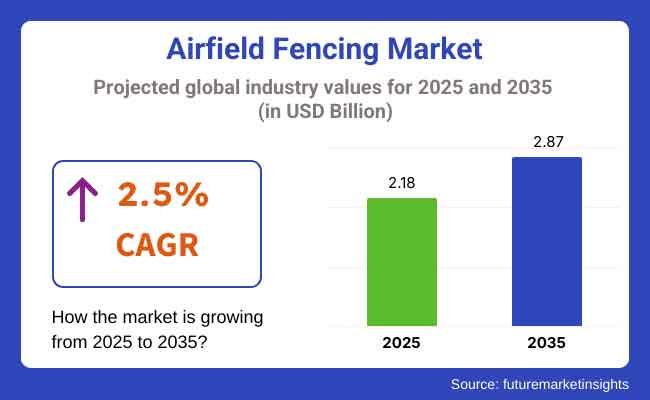

The worldwide airfield fencing market is undergoing a period of stable expansion, with the industry estimated to grow from USD 2.18 billion in 2025 to USD 2.87 billion by 2035, with a progressive CAGR of 2.5%. The industry's steady expansion is being driven by growing airport security issues, regulatory requirements and investment growth in aviation infrastructure.

In 2024, the adoption of smart fencing solutions saw a notable rise, integrating CCTV surveillance, motion detectors, and AI-powered threat analysis. Additionally, rising geopolitical tensions and an increase in unmanned aerial vehicle (UAV) activity led to stricter regulations, pushing airports to upgrade their fencing infrastructure. Growth was particularly strong in North America and Europe, where governments introduced new compliance standards.

The expansion of existing airports and development of new ones in emerging economies will also drive the segment. It is, however, anticipated that tighter aviation security regulations and technological evolution in barrier solutions will influence the industry. With expanding air traffic worldwide and escalating security threats, airfield fencing solutions will remain a critical component of aviation infrastructure.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Focus on Perimeter Security: High-tensile steel fencing, razor wire, and anti-climb barriers became standard to prevent unauthorized access. | AI-Driven Smart Fencing: Automated threat detection, facial recognition, and drone mitigation technology will enhance security. |

| Integration of Surveillance Tech: CCTV cameras, motion sensors, and infrared detection systems saw increased adoption. | Cybersecurity in Smart Fencing: Protecting automated perimeter security systems from cyber threats will become a priority. |

| Regulatory Compliance: Stricter aviation security laws required airports to enhance perimeter fencing. | Sustainable Materials: Recycled composites and corrosion-resistant alloys will replace traditional materials. |

| Drone Monitoring Rise: Drones are being increasingly used for perimeter surveillance at major airports. | Urban Air Mobility (UAM) Security: New fencing solutions for vertiports and drone corridors will emerge. |

| Regional Growth: Asia-Pacific and the Middle East saw significant demand due to airport expansion projects. | Modular & Quick-Deploy Fencing: Adaptable barriers will be used for evolving security threats and temporary expansions. |

| Cost Challenges: Smaller airports struggled with high installation and maintenance costs. | Advanced Threat Detection: AI-powered analytics and real-time monitoring will enhance response efficiency. |

Key Priorities of Stakeholders

Regional Variance

Adoption of Smart & Advanced Fencing Solutions

High Variance

Convergent & Divergent Perspectives on ROI

Material & Design Preferences

Consensus

Regional Variance

Cost Sensitivity & Pricing Trends

Shared Challenges

Regional Differences

Industry-Specific Challenges

Manufacturers

End-Users (Airports & Security Agencies)

Future Investment Priorities

Alignment

Divergence

Regulatory & Policy Impact

Conclusion: Variance vs. Consensus

High Consensus

Key Variances

Strategic Insight

A one-size-fits-all approach won’t work. Regional customization is crucial:

| Country/Region | Regulatory Policies & Impact |

|---|---|

| United States (USA) | FAA (Federal Aviation Administration) Standards mandate 8-12 feet high, non-climbable fencing with motion sensors and surveillance. TSA (Transportation Security Administration) Guidelines require tamper-resistant materials and intrusion detection systems. Federal grants support airport security fencing upgrades. |

| Canada | Transport Canada Aviation Security Regulations enforce restricted-access perimeter fencing with smart surveillance for major airports. |

| United Kingdom (UK) | UK CAA (Civil Aviation Authority) Regulations emphasize high-security steel fencing with AI-powered monitoring. BS 1722 compliance is required for fencing durability and anti-trespassing measures. |

| Germany | Luftfahrt-Bundesamt (LBA) Security Regulations require high-tensile perimeter fencing with automated breach detection. Strong focus on sustainable fencing solutions aligned with EU Green Deal goals. |

| France | Direction Generale de Aviation Civile (DGAC) Standards mandate anti-intrusion barriers and integrated electronic surveillance. Strict privacy laws impact AI-driven monitoring. |

| India | Bureau of Civil Aviation Security (BCAS) Guidelines enforce mandatory perimeter fencing with surveillance cameras. Expansion of regional airports driving demand for cost-effective fencing. |

| Japan | Ministry of Land, Infrastructure, Transport and Tourism (MLIT) Policies focus on high-durability fencing solutions with seismic-resistant designs. Increasing investment in smart surveillance integration. |

| Australia | Civil Aviation Safety Authority (CASA) Guidelines mandate anti-climb, corrosion-resistant fencing for coastal and remote airports. UAV detection technology is becoming a standard. |

Top players in the airfield fencing industry are pursuing multi-pronged strategies to sustain their competitive advantage. Pricing approaches differ across segments, with high-end players providing high-security, intelligent fencing solutions at a premium price and budget-conscious companies offering economical chain-link and modular fencing solutions.

To outperform, top producers are emphasizing innovation, with AI-based intrusion detection, anti-climb coatings, and smart materials such as galvanized steel with corrosion-resistant coatings. Key players are actively partnering with airport authorities and government agencies to ensure regulatory compliance and expand their market presence.

A consolidated distribution channel and refined technology base are achieved through mergers and acquisitions. Air traffic around the world continues to rise and security concerns grow. Companies are ramping up R&D and manufacturing to innovate the next generation of fencing solutions.

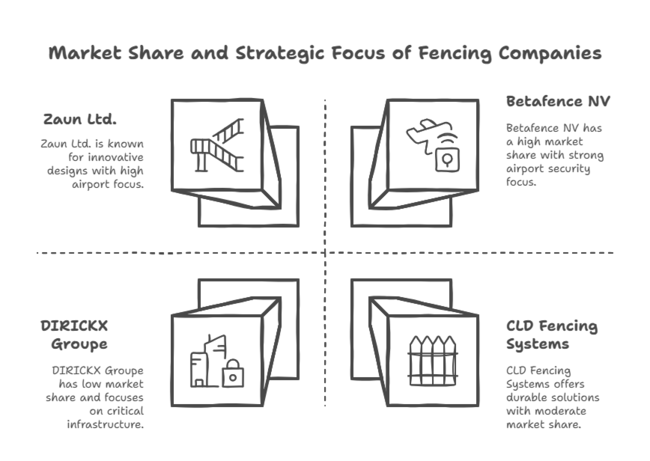

Betafence NV - 12-15%

Leading global provider of high-security fencing solutions with strong airport security integrations.

Zaun Ltd. - 10-12%

Zaun Ltd. is known for its innovative security fencing designs, which are widely used in European and international airports.

CLD Fencing Systems - 8-10%

CLD Fencing Systems specializes in durable, modular fencing solutions, which are increasingly adopted in North America and Europe.

DIRICKX Groupe - 6-8%

DIRICKX Groupe provides security fencing across critical infrastructure sectors, including airports.

The Hebei Zhengyang Wire Mesh Products - 5-7%

A strong player in the Asia-Pacific sector, supplying cost-effective fencing solutions.

Other Regional & Niche Players - 50-55%

Includes smaller, region-specific companies catering to local airport fencing needs.

Key Developments

The market for airfield fencing is part of the global aviation infrastructure and perimeter security industry, which is significantly influenced by global air traffic patterns, airport developments, and regulatory factors. The trajectory of the industry is closely tied to macroeconomic factors like GDP growth, government spending on aviation security, and trade policies.

The demand for air travel and the rise of emerging economies (such as India, China, and the Middle East) that invest significantly in the development of new airports and their modernization have been key drivers of the segment. The continued rising trend of global passenger traffic is forecast to remain, and the global aviation industry and airports across the world are upgrading their security infrastructures.

Increasing geopolitical tensions and terrorism threats are further fueling demand, prompting regulators to require high-security perimeter solutions. The rise of smart airports and automated security systems around the world is expected to make smart fencing solutions with AI-driven surveillance popular as we look forward to 2025 and beyond.

By materials, the airfield fencing landscape is segmented into fabrics where steel is the dominant material used for primary construction as it provides excellent strength, durability, and resistance to impact and damage. Aluminum fencing is becoming increasingly popular due to its lightweight and corrosion-resistant properties, which is why it is so popular in areas close to the sea or in humid conditions.

Fiberglass fencing is also of value for being non-conductive and providing weather resistance especially on airfields with stringent electrical safety management systems. Another emerging category is carbon fiber fencing, which offers a high strength-to-weight ratio. However, its high cost limits widespread adoption.

Low-security airports, private airstrips, and secondary perimeters typically use 8-foot fencing, where a general barrier to unauthorized access is sufficient. High-security areas, international airports, and MA2 airbases, where perimeter security is crucial, install fences more than 8 feet high. These taller fences not only have anti-climb designs but also include barbed wire extensions and integrated surveillance technologies to prevent unauthorized access.

The most common form of woven fencing is chain-link, which is cost-effective, flexible, and easy to install. Bar-type fencing, constructed with vertical steel or aluminum bars, is typically found at high-security airports and where rigid, tamper-proof barriers are required.

Welded fencing, which is much stronger and more durable than woven, is generally used in essential airport areas and military airfields and is much better guided to withstand critical entry attempts than woven. Different fence types address security requirements in various ways, spurring innovations in coatings, anti-corrosion treatments, and smart integrated security systems.

The USA landscape favors aluminum and steel due to their durable properties and compliance with Federal Aviation Administration (FAA) and Transportation Security Administration (TSA) security standards. This expansion is fueled by substantial investment in airport infrastructure, from the renovation of existing facilities to the creation of new airports.

There is a growing trend in the implementation of intelligent fencing alternatives, integrating IoT-enabled sensors and AI-powered surveillance, to improve real-time threat detection and response capabilities. Key product portfolio buyers across the globe, including leading companies such as, Betafence NV and CLD Fencing Systems dominate the sector in terms of integrated perimeter security solutions.

FMI opines that the United States air fencing sales will grow at nearly 2.8% CAGR through 2025 to 2035.

In the UK government is committed to improve and upgrade to enhance the aviation security and infrastructure which will help boost the demand for airfield fencing sector. With the UK boasting an established aviation sector and continuing investment in airport expansions and upgrades, effective perimeter protection protocols are essential.

High steel and aluminium quality materials are recognized as a robust choice, a current industry trend, often able to meet demanding security standards. Adoption of innovations like intelligent fencing solutions, which helps to improve real-time threat detection and response capabilities.

FMI opines that the United Kingdom air fencing sales will grow at nearly 2.5% CAGR through 2025 to 2035.

The airfield fencing sector is providing an opportunity for manufacturers to increase their presence in the country, owing to the emphasis on the upgradation of airport security and infrastructure in France. The French government has been investing in the expansion and modernisation of its airports, driving the demand for advanced perimeter security solutions.

They are generally made from steel and aluminum, which ensures durability and meets strict security standards. The advent of smart technologies, technology adoption in airfield fencing, is being widely adopted to enhance threat detection and response capabilities.

FMI opines that the France air fencing sales will grow at nearly 2.3% CAGR through 2025 to 2035.

The airfield fencing in Germany is heavily subjected to security and technological innovations. The German government has been working towards improving airport infrastructure, which has resulted in a surge of demand for sophisticated perimeter security solutions.

The materials chosen for these barriers usually more robust, and meet rigorous security requirements. Integrating smart technologies and technology adoption in airfield fencing which is a major trend to improve the ability of detecting and responding to threats. Companies such as Betafence NV and CLD Fencing Systems have a presence in the German sector and provide integrated perimeter security solutions.

FMI opines that the Germany air fencing sales will grow at nearly 2.4% CAGR through 2025 to 2035.

The airfield fencing market in Italy is driven by the country's initiatives to improve airport security and infrastructure. This reflects the increasing investment in the modernization of airports' infrastructure by the government of Italy and the subsequent demand for sophisticated perimeter security solutions.

Steel and aluminum, for example, are common materials used in the construction of bank vault doors due to their strength and ability to meet security specifications. Smart technology adoption and AI powered surveillance, is increasing to enhance threat detection and response capabilities. Some of the notable players operating in the Italy fencing sector are Dirickx Groupe, CLD Fencing Systems.

FMI opines that the Italy air fencing sales will grow at nearly 2.2% CAGR through 2025 to 2035.

The South Korea airfield fencing landscape is driven by the growing focus on improving airport security and infrastructure. The Government of South Korea has been investing in various airport expansion and modernization projects, resulting in high demand for advanced perimeter security solutions.

To enhance threat detection and response capabilities, the integration of smart technologies, technology adoption in airfield fencing, is becoming increasingly popular. The South Korean landscape also sees a presence of international companies providing perimeter security solutions, such as Betafence NV and CLD Fencing Systems.

FMI opines that the South Korea air fencing sales will grow at nearly 2.6% CAGR through 2025 to 2035.

Airfield fencing plays an important role in Japan's aviation security sector, especially as the Japanese government works to enhance airport and overall security measures. The Japanese Government is investing in multiple projects like airports expansions and modernization as a result the demand for advanced perimeter security solutions are increasing.

For these reasons, materials like aluminum are often used for their durability and adherence to various security standards. Smart technologies - such as connected sensors and artificial intelligence-powered reconnaissance - to enhance threat detection and response capabilities are increasingly being adopted.

FMI opines that the Japan air fencing sales will grow at nearly 2.4% CAGR through 2025 to 2035.

As China rapidly expands its airports, so too does demand for airport security fencing in the middle kingdom. Currently, the Chinese government has been investing heavily in construction and upgrading of new airport, which has led to a significant increase in demand for advanced perimeter security solutions. With the nation updating and expanding its aviation sector, significant airport construction and modernization projects require the latest perimeter security solutions.

FMI opines that the China air fencing sales will grow at nearly 3.2% CAGR through 2025 to 2035.

Australia and New Zealand (ANZ) airfield fencing landscape is stimulated by the increased focus on aviation security, compliance requirements, and widening airport infrastructure. The two countries have set very high standards in aviation safety and thus there's a strong need for high-security fencing systems.

The government of Australia has, through Airservices Australia, made investments in developing major airport infrastructures, and the Aviation Security Service (AvSec) in New Zealand prescribes rigorous perimeter security protocols.

FMI opines that the Australia and New Zealand air fencing sales will grow at nearly 2.7% CAGR through 2025 to 2035.

The market for airfield fencing offers major growth prospects fueled by enhanced airport infrastructure development, raised security concerns, and technological innovation. New airport development, especially in China, India, and the Middle East, is driving demand for high-security perimeter fencing.

Governments and private equity investors are spending big on enhancing airport security, offering prospects for smart fencing solutions combined with AI-driven surveillance, motion sensors, and automated breach alarms. Although carbon fiber provides a good strength-to-weight ratio, its environmental footprint remains a factor to consider.

To leverage these opportunities, businesses must invest in R&D to create anti-climb, impact-resistant, and intrusion-proof fencing systems. Expanding into growth sectors with significant airport development, such as Southeast Asia and Africa, through local alliances can enhance industry penetration.

Mid-sized airports with constrained budgets may prefer cost-effective modular fencing solutions. Mergers, acquisitions, and collaborations with security system integrators will also contribute to competitive edges. Through innovation, regulatory compliance, and strategic growth, firms can secure a leading market share through innovation, compliance, and strategic expansion.

Airfield fencing is traditionally made from steel, aluminum, fiberglass, and carbon fiber. These materials offer strength, resistance to harsh weather conditions, and compatibility with security requirements. Material selection is based on considerations such as cost, maintenance, and the extent of security.

Airfield fencing supports perimeter security by hindering unauthorized entry to designated airport sections. It supports the prevention of wildlife invasion, trespassers, and aviation safety rule compliance. Most fences also incorporate motion sensors and surveillance systems for added security.

The most typical forms are woven fencing, pelisade fencing, and welded fencing. Woven fences are inexpensive and flexible, bar fences are highly resistant to cutting and have high strength, and welded fences are a strong and stiff structure suitable for high-security areas.

The latest airfield fences incorporate smart surveillance platforms, intrusion detection units, and auto-alarm responses. AI-driven cameras, fiber optic sensors, and electrified barriers are widely adopted today to enhance airport security.

Airport fencing should be in accordance with global aviation security standards like those provided by the Federal Aviation Administration (FAA), International Civil Aviation Organization (ICAO), and European Union Aviation Safety Agency (EASA). These standards ensure fence structures are safe, meet height and material strength requirements, to effectively secure airport perimeters.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Meter) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 4: Global Market Volume (Meter) Forecast by Material, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Height, 2019 to 2034

Table 6: Global Market Volume (Meter) Forecast by Height, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 8: Global Market Volume (Meter) Forecast by Product Type, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Meter) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 12: North America Market Volume (Meter) Forecast by Material, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Height, 2019 to 2034

Table 14: North America Market Volume (Meter) Forecast by Height, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 16: North America Market Volume (Meter) Forecast by Product Type, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Meter) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 20: Latin America Market Volume (Meter) Forecast by Material, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Height, 2019 to 2034

Table 22: Latin America Market Volume (Meter) Forecast by Height, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 24: Latin America Market Volume (Meter) Forecast by Product Type, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Meter) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 28: Western Europe Market Volume (Meter) Forecast by Material, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by Height, 2019 to 2034

Table 30: Western Europe Market Volume (Meter) Forecast by Height, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 32: Western Europe Market Volume (Meter) Forecast by Product Type, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Meter) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 36: Eastern Europe Market Volume (Meter) Forecast by Material, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Height, 2019 to 2034

Table 38: Eastern Europe Market Volume (Meter) Forecast by Height, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 40: Eastern Europe Market Volume (Meter) Forecast by Product Type, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Meter) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Meter) Forecast by Material, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Height, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Meter) Forecast by Height, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Meter) Forecast by Product Type, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Meter) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 52: East Asia Market Volume (Meter) Forecast by Material, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by Height, 2019 to 2034

Table 54: East Asia Market Volume (Meter) Forecast by Height, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 56: East Asia Market Volume (Meter) Forecast by Product Type, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Meter) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Meter) Forecast by Material, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Height, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Meter) Forecast by Height, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Meter) Forecast by Product Type, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Material, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Height, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Meter) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 10: Global Market Volume (Meter) Analysis by Material, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by Height, 2019 to 2034

Figure 14: Global Market Volume (Meter) Analysis by Height, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Height, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Height, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 18: Global Market Volume (Meter) Analysis by Product Type, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 21: Global Market Attractiveness by Material, 2024 to 2034

Figure 22: Global Market Attractiveness by Height, 2024 to 2034

Figure 23: Global Market Attractiveness by Product Type, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Material, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Height, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Meter) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 34: North America Market Volume (Meter) Analysis by Material, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Height, 2019 to 2034

Figure 38: North America Market Volume (Meter) Analysis by Height, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Height, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Height, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 42: North America Market Volume (Meter) Analysis by Product Type, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 45: North America Market Attractiveness by Material, 2024 to 2034

Figure 46: North America Market Attractiveness by Height, 2024 to 2034

Figure 47: North America Market Attractiveness by Product Type, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Material, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by Height, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Meter) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 58: Latin America Market Volume (Meter) Analysis by Material, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by Height, 2019 to 2034

Figure 62: Latin America Market Volume (Meter) Analysis by Height, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Height, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Height, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 66: Latin America Market Volume (Meter) Analysis by Product Type, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Material, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Height, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Product Type, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Material, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by Height, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Meter) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 82: Western Europe Market Volume (Meter) Analysis by Material, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by Height, 2019 to 2034

Figure 86: Western Europe Market Volume (Meter) Analysis by Height, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Height, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Height, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 90: Western Europe Market Volume (Meter) Analysis by Product Type, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Material, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by Height, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Material, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by Height, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Meter) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Meter) Analysis by Material, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Height, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Meter) Analysis by Height, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Height, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Height, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Meter) Analysis by Product Type, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Material, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by Height, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Material, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by Height, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Meter) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Meter) Analysis by Material, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Height, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Meter) Analysis by Height, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Height, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Height, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Meter) Analysis by Product Type, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Material, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by Height, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by Product Type, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Material, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by Height, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Meter) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 154: East Asia Market Volume (Meter) Analysis by Material, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by Height, 2019 to 2034

Figure 158: East Asia Market Volume (Meter) Analysis by Height, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Height, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Height, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 162: East Asia Market Volume (Meter) Analysis by Product Type, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Material, 2024 to 2034

Figure 166: East Asia Market Attractiveness by Height, 2024 to 2034

Figure 167: East Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Material, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by Height, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Meter) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Meter) Analysis by Material, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Height, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Meter) Analysis by Height, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Height, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Height, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Meter) Analysis by Product Type, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Material, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Height, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by Product Type, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Geofencing Market Size and Share Forecast Outlook 2025 to 2035

Temporary Fencing Panels Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Temporary Fencing Panels Market Share

Intelligent Fencing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA