The Anti-aircraft Warfare Market is estimated to be valued at USD 24.4 billion in 2025 and is projected to reach USD 49.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period.

The anti-aircraft warfare market is witnessing strong growth, driven by heightened geopolitical tensions, increasing defense budgets, and ongoing modernization programs aimed at enhancing air defense capabilities. Nations are prioritizing the development and acquisition of advanced systems capable of countering diverse aerial threats, including unmanned aerial vehicles, cruise missiles, and fifth-generation aircraft.

The integration of radar-guided interceptors, automated fire control, and multi-layered defense architectures has significantly strengthened operational readiness. Continuous innovation in missile technology, electronic warfare, and tracking systems has improved interception accuracy and reduced response time.

Defense alliances and joint military exercises are further supporting the exchange of technology and standardization across systems. The market outlook remains positive, with rising investments in both short-range and long-range air defense networks, supported by the growing importance of autonomous defense coordination and real-time threat management.

| Metric | Value |

|---|---|

| Anti-aircraft Warfare Market Estimated Value in (2025 E) | USD 24.4 billion |

| Anti-aircraft Warfare Market Forecast Value in (2035 F) | USD 49.8 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

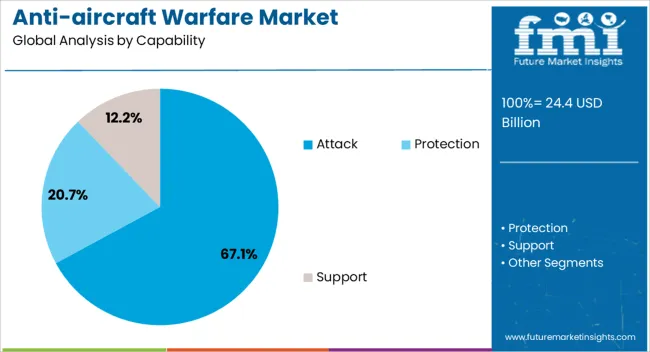

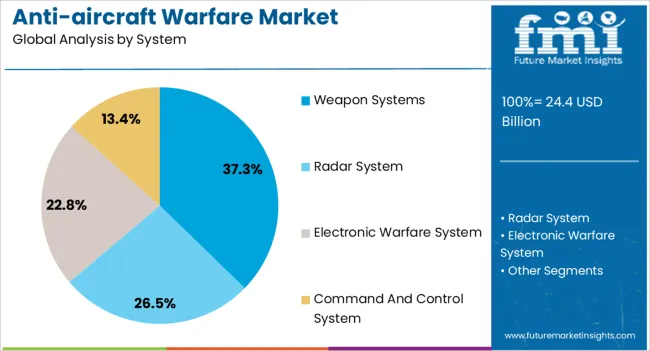

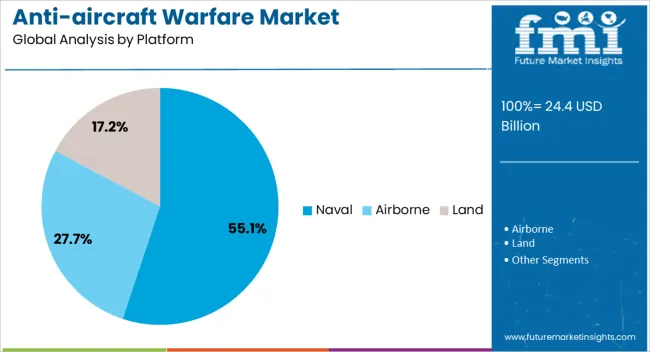

The market is segmented by Capability, System, Platform, and Range and region. By Capability, the market is divided into Attack, Protection, and Support. In terms of System, the market is classified into Weapon Systems, Radar System, Electronic Warfare System, and Command And Control System. Based on Platform, the market is segmented into Naval, Airborne, and Land. By Range, the market is divided into Medium Range (20 To 100 Km), Short Range (<20 Km), and Long Range (>100 Km). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

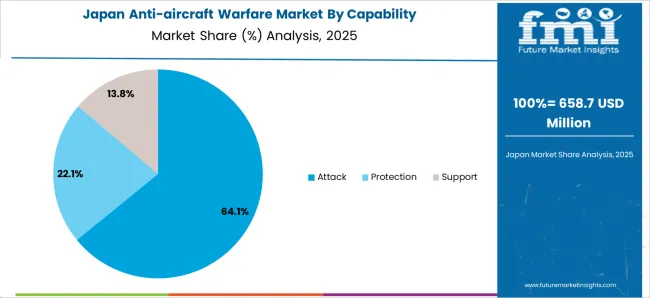

The attack segment leads the capability category with approximately 67.10% share, underscoring its critical role in the execution of offensive and defensive air engagement operations. This segment’s growth is driven by the deployment of advanced surface-to-air missile systems, anti-drone solutions, and high-energy laser technologies designed for rapid threat neutralization.

Increased emphasis on precision engagement and multi-target tracking has strengthened the demand for attack-capable systems within integrated air defense frameworks. Defense modernization initiatives across major economies prioritize platforms with higher lethality, range, and automation capabilities.

The segment’s dominance is further supported by the expansion of network-centric warfare doctrines that enhance situational awareness and strike coordination. As nations continue to upgrade existing arsenals with interoperable and autonomous systems, the attack segment is expected to sustain its leadership position in the forecast period.

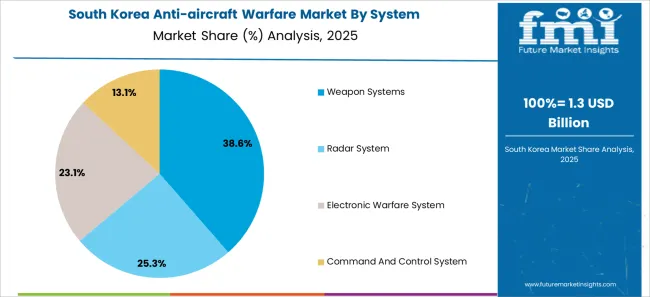

The weapon systems segment holds approximately 37.30% share of the system category, driven by continuous advancements in interceptor missile technology, artillery modernization, and hybrid defense platforms. The segment encompasses a range of kinetic and non-kinetic systems designed to engage aerial threats with high precision and minimal collateral impact.

Integration of advanced guidance systems, radar fusion, and fire control algorithms has elevated operational efficiency. Additionally, modular designs allow for scalability and interoperability across land, naval, and air defense networks.

Nations are investing in multi-mission weapon systems capable of engaging both low and high-altitude targets under varied combat conditions. As defense contractors focus on enhanced mobility, faster reload capabilities, and digital integration, the weapon systems segment is projected to maintain a strong position in the evolving air defense ecosystem.

The naval segment dominates the platform category, accounting for approximately 55.10% share, reflecting the increasing focus on maritime air defense capabilities. Naval vessels are increasingly being equipped with multi-layered missile defense systems to counter airborne threats in littoral and deep-sea environments.

The rise of hypersonic and sea-skimming missile threats has intensified the need for advanced shipborne interception technologies. Integration of radar arrays, combat management systems, and close-in weapon systems has enhanced the responsiveness of naval fleets.

Growing investments in next-generation destroyers, frigates, and aircraft carriers have further strengthened this segment’s market presence. As maritime security and naval dominance remain strategic priorities globally, the naval segment is expected to sustain its leading share through continued fleet modernization and technological advancement.

This section provides a comprehensive analysis of the industry during the last five years, highlighting the trends expected to drive the market's growth in anti-aircraft warfare. A strong historical compound annual growth rate of 9.1% indicates a slowdown in the market. The industry is predicted to develop at a steady 7.4% CAGR until 2035.

| Historical CAGR | 9.1% |

|---|---|

| Forecast CAGR | 7.4% |

The development of electronic warfare and stealth tactics, financial restraints, and a reorientation of military priorities toward new threats are among the causes that are expected to have a detrimental effect on demand for anti-aircraft warfare.

Crucial factors that are anticipated to affect the sales of anti-aircraft warfare through 2035.

Network-centric warfare enhances the anti-aircraft warfare industry by fostering real-time communication and coordination among diverse defense systems. The system allows seamless integration of sensor data, intelligence, and rapid decision-making, optimizing the deployment of anti-aircraft assets.

This interconnected approach improves situational awareness, enabling quicker response to aerial threats.

With synchronized efforts and information sharing, network-centric warfare enhances anti-aircraft systems' effectiveness, accuracy, and efficiency, providing a robust defense against evolving airborne challenges in modern warfare scenarios. The utilization of the network-centric warfare system develops the demand for the anti-aircraft warfare infrastructure.

Missile defense systems stabilize the market by addressing security concerns and providing a layer of defense against ballistic missile threats.

As geopolitical tensions persist, demand for reliable defense creates a consistent market. Technological advancements in missile defense systems foster innovation, creating a dynamic market environment.

Government support and defense budgets allocate resources for research, development, and procuring advanced missile defense technologies, contributing to a stable and lucrative market. The arms race and missile proliferation threat drive nations to invest in sophisticated systems, ensuring strategic stability.

By encouraging a common defense strategy among participating nations, international cooperation in anti-aircraft warfare increases demand. By fostering a collaborative knowledge of security concerns through shared intelligence on aerial threats, governments are encouraged to invest in cutting-edge anti-aircraft equipment.

Joint development efforts are frequently the outcome of collaborative initiatives, which save costs by taking advantage of economies of scale and promoting the adoption of cutting-edge technologies.

Demand is further increased by improved interoperability, which makes it possible for various defensive systems to function together flawlessly. Collaborative efforts to create strategic alliances lead to agreements on defense and a shared need for anti-aircraft systems.

The cooperative defense architecture guarantees a strong and coordinated reaction to changing aerial threats, discouraging possible enemies and advancing security.

This section presents in-depth analyses of certain anti-aerial warfare industry segments. The two main subjects of the current research are the support segment in the capability category and weapon systems in the system category.

| Attributes | Details |

|---|---|

| Top Capability | Support |

| CAGR from 2025 to 2035 | 7.2% |

With a promising CAGR of 7.2%, the support capabilities segment is expected to dominate the anti-aviation warfare market. This preference for support systems in anti-aircraft warfare can be attributed to several factors:

| Attributes | Details |

|---|---|

| Top System | Weapon Systems |

| CAGR from 2025 to 2035 | 7.0% |

Weapon systems became the popular system category, with a moderate CAGR of 7.0%. The dominating factors can be described as follows:

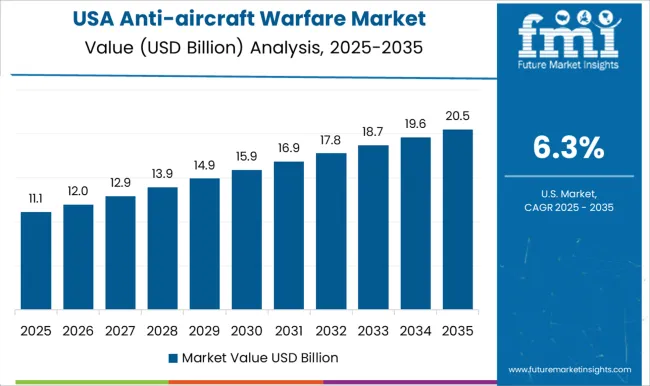

The anti-aircraft warfare markets of several significant countries, including the United States, Japan, South Korea, China, and the United Kingdom, are examined in this section. This section discusses the factors that impact the demand, recognition, and sales of anti-aircraft warfare in particular nations.

| Country | CAGR from 2025 to 2035 |

|---|---|

| United States | 7.6% |

| Japan | 9.0% |

| United Kingdom | 8.6% |

| South Korea | 8.9% |

| China | 7.9% |

Through 2035, the market for anti-aircraft warfare in the United States is anticipated to increase at a favorable CAGR of 7.6%, with an anticipated market value of USD 8.2 billion. Several of the key trends are as follows:

The anti-aircraft warfare market in Japan is expected to reach USD 49.8 billion in valuation by 2035 at a compound annual growth rate of 9.0%. The following are some of the main trends:

The anti-aircraft warfare market in China is expected to grow at a promising rate of 7.9% and be valued at USD 7.2 billion by 2035. The following factors fuel this quick expansion:

Anti-aircraft warfare strategies are expected to be valued at USD 1.9 billion and grow at a rigid rate of 8.6% through 2035 in the United Kingdom. Among the main motivators are:

South Korea is seeing increased demand for anti-aircraft warfare, with a predicted CAGR of 8.9% and an anticipated value of USD 2.9 billion through 2035. Among the main trends are:

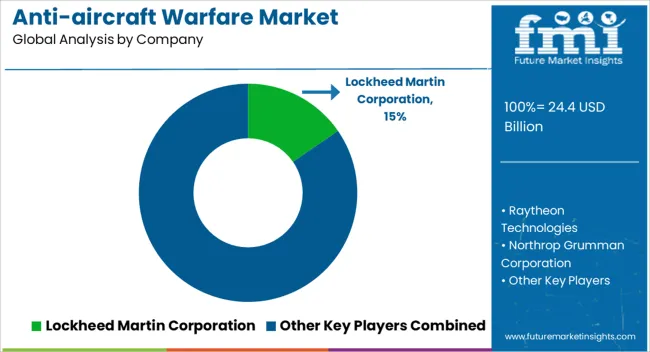

Market players in the anti-aircraft warfare industry play a pivotal role in shaping the landscape through innovative initiatives, strategic alliances, and a commitment to meeting contemporary defense needs.

Leading companies like Lockheed Martin Corporation and Raytheon Technologies are at the forefront, investing significantly in research and development to enhance technological capabilities.

Their focus spans advanced radar technologies, precision-guided missiles, and electronic warfare solutions, contributing to the continuous evolution of anti-aircraft systems.

Strategic collaborations and partnerships between industry giants, exemplified by MBDA and Northrop Grumman Corporation, foster international cooperation, developing sophisticated and interoperable anti-aircraft systems. Key market players actively seek to broaden their impact globally, exploring export opportunities and contributing to the defense capabilities of allied nations.

Developing integrated and multi-layered air defense solutions is a shared goal among industry leaders, addressing diverse threats and providing comprehensive protection against evolving aerial challenges.

A focus on integrating artificial intelligence and autonomous systems, as pursued by companies like BAE Systems plc, underscores the industry's commitment to leveraging cutting-edge technologies for quicker threat detection and response in anti-aircraft warfare.

Market participants also stress the significance of indigenous manufacturing capacities, which enable countries to lessen their reliance on foreign suppliers and promote self-sufficiency in anti-aircraft defense.

Together, the dynamic efforts of these sector leaders propel the anti-aircraft warfare market upward and guarantee that defense capabilities are anticipated to always evolve to successfully counter the complexity of contemporary airborne threats.

Recent Developments in the Anti-aircraft Warfare Industry:

The global anti-aircraft warfare market is estimated to be valued at USD 24.4 billion in 2025.

The market size for the anti-aircraft warfare market is projected to reach USD 49.8 billion by 2035.

The anti-aircraft warfare market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in anti-aircraft warfare market are attack, protection and support.

In terms of system, weapon systems segment to command 37.3% share in the anti-aircraft warfare market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drone Warfare Market Size and Share Forecast Outlook 2025 to 2035

Robotic Warfare Market Size and Share Forecast Outlook 2025 to 2035

Electronic Warfare Market Analysis by Category Type, Product, Platform, and Region from 2025 to 2035

Cognitive Electronic Warfare Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA