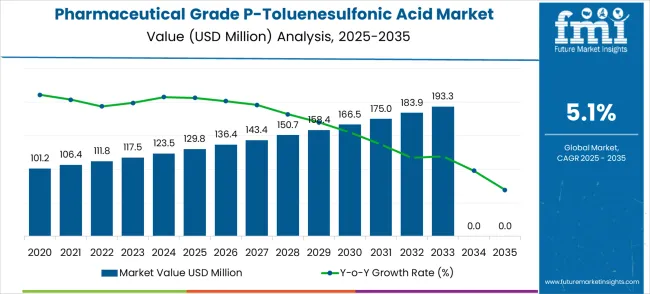

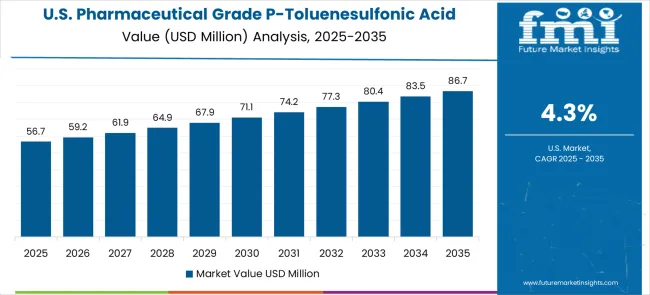

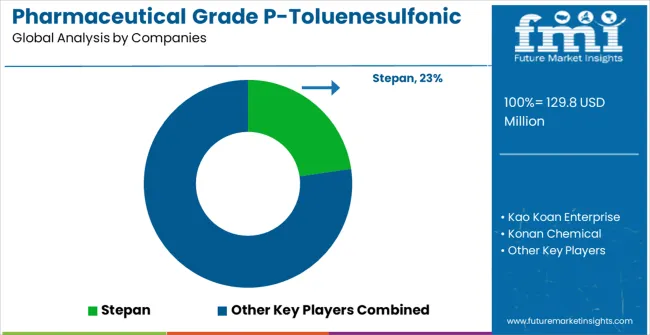

The pharmaceutical grade P-toluenesulfonic acid market is estimated at USD 129.8 million in 2025 and is forecasted to reach USD 213.5 million by 2035, reflecting a CAGR of 5.1%. This trajectory indicates consistent annual growth across the forecast horizon. The year-on-year changes demonstrate a steady upward trend, starting with USD 136.4 million in 2026 and gradually increasing to USD 213.5 million by 2035.

The incremental pattern suggests that the market is expanding in a balanced manner, driven by rising pharmaceutical manufacturing needs, increasing applications in active pharmaceutical ingredient (API) synthesis, and greater reliance on acid catalysts for drug production. The long-term consistency highlights a relatively low-risk growth environment for stakeholders.

Annual growth rates range between 4.8% and 5.4% across the decade, revealing a stable progression with no extreme spikes or downturns. From 2025 to 2026, the market grows by 5.1%, moving from USD 129.8 million to USD 136.4 million. In the following years, growth remains within a narrow band, such as 5.1% from 2026 to 2027, 5.1% from 2027 to 2028, and slightly higher at 5.4% between 2030 and 2031 when the value rises from USD 166.5 million to USD 175.0 million. This uniformity suggests that demand is stable and primarily tied to steady expansion in pharmaceutical manufacturing volumes rather than sudden regulatory or technological shocks.

A volatility check further validates the market’s predictability. Unlike industries where raw material price fluctuations or regulatory changes can create abrupt deviations, the market shows minimal volatility. The lowest YoY growth observed is 4.8% in later years such as 2034 to 2035, where the value moves from USD 203.1 million to USD 213.5 million.

The highest YoY growth of 5.4% occurs in 2030 to 2031. This narrow spread of just 0.6 percentage points between peak and trough growth rates confirms the low volatility nature of this market, indicating a resilient supply-demand structure.

The average YoY growth rate across the 2025 to 2035 period is approximately 5.1%, which aligns precisely with the forecast CAGR. This alignment demonstrates that the growth trend is consistent without irregular deviations. From a strategic perspective, this steady expansion provides predictability for producers and pharmaceutical manufacturers who rely on this compound for synthesis processes.

Over the ten-year period, the market adds USD 83.7 million in value, and the steady YoY growth pattern ensures sustainable opportunities for both established and emerging players within the pharmaceutical chemical sector.

| Pharmaceutical Grade P-Toluenesulfonic Acid Market | Value |

|---|---|

| Market Value (2025) | USD 129.8 million |

| Market Forecast Value (2035) | USD 213.5 million |

| Market Forecast CAGR | 5.1% |

Market expansion is being supported by the rapid increase in pharmaceutical manufacturing worldwide and the corresponding need for high-purity chemical intermediates that provide superior quality assurance and regulatory compliance for drug synthesis applications.

Modern pharmaceutical facilities rely on consistent purity standards and chemical quality reliability to ensure optimal drug efficacy including active pharmaceutical ingredient manufacturing, drug synthesis operations, and specialty pharmaceutical facilities. Even minor purity variations can require comprehensive synthesis protocol adjustments to maintain optimal pharmaceutical standards and regulatory compliance.

The growing complexity of pharmaceutical synthesis requirements and increasing demand for high-purity chemical intermediates are driving demand for pharmaceutical grade P-toluenesulfonic acid from certified manufacturers with appropriate purity capabilities and regulatory expertise.

Pharmaceutical companies are increasingly requiring documented purity specifications and supply reliability to maintain drug quality and manufacturing consistency. Regulatory specifications and quality standards are establishing standardized pharmaceutical synthesis procedures that require specialized chemical intermediates and trained manufacturing personnel.

The market is entering a new phase of growth, driven by demand for high-purity intermediates, pharmaceutical manufacturing expansion, and evolving regulatory and quality standards. By 2035, these pathways together can unlock USD 35-45 million in incremental revenue opportunities beyond baseline growth.

Pathway A - Ultra-High Purity Leadership (Purity≥99%) The Purity≥99% segment already holds the largest share due to its superior pharmaceutical quality and regulatory compliance. Expanding purity optimization, quality certification, and regulatory documentation can consolidate leadership. Opportunity pool: USD 10-14 million.

Pathway B - Core Antibiotic Applications (Doxycycline & Key Drugs) Doxycycline applications account for the largest demand. Growing antibiotic manufacturing, especially in emerging pharmaceutical markets, will drive higher adoption of pharmaceutical grade intermediates. Opportunity pool: USD 8-12 million.

Pathway C - Specialty Drug Synthesis Expansion Persantine, naproxen, and specialized pharmaceutical applications are expanding with increasing focus on complex drug molecules. Intermediates tailored for specialty syntheses can capture significant growth. Opportunity pool: USD 5-7 million.

Pathway D - Emerging Pharmaceutical Market Expansion Asia-Pacific and Latin America present growing demand due to rising pharmaceutical manufacturing. Targeting regulatory-compliant supply chains and quality-assured products will accelerate adoption. Opportunity pool: USD 4-6 million.

Pathway E - Enhanced Regulatory & Quality Compliance With stricter pharmaceutical regulations, there is an opportunity to promote enhanced purity specifications and regulatory-compliant product innovations. Opportunity pool: USD 3-4 million.

Pathway F - Premium Quality Features Products with enhanced purification, pharmaceutical-specific packaging, and specialized quality certifications offer premium positioning for high-end pharmaceutical manufacturing. Opportunity pool: USD 2-3 million.

Pathway G - Technical Services & Regulatory Support Recurring value from regulatory consulting, quality testing, and pharmaceutical compliance services creates long-term customer relationships. Opportunity pool: USD 2-3 million.

Pathway H - Digital Quality Assurance & Traceability Digital quality tracking, batch certification, and pharmaceutical supply chain transparency can elevate products into premium pharmaceutical chemical categories. Opportunity pool: USD 1-2 million.

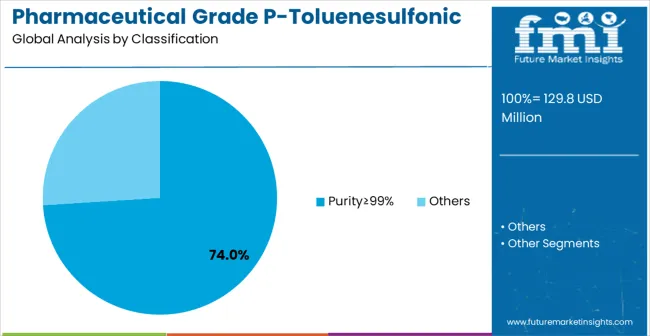

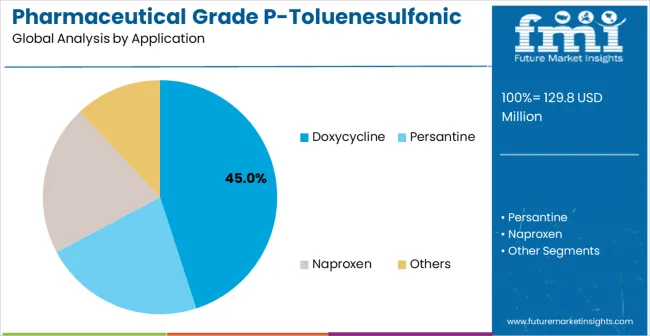

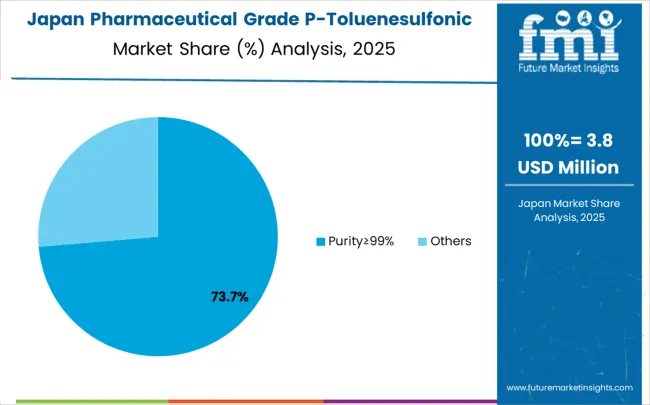

The market is segmented by purity level, application, and region. By purity level, the market is divided into Purity≥99% and Others. Based on application, the market is categorized into doxycycline, persantine, naproxen, and other pharmaceutical applications. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

In 2025, the Purity≥99% pharmaceutical grade P-toluenesulfonic acid segment is projected to capture around 74% of the total market share, making it the leading purity category. This dominance is largely driven by the widespread adoption of ultra-high-purity chemical intermediates that provide superior pharmaceutical quality and regulatory compliance, catering to a wide variety of drug manufacturing applications.

The Purity≥99% grade is particularly favored for its ability to deliver consistent chemical performance in both standard and complex pharmaceutical syntheses, ensuring manufacturing reliability. Pharmaceutical companies, active ingredient manufacturers, drug synthesis facilities, and specialty pharmaceutical complexes increasingly prefer this purity level, as it meets stringent regulatory requirements without imposing excessive processing complexity or compliance difficulties.

The availability of well-established supply chains, along with comprehensive quality certification options and regulatory documentation from leading manufacturers, further reinforces the segment's market position. This purity category benefits from consistent demand across regions, as it is considered a reliable and compliant solution for facilities requiring pharmaceutical-grade chemical intermediates and regulatory assurance.

The combination of quality, compliance, and reliability makes Purity≥99% pharmaceutical grade P-toluenesulfonic acid a dependable choice, ensuring its continued popularity in the pharmaceutical manufacturing and drug synthesis markets.

The doxycycline segment is expected to represent 45% of pharmaceutical grade P-toluenesulfonic acid demand in 2025, highlighting its position as the most significant application sector. This dominance stems from the essential role of P-toluenesulfonic acid in doxycycline manufacturing processes, where high-purity chemical intermediates and consistent synthesis reliability are critical to antibiotic efficacy and pharmaceutical quality.

Doxycycline manufacturing often features complex synthesis requirements that demand specialized chemical compounds throughout extensive production processes, requiring reliable and pharmaceutical-grade intermediate sources. Pharmaceutical grade P-toluenesulfonic acid is particularly well-suited to these applications due to its ability to provide consistent chemical performance and purity assurance, even in demanding synthesis conditions.

As antibiotic manufacturing expands globally and emphasizes improved quality standards, the demand for pharmaceutical grade P-toluenesulfonic acid continues to rise. The segment also benefits from heightened regulatory compliance requirements within the pharmaceutical industry, where manufacturers are increasingly prioritizing high-purity intermediates and quality assurance as essential manufacturing measures.

With pharmaceutical companies investing in advanced synthesis technologies and quality standards, pharmaceutical grade P-toluenesulfonic acid provides an essential component to maintain high-performance drug manufacturing.

The growth of specialized pharmaceutical networks, coupled with increased focus on antibiotic quality standards, ensures that doxycycline applications will remain the largest and most stable demand driver for pharmaceutical grade P-toluenesulfonic acid in the forecast period.

The market is advancing steadily due to increasing pharmaceutical manufacturing development and growing recognition of high-purity chemical intermediate advantages over standard industrial grades in drug synthesis applications. The market faces challenges including stringent regulatory compliance requirements across different pharmaceutical regions, higher costs compared to industrial grades, and complex quality validation processes for pharmaceutical applications. Quality assurance optimization efforts and regulatory compliance programs continue to influence product development and market adoption patterns.

The growing development of advanced purification and quality control systems is enabling higher purity levels with improved consistency and enhanced pharmaceutical compliance characteristics. Advanced purification technologies and optimized crystallization processes provide superior chemical quality while maintaining regulatory compliance requirements. These technologies are particularly valuable for pharmaceutical manufacturers who require reliable chemical quality that can support extensive drug synthesis operations with consistent pharmaceutical results.

Modern pharmaceutical grade P-toluenesulfonic acid suppliers are incorporating advanced regulatory documentation systems and quality assurance protocols that enhance pharmaceutical compliance and manufacturing reliability. Integration of comprehensive testing procedures and optimized quality control enables superior pharmaceutical assurance and comprehensive regulatory compliance capabilities. Advanced compliance features support operation in diverse pharmaceutical environments while meeting various regulatory requirements and manufacturing specifications.

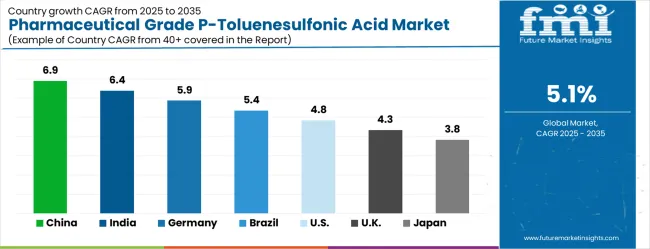

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| Brazil | 5.4% |

| United States | 4.8% |

| United Kingdom | 4.3% |

| Japan | 3.8% |

The market is growing robustly, with China leading at a 6.9% CAGR through 2035, driven by expanding pharmaceutical manufacturing infrastructure and increasing adoption of high-purity chemical intermediates. India follows at 6.4%, supported by rising pharmaceutical industry development and growing awareness of pharmaceutical-grade chemical compound benefits.

Germany grows consistently at 5.9%, integrating high-purity intermediates into its established pharmaceutical manufacturing infrastructure. Brazil records 5.4%, focusing pharmaceutical industry modernization and chemical intermediate upgrade initiatives.

The United States shows solid growth at 4.8%, focusing on regulatory compliance enhancement and quality optimization. The United Kingdom demonstrates steady progress at 4.3%, maintaining established pharmaceutical manufacturing applications. Japan records 3.8% growth, concentrating on quality advancement and specialized pharmaceutical applications.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

China is anticipated to achieve a CAGR of 6.9% during 2025–2035, backed by strong growth in pharmaceutical manufacturing and advanced chemical intermediates. Pharmaceutical grade p-toluenesulfonic acid is widely applied as a catalyst and reagent in the formulation of active pharmaceutical ingredients and specialty medicines.

The country’s large-scale generic drug production, supported by favorable government policies and expanding contract manufacturing services, has increased the role of high-quality intermediates. Domestic producers are upgrading facilities to meet both domestic consumption and rising export requirements.

International partnerships with Chinese manufacturers enhance product development and global market reach. As pharmaceutical exports continue to rise, the demand for consistent and reliable catalysts is expected to expand steadily, reinforcing China’s leadership in the sector.

India is forecasted to expand at a CAGR of 6.4% between 2025 and 2035, supported by its growing pharmaceutical manufacturing base and strong presence in global generic medicine exports. The use of pharmaceutical grade p-toluenesulfonic acid in active pharmaceutical ingredient production and drug synthesis has increased, especially with government support for bulk drug manufacturing. Rising collaborations with multinational companies are enhancing adoption in India’s pharmaceutical hubs. Local manufacturers are also expanding capacity to meet surging demand from contract research and manufacturing services. The focus on high-volume generic production has raised the requirement for cost-efficient yet reliable intermediates. Continuous investment in pharmaceutical R&D strengthens the country’s position in this market and creates new growth opportunities for both domestic and international suppliers.

Germany is projected to grow at a CAGR of 5.9% during 2025–2035, driven by strong demand in specialty pharmaceuticals and innovative formulations. Pharmaceutical grade p-toluenesulfonic acid is increasingly adopted for complex chemical reactions in laboratories and production units. Germany’s focus on cutting-edge drug development, combined with its stringent quality standards, boosts demand for high-purity catalytic intermediates.

Pharmaceutical companies are investing in environmentally sustainable formulations that align with European chemical regulations. Local producers are strengthening their portfolios with advanced intermediates to serve both domestic needs and export markets. The presence of global pharmaceutical leaders in Germany, alongside extensive collaborations with biotech firms, supports continuous innovation. Rising R&D expenditures and strategic partnerships make Germany a central hub for advanced pharmaceutical catalysts.

Brazil is set to advance at a CAGR of 5.4% from 2025 to 2035, supported by growing pharmaceutical capacity and efforts to strengthen local drug manufacturing. Pharmaceutical grade p-toluenesulfonic acid is vital for producing essential medicines, including generics that dominate the country’s pharmaceutical market.

Rising government initiatives to reduce import reliance are encouraging domestic firms to expand production. International suppliers are also forming alliances with Brazilian companies to introduce advanced intermediates. Growing healthcare infrastructure, along with increased consumption of generic medicines, has accelerated demand for catalytic agents.

Regulatory initiatives to improve drug quality standards are also pushing firms to adopt high-purity intermediates. The country’s pharmaceutical sector is therefore expected to gradually reduce dependence on imports while raising adoption of consistent chemical inputs.

The United States is expected to grow at a CAGR of 4.8% from 2025 to 2035, supported by its advanced pharmaceutical sector, robust biotech industry, and strong focus on novel drug development. Pharmaceutical grade p-toluenesulfonic acid is widely used in drug synthesis, laboratory-scale testing, and commercial manufacturing.

High regulatory standards from the FDA have compelled producers to focus on high-purity intermediates to meet strict compliance. The demand is also influenced by growing research in oncology and specialty drugs, which require advanced catalysts for formulation.

Biotechnology firms are increasingly partnering with chemical producers to enhance drug innovation. Rising exports of biopharmaceuticals, combined with new drug approvals, are strengthening demand for advanced catalytic agents, ensuring steady growth in the USA market.

The United Kingdom is projected to grow at a CAGR of 4.3% during 2025–2035, driven by strong research capacity, biopharmaceutical innovation, and expanding clinical trials. Pharmaceutical grade p-toluenesulfonic acid is increasingly applied in research laboratories, pilot-scale production, and commercial facilities.

Government funding for life sciences research has encouraged adoption of advanced catalytic intermediates. Pharmaceutical firms in the UK are focusing on high-quality drug synthesis, with increasing partnerships with chemical suppliers to enhance supply reliability. The country’s biotech sector, supported by academic research institutions, has also strengthened the demand base. Growing pharmaceutical exports and investments in high-value drug manufacturing are expected to sustain adoption of pharmaceutical grade catalysts.

Japan is projected to register a CAGR of 3.8% from 2025 to 2035, driven by strong demand in high-value pharmaceutical segments, including oncology and specialty medicines. Pharmaceutical grade p-toluenesulfonic acid is crucial in chemical synthesis processes used by Japanese manufacturers, who are known for stringent quality standards. Local firms are investing in high-purity intermediates to maintain regulatory compliance and export competitiveness. Growing R&D in precision medicine and biologics is supporting adoption of reliable catalytic agents. Domestic chemical producers are also upgrading facilities to focus on eco-friendly production practices. Partnerships with international suppliers are helping to introduce advanced formulations into the Japanese market, enhancing its technological edge in pharmaceutical manufacturing.

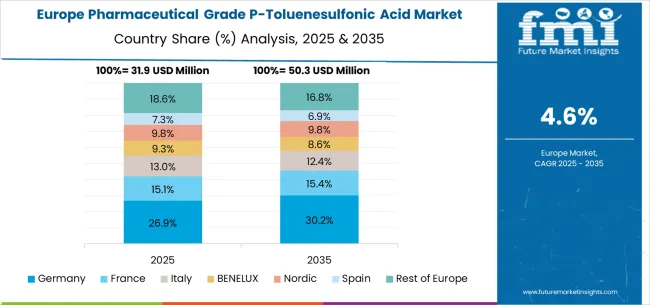

The pharmaceutical grade P-toluenesulfonic acid market in Europe is forecast to expand from USD 33.8 million in 2025 to USD 55.6 million by 2035, registering a CAGR of 5.1%. Germany will remain the largest market, holding 29.5% share in 2025, easing to 28.8% by 2035, supported by strong pharmaceutical infrastructure and advanced drug manufacturing standards.

The United Kingdom follows, rising from 21.2% in 2025 to 21.8% by 2035, driven by pharmaceutical facility modernization and regulatory compliance initiatives. France is expected to maintain stability from 17.3% to 17.0%, reflecting consistent pharmaceutical industry investments and drug synthesis requirements.

Italy holds around 14.8% throughout the forecast period, supported by pharmaceutical facility upgrades and chemical intermediate modernization programs. Spain grows from 9.8% to 10.4% with expanding pharmaceutical infrastructure and increased focus on high-purity chemical intermediates. BENELUX markets maintain 4.7% to 4.5%, while the remainder of Europe hovers near 2.7%-2.9%, balancing emerging Eastern European pharmaceutical development against mature Nordic markets with established pharmaceutical chemical adoption patterns.

The market is defined by competition among specialized pharmaceutical chemical suppliers, high-purity intermediate companies, and pharmaceutical manufacturing solution providers. Companies are investing in advanced purification technology development, regulatory compliance optimization, quality assurance improvements, and comprehensive pharmaceutical service capabilities to deliver reliable, compliant, and cost-effective pharmaceutical solutions. Strategic partnerships, quality innovation, and regulatory expertise are central to strengthening product portfolios and market presence.

Stepan offers comprehensive pharmaceutical chemical solutions with established manufacturing expertise and professional-grade pharmaceutical intermediate capabilities. Kao Koan Enterprise provides specialized chemical products with focus on purity reliability and pharmaceutical compliance. Konan Chemical delivers advanced pharmaceutical solutions with focus on quality and regulatory-friendly operation. Zu-Lon Industrial specializes in pharmaceutical intermediates with advanced purification technology integration.

Newland Pharmaceutical offers professional-grade pharmaceutical chemicals with comprehensive regulatory support capabilities. Chung Hwa Chemical delivers established pharmaceutical solutions with advanced chemical technologies.

Nanjing Ningkang Chem provides specialized pharmaceutical equipment with focus on quality optimization. Shandong Dongyue New Material Technology, Jiangsu Shengxinheng Chemical, Changshu Yuxin Chemical, Lianyungang Ningkang Chemical, Zibo Like Chemical Group, and Shandong Jichuang Chemical offer specialized manufacturing expertise, product reliability, and comprehensive development across global and regional pharmaceutical market segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 129.8 million |

| Purity Level | Purity≥99%, Others |

| Application | Doxycycline, Persantine, Naproxen, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Stepan, Kao Koan Enterprise, Konan Chemical, Zu-Lon Industrial, Newland Pharmaceutical, Chung Hwa Chemical, Nanjing Ningkang Chem, Shandong Dongyue New Material Technology, Jiangsu Shengxinheng Chemical, Changshu Yuxin Chemical, Lianyungang Ningkang Chemical, Zibo Like Chemical Group, Shandong Jichuang Chemical |

| Additional Attributes | Dollar sales by purity level and application segment, regional demand trends across major markets, competitive landscape with established pharmaceutical chemical manufacturers and emerging specialty providers, customer preferences for different purity options and regulatory compliance features, integration with pharmaceutical manufacturing systems and synthesis protocols, innovations in purification efficiency and quality assurance technologies, and adoption of regulatory compliance design features with enhanced purity capabilities for improved pharmaceutical workflows. |

The global pharmaceutical grade p-toluenesulfonic acid market is estimated to be valued at USD 129.8 million in 2025.

The market size for the pharmaceutical grade p-toluenesulfonic acid market is projected to reach USD 213.5 million by 2035.

The pharmaceutical grade p-toluenesulfonic acid market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in pharmaceutical grade p-toluenesulfonic acid market are purity≥99% and others.

In terms of application, doxycycline segment to command 45.0% share in the pharmaceutical grade p-toluenesulfonic acid market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pharmaceutical Excipient SNAC Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Zinc Powder Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Secondary Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Manufacturing Equipment Market Forecast and Outlook 2025 to 2035

Pharmaceutical Plastic Bottle Market Forecast and Outlook 2025 to 2035

Pharmaceutical Industry Analysis in Saudi Arabia Forecast and Outlook 2025 to 2035

Pharmaceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Pots Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceuticals Pouch Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Unit Dose Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Mini Batch Blender Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Continuous Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Liquid Prefilters Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Glass Container Industry Analysis in Europe Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Contract Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Container Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Sterility Testing Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceuticals Preservative Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA