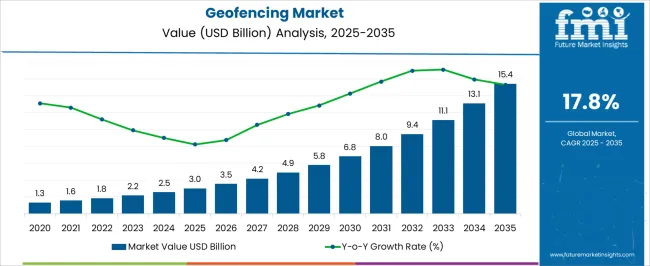

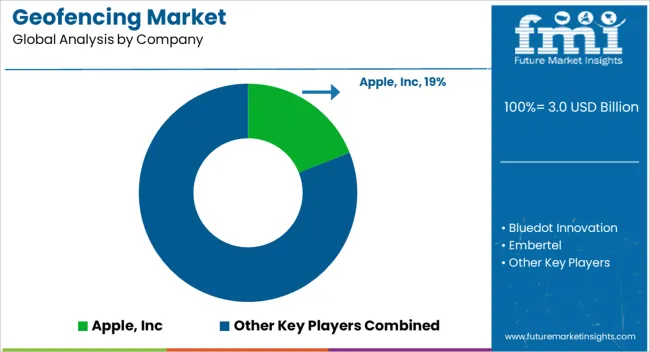

The Geofencing Market is estimated to be valued at USD 3.0 billion in 2025 and is projected to reach USD 15.4 billion by 2035, registering a compound annual growth rate (CAGR) of 17.8% over the forecast period.

| Metric | Value |

|---|---|

| Geofencing Market Estimated Value in (2025 E) | USD 3.0 billion |

| Geofencing Market Forecast Value in (2035 F) | USD 15.4 billion |

| Forecast CAGR (2025 to 2035) | 17.8% |

The geofencing market is witnessing steady advancement, driven by increased location-based service adoption, improved GPS and mobile infrastructure, and the proliferation of smart devices. Businesses are increasingly leveraging geofencing technologies to enhance real-time engagement, optimize operations, and automate location-triggered workflows.

Integration with AI, analytics platforms, and IoT ecosystems has expanded use cases across industries ranging from retail and logistics to banking and security. Regulatory developments supporting privacy frameworks and geolocation data governance are guiding innovation and deployment standards.

Cloud-based geofencing APIs, faster mobile internet, and the growth of connected vehicles are expected to strengthen adoption further. As edge computing matures and mobile platforms continue to evolve, the market is likely to benefit from enhanced responsiveness and broader application across commercial and industrial domains.

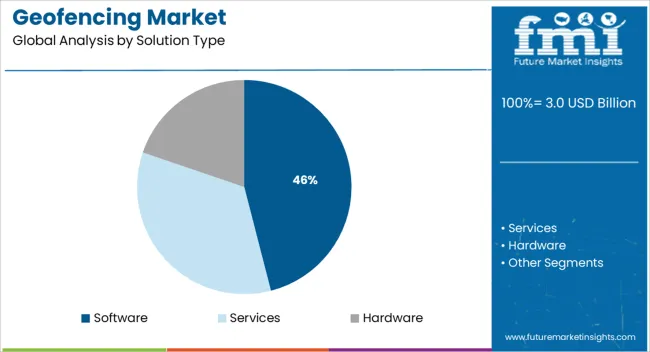

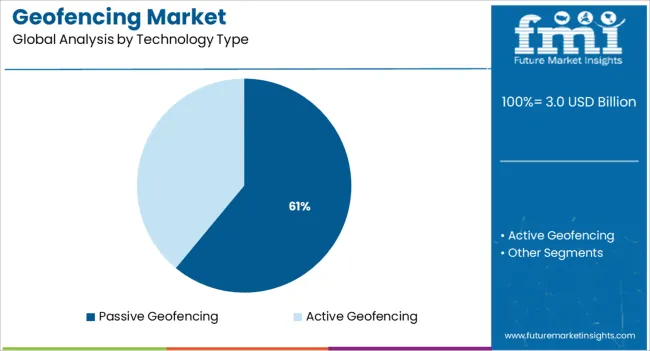

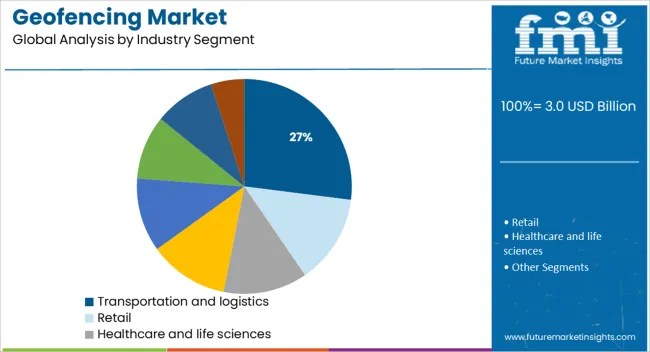

The market is segmented by Solution Type, Technology Type, and Industry Segment and region. By Solution Type, the market is divided into Software, Services, and Hardware. In terms of Technology Type, the market is classified into Passive Geofencing and Active Geofencing. Based on Industry Segment, the market is segmented into Transportation and logistics, Retail, Healthcare and life sciences, Industrial manufacturing, Media and entertainment, Government and defense, Banking, Financial Services, and Insurance (BFSI), and Others (agriculture, education, construction, energy). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Software-based solutions are projected to contribute 46.0% of the total geofencing market revenue in 2025, making it the leading solution type. This leadership is attributed to the increasing demand for cloud-integrated, real-time geofencing platforms that offer enhanced flexibility, automation, and scalability.

Software enables businesses to rapidly deploy, monitor, and adjust geofencing rules through centralized dashboards without the need for dedicated hardware infrastructure. The segment’s growth is also supported by its compatibility with multiple devices, cross-platform integration, and ability to process high volumes of location data efficiently.

With rising emphasis on hyperlocal marketing, fleet management, and proximity-based customer engagement, software-based solutions continue to dominate enterprise adoption strategies.

Passive geofencing is expected to account for 61.0% of the overall market share in 2025, leading the technology type segment. The segment’s strength is attributed to its ability to operate continuously in the background without requiring user interaction, making it highly efficient for applications in safety tracking, logistics, and automated monitoring.

Battery efficiency and improved GPS signal optimization have made passive geofencing particularly suitable for large-scale mobile operations. Organizations are increasingly deploying it for compliance tracking, behavioral analytics, and hands-free notifications.

As privacy considerations grow, passive geofencing offers discreet and consistent data collection mechanisms aligned with evolving data protection guidelines, making it the preferred choice for enterprise-grade deployments.

The transportation and logistics sector is projected to hold 27.0% of the geofencing market revenue in 2025, ranking it as the leading industry segment. This dominance stems from the sector’s ongoing digital transformation, where location intelligence plays a critical role in route optimization, asset monitoring, and real-time delivery tracking.

Geofencing is being used to automate arrival alerts, reduce dwell times, and ensure route compliance, contributing to operational efficiency and cost savings. With increasing investment in connected fleet infrastructure and real-time visibility platforms, geofencing is becoming an integral part of logistics planning and execution.

Additionally, the sector’s prioritization of safety, driver accountability, and performance benchmarking continues to reinforce the use of geofencing technologies at scale.

Geofencing Market Growth Will Be Bumped up by Extensive Use of Location-Based Marketing The latest 5G-enabled smartphones with high-speed data and location accuracy are likely to be the primary drivers of geofencing demand. The geofencing market is expected to expand as it enables businesses to target individual customers by customizing and distributing notifications and advertisements in real time.

The coronavirus outbreak has significantly increased the demand for geofencing. Many organisations are shifting to long-term remote employment as working from home becomes the new standard. As a result, geofencing software that allows employees to clock in and out electronically is in high demand.

Employees become more productive as a consequence of geofencing because it allows them to better regulate their time. As a result, the geofencing market revenue is expected to rise as a result of this factor. Geofencing is being used more often for staff training and recruiting as a result of technological advancements.

A geofence is set up to find qualified candidates quickly. In the healthcare industry, geofencing can be used to provide patient updates to physicians and nurses in specific locations. This factor is ramping up the geofencing market expansion.

An estimated 35.2% of the geofencing market is likely to belong to North America. The majority of secure, developed economies with significant R&D spending can be found in North America, which promotes the adoption of new technologies.

North America's startup scene is growing more quickly than that of other countries. With a share of 18.2% in 2024, the USA dominated the North American geofencing market. The growth of the North American market has been aided by the rising number of new SMEs and the growing digitization within large corporations.

Large businesses must make significant investments in digitalization, whereas small and medium-sized businesses (SMEs) can quickly integrate new technology into their existing systems. The geofencing market in North America is booming as a result of all of these factors.

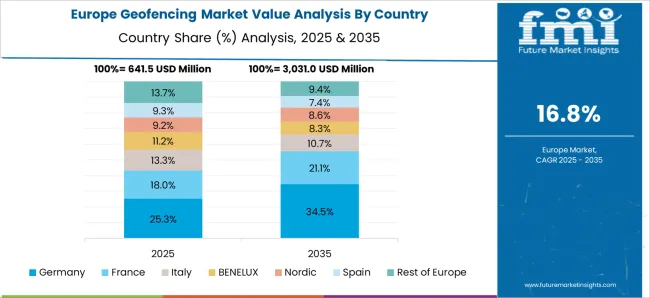

Similar incredible growth is predicted for the European region. In the upcoming years, it is anticipated that significant players and research and development efforts will generate greater profit. The rest of the world's nations are likely to continue to develop steadily. The majority of consumers regularly use smartphones.

It is anticipated that increased internet connectivity will hasten geofencing market expansion. It is simple to build the software framework required to manage communications. The Fintech industry in the area is growing quickly.

Geofencing market participants are evolving as a result of widely spread smartphone use, increasing adoption of connected devices across industries, and growing global utilisation of location-based service platforms for a variety of applications. Major players have a powerful brand identity, a competitive strategy that collaborates, and distribution control. Overall, competition in the geofencing market is intense.

In August 2025, DJI received the world's first C1 EU-type drone assessment certificate under the European Drone Regulation. This has facilitated them in improving a trustworthy brand image and luring potential clients for the firm.

Samsung and Telus officially deployed Canada's first next-generation Mission Critical Push-to-X (MCPTX) services in March 2025, combining data and information with key organizational capabilities such as geofencing and video to keep the public safer.

The adoption of geofencing is rising as it contributes to real-time monitoring, which is useful for data analysis. Furthermore, geofencing provides accurate data by utilizing technologies such as RHD and GPS. In addition, the increased usage of analytical and spatial tools is propelling the geofencing market growth.

The varied applications of geofencing uses and technology for a variety of objectives are predicted to drive the adoption of geofencing during the forecast period.

However, the high pricing of the geofencing devices is one of the primary restrictions highlighted for the geofencing market projection. It also has various limitations in terms of radius coverage, and difficult maintenance, which limits the adoption of geofencing. Furthermore, installation expenses may significantly impede geofencing market expansion in the forecast period.

The demand for geofencing is projected to rise as it allows companies to show advertisements on social media sites by building a virtual geofence. It can also monitor real-time data and allow firms to assess their advertising activity, which propels the geofencing market growth.

Furthermore, the adoption of geofencing is anticipated to grow as small and medium-sized businesses are increasingly using geofencing marketing to boost client retention and brand exposure.

Geofencing increases the chance of a purchase by allowing marketers to target a specific population. As a result, these factors are anticipated to boost the geofencing market share during the forecast period. Furthermore, notifications that are relevant and location-based have a higher click rate which boosts consumer involvement, driving the adoption of geofencing.

Widespread Usage of Location-Based Marketing to Boost Geofencing Market Growth

The latest 5G-enabled smartphones with high-speed data and location accuracy are likely to be the major factors fueling the demand for geofencing. The geofencing market is anticipated to grow as it allows businesses to target individual clients by customizing and distributing notifications and advertisements in real-time.

Geofencing Aids in Remote Employee Monitoring Which Propels the Demand

The coronavirus outbreak has increased the demand for geofencing dramatically. As working from home becomes the new standard, many organizations are shifting to long-term remote employment. As a result, there is a greater demand for geofencing software that allows employees to clock in and depart electronically.

Furthermore, geofencing makes employees more productive by allowing them to better manage their time. As a result, this aspect is projected to boost the geofencing market revenue. Due to technological advancements, geofencing is being used increasingly frequently for staff training and recruiting.

A geofence is set up to efficiently discover qualified applicants. Geofencing can be used in the healthcare industry to set up patient updates for physicians and nurses in certain places. This factor is hastening the geofencing market expansion.

The hardware segment led the geofencing market in 2024 as a result of widespread acceptance of these solutions by industries such as transportation and logistics, retail, automotive, and government. With firms extending solution capabilities in terms of analytics functions and interaction with other comparable location-based services, the hardware market now accounts for a sizable portion of the entire industry.

Active geofencing has advanced in terms of technological flexibility and utility. Mobile marketing, focused clustering, autonomous automobiles, increased BYOD acceptance, and other trends are propelling the industry forward. As a result, the market under consideration is predicted to develop steadily, with market participants driving the majority of the increase.

During the projection period, the transportation and logistics sector is predicted to have the greatest market share of 24.2%. Transportation and logistics segment is one of the most dominant sectors in terms of geofencing market solutions deployment. Asset monitoring, speed limitation, fleet and freight management, and commercial transportation management are some of the transportation and logistics industry applications of geofencing technologies.

During the forecast period, North America is likely to hold a 35.2% share of the market. North America has the majority of stable and established economies that invest heavily in R&D, hence fostering the introduction of new technologies.

When compared to other nations, North America's startup culture is expanding faster. The USA dominated the North American geofencing market with a share of 18.2% in 2024. The expanding number of new SMEs and the increasing digitization inside big organizations have aided the growth of the North American geofencing market.

Small and medium-sized organizations (SMEs) may quickly integrate technology developments into their existing systems, but large enterprises must invest heavily in digitalization. As a consequence of all of these factors, the geofencing market in North America is expanding.

The European region is likewise expected to see unprecedented growth. The important players and research and development efforts are expected to create greater profit in the next years. Countries in the Rest of the World, on the other hand, is likely to experience consistent development. Smartphones are being used on a regular basis by consumers.

Furthermore, improved internet connectivity is expected to accelerate market expansion. The software framework necessary to manage the communications is straightforward to build. The region's Fintech market is also rapidly expanding. Several banks are employing geofencing to match customer locations to card transactions to ensure that cardholder transactions are permitted and reduce the risk of fraud.

During the projection period, the South Asia & Pacific region is estimated to develop at a CAGR of 22.5% during 2025 to 2035. The Asia Pacific region includes key nations with rapidly growing economies such as China and India. In 2024, India is held a second largest share of 10.5% in Asia Pacific geofencing market.

China dominated the Asia Pacific geofencing market with a share of 12.3% in 2024. These countries have a large number of SMBs. Furthermore, government projects such as Digital India have encouraged the use of technology in these countries' economic sectors. Small and medium-sized companies (SMBs) are using beacons and geofencing to increase client interactions. This technology is reasonably priced, with numerous beacon units costing around USD 20.

Furthermore, Walmart has already begun selling in India, and the country's large e-commerce presence presents further opportunities for the geofencing sector, since both Amazon and Walmart aim to deploy unmanned drones to carry items.

Startups in the geofencing market, such as Gimbal Inc. and Radar Labs Inc., are concentrating on creating better solutions to assist consumers make better decisions using location data in order to achieve momentum in the market. The adoption of advanced technologies like IoT, advanced analytics, edge computing, and blockchain has increased device connectivity, resulting in the rise of data.

This data includes consumer behavior in retail outlets, real-time marketing analysis, sensor-driven decision analytics, and instantaneous control response in complex autonomous systems. Implementation of IoT by startups connects businesses and governments to smart opportunities including smart cities, smart transportation, and smart projects.

The geofencing market players are evolving in response to widespread smartphone use, rising adoption of connected devices in various industries (such as transportation and logistics), and rising global usage of location-based service platforms for various applications such as maps, check-ins, and so on.

Furthermore, major players like IBM, Microsoft, Google, and Samsung have a strong brand identification, effective competitive strategy, and distribution control. Overall, competitive rivalry is fierce in the geofencing market.

Geofencing Services, the Need of the Hour for Multiple Industries

Geofencing is a low-cost marketing method that provides numerous options dependents on budget. Geofencing campaigns are simple to deploy and generally available since they do not require technological skill, supporting business growth.

As a result, many firms are employing it regularly, which is boosting the demand for geofencing among multiple companies. Furthermore, it is also useful for responding to consumer problems and enquiries inside a certain geofence.

Buyers in the digital era demand a more digital-first, tailored shopping experience, when paired with geofencing and sophisticated technologies such as augmented reality (AR). The adoption of geofencing is projected to grow as more and more devices become wearable.

Over the predicted period, this is projected to increase the adoption of geofencing in retail. Furthermore, rising adoption among retailers for promotion of their deals and marketing bodes well for the growth of the geofencing market in the retail industry throughout the projection period.

Food delivery firms are growing as smartphone usage increases, and all delivery companies use geofencing technology in their applications for improved communication. In Singapore, for example, Grab Maps use geofencing to offer drivers safe transportation. Geofencing service is used by Grab to help delivery partners avoid places where traffic has been abruptly or briefly stopped.

Microsoft Corporation

Microsoft Corporation completed the acquisition of Nuance Communications, Inc., a USA-based corporation, in March 2025 for a total purchase price of USD 18.8 billion, largely in cash. Nuance is an artificial intelligence software business with experience in healthcare and enterprise AI, and the purchase is likely to allow the company to extend its industry-specific offerings.

GroundTruth

GroundTruth announced cooperation and integration with Yext, Inc., an online brand Management Company, in May 2024, to produce tailored location-based advertising campaigns for Yext platform advertisers. Customers will be able to control their listings in the Yext platform while using GroundTruth's proprietary Blueprint mapping technology to recognize and target customers with customized products and adverts.

Foursquare

Foursquare and Factual Inc., a location data business, collaborated in April 2024 to offer location-based services globally. Furthermore, the agreement is projected to give its consumers with a united product portfolio, including offline attribution, developer tools, and Point of Interest (POI) data, allowing businesses to harness the data and insights that improve their business and marketing choices.

Simpli.fi

Simpli.fi offers geo-fencing solutions with immense values to help advertisers reach, measure, as well as validate the traffic and scale. The geofencing solution provider develops solutions that determine and target relevant audience with high precision.

These solutions can help target users using physical locations with their custom polygon geo-fence tool. In addition to this, household-level targeting is also possible using the demographical and behavioural intent insights.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 17.8% from 2025 to 2035 |

| Base Year of Estimation | 2025 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and Volume in Units and F-CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, growth factors, Trends and Pricing Analysis |

| Key Segments Covered | By Solution, By Technology, By Industry, By Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East & Africa; Oceania |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, Italy, France, UK, Spain, Russia, China, Japan, India, GCC Countries, Australia |

| Key Companies Profiled | Apple, INC. (USA); Bluedot Innovation (USA); Pulsate (USA); GPSWOX, Ltd. (USA); Thumbvista (USA); Fi Holdings Inc. (USA); Localytics (USA); Geomoby (Australia); Plot Projects (Netherlands); DreamOrbit (India); LocationSmart (USA); SuccorfishM2M (UK); Embitel (India); InVisage (USA); MobiOcean (India); Visioglobe (France); Mobinius Technologies (India); Raveon Technologies (USA); Urban Airship (USA); Maven Systems (India); MAPCITE (UK); Simpli.fi |

The global geofencing market is estimated to be valued at USD 3.0 billion in 2025.

The market size for the geofencing market is projected to reach USD 15.4 billion by 2035.

The geofencing market is expected to grow at a 17.8% CAGR between 2025 and 2035.

The key product types in geofencing market are software, services and hardware.

In terms of technology type, passive geofencing segment to command 61.0% share in the geofencing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA