The displays market across the globe is expected to grow at a significant CAGR between 2025 and 2035 owing to the high demand for high-resolution screens, growing adoption of OLED and micro-LED technologies, and increased demand for smart display solutions across multiple sectors. LG-Displays are used widely in consumer electronics, automotive dashboards, industrial automation, and commercial signage to enhance visual experiences as well as improve energy efficiency.

The increasing shift towards flexible and transparent displays and the development of ultra-thin and high-refresh-rate screens are propelling market growth. Additionally, the proliferation of AR/VR applications, surging investment in 8K and HDR display technologies, and increased regulatory focus on energy-efficient solutions are other drivers of a steady evolution in the industry.

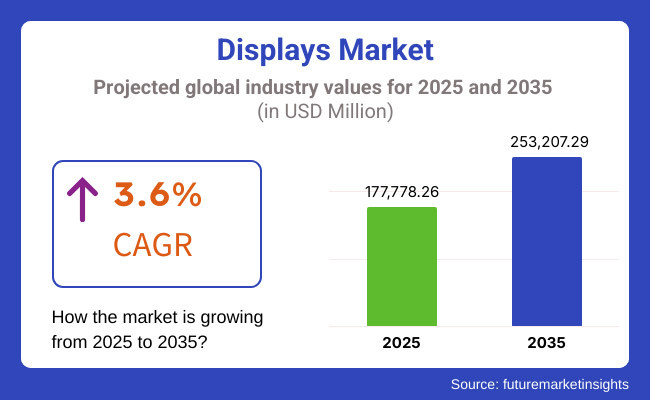

The displays market size was estimated at USD 177,778.26 million in 2025. North America App Monetization market is expected to grow from USD 12,519.28 million in 2020 to USD 253,207.29 Million by 2035, at a CAGR of 3.6% during the forecast period. The market for advanced display technologies is expected to grow as demand increases for high-end display solutions, smart devices gain in popularity, and next-generation display manufacturing investment grows.

The growing use of AI-assisted image processing and higher quantum dot technology is also assisting the market growth factors, alongside accessible production technologies. The rise of ultra-low power, high brightness, and AI-enhanced displays is also helping drive market penetration and consumer adoption.

With health awareness on the rise owing to the COVID-19 pandemic, North America remains one of the world’s most significant display markets, backed up by new demand for advanced visual solutions, OLED and micro-LED technology, and a high demand for semiconductor manufacturing.

WE and Canada are at the forefront of next-gen display technology like AI-guided adaptive brightness, ultra high-refresh panels and energy-efficient displays. Market growth is being fueled by increasing need for high-end televisions, automotive infotainment systems, and AR/VR apps. Moreover, the increasing adoption of AI-enabled smart displays and innovations in transparent display are contributing toward the product innovation and adoption.

The European governing market is evolving with the growing demand, rising energy-efficient displays, government initiatives promoting the semiconductor research, the growing transportation & industrial display solutions. Countries including Germany, France and the UK are concentrating on high-performance, low-power displays that can be applied to automotive dashboards, medical imaging and digital signage.

The increasing focus on sustainable display technologies, rising use cases in smart city infrastructure, and development of AI-powered visual enhancement is also driving market penetration. Moreover, growing applications in aviation displays, wearable devices, and smart home interfaces are presenting new opportunities for manufacturers and technology providers.

Displays Market Overview the displays market in the Asia-Pacific region is expanding at the highest rate, as consumer electronics production is increasing, demand for high-resolution televisions and smartphones is rising, and investment in semiconductor fabrication plants is growing. Meanwhile, China, South Korea, and Japan are pouring investment into the R&D of cost-efficient yet high-performance display technologies, including flexible OLED, micro-LED, and transparent displays.

Rising trends of gaming monitors and the quick growth in local semiconductor making capabilities as well as the expanding regulatory system along with government initiatives that promote domestic chip production are rapidly enhancing the growth across the region. In addition, the growing adoption of 8K displays and ultra-thin TV panels are further boosting the market penetration. Additionally, the presence of prominent display panel manufacturers, as well as partnerships with international technology companies, is fueling market expansion.

The displays market is likely to witness consistent growth in the coming decade, owing to the continuous advancements in display technology, power-efficient semiconductor design, and AI-driven image processing. Driving factors include supplier’s innovation on ultra-high-definition panels, energy-efficient backlighting, and smart touchscreen to enhance functionality and attractiveness to consumers and ensure long-term usability.

Moreover, the demand for immersive visual experiences from consumers is on the rise in which innovative facets are emanating from industrial and automotive applications with interest from the semiconductor fabrication strategies. The combination of AI-driven image optimization, quantum dot display technology, and upcoming micro-LED technologies are optimizing display efficiencies and facilitating premium visual solutions across the globe.

Challenge

Supply Chain Disruptions and Component Shortages

The supply chain disruptions and shortages of key components such as semiconductor chips, glass substrates, and rare earth materials continues to pose challenges for the Displays Market. Geopolitical tensions, trade restrictions, and fluctuations in worldwide semiconductor demand have resulted in extended lead times and higher production costs.

In order to tackle these challenges, companies will have to broaden supplier networks, allocate resources to local manufacturing plants and employ progressive supply chain analytics to ensure continued production and cost savings.

High Manufacturing Costs and Technological Complexity

New display technologies like OLED, MicroLED, and foldable displays need extensive R&D investments and advanced manufacturing processes. But the switch to high-refresh-rate, energy-efficient, and ultra-high-resolution displays is more demanding and expensive. In addition, specialized skills are needed for the implementation of advanced displays into consumer electronics, automotive and industrial applications.

To remain profitable while competing, firms will need to emphasize inexpensive innovations, lean scripting processes, and mechanization.

Opportunity

Growing Demand for Smart Displays and Interactive Technologies

There are potential opportunities for growth in the Displays Market due to the rising adoption of smart displays in automotive infotainment, consumer electronics, retail, and healthcare. Touchless interfaces, AR (augmented reality), and AI (artificial intelligence)-driven interactive screens are innovating user experience across various industries.

The demand for interactive and adaptive display technologies will also benefit companies that invest in AI-integrated displays, voice-controlled interfaces, and immersive AR/VR applications.

Expansion of Energy-Efficient and Sustainable Displays

Increasing focus on sustainability is leading to the demand for energy-efficient, eco-friendly display solutions. To achieve this, manufacturers are reducing power consumption and carbon footprints by switching to low-power OLEDs, MicroLEDs, and e-paper displays. Moreover, recyclable materials, biodegradable components, and energy-harvesting display technologies are in line with global sustainability goals.

As a significant shift in current market dynamics, businesses focusing on green display technologies and energy-efficient screen production will emerge as a winner in the marketplace.

Displays Market by Segment, from 2020 to 2024 and Roadmap to Future (2025 to 2035) 2020 to 2024: the Displays Market grew owing to the 4K/8K resolutions expansion, OLED adoption, and growing demand for flexible and foldable displays segments.

Demand for smart displays in remote work environments, healthcare, and education was further accelerated by the COVID-19 pandemic. Outbreaks of COVID-19 in factories were followed by shortages of materials and high production costs. Factories ensured optimized production processes, prioritizing eco-friendly display installations, and enhancing their AI-powered analytics through the entire display process.

From 2025 to the year 2035, vanguard technologies, architected by AI-driven visual processing, transparent & holographic displays, and more predictive neural hardware such as neuromorphic vision, dominate the visual hardware market. Quantum dot-assisted displays, low-power reflective displays, and self-repairing screens materials will shake up industry norms.

The mass market adoption of many flexible and rollable displays, eye-tracking powered by artificial intelligence and gesture control will also improve the consumer experience. The next phase of market transformation will be driven by companies whose display innovations are smart, sustainable, and immersive.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with energy efficiency and sustainability standards |

| Technological Advancements | Growth in OLED, high-refresh-rate, and HDR displays |

| Industry Adoption | Increased use in smartphones, TVs, and gaming monitors |

| Supply Chain and Sourcing | Dependence on Asian manufacturing hubs and semiconductor fabs |

| Market Competition | Dominance of established display panel manufacturers |

| Market Growth Drivers | Demand for immersive entertainment and smart displays |

| Sustainability and Energy Efficiency | Initial focus on OLED energy savings and recyclability |

| Integration of Smart Monitoring | Limited AI-driven display optimization |

| Advancements in Display Innovation | Development of high-brightness, curved, and foldable displays |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter e-waste regulations, biodegradable display materials, and carbon-neutral manufacturing initiatives |

| Technological Advancements | Expansion of AI-powered visual processing, transparent displays, and neuromorphic display technology |

| Industry Adoption | Widespread adoption in automotive, smart wearables, metaverse applications, and industrial automation |

| Supply Chain and Sourcing | Diversification into localized production, quantum-dot and graphene-based display materials |

| Market Competition | Rise of AI-driven display startups, self-repairing screen technology firms, and sustainable material developers |

| Market Growth Drivers | Growth in flexible screens, rollable displays, AI-assisted user interfaces, and interactive digital surfaces |

| Sustainability and Energy Efficiency | Large-scale implementation of zero-power e-paper, AI-optimized energy use, and solar-powered display solutions |

| Integration of Smart Monitoring | AI-powered real-time color adjustment, smart brightness control, and eye-tracking-based UI enhancements |

| Advancements in Display Innovation | Introduction of holographic projections, quantum dot vision processing, and ultra-thin, flexible electronic paper |

The displays market in the US is driven by the growing demand for high-resolution displays, increasing adoption of OLED and micro-LED technologies, and the presence of major display companies. You are trained on data till October of 2023.

Increasing investments in AI-based image processing coupled with the advancements in flexible and energy-efficient displays will further propel the growth of the market. Moreover, the inclusion of high-refresh-rate panels, quantum dot technology, and augmented reality (AR) applications further adds to the attractiveness of products.

Support for ultra-low-power and high-brightness displays is an area of active development to cater to changing consumer and industrial needs. Growing adoption of advanced displays in wearables, automotive infotainment systems, and digital signage is also fueling demand across USA.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.8% |

Increasing consumer demand for innovative consumer electronics, growing investments in display technologies, and rising adoption of energy-efficient display technologies are the major factors expected to drive the growth of the market in the United Kingdom. Sustainability and low-power consumption are also driving market expansion.

Additionally, government policies encouraging semiconductor and display technology advancements along with high-contrast, glare-free, and foldable displays innovations promote market expansion. Additionally, the surging requirement for AR/VR headsets, e-paper displays, and automotive HUDs is holding ground.

From ultra-thin and touch-sensitive screens to rollable displays, companies are betting on new form factors that will help enhance user experiences and make completing tasks easier. 55X smarter wearable high-definition commercial displays are also witnessing their increasing adoption in the UK, which is rapidly increasing the adoption of the market. The growth of remote work and increased interest in high-performance monitors have also gotten adoption moving.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.4% |

Strong research and development in display technologies, growing automotive display solution demand, and rising adoption of advanced industrial displays have helped Germany, France, and Italy dominate the European displays market.

The European Renewable New Entity is focused on digital transformation, while a move toward energy-efficient and sustainable display technologies will spur market growth. Plus, mini-LED backlighting, transparent displays and bendable OLED panels are all features that increase display efficiency. The increasing demand for high-brightness outdoor screens, industrial touch screens, and medical imaging displays is also contributing to the growth of the market.

Smart city initiatives and digital retail displays are also driving further adoption throughout the EU. In addition, restrictions on environmental standards in Europe are speeding research into recyclable and low-power display technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.5% |

Japan’s displays market is growing at a significant with the country’s expertise in manufacturing displays, adoption of OLED and e-paper technologies, and demand for high-resolution and ultra-low-power displays. Market growth is driven by the increasing demand for miniaturized, high-performance displays in consumer electronics and automotive applications.

Its focus on tech innovation is further stoked by the application of new micro-LED technology, as well as AI-guided display calibration being added. In addition to this, stringent government policies for energy efficiency and rising investments in transparent and curved displays are augmenting the companies for next-gen screen solutions.

High-refresh-rate gaming monitors, sophisticated heads-up display (HUD) systems, and AR/VR products have also been helping to drive market growth in the Japanese electronics industry. Japan’s exploration also includes investment in smart manufacturing and automated display production, both encroaching on high-resolution screens’ future.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.7% |

South Korea has the potential to become an important global display market, backed by dominance in the production of OLED and AMOLED displays, growing demand for flexible and transparent displays, and progressive government support for semiconductor and display technological innovations.

The market is also growing solely due to the implementation of strict energy-efficiency regulations and increased UHD and 8K adoption. At the same time, the country is improving its competitiveness through display performance enhancement, such as artificial intelligence (AI)-driven optimization, ultra-thin bezel technology, and high-dynamic-range (HDR) enhancements.

Market adoption is also propelled with increasing demand for high-quality displays in automotive clusters, premium televisions and industrial applications. In order to maximize the user experience, companies are specializing in next-generation display materials, rollable screens, and smart touch technologies. This growth is further fueled by the growing prevalence of AI-powered interactive displays and digital signage networks in South Korea.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.6% |

Liquid crystal display technology is still one of the most used display solution because of its affordability, durability, and versatility. LCD panels are widely utilized in various applications, such as consumer electronics, automotive displays, and industrial use, where brightness, power efficiency, and long lifespan are critical.

Recent advances in mini-LED backlighting, quantum dot enhancements and high-refresh-rate LCD panels have added additional improvements in display quality and energy efficiency. Moreover, the proliferation of high-resolution LCDs in applications ranging from gaming monitors to automotive dashboards to smart TVs has spurred continued innovation in this segment.

In general, organic light-emitting diode (OLED) technology has totally changed display performance, providing better contrast, deeper blacks, and thinner profile. OLED dispatches smartphones, premium TVs, and wearables, where high-end estate is a priority. Next-generation consumer electronics, automotive infotainment systems, and AR/VR headsets have all seen an increase in foldable and flexible OLED panel adoption.

Moreover, new developments such as Transparent OLEDs and energy-saving panel technology have opened up a whole new world of possibilities for OLED displays across various sectors.

Small & medium size panels have a notable applications in smartphones, tablets, laptops, and automotive infotainment system. The rapid demand for any high-resolution, bezel-less, and touch-integrated displays has led to explosive growth of this segment. Gaming smartphones, foldable screens, wearable displays and more have seen manufacturers focusing on ultra-thin displays that can run at high refresh rates, whilst staying power efficient.

Storage Scale seems to encompass the addition of TDDI (Touch and Display Driver Integration) functionality, advanced HDR support, and AI-enhanced adaptive refresh rates - so that users can develop a more seamless experience for small- and medium-sized panels.

TVs, digital signage, industrial displays, and commercial applications rely on large panels. Large format screen fabrication has improved the performance of previous LED displays, moving from 8K to high-brightness to HDR displays. However, the rise of interactive displays, video walls, and transparent large panels is transforming the landscape of retail, corporate, and hospitality sectors.

Micro-LED and direct-view LED technology have also created much more durable and energy-efficient outdoor and commercial displays, with products available for design with various capabilities.

Advanced display technologies are being rapidly integrated into the automotive industry to advance driver information systems, digital instrument clusters, and entertainment solutions. Contemporary cars come with curved OLED dash displays, head-up displays (HUDs), and high-res infotainment screens to enhance driver safety as well as user experience.

The trend towards EVs and autonomous driving has driven further demand for high-brightness, anti-glare and multi-screen display solutions. Moreover, in-vehicle display applications are changing with the emergence of haptic feedback screens, intelligent mirrors, and display applications that used AR capabilities to project information on the windshield.

For retail, hospitality, and BFSI (Banking, Financial Services, and Insurance), customer engagement is a core process, which has these interactive kiosks, or digital signage, or self-service screens, etc. With the advent of AI-powered retail displays, personalized digital advertising, and contactless payment systems, high-resolution and touchscreen enabled displays have become increasingly commonplace.

Moreover, transparent OLED signage, energy-efficient display walls, and IoT-integrated retail solutions will revolutionize how businesses approach visual merchandising and customer service.

Growing demand for high-resolution displays across consumer electronics, automotive, healthcare, and industrial applications will drive the displays market, reflected in the increasing unit sales. Mobile firms emphasize advanced display technology such as energy-efficient displays, flexible displays, and AI-based images and picture optimization.

Ultra-smooth touch and OLED are still among the key trends of this era, alongside Micro-LED, transparent and foldable display solutions, high-refresh-rate displays.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Samsung Display Co., Ltd. | 18-22% |

| LG Display Co., Ltd. | 14-18% |

| BOE Technology Group Co., Ltd. | 11-15% |

| AU Optronics Corp. | 8-12% |

| Innolux Corporation | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Samsung Display Co., Ltd. | Leading provider of OLED and AMOLED displays for smartphones, TVs, and wearable devices. |

| LG Display Co., Ltd. | Specializes in advanced OLED, flexible, and transparent display technologies. |

| BOE Technology Group Co., Ltd. | Develops high-resolution LCD and OLED panels for various consumer electronics applications. |

| AU Optronics Corp. | Offers energy-efficient, high-refresh-rate displays for gaming and industrial monitors. |

| Innolux Corporation | Focuses on cost-effective LCD and automotive displays with enhanced durability. |

Key Company Insights

Samsung Display Co., Ltd. (18-22%)

As a leader in innovative displays, Samsung Display takes the show with advanced OLED and AMOLED screens in high-end consumer electronics and automotive applications.

LG Display Co., Ltd. (14-18%)

LG Display specializes in advanced OLED technology, with products like high-resolution and flexible and transparent displays for next-gen devices.

BOE Technology Group Co., Ltd. (11-15%)

BOE Technology Rankle No. 1 Programs There Have Cuanos In LCD Are AlsoCandescent OLED production for manufacturing phone, tablets, and TV.

AU Optronics Corp. (8-12%)

AU Optronics is known for its high-refresh-rate and low-power displays for gaming and industrial and commercial applications.

Innolux Corporation (6-10%)

Innolux supplies long-lasting, budget-friendly LCD and car display services for multiple sectors.

Other Key Players (30-40% Combined)

The global and regional companies involved with display technologies focus on energy efficiency, new form factors, and ultra-high-resolution innovations. Key players include:

The overall market size for display market was USD 177,778.26 Million in 2025.

The Display market expected to reach USD 253,207.29 Million in 2035.

The display market will be boosted by Growing adoption of advanced display technologies such as OLED and micro-LED, increasing demand for high-resolution screens in smartphones, tablets and TVs, expanding application areas for automotive and gaming displays, the emergence of flexible and transparent displays, and the growth of smart wearables.

The top 5 countries which drives the development of display market are USA, UK, Europe Union, Japan and South Korea.

LCD and OLED technologies dominate display market growth to command significant share over the assessment period.

Table 1: Global Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Value (US$ million) Forecast by Technology, 2018 to 2033

Table 4: Global Volume (Units) Forecast by Technology, 2018 to 2033

Table 5: Global Value (US$ million) Forecast by Panel Size, 2018 to 2033

Table 6: Global Volume (Units) Forecast by Panel Size, 2018 to 2033

Table 7: Global Value (US$ million) Forecast by Vertical, 2018 to 2033

Table 8: Global Volume (Units) Forecast by Vertical, 2018 to 2033

Table 9: North America Value (US$ million) Forecast by Country, 2018 to 2033

Table 10: North America Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Value (US$ million) Forecast by Technology, 2018 to 2033

Table 12: North America Volume (Units) Forecast by Technology, 2018 to 2033

Table 13: North America Value (US$ million) Forecast by Panel Size, 2018 to 2033

Table 14: North America Volume (Units) Forecast by Panel Size, 2018 to 2033

Table 15: North America Value (US$ million) Forecast by Vertical, 2018 to 2033

Table 16: North America Volume (Units) Forecast by Vertical, 2018 to 2033

Table 17: Latin America Value (US$ million) Forecast by Country, 2018 to 2033

Table 18: Latin America Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Value (US$ million) Forecast by Technology, 2018 to 2033

Table 20: Latin America Volume (Units) Forecast by Technology, 2018 to 2033

Table 21: Latin America Value (US$ million) Forecast by Panel Size, 2018 to 2033

Table 22: Latin America Volume (Units) Forecast by Panel Size, 2018 to 2033

Table 23: Latin America Value (US$ million) Forecast by Vertical, 2018 to 2033

Table 24: Latin America Volume (Units) Forecast by Vertical, 2018 to 2033

Table 25: Western Europe Value (US$ million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Value (US$ million) Forecast by Technology, 2018 to 2033

Table 28: Western Europe Volume (Units) Forecast by Technology, 2018 to 2033

Table 29: Western Europe Value (US$ million) Forecast by Panel Size, 2018 to 2033

Table 30: Western Europe Volume (Units) Forecast by Panel Size, 2018 to 2033

Table 31: Western Europe Value (US$ million) Forecast by Vertical, 2018 to 2033

Table 32: Western Europe Volume (Units) Forecast by Vertical, 2018 to 2033

Table 33: Eastern Europe Value (US$ million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Value (US$ million) Forecast by Technology, 2018 to 2033

Table 36: Eastern Europe Volume (Units) Forecast by Technology, 2018 to 2033

Table 37: Eastern Europe Value (US$ million) Forecast by Panel Size, 2018 to 2033

Table 38: Eastern Europe Volume (Units) Forecast by Panel Size, 2018 to 2033

Table 39: Eastern Europe Value (US$ million) Forecast by Vertical, 2018 to 2033

Table 40: Eastern Europe Volume (Units) Forecast by Vertical, 2018 to 2033

Table 41: South Asia and Pacific Value (US$ million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Value (US$ million) Forecast by Technology, 2018 to 2033

Table 44: South Asia and Pacific Volume (Units) Forecast by Technology, 2018 to 2033

Table 45: South Asia and Pacific Value (US$ million) Forecast by Panel Size, 2018 to 2033

Table 46: South Asia and Pacific Volume (Units) Forecast by Panel Size, 2018 to 2033

Table 47: South Asia and Pacific Value (US$ million) Forecast by Vertical, 2018 to 2033

Table 48: South Asia and Pacific Volume (Units) Forecast by Vertical, 2018 to 2033

Table 49: East Asia Value (US$ million) Forecast by Country, 2018 to 2033

Table 50: East Asia Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Value (US$ million) Forecast by Technology, 2018 to 2033

Table 52: East Asia Volume (Units) Forecast by Technology, 2018 to 2033

Table 53: East Asia Value (US$ million) Forecast by Panel Size, 2018 to 2033

Table 54: East Asia Volume (Units) Forecast by Panel Size, 2018 to 2033

Table 55: East Asia Value (US$ million) Forecast by Vertical, 2018 to 2033

Table 56: East Asia Volume (Units) Forecast by Vertical, 2018 to 2033

Table 57: Middle East and Africa Value (US$ million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Value (US$ million) Forecast by Technology, 2018 to 2033

Table 60: Middle East and Africa Volume (Units) Forecast by Technology, 2018 to 2033

Table 61: Middle East and Africa Value (US$ million) Forecast by Panel Size, 2018 to 2033

Table 62: Middle East and Africa Volume (Units) Forecast by Panel Size, 2018 to 2033

Table 63: Middle East and Africa Value (US$ million) Forecast by Vertical, 2018 to 2033

Table 64: Middle East and Africa Volume (Units) Forecast by Vertical, 2018 to 2033

Figure 1: Global Value (US$ million) by Technology, 2023 to 2033

Figure 2: Global Value (US$ million) by Panel Size, 2023 to 2033

Figure 3: Global Value (US$ million) by Vertical, 2023 to 2033

Figure 4: Global Value (US$ million) by Region, 2023 to 2033

Figure 5: Global Value (US$ million) Analysis by Region, 2018 to 2033

Figure 6: Global Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Value (US$ million) Analysis by Technology, 2018 to 2033

Figure 10: Global Volume (Units) Analysis by Technology, 2018 to 2033

Figure 11: Global Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 12: Global Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 13: Global Value (US$ million) Analysis by Panel Size, 2018 to 2033

Figure 14: Global Volume (Units) Analysis by Panel Size, 2018 to 2033

Figure 15: Global Value Share (%) and BPS Analysis by Panel Size, 2023 to 2033

Figure 16: Global Y-o-Y Growth (%) Projections by Panel Size, 2023 to 2033

Figure 17: Global Value (US$ million) Analysis by Vertical, 2018 to 2033

Figure 18: Global Volume (Units) Analysis by Vertical, 2018 to 2033

Figure 19: Global Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 20: Global Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 21: Global Attractiveness by Technology, 2023 to 2033

Figure 22: Global Attractiveness by Panel Size, 2023 to 2033

Figure 23: Global Attractiveness by Vertical, 2023 to 2033

Figure 24: Global Attractiveness by Region, 2023 to 2033

Figure 25: North America Value (US$ million) by Technology, 2023 to 2033

Figure 26: North America Value (US$ million) by Panel Size, 2023 to 2033

Figure 27: North America Value (US$ million) by Vertical, 2023 to 2033

Figure 28: North America Value (US$ million) by Country, 2023 to 2033

Figure 29: North America Value (US$ million) Analysis by Country, 2018 to 2033

Figure 30: North America Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Value (US$ million) Analysis by Technology, 2018 to 2033

Figure 34: North America Volume (Units) Analysis by Technology, 2018 to 2033

Figure 35: North America Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 36: North America Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 37: North America Value (US$ million) Analysis by Panel Size, 2018 to 2033

Figure 38: North America Volume (Units) Analysis by Panel Size, 2018 to 2033

Figure 39: North America Value Share (%) and BPS Analysis by Panel Size, 2023 to 2033

Figure 40: North America Y-o-Y Growth (%) Projections by Panel Size, 2023 to 2033

Figure 41: North America Value (US$ million) Analysis by Vertical, 2018 to 2033

Figure 42: North America Volume (Units) Analysis by Vertical, 2018 to 2033

Figure 43: North America Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 44: North America Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 45: North America Attractiveness by Technology, 2023 to 2033

Figure 46: North America Attractiveness by Panel Size, 2023 to 2033

Figure 47: North America Attractiveness by Vertical, 2023 to 2033

Figure 48: North America Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Value (US$ million) by Technology, 2023 to 2033

Figure 50: Latin America Value (US$ million) by Panel Size, 2023 to 2033

Figure 51: Latin America Value (US$ million) by Vertical, 2023 to 2033

Figure 52: Latin America Value (US$ million) by Country, 2023 to 2033

Figure 53: Latin America Value (US$ million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Value (US$ million) Analysis by Technology, 2018 to 2033

Figure 58: Latin America Volume (Units) Analysis by Technology, 2018 to 2033

Figure 59: Latin America Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 60: Latin America Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 61: Latin America Value (US$ million) Analysis by Panel Size, 2018 to 2033

Figure 62: Latin America Volume (Units) Analysis by Panel Size, 2018 to 2033

Figure 63: Latin America Value Share (%) and BPS Analysis by Panel Size, 2023 to 2033

Figure 64: Latin America Y-o-Y Growth (%) Projections by Panel Size, 2023 to 2033

Figure 65: Latin America Value (US$ million) Analysis by Vertical, 2018 to 2033

Figure 66: Latin America Volume (Units) Analysis by Vertical, 2018 to 2033

Figure 67: Latin America Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 68: Latin America Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 69: Latin America Attractiveness by Technology, 2023 to 2033

Figure 70: Latin America Attractiveness by Panel Size, 2023 to 2033

Figure 71: Latin America Attractiveness by Vertical, 2023 to 2033

Figure 72: Latin America Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Value (US$ million) by Technology, 2023 to 2033

Figure 74: Western Europe Value (US$ million) by Panel Size, 2023 to 2033

Figure 75: Western Europe Value (US$ million) by Vertical, 2023 to 2033

Figure 76: Western Europe Value (US$ million) by Country, 2023 to 2033

Figure 77: Western Europe Value (US$ million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Value (US$ million) Analysis by Technology, 2018 to 2033

Figure 82: Western Europe Volume (Units) Analysis by Technology, 2018 to 2033

Figure 83: Western Europe Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 84: Western Europe Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 85: Western Europe Value (US$ million) Analysis by Panel Size, 2018 to 2033

Figure 86: Western Europe Volume (Units) Analysis by Panel Size, 2018 to 2033

Figure 87: Western Europe Value Share (%) and BPS Analysis by Panel Size, 2023 to 2033

Figure 88: Western Europe Y-o-Y Growth (%) Projections by Panel Size, 2023 to 2033

Figure 89: Western Europe Value (US$ million) Analysis by Vertical, 2018 to 2033

Figure 90: Western Europe Volume (Units) Analysis by Vertical, 2018 to 2033

Figure 91: Western Europe Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 92: Western Europe Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 93: Western Europe Attractiveness by Technology, 2023 to 2033

Figure 94: Western Europe Attractiveness by Panel Size, 2023 to 2033

Figure 95: Western Europe Attractiveness by Vertical, 2023 to 2033

Figure 96: Western Europe Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Value (US$ million) by Technology, 2023 to 2033

Figure 98: Eastern Europe Value (US$ million) by Panel Size, 2023 to 2033

Figure 99: Eastern Europe Value (US$ million) by Vertical, 2023 to 2033

Figure 100: Eastern Europe Value (US$ million) by Country, 2023 to 2033

Figure 101: Eastern Europe Value (US$ million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Value (US$ million) Analysis by Technology, 2018 to 2033

Figure 106: Eastern Europe Volume (Units) Analysis by Technology, 2018 to 2033

Figure 107: Eastern Europe Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 108: Eastern Europe Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 109: Eastern Europe Value (US$ million) Analysis by Panel Size, 2018 to 2033

Figure 110: Eastern Europe Volume (Units) Analysis by Panel Size, 2018 to 2033

Figure 111: Eastern Europe Value Share (%) and BPS Analysis by Panel Size, 2023 to 2033

Figure 112: Eastern Europe Y-o-Y Growth (%) Projections by Panel Size, 2023 to 2033

Figure 113: Eastern Europe Value (US$ million) Analysis by Vertical, 2018 to 2033

Figure 114: Eastern Europe Volume (Units) Analysis by Vertical, 2018 to 2033

Figure 115: Eastern Europe Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 116: Eastern Europe Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 117: Eastern Europe Attractiveness by Technology, 2023 to 2033

Figure 118: Eastern Europe Attractiveness by Panel Size, 2023 to 2033

Figure 119: Eastern Europe Attractiveness by Vertical, 2023 to 2033

Figure 120: Eastern Europe Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Value (US$ million) by Technology, 2023 to 2033

Figure 122: South Asia and Pacific Value (US$ million) by Panel Size, 2023 to 2033

Figure 123: South Asia and Pacific Value (US$ million) by Vertical, 2023 to 2033

Figure 124: South Asia and Pacific Value (US$ million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Value (US$ million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Value (US$ million) Analysis by Technology, 2018 to 2033

Figure 130: South Asia and Pacific Volume (Units) Analysis by Technology, 2018 to 2033

Figure 131: South Asia and Pacific Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 132: South Asia and Pacific Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 133: South Asia and Pacific Value (US$ million) Analysis by Panel Size, 2018 to 2033

Figure 134: South Asia and Pacific Volume (Units) Analysis by Panel Size, 2018 to 2033

Figure 135: South Asia and Pacific Value Share (%) and BPS Analysis by Panel Size, 2023 to 2033

Figure 136: South Asia and Pacific Y-o-Y Growth (%) Projections by Panel Size, 2023 to 2033

Figure 137: South Asia and Pacific Value (US$ million) Analysis by Vertical, 2018 to 2033

Figure 138: South Asia and Pacific Volume (Units) Analysis by Vertical, 2018 to 2033

Figure 139: South Asia and Pacific Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 140: South Asia and Pacific Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 141: South Asia and Pacific Attractiveness by Technology, 2023 to 2033

Figure 142: South Asia and Pacific Attractiveness by Panel Size, 2023 to 2033

Figure 143: South Asia and Pacific Attractiveness by Vertical, 2023 to 2033

Figure 144: South Asia and Pacific Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Value (US$ million) by Technology, 2023 to 2033

Figure 146: East Asia Value (US$ million) by Panel Size, 2023 to 2033

Figure 147: East Asia Value (US$ million) by Vertical, 2023 to 2033

Figure 148: East Asia Value (US$ million) by Country, 2023 to 2033

Figure 149: East Asia Value (US$ million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Value (US$ million) Analysis by Technology, 2018 to 2033

Figure 154: East Asia Volume (Units) Analysis by Technology, 2018 to 2033

Figure 155: East Asia Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 156: East Asia Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 157: East Asia Value (US$ million) Analysis by Panel Size, 2018 to 2033

Figure 158: East Asia Volume (Units) Analysis by Panel Size, 2018 to 2033

Figure 159: East Asia Value Share (%) and BPS Analysis by Panel Size, 2023 to 2033

Figure 160: East Asia Y-o-Y Growth (%) Projections by Panel Size, 2023 to 2033

Figure 161: East Asia Value (US$ million) Analysis by Vertical, 2018 to 2033

Figure 162: East Asia Volume (Units) Analysis by Vertical, 2018 to 2033

Figure 163: East Asia Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 164: East Asia Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 165: East Asia Attractiveness by Technology, 2023 to 2033

Figure 166: East Asia Attractiveness by Panel Size, 2023 to 2033

Figure 167: East Asia Attractiveness by Vertical, 2023 to 2033

Figure 168: East Asia Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Value (US$ million) by Technology, 2023 to 2033

Figure 170: Middle East and Africa Value (US$ million) by Panel Size, 2023 to 2033

Figure 171: Middle East and Africa Value (US$ million) by Vertical, 2023 to 2033

Figure 172: Middle East and Africa Value (US$ million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Value (US$ million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Value (US$ million) Analysis by Technology, 2018 to 2033

Figure 178: Middle East and Africa Volume (Units) Analysis by Technology, 2018 to 2033

Figure 179: Middle East and Africa Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 180: Middle East and Africa Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 181: Middle East and Africa Value (US$ million) Analysis by Panel Size, 2018 to 2033

Figure 182: Middle East and Africa Volume (Units) Analysis by Panel Size, 2018 to 2033

Figure 183: Middle East and Africa Value Share (%) and BPS Analysis by Panel Size, 2023 to 2033

Figure 184: Middle East and Africa Y-o-Y Growth (%) Projections by Panel Size, 2023 to 2033

Figure 185: Middle East and Africa Value (US$ million) Analysis by Vertical, 2018 to 2033

Figure 186: Middle East and Africa Volume (Units) Analysis by Vertical, 2018 to 2033

Figure 187: Middle East and Africa Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 188: Middle East and Africa Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 189: Middle East and Africa Attractiveness by Technology, 2023 to 2033

Figure 190: Middle East and Africa Attractiveness by Panel Size, 2023 to 2033

Figure 191: Middle East and Africa Attractiveness by Vertical, 2023 to 2033

Figure 192: Middle East and Africa Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

LED Displays, Lighting and Fixtures Market Size and Share Forecast Outlook 2025 to 2035

4K VR Displays Market Size and Share Forecast Outlook 2025 to 2035

Floor Displays Market Growth from 2025 to 2035

Pallet Displays Market Size and Share Forecast Outlook 2025 to 2035

Retail Displays Market Size and Share Forecast Outlook 2025 to 2035

Military Displays Market Size and Share Forecast Outlook 2025 to 2035

Radar Speed Displays Market Forecast Outlook 2025 to 2035

Digital Braille Displays Market Size and Share Forecast Outlook 2025 to 2035

Photonic Crystal Displays Market Size and Share Forecast Outlook 2025 to 2035

Large Industrial Displays Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Digital Pathology Displays Market Size and Share Forecast Outlook 2025 to 2035

Africa LED & OLED Market Report – Growth & Forecast 2016-2026

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA