The Field Programmable Gate Array (FPGA) Size Market is estimated to be valued at USD 13.7 billion in 2025 and is projected to reach USD 32.3 billion by 2035, registering a compound annual growth rate (CAGR) of 9.0% over the forecast period.

-size-market-market-value-analysis.webp)

| Metric | Value |

|---|---|

| Field Programmable Gate Array (FPGA) Size Market Estimated Value in (2025 E) | USD 13.7 billion |

| Field Programmable Gate Array (FPGA) Size Market Forecast Value in (2035 F) | USD 32.3 billion |

| Forecast CAGR (2025 to 2035) | 9.0% |

The FPGA size market is expanding steadily as demand grows for flexible and customizable semiconductor solutions across various industries. Mid-range FPGAs have gained traction because they offer a balanced combination of performance, power consumption, and cost efficiency. Advances in technology have enabled manufacturers to develop SRAM-based FPGAs that provide faster reprogramming capabilities and higher integration density.

The telecommunications sector has been a significant driver of FPGA adoption due to the increasing need for high-speed data processing and network infrastructure upgrades. Emerging technologies such as 5G and IoT have increased requirements for adaptable hardware solutions, enhancing FPGA utilization.

The overall market growth is expected to continue as industries seek efficient and scalable programmable logic devices. Segment growth is anticipated to be led by mid-range devices, SRAM technology, and applications within telecom.

The field programmable gate array (FPGA) size market is segmented by type, technology, and application and geographic regions. By type of field programmable gate array (FPGA), the market is divided into Mid-range, Low-end, and High-end. In terms of technology of the field programmable gate array (FPGA), the market is classified into SRAM, EEPROM, Antifuse, Flash, and Others. Based on the application of the field programmable gate array (FPGA) size market is segmented into Telecom, Consumer Electronics, Automotive, Industrial, Data Processing, Military & Aerospace, and Others. Regionally, the field programmable gate array (FPGA) size industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

-size-market-analysis-by-type.webp)

The mid-range FPGA segment is expected to contribute 45.7% of the market revenue in 2025, establishing its leadership among FPGA sizes. Its growth is driven by its versatility in supporting moderate complexity designs that require efficient power and cost balance. The mid-range category is favored for applications where high performance is essential but ultra-high capacity is unnecessary.

This segment is suitable for many commercial and industrial uses, including communications and automotive systems. Its ability to offer sufficient logic resources while maintaining affordability has made it a popular choice for design engineers.

As demand grows for adaptable hardware across diverse sectors, the mid-range FPGA segment is expected to sustain its market share.

-size-market-analysis-by-technology.webp)

The SRAM FPGA technology segment is projected to hold 39.8% of the market revenue in 2025, maintaining its position as the leading technology type. SRAM-based FPGAs are valued for their fast configuration speed and ability to be reprogrammed multiple times, which supports rapid prototyping and iterative design processes.

This technology is widely adopted due to its flexibility and robustness, enabling efficient updates and customization after deployment. Additionally, SRAM FPGAs consume less power compared to some older technologies, making them well suited for applications requiring both performance and energy efficiency.

Their integration with advanced design tools has further boosted their popularity among developers. As programmable logic requirements continue to evolve, the SRAM technology segment is expected to remain dominant.

-size-market-analysis-by-application.webp)

The telecom application segment is anticipated to contribute 33.5% of the FPGA size market revenue in 2025, retaining its lead as the primary application. This growth is influenced by the rapid expansion of telecommunications infrastructure and the rollout of 5G networks worldwide. FPGAs play a critical role in telecom equipment by enabling high-speed data processing, flexible protocol handling, and efficient signal processing.

Network operators require adaptable hardware to manage evolving standards and to optimize network performance. Telecom infrastructure upgrades, including base stations and optical transport systems, rely heavily on FPGA technology to meet demands for speed and reliability.

The continual growth of data traffic and the deployment of advanced services will sustain the telecom segment’s prominence in the FPGA market.

The FPGA market demand in data centers, 5G networks, automotive ADAS, and defense systems due to flexibility and low-latency performance. Competitive differentiation focuses on power-efficient architectures, SoC integration, and strategic partnerships to expand adoption across diverse applications.

The FPGA segment is witnessing strong demand from data-intensive industries that require hardware acceleration for real-time analytics, AI inference, and encryption. Data centers are incorporating FPGAs to manage workload variability and reduce latency in cloud-based platforms. This adoption trend is supported by the flexibility of FPGA architecture, allowing reprogramming without costly hardware redesigns. Telecommunications infrastructure for 5G networks and low-latency applications is also driving FPGA integration. Their ability to optimize throughput while consuming less power compared to general-purpose processors has positioned FPGAs as an essential component in modern high-performance systems. This growing reliance on programmable hardware in complex computing environments enhances market relevance globally.

Automotive manufacturers are increasingly deploying FPGA-based solutions for advanced driver-assistance systems (ADAS) and autonomous vehicle control frameworks. These devices offer the adaptability needed to meet varying safety standards and evolving design requirements across regions. FPGA’s reconfigurability provides a competitive edge over fixed ASIC solutions in handling sensor fusion and real-time decision-making in vehicles. The ability to integrate custom logic for machine learning algorithms and LiDAR processing makes FPGAs a preferred choice for automotive electronics. With electric and connected vehicles rising in prominence, FPGA integration in powertrain control, infotainment systems, and predictive maintenance platforms further strengthens its value proposition.

Industrial automation and defense systems are driving FPGA deployment due to their need for rugged, reliable, and adaptable computing solutions. Manufacturing environments are using FPGA devices to enhance machine control precision and predictive analytics capabilities in robotics and IoT-enabled platforms. In defense, these components are employed in radar, electronic warfare, and secure communication systems due to their inherent flexibility and low-latency signal processing performance. Harsh operating conditions in both industrial and military scenarios demand hardware that can be customized for specialized tasks without extended development timelines. FPGA’s field-upgradeable nature ensures long operational life and adaptability in mission-critical systems.

The FPGA market is shaped by innovation in chip architecture and strong competition among major players like AMD-Xilinx, Intel, and Lattice Semiconductor. Vendors are focusing on delivering high-performance, power-efficient FPGA solutions tailored for AI workloads, 5G infrastructure, and embedded computing. Strategic partnerships with hyperscale cloud providers and automotive OEMs are creating new revenue streams and expanding FPGA penetration in diversified sectors. The introduction of adaptive system-on-chip (SoC) solutions combining FPGA fabric with advanced processors is transforming the design ecosystem. Pricing competitiveness and supply chain reliability remain influential in procurement decisions, reinforcing the need for agile manufacturing and localized distribution strategies.

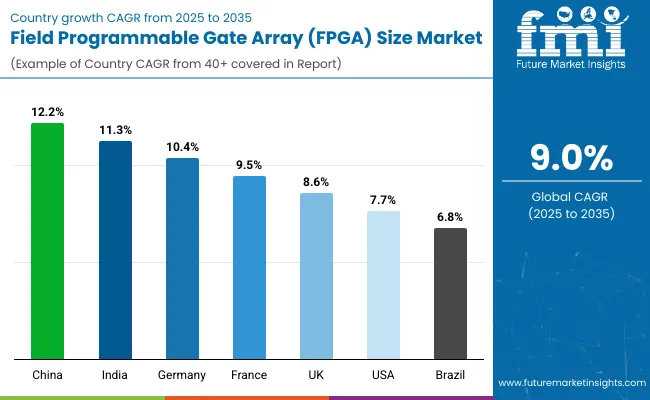

| Country | CAGR |

|---|---|

| China | 12.2% |

| India | 11.3% |

| Germany | 10.4% |

| France | 9.5% |

| UK/td> | 8.6% |

| USA | 7.7% |

| Brazil | 6.8% |

The field programmable gate array (FPGA) market, estimated to grow at a global CAGR of 9.0% from 2025 to 2035, is led by China with a 12.2% CAGR, driven by aggressive investments in AI-enabled infrastructure and data center acceleration technologies. India follows at 11.3%, supported by strong adoption in telecom and automotive electronics, particularly for 5G deployment and EV-related systems. Germany posts 10.4%, reflecting robust demand in industrial automation and automotive applications where real-time processing is critical. Growth in France stands at 9.5%, attributed to the integration of FPGAs in defense systems and communication networks for secure and adaptive processing.

The United Kingdom records 8.6%, indicating demand from aerospace and AI research projects. The United States, with a CAGR of 7.7%, shows steady performance driven by cloud computing and military-grade FPGA usage, though growth is moderated by early market maturity. These dynamics confirm that Asia-Pacific markets are set to outpace North America and Europe, fueled by large-scale semiconductor initiatives and digital transformation programs. The report includes a comprehensive analysis across 40+ countries, with these five markets representing key growth benchmarks for global FPGA adoption strategies.

-size-market-country-value-analysis.webp)

The CAGR for the FPGA market in the United States grew from 6.1% during 2020–2024 to 7.7% for 2025–2035, reflecting increasing integration in cloud infrastructure and aerospace systems. Advanced FPGA solutions have become essential in hyperscale data centers to accelerate AI inference and reduce latency in analytics processing. Military and defense programs have expanded FPGA use for radar, signal encryption, and communication platforms where flexibility is critical. Growth has also been supported by rising demand for reconfigurable hardware in IoT networks. Despite early saturation in certain segments, new FPGA designs optimized for energy efficiency are helping USA manufacturers maintain competitiveness in global markets.

-size-market-europe-country-market-share-analysis,-2025-&-2035.webp)

Germany’s CAGR improved from 8.1% in 2020–2024 to 10.4% during 2025–2035, supported by strong adoption in industrial automation and electric vehicle powertrain systems. German manufacturers are prioritizing FPGA integration in smart factory solutions to enhance robotics precision and predictive maintenance capabilities. The automotive sector is using FPGAs in ADAS, LiDAR processing, and real-time decision-making for autonomous vehicles. Partnerships between semiconductor companies and automotive OEMs have accelerated domestic production of advanced FPGA-based control units. The demand for energy-efficient SoC platforms combining FPGA fabric and processors is also shaping competitive differentiation. This environment positions Germany as a major contributor to Europe’s semiconductor modernization.

The UK FPGA market expanded from a 5.9% CAGR during 2020–2024 to 8.6% during 2025–2035, driven by rapid adoption in aerospace and AI research ecosystems. Defense modernization projects and satellite communications rely on FPGA-based solutions for low-latency signal processing and adaptable architectures. Growth in fintech and high-frequency trading platforms has also created a unique demand for FPGA-enabled hardware acceleration to reduce execution latency. University-industry collaborations focused on AI prototyping have further contributed to development momentum. Despite a smaller industrial base compared to Germany, the UK market is leveraging innovation hubs to scale FPGA use in emerging high-compute workloads.

China’s CAGR rose from 9.5% during 2020–2024 to 12.2% in 2025–2035, leading global adoption trends. National initiatives promoting semiconductor independence and AI-driven industries have fueled massive FPGA investments across data centers, telecom networks, and autonomous mobility solutions. Domestic vendors have increased R&D to replace imports and develop SoC platforms integrating FPGA fabrics for IoT and edge computing. AI-driven factories and electric vehicle production hubs have embraced FPGA modules for high-speed control and adaptive functionality. This strong policy-driven environment has positioned China as the fastest-growing market, offering opportunities for both global and regional suppliers.

India’s CAGR shifted from 8.9% during 2020–2024 to 11.3% between 2025–2035, reflecting expansion in telecom infrastructure, smart mobility, and industrial IoT applications. FPGA usage has surged in 5G network deployment and edge computing systems designed for low-latency applications. Government-backed electronics manufacturing initiatives have attracted global semiconductor vendors, creating localized assembly hubs for FPGA boards and SoC modules. The adoption of reprogrammable architectures in defense radar and avionics systems further supports high-value demand. Research institutions and automotive OEMs are collaborating to introduce FPGA solutions in EV control systems, improving power efficiency and vehicle safety.

-size-market-analysis-by-company.webp)

The field programmable gate array (FPGA) market is being shaped by major semiconductor leaders driving advancements in adaptive computing and high-performance processing. Intel Corporation remains a dominant force with its Stratix and Agilex series, targeting AI acceleration, networking, and data center workloads. Qualcomm Technologies, Inc. is leveraging FPGA integration for wireless communication and edge computing solutions, optimizing performance in 5G networks and IoT ecosystems.

Lattice Semiconductor Corporation focuses on low-power, cost-efficient FPGA architectures suited for industrial, automotive, and security applications. NVIDIA Corporation is combining FPGA capabilities with its GPU platforms to enhance AI-driven workloads and real-time processing in autonomous systems. Broadcom delivers connectivity-driven FPGA solutions to cater to networking and broadband infrastructure. AMD, Inc., following its Xilinx acquisition, is redefining adaptive computing with advanced FPGA and SoC solutions for aerospace, defense, and cloud markets.

QuickLogic Corporation specializes in ultra-low-power FPGA products designed for embedded systems and IoT applications. Collectively, these companies are investing heavily in R&D, heterogeneous integration, and strategic partnerships to develop programmable logic platforms that meet the needs of data-intensive applications. By aligning FPGA technologies with AI, machine learning, and edge intelligence trends, these players are positioning themselves to capture the growing demand for flexible, scalable, and energy-efficient computing solutions across diverse industries.

Key strategies and drivers for 2024 and 2025 in the FPGA market include expansion into AI acceleration, 5G infrastructure, and automotive ADAS systems. Vendors are prioritizing adaptive SoC platforms that integrate FPGA fabric with high-performance processors to enable flexible computing.

Investments in low-power FPGA solutions for edge devices and industrial automation are expected to boost adoption. Partnerships with cloud service providers for FPGA-as-a-Service models and localization of supply chains to mitigate component shortages are becoming critical growth enablers.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.7 Billion |

| Type | Mid-range, Low-end, and High-end |

| Technology | SRAM, EEPROM, Antifuse, Flash, and Others |

| Application | Telecom, Consumer Electronics, Automotive, Industrial, Data Processing, Military & Aerospace, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Intel Corporation, Qualcomm Technologies, Inc., Lattice Semiconductor Corporation, NVIDIA Corporation, Broadcom, AMD, Inc., and Quicklogic Corporation |

| Additional Attributes | Dollar sales, share, regional demand distribution, application-wise adoption (telecom, data center, automotive), competitive landscape, pricing benchmarks, supply chain risks, emerging SoC trends, design complexity impact, and forecasted CAGR for major economies. |

The global field programmable gate array (FPGA) size market is estimated to be valued at USD 13.7 billion in 2025.

The market size for the field programmable gate array (FPGA) size market is projected to reach USD 32.3 billion by 2035.

The field programmable gate array (FPGA) size market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in field programmable gate array (FPGA) size market are mid-range, low-end and high-end.

In terms of technology, sram segment to command 39.8% share in the field programmable gate array (FPGA) size market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Field-programmable Gate Array (FPGA) Market

Field Inspection Tester Market Size and Share Forecast Outlook 2025 to 2035

Gate Driver IC Market Size and Share Forecast Outlook 2025 to 2035

Field Force Automation Market Size and Share Forecast Outlook 2025 to 2035

Gate Impellers Market Size and Share Forecast Outlook 2025 to 2035

Field Service Management Market Size and Share Forecast Outlook 2025 to 2035

Programmable Robots Market Size and Share Forecast Outlook 2025 to 2035

Gate-All-Around (GAA) Transistor Market Size and Share Forecast Outlook 2025 to 2035

FPGA Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Programmable Logic Device (PLD) Market Growth & Demand 2025 to 2035

Programmable Logic Controller Market Growth – Trends & Forecast 2024-2034

Field Erected Cooling Tower Market Growth – Trends & Forecast 2024-2034

Gate Valve Market Growth – Trends & Forecast 2023-2033

Field-effect Rectifier Diodes Market

Field Erected Boiler Market

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Production Chemicals Market – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA