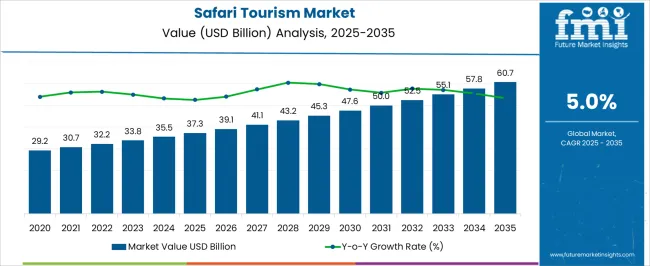

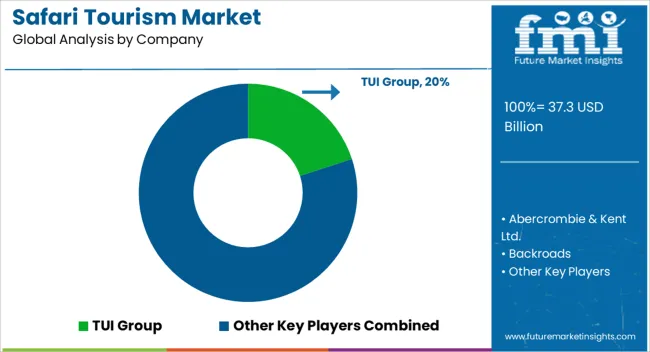

The safar tourism market, estimated at USD 37.3 billion in 2025 and projected to reach USD 60.7 billion by 2035 with a CAGR of 5.0%, exhibits a complex cost-structure and value-chain that significantly influences market expansion and profitability. The primary cost components include operational expenses, which encompass transportation, park management, accommodation, and guided tour services. These operational costs account for a substantial share of the overall market expenditure, reflecting the need for high-quality vehicles, trained personnel, and compliance with environmental and wildlife protection standards.

Accommodation and hospitality services, ranging from luxury lodges to mid-tier camps, contribute to both fixed and variable costs within the value chain. Investment in infrastructure and maintenance forms a critical part of fixed costs, while consumables and service management drive variable expenditures. Transportation, particularly off-road vehicles and safari-specific mobility solutions, represents another major cost element, influencing both pricing strategies and profit margins.

Ancillary services, including local cultural experiences, safety equipment, and travel insurance, add supplementary revenue streams while also impacting cost allocation. The value-chain extends to marketing, booking platforms, and partnerships with travel agencies, which facilitate customer acquisition and retention but introduce additional marketing and commission-related costs. Over the forecast period, efficiency in cost management, coupled with strategic value-chain integration, is expected to optimize profitability and support the market growth from USD 37.3 billion in 2025 to USD 60.7 billion in 2035, highlighting the importance of operational and service-oriented expenditure management in driving sustainable market expansion.

| Metric | Value |

|---|---|

| Safari Tourism Market Estimated Value in (2025 E) | USD 37.3 billion |

| Safari Tourism Market Forecast Value in (2035 F) | USD 60.7 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The safari tourism market represents a specialized segment within the global travel and leisure industry, emphasizing wildlife experiences, adventure, and eco-tourism. Within the broader tourism and hospitality sector, it accounts for about 5.3%, driven by demand for curated wildlife expeditions, guided tours, and immersive nature experiences. In the adventure travel and outdoor tourism segment, it holds nearly 4.8%, reflecting adoption by travelers seeking experiential and sustainable travel options. Across the luxury travel and resort accommodations market, the share is 4.2%, supporting safari lodges, exclusive camps, and high-end tour services. Within the eco-tourism and conservation-focused tourism category, it represents 3.7%, highlighting initiatives that combine wildlife protection with visitor engagement. In the travel services and tour operator sector, it secures 3.3%, emphasizing organized itineraries, transport logistics, and wildlife conservation partnerships. Recent developments in this market have focused on sustainable tourism, technology integration, and personalized experiences. Innovations include mobile app-based booking, GPS-enabled safari tracking, and virtual reality previews of wildlife destinations. Key players are collaborating with wildlife reserves, national parks, and local communities to enhance guest experiences while promoting conservation awareness. Adoption of guided photographic safaris, eco-friendly accommodations, and immersive cultural experiences is gaining traction to attract high-value tourists. The partnerships with travel platforms, airlines, and adventure gear providers are being deployed to expand reach and service quality. These trends demonstrate how sustainability, digital innovation, and experiential offerings are shaping the market.

The Safari Tourism market is witnessing robust growth driven by the increasing demand for immersive wildlife and adventure experiences across the globe. Rising disposable incomes, growing interest in nature-based travel, and expanding international connectivity have contributed to the expansion of this market. The future outlook is favorable as tourism operators and destinations continue to innovate with sustainable and personalized safari packages.

Enhanced awareness of conservation efforts and eco-tourism principles is further encouraging travelers to opt for safari tourism. Additionally, government initiatives to promote wildlife tourism and the growing popularity of experiential travel among millennials and Gen Z are expected to bolster market growth.

The market is also benefiting from improved infrastructure in key safari destinations, enabling easier access and better visitor experiences As environmental sustainability becomes a priority, the Safari Tourism market is anticipated to evolve with a focus on responsible travel, which will create new opportunities for growth.

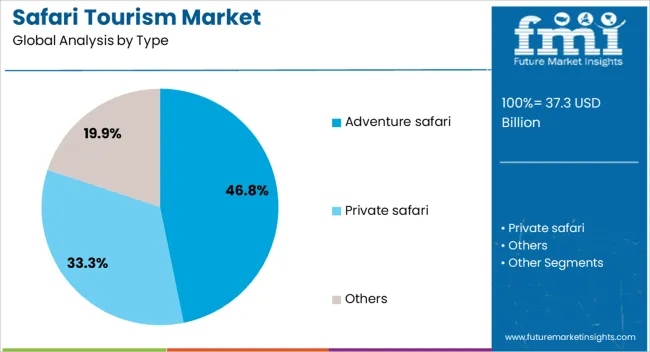

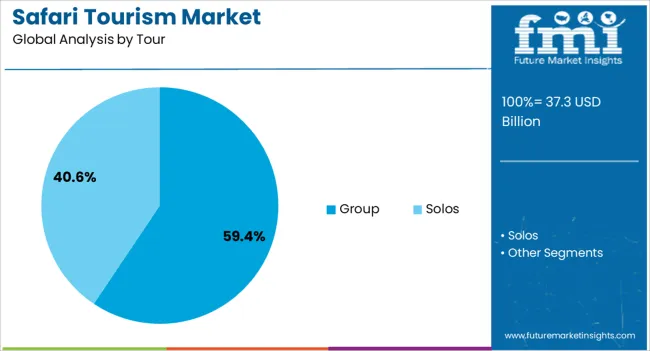

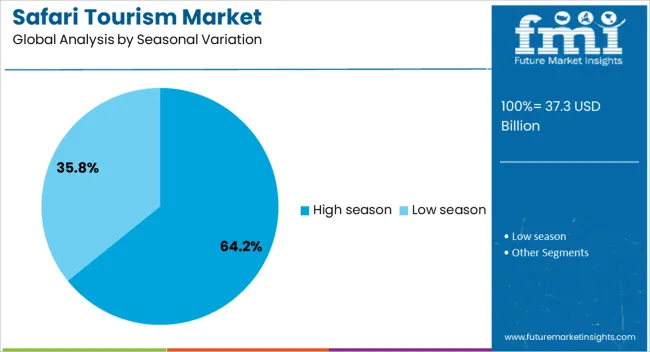

The safari tourism market is segmented by type, tour, seasonal variation, booking channel, and geographic regions. By type, safari tourism market is divided into Adventure safari, Private safari, and Others. In terms of tour, safari tourism market is classified into Group and Solos. Based on seasonal variation, safari tourism market is segmented into High season and Low season. By booking channel, safari tourism market is segmented into Online tour operators, Direct booking with safari lodge and camps, and Travel agencies. Regionally, the safari tourism industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Adventure Safari type is estimated to hold 46.8% of the Safari Tourism market revenue share in 2025, making it the leading segment by type. This prominence is attributed to the growing preference for high-thrill and physically engaging wildlife experiences that combine exploration with outdoor activities.

Adventure safaris offer unique opportunities to experience remote and diverse ecosystems, which appeals to tourists seeking more than traditional sightseeing. The flexibility to include activities such as hiking, camping, and off-road expeditions within safari packages has enhanced the appeal of this segment.

The growth has also been supported by the increasing availability of expert-guided tours and specialized services that cater to adventure seekers Furthermore, rising consumer interest in authentic and sustainable travel experiences has fueled demand for adventure safari offerings that emphasize close contact with nature and conservation education.

The Group Tour segment is projected to capture 59.4% of the overall Safari Tourism market revenue share in 2025, making it the dominant tour type. This leadership is driven by the cost-effectiveness and social appeal of group travel options, which provide safety, convenience, and shared experiences highly valued by many travelers.

Group tours often benefit from economies of scale, enabling more affordable pricing and access to premium safari destinations. The structure of group tours also simplifies logistics and planning for travelers, which has been especially important in post-pandemic recovery periods.

Tour operators have expanded group offerings to include themed and specialized safaris that attract various demographics, including families, retirees, and first-time travelers Additionally, group tours facilitate knowledge sharing and foster community among participants, enhancing overall satisfaction and encouraging repeat travel.

The High Season segment is anticipated to account for 64.2% of the Safari Tourism market revenue share in 2025, marking it as the leading seasonal variation. This segment’s growth is influenced by the concentration of wildlife activity and favorable climatic conditions during peak periods, which significantly enhance the safari experience. Tourists are inclined to travel during the high season to maximize wildlife sightings and enjoy optimal weather, driving demand for safari services.

Seasonal peaks also align with holiday periods and school vacations in major source markets, further intensifying travel volumes. Operators often design premium packages and exclusive experiences tailored to high season demand, which increases average spending per visitor.

However, the high season also necessitates robust management of tourist flows to mitigate environmental impacts and preserve destination quality As demand remains strong, investment in infrastructure and sustainable tourism practices during the high season will be critical to support continued growth.

The market has witnessed notable growth as travelers increasingly seek wildlife experiences, cultural immersion, and adventure travel. Safaris provide opportunities to explore natural habitats, observe endangered species, and engage in eco-friendly tourism activities. Growing interest in sustainable and experiential travel has expanded the appeal of safari destinations in Africa, Asia, and South America. Infrastructure improvements, including lodges, guided tour services, and transportation networks, have enhanced accessibility and comfort for tourists. Marketing strategies leveraging digital platforms, social media, and influencer campaigns have also elevated global awareness.

The growth of safari tourism has been closely linked to conservation efforts and eco-tourism initiatives. Protected areas, national parks, and wildlife reserves offer opportunities for observing species such as lions, elephants, rhinos, and gorillas in their natural habitats. Travelers are increasingly motivated by experiences that support environmental preservation and responsible tourism. Eco-lodges and sustainable accommodation models have been developed to minimize ecological impact while providing comfort. Collaborations between tourism operators, local communities, and conservation organizations ensure ethical wildlife interactions. The focus on environmentally conscious travel has strengthened market demand, attracting tourists seeking authentic and responsible safari experiences while supporting biodiversity protection.

Technological advancements have improved the safari tourism experience, making it safer, more informative, and accessible. GPS tracking, mobile applications, and online booking platforms enable tourists to plan trips efficiently and navigate park areas safely. Drones and digital photography tools enhance wildlife observation and documentation. Virtual reality previews and interactive content have allowed potential tourists to experience destinations remotely, influencing travel decisions. Communication networks and safety monitoring systems have improved emergency response and guided tours. These technological integrations provide convenience, enhance customer satisfaction, and support personalized experiences, contributing to the attractiveness and competitiveness of safari tourism in global markets.

The expansion of infrastructure and hospitality services has been a critical driver of safari tourism. Investments in lodges, resorts, luxury tented camps, and transport networks have improved accessibility to remote wildlife areas. High quality services, including guided tours, adventure activities, and cultural programs, have enhanced the overall tourist experience. Partnerships with airlines, local transport operators, and travel agencies facilitate convenient travel planning. Sustainable construction practices, water and energy efficiency, and waste management in lodges have further strengthened the eco-tourism appeal. These combined efforts support higher tourist inflows, longer stays, and repeat visits, consolidating the growth of the market.

The market faces challenges due to strict environmental regulations, seasonal fluctuations, and geopolitical factors. Wildlife protection laws, permit requirements, and park access restrictions can limit the number of visitors and operational flexibility. Seasonal weather patterns, including rainy seasons or extreme temperatures, affect wildlife visibility and travel logistics. Political instability and safety concerns in certain regions may deter tourists. The over-tourism in popular destinations can lead to habitat degradation. To address these issues, operators focus on regulated tour operations, diversified destination portfolios, and off-season promotion strategies to maintain sustainable growth while preserving environmental integrity and tourist satisfaction.

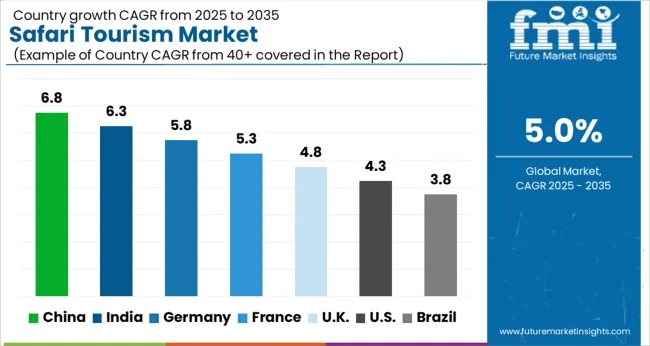

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The market is expected to advance at a CAGR of 5.0% from 2025 to 2035, driven by growing interest in wildlife experiences and eco-tourism offerings. China leads with 6.8, fueled by increasing outbound travel and leisure spending. India follows at 6.3, supported by enhanced infrastructure and national park initiatives. Germany records 5.8, reflecting rising demand for sustainable travel experiences. The United Kingdom at 4.8 and the United States at 4.3 continue steady growth through curated wildlife tours and luxury safari packages. Collectively, these countries represent pivotal hubs for tourism development, innovation in travel services, and international market engagement. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to grow at a CAGR of 6.8%, driven by increasing domestic interest in wildlife experiences, national park visits, and eco travel initiatives. Adoption has been reinforced by rising disposable income, organized travel packages, and luxury safari offerings. Travel agencies and tour operators are focusing on personalized itineraries, wildlife photography, and adventure experiences to attract urban and suburban travelers. Demand has also been encouraged by social media awareness and curated wildlife excursions. The market outlook is expected to remain positive as Chinese tourists increasingly seek immersive safari and wildlife travel experiences across domestic and international destinations.

India is expected to record a CAGR of 6.3%, supported by growing interest in national parks, wildlife sanctuaries, and eco-tourism initiatives. Adoption has been reinforced by government promotional campaigns, improved travel infrastructure, and increasing interest in guided safari experiences. Domestic tour operators focus on curated wildlife packages including jungle safaris, bird watching, and luxury lodges. The market is anticipated to expand as both domestic and international travelers seek immersive experiences in India’s diverse wildlife habitats, with emphasis on safety, comfort, and guided tours.

Germany is projected to grow at a CAGR of 5.8%, influenced by demand for wildlife photography, eco-tourism, and organized safari trips abroad. Adoption has been reinforced by interest in African and Asian safari destinations, facilitated by tour operators offering curated itineraries and guided experiences. German travelers prioritize safety, high quality accommodation, and sustainability in safari tourism. Market growth is further supported by increased digital marketing, travel expos, and partnerships between German agencies and international safari lodges.

The United Kingdom market is expected to grow at a CAGR of 4.8%, driven by increasing interest in African safaris, wildlife photography, and experiential travel. Adoption has been encouraged by tour operators providing customized itineraries, family friendly packages, and luxury safari lodges. Travel agencies focus on combining cultural experiences with wildlife tours to enhance appeal. The market is expected to expand steadily as British travelers continue to prioritize adventure, wildlife exploration, and curated safari experiences in popular international destinations.

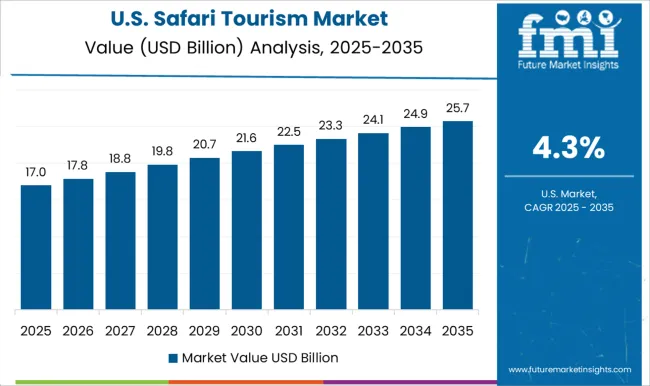

The United States market is projected to expand at a CAGR of 4.3%, supported by increasing interest in exotic destinations, wildlife photography, and organized safari tours. Adoption has been reinforced by demand for luxury safari lodges, guided tours, and adventure travel packages. Travel agencies focus on personalized itineraries, group tours, and sustainable tourism practices. Market growth remains moderate but consistent as U S travelers seek immersive wildlife experiences abroad while emphasizing safety, comfort, and quality service.

The market exhibits strong competition among luxury tour operators, regional specialists, and niche experiential travel providers. Leading global operators such as TUI Group, Abercrombie & Kent Ltd., and Thomas Cooke Group leverage brand recognition, global distribution channels, and curated travel experiences to attract high-value clientele seeking premium safari offerings. These companies focus on multi-country itineraries, exclusive lodges, and integrated travel services to maintain a competitive edge. Specialized safari providers like Gamewatchers Safaris, Great Plains, Singita, Micato Safari, and Rothchild Safaris differentiate through conservation-focused experiences, eco-lodges, and personalized wildlife tours, appealing to environmentally conscious and affluent travelers. Companies such as Backroads, Butterfield & Robinson, Enchanting Travels, Scott Dunn, and Travcoa emphasize adventure-based and bespoke itineraries, combining cultural immersion with wildlife exploration. Market competitiveness is further driven by customer service quality, itinerary customization, digital booking platforms, and sustainable tourism initiatives. Operators are increasingly investing in partnerships with local communities, wildlife conservancies, and transport providers to ensure unique experiences, regulatory compliance, and loyalty retention. Continuous innovation in luxury safari offerings, marketing strategies, and regional expansion is pivotal for maintaining a strong foothold in this growing segment of experiential tourism.

| Item | Value |

|---|---|

| Quantitative Units | USD 37.3 Billion |

| Type | Adventure safari, Private safari, and Others |

| Tour | Group and Solos |

| Seasonal Variation | High season and Low season |

| Booking Channel | Online tour operators, Direct booking with safari lodge and camps, and Travel agencies |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | TUI Group, Abercrombie & Kent Ltd., Backroads, Butterfield & Robinson, Enchanting Travels, Gamewatchers Safaris, Great Plains, Micato Safari, Rothchild Safaris, Scott Dunn, Singita, Thomas Cooke Group, Travcoa, and Wilderness |

| Additional Attributes | Dollar sales by tour type and region, demand dynamics across wildlife, adventure, and luxury travel segments, regional trends in safari destination adoption, innovation in eco-friendly accommodations, digital booking platforms, and immersive experiences, environmental impact of tourism on wildlife and habitats, and emerging use cases in conservation-focused travel, experiential tourism, and sustainable safari operations. |

The global safari tourism market is estimated to be valued at USD 37.3 billion in 2025.

The market size for the safari tourism market is projected to reach USD 60.7 billion by 2035.

The safari tourism market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in safari tourism market are adventure safari, private safari and others.

In terms of tour, group segment to command 59.4% share in the safari tourism market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Safari Tourism in Africa Market Size and Share Forecast Outlook 2025 to 2035

UK Safari Tourism Market Analysis – Growth, Demand & Forecast 2025-2035

USA Safari Tourism Market Insights – Demand, Size & Trends 2025-2035

India Safari Tourism Market Trends – Demand, Growth & Forecast 2025-2035

Brazil Safari Tourism Market Growth – Size, Demand & Forecast 2025-2035

South Africa Safari Tourism Market Analysis – Growth, Trends & Forecast 2025-2035

Cruise Safari Market Size and Share Forecast Outlook 2025 to 2035

Tourism Independent Contractor Model Market Size and Share Forecast Outlook 2025 to 2035

Tourism Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Tourism Market Trends – Growth & Forecast 2025 to 2035

Tourism Industry Big Data Analytics Market Analysis by Application, by End, by Region – Forecast for 2025 to 2035

Assessing Tourism Industry Loyalty Program Market Share & Industry Trends

Tourism Industry Loyalty Programs Sector Analysis by Program Type by Traveler Profile by Region - Forecast for 2025 to 2035

Market Share Insights of Tourism Security Service Providers

Tourism Security Market Analysis by Service Type, by End User, and by Region – Forecast for 2025 to 2035

Competitive Overview of Geotourism Market Share

Geotourism Market Insights - Growth & Trends 2025 to 2035

Global Ecotourism Market Insights – Growth & Demand 2025–2035

Agritourism Market Size and Share Forecast Outlook 2025 to 2035

Art Tourism Market Analysis by, by Service Category, by End, by Booking Channel by Region Forecast: 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA