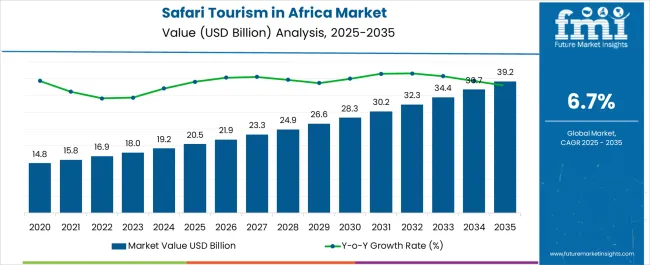

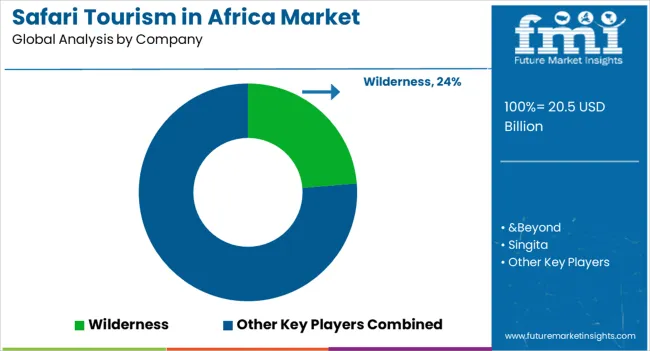

The Safari Tourism in Africa Market is estimated to be valued at USD 20.5 billion in 2025 and is projected to reach USD 39.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period.

| Metric | Value |

|---|---|

| Safari Tourism in Africa Market Estimated Value in (2025 E) | USD 20.5 billion |

| Safari Tourism in Africa Market Forecast Value in (2035 F) | USD 39.2 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The safari tourism market in Africa is experiencing steady expansion, supported by rising international travel demand, increasing disposable incomes, and a growing interest in wildlife and adventure-based experiences. Governments and private operators are investing heavily in infrastructure, sustainable tourism models, and conservation projects that enhance the appeal of safari destinations.

Digital transformation across booking channels, including mobile platforms and online travel services, has widened accessibility and convenience for global travelers. Additionally, heightened awareness of eco-tourism and responsible travel practices has elevated Africa’s position as a premier destination for authentic and sustainable wildlife experiences.

With continued support for regional connectivity, conservation-led tourism, and digital integration in customer engagement, the market outlook remains robust, offering significant opportunities for operators, suppliers, and allied service providers.

The direct suppliers category is led by airlines, which are expected to hold 41.70% of the overall market in 2025. This dominance is linked to the crucial role of direct connectivity in improving accessibility to remote safari destinations.

Increased flight frequencies, expanded routes, and competitive pricing have strengthened airline participation in safari tourism. Airlines are also partnering with regional tourism boards and luxury safari operators to offer bundled travel packages, further boosting their share.

With a rising number of international travelers seeking direct, seamless travel arrangements, airlines remain central to enabling growth in the safari tourism market..

The indirect suppliers category is led by online travel agencies, which are projected to account for 44.30% of the overall market in 2025. Growth in this segment is supported by the convenience of digital booking platforms, availability of comparative pricing, and comprehensive package offerings that combine transport, accommodation, and guided tours.

OTA platforms are increasingly investing in user-friendly mobile applications, virtual destination previews, and dynamic pricing tools, which have enhanced customer engagement.

The ability to reach global travelers and provide transparent, customizable booking experiences has positioned OTAs as the leading choice in indirect supply channels.

The under 18 age group is anticipated to represent 8.60% of the market by 2025 within the age category. This share reflects the growing popularity of family-oriented safari packages, where parents prioritize immersive educational experiences for younger travelers.

Safari operators are tailoring itineraries to include interactive wildlife education, conservation workshops, and child-friendly accommodations. The emphasis on experiential learning and safe, guided exposure to Africa’s biodiversity has made safari tourism attractive to younger demographics.

This segment’s growth is reinforced by the rising trend of family travel, ensuring that the under 18 category continues to contribute steadily to the overall market landscape.

A safari is an overland travel that is frequently taken by tourists to Africa. Earlier, an excursion of this nature frequently involved a large hunt. Originally, the word "safari" was simply a shortened form of the Swahili word "safari," which means "journey." In a more regal or regale time, the main purpose of a safari was to hunt, shoot, and then drag the kill overland by a group of local tribes’ people.

The idea of safari tourism was popularized in the United States by former US President Teddy Roosevelt. In a nutshell, a safari is a vacation taken by adventurers to view and capture wildlife or engage in hiking in addition to sight-seeing. The main draw for tourists is seeing wildlife in its natural habitat, including elephants, lions, leopards, buffaloes, hippos, and rhinos.

The COVID-19 outbreaks had a significant detrimental effect on industry expansion. By 2024, a significant fraction of safari travel providers had lost the majority of their reservations. The COVID-19 pandemic significantly reduced the number of tourists visiting the top African wildlife tourist attractions, including South Africa, Kenya, Tanzania, Botswana, and Zambia. Due to the COVID-19 pandemic, many famous wildlife travels experiences have been impacted.

One of most popular and desired kind of vacation in Africa is a safari. Most people agree that doing a safari is the only "thing to do" in Africa. A safari in Africa typically connotes a wildlife safari. People are drawn to witness the wild animals in their native habitats, including lions, elephants, rhinoceroses, giraffes, zebras, leopards, and many others.

Travelers today desire a thorough understanding of the local cultures of the destinations they visit. This issue is being taken into account by a number of new industry participants who are giving safari tourists a customized experience and so fueling market expansion.

Growth in Per Capita Income at Individual Level is Crucially Determining the Growth of the Market.

Increasing per capita income is primarily driving up demand for safari tourism in Africa and around the world. The demand for safari tourism in Africa is being driven by rising tourism spending, an increase in the number of urban working-class people, and an increase in global GDP.

A huge opportunity exists for safari tourism in Africa, where it is still in its infancy. Innovative ideas like ethno-tourism are developing as potential growth areas for safari tourism in the continent's tourism industry.

Various Factors such as High Cost, Safety and Infrastructure Issues are a Few Challenges for the Market Growth.

Although there is a sizable demand for safari tourism in Africa on the travel and tourist industry, there are certain problems that are impeding its expansion, such as the very small target demographic and the high cost of these safari packages.

Other obstacles include poor infrastructure, safety concerns, worries about the security of aircraft or airspace, and ignorance of luxury safaris among international tourists, as some people prefer comfortable vacations. Additionally, laws prohibiting the shooting of wildlife and the continent's reputation as a dangerous place are inhibiting the expansion of the safari industry in Africa.

The Emergence of Luxury Safari is Reflecting Positive Growth Trends.

Luxury safari experiences are becoming more popular among tourists going on safari in Africa. Without sacrificing their standard of living, tourists can see the majesty of African animals and tribal life in their natural setting.

Luxury Safari is a combination of a tribal and contemporary vacation destination where guests may enjoy all the comforts of home. Another obvious tendency is the evolution of the safari into a vacation focused mostly on sight-seeing and wildlife photography.

Parts of Africa are prospering owing to the rise in safari-driven tourism, and some of that money is going back into improving the safari experience for visitors. Business tourism is expanding across the continent as a result of the region's strong economic growth, particularly in East Africa, while domestic and intra-African travel is expanding as a result of big5 increasing incomes and urbanization.

In Africa, safari travelers frequently hope to see the big five (elephant, rhino, cheetah, lion and zebra). Safaris in Africa are becoming more and more well-liked as a result of chimpanzee and gorilla trekking.

International Travelers Constitute the Most of this Category.

The number of visitors visiting Africa is rising, and more people are travelling there from the Middle East, Brazil, Russia, India, and China. All of these nations are thought to be at a comparable stage of newly advanced economic development. These tourists are the ones who are keenly interested to learn about the ecosystems and animal kingdoms of indigenous African locations while also enjoying and experiencing wild creatures and diverse geographic landscapes.

Millennials are Mostly Interested in Adventure Activities Followed Closely by Generation Z

Safari Tourism is becoming all the more popular among all age groups, with millennials accounting for the majority. The age group between 20-30 years old is most likely to possess a major share of the travelers in this market. Majority of these visitors plan their own trips to new, adventurous locations. Thus, making it more popular amongst the middle-aged and young population.

Adventure Safari Dominated the Market in this Category

In 2024, the adventure sector dominated the market and contributed a sizable portion of revenue. Young travelers particularly love adventure travel. By allowing the tourists to step outside of their comfort zone, adventure tourism boosts a significant amount of its enthusiasm. Over the past few years, adventure safari has grown significantly in popularity, with the majority of tourists seeking to participate in one of a variety of safari adventure activities. Further, in the coming years private safari segment is more likely to expand over the time.

Online Booking Channels Lead the booking Channel Segmentation

Travelers enjoy their vacations, but for many, it becomes a tedious task due to the planning strategies. Before buying travel tickets, lodging, tours, or any other additional services, it typically takes a lot of time and effort to research and make the accurate selection. But there's no denying that the existence of internet travel agents has surely given customers access to more options while simultaneously reducing the time consumed.

The top safari tourism amenities are what well-known firms in the sector strive to provide its patrons. As a result, these businesses are essential to the growth of commerce everywhere in the world. Market participants are forming mergers, acquisitions, and strategic alliances to broaden their regional reach. To deliver cutting-edge features and draw clients, major operators are constantly implementing unique technologies like virtual reality, artificial intelligence, and IoT.

If visitors want to explore, they can go to one of the more than 50 safari parks in Africa that draw tourists from all over the world. A few of the well-known ones are Mala Game Reserve, Serengeti National Park, Okavango Delta, Mana Pools National Park, Moremi Game Reserve, Sabi Sand Game Reserve, Phinda Game Reserve, Masai Mara National Reserve, Ruaha National Park, South Luangwa National Park, Ngorongoro Crater, Selous Game Reserve, Kidepo Valley National Park, Kgalagadi Transfront, among others.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 20.5 billion |

| Projected Market Size (2035) | USD 39.2 billion |

| CAGR (2025 to 2035) | 6.7% |

| Base Year for Estimation | 2025 |

| Historical Period | 2020 to 2025 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value |

| Tourist Types Analyzed (Segment 1) | International, Domestic |

| Age Groups Covered (Segment 2) | Under 18, 18-25, 26-35, 36-45, 46-55, Over 55 |

| Demographics Covered (Segment 3) | Male, Female, Kids |

| Group Types Covered (Segment 4) | Corporate, Family, Couples, Youth Groups, Single Tourists |

| Safari Types Analyzed (Segment 5) | Adventure Safari, Private Safari, Others |

| Booking Channels Covered (Segment 6) | Online Booking, Phone Booking, In-Person Booking |

| Supplier Types Covered (Segment 7) | Direct: Airlines, Hotels, Car Rental, Train, Tour Operators, Government Bodies; Indirect: OTA, Travel Agencies, Travel Management Companies, Corporate Buyers, Aggregators |

| Regions Covered | Africa (including key safari destinations) |

| Key Countries Covered | South Africa, Kenya, Tanzania, Botswana, Namibia, Zimbabwe, Uganda |

| Key Players Influencing the Market | Leading Tour Operators, Safari Lodges, Travel Agencies, Online Travel Platforms |

| Additional Attributes | Dollar sales by safari type and booking channel, millennial travel trends, digital adoption for bookings, adventure tourism growth, regional tourism initiatives |

| Customization and Pricing | Customization and Pricing Available on Request |

The global safari tourism in africa market is estimated to be valued at USD 20.5 billion in 2025.

The market size for the safari tourism in africa market is projected to reach USD 39.2 billion by 2035.

The safari tourism in africa market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in safari tourism in africa market are airlines, hotel companies, car rental, train, tour operators and government bodies.

In terms of indirect suppliers, ota (online travel agency) segment to command 44.3% share in the safari tourism in africa market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Safari Tourism Market Size and Share Forecast Outlook 2025 to 2035

UK Safari Tourism Market Analysis – Growth, Demand & Forecast 2025-2035

USA Safari Tourism Market Insights – Demand, Size & Trends 2025-2035

India Safari Tourism Market Trends – Demand, Growth & Forecast 2025-2035

Cruise Safari Market Size and Share Forecast Outlook 2025 to 2035

Brazil Safari Tourism Market Growth – Size, Demand & Forecast 2025-2035

South Africa Safari Tourism Market Analysis – Growth, Trends & Forecast 2025-2035

Tourism Market Trends – Growth & Forecast 2025 to 2035

Market Share Insights of Tourism Security Service Providers

Tourism Security Market Analysis by Service Type, by End User, and by Region – Forecast for 2025 to 2035

Tourism Independent Contractor Model Market Size and Share Forecast Outlook 2025 to 2035

Tourism Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Tourism Industry Big Data Analytics Market Analysis by Application, by End, by Region – Forecast for 2025 to 2035

Assessing Tourism Industry Loyalty Program Market Share & Industry Trends

Tourism Industry Loyalty Programs Sector Analysis by Program Type by Traveler Profile by Region - Forecast for 2025 to 2035

Competitive Overview of Geotourism Market Share

Geotourism Market Insights - Growth & Trends 2025 to 2035

Global Ecotourism Market Insights – Growth & Demand 2025–2035

Agritourism Market Size and Share Forecast Outlook 2025 to 2035

Art Tourism Market Analysis by, by Service Category, by End, by Booking Channel by Region Forecast: 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA