted for under 15% of revenues, with most brands preferring direct tag adoption.

By 2035, the anti-counterfeit NFC packaging market will reach USD 4.3 billion, growing at a CAGR of 10.40%, with smart packaging platforms and cloud-linked verification services accounting for more than 40% of market value. Competition will rise as integrated providers deliver AI-powered authentication, smartphone-enabled consumer verification, and supply chain-wide digital traceability.

Established leaders are pivoting toward hybrid models combining hardware with SaaS authentication platforms. Emerging players such as Identiv, NXP Semiconductors, and PragmatIC Semiconductor are gaining traction with recyclable NFC tags, flexible printed electronics, and low-cost embedded sensors, aligning with sustainability and regulatory compliance in high-risk sectors.

The rising threat of product counterfeiting in pharmaceuticals, food, and luxury goods is driving growth in the anti-counterfeit NFC packaging market. These solutions provide secure product authentication, enhance consumer trust, and ensure regulatory compliance. Growing e-commerce and demand for transparent supply chains further accelerate market adoption.

NFC-enabled tags, labels, and embedded chips are gaining popularity for enabling instant product verification through smartphones. Integration with blockchain platforms, tamper-evident features, and real-time tracking capabilities improve security and traceability. Their compatibility with smart packaging initiatives and ability to support interactive consumer engagement contribute significantly to expanding market demand worldwide.

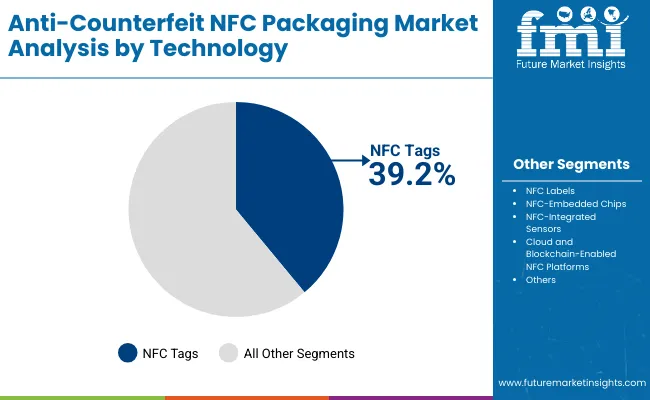

The market is segmented by technology, packaging type, function, end-use industry, and region. Technology segmentation includes NFC tags, NFC labels, NFC-embedded chips, NFC-integrated sensors, and cloud and blockchain-enabled NFC platforms, enabling secure digital authentication and real-time tracking.

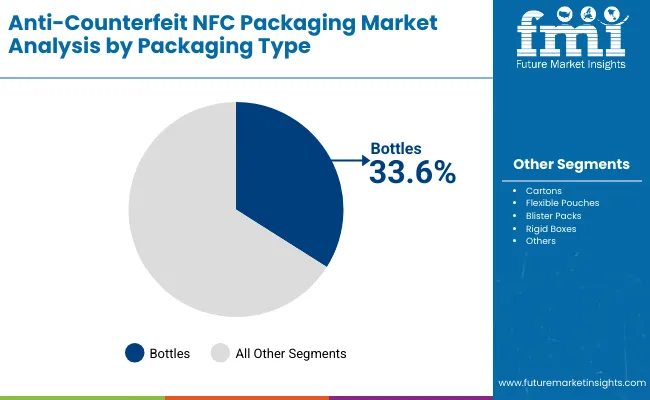

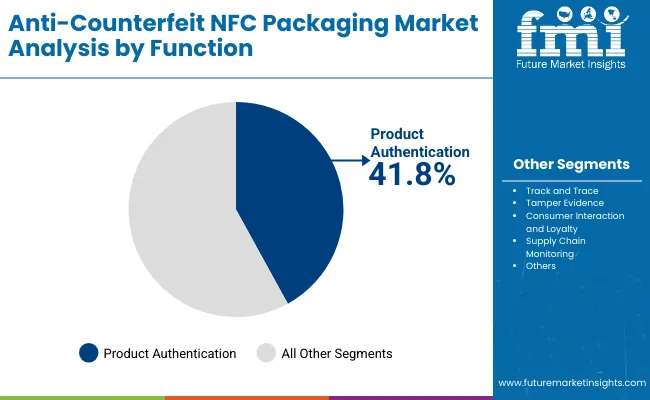

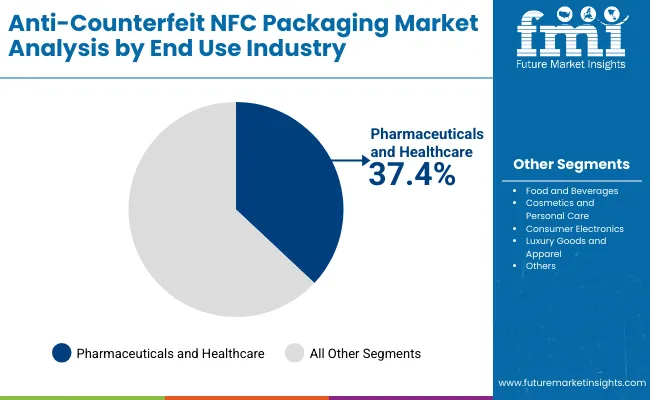

Packaging type covers bottles, cartons, flexible pouches, blister packs, and rigid boxes, integrating anti-counterfeit features across varied formats. Functional segmentation spans product authentication, track and trace, tamper evidence, consumer interaction and loyalty, and supply chain monitoring, ensuring brand protection and regulatory compliance. End-use industries include pharmaceuticals and healthcare, food and beverages, cosmetics and personal care, consumer electronics, and luxury goods and apparel. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

NFC tags are projected to account for 39.2% of the market in 2025, driven by their ease of integration and relatively low cost compared to embedded chips or sensors. These tags enable instant product verification through smartphones, giving consumers and businesses a simple tool to combat counterfeiting. Their adoption is particularly strong in pharmaceuticals and luxury goods.

The scalability of NFC tag production supports large-scale deployment across packaging lines. Advances in printing and embedding techniques enhance durability, ensuring tags remain functional through logistics and handling. As mobile-first authentication grows, NFC tags remain the entry point for widespread anti-counterfeit packaging solutions.

Bottles are expected to hold 33.6% of the market in 2025, reflecting their prominence in pharmaceuticals, beverages, and cosmetics packaging. NFC-enabled bottles allow brands to link authenticity verification with personalized digital content, building stronger consumer trust.

Adoption is supported by the need to secure liquid-based products vulnerable to tampering. NFC integration within caps or labels helps verify originality at the point of sale. With consumers increasingly seeking transparency, bottles provide an effective platform for interactive packaging experiences.

Product authentication is forecast to represent 41.8% of the market in 2025, as it directly addresses consumer concerns about counterfeit goods. By tapping an NFC-enabled package, users can instantly confirm authenticity through a secure cloud database. This function is critical in high-value and safety-sensitive sectors.

Brands leverage authentication not only to protect consumers but also to strengthen brand equity. Enhanced encryption protocols and blockchain integration are reinforcing trust in these systems. As counterfeit risks escalate across industries, authentication remains the most demanded feature in NFC packaging.

The pharmaceuticals and healthcare industry is projected to account for 37.4% of the market in 2025, reflecting regulatory mandates for product traceability and patient safety. NFC-enabled packaging allows real-time verification, ensuring medicines remain genuine throughout the supply chain.

Adoption is supported by efforts to combat counterfeit drugs, which pose significant health risks globally. Healthcare companies use NFC solutions to comply with serialization laws while improving supply chain visibility. With patient safety and regulatory compliance at stake, this sector continues to anchor NFC packaging demand.

The anti-counterfeit NFC packaging market is expanding as brands prioritize product authentication, supply chain security, and consumer engagement. Growth in pharmaceuticals, luxury goods, and food & beverages is driving adoption of NFC-enabled solutions. However, high deployment costs and consumer awareness gaps restrain mass adoption. Advances in blockchain integration, smart sensors, and interactive packaging are shaping the market’s trajectory.

Authentication, Transparency, and Consumer Trust Driving Adoption

NFC-enabled packaging provides unique digital identities for products, allowing instant verification via smartphones. This helps combat counterfeit risks in pharmaceuticals, cosmetics, and premium beverages, protecting brand equity and consumer safety. Beyond authentication, NFC tags enable real-time track-and-trace visibility throughout the supply chain. Retailers and consumers benefit from transparent data access, fostering greater trust. Brands also leverage NFC for loyalty programs and interactive experiences, reinforcing long-term engagement while ensuring regulatory compliance across global markets.

High Costs, Technical Complexity, and Awareness Limitations Restraining Growth

Adoption is challenged by the high cost of NFC tags, embedded chips, and supporting infrastructure, especially for mass-market products. Integration requires specialized printing and converting processes, raising production expenses. Consumer awareness remains limited in many regions, where end-users may not understand or use NFC features effectively. Data privacy and cybersecurity concerns also affect adoption, particularly in healthcare and financial sectors. These barriers confine widespread uptake, slowing penetration into cost-sensitive industries.

Blockchain Integration, Interactive Packaging, and Smart Sensors Trends Emerging

Key trends include the integration of blockchain with NFC tags to create immutable product histories, enhancing supply chain transparency. Interactive packaging is gaining momentum, with NFC-enabled experiences offering product tutorials, authenticity certificates, and marketing campaigns. Advances in printed electronics and miniaturized smart sensors are making NFC solutions more scalable and eco-friendlier. Brands are also experimenting with recyclable substrates and energy-efficient tags to meet sustainability goals. These developments are positioning NFC packaging as both a security solution and a powerful consumer engagement tool.

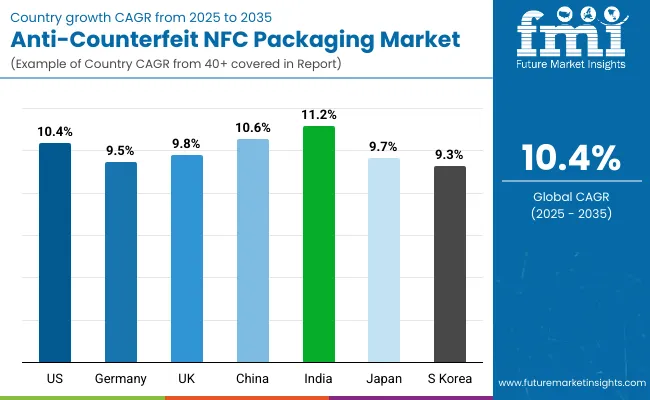

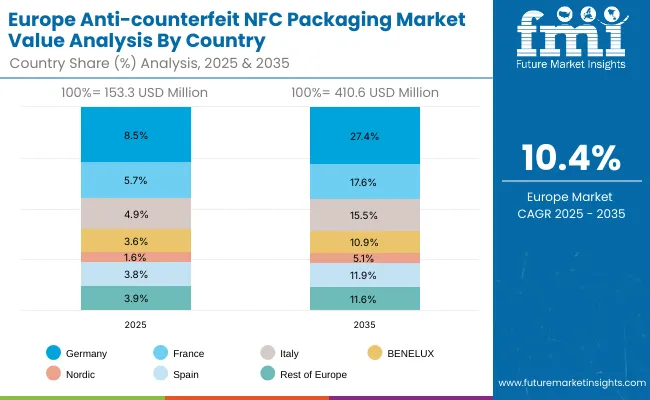

The global anti-counterfeit NFC packaging market is expanding at a strong pace, driven by rising threats of product fraud, increasing regulatory compliance, and consumer demand for transparency. Asia-Pacific is leading growth, with India and China investing in secure, smart packaging for pharmaceuticals, food, and luxury goods. Developed markets such as the USA, Germany, and Japan are focusing on advanced NFC tags, blockchain-enabled authentication, and consumer engagement features, ensuring packaging delivers both security and traceability across industries.

The USA market is projected to grow at a CAGR of 10.4% from 2025 to 2035, supported by high adoption in pharmaceuticals, healthcare, and premium beverages. Growth is fuelled by regulatory compliance and the need to combat counterfeiting. NFC-enabled packaging is being integrated with blockchain for advanced authentication and traceability. Companies are also leveraging NFC packaging to boost consumer engagement through interactive features, linking physical products with digital platforms.

Germany’s market is expected to grow at a CAGR of 9.5%, driven by strict EU regulations and high demand in pharmaceuticals and luxury goods. German manufacturers are focusing on NFC tags with tamper-evident seals and smart verification features. Sustainability goals are encouraging integration of recyclable materials with secure NFC systems. Advanced packaging lines are being developed with modular NFC integration to support both large and mid-scale industries.

The UK market is forecast to grow at a CAGR of 9.8%, driven by growth in cosmetics, premium beverages, and healthcare. Consumer engagement is a key driver, with brands offering digital storytelling through NFC-enabled products. SMEs are increasingly adopting affordable NFC solutions to protect authenticity and meet compliance. Cloud-based verification systems and mobile apps are reinforcing demand for secure, traceable packaging formats across the UK market.

China’s market is projected to grow at a CAGR of 10.6%, fuelled by government crackdowns on counterfeit goods and rapid growth in pharmaceuticals, luxury items, and e-commerce. Domestic manufacturers are producing affordable NFC tags integrated with cloud-based verification. Cross-border e-commerce is further driving demand for secure, tamper-proof packaging. Widespread smartphone penetration ensures consumer readiness for NFC authentication, accelerating adoption across industries.

India is forecast to record the fastest growth at a CAGR of 11.2%, supported by surging pharmaceutical exports, rising luxury consumption, and government initiatives against counterfeiting. NFC packaging is gaining strong traction in the healthcare and FMCG sectors, ensuring supply chain transparency. Local startups and global OEMs are collaborating to scale low-cost, secure NFC technologies. The push for digitalization and consumer trust is making India a high-potential market for smart anti-counterfeit packaging.

Japan’s market is projected to grow at a CAGR of 9.7%, driven by high demand for secure packaging in nutraceuticals, premium beverages, and electronics. Companies are innovating compact NFC tags embedded in minimalist packaging designs. Emphasis on cultural aesthetics and sustainability is shaping packaging with NFC functionality. Interactive NFC systems are also being used to promote personalized customer experiences in premium consumer markets.

South Korea’s market is expected to grow at a CAGR of 9.3%, supported by strong adoption in K-beauty, pharmaceuticals, and luxury exports. NFC-enabled packaging is being used to strengthen brand trust and protect against counterfeiting. OEMs are focusing on compact, stylish NFC solutions aligned with premium product aesthetics. Integration with mobile applications and cloud-based platforms is enhancing consumer interaction and traceability.

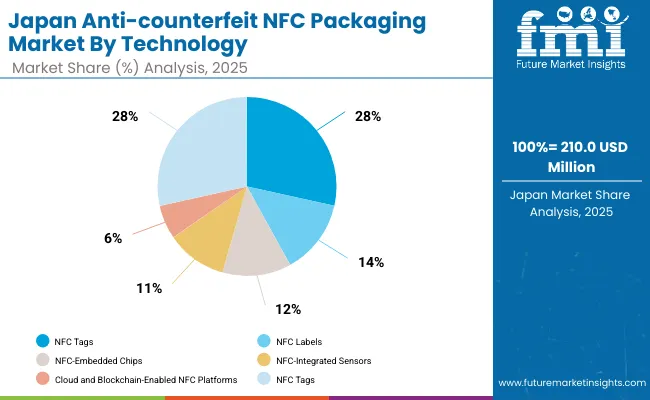

Japan’s anti-counterfeit NFC packaging market, valued at USD 210 million in 2025, is dominated by NFC tags, which account for 37.6% of share due to their cost-effectiveness and widespread deployment. NFC labels hold 19.0%, followed by NFC-embedded chips at 17.4% and NFC-integrated sensors at 16.7%. Cloud and blockchain-enabled NFC platforms represent 9.3%, showing rising potential in authentication and traceability. The leadership of NFC tags reflects their compatibility with consumer electronics and packaging, while the growing role of embedded chips and sensors highlights Japan’s focus on innovation in security, product authenticity, and connected packaging solutions across multiple industries.

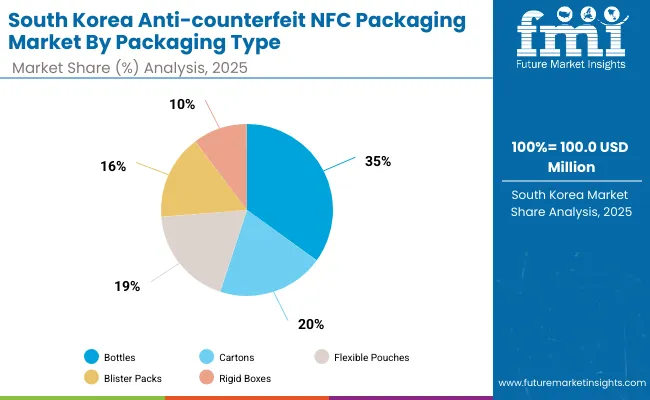

South Korea’s anti-counterfeit NFC packaging market in 2025, valued at USD 100 million, is led by bottles, which capture 32.9% of market share. Cartons follow with 21.4%, while flexible pouches represent 19.3%. Blister packs hold 16.8%, rigid boxes 9.6%. The dominance of bottles highlights their importance in pharmaceuticals, beverages, and premium products where authentication is critical. Cartons and pouches are widely used in food and consumer goods, supporting brand protection. Blister packs gain traction in healthcare packaging, ensuring medication safety. This diverse packaging distribution underscores South Korea’s emphasis on integrating NFC technology across high-demand consumer and healthcare industries.

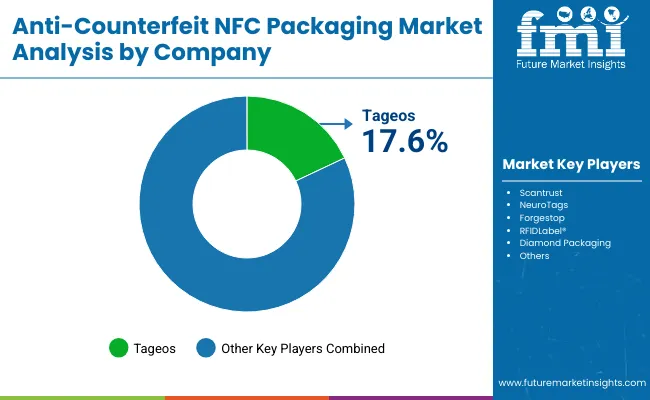

The anti-counterfeit NFC packaging market is moderately fragmented, with smart label providers, digital authentication firms, and packaging converters competing across pharmaceuticals, luxury goods, food, and electronics. Global leaders such as Tageos, Scantrust, and NeuroTags hold notable market share, driven by NFC tag innovations, secure cloud platforms, and compliance with global anti-counterfeiting regulations. Their strategies increasingly emphasize consumer engagement, real-time traceability, and blockchain-enabled product verification.

Established mid-sized players including Forgestop and RFIDLabel® are supporting adoption of advanced NFC packaging formats featuring encrypted tag identifiers, tamper-evident seals, and seamless integration with mobile authentication apps. These companies are especially active in healthcare, premium beverages, and cosmetics, offering cost-effective deployment, supply chain visibility, and heightened brand protection against counterfeit infiltration.

Specialized packaging providers such as Diamond Packaging focus on tailored NFC-enabled solutions for brand owners and regional markets. Their strengths lie in embedding NFC chips into cartons and premium rigid boxes, combining authentication with sustainable substrates, and enhancing product storytelling through interactive consumer experiences, thereby reinforcing both product safety and brand loyalty in competitive markets.

Key Development

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| By Technology | NFC Tags, NFC Labels, NFC-Embedded Chips, NFC-Integrated Sensors, Cloud and Blockchain -Enabled NFC Platforms |

| By Packaging Type | Bottles, Cartons, Flexible Pouches, Blister Packs, Rigid Boxes |

| By Function | Product Authentication, Track and Trace, Tamper Evidence, Consumer Interaction and Loyalty, Supply Chain Monitoring |

| By End-Use Industry | Pharmaceuticals and Healthcare, Food and Beverages, Cosmetics and Personal Care, Consumer Electronics, Luxury Goods and Apparel |

| Key Companies Profiled | Tageos, Scantrust, NeuroTags, Forgestop, RFIDLabel ®, Diamond Packaging |

| Additional Attributes | Growing adoption of NFC tags for real-time product authentication, increasing integration of blockchain -enabled platforms for supply chain transparency, rising use of tamper-evident NFC packaging in pharmaceuticals and luxury goods, enhanced consumer engagement through loyalty and interaction features, and strong uptake in food, beverage, and electronics packaging to combat counterfeiting while ensuring brand protection and regulatory compliance. |

The global anti-counterfeit NFC packaging market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the anti-counterfeit NFC packaging market is projected to reach USD 4.3 billion by 2035.

The anti-counterfeit NFC packaging market is expected to grow at a CAGR of 10.4% between 2025 and 2035.

The key technologies in the anti-counterfeit NFC packaging market include NFC tags, NFC labels, NFC-embedded chips, NFC-integrated sensors, and cloud & blockchain-enabled NFC platforms.

The NFC tags segment is expected to account for the highest share of 39.2% in the anti-counterfeit NFC packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anti-Counterfeit Packaging for Food & Beverages Market Growth - Forecast 2025 to 2035

Anti-Counterfeit Packaging Market Trends - Growth & Forecast 2025 to 2035

Anti-counterfeit Cosmetic Packaging Market Growth - Demand & Forecast 2025 to 2035

Anti-counterfeit Pharmaceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Anti-Counterfeit Pharmaceutical Packaging Providers

NFC Reader ICs Market Analysis - Size, Share, and Forecast 2025 to 2035

NFC Juice Market Analysis by Product Type, Product Claim, End-Use Application and by Region from 2025 To 2035

NFC Tag ICs Market Analysis by Memory, Connection, Application, Industry and Region Through 2025 to 2035

Competitive Breakdown of NFC Reader ICs Market Share & Key Players

UK NFC Reader ICs Market Outlook – Size, Share & Trends 2025-2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA NFC Reader ICs Market Insights – Trends, Growth & Forecast 2025-2035

Japan NFC Reader ICs Market Trends – Growth, Demand & Forecast 2025-2035

Germany NFC Reader ICs Market Report – Size, Trends & Industry Growth 2025-2035

Automotive NFC Market Growth – Trends & Forecast 2025-2035

GCC Countries NFC Reader ICs Market Growth – Demand, Trends & Forecast 2025-2035

Analyzing Not From Concentrated (NFC) Puree Market Share & Industry Leaders

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA