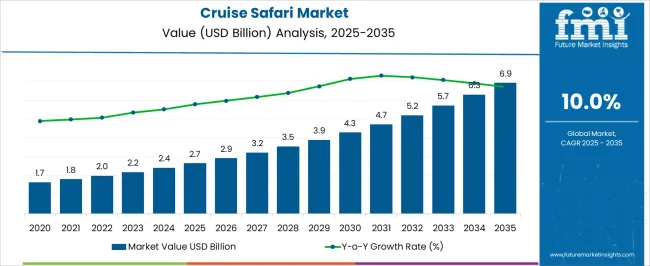

The cruise safari market is projected to grow from USD 2.7 billion in 2025 to USD 6.9 billion in 2035, reflecting a robust CAGR of 10.0%. During the early adoption phase (2020–2024), the market experienced gradual growth as initial consumer interest and niche operators established a foothold.

By 2025, the market will reach USD 2.7 billion, signaling readiness for broader adoption. In this period, pilot programs, regional offerings, and targeted marketing helped validate demand, while incremental increases from USD 1.7 billion in 2020 to USD 2.7 billion in 2025 illustrate the initial scaling potential and confidence among early participants. From 2025 to 2035, the market transitions into scaling (2025–2030) and eventually consolidation (2030–2035).

By 2030, the market will surpass USD 3.9 billion, reflecting the rapid expansion of operators, broader geographic coverage, and enhanced service accessibility. The consolidation phase sees growth tapering toward USD 6.9 billion by 2035, with the market structure stabilizing as leading providers dominate and smaller players align or exit. The CAGR of 10.0% over the decade highlights strong but manageable expansion, demonstrating how the ,market matures from experimental adoption into a more standardized and widely accepted offering.

| Metric | Value |

|---|---|

| Cruise Safari Market Estimated Value in (2025 E) | USD 2.7 billion |

| Cruise Safari Market Forecast Value in (2035 F) | USD 6.9 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

The Cruise Safari Market operates within several interconnected parent markets, each contributing differently to its growth. The Global Tourism & Travel Market represents the largest influence, accounting for approximately 35% of the market potential, driven by rising global leisure travel. The Cruise Tourism Market contributes around 20%, as ocean and river cruise experiences provide the operational model and consumer familiarity that Cruise Safaris leverage.

The Adventure Tourism Market adds 15%, reflecting the demand for experiential and nature-focused journeys. The Luxury Travel Market influences roughly 10%, as high-net-worth travelers seek premium services and exclusive itineraries. Wildlife & Safari Tourism forms about 8%, providing the thematic core for cruise safari experiences. Hospitality & Lodging Services account for 5%, given the integration of shore-side accommodations and onboard amenities. Transportation & Logistics, particularly marine transport, represent 4%, enabling smooth operational execution across destinations. Finally, Online Travel Platforms & Booking Services contribute 3%, facilitating accessibility, digital visibility, and consumer engagement. Collectively, these parent markets define both the scale and trajectory of the Cruise Safari sector, offering a multi-dimensional growth framework.

The Cruise Safari market is experiencing dynamic growth, fueled by rising consumer interest in experiential travel that combines adventure with luxury and cultural immersion. The current market environment reflects a shift toward personalized travel experiences that emphasize both exploration of natural landscapes and high-end comfort. The market’s future outlook is promising due to increased disposable incomes, expanding global tourism infrastructure, and growing demand for sustainable and nature-based tourism options.

Adventurous travelers are increasingly seeking curated safari cruises that allow access to remote destinations with minimal environmental impact. The fusion of tour-based adventure with vessel amenities enhances the appeal to diverse traveler segments, including those interested in wildlife viewing, cultural encounters, and exclusive experiences.

The growing trend of combining traditional safari elements with cruising technology is creating new opportunities for operators to expand itineraries and target niche markets Overall, the Cruise Safari market is positioned for sustained expansion as consumer preferences evolve toward more immersive and eco-conscious travel models.

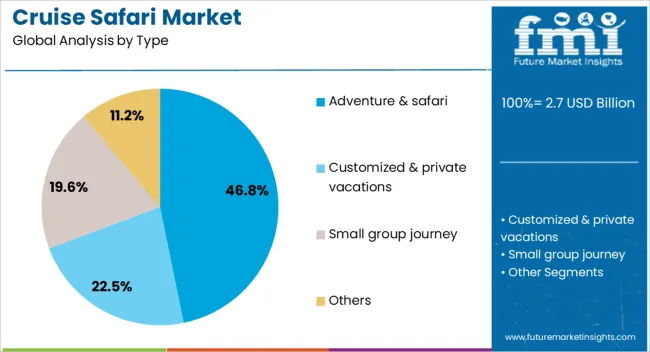

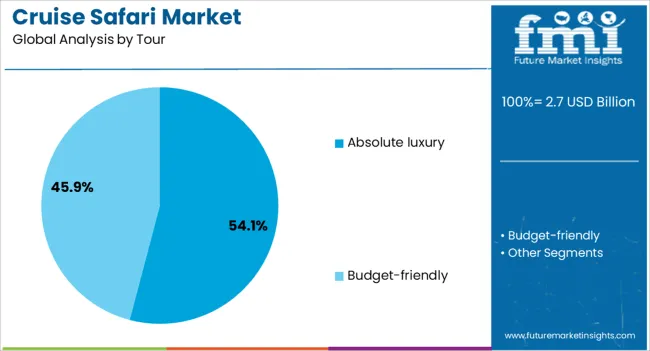

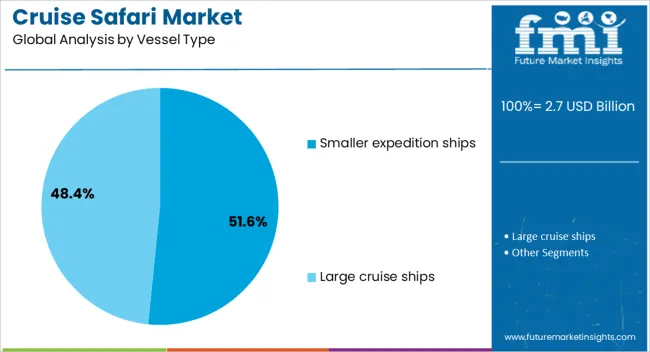

The cruise safari market is segmented by type, tour, vessel type, booking channel, and geographic regions. By type, cruise safari market is divided into Adventure & safari, Customized & private vacations, Small group journey, and Others. In terms of tour, cruise safari market is classified into Absolute luxury and Budget-friendly. Based on vessel type, cruise safari market is segmented into Smaller expedition ships and Large cruise ships. By booking channel, cruise safari market is segmented into Online platform, Direct booking, and Travelling agencies. Regionally, the cruise safari industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Adventure and Safari tour segment is expected to hold approximately 46.8% of the Cruise Safari market revenue share in 2025, making it the leading tour type in this market. This segment’s growth is driven by the rising popularity of immersive wildlife and nature exploration experiences among travelers seeking unique and authentic adventures.

Increased environmental awareness and demand for sustainable travel options have encouraged operators to develop eco-friendly itineraries that minimize ecological footprints. The appeal of combining adventure travel with educational and conservation-focused activities has further propelled demand.

Additionally, adventure tours are supported by advancements in safety and navigation technology that enable access to previously remote areas, enhancing the overall experience without compromising comfort. The ability to offer personalized, small-group tours has attracted high-value customers who prioritize exclusivity and meaningful interactions with the environment, fostering strong growth in this segment.

The Absolute Luxury vessel type segment is projected to capture 54.1% of the Cruise Safari market revenue share in 2025, emerging as the leading vessel category. This prominence is attributed to the increasing demand for high-end travel experiences that combine the thrill of safari adventures with upscale comfort and exclusive services.

Luxury vessels offer state-of-the-art amenities, gourmet dining, personalized guest services, and spacious accommodations, which appeal to affluent travelers seeking indulgence alongside exploration. The segment’s growth has also been influenced by a broader trend toward experiential luxury travel, where travelers prioritize unique, once-in-a-lifetime journeys over conventional tourism.

Enhanced onboard facilities coupled with curated shore excursions allow operators to attract discerning customers who are willing to invest significantly in premium experiences. The rising preference for privacy, wellness options, and tailored itineraries has further cemented the absolute luxury vessel as a preferred choice within the Cruise Safari market.

The Smaller Expedition Ships vessel type segment is anticipated to hold approximately 51.6% of the Cruise Safari market revenue share in 2025, positioning it as a key growth driver. This segment’s strength lies in the vessels’ ability to access narrow waterways, remote coastal regions, and ecologically sensitive areas that larger ships cannot reach. Smaller expedition ships offer an intimate and flexible cruising experience, allowing passengers to engage closely with natural environments and wildlife.

The compact size facilitates personalized service and promotes sustainable tourism practices by reducing environmental impact. These ships are often equipped with advanced technology to support exploration in diverse terrains, from polar regions to tropical safaris.

The growing interest in adventure travel, combined with heightened environmental consciousness among travelers, has fueled demand for these vessels As cruise safari operators seek to differentiate their offerings and deliver unique, immersive experiences, smaller expedition ships are becoming increasingly favored for their versatility and ability to connect travelers with remote destinations.

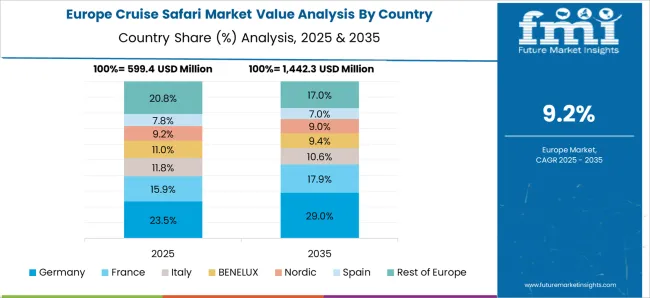

The cruise safari market is evolving as travelers seek immersive experiences combining luxury cruising with wildlife exploration. North America and Europe lead in demand for premium safari cruises, emphasizing exclusivity, comfort, and tailored itineraries. Asia-Pacific and Africa are witnessing increasing interest, supported by rising adventure tourism and infrastructure investments. Operators differentiate through onboard amenities, eco-conscious operations, unique wildlife routes, and cultural excursions. Regional contrasts in consumer spending, accessibility, and regulatory frameworks shape adoption patterns, competitive positioning, and expansion strategies across this niche tourism segment.

Cruise safari operators serve distinctly different traveler segments, balancing luxury-focused clientele with adventure-driven explorers. In Europe and North America, demand centers on high-end safari cruises offering five-star accommodations, personalized services, and exclusive wildlife encounters. These experiences appeal to affluent travelers seeking comfort combined with curated nature exploration. Conversely, Asia-Pacific and African markets emphasize adventure-oriented safari cruises, often prioritizing affordability, outdoor immersion, and cultural integration over luxury. This divergence directly affects itinerary design, onboard service levels, and pricing strategies. Premium global operators invest in luxury fleets and exclusive reserves, while regional providers focus on accessible routes and diverse group packages. The contrast between luxury-driven travelers and budget-conscious adventure seekers creates segmentation opportunities, influencing market positioning, customer acquisition strategies, and the balance between exclusivity and accessibility across global cruise safari operations.

Destination offerings and wildlife access strongly influence cruise safari adoption. In Europe and North America, travelers prefer African safari cruises that combine wildlife reserves with river and coastal cruising experiences, emphasizing rare animal sightings and scenic exploration. Meanwhile, regional demand in Asia-Pacific increasingly targets destinations within Southeast Asia and coastal wildlife habitats, where affordability and accessibility drive growth. Differences in destination diversity and route planning affect traveler experience, booking rates, and overall demand. Leading global operators collaborate with wildlife conservation authorities to secure exclusive access to reserves, while regional companies offer shorter, cost-effective routes appealing to group travelers. Contrasts in wildlife access, itinerary length, and destination uniqueness create differentiation across operators, shaping adoption patterns, competitive rivalry, and growth opportunities in both developed and emerging tourism markets.

Environmental awareness increasingly shapes consumer choice in the cruise safari market. European and North American travelers prioritize eco-conscious operations, including low-emission vessels, waste management systems, and partnerships with conservation projects. These travelers often prefer operators demonstrating measurable commitments to environmental preservation. In contrast, price-sensitive markets in Asia-Pacific and Africa emphasize affordability and accessibility, with eco-friendly practices viewed as secondary value-adds rather than primary decision factors. This divergence impacts operator investment strategies, fleet design, and marketing campaigns. Premium operators invest in hybrid propulsion technologies and eco-certifications to build trust with environmentally conscious travelers, while regional providers maintain simpler, low-cost operations. The contrast in eco-conscious adoption highlights differences in consumer priorities across regions, shaping competitiveness, traveler perception, and long-term sustainability strategies within the cruise safari industry worldwide.

Booking channels and distribution networks determine consumer access and operator visibility in the cruise safari market. North America and Europe rely heavily on luxury travel agencies, online platforms, and direct bookings through premium operators, reflecting the emphasis on curated experiences and trust in established brands. Asia-Pacific and African markets depend more on local tour operators, regional distributors, and group package providers, where affordability and accessibility drive demand. These differences in booking behavior directly influence marketing strategies, customer outreach, and revenue models. Global cruise safari companies strengthen their presence through strategic partnerships with high-end agencies and digital booking platforms, while regional players expand via bundled packages and community-based promotion. Contrasts in distribution networks and booking preferences create distinct adoption pathways, shaping accessibility, consumer trust, and overall market expansion strategies worldwide.

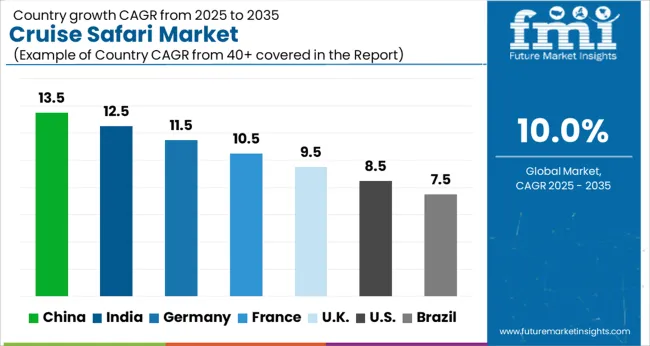

| Country | CAGR |

|---|---|

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| France | 10.5% |

| UK | 9.5% |

| USA | 8.5% |

| Brazil | 7.5% |

The global cruise safari market was projected to grow at a 10.0% CAGR through 2035, driven by demand in adventure tourism, leisure travel, and experiential vacations. Among BRICS nations, China recorded 13.5% growth as large-scale cruise and safari service operations were commissioned and compliance with travel and safety regulations was enforced, while India at 12.5% growth saw expansion of service offerings to meet rising regional tourism demand. In the OECD region, Germany at 11.5% maintained substantial market presence under strict operational and safety standards, while the United Kingdom at 9.5% relied on moderate-scale operations for adventure and leisure tourism experiences. The USA, expanding at 8.5%, remained a mature market with steady demand across recreational and luxury travel segments, supported by adherence to federal and state-level tourism and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The cruise safari market in China is expanding at a CAGR of 13.5% due to increasing domestic tourism and rising interest in adventure based travel experiences. Growing disposable incomes, enhanced travel infrastructure, and government support for tourism are driving demand for cruise safari packages combining wildlife observation, river cruises, and cultural excursions. Travel agencies and tour operators are offering customizable itineraries for both individual travelers and group tourists. Luxury and mid tier cruise safari options are gaining popularity, with emphasis on comfort, safety, and immersive experiences. Digital booking platforms and online marketing have made access to cruise safari packages easier for consumers. Urban residents and leisure travelers are showing strong preference for experiential travel, boosting demand for adventure oriented cruise safari services. China is emerging as a key market for both domestic tourism and international travel operators targeting Chinese tourists.

India is witnessing growth at a CAGR of 12.5% in the cruise safari market driven by increasing interest in adventure tourism, wildlife exploration, and river cruises. The expansion of tourism infrastructure, including luxury resorts and river cruise services, is supporting market growth. Travel agencies and tour operators provide tailored itineraries featuring wildlife observation, cultural experiences, and eco tours. Online platforms and digital marketing tools have simplified the booking process, reaching urban and semi urban populations effectively. Indian consumers increasingly seek experiential travel that combines leisure, adventure, and education. Rising domestic tourism, coupled with awareness campaigns about ecological and cultural tourism, is boosting adoption of cruise safari packages. The Indian market is gaining prominence due to diverse natural habitats, national parks, and river systems suitable for cruise safari experiences.

Germany’s cruise safari market is growing at a CAGR of 11.5% driven by demand from travelers seeking unique adventure experiences combining river cruises, wildlife observation, and cultural tours. German consumers are increasingly adopting eco friendly and sustainable travel options. Travel agencies are offering premium cruise safari packages focusing on comfort, safety, and immersive experiences. Distribution through online platforms and specialized tour operators ensures easy access to products. Interest in experiential and adventure tourism is rising among young adults and families seeking educational and recreational travel. Cruise safari operators are customizing offerings to include guided wildlife tours, photography excursions, and cultural immersion. Germany remains a significant European market with steady growth driven by high disposable incomes and a strong preference for structured and comfortable adventure travel experiences.

The United Kingdom market is expanding at a CAGR of 9.5% with travelers showing growing interest in adventure and wildlife tourism. Cruise safari packages combining river cruises, cultural tours, and wildlife exploration are gaining popularity. Travel operators provide diverse itineraries catering to families, solo travelers, and group tourists. Online booking platforms and digital marketing have improved accessibility and awareness among consumers. Demand is supported by higher disposable incomes, interest in experiential travel, and desire for immersive leisure experiences. Tourists are increasingly seeking eco friendly and safe options for wildlife observation and cultural excursions. The United Kingdom continues to see steady growth in cruise safari adoption due to an established outbound travel market and preference for guided and structured adventure travel experiences.

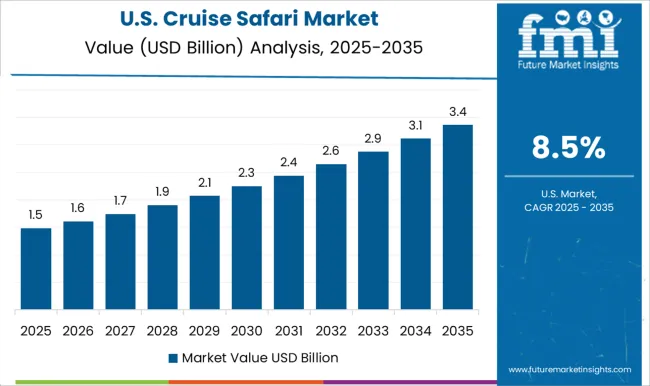

The United States market is growing at a CAGR of 8.5% driven by rising interest in adventure and experiential travel combining wildlife tours, river cruises, and cultural experiences. Travel agencies and cruise safari operators are providing customizable packages that cater to families, solo travelers, and organized groups. Distribution through online travel platforms, specialized tour operators, and marketing campaigns ensures broad accessibility. Consumers increasingly prefer immersive and eco friendly experiences that combine leisure, education, and adventure. Rising disposable incomes, enhanced travel infrastructure, and awareness of adventure tourism are contributing to steady market growth. The United States remains a major market for cruise safari tourism with strong adoption among urban and suburban travelers seeking structured, safe, and engaging adventure travel packages.

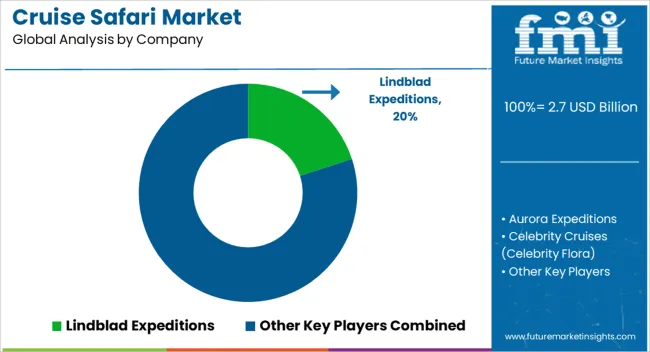

The cruise safari market is dominated by prominent expedition and adventure travel providers such as Lindblad Expeditions, Aurora Expeditions, Celebrity Cruises (Celebrity Flora), G Adventures, Hapag-Lloyd Cruises (HANSEATIC Nature), Hurtigruten, National Geographic Expeditions, Oceanwide Expeditions, and Pandaw Cruises. These companies specialize in immersive experiences that combine luxury cruising with wildlife exploration, eco-tourism, and cultural discovery, catering to travelers seeking unique adventure-based itineraries across polar, tropical, and riverine destinations. Lindblad Expeditions and National Geographic Expeditions are renowned for their scientific approach and expert-led journeys, offering travelers educational insights alongside close encounters with wildlife in remote regions. Aurora Expeditions and Oceanwide Expeditions focus heavily on polar exploration, providing robust vessels equipped to navigate Arctic and Antarctic waters while emphasizing sustainable tourism practices. Celebrity Cruises, G Adventures, Hapag-Lloyd Cruises, and Pandaw Cruises provide a mix of luxury and adventure, targeting niche segments such as Amazon river safaris, Galápagos expeditions, and Southeast Asian river journeys. These operators differentiate themselves through curated experiences, high-end onboard amenities, and small-ship designs that allow access to less-visited locations. The market continues to grow as demand rises for sustainable, educational, and experiential travel, blending comfort with adventure in some of the world’s most remote and ecologically significant regions.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.7 Billion |

| Type | Adventure & safari, Customized & private vacations, Small group journey, and Others |

| Tour | Absolute luxury and Budget-friendly |

| Vessel Type | Smaller expedition ships and Large cruise ships |

| Booking Channel | Online platform, Direct booking, and Travelling agencies |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lindblad Expeditions, Aurora Expeditions, Celebrity Cruises (Celebrity Flora), G Adventures, Hapag-Lloyd Cruises (HANSEATIC Nature), Hurtigruten, National Geographic Expeditions, Oceanwide Expeditions, and Pandaw Cruises |

| Additional Attributes | Dollar sales vary by cruise type, including river cruises, ocean cruises, and luxury expedition safaris; by package, spanning wildlife tours, adventure travel, cultural exploration, and luxury leisure; by end-use, covering families, couples, and group travelers; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for experiential travel, luxury tourism, and wildlife-based adventure packages. |

The global cruise safari market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the cruise safari market is projected to reach USD 6.9 billion by 2035.

The cruise safari market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in cruise safari market are adventure & safari, customized & private vacations, small group journey and others.

In terms of tour, absolute luxury segment to command 54.1% share in the cruise safari market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Safari Tourism Market Size and Share Forecast Outlook 2025 to 2035

Safari Tourism in Africa Market Size and Share Forecast Outlook 2025 to 2035

Assessing Cruise Tourism Market Share & Industry Outlook

Cruise Tourism Industry Analysis By Cruise Type, By Experience Type, By End User (Solo Travelers, Families, Retirees, Business Travelers), By Region – Forecast for 2025 to 2035

UK Cruise Tourism Market Size and Share Forecast Outlook 2025 to 2035

UK Safari Tourism Market Analysis – Growth, Demand & Forecast 2025-2035

USA Safari Tourism Market Insights – Demand, Size & Trends 2025-2035

River Cruise Market Size and Share Forecast Outlook 2025 to 2035

India Safari Tourism Market Trends – Demand, Growth & Forecast 2025-2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Brazil Safari Tourism Market Growth – Size, Demand & Forecast 2025-2035

Glacier Cruises Market Size and Share Forecast Outlook 2025 to 2035

Alaskan Cruises Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Cruise Control and Blind Spot Detection Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Adaptive Cruise Control System Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Cruise Control Market - Size, Share, and Forecast 2025 to 2035

Caribbean Cruises Market Size and Share Forecast Outlook 2025 to 2035

South Africa Safari Tourism Market Analysis – Growth, Trends & Forecast 2025-2035

UK River Cruise Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA