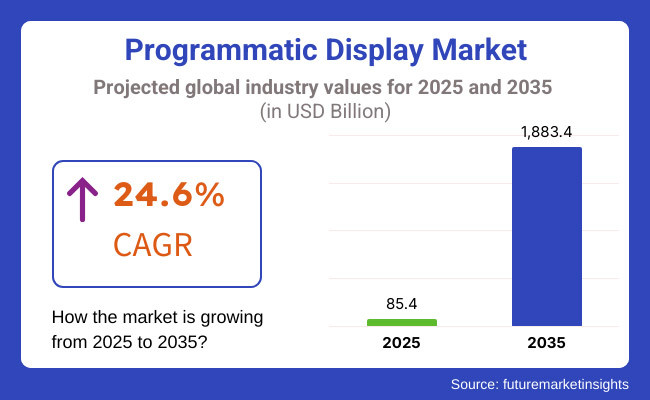

The global programmatic display market is set to depict USD 85.4 billion in 2025. The industry is poised to register 24.6% CAGR from 2025 to 2035, reaching USD 1,883.4 billion by 2035.

This growth is fuelled by the growing demand for automated ad bidding and AI-driven campaign management, as well as the need for smarter audience behaviour analysis. Machine learning algorithms and RTB (real-time bidding) platforms are used by businesses to optimize ad performance and ensure targeted accuracy and better engagement. The ability to analyse massive amounts of consumer data instantly allows advertisers to tailor marketing approaches, maximizing advertisement effectiveness and budget use.

The industry is the marketplace that automatically buys, sells, and places digital ad placements based on algorithms powered by artificial intelligence (AI) and real time bidding (RTB) methods. It’s an authentication advertising mechanism which helps advertisers, media agencies, and digital marketers make the most Aden the need for a more efficient and focused solution. Real-time, targeted and highly relevant ads on large scale-programmatic display solutions chronicling data-enabled segmentation, data-based analysis, cross-channel optimization are changing the way digital is conceived.

With advancements as AI, machine learning, and data marketing, the industry is undergoing a paradigm shift toward developing highly targeted advertisement campaigns to enhance user engagement and brand awareness.

Programmatic advertising is getting more effective, and the primary innovations that enable that are contextual targeting, dynamic creative optimization (DCO) and privacy-friendly data collection. As stricter data privacy laws come into effect, businesses are focusing on first-party data strategies and ethical audience tracking methods to remain compliant while providing customized advertisement experiences.

The increasing emphasis on fraud prevention, brand protection, and transparency in online advertising is driving the adoption of programmatic display solutions. To combat this, companies are doing more with AI powered fraud prevention Solution that detects invalid traffic, reduces ad fraud, and protects advertisement budgets. And now, these platforms are built to easily integrate with DSPs, CRMs, and Omni channel marketing platforms to foster facilitating execution of data-driven marketing strategies all under the same roof.

The industry can vary as per the implementation of AI and Automation; hence a continuous growth can be expected. Predictive analytics and targeted advertising will soon become one of the most priority campaigns for advertisers and marketers as advertisement placement will develop in real time in order for maximum efficiency. Programmatic display solutions will lead the way in shaping the future of online advertising and facilitate businesses in reaching people with precision and efficacy across various digital territories as digital advertising technologies continue to advance relentlessly.

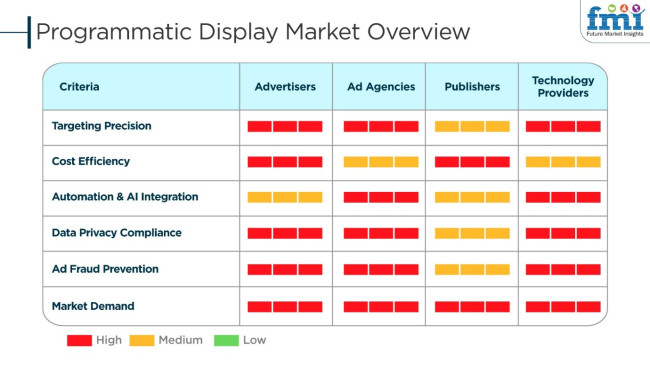

The industry is witnessing tremendous transformations with the use of AI, machine learning, and real-time bidding (RTB), thus significantly enhancing the effectiveness of advertising. Advertisers are interested in accurate targeting and affordable outreach, leveraging data-driven insights to maximize their ROI to the maximum.

Ad agencies are the major parties concerned with automation and AI strategic decision-making, which are the tools used for optimizing campaign performance along with the adherence to the newly arising privacy regulations. Publishers are hunting for more advertisement revenues through the utilization of premium inventory management and company safety controls, thus confirming that the advertisements go to right audiences.

Technology providers are the backbone of the ecosystem that creates two types of platforms (DSPs & SSPs) which are peg & adapter through programmatic inter-operation. The audience segmentation capabilities, fraud detection, cross-channel compatibility, and data privacy compliance are the major purchasing criteria. The increasing popularity of connected TV (CTV) and mobile advertising has also altered the structure of the industry thus necessitating the development of real-time optimization and Omni channel programmatic schemes for better engagement and monetization.

| Company | Google LLC |

|---|---|

| Contract/Development Details | Google announced a partnership with a major retail chain to enhance its programmatic display advertising capabilities. This collaboration aims to leverage Google's advanced ad technologies to improve targeted advertising for the retailer's extensive customer base. |

| Date | March 2024 |

| Contract Value (USD Million) | Approximately USD 500 - USD 700 |

| Estimated Renewal Period | 3 - 5 years |

| Company | The Trade Desk, Inc. |

|---|---|

| Contract/Development Details | The Trade Desk secured a contract with a leading global automotive manufacturer to provide programmatic display advertising services. The agreement focuses on utilizing data-driven strategies to reach potential customers more effectively across digital platforms. |

| Date | July 2024 |

| Contract Value (USD Million) | Approximately USD 300 - USD 500 |

| Estimated Renewal Period | 2 - 4 years |

| Company | Adobe Inc. |

|---|---|

| Contract/Development Details | Adobe entered into an agreement with a prominent financial services company to deliver programmatic display solutions through its Advertising Cloud platform. This partnership aims to optimize the company's digital advertising efforts by employing sophisticated audience segmentation and real-time bidding strategies. |

| Date | November 2024 |

| Contract Value (USD Million) | Approximately USD 400 - USD 600 |

| Estimated Renewal Period | 3 - 5 years |

In 2024, the industry experienced significant growth, with major players securing substantial contracts across various industries. Google's collaboration with a major retail chain underscores the increasing demand for advanced ad technologies to enhance customer targeting. The Trade Desk's partnership with a global automotive manufacturer highlights the automotive sector's shift towards data-driven advertising strategies.

Adobe's agreement with a financial services company reflects the financial industry's commitment to optimizing digital advertising through sophisticated platforms. These developments indicate a robust expansion of the industry, as companies across diverse sectors adopt automated and data-centric approaches to reach their target audiences more effectively.

From 2020 to 2024, the industry grew strongly as companies embraced AI-based automation, real-time bidding (RTB), and data-centric ad strategies. The emergence of privacy laws such as GDPR and CCPA forced advertisers to turn towards first-party data solutions and contextual targeting.

Omni channel programmatic advertising accelerated, blending display, mobile, connected TV (CTV), and digital out-of-home (DOOH) platforms for uninterrupted ad placements. But issues of ad fraud, brand safety issues, and lack of transparency drove more adoption of blockchain-based verification and AI-based fraud detection tools.

From 2025 to 2035, artificial intelligence will personalize various things. Quantum mechanics will redefine industry. Sentiments of users will be analysed to allow advertisers to show relevant advertisements. Blockchain will bring more transparency by allowing direct transactions between advertisers and publishers. Privacy-first solutions will ensure a balance between personalization and data protection. AR and VR ads will help immerse consumers, while diffusion will rely on energy-efficient and carbon-free ad campaigns.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Advertisers adapted to GDPR and CCPA regulations, focusing on first-party data and privacy-compliant targeting. | Blockchain-secured ad transactions, AI-driven compliance automation, and decentralized identity solutions will redefine privacy-compliant advertising. |

| AI and ML optimized ad targeting, real-time bidding, and Omni channel programmatic advertising. | Quantum-enhanced ad targeting, AI-driven generative advertising, and immersive AR/VR ad placements will revolutionize programmatic display. |

| Programmatic advertising enhanced brand awareness, audience engagement, and conversion rates. | AI-powered sentiment analysis, decentralized ad marketplaces, and privacy-first targeting solutions will expand industry applications. |

| Brands used AI-driven audience segmentation, contextual targeting, and cross-device ad personalization. | AI-created dynamic ad copy, interactive AR/VR ad experiences, and blockchain-based ad tracking will increase viewer engagement. |

| AI-powered audience data enhanced ad targeting and conversion monitoring. | Quantum computing-based ad bidding, AI-informed ad placement strategies, and real-time sentiment analysis of user opinions will streamline advertising effectiveness. |

| Industry challenges faced were ad fraud, brand risk safety, and transparency issues with programmatic buying. | Decentralized ad exchanges, blockchain-protected ad supply chains, and AI-based fraud detection will mitigate advertising risks. |

The industry is a multi-thronged risk space which houses risks like data privacy policies, digital advertising fraud, supply chain complexity, and disruptive technologies. The most significant threat that looms over the industry is compliance to the global data privacy laws such as GDPR in Europe, CCPA in California, and the other emerging laws.

The demand-side platforms (DSPs), supply-side platforms (SSPs), ad exchanges, and data management platforms (DMPs) of programmatic advertising comprise a complex supply chain which increases the visibility challenge. The imposition of transparency around the structure of costs, auction mechanics, and data handling can make the inefficiencies visible and can lead to the inefficient spending of ads without having the expected return.

Another issue is the technological obsolescence. The rapid development of artificial intelligence (AI), machine learning, and cookies less tracking methods require advertisers and platforms to work on innovative projects to remain competitive. In case of failure to make necessary changes fast, these traditional methods will become obsolete in the fast-moving programmatic identifying area.

Brand safety is the concern when ads are displayed on unsuitable or low-quality sites. To protect their reputation and credibility, advertisers must adhere to rigorous content filtering, context targeting, and brand protection policies.

Smartphones are now ubiquitous, and online video as a marketing platform on sites like YouTube, TikTok, and Instagram has become one of the most popular forms of reaching digital marketing firms. Advertise such as Google (YouTube Ads), Meta (Facebook and Instagram Video Ads), and Amazon Advertising are well ahead in the transition by utilizing AI-based advertisement placements by which the targeting precision will be better as well as will help in increasing the return on the investment.

Likewise, the mobile video ad format is set to dominate the industry, contributing 55% of total revenue in 2025. In particular, brands such as Coca-Cola, Nike, or Samsung are betting big on programmatic in-app video ads, leveraging the success of platforms like Netflix (and Disney+ with ads) and mobile gaming platforms (like Unity Ads and AdMob).

The industry is expected to witness sustainable growth in the upcoming years, owing to the increasing adoption of automation, guaranteed ad systems, and the rise in consumption of mobile/online video content over digital platforms.

By 2025, automated guaranteed distribution will represent a large share of industry sales. This simplifies direct dealings between advertisers and publishers, reducing the need for manual processes like troubleshooting discrepancies and managing multiple invoices.

With companies such as Google (DV360), The Trade Desk, and Adobe Advertising Cloud pioneering the move toward automated guaranteed deals, advertisers now benefit from greater efficiency and improved negotiating power. This growing automation, in turn, is likely to impact the adoption and provide a significant push to the industry share.

A private marketplace (PMP) is an invitation-only marketplace where suppliers of ad inventory (usually premium publishers) offer inventory to a select group of advertisers. Publishers benefit from greater control over their inventory with platforms like Xandr (Microsoft), Magnite, and PubMatic, which allow them more freedom and flexibility to package and sell ad space as they please.

Brands, including Nike, Coca-Cola, and Procter & Gamble, work with advertisers who use PMPs to secure premium inventory and improve brand safety and ad performance. However, the transparency offered, in addition to reduced ad fraud risk, makes PMPs increasingly preferred across advertisers, propelling their implementation and further data studies claim PMPs to contribute significantly towards overall industry growth.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 9.5% |

| UK | 9.1% |

| European Union | 9.3% |

| Japan | 9.2% |

| South Korea | 9.6% |

The USA industry expands considerably by adopting AI-based automation, real-time auctions, and targeting through data by marketers. Organizations design intelligent programmatic platforms to optimize advertisement placement, deliver high audience engagement, and better return on investment.

Increased demand for customized ad experience, Omni channel-based advertisement practices, and dynamic creative optimization propel industry expansion. The USA digital advertising, e-commerce, and media industries leverage programmatic display solutions to enhance campaign delivery and maximum reach. In addition, regulatory requirements encourage businesses to adopt secure and transparent ad-buying solutions. FMI forecasts the USA industry to grow at 9.5% CAGR during the forecast period.

| Key Drivers in the USA | Details |

|---|---|

| Artificial intelligence-based automation | Enhances ad targeting and efficiency on digital media. |

| Real-time bidding | Enhances ad placements and return on investment. |

| Personalized ad experiences | Engage customers with compelling and relevant content. |

| Regulatory laws | Encourages security and openness in advertising transactions. |

The UK industry expands as companies utilize ad placement driven by artificial intelligence to maximize the targeting of audiences and campaign results. Organizations leverage programmatic advertisement solutions for enhanced budget optimization, advertisement pertinence, and conversion.

Growth in digital advertising, immediate data, and programmatic purchases of advertisements accelerate the industry's expansion. The British government has rigorous data privacy laws, and companies spend on secure and transparent programmatic solutions. The video and mobile ad trend also accelerates industry adoption.

| Key Drivers in the UK | Information |

|---|---|

| AI-powered ad placements | It makes campaigns more effective and targeting more accurate. |

| Automated budget optimization | It makes ad spending more effective and conversion rates higher. |

| Data privacy regulation | Drives investment in secure programmatic solutions. |

| Mobile and video ad growth | Improves opportunities for engagement and visibility. |

The European Union industry expands as business organizations embrace AI-based audience segmenting, real-time auctioning, and data-driven advertising campaigning. Germany, France, and Italy lead the industry by implementing programmatic display advertisements in online marketing campaigns.

The European Union is well-supported by data privacy legislation, and the companies are investing in programmatic solutions that are GDPR compliant. The development of machine learning and predictive analytics also accelerates the increase in programmatic advertising on a cross-industry basis. According to FMI, the European Union's industry is also expected to grow at a 9.3% CAGR during the study period.

| Growth Drivers in the European Union | Information |

|---|---|

| AI-driven audience segmentation | Boosts accuracy of target audience and enhanced campaign performance. |

| GDPR-compliant solutions | Protects data and regulatory compliance. |

| Predictive analytics | Enhances ad personalization and consumer interaction. |

| Real-time bidding | Optimizes ad placement for impact. |

The Japanese industry expands as business houses adopt AI-powered ad optimization, automated purchases, and cross-channel advertising. Business houses design innovative programmatic ad solutions to expand audience reach, brand remembrance, and engagement rate.

Japan's emphasis on high-precision consumer behavior analysis and high-precision marketing drives programmatic display adoption. Retail, finance, and entertainment sectors spend on AI-based ad campaigns to lead the industry.

| Growth Drivers in Japan | Information |

|---|---|

| AI-based ad optimization | Increases engagement and reach via data insights. |

| Consumer behavior analysis | Directs targeted advertising strategies. |

| Cross-channel ads | Turns brand presence across channels. |

| Industry investments | Retail, finance, and entertainment sectors lead adoption. |

The South Korean industry grows incrementally with the rising use of AI-based ad targeting, programmatic video ads, and automated media buying as business-as-usual. Governmental digital transformation projects encourage companies to adopt programmatic advertising.

Advertisers adopt real-time advertising, data analytics, and machine learning processes to improve advertisement performance. Additionally, innovation in connected TV advertising and custom-programmatic practices improves opportunity within the industry. South Korea's industry will expand at a 9.6% CAGR during the study period by FMI.

| Growth Drivers in South Korea | Information |

|---|---|

| Targeting advertisements via AI | Enhances accuracy in segmenting audiences. |

| Programmatic video advertising | Increases engagement and conversion rates. |

| Government digital programs | Facilitates business adoption of programmatic offerings. |

| Connected TV advertising | Expands industry coverage and revenue opportunity. |

The industry is now growing quickly, with advertisers turning more to automated ad buying to enhance targeting accuracy, increase efficiency, and improve ROI. Some key drivers to this demand include AI bidding technologies, real-time analytics, and data-driven advertisement personalization, which are seeking more intelligent and adaptive advertising solutions.

Industry share leaders like Google, The Trade Desk, Amazon Advertising, Magnite, and Adobe Advertising Cloud command the majority share of the industry thanks to their highly sophisticated demand-side platforms (DSPs) and supply-side platforms (SSPs). These companies are focused on advancing AI-driven ad placements along with predictive analytics and Omni channel programmatic solutions that enable optimal ad performance across web, mobile, video, and connected TV (CTV) environments.

Start-ups and niche solution providers disrupt the players by creating privacy-oriented targeting solutions, contextual advertising models, and blockchain-based transparency tools against the backdrop of recent data privacy regulations like GDPR and CCPA. Mergers and acquisitions across the space combined with integrations with customer data platforms (CDPs) and data management platforms (DMPs) are increasing the competitive pressure.

As cookie-based tracking begins to fade out and privacy-first approaches to advertising begin to take hold, the competitor landscape will favour companies using first-party data strategies, AI-driven contextual targeting, and a bridged cross-channel programmatic execution.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Google Ads | 25-30% |

| Amazon Advertising | 15-20% |

| The Trade Desk | 12-17% |

| Adobe Advertising Cloud | 8-12% |

| Magnite | 5-9% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Google Ads | Provides AI-powered programmatic ad bidding, real-time analytics, and audience segmentation tools. |

| Amazon Advertising | Develops programmatic advertising solutions for e-commerce brands, leveraging first-party shopping data. |

| The Trade Desk | Specializes in demand-side platform technology, cross-channel programmatic buying, and real-time bidding. |

| Adobe Advertising Cloud | Focuses on AI-driven ad targeting, omnichannel advertising solutions, and automated campaign management. |

| Magnite | Offers supply-side platform solutions, connected TV advertising and publisher monetization tools. |

Key Company Insights

Google Ads (25-30%)

With its AI-powered bidding, automated audience segmentation, and real-time campaign analytics, dominates the industry space.

Amazon Advertising (15-20%)

Industry leaders in e-commerce advertising with a twist on industry solutions have created a wealth of consumer shopping data harnessed for targeted placements.

The Trade Desk (12-17%)

The Trade Desk is a leading technological provider of a demand-side platform, real-time ad bidding, and omnichannel programmatic advertising.

Adobe Advertising Cloud (8-12%)

Adobe Advertising Cloud optimizes digital campaigns, using AI to target consumers and data to place ads.

Magnite (5-9%)

Magnite gives programmatic monetization, supply-side platform technologies, and advanced advertising for connected TV and digital publishers.

Other Key Players (20-30% Combined)

By ad format, the industry covers online display, online video, mobile display, and mobile video.

By sales channel, the industry includes real time bidding (RTB), private market places (PMP), and automated guaranteed (AG).

Region wise, the industry is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA).

The industry is slated to reach USD 85.4 billion in 2025.

The industry is predicted to reach USD 1,883.4 billion by 2035.

The key companies in the industry include oogle Ads, Amazon Advertising, The Trade Desk, Adobe Advertising Cloud, Magnite, PubMatic, Criteo, MediaMath, Xandr (Microsoft), and Verizon Media.

South Korea, poised to witness 9.6% CAGR during the study period, is slated for fastest growth.

Mobile videos are being widely deployed.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Ad Format, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Ad Format, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Ad Format, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ Million) Forecast by Ad Format, 2018 to 2033

Table 12: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Ad Format, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Ad Format, 2018 to 2033

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: East Asia Market Value (US$ Million) Forecast by Ad Format, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Ad Format, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Ad Format, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Ad Format, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Ad Format, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Ad Format, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 13: Global Market Attractiveness by Ad Format, 2023 to 2033

Figure 14: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Ad Format, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Ad Format, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Ad Format, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Ad Format, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 28: North America Market Attractiveness by Ad Format, 2023 to 2033

Figure 29: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Ad Format, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Ad Format, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Ad Format, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Ad Format, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Ad Format, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ Million) by Ad Format, 2023 to 2033

Figure 47: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 48: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ Million) Analysis by Ad Format, 2018 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Ad Format, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Ad Format, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Ad Format, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ Million) by Ad Format, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Ad Format, 2018 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Ad Format, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Ad Format, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Ad Format, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Market Value (US$ Million) by Ad Format, 2023 to 2033

Figure 77: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Ad Format, 2018 to 2033

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Ad Format, 2023 to 2033

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Ad Format, 2023 to 2033

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness by Ad Format, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Ad Format, 2023 to 2033

Figure 92: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) Analysis by Ad Format, 2018 to 2033

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Ad Format, 2023 to 2033

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Ad Format, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 101: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 103: East Asia Market Attractiveness by Ad Format, 2023 to 2033

Figure 104: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ Million) by Ad Format, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Ad Format, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Ad Format, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Ad Format, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Ad Format, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Display Material Market Size and Share Forecast Outlook 2025 to 2035

Display Packaging Market Size and Share Forecast Outlook 2025 to 2035

Display Panel Market Size and Share Forecast Outlook 2025 to 2035

Display Pallets Market Size and Share Forecast Outlook 2025 to 2035

Display Controllers Market by Type, Application, and Region-Forecast through 2035

Displays Market Insights – Growth, Demand & Forecast 2025 to 2035

Display Drivers Market Growth – Size, Demand & Forecast 2025 to 2035

Market Share Distribution Among Display Pallet Manufacturers

Display Paper Box Market

Display Cabinets Market

3D Display Market Size and Share Forecast Outlook 2025 to 2035

4K Display Resolution Market Size and Share Forecast Outlook 2025 to 2035

3D Display Module Market

LED Displays, Lighting and Fixtures Market Size and Share Forecast Outlook 2025 to 2035

OLED Display Market Size and Share Forecast Outlook 2025 to 2035

Microdisplay Market Size and Share Forecast Outlook 2025 to 2035

IGZO Display Market Size and Share Forecast Outlook 2025 to 2035

Food Display Counter Market Size and Share Forecast Outlook 2025 to 2035

4K VR Displays Market Size and Share Forecast Outlook 2025 to 2035

Shelf Display Trays Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA