The Nordics Executive Education Program Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 3.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period.

| Metric | Value |

|---|---|

| Nordics Executive Education Program Market Estimated Value in (2025 E) | USD 1.8 billion |

| Nordics Executive Education Program Market Forecast Value in (2035 F) | USD 3.5 billion |

| Forecast CAGR (2025 to 2035) | 6.9% |

The Nordics executive education program market is experiencing notable expansion as organizations prioritize leadership development, digital transformation skills, and behavioral competencies to strengthen competitive positioning in a dynamic business environment. Strong demand is being observed for programs that combine academic rigor with practical industry insights, driven by the region’s emphasis on lifelong learning and innovation-led growth.

The increasing integration of hybrid and digital delivery formats has made executive education more accessible, catering to busy professionals seeking flexible yet impactful learning experiences. Investments by universities and private institutions in global partnerships, experiential modules, and technology-enhanced content are further fueling growth.

The market outlook remains positive, supported by corporate training budgets, rising participation from mid-career executives, and a strong cultural inclination toward continuous professional development in the Nordics.

The educational institutes type segment is projected to represent 42.70% of total revenue by 2025, making it the leading category within the market. This dominance is being driven by the credibility and global recognition of established universities and business schools in the Nordics, which continue to attract executives seeking structured learning frameworks.

The ability of these institutes to offer accredited programs, cutting-edge curriculum, and access to international faculty has reinforced their position. Additionally, partnerships with corporate organizations for tailored leadership training have expanded their outreach, ensuring consistent enrollment.

As organizations value formalized programs that combine academic excellence with practical leadership insights, educational institutes remain the cornerstone of the market.

The personal counselling social and behavioral leadership course segment is expected to account for 38.60% of total revenue by 2025, positioning it as the most prominent course offering. The growth of this segment is being driven by heightened awareness of the importance of emotional intelligence, interpersonal skills, and leadership adaptability in organizational success.

Executives are increasingly seeking programs that enhance personal growth alongside strategic capabilities, with a focus on navigating complex workplace dynamics. The integration of coaching, behavioral assessments, and leadership psychology has elevated demand for such courses.

As enterprises emphasize holistic leadership development, this course segment continues to expand, reflecting its critical role in executive education.

The less than 1 week duration segment is projected to capture 55.20% of total revenue by 2025, making it the leading segment in terms of duration. This preference is driven by the need for compact, intensive programs that deliver high impact learning without significantly disrupting executive schedules.

Short-term formats offer concentrated insights, immediate applicability of skills, and strong value for time invested. The rising adoption of modular and blended formats has further supported this trend, allowing participants to gain focused expertise within limited timeframes.

As time efficiency and flexibility become decisive factors for executives, the less than 1 week segment continues to dominate, reflecting its alignment with the professional demands of senior leaders in the Nordics.

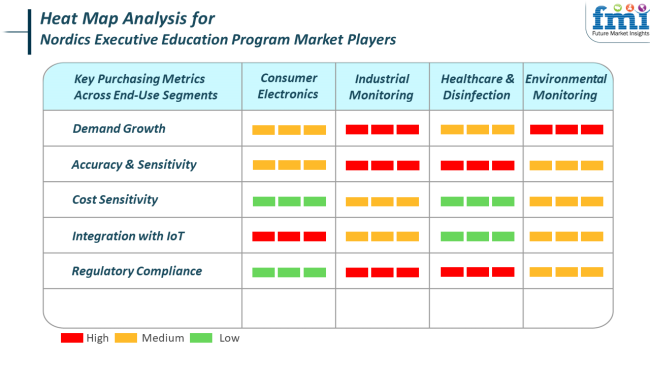

According to contemporary executive development practices, the purchasing decisions shall be made with relevance, customization, and long-term professional utility in mind. In consumer-oriented areas like electronics, executives now look for programs on quick-response leadership, innovation pipelines, and customer-driven design, with live case studies and the implementation of digital strategy very much at the heart of things.

Practitioners from industrial and environmental monitoring agencies lay stress on precision learning in conformance with safety, automation, and alignment. Executive learners within those segments would be looking for programs in which strong data governance would be partnered with intelligent infrastructure management and regulatory policy adaptation. Ethical leadership and system change, especially digital health integration and public-private partnerships rank high on the healthcare priority list.

Leaders across verticals increasingly seek alliances with programs aligning core leadership skills to forward-looking skills such as climate risk planning, stakeholder governance, and AI integration. The current industry demand is a move toward interdisciplinary curricular offerings designed to permit customized certification and rapid rollout within dynamically updating organizational environments.

Among the main challenges for the Nordics executive education industry is oversaturation by web-based education platforms offering comparable content without substantial differences. With international providers expanding into the Nordic industry using virtual delivery, indigenous providers must get creative to maintain competitive advantage and cultural relevance in their offerings.

However, another danger is linked to corporate budget cuts and economic cyclicality. During periods of fiscal restraint, organizations decouple discretionary expenditures such as executive development, reducing program enrollment. This volatility forces providers to demonstrate measurable ROI and long-term strategic value based on outcomes-driven data.

Lastly, accelerating skill requirements and shortened learning cycles require rapid curriculum adaptation that can be anathema to traditional academic organizations. Those offering providers who don't integrate new materials around fresh technologies, ESG drivers, and inter-sectoral cooperation can risk obsolescence. Nordics' leaders' need to transform rapidly ensures that more responsive, technology-leveraged peers will dominate continuous Learning Practices refreshments.

The Nordics executive education industry developed steadily between 2024 and 2025 on the strength of strong demand for leadership and digital transformation skills. Over these years, the expansion of hybrid and online platforms was a key driver, broadening access to executive education across professionals in the region.

In another context, increased focus on industry and customized programs led organizations to invest more in executive education in a bid to unlock their leadership potential. Organizations such as Sweden's Stockholm School of Economics (SSE) and Denmark's DTU Executive Education led the way with customized executive courses for business managers.

Over the next several years, through 2025 to 2035, the industry will continue to expand on the back of robust trends such as the uptake of new digital technologies in education prospects. Artificial intelligence (AI), virtual reality (VR), and gamification will be poised to dominate the creation of customized and immersive learning programs.

Besides, there will be greater focus on sustainability, with institutions offering executive education that addresses global challenges in the areas of climate change, diversity, and inclusion. As the business environment continues evolving, the Nordics executive education industry will train professionals to solve complex challenges, drive in a digital-first economy, and spur innovation.

Comparative Market Shift Analysis 2024 to 2025 vs. 2025 to 2035

| 2024 to 2025 | 2025 to 2035 |

|---|---|

| Digital transformation, hybrid learning, leadership development needs | Intersection of AI, VR, gamification, and individualized learning experiences |

| Shifting programs to meet industry challenges | Smart, data-based learning platforms with compelling experiences |

| Stepped-up demand for online and flexible learning | Aspirational option for individualized, AI-driven learning pathways and immersive learning experiences |

| Innovator schools in Sweden, Denmark, Norway, and Finland | Expansion of interest in digital skills, innovation, and sustainable leadership in the Nordics |

| Early innovation in provision of sustainability-oriented leadership programs | High sustainability, diversity, and inclusion focus in executive development |

| Hybrid and online learning environments gained popularity | Immersive-type digital platforms with AI-based content, virtual reality simulation, and simultaneous collaboration |

| Consistent growth fueled by demands for leadership in digital transformation | Evolving programs with focus on addressing global challenges and creating leaders for a digital, complex future |

B-schools will primarily contribute to the Nordics executive education industry in 2025, with 28.3% of the total industry share. Educational institutes closely follow with 21.5%, marking their value in contributing to the executive learning experience across the Nordics.

B-schools dominate in this segment since they are the only ones that have running specialized programs meant for strategic leadership, innovation, or digital transformation- all subjects imperative for today's executives to row their boats through the chaotic and rapidly changing business landscape. There are many executive programs for C-level and senior management personnel available at the very widely reputed BI Norwegian Business School and Copenhagen Business School.

Short leadership boot camps, modular MBA programs, and custom-designed corporate courses are a few of them. They have a strong international ranking, have the most experienced faculty, and have great cooperation with the industry, so they are attractive to executives looking for structured, research-backed learning.

Flexible and hybrid executive education programs have become extremely valuable to the Stockholm School of Economics and Lund University. The universities in question often get together with government agencies and the largest companies in the provision of development tracks that focus on sustainability, structural inclusion, and public-private cooperation. They contribute by marrying scholarly and practical insight, especially for public sector leaders or professionals stepping out of the technical to the managerial terrain.

Management consultancies like McKinsey & Company and industrial associations like the Confederation of Danish Industry (DI), which mainly offer niche, strategy-focused programs, also add to the Nordic executive education ecosystem. Such providers are making deeper inroads in uplifting the executive education industry competitiveness in terms of addressing specific sector needs.

Nearly half the total Nordics executive education industry is represented by B-schools and educational institutes, thereby reaffirming what the regions have been about: structured, high-quality learning pathways enabling leadership excellence in private and public domains.

In 2025, the Nordics executive education industry will be mainly driven by two primary course categories: entrepreneurship/self-employment and organizational leadership, which together are projected to hold an industry share of 14.8% and 13.1%, respectively.

In the Nordic region, entrepreneurship and self-employment courses have gained ground due to an increasing number of startups and the region's focus on nurturing innovation and small business growth. For example, in Sweden and Finland, which have strong startup ecosystems, the programs at the Helsinki School of Economics and the Stockholm School of Entrepreneurship cater to entrepreneurial students.

Their curricula include areas such as venture capital, business planning, and scaling up operations. Through partnerships with leading companies such as Spotify and Klarna, the Nordic unicorns are also involved in educating students on the real-life trajectory of entrepreneurs. This establishes a conducive environment for executive education targeted at new business ventures.

Organizational leadership development courses are another important domain in the executive-educational industry, taking in 13.1% of the projected industry volume. They are tailored toward helping employees develop leadership skills for different kinds of high-performing teams and work environments.

Such programs are offered by universities such as the Norwegian School of Economics (NHH) and Copenhagen Business School, which give students insight into strategic decision-making, emotional intelligence, and corporate governance. Nordic multinationals such as Volvo and Novo Nordisk send their senior management to these institutions to build leadership capabilities and link their new ideas with research and practices.

Both categories represent a constantly changing demand for customized training in leadership, which is of utmost importance for innovation and strong management practices required to maintain global competitiveness in the Nordic region.

| Countries | CAGR (2025 to 2035) |

|---|---|

| Denmark | 7.1% |

| Norway | 6.8% |

| Finland | 6.5% |

| Sweden | 7.3% |

| Iceland | 5.9% |

The Danish industry will expand at 7.1% CAGR during the study period. Denmark has a robust ecosystem for executive education programs based on a thriving culture of lifelong learning, digital transformation initiatives, and an open business environment focusing on continuous skill development. Danish firms, especially those in the pharmaceuticals, clean tech, and design sectors, are heavily investing in executive-level training to succeed globally.

Danish executive education providers were the first to adopt hybrid models of learning and technology, responding to the needs of modern-day executives who require adaptable learning pathways. Government support in the form of education grants and subsidies for innovation continues to fuel the industry.

Denmark's strategic emphasis on sustainability and ESG practices has also been driving demand for executive education in green leadership and circular economy thinking. The integration of AI, data analytics, and innovation management in program offerings has made the industry more appealing to high-level professionals looking to extend global influence.

High English competence and international study alliances in Denmark have also increased the target industry, thus making the industry appealing to cross-border players. With firm university-industry relations, the industry is likely to grow consistently and remain highly sensitive to corporate and international learning requirements through 2035.

The Norwegian industry will expand at 6.8% CAGR during the forecast period. A knowledge-based economy backs the executive education industry in Norway with a thrust for upskilling and continuing professional education. With an educated workforce and digitalization momentum, executive education is emerging as a key national competitiveness driver. Executive education segment growth is being driven by a rising need for expert training in leadership, particularly energy transition, ESG strategy, and digital leadership.

The presence of multinational corporations, particularly in the oil and gas, shipping, and aquaculture sectors, has driven the demand for tailored executive programs to address industry-specific issues. Executive education institutions in Norway are now providing modular and stackable credentials that enable executives to customize learning experiences in accordance with evolving career goals.

In addition, government initiatives to enhance digital literacy and business innovation have created a favorable climate for the executive learning ecosystem. Multinational companies and international universities have also partnered with schools to offer co-branded programs, thus enhancing the local industry supply with global flavors. Despite its relatively modest size, the executive education industry in Norway has good long-term prospects due to its congruence with national strategic priorities and strong corporate learning culture.

The Finland industry will register growth at a 6.5% CAGR during the period under study. Finland has had a long history of being recognized for its strong school system and innovation focus and hence is ground for the development of executive education programs.

Finnish businesses are increasingly prioritizing strategic leadership development, driven by international competitiveness, rapid digitalization, and a growing focus on sustainable innovation. Finnish executive education providers are meeting this need by delivering future-oriented programs that integrate subjects such as artificial intelligence, change management, and digital leadership.

The corporate sector's openness to continuous learning and experimentation has led to rising demand for executive micro-credentials and responsive online formats. Finland's executive education industry is also seeing increased involvement by tech and manufacturing businesses looking to reskill middle to senior management in agile techniques and innovation frameworks.

As a result of strong government support for continuous learning and online training, providers will continue to diversify their offerings. Moreover, cooperation between universities and the private sector guarantees program relevance and responsiveness. While Finland's population remains modest, the industry's high per capita investment in leadership development and education underlies a steady upward growth rate through 2035.

The Sweden industry will grow at 7.3% CAGR throughout the study. Sweden is one of the most dynamic industries in the Nordic region for executive learning, driven by an extremely innovative economy, world-leading academic institutions, and a strong leadership development culture. Executive learning solutions in Sweden are being driven by sectors such as automotive, fintech, and sustainability industries that are constantly demanding adaptive leadership to manage digital disruption and global expansion.

Sweden-based executive education providers are developing strongly customized programs centered on practical application, strategic thought, and worldwide leadership. The programs are often delivered in mixed formats, based on advanced e-learning technologies appealing to busy executives.

Sweden's advanced level of digital readiness and IT infrastructure facilitates the simple adoption of AI-powered learning analytics and individualized content presentation. The country's corporate training budgets are healthy, and further investment in executive talent development is viewed as a competitive advantage.

In addition, public-private collaborations and cross-border alliances have enriched program variety and enhanced international presence. With staff committed to innovation and learning culture, Sweden is well-positioned to propel Nordic region executive education industry development through the forecast period.

The Icelandic industry is predicted to grow at 5.9% CAGR during the period to be researched. Iceland, in spite of having a smaller population, presents unique opportunities in the executive education industry because of the growing demand for leadership agility in sectors such as tourism, renewable energy, and creative industries.

Executive training in Iceland is being valued more and more as firms recognize the worth of global competitiveness and strategic management in a post-pandemic recovery environment. Training organizations and higher education institutions in Iceland are aligning programs with Iceland's economic diversification goals, delivering executive training that emphasizes sustainability, innovation, and cross-cultural management.

The industry is gradually shifting towards flexible, modular programs designed to service the needs of senior professionals managing leadership duties and skill acquisition. Iceland's investments in digital infrastructure deliberately created opportunities for greater access to executive programs online, including international collaborations that inject global best practices into local utilization.

Although the overall size of the industry continues to be limited by population, demand intensity and sophistication of the industry are expected to rise progressively. With an innovative drive in education reform and development, Iceland's executive education industry will evolve into a high-value niche industry over the next decade.

Nordics executive education program market is admired for academic rigor, global dimension, and integration with the local business ecosystem. The leading institutions in the field of executive education in the region include Aalto University Executive Education, Copenhagen Business School Executive Education, and BI Norwegian Business School, as well as Hanken School of Economics Executive Education and Lund University.

These actors are shaping the future of executive education in the region through their investments in digital delivery models, international partnerships, and client-customized leadership development programs aimed at Nordic and global executives.

New leadership programs at Aalto University Executive Education are being developed with sustainability and AI in mind, cementing links to Finnish technology firms. Copenhagen Business School Executive Education harnesses Denmark's vibrant business environment to provide experiential learning for executives in the areas of ESG, strategy, and finance.

BI Norwegian Business School is investing in blended learning formats while expanding through online modules Targeted at C-suite and senior managers. Hanken School of Economics Executive Education is focusing its offerings on Nordic governance and inclusive leadership. Lund University instead concentrates on executive innovation labs and engagement with startup ecosystems, carving its niche in entrepreneurship education.

The industry is additionally supported by institutes from Sweden, Norway, Finland, and Iceland, offering specialized programs in public sector leadership, healthcare management, as well as green economy transformation.

Market Share Analysis by Company

| Institution Name | Market Share (%) |

|---|---|

| Aalto University Executive Education | 18-22% |

| Copenhagen Business School Executive Education | 14-18% |

| BI Norwegian Business School | 12-16% |

| Hanken School of Economics Executive Education | 10-14% |

| Lund University | 8-12% |

| Other Institutions | 24-28% |

| Institution Name | Offerings & Activities |

|---|---|

| Aalto University Executive Education | Sustainability-driven, AI-integrated programs with tech-sector partnerships. |

| Copenhagen Business School Executive Education | Offers ESG and strategy-based programs for executive-level learners. |

| BI Norwegian Business School | Investing in blended learning as well as online executive certifications. |

| Hanken School of Economics Executive Education | Focus on Nordic governance, inclusive leadership, and diversity. |

| Lund University | Executive innovation labs and startup-focused leadership training. |

Key Institute Insights

Aalto University Executive Education (18-22%)

A regional champion with state-of-the-art executive education tuned to Finland's technology-driven economy and global sustainability objectives.

Copenhagen Business School Executive Education (14-18%)

Recognized for strategic and ESG-oriented programs grounded in Denmark's corporate leadership as well as international trade capabilities.

BI Norwegian Business School (12-16%)

Leading in novel delivery modes and emphasizing public-private leadership issues in the Nordics.

Hanken School of Economics Executive Education (10-14%)

Specializes in programs focusing on ethical leadership and diversity in executive decision-making.

Lund University (8-12%)

Aims at entrepreneurship, innovation management and integration with regional startup ecosystems.

Theindustry is segmented into educational institutes, b-schools, management consultancy, industrial training institutions, personality development institutions, employment consultancies, and industry associations.

CategoryThe industry includes personal counselling/social and behavioral/leadership, marketing, organizational leadership, data analytics, enterprise management, finance & accounting, technology & IT, HR & talent management, corporate governance, entrepreneurship/self-employment, channel management, customer service, software testing, supply chain & e-commerce, industrial process & certifications, personal care and wellness, legal assistance, and others.

By duration, the industry is segmented into less than 1 week, 1 week to 1 month, and more than 1 month.

By mode of delivery, the industry includes classroom, virtual, live online, pre-recorded, and blended delivery formats.

The global Nordics executive education program market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the Nordics executive education program market is projected to reach USD 3.5 billion by 2035.

The Nordics executive education program market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in Nordics executive education program market are educational institutes, b-schools, management consultancy, industrial training institutions, personality development institutions, employment consultancies and industry associations.

In terms of course, personal counselling / social & behavioral / leadership segment to command 38.6% share in the Nordics executive education program market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Executive Coaching Certification Market Size and Share Forecast Outlook 2025 to 2035

Executive Education Program Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Executive Education Program

Key Companies & Market Share in United States Executive Education Program Sector

Canada Executive Education Program Market Size and Share Forecast Outlook 2025 to 2035

Online Executive Education Program Market Trends – Growth & Forecast 2024-2034

United States Executive Education Program Market Size and Share Forecast Outlook 2025 to 2035

Programmable Robots Market Size and Share Forecast Outlook 2025 to 2035

Programmable Logic Device (PLD) Market Growth & Demand 2025 to 2035

Programmatic Display Market Analysis by Ad Format, Sales Channel, and Region Through 2035

Programmable Logic Controller Market Growth – Trends & Forecast 2024-2034

Field Programmable Gate Array (FPGA) Size Market Size and Share Forecast Outlook 2025 to 2035

Field-programmable Gate Array (FPGA) Market

CPLD Market – Trends & Growth through 2034

Cellular Reprogramming Tools Market – Demand & Forecast 2025 to 2035

Application Programming Interface (API) Security Market Size and Share Forecast Outlook 2025 to 2035

India Loyalty Program Market Analysis - Size, Share, and Forecast 2025 to 2035

Analyzing India Loyalty Program Market Share & Industry Leaders

Leadership Development Program Market Analysis - Size, Share, and Forecast 2025 to 2035

Examining Market Share Trends in Leadership Development Programs

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA