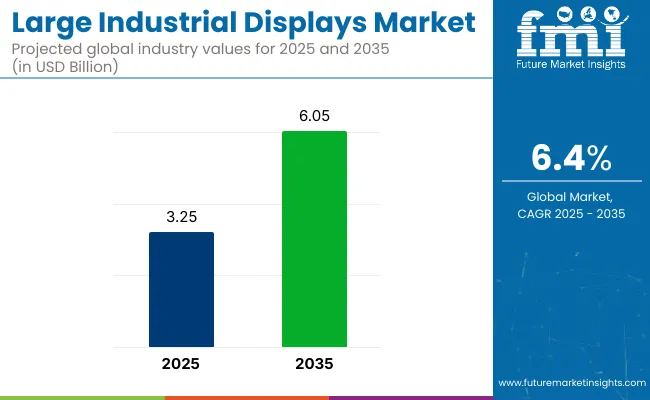

The global large industrial displays market is valued at USD 3.25 billion in 2025 and is expected to be worth USD 6.05 billion by 2035, which shows a CAGR of 6.4%. This growth is being driven by the increasing adoption of smart manufacturing systems, the demand for real-time data visualization, and the integration of advanced display technologies in automation workflows.

| Metric | Value |

|---|---|

| Market Size (2025) | USD 3.25 billion |

| Market Value (2035) | USD 6.05 billion |

| CAGR (2025 to 2035) | 6.4% |

Innovations in large industrial displays include the integration of AI-powered interfaces, AR-enabled diagnostics, and ultra-high brightness OLED and microLED panels. Companies are developing flexible, touchless, and nano-coated displays for harsh environments. Smart HMIs with IoT connectivity, predictive analytics, and energy-efficient designs are also being prioritized to enhance real-time data visualization and industrial automation across advanced manufacturing ecosystems.

Government initiatives promoting smart manufacturing and Industry 4.0 adoption, coupled with rising investments in automation, are driving the growth of the large industrial displays market. The integration of IoT-enabled touchscreen interfaces is enhancing operational efficiency across industrial environments. Applications such as human-machine interface (HMI) and process monitoring are expected to dominate, supported by demand for real-time visualization and control.

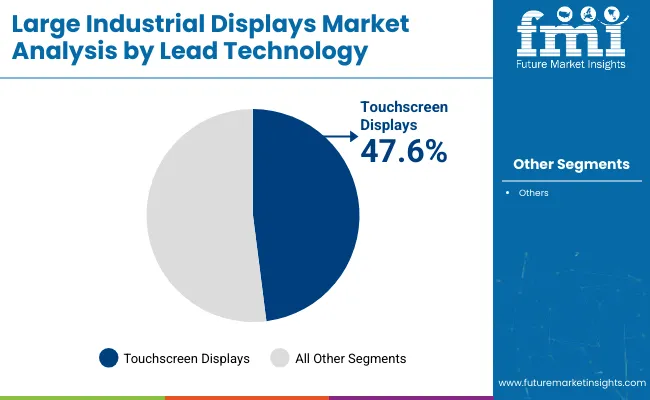

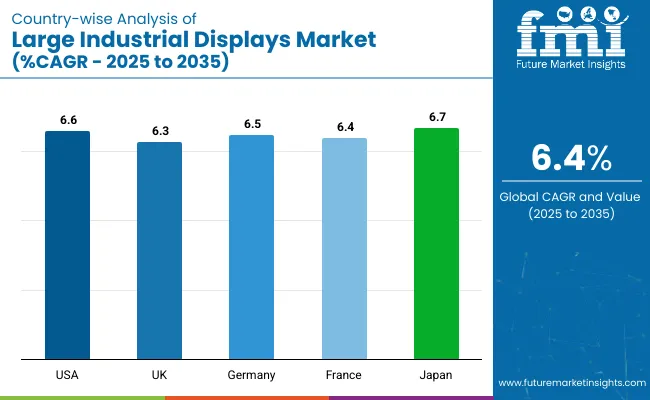

Japan is expected to be the fastest-growing market, with a projected CAGR of 6.7% from 2025 to 2035. Touchscreen displays will dominate the technology segment with a 47.6% market share by 2025. The 40”- 60” size segment will lead with 45.2% share, while the USA and Germany are also projected to witness strong growth, with CAGRs of 6.6% and 6.5%, respectively.

The market is segmented based on display type, size, technology, application, end use, and region. By display type, the market is divided into LCD displays, LED displays, OLED displays, and E-paper displays. In terms of size, it is categorized into 20”-40”, 40”-60”, and above 60”. By technology, the market includes touchscreen displays, non-touchscreen displays, and smart displays.

Based on application, the segments include process control & monitoring, data visualization, digital signage, and human-machine interface (HMI). By end use, the market covers manufacturing, oil & gas, transportation & logistics, energy & power, healthcare, and aerospace & defense. Regionally, the market is classified into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and Middle East & Africa.

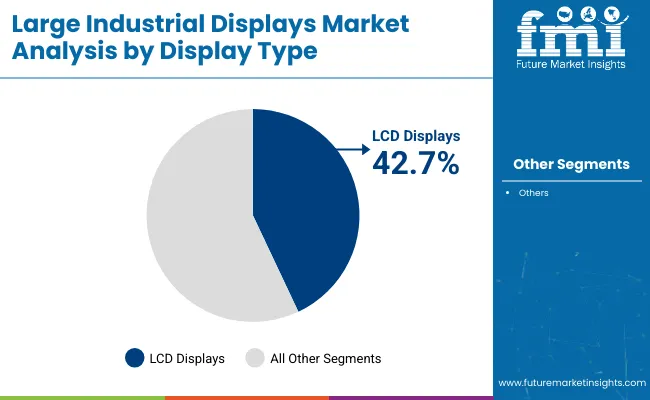

LCD displays are projected to be the most lucrative segment, expected to capture a market share of approximately 42.7% in 2025, owing to their widespread industrial applicability, affordability, and long operational lifespan.

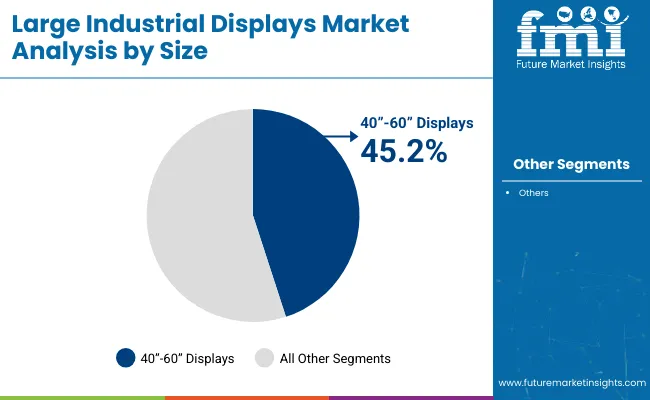

The 40”-60” display segment is anticipated to be the most lucrative in 2025, accounting for around 45.2% of the market share, driven by its optimal combination of screen clarity and efficient space utilization in industrial settings.

Touchscreen displays are projected to be the most lucrative segment, expected to capture a market share of approximately 47.6% in 2025, driven by their rising adoption in automated systems, control interfaces, and human-machine interaction applications.

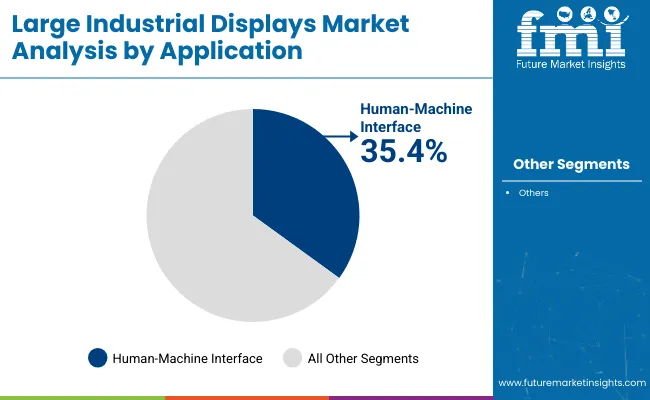

Human-machine interface (HMI) is projected to be the most lucrative application segment, expected to capture a market share of approximately 35.4% in 2025, owing to its central role in enabling real-time operator interaction and seamless control in automated industrial environments.

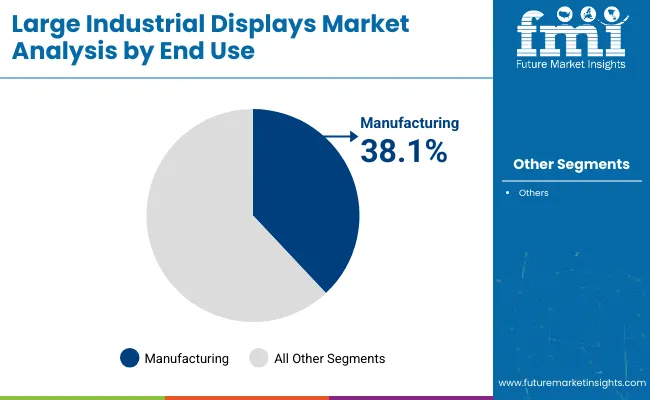

Manufacturing is projected to be the most lucrative segment, expected to capture a market share of approximately 38.1% in 2025.

The global large industrial displays market is experiencing steady expansion, fueled by the rapid adoption of Industry 4.0, rising demand for real-time data visualization, and increasing integration of advanced display technologies in automated and IoT-enabled industrial environments.

The USA large industrial displays market is projected to grow at a CAGR of 6.6% from 2025 to 2035, driven by rapid adoption of smart manufacturing technologies and advanced human-machine interface systems.

The UK large industrial displays market is expected to register a CAGR of 6.3% during the forecast period, propelled by growing adoption of industrial IoT and increased emphasis on AI-driven process control systems.

Germany’s large industrial displays market is anticipated to witness a CAGR of 6.5% between 2025 and 2035, driven by its leadership in industrial automation and robotics. As a key player in Europe’s smart manufacturing landscape, the country is heavily investing in high-resolution, energy-efficient display systems for enhanced process visualization and real-time equipment control.

the French large industrial displays market is forecasted to expand at a CAGR of 6.4% through 2035, owing to increasing digitization in industrial sectors and nationwide efforts toward green automation.

Japan’s large industrial displays market is projected to grow at the highest CAGR of 6.7% from 2025 to 2035, owing to its advanced manufacturing ecosystem, robotics leadership, and high demand for precision industrial systems. With strong R&D in display technologies and rapid smart factory expansion, Japan is emerging as a major player in high-performance industrial displays.

The large industrial displays market is moderately consolidated, with tier-one players like Samsung Electronics, LG Display, Planar Systems, Sharp, and Advantech collectively commanding a significant share through innovation, pricing strategies, and strategic alliances.

These companies are observed to be competing through cutting-edge technologies (e.g., Micro‑LED, QD‑OLED, Color E‑Paper), scalable global production, and B2B ecosystem partnerships, while smaller niche players and regional firms add fragmentation in specialized segments.

Samsung and LG have been vying for leadership via investment in next‑gen display R&D, expansion into commercial and automotive sectors, and sustainability initiatives. Samsung’s approach has been marked by AI integration, ultra-high brightness commercialization, and strategic content partnerships, while LG has focused on 4th-generation OLED innovations, blue phosphorescent OLED rollouts, and automotive display commencements. Both are also extending capabilities through eco-design, global exhibit presence, and forging OEM alliances.

Recent Large Industrial Displays Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 3.25 billion |

| Projected Market Size (2035) | USD 6.05 billion |

| CAGR (2025 to 2035) | 6.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion/Units Sold in Thousand Units |

| Display Type Analyzed | LCD Displays, LED Displays, OLED Displays, and E-Paper Displays |

| Size Analyzed | 20”-40”, 40”-60”, and Above 60” |

| Technology Analyzed | Touchscreen Displays, Non-Touchscreen Displays, and Smart Displays |

| Application Analyzed | Process Control & Monitoring, Data Visualization, Digital Signage, and Human-Machine Interface (HMI) |

| End Use Analyzed | Manufacturing, Oil & Gas, Transportation & Logistics, Energy & Power, Healthcare, and Aerospace & Defense |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Samsung Electronics Co., Ltd., LG Display Co., Ltd., Planar Systems, Inc., Sharp Corporation, Advantech Co., Ltd., Mitsubishi Electric Corporation, NEC Display Solutions, Barco NV, AU Optronics Corp., and Elo Touch Solutions, Inc. |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis. |

The market is segmented into LCD Displays, LED Displays, OLED Displays, and E-Paper Displays.

The industry is divided into 20”-40”, 40”-60”, and Above 60”.

The market caters to Touchscreen Displays, Non-Touchscreen Displays, and Smart Displays.

The industry includes Process Control & Monitoring, Data Visualization, Digital Signage, and Human-Machine Interface (HMI).

The report covers key sectors, including Manufacturing, Oil & Gas, Transportation & Logistics, Energy & Power, Healthcare, and Aerospace & Defense.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East & Africa (MEA).

The market is valued at USD 3.25 billion in 2025.

By 2035, the market is projected to reach USD 6.05 billion.

LCD displays lead the market with an estimated 42.7% share in 2025.

Japan is the fastest-growing country with a CAGR of 6.7% from 2025 to 2035.

Top companies include Samsung, LG Display, Planar Systems, Sharp, and Advantech.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Large Synchronous Motor Market Size and Share Forecast Outlook 2025 to 2035

Large Mining Shovel Market Size and Share Forecast Outlook 2025 to 2035

Large Scale Bearing Market Size and Share Forecast Outlook 2025 to 2035

Large Spot Fiber Collimator Market Size and Share Forecast Outlook 2025 to 2035

Large Scale Variable Frequency Drives Market Size and Share Forecast Outlook 2025 to 2035

Large Capacity Stationary Fuel Cell Market Size and Share Forecast Outlook 2025 to 2035

Large Scale Medium Voltage Drives Market Size and Share Forecast Outlook 2025 to 2035

Large Volume Wearable Injectors Market Growth - Trends & Forecast 2025 to 2035

Large Granular Lymphocytic Leukemia (LGLL) Therapeutics Market - Growth, Demand & Outlook 2025 to 2035

Large Molecule Bioanalytical Testing Services Market - Growth & Demand 2025 to 2035

Large Diameter Steel Pipes Market Growth - Trends & Forecast 2025 to 2035

Large Format Display Market Report – Growth & Trends through 2034

Large Scale Natural Refrigerant Heat Pump Market Growth – Trends & Forecast (2024-2034)

Large Character Printers Market

Large Breed Dog Food Market

Built-in Large Cooking Appliance Market Insights – Growth & Forecast 2025 to 2035

Anaplastic Large Cell Lymphoma (ALCL) Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Freestanding Large Cooking Appliance Market Trends - Growth & Forecast 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA