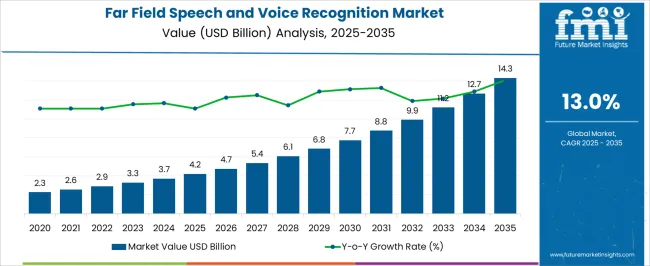

The Far Field Speech and Voice Recognition Market is estimated to be valued at USD 4.2 billion in 2025 and is projected to reach USD 14.3 billion by 2035, registering a compound annual growth rate (CAGR) of 13.0% over the forecast period.

| Metric | Value |

|---|---|

| Far Field Speech and Voice Recognition Market Estimated Value in (2025 E) | USD 4.2 billion |

| Far Field Speech and Voice Recognition Market Forecast Value in (2035 F) | USD 14.3 billion |

| Forecast CAGR (2025 to 2035) | 13.0% |

The far field speech and voice recognition market is expanding rapidly, fueled by the proliferation of voice-enabled devices, smart home adoption, and advancements in natural language processing technologies. Far field recognition systems enable accurate voice command detection from a distance, even in noisy environments, enhancing user experience across consumer electronics and smart assistants.

Market growth is supported by integration into automotive systems, healthcare devices, and enterprise applications, where hands-free operation provides safety and convenience. The current landscape reflects increased investment in improving microphone arrays, speech processing algorithms, and AI-driven contextual understanding.

Future outlook remains favorable as voice interfaces become central to human-machine interaction, driven by consumer preference for intuitive, touch-free controls. With expanding application scope and ongoing technological innovation, the far field speech and voice recognition market is positioned for sustained growth.

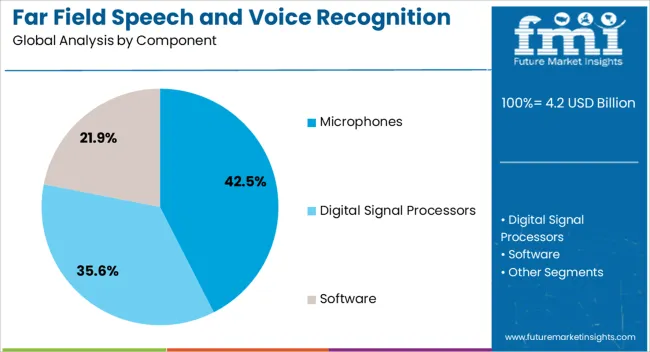

The microphones segment leads the component category with approximately 42.50% share, supported by its critical role in capturing accurate voice signals for processing. Microphone arrays are essential for noise cancellation, beamforming, and echo reduction, which enhance recognition accuracy in real-world conditions.

Growing demand for high-quality audio input in consumer electronics, smart speakers, and automotive systems has reinforced this segment’s dominance. Technological improvements in miniaturization and power efficiency are expanding microphone deployment across compact devices.

With rising demand for precise far field input capture, the microphones segment is expected to maintain its leading position.

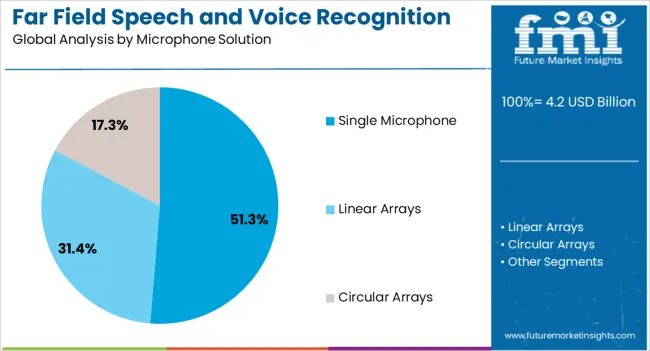

The single microphone segment dominates the microphone solution category with approximately 51.30% share, reflecting its cost-effectiveness and suitability for basic consumer electronics applications. While multi-microphone arrays offer advanced features, single microphone configurations continue to find strong demand in entry-level smart devices and compact consumer products.

This segment benefits from reduced manufacturing costs, simplified design integration, and consistent performance in controlled environments. The balance between affordability and adequate functionality ensures steady adoption, particularly in price-sensitive markets.

With growing penetration of budget-friendly voice-enabled devices, the single microphone segment is expected to retain significant demand.

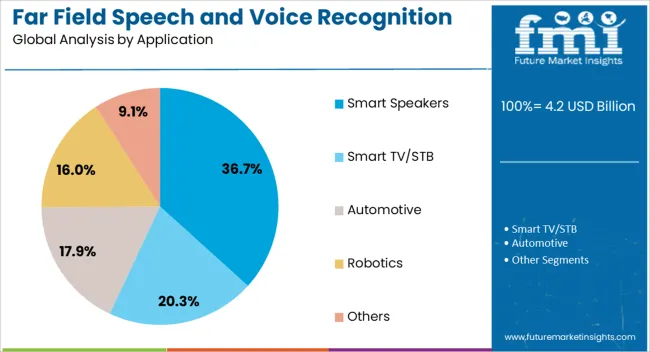

The smart speakers segment accounts for approximately 36.70% share in the application category, underscoring its central role in the far field speech and voice recognition market. Growth is driven by increasing consumer adoption of voice assistants integrated into smart home ecosystems.

Smart speakers rely heavily on accurate far field recognition to provide seamless interaction across entertainment, information retrieval, and home automation functions. Major consumer electronics brands have prioritized far field technologies to differentiate products, further accelerating market expansion.

With continued global adoption of smart homes and rising integration of multilingual recognition capabilities, the smart speakers segment is expected to sustain its leading share.

The scope for far field speech and voice recognition rose at a 14.5% CAGR between 2020 and 2025. The global market for far field speech and voice recognition is anticipated to grow at a moderate CAGR of 13.1% over the forecast period 2025 to 2035.

The market experienced steady growth during the historical period from 2020 to 2025. The period saw increased adoption of smart devices with integrated voice recognition, such as smart speakers, smartphones, and other IoT devices.

Looking ahead to the forecast period from 2025 to 2035, the market is expected to witness significant growth. The market is likely projected to witness even broader adoption across diverse industries, with an emphasis on applications such as healthcare, automotive, education, and beyond.

Privacy issues related to the collection and storage of voice data can be a significant barrier. Consumers are increasingly concerned about how their voice data is handled, leading to hesitancy in adopting voice recognition technologies.

The below table showcases revenues in terms of the top 5 leading countries, spearheaded by Korea and Japan. The countries are expected to lead the market through 2035.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 13.4% |

| China | 13.7% |

| The United Kingdom | 13.9% |

| Japan | 14.1% |

| Korea | 15.4% |

The far field speech and voice recognition market in the United States expected to expand at a CAGR of 13.4% through 2035. The widespread adoption of smart devices, including smartphones, smart speakers, and wearable devices, contributes to the demand for far field speech and voice recognition technologies. Consumers in the United States increasingly use voice commands to interact with these devices.

The far field speech and voice recognition market in the United Kingdom is anticipated to expand at a CAGR of 13.9% through 2035. The adoption of virtual assistants, such as Amazon Alexa, Google Assistant, and Apple Siri, has led to an increased demand for far field speech recognition. The virtual assistants are integrated into various devices, providing users with voice activated functionalities.

Far field speech and voice recognition trends in China are taking a turn for the better. A 13.7% CAGR is forecast for the country from 2025 to 2035. The automotive industry in China is incorporating voice recognition systems for in car infotainment, navigation, and hands free communication. Far field speech recognition enhances the driving experience and aligns with the growing demand for connected vehicles.

The far field speech and voice recognition market in Japan is poised to expand at a CAGR of 14.1% through 2035. Japan has a culture of early technology adoption and a strong focus on innovation.

The far field speech and voice recognition market in Korea is anticipated to expand at a CAGR of 15.4% through 2035. Korea has a highly tech savvy population with a strong affinity for adopting new technologies. The consumer behavior contributes to the rapid adoption of voice recognition technologies in various applications.

The below table highlights how microphones segment is projected to lead the market in terms of component, and is expected to account for a CAGR of 12.8% through 2035. Based on application, the smart TV/STB segment is expected to account for a CAGR of 12.5% through 2035.

| Category | CAGR through 2035 |

|---|---|

| Microphones | 12.8% |

| Smart TV/STB | 12.5% |

Based on component, the microphones segment is expected to continue dominating the far field speech and voice recognition market. Ongoing advancements in microphone technology focus on improving the acoustic design to enhance sensitivity and capture a wide range of frequencies, which allows for more accurate and clear voice recognition in various environments.

In terms of application, the smart TV/STB segment is expected to continue dominating the far field speech and voice recognition market. Far field speech and voice recognition technology enhance user convenience by allowing users to control their smart TVs and STBs through voice commands. The hands free interaction contributes to an improved overall user experience.

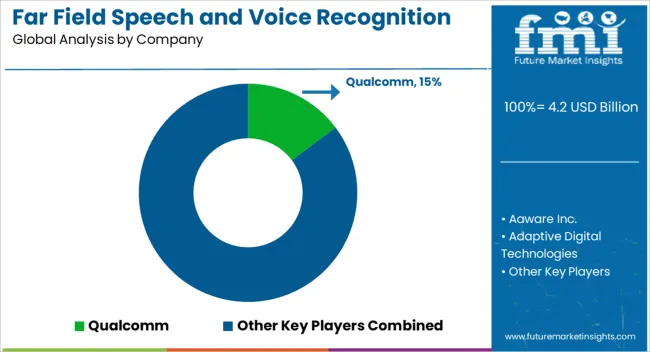

The far field speech and voice recognition market is highly dynamic and competitive, driven by the increasing demand for voice enabled technologies across various industries. Key players in this market are engaged in continuous innovation, strategic partnerships, and acquisitions to gain a competitive edge.

The competitive landscape is characterized by a mix of established technology giants, emerging startups, and companies specializing in specific applications of voice recognition technology.

Recent Development

| Attribute | Details |

|---|---|

| Estimated Market Size in 2025 | USD 4.2 billion |

| Projected Market Valuation in 2035 | USD 14.3 billion |

| Value-based CAGR 2025 to 2035 | 13.0% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Component, Microphone Solution, Application, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, France, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Aaware Inc.; Adaptive Digital Technologies; Alango; Ami Technologies; Analog Devices Inc.; Andrea Electronics Corp.; Cadence Design Systems Inc.; Ceva Inc.; Cirrus Logic Inc.; DSP Concepts; DSP Group Inc.; Harman International; Knowles Corp.; Meeami Technologies; Microsemi Corp.; NXP Semiconductors N.V.; Qualcomm; Retune Dsp; Sensory; Stmicroelectronics N.V. |

The global far field speech and voice recognition market is estimated to be valued at USD 4.2 billion in 2025.

The market size for the far field speech and voice recognition market is projected to reach USD 14.3 billion by 2035.

The far field speech and voice recognition market is expected to grow at a 13.0% CAGR between 2025 and 2035.

The key product types in far field speech and voice recognition market are microphones, digital signal processors and software.

In terms of microphone solution, single microphone segment to command 51.3% share in the far field speech and voice recognition market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Farm Animal Drug Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Farm Tire Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Farm Equipment Market – Advanced Agricultural Machinery 2024-2034

Farnesol Market

Farming Sack and Tote Market Report – Trends, Size & Forecast 2024 to 2034

Far-field Tag Antennas Market Size and Share Forecast Outlook 2025 to 2035

Safari Tourism Market Size and Share Forecast Outlook 2025 to 2035

Safari Tourism in Africa Market Size and Share Forecast Outlook 2025 to 2035

Warfarin Sensitivity Testing Market

UK Safari Tourism Market Analysis – Growth, Demand & Forecast 2025-2035

USA Safari Tourism Market Insights – Demand, Size & Trends 2025-2035

Indoor Farming Market Analysis - Size, Share, and Forecast 2025 to 2035

A Detailed Global Analysis of Brand Share for the Indoor Farming Market

Poultry Farming Equipment Market Size and Share Forecast Outlook 2025 to 2035

India Safari Tourism Market Trends – Demand, Growth & Forecast 2025-2035

Cruise Safari Market Size and Share Forecast Outlook 2025 to 2035

Vertical Farming Market Size and Share Forecast Outlook 2025 to 2035

Drone Warfare Market Size and Share Forecast Outlook 2025 to 2035

Brazil Safari Tourism Market Growth – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA