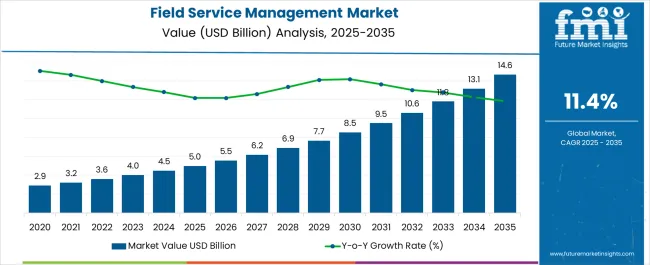

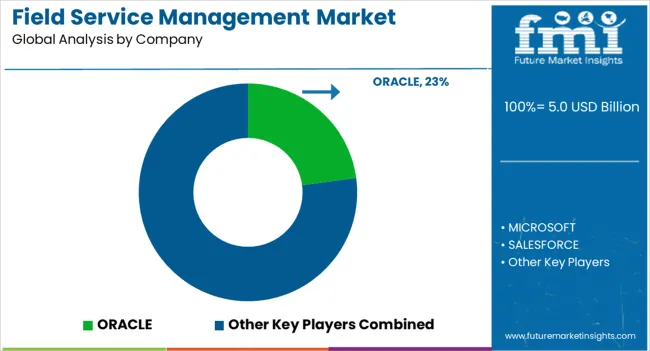

The Field Service Management Market is estimated to be valued at USD 5.0 billion in 2025 and is projected to reach USD 14.6 billion by 2035, registering a compound annual growth rate (CAGR) of 11.4% over the forecast period.

| Metric | Value |

|---|---|

| Field Service Management Market Estimated Value in (2025 E) | USD 5.0 billion |

| Field Service Management Market Forecast Value in (2035 F) | USD 14.6 billion |

| Forecast CAGR (2025 to 2035) | 11.4% |

The field service management market is expanding steadily, supported by the increasing need for operational efficiency, customer satisfaction, and digital transformation across service-driven industries. Growing demand for real time tracking, predictive maintenance, and mobile workforce management is encouraging enterprises to deploy advanced FSM solutions.

Integration of technologies such as AI, IoT, and cloud-based platforms has significantly improved scheduling accuracy, asset management, and field technician productivity. Additionally, regulatory compliance and rising customer expectations are further accelerating adoption, particularly in industries where service quality directly impacts brand reputation.

With companies prioritizing automation and data-driven decision making, the field service management market is poised for sustained growth, offering opportunities for innovation in deployment models, vertical-specific solutions, and scalability across enterprise sizes.

The market is segmented by Organization Size, Vertical, Deployment, and Component and region. By Organization Size, the market is divided into SMEs and Large Enterprises. In terms of Vertical, the market is classified into Telecom, IT and ITES, Healthcare and Life Sciences, Manufacturing, Construction and Real Estate, Transportation and Logistics, Energy Utilities, Oil and Gas, and Others. Based on Deployment, the market is segmented into On-premises and Cloud. By Component, the market is divided into Solutions (Schedule, Dispatch, and Route Optimization, Customer Management, Work Order Management, Inventory Management, Service Contract Management, Reporting, and Analytics) and Services (Integration and Implementation Services, Training and Support Services, Consulting Services). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

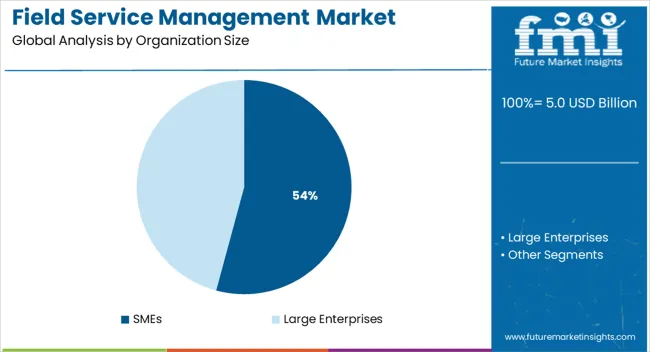

The SMEs segment is projected to contribute 54.20% of total market revenue by 2025, making it the largest segment within organization size. This growth is driven by the increasing adoption of digital platforms that enable smaller enterprises to streamline scheduling, invoicing, and asset tracking with minimal upfront investment.

Cost-effective solutions and growing availability of scalable cloud-based offerings have allowed SMEs to compete with larger organizations by enhancing service delivery.

Additionally, the push for customer retention and rising pressure to improve workforce productivity are influencing SMEs to adopt FSM solutions at a faster pace, reinforcing their leading position in this category.

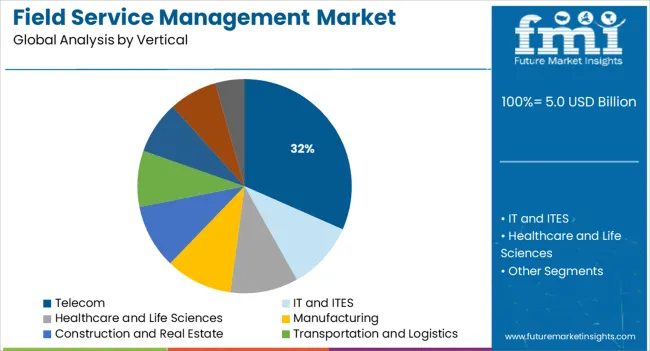

The telecom segment is expected to account for 31.60% of total revenue by 2025 within the vertical category, positioning it as the leading industry. This dominance is attributed to the sector’s reliance on large, geographically dispersed workforces, which require efficient service scheduling and real time coordination.

Telecom operators face increasing demand for rapid network maintenance, installation, and troubleshooting services, making FSM solutions critical for operational continuity.

Integration of FSM platforms has supported cost reduction, improved technician utilization, and enhanced service delivery for telecom companies, strengthening their position as the largest vertical segment.

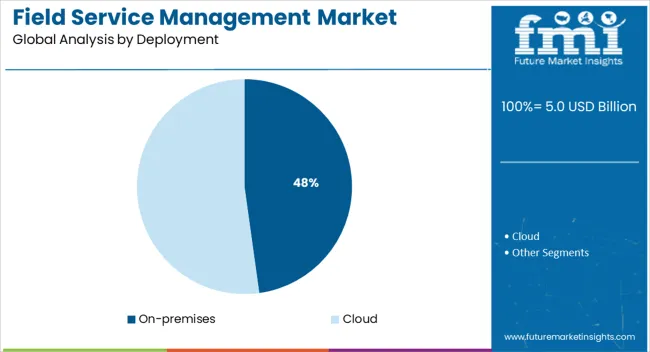

The on premises deployment model is projected to hold 47.80% of total revenue by 2025 within the deployment category, establishing it as the leading segment. Its dominance is driven by enterprises requiring greater control, security, and customization of field service operations, particularly in industries handling sensitive data.

Organizations with established IT infrastructure prefer on premises deployment due to compliance requirements and integration flexibility with existing enterprise systems.

Despite the rise of cloud adoption, the demand for secure and fully controlled environments continues to sustain growth in the on premises segment, ensuring its position as the primary deployment model in the field service management market.

As companies look to increase productivity by automating the majority of the tasks, the sales of field service management systems are expected to surge. The ability to make effective applications of client databases is something that has captured the attention of several stakeholders. With the continuous evolution of cloud technology, the market has a lot of opportunities in the future.

However, the COVID-19 pandemic brought about a temporary slump in market growth. This was because of the disruption in supply chain management. This has ultimately led to a reduction in the anticipated CAGR. While the historical CAGR for the market was 12.9%, the anticipated CAGR is 11.4%. But, with technology shaping up at a rapid pace, and the increased adoption of automation processes, the growth might surge in the future.

Majority of field service data functions on servers behind corporate firewalls. However, devices that access this data do not have such protection. With the growing digitization, there have been increasing cyberattacks. Therefore, data security has become a substantial issue for several organizations.

There is a considerable increase in cybersecurity attacks with a rising transfer of data from the field to the cloud since servers, communication channels, and networks can be easily attacked. Besides, the BYOD policies have enhanced such cases. The personal devices of technicians are vulnerable to attacks when they are connected to an unsecured network.

As per the analysis, service contract management is expected to gain significant traction in the coming years. Organizations that rely on third-party service providers for their fieldwork demand the same services as those offered by enterprise businesses where client visibility is a priority. The outsourcing of field services can aid companies in lessening labor costs and augmenting their functionalities.

In September 2024, the Salesforce field service platform got a third-party add-on that may assist service providers and customers monitor and manage equipment more efficiently. ServiceMax Asset 360 for Salesforce offers a 360-degree view into several metrics, including install base, asset performance, and warranties for reducing maintenance costs.

In addition, there has been a rise in cloud-integrated contract management solutions across several organizations since digital transformation has been increasing. It facilitates efficient management and enables organizations from several industries to track, approve, sign, and negotiate contracts in a consolidated form.

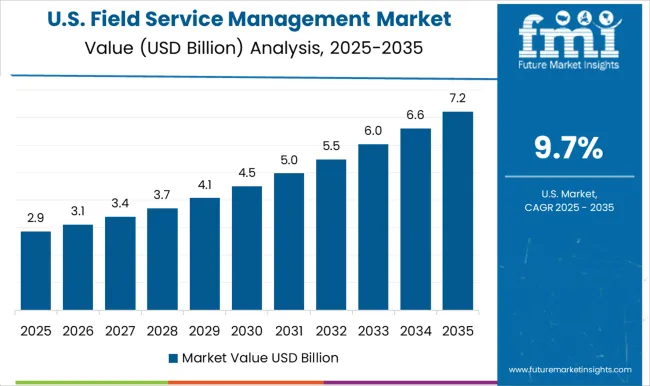

| Regions | North America |

|---|---|

| Countries | United States |

| CAGR (2025 to 2035) | 11.1% |

| Regions | Europe |

|---|---|

| Countries | United Kingdom |

| CAGR (2025 to 2035) | 10.7% |

| Regions | Asia Pacific |

|---|---|

| Countries | China |

| CAGR (2025 to 2035) | 10.4% |

| Regions | Asia Pacific |

|---|---|

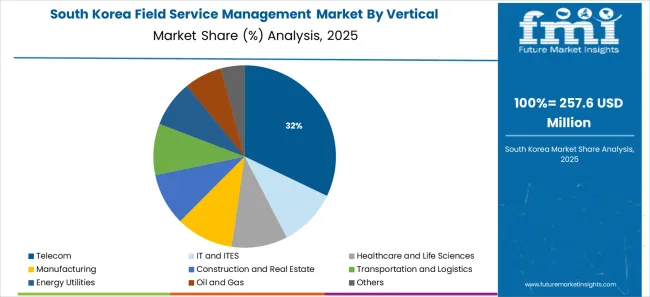

| Countries | South Korea |

| CAGR (2025 to 2035) | 9.4% |

| Regions | Asia Pacific |

|---|---|

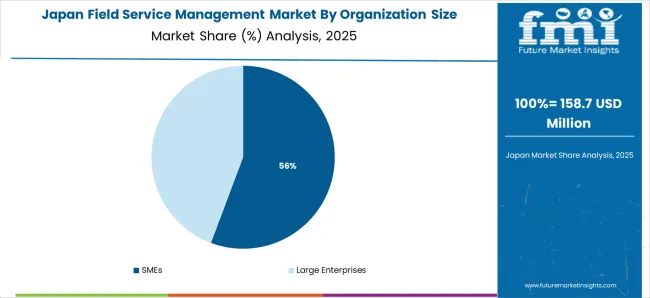

| Countries | Japan |

| CAGR (2025 to 2035) | 9.8% |

The United States is currently one of the significant markets of oil and gas. As per the research conducted, the oil and gas market in the United States is expected to grow at nearly 7% during the forecast period. The increase in oil prices and reduction in the cost of machinery is expected to massively drive the market.

This business management software ensures the smooth functioning of all the key activities and coherence at various levels. By utilizing the checklist feature, which includes inspections, site surveys, maintenance procedures, etc. efficiency offered by the oil and gas companies sky-rockets.

| Attributes | Details |

|---|---|

| United States Market Expected Size (2035) | USD 4.3 billion |

| United States Market Absolute Dollar Growth | USD 2.8 billion |

| CAGR % 2020 to 2025 | 15.3% |

The United Kingdom is known for its huge fire and life safety market. In 2024, the fire detection market was valued at close to USD 1.5 billion, and it is expected to grow at 6%. The application of field service management in the fire detection market ensures that the equipment and safety systems run at peak efficiency.

The field service management provides appropriate services which assist in the functioning of this equipment. The business software that is used in field service management helps in monitoring security technologies, responding to customers, and managing compliance.

| Attributes | Details |

|---|---|

| United Kingdom Market Expected Size (2035) | USD 959.2 million |

| United Kingdom Market Absolute Dollar Growth | USD 613.3 million |

| CAGR % 2020 to 2025 | 14.8% |

China is in the second spot when it comes to the medical devices market. Increasing investment in healthcare infrastructure and a surging geriatric population are some of the factors driving growth. The field service operations help in improving the sales and service of medical device manufacturers. The installation, repair, and maintenance of medical devices are taken care of by the field service management. Through the software of field service management, companies can adopt a better way of tracking crucial records, which is useful for compliance. These also shorten the billing process by integrating the invoice procedure into the accounting systems.

| Attributes | Details |

|---|---|

| China Market Expected Size (2035) | USD 468.6 million |

| China Market Absolute Dollar Growth | USD 294.5 million |

| CAGR % 2020 to 2025 | 14.2% |

Japan has always exhibited dominance when it comes to Information Technology. In 2024, the IT market in Japan was valued at a mammoth USD 450 billion. Internet service providers and communications enterprises are looking for ways to improve service delivery. The software that is being used by the field service management system can design and install complex internet infrastructure. The technology also helps IT companies to set up recurring maintenance plans to ensure the smooth functioning of the installed internet systems. The technology also provides a foundation to handle complex data architectures.

| Attributes | Details |

|---|---|

| Japan Market Expected Size (2035) | USD 715.5 million |

| Japan Market Absolute Dollar Growth | USD 435.2 million |

| CAGR % 2020 to 2025 | 13.7% |

The South Korea construction market was valued at USD 4.5 billion in 2024. Massive demand for shipbuilding is expected to further surge the market growth during the forecast period. Since the construction industry is an amalgamation of on-site and off-site work, the field service management system can efficiently integrate field and office work. This technology maintains an effective communication channel between the office staff and field workers. Through software tools, supervisors can easily manage daily operations. The documentation process is also simplified and these folders are documented in a central place. This makes the retrieval of information extremely simple.

| Attributes | Details |

|---|---|

| South Korea Market Expected Size (2035) | USD 434.9 million |

| South Korea Market Absolute Dollar Growth | USD 257.9 million |

| CAGR % 2020 to 2025 | 12.3% |

| Segment | Organization Size |

|---|---|

| Attributes | Large Enterprises |

| CAGR (2020 to 2025) | 12.6% |

| CAGR (2025 to 2035) | 11.1% |

| Segment | Deployment |

|---|---|

| Attributes | On-premises |

| CAGR (2020 to 2025) | 12.4% |

| CAGR (2025 to 2035) | 10.8% |

The large enterprise segment is anticipated to make a significant contribution to the growth of the market. There is a higher adoption of field service management solutions in large enterprises. The trend is expected to continue throughout the forecast period. The evolution of technology and the growing adoption of BYOD culture in enterprises is expected to propel the market in the forecast period. Owing to the size of the organization, the frequency of application may be much more in large enterprises as compared to SMEs.

As per the estimations, the on-premise segment is anticipated to witness a higher expansion rate during the forecast period. The development of the segment can be attributed to its ability to provide security and flexibility offered by them while retrieving data. On-premise solutions are installed in an enterprise’s IT infrastructure and are operated by IT staff.

The on-premise segment demands high initial investment by organizations. However, they do not require incremental expenses. They also lessen the reliance of companies on third-party applications, which could pose a significant threat to the personal details of the end user. The ease of integration with the existing IT infrastructure is more as compared to the cloud deployment.

The start-ups have made creative use of field service management and have developed software for calculating hourly wages. The software has been providing features like shift management, schedule creation, training, and evaluation of employees. The employees and managers can collaborate on scheduling shifts, and the platform automates scheduling as per availability.

Workrise: The start-up has been providing employee wellness tracking and a management platform. It has also been providing employee wellness and happiness indices. Workrise has mainly been catering to construction, solar, defense, upstream oil and gas, and midstream oil and gas. In 2024, Workrise raised USD 300 million in the Series E round which was led by Baillie Gifford.

The manufacturers operating in the market are entering into strategic partnerships with players from other niches. The idea is to curb carbon emissions and power the clean energy economy. Through this alliance, it is expected that electricity of more than 2.5 gigawatts might be generated by the usage of solar panels. In January 2025, Microsoft and Qcells announced a strategic collaboration to contain carbon emissions, and focus more on the renewable source of energy.

Key developments in the market:

Dominant field service management companies are

|

Company |

Description |

|

Microsoft |

Microsoft has been enabling digital transformation in the era of an intelligent cloud and intelligent edge. The mission has always been to empower every person and organization on the planet to achieve much more. The company has been offering cloud services to every organization, ranging from local data centers to start-ups, businesses, and government agencies. Microsoft has been helping businesses to reimagine how they can bring together people, data, and processes to create value for their customers. The cyber security engagement center brings together the capabilities to foster collaborations with public and private sector organizations. |

|

Oracle |

Oracle has been at the forefront of building a vibrant future that is technologically robust and environmentally friendly. The company has been taking bold and urgent action to drive sustainable development. Oracle has been offering more than 100 cloud infrastructure and platform services. Across application and infrastructure, with public and hybrid cloud options, Oracle has been supporting local access, regional compliance, and true business continuity. |

|

Salesforce |

Salesforce is the world’s number one Customer Relationship Management platform. It enables marketing, sales, commerce, service, and IT teams to work as one from anywhere. Using salesforce’s Customer 360, employees can focus on what is right at a given point in time for a business. The company has always been working on trust, customer success, innovation, equality, and sustainability. The company has always championed its customers to achieve extraordinary things. |

Other key players profiled: SERVICEMAX and SAP SE

The global field service management market is estimated to be valued at USD 5.0 billion in 2025.

The market size for the field service management market is projected to reach USD 14.6 billion by 2035.

The field service management market is expected to grow at a 11.4% CAGR between 2025 and 2035.

The key product types in field service management market are smes and large enterprises.

In terms of vertical, telecom segment to command 31.6% share in the field service management market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cloud Field Service Management (FSM) Market Size and Share Forecast Outlook 2025 to 2035

Field Inspection Tester Market Size and Share Forecast Outlook 2025 to 2035

Field Force Automation Market Size and Share Forecast Outlook 2025 to 2035

Field Programmable Gate Array (FPGA) Size Market Size and Share Forecast Outlook 2025 to 2035

Field Erected Cooling Tower Market Growth – Trends & Forecast 2024-2034

Field-effect Rectifier Diodes Market

Field Erected Boiler Market

Field-programmable Gate Array (FPGA) Market

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Production Chemicals Market – Trends & Forecast 2025 to 2035

Oilfield Chemicals Market Report - Growth, Demand & Forecast 2025 to 2035

Airfield Fencing Market Insights by Material, Height, Product Type, and Region through 2035

Oilfield Roller Chain Market

Far-field Tag Antennas Market Size and Share Forecast Outlook 2025 to 2035

Far Field Speech and Voice Recognition Market Size and Share Forecast Outlook 2025 to 2035

Fin Field Effect Transistor (FinFET) Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Field Drill Bits Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA