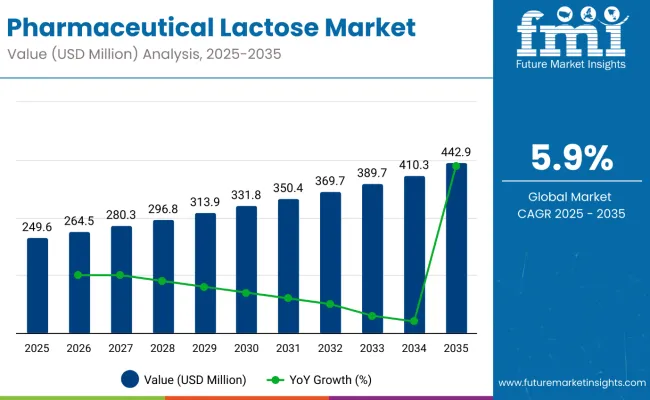

The pharmaceutical lactose market is projected to witness substantial growth during the forecast period owing to the rising demand for oral solid dosage forms, where lactose serves as a critical excipient. The market is estimated at USD 249.6 million in 2025, with an expected rise to USD 442.9 million by 2035, progressing at a 5.9% CAGR from 2025 to 2035. Growing adoption of lactose as a binder and filler in tablet and capsule manufacturing, alongside its recognized role in enhancing drug stability and compressibility, is driving this upward trend.

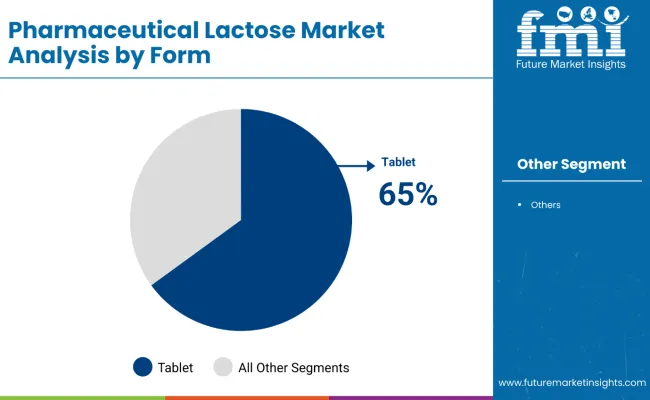

By application, tablet formulations are set to remain the leading segment, accounting for 65% of the market share in 2025. The segment’s dominance is underpinned by the widespread use of lactose in direct compression processes for solid oral dosage forms, especially in the production of generic drugs and over-the-counter medicines globally. Increasing drug demand from emerging economies also supports this segment’s growth.

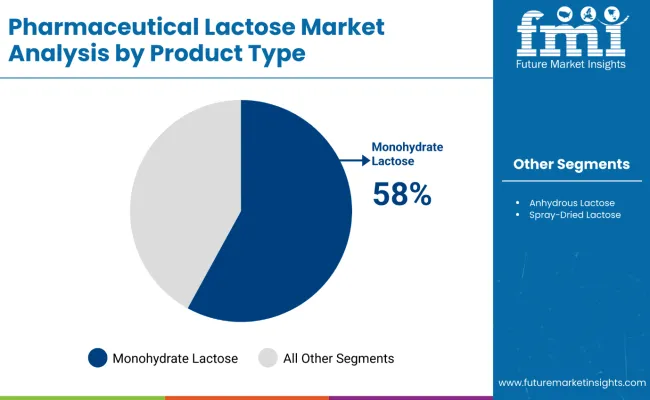

In terms of product type, monohydrate lactose will lead with an estimated 58% share in 2025. Its stable crystalline structure, low hygroscopicity, and suitability for both wet granulation and dry powder inhalation processes make it highly preferred among pharmaceutical manufacturers. This form of lactose is integral in formulations requiring strict moisture control and stability.

In an official press release from MEGGLE Excipients dated April 7, 2025, the company confirmed the launch of three new premium low-nitrite lactose grades-GranuLac® 200 Low Nitrite, Tablettose® 100 Low Nitrite, and FlowLac® 100 Low Nitrite. Each product is meticulously tested to contain no more than 0.10 ppm nitrite, addressing the growing industry need to reduce nitrosamine impurities in drug formulations. This development reflects a proactive approach to tightening regulatory standards for excipient purity and safety, and underscores MEGGLE’s position as a leader in lactose innovation for pharmaceutical applications

Despite positive market trends, the sector faces challenges such as variability in raw milk supply impacting lactose production, stringent purity regulations, and increasing competition from alternative excipients. Nevertheless, ongoing R&D efforts, like MEGGLE's new low-nitrite product line, are expected to create opportunities for market growth by aligning with evolving global safety requirements.

Pharmaceutical lactose is a critical excipient in drug formulation and is strictly regulated to ensure it meets global safety, quality, and purity standards. Regulatory authorities require manufacturers to follow established pharmacopeial specifications, good manufacturing practices, and allergen labeling guidelines. Certifications and documentation are essential to ensure traceability, consistent product quality, and compliance with international pharmaceutical requirements. These controls support safe patient outcomes, minimize contamination risks, and enable pharmaceutical companies to meet regulatory obligations across various global markets.

In 2025, α-Monohydrate Lactose will dominate the product type segment, accounting for 58% market share due to its superior performance in tablet and capsule formulations. Tablet Formulations will lead the application segment with a 65% share, driven by the growing demand for solid oral dosage forms globally, supporting the industry's preference for lactose as an excipient.

In 2025, α-Monohydrate Lactose is projected to lead the product type segment with a commanding 58% market share in the global pharmaceutical lactose market. This dominance is attributed to its superior physical and chemical characteristics, including excellent compressibility, flowability, and stability, which make it a preferred excipient in solid oral dosage forms such as tablets and capsules.

Monohydrate Lactose is extensively used in direct compression and wet granulation techniques, essential for high-volume drug manufacturing. Its high aqueous solubility and inertness improve the uniformity of drug mixtures, ensuring consistent dosage delivery. Key pharmaceutical excipient suppliers such as DFE Pharma, Kerry Group, and Meggle provide high-purity monohydrate lactose variants tailored for the pharmaceutical industry’s needs.

Additionally, monohydrate lactose's compatibility with a wide range of active pharmaceutical ingredients (APIs) supports its application across therapeutic areas. The continued expansion of tablet and capsule drug formulations worldwide underpins the sustained demand for this lactose type. With the industry emphasizing quality, efficiency, and scalability in drug production, monohydrate lactose remains integral to meeting pharmaceutical manufacturing standards.

Tablet Formulations are forecast to dominate the application segment in 2025, commanding a significant 65% market share in the pharmaceutical lactose market. The popularity of lactose as an excipient in tablet production stems from its role as a binder, filler, and diluent that enhances drug stability, compressibility, and overall manufacturing efficiency.

Lactose, particularly α-Monohydrate, is integral to direct compression and wet granulation processes, ensuring tablets are durable and dissolve appropriately. This makes it indispensable for solid oral dosage forms, which represent approximately 50% of all pharmaceutical products worldwide. Market leaders such as DFE Pharma, Kerry Group, and Meggle supply lactose excipients optimized for rapid and consistent tablet production.

The increasing global preference for orally administered drugs, driven by patient convenience and cost-effectiveness, propels demand for tablet formulations. Furthermore, the growth in chronic disease treatments and over-the-counter medications reinforces the segment’s importance. As pharmaceutical companies seek reliable and high-quality excipients to improve drug formulation performance, tablet applications will continue to offer lucrative opportunities in the pharmaceutical lactose industry.

The industry is growing because of its extensive application as an excipient in solid and liquid dosage formulations. It is preferred because of its binding, filler, and carrier ability, and hence it is an essential ingredient in tablet, capsule, and dry powder inhaler (DPI) products.

The industry is especially valued in tablets and capsules due to its excellent flow ability and compressibility, ensuring smooth production. DPI business concentrates on lactose purity and particle size distribution for better drug delivery.

Parenteral products employ lactose as an osmotic agent with high solubility and purity standards. At the same time, nutraceuticals incorporate lactose as a stabilizer and carrier in nutritional supplements. As there is growing demand for lactose-free drugs and other excipients, producers are developing new lactose grades and microencapsulation methods to optimize performance in niche drug delivery systems.

The below table highlights a comparative analysis of the change in six-month CAGR in the base period (2024 to 2034) and forecast period (2025 to 2035) of the global industry. Representing missing adaptations of industry performance trends and account realization patterns over a decade, the analysis helps stakeholders realize critical changes. The first half of the year (H1) which runs from January to June, and the second half (H2) that runs from July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 5.7% |

| H2 (2024 to 2034) | 6% |

| H1 (2025 to 2035) | 5.8% |

| H2 (2025 to 2035) | 6.1% |

The industry is projected to grow 5.7% in H1 (2025 to 2035) and a higher 6.1% in H2 (2025 to 2035). This sector delivered a never-ending growth of 20 BPS in H1, and H2 followed with 40 BPS more, in Pharma applications demand reflection.

The industry is getting bigger with its extensive application as an excipient in drug formulations. Nevertheless, pharmaceutical-grade lactose being under strict regulatory requirements presents a compliance problem.

The companies have to guarantee their following the changes in safety and power standards, obtain the related certifications and be transparent to customers to preserve their trust and the industry acceptance. Production stumbling blocks, covering the lower milk supply, transport problems, and price cockeyed, have a direct effect on making the production steady and maintain costs.

Global warming, dairy sector regulations, and geopolitics disturbance of lactose trading largely create big uncertainties in the industry. For tackling those issues, firms are supposed to set up alternative supply channels and inject into local assembling.

Changing buyer preferences toward lactose-free and plant-based alternatives challenge traditional pharmaceutical lactose manufacturers. The enhancement of vegan-friendly drug formulations and growing concerns over lactose intolerance drive competition from synthetic and non-dairy excipients even higher.

Economic reverses, trade policies being changed, and the pharmaceutical industry shifting gears all impact industry growth. In order to ensure long-term success, companies should work on making their supply chain more efficient, enter new industries, and work with the drug manufacturers on the development of state-of-the-art pharmaceutical lactose solutions according to the industry needs.

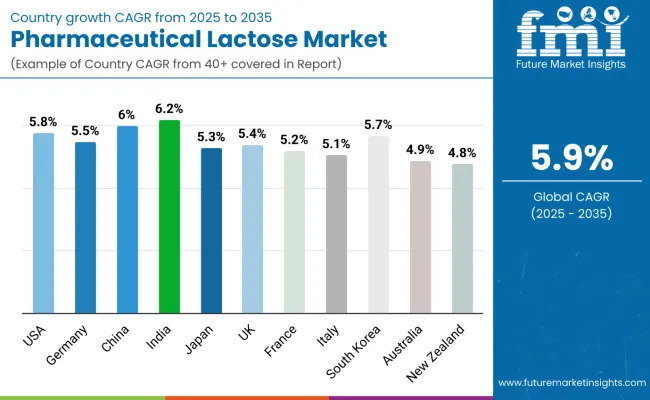

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.8% |

| Germany | 5.5% |

| China | 6% |

| India | 6.2% |

| Japan | 5.3% |

| UK | 5.4% |

| France | 5.2% |

| Italy | 5.1% |

| South Korea | 5.7% |

| Australia | 4.9% |

| New Zealand | 4.8% |

The USA is the leader in the worldwide industry, with a forecasted volume of USD 60.5 million in 2025 and a 5.8% CAGR from 2025 to 2035. This is because it has a highly developed pharmaceutical industry in which lactose is used extensively as an excipient in capsules and tablets. The USA is the lucky beneficiary of the finest research and development centers that produce novel and innovative lactose products.

Bodies such as the FDA aid in developing strict product standards, further stabilizing the industry. Groups such as Kerry Group and Foremost Farms USA act to increase industry size positively through high-purity lactose production.

With the growing need for solid oral dosage forms, lactose remains a popular excipient among manufacturers because of its higher compressibility and stability. The availability of various contract manufacturers and generic drug firms also increases the demand for lactose. Higher health consciousness has also assisted in the creation of derivatives of lactose, like lactose monohydrate, in fulfilling specialty formulations like pediatric and geriatric drugs.

Germany is a major lactose pharmacy industry in the European industry with a forecasted volume in 2025 of USD 45.2 million and 5.5% CAGR during the forecast period. German pharmaceuticals have experienced goodwill for precision and strict compliance with Good Manufacturing Practices (GMP) in delivering quality lactose utilized in formulation.

The availability of prominent pharma players such as Boehringer Ingelheim and Merck KGaA here supports formulation innovations with lactose to perpetuate. German research centers focus on new lactose derivatives to increase drug stability and bioavailability. In addition, the biopharmaceutical trend has also boosted the demand for lactose excipients in protein drug products. The German export-based pharmaceutical industry also supports the use of lactose as domestic drugs are being exported to every corner of the globe.

The industry of lactose in the Chinese pharma industry is expanding robustly, with an industry value of USD 38.7 million in 2025 and a 6.0% CAGR during 2025 to 2035. Demand has been driven by enhanced pharma production and healthcare spending in China. Greater activity by local drug makers like Sinopharm and Shanghai Pharma has played a crucial role in the surge in demand for quality excipients like lactose, which is an important component in tablet formulations.

Government efforts to boost pharma production in the country also align with lactose industry expansion. Since China is tightening its laws to international standards, the need for lactose is also on the increase. Moreover, increased research in lactose-based sustained-release products further pushes the industry.

The UK industry is anticipated to grow at a CAGR of 5.4% during 2025 to 2035. The robust pharmaceutical sector in the country, dominated by companies such as GlaxoSmithKline and AstraZeneca, is dependent on lactose as a filler for solid dosage forms. Lactose derivatives for precision medicine and targeted drug delivery are becoming increasingly popular with the increasing emphasis on precision medicine.

Regulatory bodies like the MHRA embrace rigorous control of quality, and thus, lactose of high purity is called for. On top of this, the UK's stable foundation of contract manufacturers likewise creates demand for lactose because overseas drugmakers buy excipients for their UK production facilities.

France's pharma lactose industry will grow at a 5.2% CAGR during 2025 to 2035. High-quality excipients, with the country's well-established pharma industry being the pioneer, are being tapped by pharmaceutical companies like Sanofi. Lactose-containing excipients are targeted by regional manufacturers in controlled-release drugs, improving drug efficacy and stability.

Increasing drug demand among the pediatric and geriatric populations has also encouraged lactose use in specialty pharmaceuticals. Moreover, France's research intensity is high, which facilitates innovation in lactose-based excipients with increased solubility to counter the growing demand for orally disintegrating tablets.

Italy's pharma lactose industry is predicted to grow at a CAGR of 5.1% during the forecast period. Italy's contract manufacturing and very generic pharma industry rely to a great extent on lactose as a bulk excipient. Lactose is applied by drug product makers like Chiesi Farmaceutici, further driving the industry.

Increased investment in more sophisticated drug delivery systems has also facilitated innovation in such lactose carriers. Lactose-free drug formulation for patients is also being developed, and this exhibits pharmaceutical lactose-free industry diversification.

South Korean lactose pharmaceutical industry will register a growth of 5.7% during the period between 2025 and 2035. South Korean pharmaceutical industry with the domination of industry giants such as Celltrion and Hanmi Pharmaceutical is making most of the usage of lactose in biosimilars. The strong biopharmaceutical sector of South Korea also contributes to lactose demand.

Since the government encourages domestic manufacture of drugs, excipients like lactose remain on the rise in terms of demand. Expansion in orally dispersible tablets, in which lactose forms a core constituent, is also increasingly becoming popular, thereby contributing to the growth of the industry.

The Australian industry will expand at 4.9% per year during the forecast period. Demand for excipients from renowned pharmaceutical players such as CSL Limited guarantees perpetual demand for lactose-based excipients. Increasing demand for natural and organic excipients in Australia has created opportunities for the development of lactose derivatives for clean-label drugs.

Increasing requirements for generic drugs, especially rural drugs, have also stimulated demand for lactose. The increase in the occurrence of chronic diseases has also created long-term demand for lactose in the form of extended-release formulations.

The New Zealand industry is expected to grow at a CAGR of 4.8% from 2025 to 2035. The New Zealand pharmaceutical industry, although smaller in scale compared to its peers, enjoys robust regulatory oversight along with quality production processes. Douglas Pharmaceuticals is one such firm that utilizes lactose in generics, thereby attaining high industry penetration.

New Zealand's focus on the utilization of natural drug ingredients has presented scientific investigation for alternatives to lactose. Lactose remains a top excipient as a result of its usefulness and stability. New Zealand's export of drugs to Asian-Pacific nations provides more demand for unpurified lactose.

Pharmaceutical lactose is gaining traction due to its multiplex applications in excipients for tablets, filling capsules with powder, and dry powder inhalers. With the increased demand to produce pharmaceuticals coupled with the ever-increasing demands of high-purity lactose, along with ongoing advancements in the field of lactose-based delivery systems for drug formulations, the industry is expected to grow strongly in the future.

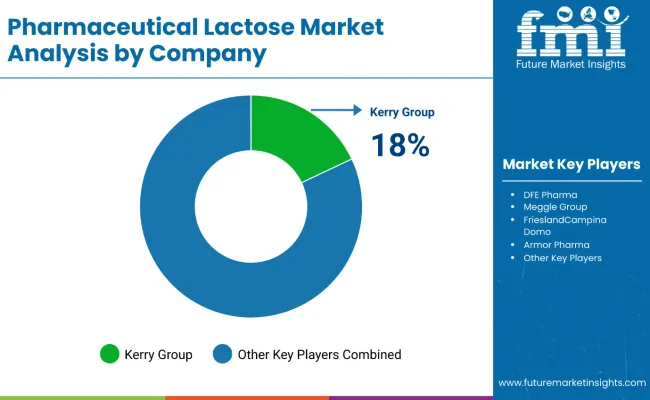

Leading players in the industry include Kerry Group, DFE Pharma, FrieslandCampina, Meggle, and Armor Pharma. They present many grades of lactose that are predominately available for their functions in pharmaceutical applications.

DFE Pharma has extended its portfolio to include lactose for continuous manufacturing, while Meggle is focused on spray-dried as well as micronized lactose for drug formulation efficiency improvements. The changing phases of the industry are mainly emerging through the enforcement of doc-level regulatory standards, advances in lactose-free alternatives, and rising applications in biopharmaceuticals.

Today, investments into advanced purification and eco-friendly production processes, as well as extensive collaborative strategic partnerships with drug manufacturers, to strengthen industry position are what can be seen in many pharmaceutical excipient firms.

Nevertheless, the strategic factors above concerning competition are supply chain optimization, compliance with global standards on pharmaceutical regulations, and innovations in lactose modification. Industry players are expanding R&D efforts, optimizing raw material sourcing, and leveraging digital solutions to enhance production efficiency and meet evolving pharmaceutical demands.

Kerry Group (18-22%)

Industry leader in pharmaceutical lactose, providing high-purity excipients for direct compression and tablet forms.

DFE Pharma (14-18%)

Leading provider of inhalation-grade lactose, serving the increasing respiratory drug and DPI industry.

Meggle Group (10-14%)

Specialized in high-purity lactose for solid oral dosage forms, with competence in spray-dried and anhydrous lactose solutions.

FrieslandCampina Domo (8-12%)

Recognized for pharmaceutical-grade lactose with accurate excipient functionality, with support for customized drug formulation.

Armor Pharma (6-10%)

It specializes in customized lactose excipients, especially for controlled-release and enhanced bioavailability applications.

| Attribute | Details |

|---|---|

| Market Size (2025E) | USD 249.6 million |

| Market Size (2035F) | USD 442.9 million |

| CAGR (2025 to 2035) | 5.9% |

| Forecast Period | 2025 to 2035 |

| Historical Data | 2018 to 2024 |

| Base Year | 2024 |

| Quantitative Units | Value USD million, Volume in tons |

| Segments Covered | Product Type, Region |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, Middle East & Africa (MEA) |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, United Kingdom, France, Italy, Spain, Russia, China, Japan, South Korea, India, Australia, Indonesia, Vietnam, UAE, Saudi Arabia, South Africa, Turkey |

| By Product Type | Monohydrate Lactose, Anhydrous Lactose, Spray-dried Lactose, Specialty Lactose |

| Key Companies Profiled | Ba'emek Advanced Technologies Ltd (Tnuva Group), Hilmar Ingredients, Armor Pharma, Avantor Inc., Alpavit Käserei Champignon Hofmeister GmbH & Co. KG, Lactose (India) Limited, DFE Pharma, Hoogwegt Groep B.V., Merck KGaA, Kerry plc, Miles GmbH, BASF SE, MEGGLE Excipients & Technology |

| Additional Attributes | What would a manufacturer of Pharmaceutical Lactose Market want to know from a market research report? Also use the words dollar sales, share separated by comma and only key pointers in 200-250 characters sentence. Answer: Regional dollar sales, product type share, price sensitivity by application, demand growth in emerging regions, competitive landscape shifts, and rising specialty lactose adoption by pharmaceutical firms. |

By product type, the industry is segmented into monohydrate lactose, anhydrous lactose, spray-dried lactose, and specialty lactose.

In terms of form, the market is divided into tablets, granules, spray-dried, and others.

By region, the industry is divided as North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and The Middle East & Africa.

The global industry is projected to grow at a CAGR of 5.9% from 2025 to 2035.

The industry is anticipated to reach a valuation of approximately USD 442.9 million by 2035.

The tablet formulations segment is expected to witness the fastest growth due to its extensive use in drug manufacturing.

Increasing pharmaceutical production, rising demand for excipients, growing preference for high-purity lactose, and regulatory compliance requirements are key growth drivers.

Kerry Group, DFE Pharma, Meggle Group, FrieslandCampina Domo, Armor Pharma, Lactose India Limited, Molkerei Ammerland, Hilmar Ingredients, Innophos Holdings Inc., and DMV Fonterra Excipients are the key players in the industry.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 8: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 17: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: East Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 21: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: South Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: South Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Oceania Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 29: Middle East & Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Middle East & Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 31: Middle East & Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 32: Middle East & Africa Market Volume (MT) Forecast by Product Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 3: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 4: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 8: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 11: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 12: Global Market Attractiveness by Region, 2023 to 2033

Figure 13: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 14: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 15: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 16: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 17: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 18: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 20: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 21: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 22: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 23: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 24: North America Market Attractiveness by Country, 2023 to 2033

Figure 25: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 27: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 28: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 29: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 30: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 32: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 33: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 34: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 35: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 36: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 37: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 39: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 40: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 41: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 42: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 43: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 44: Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 45: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 46: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 47: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 48: Europe Market Attractiveness by Country, 2023 to 2033

Figure 49: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 51: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 52: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 53: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 54: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 55: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 56: East Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 57: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 58: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 59: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 60: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 61: South Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 63: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 64: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 65: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: South Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 68: South Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 69: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 70: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 71: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 72: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 73: Oceania Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 75: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 76: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 77: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 78: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 79: Oceania Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 80: Oceania Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 81: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 82: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 83: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 84: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 85: Middle East & Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 86: Middle East & Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 87: Middle East & Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 88: Middle East & Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 89: Middle East & Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 90: Middle East & Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 91: Middle East & Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 92: Middle East & Africa Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 93: Middle East & Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 94: Middle East & Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 95: Middle East & Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 96: Middle East & Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pharmaceutical Secondary Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Manufacturing Equipment Market Forecast and Outlook 2025 to 2035

Pharmaceutical Plastic Bottle Market Forecast and Outlook 2025 to 2035

Pharmaceutical Grade Sodium Carbonate Market Forecast and Outlook 2025 to 2035

Pharmaceutical Industry Analysis in Saudi Arabia Forecast and Outlook 2025 to 2035

Pharmaceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Pots Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceuticals Pouch Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Unit Dose Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Mini Batch Blender Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Continuous Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Liquid Prefilters Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade P-Toluenesulfonic Acid Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Glass Container Industry Analysis in Europe Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Contract Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Container Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Sterility Testing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA