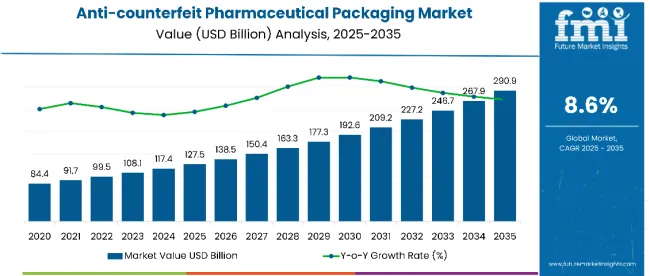

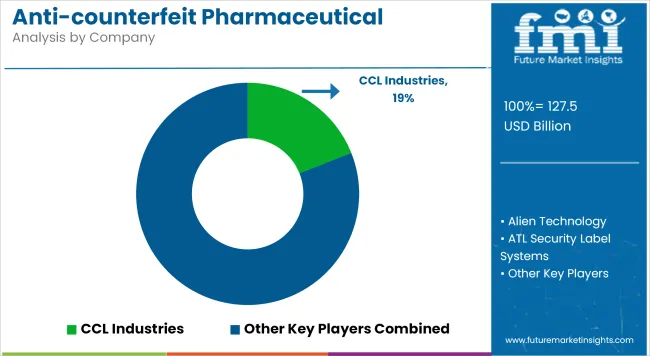

The global anti-counterfeit pharmaceutical packaging market is projected to grow from USD 127.5 billion in 2025 to USD 290.9 billion by 2035, registering a CAGR of 8.6% over the forecast period.

| Attributes | Value |

|---|---|

| Industry Size (2025) | USD 127.5 billion |

| Projected Industry Size (2035) | USD 290.9 billion |

| CAGR (2025 to 2035) | 8.6% |

Market expansion is driven by heightened regulatory scrutiny, rising incidences of drug counterfeiting, and the pharmaceutical industry's shift toward serialized, tamper-evident, and track-and-trace solutions. Authentication technologies are increasingly being integrated across both primary and secondary packaging formats, enabling real-time verification across the supply chain and improving compliance with national and regional mandates.

The surge in anti-counterfeit pharmaceutical packaging demand reflects escalating risks tied to globalized supply chains, online drug sales, and parallel trade. Regulators in key markets such as the USA, EU, and China have tightened mandates on serialization, traceability, and tamper evidence-accelerating adoption across generics and branded formulations.

WHO data estimates that 10.5% of medical products in low- and middle-income countries are substandard or falsified, prompting both public and private sector investment in packaging-integrated authentication. At the same time, pharma brands face mounting litigation risks and reputational exposure, making packaging a frontline defense in quality assurance.

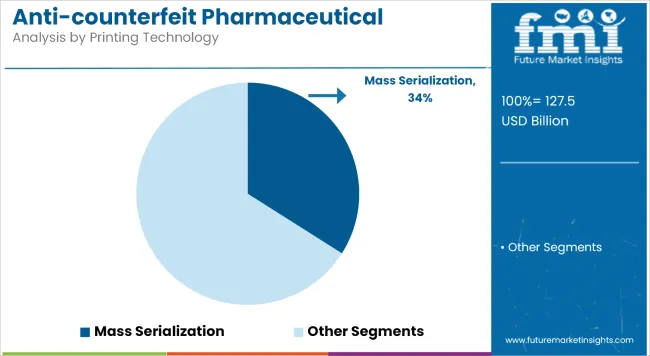

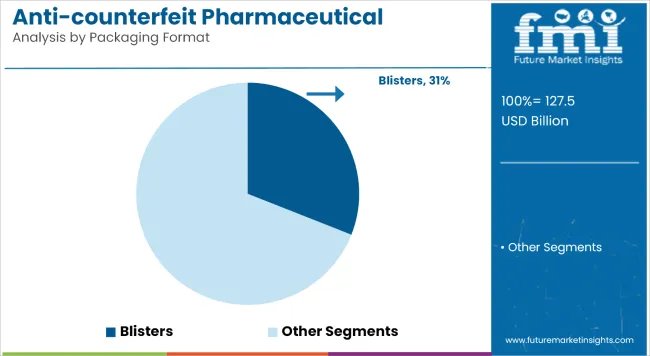

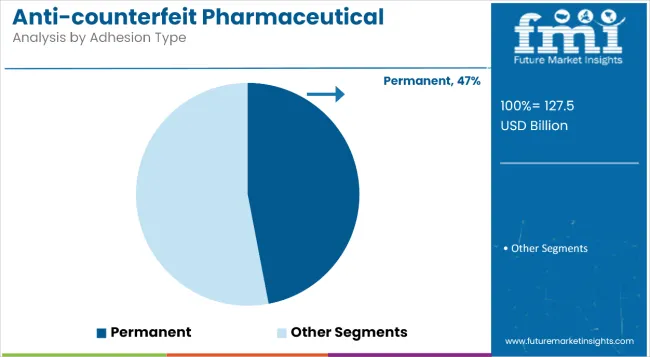

The anti-counterfeit pharmaceutical packaging market is segmented into multiple layers of analysis to capture the diverse technologies and use cases driving adoption. By packaging format, the market includes bottles & jars; vials & ampoules; blisters; trays; pouches & sachets; and others. In terms of printing technology, it spans RFID; security inks & coatings; security seals; holograms; mass encryption; barcode; and mass serialization. By adhesion type, segmentation covers permanent, removable, and repositionable formats.

The end-application category comprises pharma & biological; medical & supplies; gloves; scissors; syringes & needles; surgical tapes; medical equipment; surgical; therapeutic; diagnostic; and others. Regional analysis spans North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

Mass serialization will lead the printing technology segment in 2025, commanding a 34% market share. This method enables item-level tracking by assigning unique identifiers to each unit, allowing real-time traceability from manufacturer to end-user-making it indispensable in high-risk and high-volume pharmaceutical supply chains.

Key factors driving this growth include global mandates such as the USA DSCSA and EU Falsified Medicines Directive requiring full serialization for prescription drugs. Further, its integration with existing ERP and warehouse systems, which reduces recall execution time by nearly 60% and strengthens regulatory audits.

A pivotal disruptor is the expansion of interoperable cloud databases, now adopted by over 65% of licensed European and USA wholesalers, which scan and verify serialized units before secondary distribution, cutting counterfeit entry by up to 42% in pilot zones.

Blisters will lead the packaging format segment in 2025 with a 31% market share, driven by their unit-dose precision and tamper-evident structure. This format remains preferred for solid-dose pharmaceuticals due to its high barrier properties and ease of product authentication at retail and institutional checkpoints.

Key factors driving demand for blisters are

An underappreciated disruptor is cold-form foil blister technology, which reduces oxygen and moisture ingress by up to 95% compared to thermoform variants, allowing higher-value drugs to be protected and authenticated simultaneously, reducing spoilage and fraud losses across the supply chain.

Permanent adhesives will dominate the adhesion type segment in 2025, holding a 47% market share, due to their critical role in ensuring irreversible tamper evidence. These adhesives are widely used in security labels, holographic seals, and multi-layer authentication strips where repositioning or removal would compromise package integrity.

Two key adoption levers include regulatory requirements such as the USA FDA’s 21 CFR Part 211.132 and EU’s MDR packaging guidelines mandating non-resealablelabeling for high-risk drugs; their durability across varying temperature and humidity conditions, enabling consistent performance during global transit.

A less visible disruptor is the integration of destructible film layers within permanent labels, which trigger visible breakage if tampered with-reducing counterfeit-related returns by nearly 32% in pilot tests conducted across North American wholesalers.

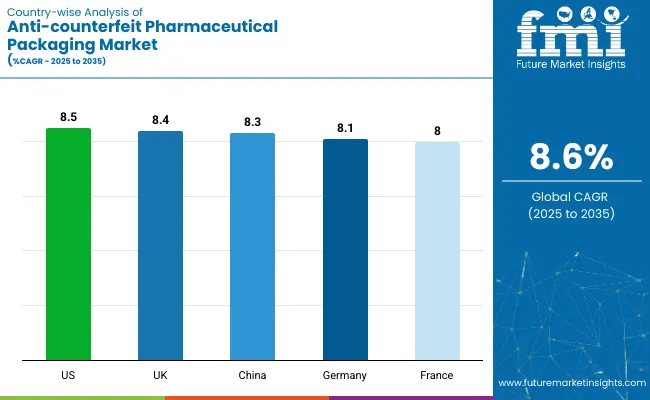

The adoption of anti-counterfeit pharmaceutical packaging varies sharply across countries, shaped by differences in regulatory enforcement, pharmaceutical export exposure, and domestic drug safety priorities. In the United States, mandatory serialization under the DSCSA has created strong pull for mass serialization and tamper-evident labels across the full supply chain.

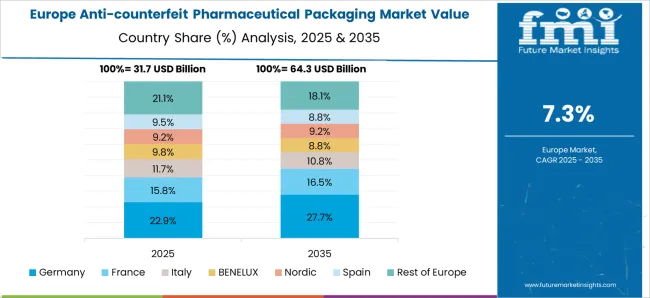

Western European countries-particularly Germany and France-have aligned tightly with EU FMD compliance, integrating unit-level tracking and interoperable verification systems. China has accelerated digital traceability frameworks for domestic generics and export-bound APIs, while India has mandated barcoding and serialization on all export consignments, boosting uptake of low-cost authentication formats.

Meanwhile, Japan and South Korea have focused on securing high-value biologics and patented therapies through holograms, RFID, and cloud-based serial registries. Overall, national trajectories reflect the balance between compliance burden, counterfeit risk exposure, and digital infrastructure maturity.

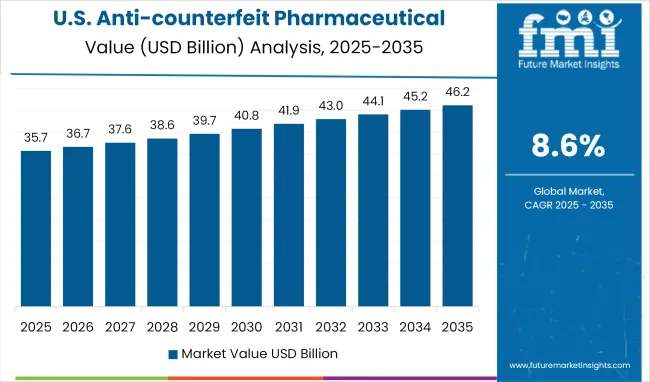

The USA anti-counterfeit pharmaceutical packaging market is projected to expand at a CAGR of 8.5% from 2025 to 2035, driven by the final phase of DSCSA enforcement mandating unit-level traceability across the supply chain.

Strong margins stem from adoption of mass serialization, with implementation costs offset by up to 60% in federal compliance penalties and product recalls. However, high integration costs with legacy systems pose a friction point for smaller manufacturers. Channel transformation is also underway; major wholesalers and pharmacy chains now mandate serialized data exchange before fulfillment, elevating infrastructure expectations for all players.

The UK market is expected to grow at 8.4% CAGR between 2025 and 2035, supported by post-Brexit continuity in drug safety standards and increasing scrutiny of parallel imports. Revenue growth is sustained by tamper-evident labeling and mass encryption, particularly across hospital supply contracts.

However, mid-sized pharma firms cite a 24% rise in compliance-related packaging costs, impacting price-sensitive therapeutic categories. Government-funded digital medicine programs now require serialized tracking on all Tier 1 drug reimbursements, further boosting tech-led packaging demand. A 2025 YouGov survey reported that 64% of UK patients trust medicine authentication via packaging over pharmacist validation alone.

China’s anti-counterfeit pharmaceutical packaging market is forecast to grow at 8.3% CAGR from 2025 to 2035, underpinned by government-led bulk procurement programs and new serialization mandates for APIs. The margin structure is shaped by low-cost manufacturing but increasing regulatory overhead.

In 2025, domestic pharma exporters faced new inspection thresholds under EU and WHO-import frameworks, prompting a surge in demand for GS1-compliant packaging. Friction remains in rural distribution chains, where only 43% of providers use serialization verification tools. Public sentiment is shifting: a 2025 CNHDA poll showed 58% of consumers consider holograms and codes necessary for trust in medicines.

Germany’s market is poised to grow at a steady CAGR of 8.1% through 2035, anchored by its high-value biologics segment and centralized pharmaceutical distribution model. Packaging innovation is a margin lever, with 3D barcode deployment rising by 36% YoY in 2025 to enable full product lineage tracking.

However, friction arises from EU-level audit variability and rising anti-tamper packaging costs for small batch products. Nearly 68% of hospital procurement units now consider serialization data a procurement prerequisite. Additionally, the German Medicines Verification System (SecurPharm) extended access to private pharmacy networks in 2025, enabling verification by end-dispensers.

Assuming the final bar represents France (based on typical report inclusions), the market is set to grow at a CAGR of 8.0% from 2025 to 2035. Regulatory alignment with EU serialization norms remains the dominant tailwind, with unit-level tracking mandatory across all reimbursed prescription drugs.

Gross margins are supported by government co-financing for serialization equipment, benefiting 48% of small-scale packagers. Friction is observed in multi-country contract manufacturing, where serialization handoff between plants still lacks standardization. A national survey by France Assos Santé in 2025 found that 61% of patients believe tamper-proof packaging improves medication safety and recall trust.

The players in the anti-counterfeit pharmaceutical packaging market are focusing on serialization systems, overt/covert authentication, and integrated smart-packaging platforms to support regulatory compliance and improve supply chain security. Investments are being directed toward cloud-based tracking, thermal-sensitive indicators, and tamper-evident label technologies to meet evolving DSCSA, FMD, and global traceability mandates.

CCL Industries holds significant market share, benefiting from scale in security labels and multi-layer authentication tags deployed across both primary and secondary packaging. SICPA Holdings and Authentix Inc. lead in ink-based and covert forensics solutions, catering to government-backed schemes. ATL Security Label Systems and Zebra Technologies are expanding in barcode and serialization equipment, with increased demand from contract manufacturers and generics exporters.

Short-term challenges include rising raw material costs for RFID inlays and printable electronics, along with slower adoption in low-volume therapeutic categories. However, regulatory harmonization and cloud-based verification ecosystems are likely to favor vertically integrated vendors. Players investing in hybrid security formats and regional traceability APIs are best positioned to capture market leadership by 2035.

| Metric | Details |

|---|---|

| Market Size 2025 | USD 127.5 billion |

| Market Size 2035 | USD 290.9 billion |

| CAGR (2025 to 2035) | 8.6% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2035 |

| Historical Period | 2018 to 2023 |

| Units | Revenue in USD Billion |

| Segments Covered | Packaging Format; Printing Technology; Adhesion Type; End-application |

| Packaging Format | Bottles & Jars; Vials & Ampoules; Blisters; Trays; Pouches & Sachets; Others |

| Printing Technology | RFID; Security Inks & Coatings; Security Seals; Holograms; Mass Encryption; Barcode; Mass Serialization |

| Adhesion Type | Permanent; Removable; Repositionable |

| End-application | Pharma & Biological; Medical & Supplies; Gloves; Scissors; Syringes & Needles; Surgical Tapes; Medical Equipment; Surgical; Therapeutic; Diagnostic; Others |

| Regional Coverage | North America; Latin America; Western Europe; Eastern Europe; South Asia & Pacific; East Asia; Middle East & Africa |

| Country Coverage | United States; United Kingdom; Germany; China; France; Japan; 40+ others |

| Key Companies Covered | CCL Industries; SICPA Holdings; Alien Technology; ATL Security Label Systems; Authentix Inc.; Zebra Technologies; TruTag Technologies; AlpVision ; Stevanato Group; 3M; others |

The global anti-counterfeit pharmaceutical packaging market is estimated to be valued at USD 127.5 billion in 2025.

The market size for the anti-counterfeit pharmaceutical packaging market is projected to reach USD 279.6 billion by 2035.

The anti-counterfeit pharmaceutical packaging market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in anti-counterfeit pharmaceutical packaging market are bottles & jars, vials & ampoules, blisters, trays, pouches & sachets and others (tubes, syringes, etc.).

In terms of printing technology, RFID segment to command 27.4% share in the anti-counterfeit pharmaceutical packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pharmaceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Packaging Equipment Market Size, Share & Forecast 2025 to 2035

Market Share Breakdown of Pharmaceutical Packaging Companies

Pharmaceutical Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Pharmaceutical Glass Packaging Manufacturers

Biopharmaceuticals Packaging Market Growth – Forecast 2025 to 2035

Pharmaceutical Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Pharmaceutical Plastic Packaging

USA Pharmaceutical Packaging Market Insights – Demand, Size & Industry Trends 2025-2035

Pharmaceutical Contract Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Pharmaceutical Contract Packaging Providers

Pharmaceutical Secondary Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Unit Dose Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Pharmaceutical Unit Dose Packaging Providers

Industry Share & Competitive Positioning in Pharmaceutical Secondary Packaging

Pharmaceutical Cold Chain Packaging Market Size, Share & Forecast 2025 to 2035

Pharmaceutical Cold Chain Packaging Industry Analysis in United States - Size, Share, and Forecast Outlook 2025 to 2035

Japan Pharmaceutical Packaging Market Report – Demand, Growth & Innovations 2025-2035

Germany Pharmaceutical Packaging Market Insights – Size, Trends & Innovations 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA