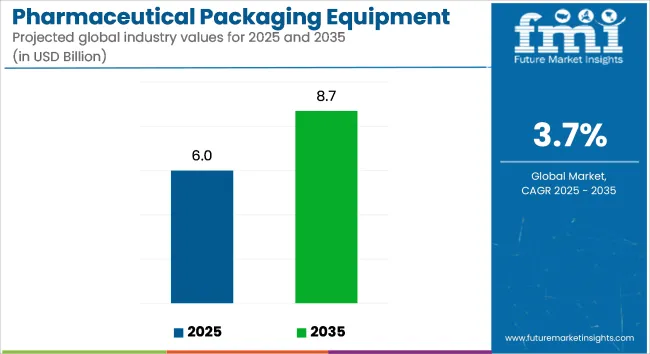

The pharmaceutical packaging equipment market is projected to grow from USD 6.0 billion in 2025 to USD 8.7 billion by 2035, registering a CAGR of 3.7% during the forecast period. Sales in 2024 reached USD 5.7 billion. This growth is driven by the increasing demand for efficient and compliant packaging solutions in the pharmaceutical industry.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 6.0 billion |

| Industry Value (2035F) | USD 8.7 billion |

| CAGR (2025 to 2035) | 3.7% |

Advancements in drug formulations, including biologics and personalized medicines, necessitate sophisticated packaging equipment to ensure product integrity and regulatory compliance. Additionally, the rise in global pharmaceutical production and the need for tamper-evident and child-resistant packaging have further propelled the adoption of advanced packaging machinery.

In 2025, Syntegon, a leading strategic partner to the global pharmaceutical, biotech, and food industries, hosted the 10th edition of its industry-leading Pharmatag. A record number of more than 350 global customers, partners, innovators, and leaders accepted Syntegon’s invitation to join the event.

“Close collaboration between customers and technology providers is more important than ever - especially when developing mission-critical solutions for the pharmaceutical and biotech industries,” said Torsten Türling, CEO of the Syntegon Group. “The many successful examples shared at Pharmatag clearly demonstrate this. What truly sets Syntegon apart is our unwavering commitment to partnership.”

Major OEMs are redesigning equipment with sustainable and smart engineering principles to enhance energy efficiency and reduce waste. Machinery is being optimized to support recyclable materials, multi-dose unit packaging, and zero-touch operations. Digital twin technology and predictive maintenance are also being embedded into packaging workflows.

These innovations are allowing packaging lines to become smarter, leaner, and more adaptive to personalized medicine and fast-changing formulations. Innovation is no longer product-bound but is deeply integrated into the packaging equipment lifecycle. Stakeholders are also investing in training modules and virtual reality interfaces to improve operator efficiency while maintaining hygiene and GMP compliance.

Over the next decade, the market for pharmaceutical packaging equipment is expected to benefit from continued investment in biologics, injectables, and combination therapies. With global health authorities tightening traceability requirements, machine-level serialization and tamper-evident labeling capabilities are being prioritized.

The market outlook remains positive as R&D advances demand flexible and rapid format-switching equipment. Automation and digital diagnostics will further drive competitiveness by reducing operational downtime and enhancing real-time quality control. Vendors focusing on compact, modular, and scalable systems are expected to gain significant market share. Industry partnerships and government incentives for local manufacturing of critical healthcare products will provide an additional growth boost.

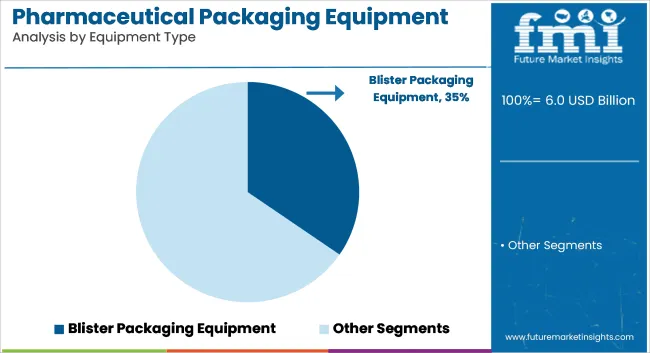

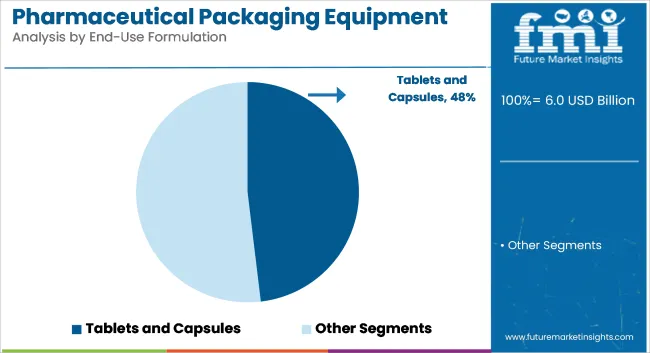

The market is segmented by equipment type, product type, end-use formulation, and region. Equipment types include blister, strip, bottle, cartoning, pouching & sachet equipment. Product types encompass solid, semi-solid, liquid, and aseptic packaging equipment, tailored to dosage form requirements and regulatory compliance.

Formulation or form type segmentation includes tablets & capsules, injectable drugs, syrups & suspensions, topical/ointments, and inhalable & nasal sprays-each driving distinct automation and sterility needs. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and Middle East & Africa.

Blister packaging equipment is expected to account for 34.6% of the pharmaceutical packaging equipment market by 2025. It has been widely adopted for its precise dose protection, tamper evidence, and improved patient compliance. High adaptability for tablets and capsules has made this machinery a standard in both branded and generic drug manufacturing.

Automation and integration capabilities have further supported its widespread deployment. The equipment has been engineered to deliver high-speed sealing, cavity forming, and cold or thermoforming functions. Materials like PVC, PVDC, and aluminum foil have been processed efficiently for unit-dose packaging. Validation and track-and-trace modules have been integrated to align with global serialization mandates. Demand has grown due to strict regulations and extended shelf-life requirements.

Leading pharmaceutical manufacturers have adopted blister machines for multi-product handling, compact footprints, and precise perforation. Integration with labeling, vision inspection, and rejection systems has ensured compliance with GMP standards. These systems have supported high-volume production with low rejection rates and minimal operator intervention.

Equipment upgrades have focused on modular formats and digital control. Global exports of oral solids have increased reliance on blister lines with climate-adapted sealing technology. Developing markets have invested in cost-effective blistering units for local drug production. Flexible changeovers and low downtime have added to operational efficiency. Continuous innovation has positioned blister packaging as a versatile and regulatory-compliant solution.

Tablets and capsules are projected to hold a 48.1% share of the pharmaceutical packaging equipment market by 2025. These solid dosage forms have been produced in the highest volumes, demanding rapid, scalable, and tamper-evident packaging solutions. High compatibility with blister, strip, and bottle equipment has reinforced demand for dedicated machinery.

Ease of handling and extended stability have made these formats preferred globally. Packaging lines for tablets and capsules have been developed to meet stringent validation and contamination control norms. Integration with counting, filling, desiccant insertion, and capping systems has ensured accurate output. Track-and-trace features have been embedded to fulfill serialization mandates across regulated markets. Blister and bottling lines have offered seamless throughput and high operational reliability.

Generic and OTC drug manufacturers have heavily invested in automated systems for solid oral dosage packaging. Demand for unit-dose formats and multi-product packs has been supported by blister-based machinery. Pharmaceutical CDMOs have upgraded their capabilities to offer quick turnarounds for global tablet supply.

Growth in lifestyle diseases and healthcare penetration has driven further equipment installations. Oral solids packaging has seen increased digitalization for fault detection and data logging. Compact, plug-and-play machines have catered to mid-scale producers with budget constraints. Modular equipment with 21 CFR Part 11 compliance has supported regulatory alignment. These factors have maintained tablets and capsules as the largest formulation segment in pharmaceutical packaging equipment.

Regulatory Compliance and Validation Complexity

Pharmaceutical packaging equipment market has a lot of challenges including regulatory compliance and validation of the equipment. So any packaging equipment for pharmaceuticals must comply with a host of stringent quality control regulations set forth by governing bodies from around the world (including the FDA, EMA, and WHO+).

These regulations dictate sterility, tamper-evidence, traceability and prevention of contamination, which have made the design and qualification of packaging lines increasingly complex and lengthy processes. Providing thorough documentation, software validation, and process traceability in the equipment manufacturers incurs additional cost and slows down the ability to scale up production.

Moreover, packaging equipment must be reconfigured to accommodate changing drug formulations, personalized medicine, and combination products, which requires increased flexibility and substantial capital costs.

Demand for Automation, Serialization, and Flexible Packaging Lines

This transition towards automated, efficient, and compliance-ready packaging solutions presents an opportunity for the pharmaceutical packaging equipment market. To answer the growing demand for precision, speed and safety in drug packaging, manufacturers are increasingly turning to robotic packaging systems, modular machinery and real-time inspection technologies.

Data-rich coding, barcoding, and tamper-proof labeling systems are becoming integrated into the design of the equipment as a result of the ongoing pressure to incorporate global serialization standards and track-and-trace capabilities. Furthermore, the trend for flexible packaging formats, single-dose units and temperature sensitive biologics is fuelling demand for multi-functional, compact packaging equipment capable of delivering high throughput for both large-scale and specialty drug manufacturing.

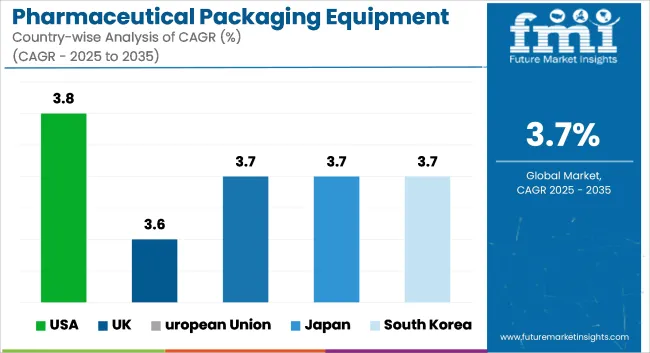

Growing production of complex formulations, high demand for blister and vials packaging systems, and the USA leading pharmaceutical manufacturing capacity contribute to the growth of the USA pharmaceutical packaging equipment market for the forecast period. Regulatory compliance for drug safety and compliance, regulated by FDA, has led to the requirements of automated, contamination-free, and tamper-evident packaging solutions.

Automation technologies (e.g. robotic filling lines, serialization, and smartlabeling systems) are increasingly being adopted to enhance efficiency and traceability throughout pharmaceutical supply chains. The demand for sensitive formulations continues to rise with the increasing market of biologics and injectables.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.8% |

Investments in drug production, government-supported life sciences strategies in the UK pharmaceutical packaging equipment market support it. They are moving towards automated, flexible packaging lines that can accommodate dosage forms from oral solids and parenteral to solutions.

The stringent MHRA regulations and preload anti-counterfeit measures are pushing the demand for the use of track-and-trace equipment, smart labels, and high-speed inspection systems. Furthermore, the focus on sustainability is leading manufacturers to develop more eco-friendly packaging materials and modular equipment solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.6% |

Rapid enforcement of regulatory standards under EMA guidelines, advances in packaging automation, and export growth in the pharmaceutical sector are driving consistent growth in the European Union pharmaceutical packaging equipment market. For instance, Germany, France and Italy are the leading countries to accept modern blister pack machines, vial filling systems, and serialization innovations.

Growing demand for digitally-integrated and energy-efficient packaging equipment: EU regulations for pharmaceutical traceability, patient safety, and green packaging initiatives. R&D efforts in biologics and biosimilar have additionally driven the uptake of sterile, barrier isolator-friendly machines throughout the larger production facilities.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.7% |

The need for adherence to high-quality standards for drug manufacturing, operator safety due to an aging workforce, and to enable strict hygiene protocols as per requirements for packaging, which have a commendable contribution towards the growth of the market. Japanese pharma corporations favour miniaturised, fast, and all-in-one machines that can offer accuracy, compliance and productivity.

The growing demand for unit-dose packaging and tamper-proof closures, particularly in geriatric patient populations, is also one of the factors responsible for the growth of this market. Domestic demand for biopharmaceuticals and advanced therapy medicines is also intensifying the demand for isolator-compatible filling and packaging technologies that require as little human intervention as possible.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.7% |

The South Korean pharmaceutical packaging equipment market is growing due to government support for life sciences, growing investments in bio manufacturing, and increasing demand for precision packaging systems. With a prominent shift towards injectable drugs, biosimilar, and export quality generics, the pharmaceutical landscape of the country is changing rapidly where highly standardized & automated packaging equipment is essential.

Trends in smart packaging including machine vision inspection, data-driven packaging validation, and digital serialization are taking hold. Also, due to this characteristics, the manufacturers are moving towards cleanroom compatible, high-throughput systems which comply with GMP and international compliance thus South Korean becomes a competitive place for advanced packaging solution.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.7% |

Agile and innovative market conditions characterize the pharmaceutical packaging equipment industry because pharmaceutical companies actively seek precise solutions to meet regulations for automated packaging procedures. Growing pharmaceutical industry requirements for tamper-evident and contamination-free solutions with high efficiency drive activity in this market for solid and liquid and parenteral dosage form packaging applications.

Companies in the market specialize in developing machinery that meets regulatory needs while adding serialization functions and automation capabilities for worldwide safety regulations. The pharmaceutical packaging market includes international technology providers as well as firms that specialize in pharmaceutical engineering alongside equipment producers who meet the requirements of large pharmaceutical organizations along with CMOs.

The overall market size for the pharmaceutical packaging equipment market was USD 6.0 billion in 2025.

The pharmaceutical packaging equipment market is expected to reach USD 8.7 billion in 2035.

The increasing demand for safe and tamper-evident packaging, rising pharmaceutical production volumes, and growing adoption of automated blister packaging solutions fuel the pharmaceutical packaging equipment market during the forecast period.

The top 5 countries driving the development of the pharmaceutical packaging equipment market are the USA, UK, European Union, Japan, and South Korea.

Automatic equipment and blister packaging solutions lead market growth to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pharmaceutical Grade Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Pots Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceuticals Pouch Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Mini Batch Blender Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Liquid Prefilters Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade P-Toluenesulfonic Acid Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Glass Container Industry Analysis in Europe Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Container Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Sterility Testing Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceuticals Preservative Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Track and Trace Systems Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Vials Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceuticals Machinery Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Logistics Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Lactose Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Pharmaceutical Dissolution Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Fittings Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Cleaning Validation Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Tubes Market Analysis Size, Share & Forecast 2025 to 2035

Pharmaceutical Filtration Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA