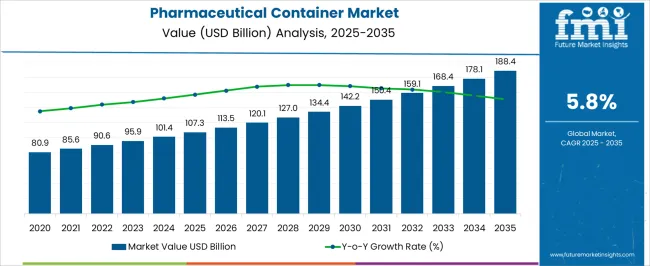

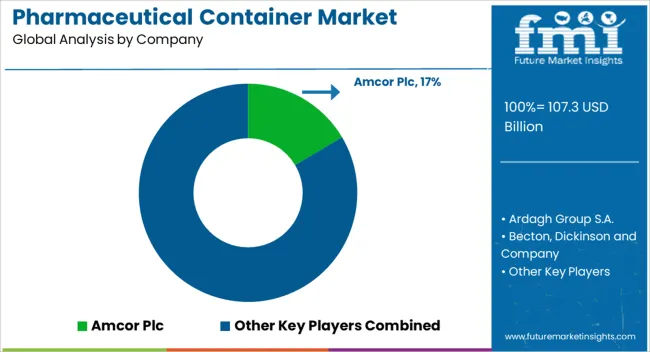

The Pharmaceutical Container Market is estimated to be valued at USD 107.3 billion in 2025 and is projected to reach USD 188.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

| Metric | Value |

|---|---|

| Pharmaceutical Container Market Estimated Value in (2025 E) | USD 107.3 billion |

| Pharmaceutical Container Market Forecast Value in (2035 F) | USD 188.4 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The pharmaceutical container market is experiencing robust growth driven by increasing pharmaceutical production, rising demand for safe and compliant drug packaging, and expanding global healthcare infrastructure. Current market dynamics are shaped by stringent regulatory requirements for drug safety, stability, and traceability, as well as growing adoption of innovative packaging solutions that ensure product integrity.

The market is further influenced by shifts in patient-centric packaging trends, rising biologics and specialty drug production, and the need for cost-effective yet high-quality materials. The future outlook is supported by technological advancements in container design, material enhancements, and automated filling and sealing processes, which are improving operational efficiency and reducing contamination risks.

Growth rationale is founded on the sustained requirement for reliable pharmaceutical packaging across hospitals, retail pharmacies, and logistics networks, coupled with manufacturers’ focus on developing compliant, sustainable, and lightweight solutions, thereby driving steady market expansion and broader adoption across global pharmaceutical supply chains.

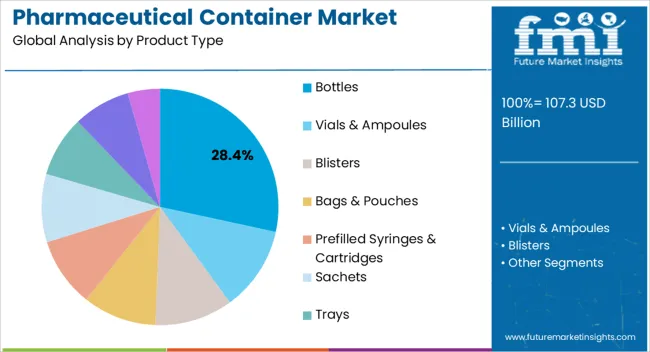

The bottles segment, representing 28.40% of the product type category, has been leading the market due to its versatility, ease of handling, and suitability for a wide range of pharmaceutical formulations. Its adoption has been supported by compatibility with automated filling systems, standardized closures, and labeling solutions, which ensure compliance with regulatory standards.

Market preference has been reinforced by operational efficiency, cost-effectiveness, and widespread acceptance across hospitals, retail pharmacies, and distribution channels. Quality assurance measures and enhanced barrier properties have strengthened end-user confidence.

Technological improvements in bottle design, including tamper-evident and child-resistant features, have further enhanced the segment’s market position Continued focus on durability, safety, and functional innovation is expected to sustain the segment’s market share and support incremental growth across emerging and mature markets.

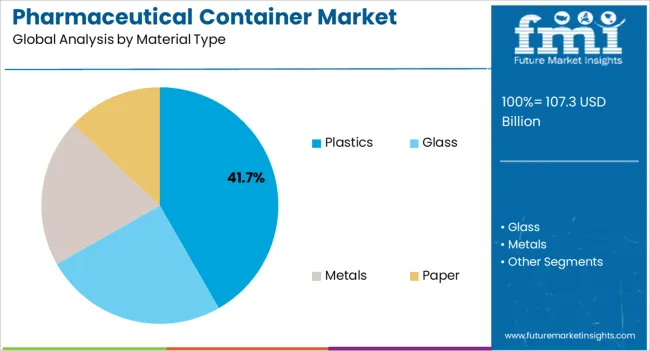

The plastics segment, accounting for 41.70% of the material type category, has maintained dominance due to its lightweight nature, cost-effectiveness, chemical resistance, and ease of customization. Its market leadership has been reinforced by compatibility with various pharmaceutical formulations and processing techniques, ensuring product integrity and safety.

Adoption has been supported by supply chain efficiency, recyclability initiatives, and regulatory compliance for medical-grade plastics. Technological advancements in polymer formulations and barrier properties have improved shelf life and stability of pharmaceutical products.

The segment’s growth is further driven by manufacturers’ focus on sustainable packaging solutions and innovative material blends that meet environmental standards while maintaining performance Continued R&D and adoption in emerging markets are expected to sustain the plastics segment’s leading market share and reinforce its strategic role within the pharmaceutical container landscape.

Rising Global Healthcare Needs to Drive the Market Growth

The last few years saw substantial growth in the pharmaceutical industry due to various factors like the COVID-19 pandemic, the aging population, and the everlasting prevalence of chronic diseases like diabetes, hypertension, and renal diseases.

As the demand for medications worldwide continues to grow, the need for pharmaceutical containers to package and transport medical products like medications, vaccines, and healthcare supplies also experiences a significant surge.

Pharmaceutical companies worldwide are investing extensively to create innovative drugs and medical procedures like biologics, gene therapies, and precision medicines. These medical operations require specialized packaging to ensure the product's stability and safety of the patient consuming it.

These factors have made pharmaceutical containers crucial in the medicare industry, subsequently expanding the market.

The growth of the pharmaceutical container market is heavily dependent on global healthcare and medical services. Due to the recent pandemic, the healthcare industry has seen a tremendous surge in the last few years.

This also meant a need for the packaging of vast amounts of medications, vaccines, PPE kits, etc. This also witnessed significant growth in the market for pharmaceutical containers.

| Attributes | Key Statistics |

|---|---|

| Expected Base Year Value (2020) | USD 69.73 billion |

| Anticipated Forecast Value (2025) | USD 89.7 billion |

| Estimated Growth (2020 to 2025) | 6.5% CAGR |

Product-wise, the pharmaceutical container market is segmented into bottles, vials and ampoules, blisters, bags and pouches, and many more. Bottles are essential for storing pharmaceutical products such as pills, capsules, and tablets.

They provide a protective barrier that shields medications from external factors like moisture, light, and contamination, which can degrade the quality and effectiveness of the drugs.

| Attributes | Details |

|---|---|

| Product | Bottles |

| Market share | 37.3% |

When it comes to products, bottles dominate the pharmaceutical container market with a global share of 37.3%. They are considered great dispensers that can help patients pour out the desired quantity of medication prescribed by healthcare providers. Bottles also have easy-to-open closures and clear labeling that cater to seniors and patients with disabilities.

The average global age is rising, and the pharmaceutical industry is constantly seeking alternatives like these that provide packaging solutions to promote accessibility and safety for this growing demographic.

Bottled pharmaceutical containers are also very easy to design, store, and transport, essential in the medicare field. As the demand for medications in the world continues to grow, bottled containers are set to dominate the pharmaceutical container market because of their flexibility, safety, and familiarity with consumers for an extended period.

Pharmaceutical packaging solutions companies continuously seek materials that are easy to mold into different shapes and sizes to accommodate diverse packaging needs. Plastic materials offer a wide range of options suitable for various pharmaceutical products, including tablets, capsules, liquids, and creams. Material-wise, plastic dominates the pharmaceutical container market with a global share of 62.3%.

| Attributes | Details |

|---|---|

| Material | Plastic |

| Market share | 62.3% |

Plastic is generally more cost-effective than alternative materials like glass or metal. This affordability is crucial for pharmaceutical companies looking to manage production costs without compromising quality.

They are also very lightweight, which becomes an important factor in transporting and distributing medications on long routes. Also, plastic is readily available in every part of the world, making manufacturing pharmaceutical containers comparatively less easy.

In the past few years, there has been a huge demand for bottled plastic pharmaceutical containers worldwide to support the growing healthcare infrastructure. Plastic materials continue to evolve and adapt to the evolving needs of the pharmaceutical sector, making them a trusted and preferred choice for packaging pharmaceutical products.

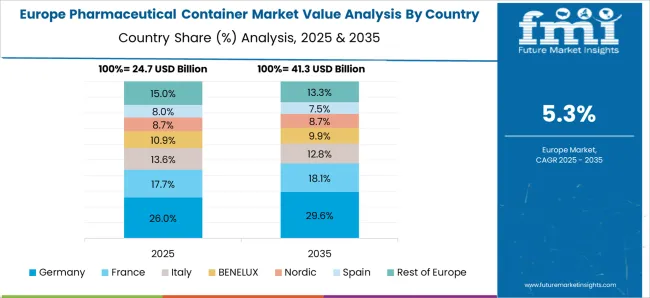

| Region | Value Share in 2025 |

|---|---|

| Asia Pacific | 29.2% |

| Europe | 22.7% |

| North America | 10.7% |

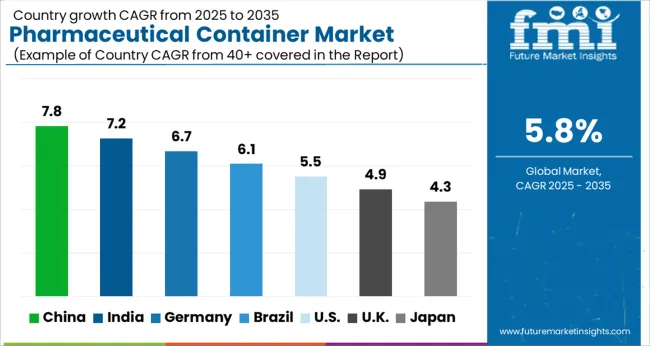

Asia Pacific comprises two of the world’s most populous countries, India and China. These countries have significantly transformed the pharmaceutical industry in the last decade. This infrastructure development results from huge investments by international and local players in the healthcare packaging industry, leading to increased demand for pharmaceutical containers.

The government here has also invested heavily in promoting medical facilities among the residents. This has eventually made a huge impact on the pharmaceutical industry, which in turn drives the need for pharmaceutical containers for storage, distribution, and dispensing.

Europe is home to many developed countries, which have reached the highest peaks when it comes to the pharmaceutical industry. The development of innovative medical treatments and therapies has often driven the growth in the pharmaceutical container market to package and distribute these products.

These complex and sensitive products require specialized packaging to maintain product stability and safety during storage and transportation. This investment, hence, supports the growth of advanced Medicare and the pharmaceutical container market.

Pharmaceutical container consumers, such as patients and healthcare providers, have become conscious of the environmental footprint of their products. The majority of them prefer pharmaceuticals that are packed in environmentally friendly containers.

This considerable shift in consumer preferences has directly impacted the demand for pharmaceutical containers that use recyclable materials and minimize packaging waste.

Regulatory authorities in these respective countries also encourage the leading pharmaceutical companies to adopt sustainable packaging practices, which drives the demand for specialized pharmaceutical containers.

The Indian government's initiatives to promote the pharmaceutical sector, attract investments, and promote local pharmaceutical equipment manufacturing have fueled pharmaceutical production and increased the demand for pharmaceutical containers.

These policies have significantly supported the pharmaceutical industry to thrive, making India a significant player in the global pharmaceutical container market.

| Country | India |

|---|---|

| Value CAGR (2025 to 2035) | 7.2% |

Thanks to its robust manufacturing capabilities and a competitive edge in producing a wide range of pharmaceutical products, China has the world's most advanced pharmaceutical industry, with many export opportunities. Chinese companies, hence, contribute significantly to the global pharmaceutical industry, subsequently expanding the drug packaging container market.

| Country | China |

|---|---|

| Value CAGR (2025 to 2035) | 6.7% |

While visiting Thailand, medical tourists seek a wide range of healthcare services, including pharmaceutical treatments. This surge in demand for medications creates a substantial market for pharmaceutical companies.

To meet this demand, pharmaceutical manufacturers require reliable and efficient packaging solutions, which, in turn, fuels the growth of the pharmaceutical container market.

| Country | Thailand |

|---|---|

| Value CAGR (2025 to 2035) | 6.1% |

The pharmaceutical container market is filled with opportunities and business growth due to the tremendous scope for innovation and adaptation to evolving industry needs.

The market experienced rapid growth during the pandemic as the demand for treatments and vaccines surged, but it is slowly declining as the immediate urgency subsides. How this change will impact the pharmaceutical container market's growth trajectory is still being determined.

Recent Developments in the Pharmaceutical Container Market

The global pharmaceutical container market is estimated to be valued at USD 107.3 billion in 2025.

The market size for the pharmaceutical container market is projected to reach USD 188.4 billion by 2035.

The pharmaceutical container market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in pharmaceutical container market are bottles, _packer bottles, _liquid bottles, vials & ampoules, blisters, bags & pouches, prefilled syringes & cartridges, sachets, trays, tubes and containers, jars, & others.

In terms of material type, plastics segment to command 41.7% share in the pharmaceutical container market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pharmaceutical Glass Container Industry Analysis in Europe Size and Share Forecast Outlook 2025 to 2035

Reefer Container for Pharmaceutical Market Insights – Trends & Future Outlook 2024 to 2034

Temperature Controlled Pharmaceutical Container Market Analysis, Size, Share & Forecast 2024 to 2034

Pharmaceutical Autoclave Machine Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Excipient SNAC Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Zinc Powder Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade Magnesium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Secondary Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Manufacturing Equipment Market Forecast and Outlook 2025 to 2035

Pharmaceutical Plastic Bottle Market Forecast and Outlook 2025 to 2035

Pharmaceutical Grade Sodium Carbonate Market Forecast and Outlook 2025 to 2035

Pharmaceutical Industry Analysis in Saudi Arabia Forecast and Outlook 2025 to 2035

Container-based Firewall Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Pots Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceuticals Pouch Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Unit Dose Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA