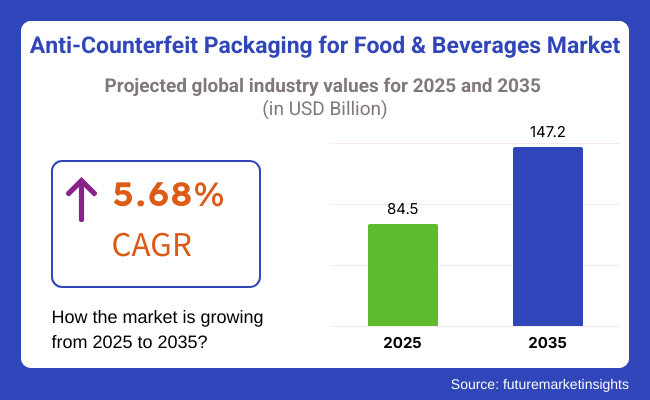

The anti-counterfeit packaging for food & beverages market is projected to grow from USD 84.5 billion in 2025 to USD 147.2 billion by 2035, registering a CAGR of 5.6% during the forecast period. Sales in 2024 reached USD 80.0 billion, indicating a steady demand trajectory. This growth has been attributed to the increasing demand for secure and tamper-evident packaging solutions across various sectors, including food and beverage industries.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 84.5 billion |

| Industry Value (2035F) | USD 147.2 billion |

| CAGR (2025 to 2035) | 5.6% |

The rise in consumer awareness regarding product authenticity and safety has further propelled the adoption of anti-counterfeit packaging. Additionally, advancements in technologies such as RFID, holograms, and block chain have enhanced the effectiveness of anti-counterfeit measures, aligning with the evolving needs of manufacturers and consumers alike.

In 2024, SICPA, a global leader in product security, revenue realization, and track and trace solutions, today announced the release of new, integrated product security labels with innovative, counterfeit-resistant visual effects; secure traceable codes; and covert features to protect brands and consumers as the prevalence of counterfeit products reaches all-time highs.

“Produced using propriety technologies and SICPA’s fully controlled supply chain, this new solution provides business and governments both unrivaled security features and unique customization opportunities,” says Karen Gardner. “Taken together, this allows customers to not only achieve optimum brand and product protection, but also to leverage a unique marketing opportunity - creating a unique, counterfeit-resistant marking that makes it easy for consumers to identify authentic products.”

Technological advancements have been embraced across food packaging sectors to integrate sustainable and smart authentication tools. Biodegradable substrates embedded with UV-reactive inks and invisible watermarks have been deployed in dairy and premium beverage packaging.

Block chain-driven traceability has been developed to authenticate origin, particularly in organic food sectors. Low-carbon smart labels and scan able QR codes printed using water-based coatings have contributed to material efficiency and waste reduction. Adoption of inkjet-printed digital signatures that minimize carbon impact while maximizing code density has also been reported.

The market outlook for anti-counterfeit packaging in food and beverages remains robust, with an expected surge in demand for trackable, tamper-proof systems. Investments are projected to shift toward integrated cloud-connected solutions that offer predictive alerts and dynamic authentication.

Competitive advantages are anticipated for brands that offer verifiable packaging experiences via mobile integration and consumer traceability. The regulatory landscape is also expected to intensify, with evolving standards in import/export labeling and food traceability. Collaborations between packaging providers and digital platforms are forecasted to dominate strategy pipelines.

The market is segmented based on technology type, type, end-use application, and region. By technology type, the market includes barcode-based solutions, RFID/NFC tags, holograms, tamper-evident seals, invisible printing/inks, QR code tracking, and block chain-enabled packaging. In terms of type, the market is categorized into invisible printing, embedded image, digital watermarks, hidden marks, and others.

By end-use application, the market comprises packaged foods, dairy products, baby food, functional & nutraceutical beverages, alcoholic beverages, and non-alcoholic beverages. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

QR code tracking has been projected to account for 28.4% of the anti-counterfeit packaging market for food and beverages in 2025 due to its widespread compatibility with smartphones and digital platforms. Unique codes have been integrated onto packaging to allow consumers and regulators to verify product authenticity instantly.

Scanning capabilities have enabled brand protection through track-and-trace systems. Retailers and distributors have also used QR codes for inventory checks and anti-diversion efforts. Dynamic QR codes have been adopted to redirect users to secure, tamper-proof databases hosted by brand owners. Real-time analytics have been generated from scanning patterns to detect counterfeit activity and distribution irregularities.

Integration of block chain technology with QR codes has allowed immutable recordkeeping from production to point-of-sale. This combination has proven valuable for premium brands and functional beverage producers where origin assurance is required. Regulatory frameworks such as FSMA and EU Falsified Medicines Directive have encouraged such digital traceability methods in food packaging.

Cloud platforms supporting QR verification have been increasingly deployed across cross-border logistics networks. Consumer preference for transparency and ethical sourcing has fueled the demand for QR-enabled packaging formats. Verification via mobile apps has gained traction in urban markets with digital penetration.

Additionally, counterfeit alerts and recall notices have been transmitted through these platforms, boosting safety standards. As digital infrastructure expands globally, QR code usage in food anti-counterfeit packaging is expected to grow steadily.

Packaged foods have been estimated to represent 32.7% of the anti-counterfeit packaging demand in 2025, due to heightened risk of fraud and contamination across processed food categories. High-frequency SKUs such as snacks, cereals, instant meals, and nutritional bars have necessitated brand protection measures at every stage. Supply chain fragmentation and global sourcing have further increased vulnerability to counterfeit infiltration.

Anti-tamper seals, serialized coding, and authentication tools have been used to safeguard consumer trust. Manufacturers have prioritized multi-layered packaging technologies combining tamper-evident seals and QR tracking for high-risk packaged goods.

Consumer awareness campaigns have been launched to educate buyers on verifying authenticity at the point of sale. Legal compliance and recall traceability have also been supported by these solutions. Retailers and e-commerce platforms have adopted these tools to ensure only legitimate stock enters their shelves.

Digital printing advancements have allowed unique identifiers to be printed directly on individual packs, reducing reliance on external labeling. Functional food and fortified snack brands have deployed verification features to differentiate from lookalike counterfeit products. Serialized tracking has enabled batch-level traceability for recalls and quality assurance.

In addition, allergen-sensitive products have benefitted from secure verification systems that ensure correct sourcing and handling. With growth in online grocery and cross-border food commerce, packaged food brands have been under pressure to validate authenticity across distribution layers. Traceability expectations among health-conscious consumers have reinforced investment in security packaging.

Increasing Complexity of Supply Chains and Counterfeit Risks

While the anti-counterfeit packaging market for food and beverages is arguably challenged by the increasing complexity of global supply chains, and the sophistication of counterfeit operations, such companies remain in high demand. Imitation foodstuffs harm not just brand confidence but also can have major health risks for those who eat them.

The food manufacturers need to create an extra level of safe technology (RFID tracking, tamper-evident seals, and encryption) that also requires an investment of time and money for small and mid-size businesses. Addressing these challenges necessitates a concerted effort between regulators, industry stakeholders, and technology providers to develop cost-effective and scalable anti-counterfeit solutions.

Integration of Smart Packaging and AI-based Authentication

There is significant promise for fighting food and beverage fraud in the form of smart packaging. AI solutions, QR-code traceable supply chain, and block chain based transparency tools empower the real-time verification of product authenticity guaranteeing consumer safety and protection of brands.

This contributes toward sustainability of packaging and advances the visibility of the supply chain & biscuits. As governments tighten measures on food safety and authentication, the global anti-counterfeit packaging market is one that will only win big through innovations.

North America, led by stringent regulations enforced by the USA Food and Drug Administration (FDA) and the Food Safety Modernization Act (FSMA), dominates the anti-counterfeit packaging for food and beverage market. Increasing Food fraud, mislabelling, and contamination concerns are pushing manufacturers to incorporate advanced authentication solutions like tamper-proof seals, holographic labels, block chain based traceability, QR code verification, etc.

Moreover, explosive growth of e-commerce has increased the imperative for stringent anti-counterfeit measures to guard consumers from counterfeit food and beverage products. Rising consumer awareness regarding the authenticity of products, along with the growing demand for organic and premium food products, further drives the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.2% |

The food and beverages anti-counterfeit packaging market in the United Kingdom is witnessing a fair growth, which can be attributed to rising focus on food safety and increasing incidences of counterfeit products structured in the e-commerce channels.

There are much stricter guidelines to prevent food fraud, enforced by regulatory bodies like the UK Food Standards Agency (FSA) and the Intellectual Property Office (IPO). Food and beverage manufacturers are increasingly turning to intelligent packaging solutions such as smart labels, NFC-enabled tracking, and serialization technology to boost transparency and traceability. Increased demand for sustainable packaging along with the features of anti-counterfeit is anticipated to drive the growth of this market substantially.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.0% |

EC regulations on food safety and traceability, along with the EU Food Fraud Network, provide strong legal parameters in this regard, creating key opportunities for anti-counterfeit packaging.

Germany, France, and Italy are leading the way in the development of secure packaging technologies such as blockchain-enabled authentication, tamper-proof packaging, and forensic markers. In 2019, the adoption of advanced anti-counterfeit solutions is primarily being driven by increased focus on cross-border food safety and growing incidences/volumes of counterfeit wine, spirits and organic food products.

European consumers are also especially invested in food authenticity which has been driving brands to take further and innovative security packaging measures.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.1% |

Japan’s anti-counterfeit packaging market for food and beverage products is increasing, owing to food safety standards and technological development in the country. Japanese manufacturers have been industry leaders in the adoption of smart packaging solutions including: edible security markers, tamper-proof radio-frequency identification (RFID) tags, and laser-etched serialization for food and beverage products.

There has been rising investment into authentication technologies due to the increasing risk of counterfeit sake, imported luxury food items and functional beverages on the market. Furthermore, the government's approach towards maintaining food quality for domestic consumers and exports also reinforces market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.2% |

The anti-counterfeit packaging for food and beverage market in South Korea is emerging at a fast pace due to the rising number of counterfeiting cases for the alcoholic beverages, dairy products, and functional drinks. The Ministry of Food and Drug Safety (MFDS) and other regulatory authorities in the country of late have adopted stronger measures to prevent food fraud.

AI-based verification technology, QR code-based tracking, block chain enabled authentication solution adoption is on the rise. Moreover, consumers in South Korea have a high level of food safety awareness, particularly in urban areas, driving demand for anti-counterfeit solutions as they are willing to pay extra for products with authentication features that are visible to them.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

Anti-counterfeit Packaging for Food & Beverages Market Scenario: The anti-counterfeit packaging for food & beverages market is anticipated to grow over the forecast period due to increasing concerns about food safety, brand protection, and compliance to regulations.

The growing number of counterfeit food and beverage products is also pushing demand for next-generation security solutions. The enterprises are implementing advanced technologies like RFID-based tracking, holograms, serialization, tamper-evident seals, and block chain supported supply chain management which guarantees monitoring the products back to their original manufacturers.

Moreover, the increasing trend for eco-friendly and biodegradable packaging is driving sustainable anti-counterfeit solutions in the industry.

The overall market size for the anti-counterfeit packaging for food & beverages market was USD 84.5 billion in 2025.

The anti-counterfeit packaging for food & beverages market is expected to reach USD 147.2 billion in 2035.

The anti-counterfeit packaging for food & beverages market is expected to grow at a CAGR of 5.68% during the forecast period.

The demand for the anti-counterfeit packaging for food & beverages market will be driven by increasing concerns over food safety, rising incidents of food fraud, advancements in smart packaging technologies, stringent regulatory requirements, and growing consumer awareness regarding product authenticity.

The top five countries driving the development of the anti-counterfeit packaging for food & beverages market are the USA, China, Germany, France, and Japan.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Tester Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Market Size, Share & Forecast 2025 to 2035

Market Share Breakdown of Food Packaging Film Providers

Food Packaging Equipment Market

Food & Beverages Air Filters Market Size and Share Forecast Outlook 2025 to 2035

Food Tub packaging Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverages Color Fixing Agents Market Analysis by Product Type, Application and Region through 2035

Seafood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Seafood Packaging Market Size, Share & Forecast 2025 to 2035

Food Grade Packaging Market Insights – Demand, Size & Industry Trends 2025-2035

Evaluating Seafood Packaging Market Share & Provider Insights

Food Powder Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Food Powder Packaging Machine Market Share & Industry Trends

Pet Food Packaging Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Baby Food Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

PVDC Food Packaging Market

Fresh Food Packaging Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA