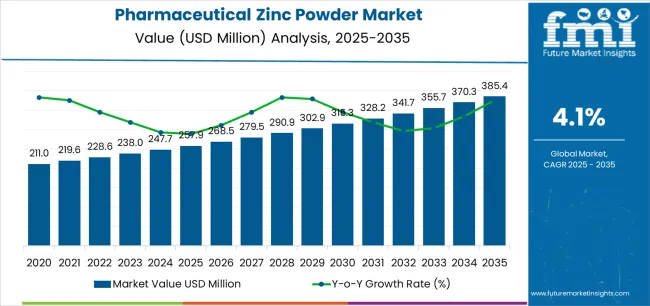

The global pharmaceutical zinc powder market, valued at USD 257.9 million in 2025, is projected to reach USD 385.5 million by 2035, expanding at a CAGR of 4.1% and recording an absolute increase of USD 127.6 million over the forecast period. The pharmaceutical zinc powder market is expected to grow by nearly 1.5X, supported by expanding pharmaceutical formulations, increasing demand for high-purity zinc intermediates, and the adoption of zinc-based compounds in therapeutic and nutraceutical applications. The pharmaceutical zinc powder market’s steady expansion reflects the broader shift toward trace mineral integration in drug development and the vital role of pharmaceutical-grade zinc powder in formulations requiring antioxidant, catalytic, and immune-modulating properties.

The pharmaceutical manufacturing sector remains the primary end-use segment driving the demand for pharmaceutical zinc powder, particularly in tablet coatings, controlled-release formulations, and micronutrient fortification blends. Zinc powder’s reactivity and compatibility with active pharmaceutical ingredients (APIs) have made it essential for reducing agents, stabilizing compounds, and as a component in excipient systems. The growth trajectory is supported by ongoing innovation in solid dosage formulations, especially in effervescent and dispersible tablets where zinc plays both a therapeutic and functional role. Moreover, the rising awareness of zinc’s efficacy in immune support, wound healing, and metabolic regulation has expanded its utilization in both over-the-counter nutraceuticals and prescription-grade supplements.

The nutraceutical and dietary supplement industry exhibits increasing penetration of pharmaceutical zinc powder, primarily in zinc gluconate, zinc sulfate, and zinc acetate derivatives used in functional foods and fortified beverages. The global rise in preventive health awareness and post-pandemic emphasis on immune resilience have intensified the adoption of zinc-enriched formulations, boosting consumption across Asia-Pacific, North America, and Europe. Manufacturers are emphasizing high-purity, microfine zinc powders that ensure enhanced bioavailability and reduced impurity levels, aligning with pharmacopeia compliance across major markets.

In API synthesis and chemical intermediates, zinc powder plays a crucial role as a reducing agent in the production of key pharmaceutical molecules, including antibiotics and anti-inflammatory compounds. The steady demand for pharmaceutical zinc powder from contract manufacturing organizations (CMOs) and specialty API producers highlights its importance in high-throughput synthesis environments. The increasing focus on green chemistry and controlled reaction efficiency has also stimulated interest in zinc’s recyclability and its compatibility with solvent-free synthesis routes.

Regional dynamics indicate that Asia-Pacific dominates production due to established metal refining capabilities and growing pharmaceutical manufacturing bases in India, China, and South Korea. Europe and North America show consistent consumption driven by high regulatory standards, purity validation, and advanced formulation technology adoption. The pharmaceutical zinc powder market continues to evolve with performance differentiation centered around particle size uniformity, purity level (≥99.9%), and controlled oxidation resistance. As global healthcare and nutraceutical demand expands, the adoption of pharmaceutical zinc powder is expected to intensify across formulation technologies, ensuring its role as a core excipient and catalytic agent in next-generation pharmaceutical manufacturing through 2035.

The pharmaceutical zinc powder market faces headwinds from raw material price volatility affecting zinc metal costs, stringent pharmaceutical quality regulations requiring extensive documentation and validation, and competition from alternative zinc compound formulations including zinc oxide and zinc sulfate. The competitive landscape is characterized by ongoing investments in purification technologies, vertical integration strategies among zinc metal producers, and specialized pharmaceutical ingredient suppliers gaining market share through comprehensive regulatory support and technical expertise in pharmaceutical manufacturing requirements.

The forecast period will witness accelerated adoption of ultra-fine zinc powder grades featuring optimized particle size distributions, enhanced surface area characteristics enabling improved bioavailability, and comprehensive quality documentation supporting pharmaceutical compendial compliance across multiple jurisdictions. Geographic expansion in Asia-Pacific pharmaceutical manufacturing hubs, North American nutraceutical production facilities, and European pharmaceutical ingredient operations will drive volume growth, while premium segments focused on specialized particle size grades and comprehensive regulatory support will support value expansion through technology differentiation and full-service supply capabilities.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 257.9 Million |

| Market Forecast Value (2035) | USD 385.5 Million |

| Forecast CAGR (2025 to 2035) | 4.1% |

The pharmaceutical zinc powder market grows by enabling pharmaceutical companies, nutraceutical manufacturers, and dietary supplement producers to achieve superior product quality and bioavailability while meeting stringent regulatory standards for pharmaceutical ingredient purity and safety. Formulators face mounting pressure to deliver effective zinc supplementation solutions, with pharmaceutical-grade zinc powder typically providing 30-45% improvement in dissolution rate and bioavailability compared to coarser particle grades, making these specialized materials essential for premium supplement positioning and therapeutic efficacy optimization in clinical applications.

The immune health revolution's need for reliable micronutrient supplementation creates steady demand for high-purity zinc powder that can deliver consistent nutritional support, meet pharmacopeial specifications, and integrate seamlessly with diverse pharmaceutical formulation platforms including immediate-release tablets, sustained-release systems, and liquid supplement preparations. Growing scientific evidence supporting zinc's role in immune function, wound healing, and metabolic health drives adoption across pharmaceutical and nutraceutical segments where clinical efficacy documentation and regulatory compliance directly impact market access and product credibility.

Government health initiatives promoting micronutrient supplementation and preventive healthcare strategies accelerate adoption in dietary supplement, pharmaceutical, and fortified food applications, where zinc bioavailability has direct impact on therapeutic outcomes and nutritional adequacy. The global aging population trend creates increasing demand for immune support supplements and age-related health maintenance products incorporating pharmaceutical-grade zinc formulations. The complex pharmaceutical quality requirements including heavy metal specifications, microbial limits, and particle size control may limit supplier participation to specialized manufacturers with comprehensive quality systems, while price sensitivity in commodity supplement segments creates pressure on premium pharmaceutical-grade zinc powder positioning.

The pharmaceutical zinc powder market is segmented by particle size, application, and region. By particle size, the pharmaceutical zinc powder market is divided into 325 mesh, 400 mesh, 500 mesh, 600 mesh, and others. Based on application, the pharmaceutical zinc powder market is categorized into pharmaceutical production, nutritional supplements, and others. Regionally, the pharmaceutical zinc powder market is divided into Asia Pacific, Europe, North America, Latin America, and the Middle East & Africa.

.webp)

The 325 mesh segment represents the dominant force in the pharmaceutical zinc powder market, capturing approximately 42.0% of total market share in 2025. This advanced category encompasses fine powder grades with particle sizes approximately 45 micrometers, deliveringan optimal balance between dissolution performance, processing characteristics, and cost-effectiveness for pharmaceutical and nutraceutical formulation requirements. The 325 mesh segment's market leadership stems from its universal acceptance across pharmaceutical compendial standards, proven manufacturing compatibility with conventional tablet compression and encapsulation equipment, and established regulatory documentation supporting global pharmaceutical ingredient approvals.

The 400 mesh segment maintains a substantial 25.0% market share, serving premium formulations requiring enhanced dissolution characteristics through 38-micrometer particle sizes optimized for rapid bioavailability in immediate-release pharmaceutical applications. The 500 mesh segment accounts for 16.0% market share, featuring ultra-fine 25-micrometer particles enabling superior suspension stability and specialized formulation requirements. The 600 mesh and others segments collectively hold 17.0% market share, encompassing specialized ultra-fine grades for advanced pharmaceutical systems and coarser grades for specific industrial applications.

Key advantages driving the 325 mesh segment include:

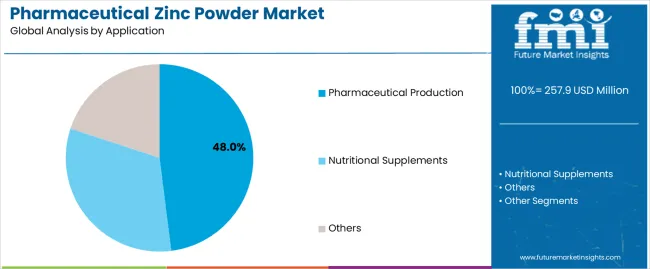

Pharmaceutical production dominates the pharmaceutical zinc powder market with approximately 48.0% market share in 2025, reflecting the critical role of pharmaceutical-grade zinc in prescription medications, over-the-counter treatments, and clinical nutrition products requiring stringent quality standards and regulatory compliance. Mandatory GMP manufacturing requirements reinforce the pharmaceutical production segment's market leadership, extensive quality documentation including certificates of analysis and regulatory support files, and continuous quality assurance programs ensuring batch-to-batch consistency for critical pharmaceutical applications.

The nutritional supplements segment represents 38.0% market share through dietary supplement formulations, vitamin-mineral combinations, and immune support products serving health-conscious consumers and preventive healthcare applications. Other applications account for 14.0% market share, including dermatological preparations, topical wound care products, and specialized industrial uses requiring high-purity zinc powder materials.

Key market dynamics supporting application preferences include:

The pharmaceutical zinc powder market is driven by three concrete demand factors tied to health awareness and pharmaceutical quality requirements. First, immune health consciousness creates increasing requirements for zinc supplementation, with global dietary supplement market growing 8-12% annually in developed markets as consumers prioritize preventive healthcare and immune function support, requiring pharmaceutical-grade zinc powder meeting stringent quality specifications for consumer safety and therapeutic efficacy. Second, pharmaceutical formulation innovation drives demand for specialized particle sizes, with controlled-release systems, orally disintegrating tablets, and liquid pharmaceutical preparations requiring optimized zinc powder characteristics including specific surface areas, particle size distributions, and dissolution profiles. Third, regulatory harmonization efforts facilitate market expansion, with growing acceptance of international pharmaceutical compendial standards including USP, EP, and JP specifications enabling suppliers to serve multiple regional markets with standardized product offerings.

Market restraints include zinc metal price volatility affecting raw material costs, with zinc commodity prices fluctuating 25-40% annually based on global mining production and industrial demand cycles, impacting pharmaceutical ingredient pricing and long-term supply agreements. Stringent pharmaceutical quality requirements create supplier consolidation pressures, as comprehensive GMP compliance, extensive analytical testing capabilities, and regulatory expertise requirements favor established pharmaceutical ingredient manufacturers over commodity zinc producers lacking pharmaceutical quality infrastructure. Technical complexity in achieving narrow particle size distributions with high purity levels increases manufacturing costs, particularly for ultra-fine mesh grades requiring specialized milling equipment and classification systems to meet pharmaceutical specifications.

Key trends indicate accelerated adoption in India and China pharmaceutical ingredient manufacturing, where expanding domestic pharmaceutical production and government initiatives supporting API manufacturing create growing demand for pharmaceutical-grade zinc powder. Technology advancement toward surface-modified zinc powder grades with enhanced stability characteristics, nano-particle zinc formulations offering superior bioavailability, and organic acid-stabilized zinc systems improving pharmaceutical compatibility are driving next-generation product development. The pharmaceutical zinc powder market thesis could face disruption if alternative zinc delivery systems, including chelated zinc compounds, nanoparticle formulations, or zinc-ionophore combinations, demonstrate superior bioavailability, potentially reducing demand for conventional pharmaceutical zinc powder in premium supplement segments.

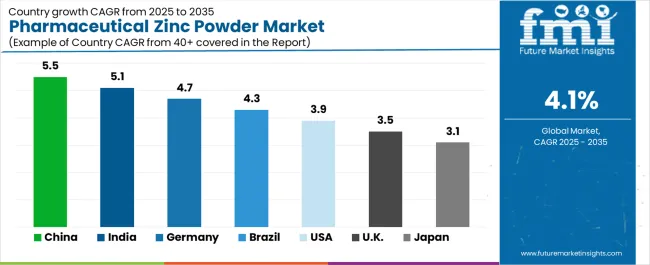

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| Brazil | 4.3% |

| USA | 3.9% |

| UK | 3.5% |

| Japan | 3.1% |

The pharmaceutical zinc powder market is gaining momentum worldwide, with China taking the lead thanks to massive pharmaceutical ingredient manufacturing scale and government initiatives supporting domestic API production capabilities. Close behind, India benefits from expanding pharmaceutical manufacturing operations and growing nutraceutical industry development, positioning itself as a strategic growth hub in the Asia-Pacific region. Germany shows strong advancement, where pharmaceutical quality standards and established ingredient supply chains strengthen its role in European pharmaceutical markets. Brazil demonstrates robust growth through expanding pharmaceutical production and increasing health supplement consumption, signaling continued investment in pharmaceutical ingredient sourcing. The USA maintains steady expansion driven by nutraceutical market maturity and pharmaceutical innovation activities. Meanwhile, the U.K. and Japan continue to record consistent progress through established pharmaceutical industries and quality-focused supplement markets. Together, China and India anchor the global expansion story, while established markets build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

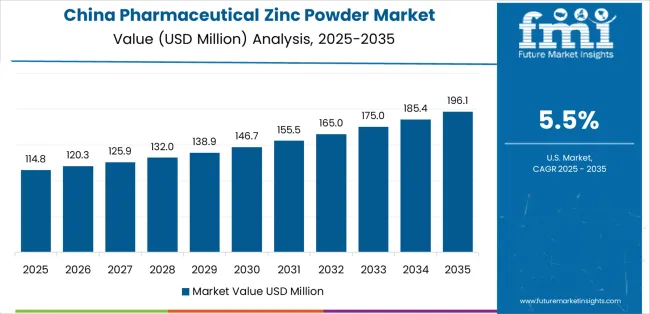

China demonstrates the strongest growth potential in the pharmaceutical zinc powder market with a CAGR of 5.5% through 2035. The country's leadership position stems from a comprehensive pharmaceutical ingredient manufacturing infrastructure, massive zinc metal production capacity, and expanding domestic pharmaceutical and nutraceutical industries, driving demand for pharmaceutical-grade zinc powder. Growth is concentrated in major pharmaceutical manufacturing hubs, including Zhejiang, Jiangsu, Shandong, and Hubei, where pharmaceutical companies, dietary supplement manufacturers, and pharmaceutical ingredient suppliers are implementing pharmaceutical-grade zinc powder for domestic formulation requirements and export markets. Distribution channels through pharmaceutical ingredient distributors, direct pharmaceutical manufacturer relationships, and nutraceutical supply chains expand deployment across domestic pharmaceutical production and international export operations. The country's Healthy China 2030 initiative provides policy support for pharmaceutical ingredient quality enhancement, including focus on pharmaceutical-grade material specifications and quality system development.

Key market factors:

In the Maharashtra, Gujarat, Telangana, and Tamil Nadu regions, the adoption of pharmaceutical zinc powder systems is accelerating across pharmaceutical manufacturing facilities, nutraceutical production operations, and dietary supplement formulation centers, driven by expanding pharmaceutical production capacity and growing consumer health awareness supporting supplement market growth. The pharmaceutical zinc powder market demonstrates strong growth momentum, with a CAGR of 5.1% through 2035, driven by comprehensive pharmaceutical manufacturing expansion and an increasing focus on sourcing high-quality pharmaceutical ingredients. Indian pharmaceutical manufacturers are implementing pharmaceutical-grade zinc powder to support competitive product development while meeting international pharmaceutical quality standards for export markets, including the USA, Europe, and regulated emerging markets. The country's National Health Policy creates steady demand for quality pharmaceutical ingredients, while increasing focus on preventive healthcare drives nutraceutical market expansion.

Germany's advanced pharmaceutical industry demonstrates sophisticated implementation of pharmaceutical zinc powder systems, with documented case studies showing comprehensive quality management ensuring pharmaceutical compendial compliance and batch-to-batch consistency. The country's pharmaceutical manufacturing infrastructure in major industrial regions, including North Rhine-Westphalia, Bavaria, Hesse, and Baden-Württemberg, showcases integration of pharmaceutical-grade zinc powder with existing pharmaceutical production systems, leveraging expertise in pharmaceutical quality management and stringent regulatory compliance. German pharmaceutical manufacturers emphasize quality standards and supply chain reliability, creating demand for premium zinc powder solutions that support pharmaceutical manufacturing excellence and regulatory compliance across European and international markets. The pharmaceutical zinc powder market maintains strong growth through focus on pharmaceutical quality and specialized supplement formulations, with a CAGR of 4.7% through 2035.

Key development areas:

The Brazilian market leads in Latin American pharmaceutical zinc powder adoption based on expanding pharmaceutical production capacity and growing health supplement consumption supporting domestic pharmaceutical ingredient demand. The country shows solid potential with a CAGR of 4.3% through 2035, driven by pharmaceutical industry development and increasing consumer health awareness across major production regions, including São Paulo, Rio de Janeiro, Paraná, and Minas Gerais. Brazilian pharmaceutical manufacturers are adopting pharmaceutical-grade zinc powder for competitive product formulation capabilities, while nutraceutical companies implement quality zinc ingredients meeting domestic regulatory requirements and supporting premium product positioning. Technology deployment channels through pharmaceutical ingredient distributors, pharmaceutical manufacturer direct relationships, and specialized pharmaceutical ingredient importers expand coverage across pharmaceutical and nutraceutical applications.

Leading market segments:

The USA market demonstrates mature implementation focused on nutraceutical market leadership, pharmaceutical manufacturing excellence, and specialized dietary supplement formulations requiring pharmaceutical-grade zinc powder. The country shows steady potential with a CAGR of 3.9% through 2035, driven by established nutraceutical industry and pharmaceutical quality requirements across major manufacturing and research centers, including California, New Jersey, New York, and North Carolina. American pharmaceutical and nutraceutical companies are implementing pharmaceutical-grade zinc powder for regulatory compliance with FDA dietary supplement regulations and pharmaceutical compendial requirements, particularly in immune support supplements requiring documented ingredient quality and bioavailability characteristics. Technology deployment channels through pharmaceutical ingredient distributors, nutraceutical raw material suppliers, and direct pharmaceutical manufacturer relationships expand coverage across diverse pharmaceutical and dietary supplement applications.

Leading market segments:

The UK's market demonstrates steady implementation focused on pharmaceutical manufacturing standards, nutraceutical quality requirements, and dietary supplement market maturity requiring reliable pharmaceutical-grade ingredient sourcing. The country maintains consistent growth momentum with a CAGR of 3.5% through 2035, driven by pharmaceutical quality expectations and established supplement industry across major regions including Southeast England, East of England, and Scotland. British pharmaceutical and nutraceutical manufacturers are implementing pharmaceutical-grade zinc powder to support quality product development while meeting MHRA pharmaceutical ingredient regulations and European Pharmacopoeia specifications for pharmaceutical and dietary supplement applications.

Key market characteristics:

.webp)

Japan's market demonstrates mature implementation focused on pharmaceutical manufacturing precision, stringent quality requirements, and specialized supplement formulations, with documented integration of advanced quality control systems ensuring pharmaceutical compendial compliance. The country maintains steady growth momentum with a CAGR of 3.1% through 2035, driven by pharmaceutical industry excellence and established quality standards across major manufacturing regions, including Kanto, Kansai, Chubu, and Kyushu. Japanese pharmaceutical manufacturers showcase advanced deployment of pharmaceutical-grade zinc powder featuring comprehensive quality verification, precise particle size specifications, and extensive regulatory documentation ensuring compliance with Japanese Pharmacopoeia requirements and pharmaceutical manufacturing standards.

Key market characteristics:

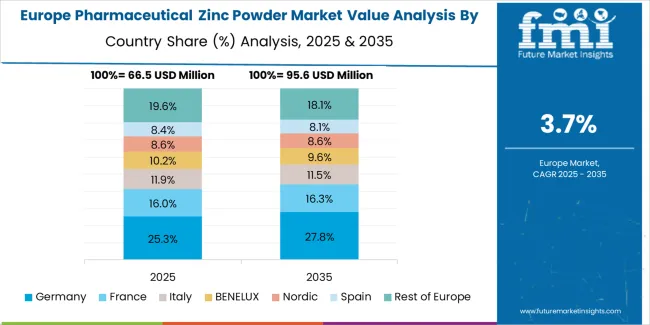

The pharmaceutical zinc powder market in Europe is projected to grow from USD 97.9 Million in 2025 to USD 141.9 Million by 2035, registering a CAGR of 3.8% over the forecast period. Germany is expected to maintain its leadership position with a 31.2% market share in 2025, declining slightly to 30.5% by 2035, supported by its extensive pharmaceutical manufacturing infrastructure and major pharmaceutical ingredient centers, including North Rhine-Westphalia, Bavaria, and Hesse production regions.

The United Kingdom follows with a 18.6% share in 2025, projected to reach 18.2% by 2035, driven by established pharmaceutical industry and mature nutraceutical market operations. France holds a 16.4% share in 2025, expected to reach 16.8% by 2035 through pharmaceutical manufacturing activities and supplement industry development. Italy commands a 12.7% share in both 2025 and 2035, backed by pharmaceutical ingredient production and dietary supplement manufacturing. Spain accounts for 8.9% in 2025, rising to 9.4% by 2035 on pharmaceutical industry expansion and growing health supplement consumption. The Netherlands maintains 4.8% in 2025, reaching 5.1% by 2035 on pharmaceutical ingredient distribution activities and nutraceutical production. The Rest of Europe region is anticipated to hold 7.4% in 2025, expanding to 7.8% by 2035, attributed to increasing pharmaceutical zinc powder adoption in Nordic pharmaceutical operations and emerging Central & Eastern European pharmaceutical ingredient manufacturing activities.

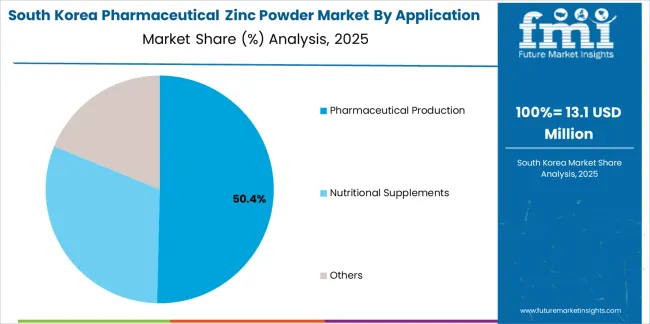

The South Korean market is characterized by strong international pharmaceutical ingredient provider presence, with companies maintaining significant positions through comprehensive regulatory support and quality documentation capabilities for pharmaceutical manufacturing and nutraceutical applications. The pharmaceutical zinc powder market demonstrates increasing focus on pharmaceutical quality standards and supplement industry sophistication, as Korean pharmaceutical manufacturers increasingly demand pharmaceutical-grade zinc powder that meets international compendial requirements and integrates with advanced pharmaceutical manufacturing systems deployed across major pharmaceutical production facilities. Regional pharmaceutical ingredient distributors are gaining market share through strategic partnerships with international suppliers, offering specialized services including Korean pharmaceutical regulatory support and pharmaceutical ingredient qualification assistance for domestic manufacturing operations. The competitive landscape shows increasing collaboration between multinational pharmaceutical ingredient companies and Korean pharmaceutical manufacturers, creating hybrid service models that combine international pharmaceutical quality standards with local market responsiveness and comprehensive technical support capabilities.

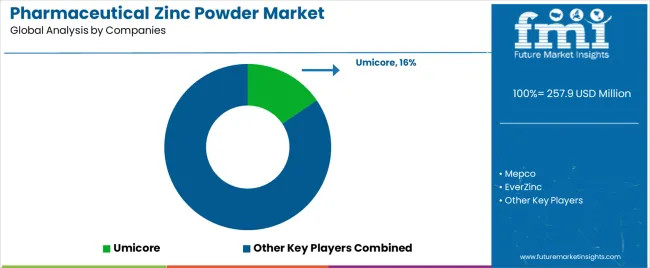

The pharmaceutical zinc powder market features approximately 20-30 meaningful players with moderate concentration, where the top three companies control roughly 35-42% of global market share through established pharmaceutical ingredient certifications, comprehensive quality management systems, and strong customer relationships with major pharmaceutical and nutraceutical manufacturers. Competition centers on pharmaceutical quality consistency, regulatory documentation support, supply chain reliability, and technical service capabilities rather than price competition alone. Umicore leads with approximately 15.5% market share through its comprehensive pharmaceutical ingredient portfolio and global pharmaceutical manufacturing customer base.

Market leaders include Umicore, EverZinc, and US Zinc, which maintain competitive advantages through pharmaceutical-grade production facilities with GMP compliance, extensive regulatory experience supporting pharmaceutical ingredient approvals across multiple jurisdictions, and vertical integration capabilities from zinc metal production through pharmaceutical-grade purification, creating comprehensive supply chain control and quality assurance capabilities for pharmaceutical applications. These companies leverage research and development capabilities in advanced purification technologies, particle size optimization, and pharmaceutical quality system management to defend market positions while expanding into specialized application segments including controlled-release formulations, nano-particle zinc systems, and customized pharmaceutical ingredient solutions.

Challengers encompass Mepco, Purity Zinc Metals, and Transpek-Silox Industry, which compete through regional market strength, specialized pharmaceutical ingredient expertise, and competitive pricing strategies addressing cost-sensitive nutraceutical segments while maintaining pharmaceutical quality standards. Product specialists, including Grillo, Toho Zinc, and Hakusui Tech, focus on specific particle size grades or regional pharmaceutical markets, offering differentiated capabilities in ultra-fine powder production, customized particle size distributions, and application-specific technical support for specialized pharmaceutical formulation requirements.

Regional players and emerging Chinese pharmaceutical ingredient manufacturers including Hunan New Welllink Advanced Metallic Material, Jiangsu Yejian Zinc Industry, and Shandong Xingyuan Zinc Technology create competitive pressure through cost advantages in domestic markets, proximity to pharmaceutical manufacturing clusters, and growing pharmaceutical quality system capabilities that enable competitive alternatives to established international suppliers. Market dynamics favor companies that combine reliable pharmaceutical-grade quality with comprehensive regulatory documentation, established pharmaceutical customer relationships providing market stability, and technical support resources that assist formulators with particle size selection, dissolution optimization, and pharmaceutical compendial compliance verification for accelerated product development and regulatory approval processes.

| Item | Value |

|---|---|

| Quantitative Units | USD 257.9 million |

| Particle Size (Mesh) | 325 Mesh, 400 Mesh, 500 Mesh, 600 Mesh, Others |

| Application | Pharmaceutical Production, Nutritional Supplements, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, U.S., U.K., Japan, and 40+ countries |

| Key Companies Profiled | Umicore, Mepco, EverZinc, US Zinc, Purity Zinc Metals, Hanchang, Transpek-Silox Industry, Toho Zinc, Hakusui Tech, Pars Zinc Dust, Grillo, Hunan New Welllink Advanced Metallic Material, Jiangsu Yejian Zinc Industry, Yunnan luoping Zinc&Electricity, Jiangsu Shenlong Zinc Industry, Shandong Xingyuan Zinc Technology |

| Additional Attributes | Dollar sales by particle size and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with pharmaceutical ingredient manufacturers and zinc metal producers, quality specification requirements and pharmaceutical compendial compliance, integration with pharmaceutical formulation systems and nutraceutical manufacturing operations, innovations in purification technology and particle size control systems, and development of specialized grades with enhanced bioavailability characteristics and pharmaceutical quality documentation. |

The global pharmaceutical zinc powder market is estimated to be valued at USD 257.9 million in 2025.

The market size for the pharmaceutical zinc powder market is projected to reach USD 385.4 million by 2035.

The pharmaceutical zinc powder market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in pharmaceutical zinc powder market are 325 mesh, 400 mesh, 500 mesh, 600 mesh and others.

In terms of application, pharmaceutical production segment to command 48.0% share in the pharmaceutical zinc powder market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pharmaceutical Grade Magnesium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Secondary Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Manufacturing Equipment Market Forecast and Outlook 2025 to 2035

Pharmaceutical Plastic Bottle Market Forecast and Outlook 2025 to 2035

Pharmaceutical Grade Sodium Carbonate Market Forecast and Outlook 2025 to 2035

Pharmaceutical Industry Analysis in Saudi Arabia Forecast and Outlook 2025 to 2035

Pharmaceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Pots Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceuticals Pouch Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Unit Dose Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Mini Batch Blender Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Continuous Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Liquid Prefilters Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade P-Toluenesulfonic Acid Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Glass Container Industry Analysis in Europe Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Contract Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Container Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA