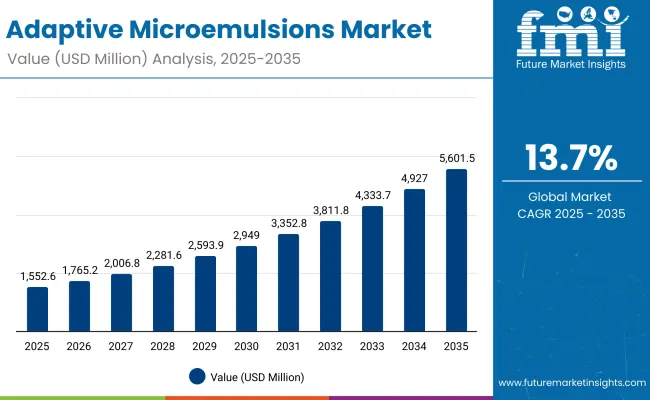

The Adaptive Microemulsions Market is expected to record a valuation of USD 1,552.6 million in 2025 and USD 5,601.5 million in 2035, with an increase of USD 4,048.9 million, which equals a growth of 260.7% over the decade. The overall expansion represents a CAGR of 13.7% and a 3.6X increase in market size.

Adaptive Microemulsions Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 1,552.6 million |

| Market Forecast Value in (2035F) | USD 5,601.5 million |

| Forecast CAGR (2025 to 2035) | 13.7% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,552.6 million to USD 2,949.0 million, adding USD 1,396.4 million, which accounts for 34.5% of the total decade growth. This phase records steady adoption in cosmetic actives delivery, B2B ingredient supply, and fast-absorbing skincare formats, driven by the need for high penetration and product stability. Deep delivery/penetration functions dominate this period as they cater to over 54.5% of ingredient applications requiring optimal bioavailability.

The second half from 2030 to 2035 contributes USD 2,652.5 million, equal to 65.5% of total growth, as the market jumps from USD 2,949.0 million to USD 5,601.5 million. This acceleration is powered by widespread deployment of adaptive emulsion platforms, AI-supported skin diagnostics, and multi-functional actives integration in high-end personal care. Fast-absorbing claims and B2B distribution capture a larger share above 52% by the end of the decade. Subscription skincare, clinical-grade personalization, and microemulsion-based product layering systems add recurring revenue, boosting the innovation pipeline and long-term value capture.

From 2020 to 2024, the Adaptive Microemulsions Market experienced strong growth, led by the rapid incorporation of oil-in-water microemulsion systems into B2B cosmetic ingredient supply and advanced skincare formulations. Demand surged across Asia and the USA, where dermocosmetic brands favored fast-absorbing textures and deep delivery mechanisms. During this period, the market was dominated by multinational ingredient suppliers, with players like Evonik, BASF, and Croda accounting for nearly 40-45% of total value. Competitive strength came from emulsion stability, active retention, and regulatory-ready ingredient innovation. Clean-label and clinical-grade positioning were rising but had not yet become dominant.

Demand for adaptive microemulsions will expand to USD 1,552.6 million in 2025, growing steadily toward USD 5,601.5 million by 2035. The revenue mix will evolve as claims such as fast-absorbing, clean-label, and dermatologist-tested gain traction. Ingredient manufacturers are pivoting toward multifunctional delivery systems that combine hydration, actives stabilization, and sensorial enhancement in a single platform. Innovation is being driven by solvent-free emulsions, vitamin-compatible carriers, and sun-care pigment wetting applications. Emerging players are disrupting with biocontinuous and low-surfactant systems, while global leaders are focused on expanding regional footprints and customizing emulsions for premium skincare brands. The future of competitiveness will rely less on basic formulation and more on regulatory robustness, IP-backed claims, and co-development partnerships with end-user brands.

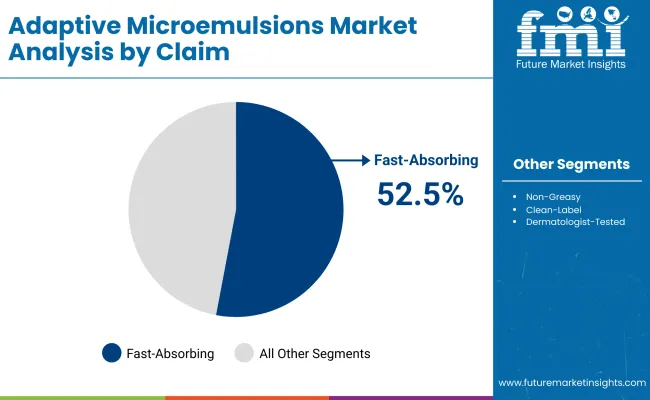

Consumer preferences are shifting toward skincare products that deliver instant absorption, non-greasy texture, and visible results. Adaptive microemulsions enable deeper penetration of active ingredients such as retinoids and vitamins, which enhances both efficacy and skin feel. As premium and clinical skincare brands prioritize performance, these emulsions offer a powerful delivery vehicle. The fast-absorbing claim already leading with a 52.5% share reflects growing interest in sensorially optimized and technically advanced skin treatments.

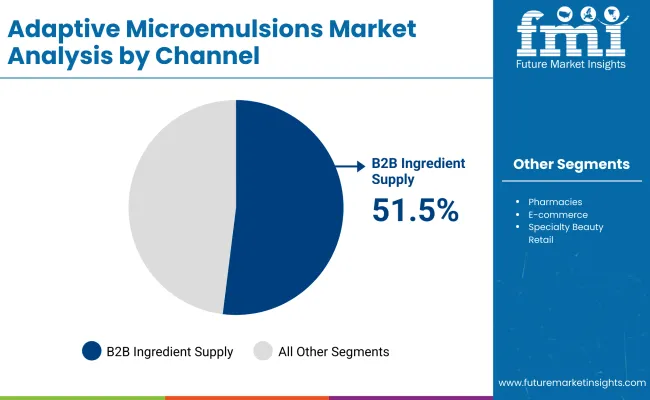

The B2B ingredient supply channel is rapidly expanding as brands seek specialized emulsifiers and delivery systems tailored to specific functional claims like hydration, pigment dispersion, or stabilization. Adaptive microemulsions offer unmatched flexibility for formulators working with sensitive actives or clean-label constraints. With 51.5% of sales in 2025 coming from the B2B segment, the market is witnessing strong partnerships between ingredient suppliers and skincare brands, accelerating innovation and regional adaptation of emulsion platforms.

The market is segmented by emulsion type, function, product type, claim, channel, and region. Emulsion types include oil-in-water, water-in-oil, bicontinuous, and solvent-free/low-surfactant systems, representing the structural backbone of adaptive microemulsion platforms used in skincare and cosmetic delivery. Functions encompass deep delivery/penetration enhancement, hydration and sensorial finish, actives stabilization (retinoids, vitamins), and sun-care dispersion/pigment wetting, highlighting the broad utility of microemulsions across dermatological and aesthetic applications.

Based on product type, the segmentation includes sprays/mists, gels, creams, and serums, reflecting the versatile use of microemulsions in both leave-on and treatment formulations. By claim, the market covers fast-absorbing, non-greasy, clean-label, and dermatologist-tested attributes critical for consumer acceptance and regulatory positioning in cosmeceuticals.

In terms of channel, the market is segmented into B2B ingredient supply, e-commerce, specialty beauty retail, and pharmacies, with B2B leading due to its role in early-stage formulation partnerships. Regionally, the market spans North America (USA), Europe (Germany, UK), and Asia-Pacific (China, India, Japan), with India and China showing the highest growth rates due to increased demand for high-performance skincare and rapid expansion of domestic beauty brands.

| Claim | Value Share% 2025 |

|---|---|

| Fast-absorbing | 52.5% |

| Others | 47.5% |

The fast-absorbing segment is projected to contribute 52.5% of the Adaptive Microemulsions Market revenue in 2025, maintaining its lead as the dominant claim category. This growth is driven by rising consumer preference for non-greasy, quick-penetrating formulations that deliver immediate sensory appeal and active delivery. These claims are especially critical for serums, mists, and emulsified actives used in high-performance skincare.

The segment’s expansion is further supported by its compatibility with microemulsion structures that enhance skin penetration without compromising formulation stability. As brands increasingly position products for clinical-grade results and lightweight feel, fast-absorbing systems are becoming a benchmark for efficacy and consumer satisfaction. The fast-absorbing claim is expected to remain central to product development across both retail and B2B ingredient segments.

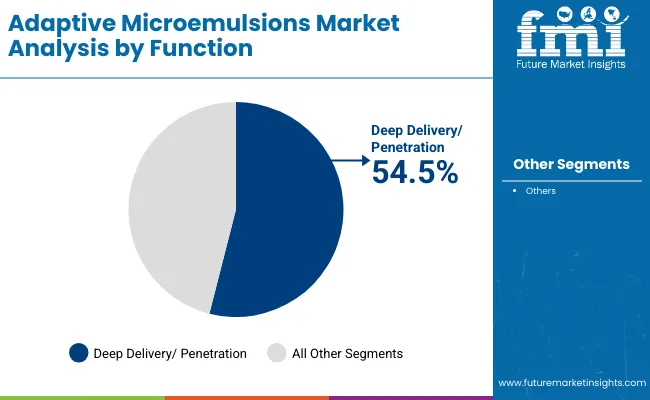

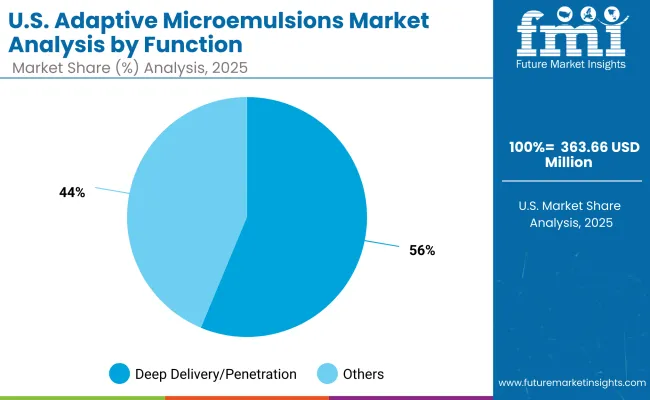

| Function | Value Share% 2025 |

|---|---|

| Deep delivery/penetration | 54.5% |

| Others | 45.5% |

The deep delivery/penetration segment is forecasted to hold 54.5% of the market share in 2025, led by its ability to enhance active ingredient absorption and improve dermal efficacy in advanced skincare formulations. These systems are favored for delivering retinoids, peptides, and vitamins more efficiently into deeper skin layers, making them ideal for clinical-grade and performance-driven products.

Their compatibility with oil-in-water microemulsion structures has facilitated widespread adoption in serums, sprays, and creams across both consumer and professional channels. The segment’s growth is bolstered by the increased demand for visible results and multi-benefit skincare solutions. As brands continue to emphasize scientifically backed efficacy, deep delivery functions are expected to remain a defining feature of innovation in the Adaptive Microemulsions Market.

| Channel | Value Share% 2025 |

|---|---|

| B2B ingredient supply | 51.5% |

| Others | 48.5% |

The B2B ingredient supply segment is projected to account for 51.5% of the Adaptive Microemulsions Market revenue in 2025, making it the leading distribution channel. This growth is driven by skincare and cosmetic brands seeking customizable emulsion systems for complex formulations, including pigment dispersion, hydration delivery, and active stabilization.

With increasing product differentiation and clean-label positioning, brands are partnering directly with ingredient suppliers to co-develop functional emulsions. This channel also supports regulatory compliance and formulation guidance, making it a preferred route for both established and emerging players. As demand rises for clinically validated and performance-focused skincare, B2B ingredient supply will continue to dominate the channel landscape in the Adaptive Microemulsions Market.

Demand for Enhanced Delivery Systems in High-Performance Skincare

The Adaptive Microemulsions Market is rapidly expanding due to increasing demand for delivery systems that improve the penetration and bioavailability of active ingredients such as retinoids, peptides, and vitamins. These emulsions enable deep dermal absorption without irritation, making them ideal for sensitive skin and clinical-grade formulations. With premium skincare brands prioritizing results-driven products, adaptive microemulsions provide a non-greasy, fast-absorbing experience, which boosts consumer preference. Their role in targeted delivery and sensorial enhancement positions them as essential in next-generation cosmeceuticals and dermatological innovations.

Expansion of Clean-Label and Customizable Ingredient Technologies

Formulators and brands are embracing adaptive microemulsions for their versatility in clean-label and functional formulations. These systems allow precise control over surfactant levels, reduce the need for harmful solvents, and improve stability of sensitive actives. The ability to tailor emulsions for hydration, UV dispersion, or actives encapsulation empowers B2B suppliers to meet evolving consumer demands. As regulatory pressure and consumer scrutiny increase across global markets, microemulsions offer a pathway to innovation while aligning with safety, sustainability, and customization imperatives.

Formulation Complexity and Cost Sensitivity Among Mass Market Brands

Despite their technical advantages, adaptive microemulsions face challenges in mass adoption due to high formulation complexity and cost. These systems often require advanced surfactant engineering, rheological balancing, and specialized equipment, which increases R&D and production expenses. Many mass-market brands, especially in price-sensitive markets, find it difficult to justify these costs over traditional emulsions. Additionally, the limited shelf stability of certain actives in microemulsified systems may deter formulators. This cost-performance tradeoff restricts broader commercialization beyond premium and clinical segments.

Rising Use of Adaptive Microemulsions in Hybrid Skincare Categories

A notable trend in the Adaptive Microemulsions Market is their integration into hybrid product formats such as serum-mists, gel-creams, and sun-serum fusions. These formats blend multiple functionalities hydration, actives delivery, sensorial enhance mentin to a single adaptive formula. Consumers increasingly seek multi-functional skincare, reducing the number of products in their routines. Adaptive microemulsions enable brands to combine performance with convenience, especially in minimalist, travel-friendly, and dermo-cosmetic formats. This convergence of utility and luxury is reshaping product innovation strategies across both mass and prestige skincare markets.

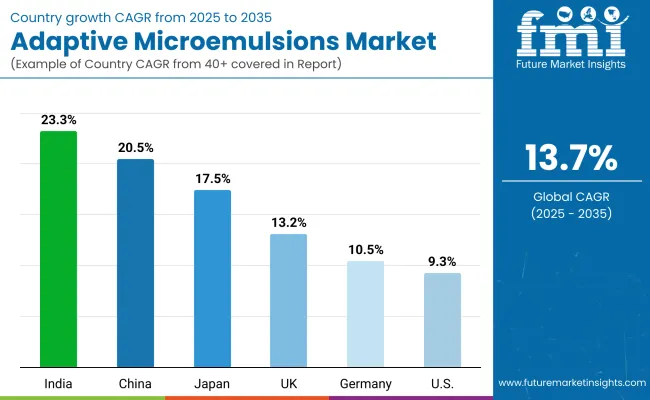

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 20.5% |

| USA | 9.3% |

| India | 23.3% |

| UK | 13.2% |

| Germany | 10.5% |

| Japan | 17.5% |

The global Adaptive Microemulsions Market is witnessing rapid regional expansion, with Asia-Pacific leading due to its dual consumer profile: tech-savvy, efficacy-driven urban buyers and emerging middle-class consumers prioritizing sensorial quality. India, growing at 23.3% CAGR, stands out as a hotspot for dermatologist-tested, non-greasy actives in both clinical skincare and premium ayurvedic fusions. The country is seeing fast adoption in B2B ingredient customization, especially among local D2C and cosmeceutical brands.

China, with a 20.5% CAGR, is dominated by innovation in luxury serums and functional skincare formats using adaptive delivery. Clean-label trends, KOL-driven beauty consumption, and smart packaging integration are accelerating interest in microemulsion-enabled systems. Japan, growing at 17.5%, continues to emphasize skin texture, hydration layering, and minimalist routines, aligning well with adaptive microemulsions designed for deep delivery and sensorial finish.

In Europe, Germany and the UK are registering solid growth at 10.5% and 13.2% respectively, due to strong regulatory frameworks around ingredient safety, growing preference for vegan, fragrance-free, and fast-absorbing systems, and deep partnerships between ingredient houses and formulation labs. European luxury houses are also turning to adaptive systems to achieve sensorial differentiation without heavy emulsifiers. The USA, with a 9.3% CAGR, reflects a mature market shifting from conventional emulsions to high-efficacy formulations. Growth is led by clinical skincare, celebrity brands, and demand for multi-functional formats like spray-serums and ampoules. B2B demand is rising among contract manufacturers and indie brands seeking performance customization with clean-label compliance.

Overall, luxury-led innovation is reshaping the landscape across both mass and prestige skincare markets, as adaptive microemulsions become a tool for delivering sensorial superiority, actives stability, and consumer trust, especially in Asia and Western Europe.

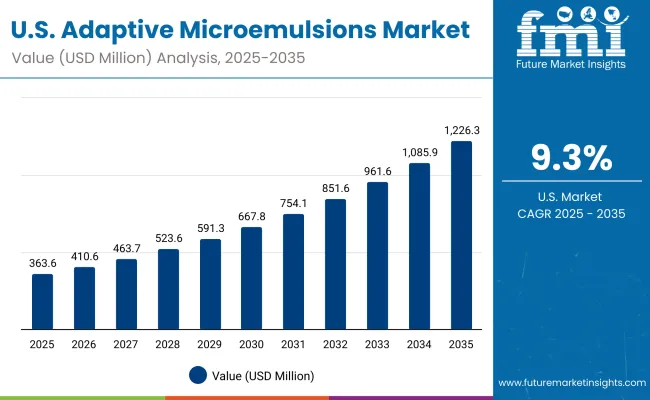

| Year | USA Adaptive Microemulsions Market (USD Million) |

|---|---|

| 2025 | 363.66 |

| 2026 | 410.67 |

| 2027 | 463.75 |

| 2028 | 523.69 |

| 2029 | 591.38 |

| 2030 | 667.82 |

| 2031 | 754.14 |

| 2032 | 851.61 |

| 2033 | 961.69 |

| 2034 | 1,085.99 |

| 2035 | 1,226.36 |

The Adaptive Microemulsions Market in the United States is expected to grow from USD 363.66 million in 2025 to USD 1,226.36 million by 2035, nearly tripling in size. This strong growth trajectory is driven by the rising demand for fast-absorbing, high-efficacy skincare in both the clinical-grade and premium retail segments. Dermatologists and advanced skin clinics are increasingly integrating adaptive delivery systems for deep penetration of actives, aligning with consumer preferences for clean-label, fragrance-free, and non-greasy products.

The B2B ingredient supply model is also gaining momentum, especially among indie brands and contract manufacturers, who are leveraging adaptive microemulsions to customize product textures and performance. USA formulators are particularly focused on emulsions that offer stability for retinoids and vitamins, along with hydration and sensorial finish without occlusive residues.

The Adaptive Microemulsions Market in the United Kingdom is poised for steady growth, expanding from early-stage innovation hubs into broader commercial applications across premium skincare, dermatological formulations, and clean-label beauty. With a strong foundation in cosmetic science research and regulatory excellence, UK-based brands are embracing adaptive microemulsions for retinoid stabilization, hydration optimization, and sensorial skin finishes. The country’s prestige skincare sector continues to prioritize fast-absorbing and non-greasy textures, positioning adaptive microemulsions as a preferred delivery format.

Academic collaborations with cosmetic chemistry departments and funded R&D programs are fostering deeper exploration into bicontinuous and solvent-free microemulsion systems. Simultaneously, private-label beauty retailers are integrating these emulsions for differentiated positioning in both brick-and-mortar and online sales environments. This is bolstered by the rise in clinical skincare clinics offering customized treatments using active-stabilized microemulsion carriers.

India is emerging as one of the fastest-growing markets for Adaptive Microemulsions, driven by the convergence of dermatology, Ayurvedic formulations, and performance-driven skincare innovations. A rising wave of homegrown and D2C beauty brands is embracing adaptive microemulsions to deliver actives like niacinamide, retinoids, and vitamin C more effectively to consumers seeking fast results. With a 2025-2035 CAGR of 23.3%, India’s expansion is fueled by demand for fast-absorbing, sensorially rich formulations with clinical-grade efficacy.

The B2B ingredient supply chain in India is undergoing a shift, as contract manufacturers and formulation labs collaborate closely with ingredient players to create tailored emulsion platforms. These adaptive systems are being used in both mass-market hydration creams and premium serums targeting urban consumers. Additionally, pharmacies and specialty retailers are broadening their advanced skincare portfolios by integrating dermatologist-tested products featuring adaptive emulsions.

The Adaptive Microemulsions Market in China is projected to register the fastest growth among major economies, fueled by its 20.5% CAGR from 2025 to 2035. This acceleration is driven by large-scale B2B demand for emulsion systems that offer enhanced delivery of actives and sensorily optimized finishes in clinical-grade and clean-label skincare products. Chinese brands are scaling up product development with encapsulated caviar-like peptide complexes integrated into adaptive microemulsion formats. Growth is also supported by the rise of fast-absorbing claims, which account for 54.8% of value in 2025.

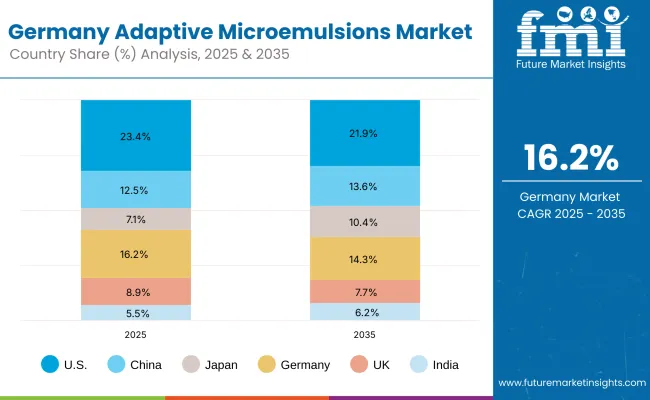

| Countries | 2025 Share (%) |

|---|---|

| USA | 23.4% |

| China | 12.5% |

| Japan | 7.1% |

| Germany | 16.2% |

| UK | 8.9% |

| India | 5.5% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 21.9% |

| China | 13.6% |

| Japan | 10.4% |

| Germany | 14.3% |

| UK | 7.7% |

| India | 6.2% |

The Adaptive Microemulsions Market in Germany is forecast to expand steadily, supported by the country’s strength in dermaceutical innovation and sustainable formulation design. As of 2025, Germany holds a 16.2% share of the global market, which is expected to adjust slightly to 14.3% by 2035 as emerging economies gain momentum. German skincare and pharma-cosmetic brands are leveraging adaptive microemulsions to meet EU mandates on ingredient transparency and performance efficacy. Applications in barrier restoration, vitamin stabilization, and pigment dispersion are expanding across both cosmeceuticals and prescription-grade formulations, with dermatology clinics and premium retail driving commercial usage.

| USA by Function | Value Share% 2025 |

|---|---|

| Deep delivery/penetration | 56.3% |

| Others | 43.7% |

The Adaptive Microemulsions Market in the United States is projected to reach USD 363.66 million in 2025, with strong momentum expected through 2035. The USA leads in demand for adaptive systems that enhance deep delivery and sensory feel, particularly within premium and clinical skincare lines. Fast-absorbing and high-efficacy formulations are a key growth lever, accounting for over 56.3% of market value by function in 2025.

Innovation in USA laboratories and dermatology chains is pushing formulators to adopt adaptive microemulsions for retinoid stabilization, vitamin encapsulation, and improved penetration of bioactive ingredients. The rise of dermatology-led retail brands, DTC cosmeceutical startups, and hybrid OTC-Rx skincare platforms is creating new opportunities for emulsifiers that deliver clinical results with cosmetic elegance. Digital product customization, backed by consumer skin data, is also emerging as a driverfueling interest in adaptive delivery systems that respond to skin condition and environment in real-time.

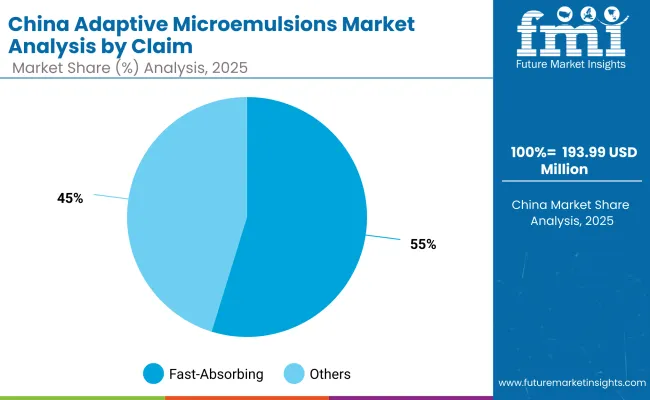

| China by Claim | Value Share% 2025 |

|---|---|

| Fast-absorbing | 54.8% |

| Others | 45.2% |

The Adaptive Microemulsions Market in China is valued at USD 193.99 million in 2025, representing 12.5% of the global market. Fast-absorbing claims dominate this space, accounting for 54.8% of national sales, or approximately USD 106 million. This aligns with China’s rising demand for high-efficacy, fast-delivery skincare driven by urban consumer lifestyles and influencer-driven marketing.

The country is the fastest-growing market globally with a CAGR of 20.5% (2025-2035). Growth is driven by the convergence of domestic innovation in skincare actives, AI-driven formulation tools, and hybrid channels that blur B2B ingredient supply and D2C cosmetic launches. Homegrown ingredient makers and multinational suppliers are investing in adaptive emulsion platforms for pigmentation, hydration, and UV response. Local partnerships with e-commerce giants are also accelerating new product experimentation cycles.

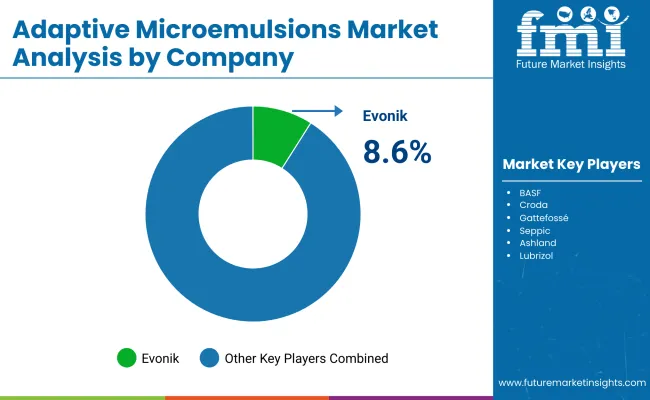

The Adaptive Microemulsions Market is moderately consolidated, with Evonik emerging as the leading player, holding 8.6% of the global value share in 2025. The remaining 91.4% of the market is distributed among other key ingredient suppliers and formulation partners, including both multinational chemical companies and regional formulation specialists.

Evonik’s leadership stems from its deep investments in smart delivery systems, patented surfactants, and adaptive emulsion platforms tailored for skin penetration and stability. The company’s Tego® and Dermosoft® lines are widely adopted in both B2B ingredient supply and prestige cosmetic formulations, particularly those demanding clean-label compliance and bioavailability enhancement. Other major players include BASF, Croda, Gattefossé, Seppic, and DSM-Firmenich, all of which have established product portfolios catering to emulsifier systems, co-solvents, and microemulsion stabilizers. These firms differentiate through performance-tested ingredients, support for rapid formulation prototyping, and regional technical support labs.

Specialty players such as Ashland, Clariant, and Lubrizol focus on targeted functional claims like anti-aging, hydration boosting, and pigment dispersionusing adaptive microemulsion platforms. Their collaborative R&D with cosmetic brands enables customized ingredient development for specific applications such as sun care, acne care, and hybrid skincare-makeup products. The competitive landscape is evolving toward modular ingredient toolkits, where suppliers offer mix-and-match emulsion bases, penetration enhancers, and sensorily optimized textures. Digital formulation support, AI-driven claim validation, and sustainability metrics are becoming critical differentiators as brands demand rapid turnaround from lab to shelf.

Key Developments in Adaptive Microemulsions Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,552.6 Million |

| Emulsion Type | Oil-in-water microemulsion, Water-in-oil microemulsion, Bicontinuous microemulsion, Solvent-free/low-surfactant systems |

| Function | Deep delivery/penetration enhancement, Hydration & sensorial finish, Actives stabilization (retinoids, vitamins), Sun-care dispersion / pigment wetting |

| Product Type | Serums, Gels, Sprays/mists, Creams |

| Channel | B2B ingredient supply, Pharmacies, E-commerce, Specialty beauty retail |

| Claim | Fast-absorbing, Non-greasy, Clean-label, Dermatologist-tested |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Evonik, BASF, Croda, Gattefossé, Seppic, Clariant, Ashland, Lubrizol, DSM- Firmenich, Kao Chemicals |

| Additional Attributes | Dollar sales by emulsion type and function, adoption trends in dermo -cosmetic and pharmaceutical formulations, rising demand for fast-absorbing and deep-penetration delivery systems, sector-specific growth in dermatology, personal care, and specialty pharmaceuticals, product and channel-based revenue segmentation, integration with clean-label and dermatologist-tested positioning, regional trends influenced by luxury skincare and sustainability mandates, and innovations in solvent-free, retinoid-stabilizing, and vitamin-delivery microemulsion systems. |

The global Adaptive Microemulsions Market is estimated to be valued at USD 1,552.6 million in 2025.

The market size for the Adaptive Microemulsions Market is projected to reach USD 5,601.5 million by 2035.

The Adaptive Microemulsions Market is expected to grow at a 13.7% CAGR between 2025 and 2035.

The key product types in the Adaptive Microemulsions Market are gels, sprays/mists, creams, and serums.

The deep delivery/penetration enhancement segment is expected to command a 54.5% share of the Adaptive Microemulsions Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Adaptive Shapewear Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Stroller Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Cruise Control and Blind Spot Detection Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Adaptive Optics Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Cruise Control System Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Camouflage Materials Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Steering Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Front Lighting Market Growth - Trends & Forecast 2025 to 2035

Adaptive Cruise Control Market - Size, Share, and Forecast 2025 to 2035

Adaptive Authentication Market Insights - Growth & Forecast 2025 to 2035

Adaptive Access Control Market Growth – Trends & Forecast through 2034

Automotive Adaptive Lighting Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA