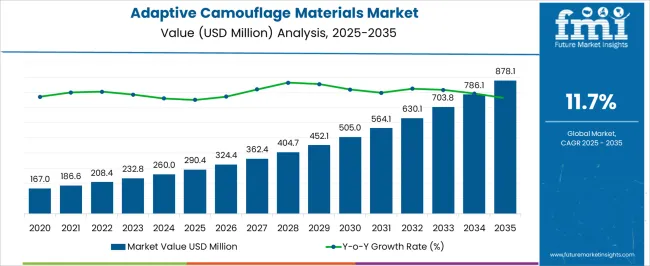

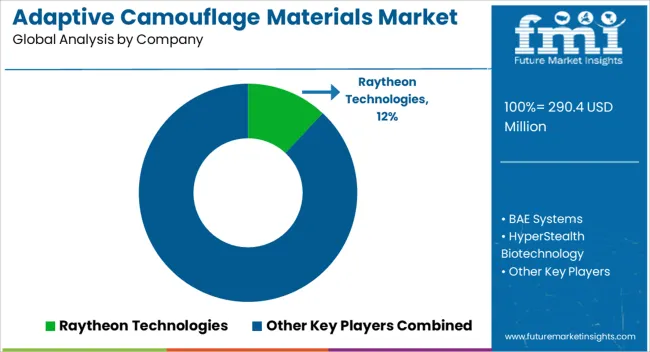

The adaptive camouflage materials market is estimated to be valued at USD 290.4 million in 2025 and is projected to reach USD 878.1 million by 2035, registering a compound annual growth rate (CAGR) of 11.7% over the forecast period.

The early trajectory to 2030 follows 290.4, 324.4, 362.4, 404.7, 452.1, and 505.0, creating an absolute dollar opportunity of USD 214.6 billion in the first half. Yearly increments widen as adoption spreads across uniforms, vehicle skins, shelter fabrics, and low observable coatings for UAS and ground platforms. Preference is expected for electrochromic and thermochromic films, near infrared tone matching textiles, radar absorbent composites, and adaptive nets used for signature management. Procurement criteria center on switching speed, cycle life, spectral coverage across visible to thermal infrared, abrasion resistance, wash durability, and low power draw where active layers are used. Supply chains that secure specialty pigments, conductive polymers, microcapsule chemistries, and rugged e textile architectures are viewed as strategically important for scale and reliability. From 2030 to 2035 the path advances through 564.1, 630.1, 703.8, 786.1, and 878.1, implying USD 373.1 billion of incremental value in the latter half and signaling stronger late period step ups.

Momentum is expected from fleet retrofits, border and perimeter security deployments, maritime hull panels, and multispectral decoys that demand consistent performance under heat, moisture, and salt exposure. Civil extensions are being evaluated for outdoor gear, architectural shading, display backdrops, and automotive wraps where thermal load and reflectance must be moderated without constant power. Vendor differentiation is likely to hinge on environmental endurance, form factor flexibility, field repair kits, and clear conformance to standards such as MIL STD 810H, STANAG blast and fragment protocols, and RoHS material restrictions. With training modules, maintenance playbooks, and assured spares, program managers tend to prioritize predictable lifetime costs and stable supply over cosmetic features.

| Metric | Value |

|---|---|

| Adaptive Camouflage Materials Market Estimated Value in (2025 E) | USD 290.4 million |

| Adaptive Camouflage Materials Market Forecast Value in (2035 F) | USD 878.1 million |

| Forecast CAGR (2025 to 2035) | 11.7% |

The adaptive camouflage materials market represents a focused but meaningful segment within the broader camouflage systems market, contributing around 2% of that expansive market. Within the more specialized camouflage coatings market, its share is slightly higher, estimated at 3%, reflecting its dynamic functional edge over static coatings. In the military and defense textiles sector, adaptive camouflage materials account for approximately 4%, indicating growing adoption of advanced stealth fabrics in uniform and equipment design. When viewed through the lens of the smart textiles market—which encompasses a full range of responsive fabrics—the adaptive camouflage segment commands about 5%, highlighting its relevance as a cutting-edge smart textile application.

Finally, within the emerging wearable technology and AR applications sphere, adaptive camouflage materials represent roughly 6%, driven by demand for interactive concealment in both tactical and consumer scenarios. Together, these percentages underscore that while adaptive camouflage materials remain niche relative to vast legacy markets, their share increases substantially when compared to more technologically oriented or emerging segments. This pattern reflects how maturity and scale of the parent market inversely correlate with the proportional presence of adaptive camouflage materials, emphasizing their growing significance in innovation-led sectors even as they remain specialized in traditional defense and textile industries.

The market is experiencing accelerated growth due to rising demand for advanced concealment technologies across defense, security, and specialized commercial applications. Increasing geopolitical tensions and evolving warfare strategies have prompted governments and defense contractors to invest heavily in materials capable of dynamic environmental adaptation. Continuous advancements in nanotechnology, smart fabrics, and responsive coatings are enabling higher performance, greater durability, and enhanced operational flexibility.

The integration of adaptive camouflage into uniforms, vehicles, and equipment is being driven by the need for tactical superiority and survivability in complex combat environments. Growing collaboration between defense agencies and material science innovators is further broadening the application scope.

Additionally, the emergence of multifunctional materials that provide not only concealment but also environmental protection and sensor integration is shaping future market trends As technological maturity increases and production scalability improves, adaptive camouflage materials are expected to become a standard feature in next-generation defense and security solutions, ensuring sustained market expansion.

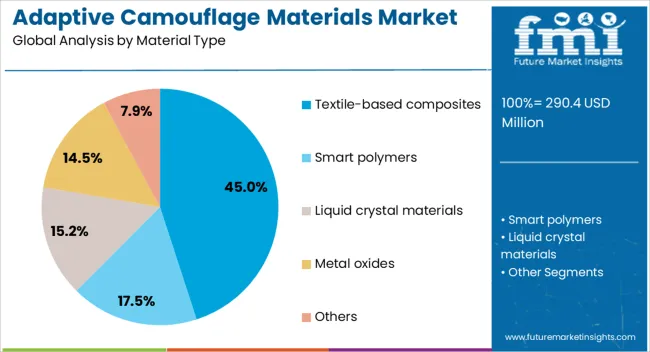

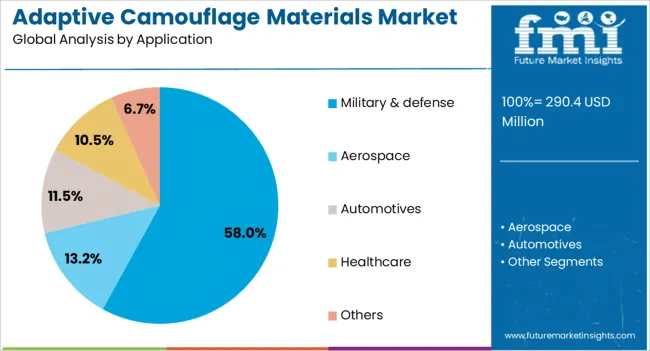

The adaptive camouflage materials market is segmented by material type, application, and geographic regions. By material type, adaptive camouflage materials market is divided into textile-based composites, smart polymers, liquid crystal materials, metal oxides, and others. In terms of application, adaptive camouflage materials market is classified into military & defense, aerospace, automotives, healthcare, and others. Regionally, the adaptive camouflage materials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The textile based composites segment is projected to hold 45% of the market revenue share in 2025, making it the leading material type. This leadership is being supported by the segment’s ability to combine lightweight properties with high tensile strength, ensuring both durability and flexibility. The adaptability of textile based composites to various environmental conditions has made them a preferred choice for advanced camouflage applications.

These materials can incorporate responsive fibers and coatings that alter their appearance in real time, enhancing operational effectiveness in dynamic field scenarios. Cost efficiency in manufacturing and the ease of integrating these materials into existing supply chains have further accelerated adoption.

Additionally, textile based composites allow for seamless embedding of electronic components and sensors, enabling multifunctional use without compromising comfort or performance Ongoing research into improving weather resistance and reducing thermal signatures is expected to further strengthen the market position of this segment in the years ahead.

The military and defense segment is expected to account for 58% of the market revenue share in 2025, positioning it as the dominant application area. This dominance is being driven by the critical role adaptive camouflage plays in enhancing mission success, survivability, and strategic advantage in modern combat operations. Armed forces are prioritizing the integration of materials that can dynamically match the surrounding terrain, thereby reducing visual and infrared detectability.

Increased investments in soldier modernization programs and vehicle stealth technologies have supported large scale procurement of advanced camouflage solutions. The ability of adaptive materials to perform in diverse operational environments, including urban, desert, and forest terrains, has further boosted adoption.

In addition, rapid advancements in smart fabric technologies are enabling military gear that can respond in real time to environmental changes The segment’s growth is also being reinforced by government contracts and long term defense procurement strategies that favor innovative and high performance material solutions.

The adaptive camouflage materials market is advancing as demand from defense sectors for stealth-enhancing systems continues to rise. Opportunities are opening in commercial and civilian applications, while trends indicate a shift toward multi-functional, sensor-integrated, and flexible solutions. High costs, scalability concerns, and performance durability remain major hurdles. In my opinion, success in this market will depend on suppliers that balance innovation with cost efficiency, creating adaptive materials that meet defense-grade requirements while capturing new value in emerging civilian applications.

Demand for adaptive camouflage materials has been stimulated by their critical role in enhancing concealment for soldiers, vehicles, and equipment during defense operations. These materials alter their appearance to mimic surroundings, reducing visibility across multiple terrains. Defense agencies are investing heavily in adaptive systems to strengthen battlefield survivability, making adoption a priority in procurement programs. In my opinion, demand will remain concentrated in military and security sectors, where stealth capabilities are directly tied to mission success and operational safety, ensuring sustained growth for adaptive camouflage applications.

Opportunities have emerged beyond defense, with applications being tested in wildlife observation, architecture, and consumer electronics. Designers and researchers are exploring adaptive materials for clothing, shelters, and automotive coatings to provide environmental blending and aesthetic appeal. Interest from commercial sectors is growing, especially where customization and energy-efficient camouflage are valued. I believe companies that expand into dual-use applications, offering solutions that serve both defense and commercial markets, will secure long-term opportunities by diversifying revenue streams and capitalizing on rising interest in smart material adoption.

Trends show strong momentum toward integrating adaptive camouflage with sensors, responsive coatings, and digital control systems. Defense manufacturers are developing materials capable of adjusting in real time to changes in light, heat, or background. The pursuit of lightweight, flexible, and durable fabrics is another visible trend, catering to mobility requirements in combat zones. In my opinion, this transition signals a move toward multi-functional camouflage solutions that not only conceal but also enhance tactical advantage, reinforcing their importance in future defense procurement and cross-industry material innovation.

Challenges for adaptive camouflage materials revolve around high production costs, limited scalability, and durability under extreme conditions. Manufacturing processes remain expensive, making large-scale deployment difficult for budget-constrained defense forces and commercial buyers. Another obstacle is maintaining functionality across diverse climates and terrains, which requires extensive research and development. In my assessment, only organizations with significant funding and long-term contracts will overcome these barriers, while smaller companies may struggle to compete. Achieving a balance between cost efficiency and technical performance remains the most pressing challenge facing widespread adoption of adaptive camouflage systems.

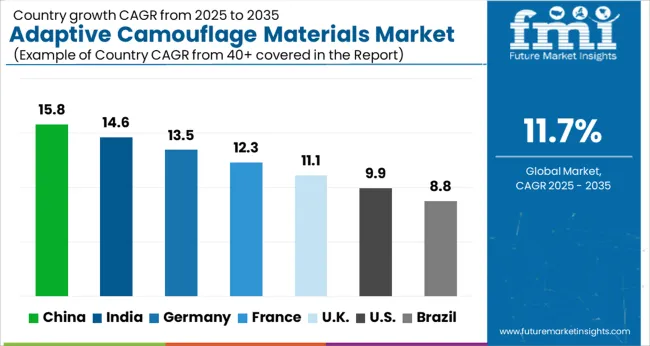

| Country | CAGR |

|---|---|

| China | 15.8% |

| India | 14.6% |

| Germany | 13.5% |

| France | 12.3% |

| UK | 11.1% |

| USA | 9.9% |

| Brazil | 8.8% |

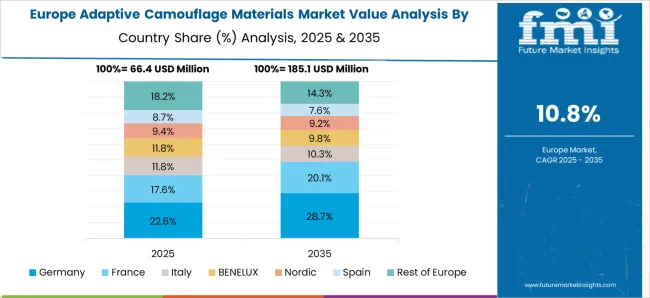

The global adaptive camouflage materials market is projected to grow at a CAGR of 11.7% from 2025 to 2035. China leads with a growth rate of 15.8%, followed by India at 14.6%, and France at 12.3%. The United Kingdom records a growth rate of 11.1%, while the United States shows the slowest growth at 9.9%. Growth is driven by rising investments in defense modernization, increasing applications in aerospace, automotive, and textiles, and advancements in nanotechnology and smart materials. Emerging economies such as China and India are seeing accelerated adoption due to expanding defense budgets and industrial innovation, while developed economies like the USA and UK emphasize integration of adaptive camouflage in defense, security, and next-gen protective gear.

The adaptive camouflage materials market in China is projected to grow at a CAGR of 15.8%. Rising defense expenditure, coupled with increasing focus on next-generation military technologies, is driving demand. China is investing heavily in nanomaterials, metamaterials, and smart textiles for use in ground forces, naval fleets, and aerospace. Beyond defense, sectors such as automotive and consumer electronics are exploring applications of adaptive camouflage for thermal regulation and design flexibility. Government support for material innovation and strong R&D infrastructure are further accelerating market adoption.

The adaptive camouflage materials market in India is expected to grow at a CAGR of 14.6%. Expanding defense modernization programs, increasing focus on border security, and demand for advanced protective materials in military equipment are key growth drivers. The country’s growing collaborations with global defense technology companies are also fueling innovation in adaptive camouflage systems. Additionally, applications in civilian areas such as automotive coatings and smart textiles are emerging. Government initiatives under “Make in India” are boosting domestic R&D and production of adaptive materials, creating significant opportunities for both local and international players.

The adaptive camouflage materials market in France is projected to grow at a CAGR of 12.3%. France’s strong defense sector and advanced research capabilities in materials science contribute significantly to market growth. The government’s focus on modernizing military gear with adaptive textiles and coatings is driving adoption. Civilian applications in fashion, textiles, and architectural coatings are also gaining traction. With significant investments in sustainable materials and energy-efficient technologies, French firms are innovating adaptive camouflage solutions that combine performance with eco-friendly attributes, further strengthening their market position.

The adaptive camouflage materials market in the UK is projected to grow at a CAGR of 11.1%. Defense remains the primary sector adopting adaptive camouflage technologies, particularly for land forces and aerospace applications. The country is also seeing an increase in research collaborations between universities and defense contractors, focusing on smart textiles and responsive coatings. Civilian applications in luxury automotive and designer textiles are gradually emerging. Government emphasis on strengthening national defense capabilities and supporting material innovation ensures steady growth opportunities in the UK market.

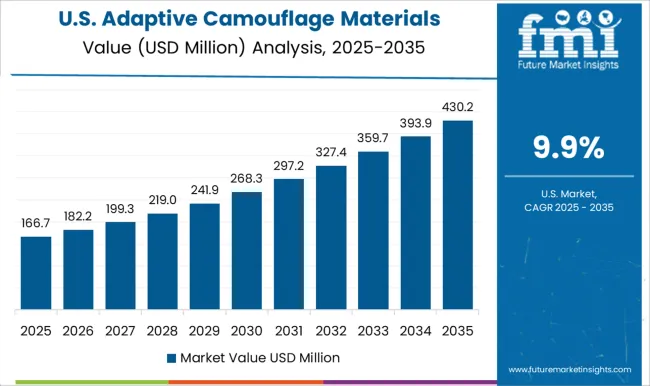

The adaptive camouflage materials market in the USA is projected to grow at a CAGR of 9.9%. Although growth is slower than in emerging markets, the USA remains a global leader in defense R&D and adoption of advanced material technologies. Military applications in ground vehicles, naval assets, and next-gen combat uniforms are key demand drivers. Significant investments by private companies and defense agencies in nanomaterials, liquid crystal coatings, and electrochromic films continue to strengthen innovation. Civil applications in construction coatings and consumer products are also contributing to steady expansion.

A clear competitive hierarchy has been established in the adaptive camouflage materials market, where a select group of players has been leading the field. Raytheon Technologies and BAE Systems have been regarded as dominant due to their deep integration with defense systems and multispectral concealment platforms. HyperStealth Biotechnology has been acknowledged for its vast library of camouflage designs, with millions of uniforms issued and fractal-based patterning distinguishing its market presence. Saab AB and Boeing Phantom Works have been placed under the spotlight for advanced deployable surface systems and airborne adaptive concealment applications.

QinetiQ and Eltics Ltd have been gaining attention through efforts in smart textile integration and spectral reflectance control. Alpha Micron and Stealth Technologies have been seen as material science contributors, where nano-structured layers and infrared modulation have drawn interest. Draper and Lockheed Martin have commanded prestige via research-backed frameworks and platform-level adaptive systems, while Crye Precision has been recognized for garment-integrated concealment suited to infantry. Invisio AB and Rheinmetall have been noted for modular concealment attachments aimed at communication or armor elements, where adaptability to optical and radar signatures has been stressed. Battelle has been positioned as a systems integrator, where adaptive material modules have been merged with sensor networks.

Collectively, these suppliers have been shaping the market around concealment materials, active camouflage textiles, and multispectral adaptation. Distinct strategic pathways have been followed by each firm, shaping competitive tension around material differentiation, application scope, and domain expertise. Raytheon and Lockheed Martin have been categorized as platform-oriented, where full-system concealment integration has underpinned contract wins. HyperStealth and Crye Precision have been seen as pattern-focused, where garment-level responsiveness and natural mimicry have guided adoption across ground forces. Saab and Boeing Phantom Works have been grouped as airborne-application leaders, where adaptive surface panels and conformal systems have influenced procurement.

QinetiQ, Eltics, Alpha Micron, and Stealth Technologies have been grouped as innovation drivers, where material layering and spectral control have been emphasized in developer circles. Invisio, Rheinmetall, and Battelle have been treated as modular-support providers, where targeted material kits or retrofit modules have been trusted to enhance existing platforms. This competitive matrix has been defining buyer expectations, where deliverables such as spectral adaptability, rapid deployment capability, and integration simplicity have become key selection criteria. Market perception has been tilting toward those suppliers capable of delivering concealment solutions that feel seamless, responsive, and suited to unique mission requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 290.4 Million |

| Material Type | Textile-based composites, Smart polymers, Liquid crystal materials, Metal oxides, and Others |

| Application | Military & defense, Aerospace, Automotives, Healthcare, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Raytheon Technologies, BAE Systems, HyperStealth Biotechnology, Saab AB, Boeing Phantom Works, QinetiQ, Eltics Ltd, Alpha Micron, Stealth Technologies, Draper, Lockheed Martin, Crye Precision, Invisio AB, Rheinmetall, and Battelle |

| Additional Attributes | Dollar sales by product type (thermochromic, photochromic, electrochromic), Dollar sales by application (defense, textiles, automotive, consumer goods), Trends in smart materials and responsive coatings, Use in military stealth systems and wearable textiles, Growth of automotive body applications and fashion integration, Regional development clusters in North America, Europe, and Asia-Pacific. |

The global adaptive camouflage materials market is estimated to be valued at USD 290.4 million in 2025.

The market size for the adaptive camouflage materials market is projected to reach USD 878.1 million by 2035.

The adaptive camouflage materials market is expected to grow at a 11.7% CAGR between 2025 and 2035.

The key product types in adaptive camouflage materials market are textile-based composites, _textile-based composites (examples: thermochromic fabrics, smart textile composites), smart polymers, _electroactive polymers, _shape memory polymers, liquid crystal materials, _cholesteric liquid crystals, _nematic liquid crystals, metal oxides, _thermochromic metal oxide coatings, others, _metamaterials and _bio-inspired polymers.

In terms of application, military & defense segment to command 58.0% share in the adaptive camouflage materials market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Adaptive Shapewear Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Stroller Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Cruise Control and Blind Spot Detection Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Adaptive Optics Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Microemulsions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Adaptive Cruise Control System Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Steering Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Front Lighting Market Growth - Trends & Forecast 2025 to 2035

Adaptive Cruise Control Market - Size, Share, and Forecast 2025 to 2035

Adaptive Authentication Market Insights - Growth & Forecast 2025 to 2035

Adaptive Access Control Market Growth – Trends & Forecast through 2034

Automotive Adaptive Lighting Market

Camouflage (CAMO) Netting Market Forecast Outlook 2025 to 2035

Camouflage Coatings Market Size and Share Forecast Outlook 2025 to 2035

Nanomaterials Market Insights - Size, Share & Industry Growth 2025 to 2035

Tire Materials Market Insights – Size, Trends & Forecast 2025–2035

Facade Materials Market Size and Share Forecast Outlook 2025 to 2035

Solder Materials Market Size and Share Forecast Outlook 2025 to 2035

Sheath Materials Market Size and Share Forecast Outlook 2025 to 2035

Exosuit Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA