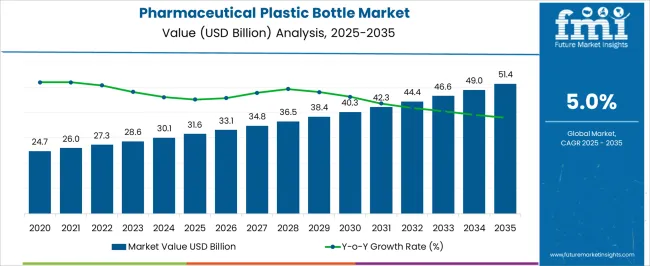

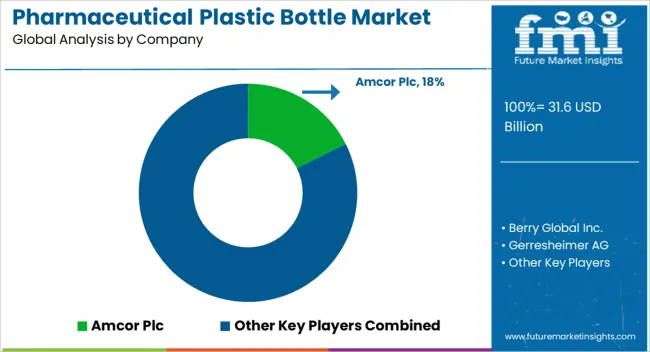

The Pharmaceutical Plastic Bottle Market is estimated to be valued at USD 31.6 billion in 2025 and is projected to reach USD 51.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

The pharmaceutical plastic bottle market is expanding steadily. Growth is being driven by increasing demand for secure, lightweight, and cost-effective packaging solutions across pharmaceutical applications. The current market scenario reflects the growing adoption of high-performance polymers that ensure product safety, chemical resistance, and extended shelf life.

Stringent regulatory requirements and rising focus on patient convenience have encouraged manufacturers to enhance design precision and labeling capabilities. The future outlook indicates strong potential supported by pharmaceutical industry growth, rising production of liquid formulations, and advances in material innovation. Manufacturers are investing in sustainable production processes and recyclable materials to align with environmental standards.

Expansion in e-pharmacy networks and global supply chains is further boosting demand for robust, tamper-proof packaging Overall, the market’s growth rationale is underpinned by consistent healthcare consumption, evolving packaging standards, and ongoing innovation in material performance and bottle design, ensuring steady revenue progression and market competitiveness.

| Metric | Value |

|---|---|

| Pharmaceutical Plastic Bottle Market Estimated Value in (2025 E) | USD 31.6 billion |

| Pharmaceutical Plastic Bottle Market Forecast Value in (2035 F) | USD 51.4 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

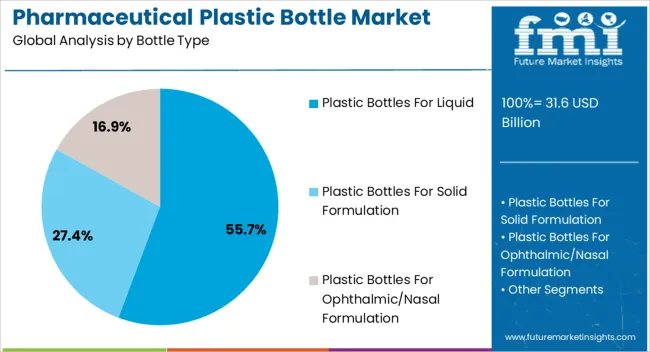

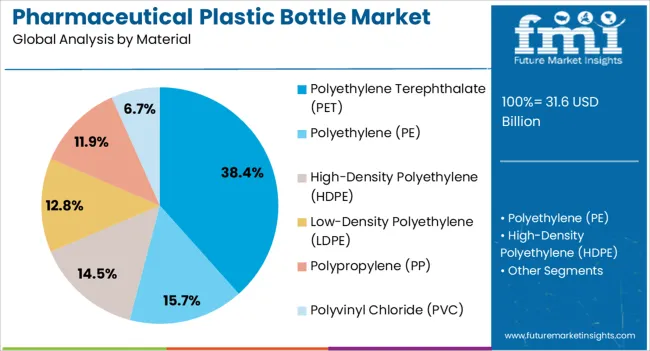

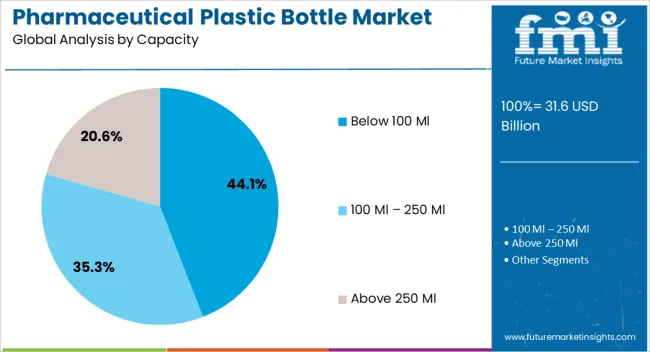

The market is segmented by Bottle Type, Material, and Capacity and region. By Bottle Type, the market is divided into Plastic Bottles For Liquid, Plastic Bottles For Solid Formulation, and Plastic Bottles For Ophthalmic/Nasal Formulation. In terms of Material, the market is classified into Polyethylene Terephthalate (PET), Polyethylene (PE), High-Density Polyethylene (HDPE), Low-Density Polyethylene (LDPE), Polypropylene (PP), and Polyvinyl Chloride (PVC). Based on Capacity, the market is segmented into Below 100 Ml, 100 Ml – 250 Ml, and Above 250 Ml. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plastic bottles for liquid segment, accounting for 55.70% of the bottle type category, has established dominance due to widespread use in storing syrups, suspensions, and other liquid formulations. Its high share is driven by advantages such as lightweight design, break resistance, and compatibility with pharmaceutical-grade closures.

Growing production of liquid medications and vaccines has reinforced the segment’s adoption across global manufacturing hubs. Enhanced molding technologies and precision dosing features are improving functionality and patient safety.

Demand has also been sustained by increased focus on hygienic, tamper-evident designs that comply with international regulatory standards Continued innovations in shape optimization and labeling integration are expected to strengthen the segment’s position and ensure consistent usage across diverse therapeutic applications.

The polyethylene terephthalate (PET) segment, representing 38.40% of the material category, leads due to its superior clarity, high impact strength, and excellent barrier properties. PET’s recyclability and lightweight characteristics have made it a preferred choice for pharmaceutical manufacturers seeking sustainability and compliance with environmental regulations.

The material’s chemical stability ensures safety for a wide range of formulations, reducing the risk of contamination. Advanced polymer modification techniques have enhanced PET’s resistance to heat and moisture, supporting its suitability for sterile packaging environments.

Increasing global initiatives toward eco-friendly packaging and high-volume production scalability are further propelling segment growth As pharmaceutical companies continue prioritizing recyclable materials, PET is expected to maintain its leadership and contribute significantly to long-term market expansion.

The below 100 ml segment, holding 44.10% of the capacity category, dominates due to rising demand for small-dose liquid medications, ophthalmic solutions, and pediatric formulations. Its preference is reinforced by convenience in handling, lower material usage, and suitability for single-use or travel-size packaging.

Pharmaceutical companies are increasingly adopting smaller bottle formats to support accurate dosing and reduce product waste. Enhanced filling technologies and compact design optimization have further improved production efficiency and cost-effectiveness.

The growth of e-pharmacy distribution and patient-centric packaging trends is also influencing higher adoption of below 100 ml bottles As manufacturers focus on optimizing storage and logistics costs, this segment is expected to sustain its strong market position and register stable growth in the coming years.

Growing Demand for Anti-counterfeit and Child Resistant Pharmaceutical Plastic Bottle

The pharmaceutical packaging industry has seen an enhancement in the demand for counterfeit protection solutions and child-resistant packaging solutions in the past couple of years. In the pharmaceutical industry, counterfeiting has been a major cause of concern for manufacturers as well as consumers. The introduction of anti-counterfeit technologies like barcodes, labels, tags, etc., to minimize this problem is gaining traction among the manufacturers of the pharmaceutical plastic bottles market.

The increase in the number of poisoning cases in underage children caused by accidental ingestion of medicines boosted the introduction of child-resistant packaging solutions in the industry. Many key players in the industry started offering these bottles with child-resistant closures to prevent accidental ingestion of medicines. For Instance, Berry Global Healthcare, in February 2025, launched a comprehensive bundle solution to help customers capitalize on the increasing demand for child-resistant (CRC) and tamper-evident (TE) packaging for the pharmaceutical and herbal market for syrup and liquid medicines.

Biopharmaceuticals Industry Strongly Contributes to Market Growth

Biopharmaceutical industry plays a crucial role in the well-functioning of healthcare systems and the development of new medicines and vaccines for the prevention of diseases and treatments. Biopharmaceutical product sales are growing and continue to stay driven by highly intensive research and development in the sector. Medicines are effectively contributing to the healthcare system's sustainability by reducing the cost of medical treatments and cost of long-term care.

The healthcare sector has remarkably grown, driven by the rising necessity of health and wellness. The increasing occurrence of diseases and viruses has increased the development and consumption of medications in the forecast period. Increasing health problems among people driven by unhealthy lifestyles are generating the demand for new and improved treatment. These developments in the healthcare sector are significantly increasing the demand for pharmaceutical plastic bottles.

Spurring Demand for Blister Packaging May Hamper the Market Growth

The availability of alternatives, such as blister packaging, may impede the growth of pharmaceutical plastic bottle market growth. Alternative packaging solutions are being introduced that are more cost-efficient than plastic bottles in the market. Blister packaging is one such alternative that is widely used as a convenient and economical alternative to pharmaceutical plastic bottles.

The blister packs require less storage space, offer visibility of inside contents, and restrict the movement of its contents during transportation, adding additional safety to the product. Further, the blister packs also reduce the chances of missing prescribed dosages and consumption of additional dosages, making them popular among consumers. Additionally, rising concerns over plastic pollution and the imposition of stricter regulations on plastic usage on the environment are some of the key factors resisting the market expansion.

The global market recorded a CAGR of 3.7% during the historical period between 2020 and 2025. The growth of the pharmaceutical plastic bottle industry was positive as it reached a value of USD 31.6 billion in 2025 from USD 24.7 million in 2020.

Pharmaceutical plastic bottles are driven by the need to meet stringent packaging standards to ensure the safety of patients. Manufacturers are combating ways to provide solutions that preserve the medicines while maintaining the sustainability factor.

Consumers are also inclined towards eco-friendly packaging solutions. This has generated the need for producing plastic bottles using recycled plastic for the pharmaceutical industry ensuring the safety of the medicines.

Companies are moving towards using biodegradable and compostable materials in manufacturing plastic bottles. Companies also incorporate QR codes that enable providing necessary information and easy tracking in the suppler chain.

It also enables to identification of the originality of the products, combating counterfeiting. Rising health concerns and disease due to growing urbanization have been pushing the demand for prominent and improvised healthcare services across regions.

Plastic bottles are increasingly used in pharmaceuticals because they are easily available, lightweight, safe, and inexpensive. Increasing demand for oral drugs and over-the-counter sales are pushing the market forward. Continuous innovation and development in healthcare for improved medication and treat new emerging diseases is boosting the demand for pharmaceutical plastic bottles.

Plastic bottles are reliable packaging solutions for a range of medicines and healthcare products. They keep the products fresh and safe for consumption. Ongoing research and developments on combining the need for security with usability are leading beyond the mechanical characteristics. For instance, an ID-cap is a biometric recognition integrated capsule that helps to easily open the product by fingertips and twist caps are being offered by Bormioli Pharma.

Increasing demand for personalized and specialized medical treatments is translating into growing investment in the research and development of modern medicines. The growth in medical innovation is supplementing the demand for reliable and effective packaging ensuring optimal protection with sustainability.

The section below covers the industry analysis for the pharmaceutical plastic bottles market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, South Asia, Europe, East Asia, and others, is provided.

Russia is anticipated to remain leading in Europe, with a value share of more than 18.3% through 31.6034. In North America, Canada is projected to witness a remarkable CAGR of 5.3% by 31.6034.

| Countries | Value CAGR (31.6031.64 to 31.6034) |

|---|---|

| Canada | 5.3% |

| Argentina | 6.6% |

| Germany | 31.6.9% |

| China | 5.4% |

| Malaysia | 7.6% |

| Turkey | 7.3% |

| Australia | 5.3% |

The United States is projected to generate USD 51.4 billion in revenue and capture a 78.3% value share by 31.6034. The rising demand for excellent healthcare faculties in the USA driven by favorable healthcare policies and services has supplemented the healthcare sector of the USA.

PETERSON-KFF Health System Tracker reported that the USA recorded the highest per capita healthcare spending of USD 131.6,555 million in 31.6031.631.6. This value is over USD 4,000 million more than the other nations with high income. Increasing healthcare spending will supplement the demand for plastic bottles in the region, particularly for in-house and outpatient healthcare services.

The USA has experienced a rise in several chronic diseases and healthcare issues, which will boost the demand for medications. The rising prevalence of pandemics and contagious viruses has necessitated innovation for plastic bottles for better prevention and medication administration.

India is anticipated to generate incremental opportunity worth USD 31.6 billion and capture a 48.7% value share during the forecast period. India Brand Equity Foundation (IBEF) estimated that the Indian pharmaceutical industry is witnessing remarkable growth, with revenue of USD 65 billion in 31.6031.64, and it is anticipated to reach 51.4 billion by 31.6030.

India’s pharmaceutical industry is expanding due to rising consensus to provide innovative treatments and therapies to patients. Indian pharmaceutical industry is known for its low-cost generic medicines contributing to sales of pharmaceutical plastic bottles.

The country covers the demand for 40% of generic pharmaceutical plastic bottles needed in the USA and 31.65% of all medication within the UK India has 3,000 drug companies and 10,500 manufacturing facilities that are supplementing the demand for plastic bottles. India is continually innovating and developing drugs to treat numerous diseases at the lowest cost and highest quality, resulting in its preference worldwide.

India has a major share in generic drugs, bulk drugs, and OTC medications, which will create a future growth opportunity for the plastic bottles industry.

The aged population generally consumes more medications regularly because of the high prevalence of chronic diseases and other health issues due to age. This is likely to generate the demand for pharmaceuticals pushing the sales of plastic bottles in Japan since they are easy and trouble-free to use.

The lightweight and sturdy nature of plastic bottles facilitates elder people in handling medicines. There is also more focus on preventive medications such as vitamins and supplements to manage wellbeing over the years. Japan is anticipated to be at 7% CAGR holding 33.5% of the market share by 31.6034

The section contains information about the leading segments in the industry. Plastic bottles for solid formulations are leading in the global industry, with an estimated market share of 44.3% in 2025.

PET bottles are taking prominence over the pharmaceutical industry which is anticipated to grow further at 6% CAGR by 2035. Pharmaceutical plastic bottles within below 100 ml capacity range projected to have revenue of USD 31.6 billion by 2025.

| Bottle Type | Plastic Bottles for Solid Formulations |

|---|---|

| Value Share (2035) | 40.6% |

Plastic bottles for solid formulations are a leading contributor to pharmaceutical plastic bottle industry's growth. The target segment is anticipated to generate revenue of USD 13.3 billion by 2025 end and lead to a gain of 2/5th of revenue share by the the assessment period.

Solid formulations such as tablets and capsules are highly consumed by patients because they are easy to administer and have dosage accuracy. Solid medicines are less susceptible to damage by contamination, providing longer shelf life and retaining the effectiveness of medications. Plastic bottles provide cost-effective, durable, lightweight, and barrier properties, which make them ideal for solid formulation packaging.

Plastic bottles are leading among the bottle types as they can be easily customized for different needs, shapes and sizes. Manufacturers prefer these bottle types as they can be incorporated with tamper evident and child-resistance closures, ensuring safe medication storage.

Consumers prefer plastic bottles because they are easy to handle and provide clear labeling for patients, ensuring easy medication administration.

| Material | Polyethylene terephthalate (PET) |

|---|---|

| Value Share (2035) | 32.3% |

The polyethylene terephthalate bottle is expected to surpass a valuation of USD 51.4 billion in 2035. The use of PET bottles in pharmaceutical sector is growing at a comparatively higher rate, recording a 6% CAGR during the upcoming decade.

The increasing restrictions and regulations globally on the usage of plastics have compelled manufacturers to increase the utilization of recycled polyethylene terephthalate for the production of pharmaceutical plastic bottles. Polyethylene terephthalate offers comparatively higher barrier strength and recyclability, making it a favorable choice.

Polyethylene bottle are also anticipated to contribute a significant revenue of USD 8.6 billion in 2025, expanding 1.6 times its current market value over assessment years. PE bottle provides excellent chemical resistance, durability, and flexibility which ensures the stability and integrity of medications. PE bottles provide high barrier against moisture and they are shatterproof which is essential for medicines in storage and transportation.

| Capacity | Below 100 ml |

|---|---|

| Value Share (2035) | 52.9% |

Pharmaceutical bottles with a capacity below 100 ml are anticipated to hold a major market share by 2035 accounting for more than half of the market. The demand for below 100 capacity bottles is experiencing an upward trend with an increasing preference towards smaller packaging.

Smaller bottles provide accuracy and precise doing of medications suitable for patients. The trend of single-dose packaging offers medication adherence and reduces wastage. They are also easy to carry which makes them a convenient option for patients.

Below 100 ml capacity bottles are widely used in the packaging of ophthalmic and nasal formulations which is projected to witness prominent growth in the upcoming period. The segment will expand 1.8 times its current market value during the forecast period.

Key players in pharmaceutical plastic bottles increasingly investing in automation and advanced technologies to improve efficiency and quality. Companies are adopting the new trends and developing products using recycled, and lightweight materials. Companies are adopting strategies for acquisitions, collaborations, and expansions. Companies are exploring emerging markets to boost sales and market share.

Recent Developments in Pharmaceutical Plastic Bottle Market:

The industry is segregated into plastic bottles for solid formulations, plastic bottles for liquid formulations, and plastic bottles for ophthalmic or nasal formulations.

In terms of material, the industry is divided into polyethylene terephthalate (PET), polypropylene (PP), polyethylene (PE), and polyvinyl chloride (PVC). Polyethylene is further segmented as low density polyethylene (LDPE) and high density polyethylene (HDPE).

Few of the important capacities include below 100 ml, 100 to 250 ml and above 250 ml.

Key countries of North America, Latin America, South Asia, East Asia, Europe, Oceania, and the Middle East and Africa are covered.

The global pharmaceutical plastic bottle market is estimated to be valued at USD 31.6 billion in 2025.

The market size for the pharmaceutical plastic bottle market is projected to reach USD 51.4 billion by 2035.

The pharmaceutical plastic bottle market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in pharmaceutical plastic bottle market are plastic bottles for liquid, plastic bottles for solid formulation and plastic bottles for ophthalmic/nasal formulation.

In terms of material, polyethylene terephthalate (pet) segment to command 38.4% share in the pharmaceutical plastic bottle market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plastic Bottle Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Bottles Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Pots Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Pharmaceutical Plastic Packaging

Plastic Medicine Bottles Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Plastic Medicine Bottles Manufacturers

Anti-Neoplastic Pharmaceutical Agents Market Report – Growth & Forecast 2025 to 2035

Vietnam Plastic Bottle Market Analysis by Capacity, Material, End-use, and Region Forecast Through 2035

Plastic Fittings and Tubing for Pharmaceutical and Medical Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Autoclave Machine Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Excipient SNAC Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tubes for Effervescent Tablets Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Zinc Powder Market Size and Share Forecast Outlook 2025 to 2035

Plastic Banding Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tube Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade Magnesium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Secondary Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Packaging Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA