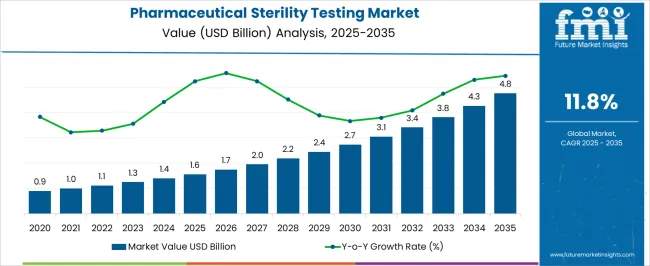

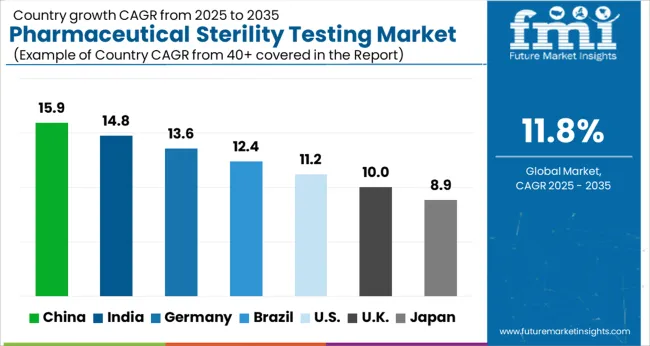

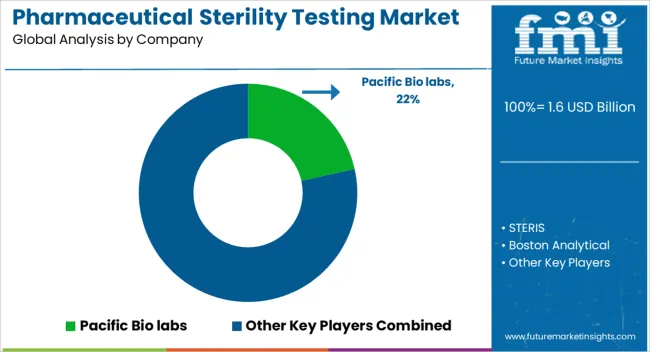

The Pharmaceutical Sterility Testing Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 4.8 billion by 2035, registering a compound annual growth rate (CAGR) of 11.8% over the forecast period.

| Metric | Value |

|---|---|

| Pharmaceutical Sterility Testing Market Estimated Value in (2025 E) | USD 1.6 billion |

| Pharmaceutical Sterility Testing Market Forecast Value in (2035 F) | USD 4.8 billion |

| Forecast CAGR (2025 to 2035) | 11.8% |

The pharmaceutical sterility testing market is expanding steadily as regulatory bodies place greater emphasis on ensuring the safety and efficacy of drugs and biologics. Increasing production of sterile pharmaceuticals, injectable formulations, and biologic therapies has heightened the demand for rigorous sterility validation procedures.

The rising complexity of drug development and the growing prevalence of chronic conditions are driving manufacturers to adopt advanced testing solutions that guarantee product integrity. The integration of rapid microbiological methods and automation in sterility testing is further enhancing accuracy, reducing turnaround time, and improving compliance with international standards.

With biopharmaceutical innovation and stringent global regulatory frameworks shaping industry practices, the market outlook remains favorable, supported by the critical need to safeguard patient health and maintain product quality across diverse therapeutic categories.

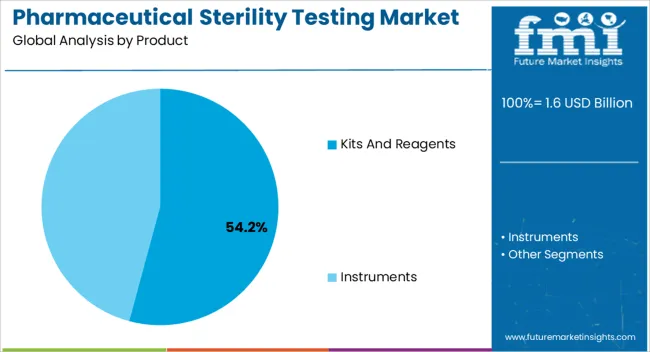

The kits and reagents segment is projected to hold 54.20% of total market revenue by 2025 within the product category, making it the leading contributor. Growth in this segment is supported by the wide availability of ready-to-use kits that streamline sterility testing workflows, reduce preparation errors, and enhance efficiency.

The use of high-quality reagents ensures consistency, reliability, and compliance with pharmacopeial standards, making them indispensable for routine testing in pharmaceutical and biotechnology industries.

Continuous advancements in reagent formulations and kit design have further improved sensitivity and reproducibility, driving adoption across both small and large-scale manufacturing facilities.

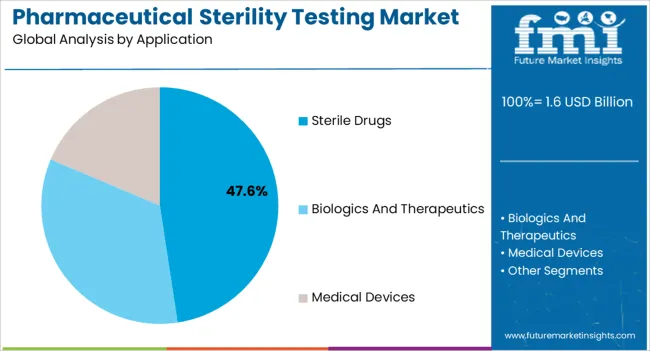

The sterile drugs segment is expected to account for 47.60% of total market revenue by 2025 within the application category, establishing it as the dominant area. This prominence is attributed to the growing demand for injectables, ophthalmic solutions, and other sterile dosage forms where patient safety is paramount.

Strict regulatory requirements governing the manufacture of sterile pharmaceuticals have intensified the need for robust sterility testing protocols. Increasing investments in biologics and biosimilars are further fueling the demand for advanced testing approaches that can ensure safety and quality.

The reliance on sterility validation as a core compliance requirement continues to position sterile drugs as the largest application segment.

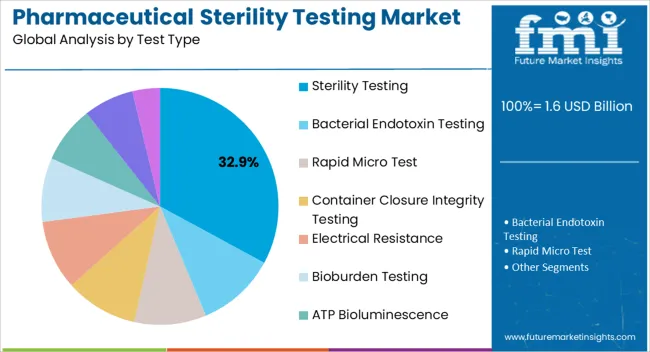

The sterility testing segment is projected to represent 32.90% of market revenue by 2025 within the test type category, making it a key growth driver. The necessity of confirming the absence of viable microorganisms in final products has cemented the importance of sterility testing across pharmaceutical production lines.

Regulatory mandates have reinforced its adoption as a standard quality control practice. Furthermore, the shift toward rapid microbiological methods and automated sterility testing systems is improving accuracy and reducing the risk of false positives or contamination during testing.

These advancements are strengthening sterility testing’s role as a critical component of pharmaceutical quality assurance.

The background of the market is quite promising, and numbers are likely to increase during the research period. A number of developing nations have sped up the launch of new medicines in order to meet the world's rising need for healthcare. By doing this, the scope for CAGR increases from 9.8% (2020 to 2025) to 11.8% by 2035. As a result of the rising prevalence of chronic and infectious diseases, there is an increasing demand for pharmaceuticals on a global scale. For instance,

Future illness load is anticipated to increase demand for pharmaceuticals, supporting the need for pharmaceutical sterility testing. Due to this, the global market had the potential to thrive. In 2020, the market was valued at USD 1.6 million, and by 2025, it reached USD 1,124.7 million.

The regulatory changes have significantly improved the likelihood of widespread adoption. Drugs like Elagolix and Lanadelumab, whose debut is considerably assisting the market's growth, are biopharmaceutical products that require special sterility testing. Given all of these influences, the market is probably anticipating a 1.1x growth between 2025 and 2025.

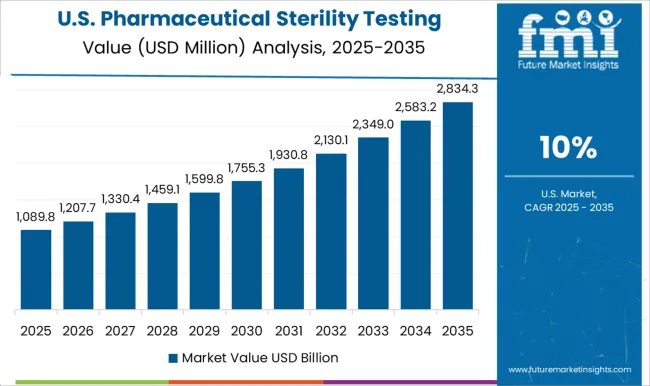

In 2025, it is anticipated that North America accounted for 39% of the global pharmaceutical sterility testing market. The existence of numerous international and domestic competitors in the area is responsible for the region's rise.

During the forecast period, a huge amount of money is likely to be spent on research and development to support the growth of North America market. The biopharmaceutical business has a substantial total economic impact on the economy of America.

The United States held a dominant market share of 41.5% in 2025. This is due to the factors such as:

For instance, PreHevbrio was introduced by VBI Vaccines Inc. in March 2025 for the treatment of persons aged 18 years old. It is for those who are at risk of contracting any of the recognized subtypes of the hepatitis B virus (HBV). In November 2024, the FDA authorized this vaccine as the exclusive adult 3-antigen HBV vaccine. Consequently, Canada spent USD 23,400 million internally on pharmaceutical research and development in 2024, and it reached USD 23,800 million in 2025, a 1.7% increase.

By 2035, China is anticipated to hold a significant rank in the pharmaceutical sterility testing sector, with a CAGR of 12.1%. This is a result of emerging countries increasingly harmonizing their regulatory norms with ICH standards. Additionally, the region's emerging economies are taking a variety of steps to expand their domestic pharmaceutical market and are enticing multinational corporations to establish operations there.

Contract research organizations (CROs) are anticipated to expand significantly over the next few years. Sterile testing services are significantly being outsourced to CROs because of the benefits they provide including flexibility, cost-effectiveness, and access to specialist knowledge. The primary end-users of sterility testing services in the nation are anticipated to be the biopharmaceutical industry and CROs.

India is prepared to manufacture medical devices and conduct extensive sterility testing due to substantial pharmaceutical investment. By 2035, India is projected to have a 12.8% CAGR.

According to the Union Budget for the years 2024 to 2025, the Indian Ministry of Science and Technology allocated USD 1.4 million, a 25% increase from the budget for the years 2024 to 2024, for the DBT (Department of Biotechnology). This is primarily for biotechnology research and development, as well as industrial and entrepreneurship development in the nation. This budget sets new goals for India pharmaceutical sterility testing market. In accordance with the analysis, the Indian biotechnology market was estimated to be worth USD 70,200 million in 2024; by 2025, it is anticipated to be worth USD 150,000 million.

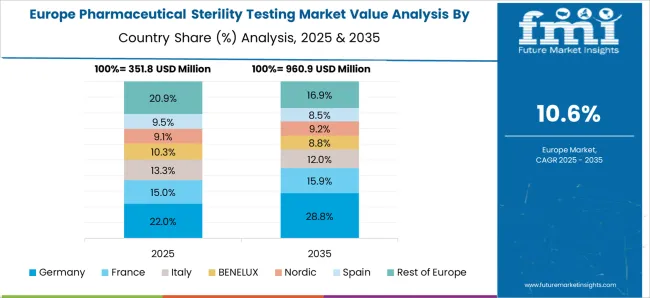

In Germany, automated methods rule the market. The market was initially growing, with a share of 6.2% in 2025, and by 2035, it is projected to have a wide scope. Automated systems that contribute effectively to the global industry include the BacT/ALERT system. These techniques are made to be highly sensitive and specific in identifying the presence of microorganisms in pharmaceutical items.

Germany has a stringent regulatory framework that is overseen by the European Pharmacopoeia (Ph. Eur.) and the German Medicines Act (AMG). All pharmaceutical products that are intended for infusion, implantation, or injection into the human body must pass sterility testing. This testing is essential to make sure the product is devoid of living microorganisms like bacteria, viruses, and fungi that possibly infect people or create other adverse effects.

| Category | Product Type |

|---|---|

| Top-segment | Kits & Reagents |

| Market Share (2025) | 39.7% |

| Category | Services |

|---|---|

| Top-segment | Outsourced |

| Market Share (2025) | 54.1% |

| Category | Test type |

|---|---|

| Top-segment | Bacterial endotoxin testing |

| Market Share (2025) | 38.4% |

Through 2035, the kits and reagents market is predicted to experience significant growth. The availability of a variety of items that aid in reducing the danger of false negative and false positive results is credited with this increase. These also consist of sterility testing pumps, which are easily integrated into any testing environment, streamline workflow, and help to maximize safety.

Over the anticipated period, segmental growth is expected to be boosted by the rising demand for comparable products.

In 2025, the segment for bacterial endotoxin testing held the leading market share with 38.4%. These tests are used to evaluate medical equipment like implants. The market for this category is expanding as a result of rising parenteral medication and implant demand. Along with an increase in the number of drug and medical device launches, there is a growing emphasis on product quality.

How do Pharmaceutical Sterility Testing Manufacturers Expand in the Market?

The demand for pharmaceutical sterility testing is projected to increase along with medical improvements, and producers can profit from these technological developments.

The growth of the biotechnology sector offers businesses a lot of room for future advancements.

Concerns like the safety of biological pharmaceuticals are surging. New technological advancements in the area of sterility testing have improved the procedure's efficiency, allowing manufacturers to introduce new products in the market.

The market is highly fragmented due to the presence of multiple local and MNC contract service providers and research facilities. The main strategies employed by the bulk of these organizations include regional growth and digitalization of service delivery for sterility testing. Companies in the sector are subject to intense regulatory scrutiny and must abide by rules relating to the security of pharmaceutical products. As a result, specialized consulting companies have emerged. These companies offer services related to pharmaceutical sterility testing that are related to regulatory compliance and quality assurance.

Recent Developments:

The global pharmaceutical sterility testing market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the pharmaceutical sterility testing market is projected to reach USD 4.8 billion by 2035.

The pharmaceutical sterility testing market is expected to grow at a 11.8% CAGR between 2025 and 2035.

The key product types in pharmaceutical sterility testing market are kits and reagents and instruments.

In terms of application, sterile drugs segment to command 47.6% share in the pharmaceutical sterility testing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pharmaceutical Dissolution Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Dosage Form Testing Systems Market

Pharmaceutical Autoclave Machine Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Excipient SNAC Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Zinc Powder Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade Magnesium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Secondary Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Manufacturing Equipment Market Forecast and Outlook 2025 to 2035

Pharmaceutical Plastic Bottle Market Forecast and Outlook 2025 to 2035

Pharmaceutical Grade Sodium Carbonate Market Forecast and Outlook 2025 to 2035

Pharmaceutical Industry Analysis in Saudi Arabia Forecast and Outlook 2025 to 2035

Pharmaceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Pots Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceuticals Pouch Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Unit Dose Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Mini Batch Blender Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Continuous Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA