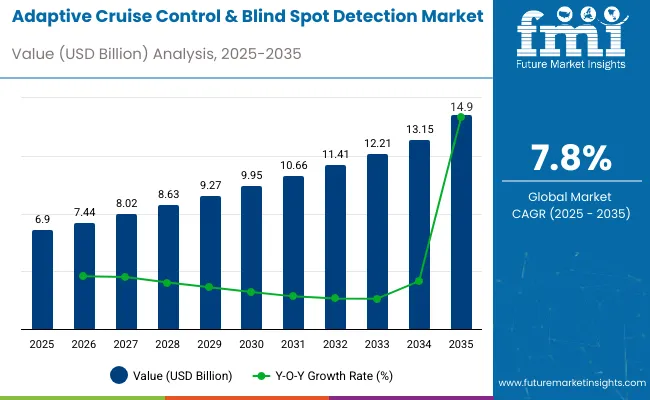

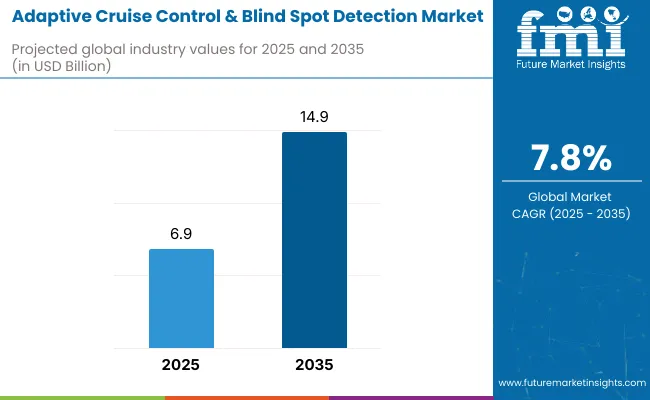

The global adaptive cruise control and blind spot detection market is estimated at 6.9 billion in 2025 and is projected to reach 14.9 billion by 2035, reflecting a compound annual growth rate of 7.8% and a multiplying factor of approximately 2.2 over the decade. Market share dynamics are influenced by technological advancement, regulatory frameworks, and consumer demand for enhanced vehicle safety.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 6.9 billion |

| Forecast Value in (2035F) | USD 14.9 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

Companies offering integrated systems with superior sensor accuracy, rapid response, and advanced connectivity are positioned to strengthen their presence, while those slower to adopt innovation may experience gradual decline.

Regional developments play a significant role in shaping competitive positions. North America and Europe retain considerable market influence due to early adoption of advanced driver assistance technologies and strict safety regulations. Asia Pacific is expected to record substantial growth driven by rising automotive production and increased awareness of vehicle safety features.

The 7.8% CAGR signals steady market expansion, with individual company performance depending on system integration, strategic partnerships with vehicle manufacturers, and cost efficiency. By 2035, with the market reaching 14.9 billion, firms emphasizing AI-enabled detection, seamless integration, and technological differentiation are expected to consolidate market share, whereas less adaptive players may face incremental erosion, reflecting the sector’s innovation-driven and competitive landscape.

The adaptive cruise control and blind spot detection market is supported by multiple parent sectors. Automotive electronics and advanced driver-assistance systems (ADAS) contribute around 36%, as these features are integrated into modern vehicles for safety and convenience.

Vehicle manufacturing represents roughly 29%, reflecting adoption in both passenger cars and commercial vehicles. Sensor and radar technology providers account for approximately 18%, supplying LIDAR, ultrasonic, and radar modules. Software and connectivity solutions make up about 11%, covering AI algorithms, control units, and vehicle network integration. Aftermarket and regulatory services contribute near 6%, assisting with retrofitting, testing, and compliance certification.

The industry is moving toward enhanced automation, AI-driven detection, and integration with smart vehicle systems. Manufacturers are deploying multi-sensor solutions that combine radar, lidar, and cameras for precise object recognition and collision avoidance. Machine learning algorithms improve adaptive cruise control by predicting traffic patterns and adjusting speed proactively.

Blind spot detection systems are being paired with lane-keeping assistance and automated braking for holistic safety. Automakers are increasingly collaborating with software and sensor technology firms to offer scalable ADAS features across vehicle segments. Energy-efficient, compact modules and predictive diagnostics are becoming standard to reduce system cost while enhancing performance and reliability.

Growth is driven by increasing adoption of advanced driver-assistance systems (ADAS) in passenger vehicles, commercial trucks, and electric vehicles. ACC and BSD enhance safety and reduce collision risk by maintaining safe distance and alerting drivers to adjacent vehicle presence. Premium and mid-range vehicle segments contribute the majority of revenue, while fleet operators are adopting these technologies in commercial trucks.

Integration with lane keeping, automated braking, and connected vehicle systems increases functionality, while component costs per vehicle range from USD 400 to USD 1,200 depending on sensor type and software complexity.

Driving Force Safety Regulations and Consumer Awareness

Governments are encouraging adoption of ACC and BSD through safety standards and incentives, particularly in Europe, North America, and Asia Pacific. Consumer awareness of collision avoidance and accident reduction drives demand. ACC improves highway driving efficiency, reducing fuel consumption by up to 8% in stop-and-go traffic, while BSD mitigates lane-change accidents.

Electric and hybrid vehicle adoption supports the growth of ACC/BSD systems due to integration with smart propulsion and braking controls. OEMs increasingly standardize these systems to maintain competitiveness, and software upgrades enhance long-term value.

Growth Avenue Sensor and Software Innovation

Radar, LiDAR, ultrasonic, and camera-based sensors are advancing system accuracy and detection range. Sensor fusion improves reliability under varying weather and lighting conditions. Software algorithms are evolving to provide adaptive responses, emergency braking, and predictive alerts. Modular system design allows OEMs to integrate ACC/BSD with other ADAS features efficiently. Expansion in mid-range vehicle segments and commercial fleets presents opportunities for wider adoption and recurring software updates as a revenue stream.

Emerging Trend Connectivity and Autonomous Integration

ACC and BSD systems are increasingly integrated with connected vehicle platforms and semi-autonomous driving technologies. Data from fleet vehicles is used to improve system performance and predictive maintenance. Adaptive algorithms adjust cruise and braking behavior based on traffic patterns, enhancing safety and reducing wear on brakes.

Integration with vehicle-to-vehicle (V2V) communication supports coordinated driving in congested corridors, while telematics provides operators with real-time diagnostics. Consumer demand for connected features drives investment in cloud-based software and over-the-air updates.

Market Challenge High Costs and Regulatory Complexity

High system costs, ranging from USD 400 to USD 1,200 per vehicle, limit adoption in entry-level models. Integration into existing vehicle electronics, braking, and steering systems increases engineering and calibration time by 5-10%. Different safety standards across regions require multiple system certifications and software variants.

Supply chain constraints for radar, LiDAR, and high-precision cameras can extend lead times by 6-8 weeks. Smaller manufacturers face challenges in meeting regulatory compliance and controlling production costs, creating barriers to market penetration.

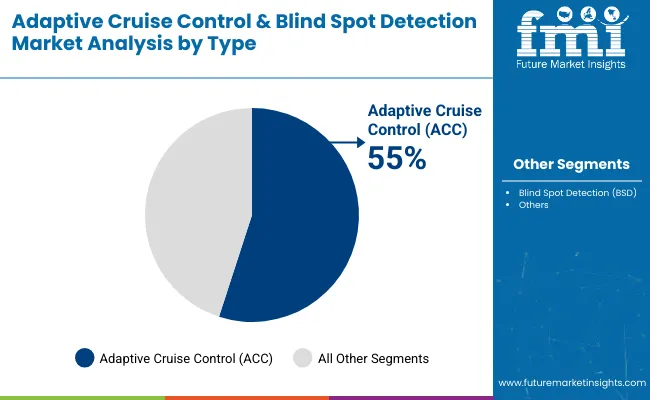

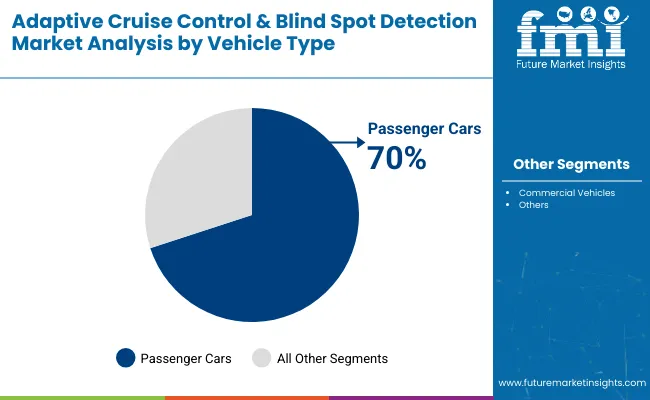

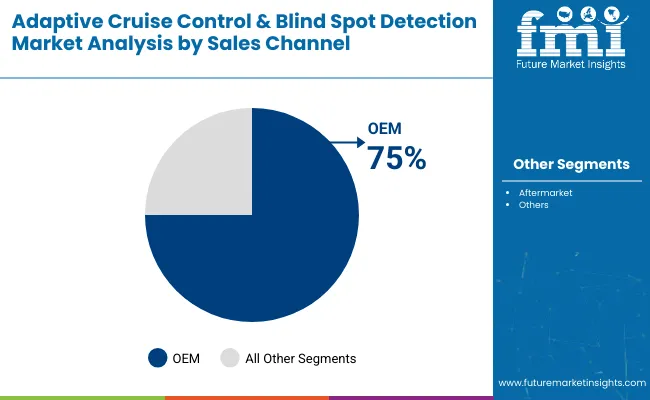

The Adaptive Cruise Control (ACC) & Blind Spot Detection (BSD) market is expanding due to rising demand for advanced driver assistance systems. ACC leads with 55% share, supported by passenger car adoption at 70%. OEM channels dominate with 75% share, reflecting strong integration into new models.

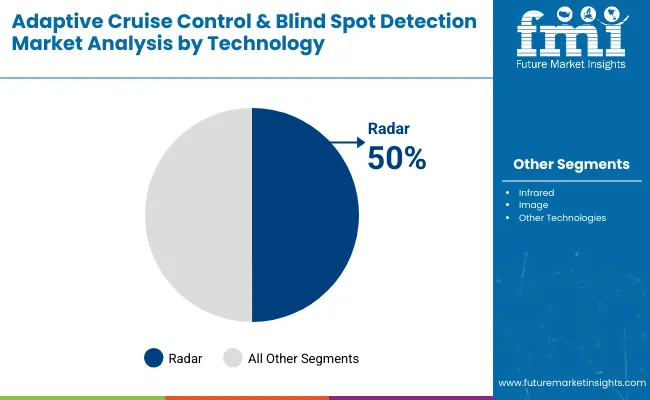

Radar technology accounts for 50%, offering reliability in various weather conditions. Companies such as Bosch, Continental, Denso, and Autoliv drive innovation through radar-based modules and camera-assisted systems. Regulations in Europe, North America, and Asia are accelerating adoption across passenger and commercial vehicles. Growth is supported by consumer demand for improved safety, reduced collision risk, and comfort in long-distance driving.

Adaptive Cruise Control accounts for 55% of the market, as automakers equip vehicles with speed and distance management features that enhance highway driving safety. Blind Spot Detection follows with 45%, supporting lane-changing assistance. Leading companies including Bosch, Continental, and ZF Friedrichshafen deliver ACC systems using radar, cameras, and control modules integrated into driver assistance packages. Passenger cars, SUVs, and luxury vehicles show higher ACC integration rates compared to commercial fleets. Expansion of semi-autonomous driving technologies further boosts demand for ACC, particularly in developed markets where driver convenience is a priority.

Passenger cars represent 70% of demand, reflecting the rising use of ADAS features in mid-range and premium vehicles. Commercial vehicles hold 30%, driven by fleet safety requirements and government mandates. Carmakers such as Toyota, Hyundai, BMW, and Mercedes-Benz deploy ACC and BSD systems in sedans, SUVs, and electric vehicles, creating higher penetration in advanced markets.

Safety regulations in Europe and Asia Pacific require passenger vehicles to feature collision-prevention systems, which drives rapid adoption. Premium passenger car brands integrate multi-sensor configurations to provide lane-keeping, speed control, and blind spot alerts simultaneously, enhancing driver confidence in congested roads.

Original Equipment Manufacturers account for 75% of ACC and BSD demand as systems are factory-installed in new vehicles to meet global safety mandates. Aftermarket suppliers cover 25%, mainly serving older vehicles or regional fleets. Companies like Denso, Valeo, and Continental collaborate with automakers for large-scale integration of radar, infrared, and camera-based detection units.

OEM dominance is fueled by rising consumer expectations for safety features as standard equipment, reducing aftermarket reliance in developed markets. Emerging economies also show OEM-led adoption, with compact and mid-range cars increasingly offering ACC and BSD as part of standard or optional safety packages.

Radar leads AVAS technology with 50% share, providing reliable detection of surrounding vehicles under multiple weather conditions. Infrared and image-based systems each capture 20%, while other technologies contribute 10%. Radar modules operate effectively in poor visibility, making them widely adopted by automakers.

Bosch, Autoliv, and Continental manufacture compact radar units that integrate with braking and steering control systems, enabling adaptive cruise and blind spot features. Radar systems are particularly important in highway safety, collision avoidance, and long-range detection. Image and infrared sensors complement radar by providing close-range accuracy, but radar continues to dominate due to cost efficiency and proven reliability.

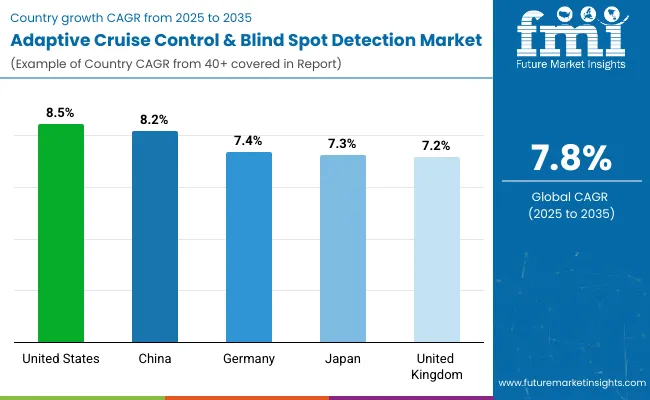

CAGR trends in the adaptive cruise control (ACC) and blind spot detection (BSD) market reflect varying growth across economies. The United States records the highest growth at 8.5%, supported by OECD-driven safety regulations and a strong demand for advanced driver-assistance systems. China follows at 8.2%, with BRICS-led automotive innovation and rising adoption of connected vehicles strengthening expansion.

Germany posts 7.4%, while Japan stands at 7.3%, both aligned with steady integration in technologically advanced but mature automotive markets. The United Kingdom records 7.2%, reflecting consistent demand within OECD frameworks. Overall, BRICS economies such as China are showing faster adoption, while OECD members focus on regulatory compliance, incremental innovation, and enhancing vehicle safety standards across passenger and commercial fleets.

The United States market is projected to grow at a CAGR of 8.5%, supported by rising demand for advanced driver assistance systems across premium and mid-range passenger vehicles. Regulatory frameworks for vehicle safety are pushing automakers to integrate ACC and BSD as standard in new models. Increasing highway traffic and accident rates are strengthening adoption, particularly in states with large commuting populations.

Local manufacturers are investing in radar and camera-based solutions to improve lane monitoring and adaptive braking efficiency. Strong presence of global automotive technology firms ensures continuous innovation. By 2035, ACC and BSD are expected to be integrated into more than 70% of new cars sold in the country.

China, with a CAGR of 8.2%, is witnessing strong uptake of adaptive safety systems due to rapid electrification and government safety mandates. Domestic automakers are heavily investing in integrating ACC and BSD into both low-cost and luxury vehicles.

The presence of large-scale production hubs gives China a cost advantage in component manufacturing. Rising demand for smart mobility solutions in tier 1 and tier 2 cities is further accelerating the market. Partnerships between Chinese automakers and global suppliers are improving system reliability and affordability. By 2035, China is expected to account for one of the largest shares of ACC and BSD-equipped vehicles globally, with exports expanding across Asia.

Germany is expected to record a CAGR of 7.4%, driven by high adoption rates among premium automakers. Integration of ACC and BSD into advanced driver assistance packages is becoming a competitive differentiator. Demand is supported by European Union safety directives, which require lane monitoring and adaptive braking in new vehicles.

German automakers are focusing on sensor fusion technologies, combining radar, lidar, and camera inputs to enhance performance in varied driving conditions. With one of the highest proportions of premium vehicles in Europe, the country is leading innovation in adaptive highway driving features. By 2035, ACC and BSD adoption is expected to be universal across luxury car segments.

Japan is expanding at a CAGR of 7.3%, supported by its established automotive sector and focus on compact vehicle safety. Automakers are embedding ACC and BSD into hybrid and small passenger vehicles to meet rising consumer demand for affordable safety systems. The market is also benefiting from government-backed research programs aimed at autonomous driving technologies, where ACC and BSD play a foundational role.

Integration in commercial fleets, particularly logistics and ride-hailing, is increasing. Local suppliers are developing miniaturized sensors and cost-effective radar modules suitable for smaller vehicles. By 2035, ACC and BSD are projected to be standard in nearly all new vehicles in Japan.

The United Kingdom market, growing at a CAGR of 7.2%, is supported by regulatory frameworks mandating improved vehicle safety and rising EV adoption. Automakers are integrating ACC and BSD to enhance safety in both city and highway driving. Growth is concentrated in mid-sized passenger vehicles and urban fleets, where accident reduction is a priority.

Partnerships between UK-based engineering firms and European OEMs are driving the development of advanced radar calibration technologies. With increasing consumer preference for semi-autonomous features, adoption is rising in both premium and non-premium vehicle categories. By 2035, ACC and BSD are expected to cover the majority of new cars sold in the UK.

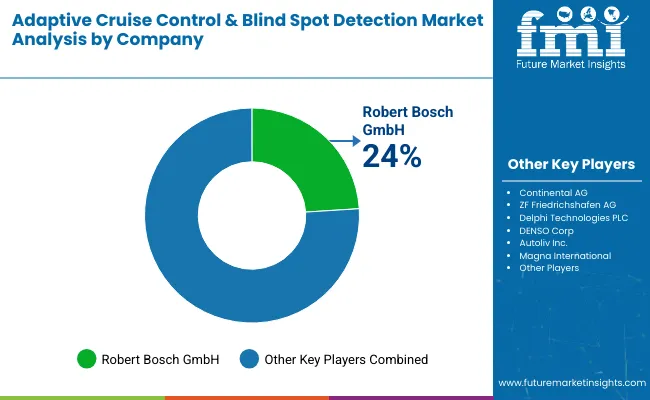

The adaptive cruise control and blind spot detection industry has been shaped by established automotive component suppliers that focus on enhancing vehicle safety systems through continuous product development. Continental AG, Robert Bosch GmbH, and ZF Friedrichshafen AGare among the strongest players, frequently investing in advanced driver assistance systems (ADAS) portfolios.

For example, Bosch has focused on integrating radar and camera-based solutions to create seamless safety packages for both passenger and commercial vehicles. Similarly, Continental has emphasized sensor fusion technologies to deliver higher detection accuracy across diverse road conditions.

Alongside the market leaders, companies such as DENSO Corp, Delphi Technologies, and Autoliv Inc. are working to strengthen their positions by aligning adaptive cruise control with braking and steering systems. WABCO Vehicle Control Services and Bendix Commercial Vehicle Systems, operating under Knorr-Bremse, are tailoring these technologies for heavy-duty trucks and buses.

Magna International has introduced scalable driver assistance platforms, while Mando-Hella Electronics Corp. continues to focus on supplying cost-efficient radar modules to emerging markets. The competition is marked by collaborative ventures, targeted R&D efforts, and new product launches aimed at improving safety, reducing accidents, and supporting global adoption of advanced safety features in vehicles.

Recent Industry News Mitsubishi Motors Europe BV introduced the new-generation ASX to the European market, featuring a central screen connected to smartphones and advanced driver assistance programs such as MI-PILOT, which combines Adaptive Cruise Control and Lane Centering Assist for enhanced safety.

The model is produced at Renault’s Valladolid plant in Spain and offered through Mitsubishi dealerships in select European markets. Nanjing Chuhang Technology began mass production of the Zero Sports Car, equipped with 77GHz radar and optical vision systems, while Nissan Australia unveiled the fourth-generation X-TRAIL with advanced safety features.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 6.9 billion |

| Projected Market Size (2035) | USD 14.9 billion |

| CAGR (2025 to 2035) | 7.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Type Segments Analyzed | Adaptive Cruise Control (ACC), Blind Spot Detection (BSD) |

| Vehicle Type Segments Analyzed | Passenger Cars, Commercial Vehicles |

| Sales Channel Segments Analyzed | OEM, Aftermarket |

| Technology Segments Analyzed | Infrared, Radar, Image, Other Technologies |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, United Kingdom, France, Italy, Spain, Netherlands, Sweden, Poland, China, Japan, India, South Korea, Thailand, Vietnam, Australia, New Zealand, United Arab Emirates, Saudi Arabia, South Africa, Turkey, Egypt |

| Leading Players | Continental AG, Delphi Technologies PLC, DENSO Corp, Autoliv Inc., Magna International, WABCO Vehicle Control Services, Robert Bosch GmbH, ZF Friedrichshafen AG, Bendix Commercial Vehicle Systems LLC (Knorr- Bremse AG), Mando-Hella Electronics Corp. |

| Additional Attributes | Dollar sales by technology and vehicle type, demand dynamics across passenger cars and commercial fleets, regional adoption trends across North America, Europe, and Asia-Pacific, innovation in radar and image-based detection, AI integration for adaptive response, environmental impact of efficient driving systems, and emerging use in autonomous and connected vehicles |

The market is projected to reach USD 14.9 billion by 2035.

The market is forecasted to grow at a CAGR of 7.8% during 2025 to 2035.

Adaptive cruise control accounts for 55% share in 2025.

Passenger cars represent 70% of the market in 2025.

Robert Bosch GmbH is the leading player with a 24% share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Adaptive Shapewear Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Stroller Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Optics Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Microemulsions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Adaptive Camouflage Materials Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Steering Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Front Lighting Market Growth - Trends & Forecast 2025 to 2035

Adaptive Authentication Market Insights - Growth & Forecast 2025 to 2035

Adaptive Access Control Market Growth – Trends & Forecast through 2034

Adaptive Cruise Control System Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Cruise Control Market - Size, Share, and Forecast 2025 to 2035

Automotive Adaptive Lighting Market

Cruise Safari Market Size and Share Forecast Outlook 2025 to 2035

Assessing Cruise Tourism Market Share & Industry Outlook

Cruise Tourism Industry Analysis By Cruise Type, By Experience Type, By End User (Solo Travelers, Families, Retirees, Business Travelers), By Region – Forecast for 2025 to 2035

UK Cruise Tourism Market Size and Share Forecast Outlook 2025 to 2035

River Cruise Market Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Glacier Cruises Market Size and Share Forecast Outlook 2025 to 2035

Alaskan Cruises Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA