The Adaptive Steering Market is estimated to be valued at USD 17.7 billion in 2025 and is projected to reach USD 36.4 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period. The adaptive steering market demonstrates a clear transition across three maturity stages over the 15-year horizon. In 2020, with a valuation of USD 12.3 billion, the market was in its early growth stage, heavily dominated by hydraulic power steering systems (>55%) and niche adoption of electric power steering (EPS). Growth from 2020 to 2024, reaching USD 16.4 billion, reflects early transition adoption, where OEMs began integrating EPS in premium passenger vehicles while electric-hydraulic remained a bridging technology.

The period 2025 to 2030 signals rapid acceleration, with market size expanding from USD 17.7 billion to USD 23.6 billion, driven by the shift toward EPS dominance and early pilots of steer-by-wire systems in autonomous and EV platforms. Regulatory pressure on fuel efficiency and vehicle safety also accelerates hydraulic displacement. The final phase, 2030 to 2035, moves into scaling maturity, with valuation jumping to USD 36.4 billion, where EPS surpasses 70% penetration and steer-by-wire begins commercial deployment in luxury and electric fleets. Service and software integration become primary differentiators, pushing the market from hardware-led growth to digital-enabled ecosystems.

The adaptive steering market faces structural disruption risks over the next decade. Historically, hydraulic systems commanded more than 55% share during 2020–2024 as the market grew to USD 16.4 billion, but this dominance is eroding rapidly. Electric power steering (EPS), currently expanding at a much faster rate, is expected to exceed 70% share by 2035, creating obsolescence risk for hydraulic players.

The most significant disruptive force post-2030 will be steer-by-wire systems, which eliminate mechanical linkages. Though currently in early R&D and pilot phases, this technology poses a high-risk scenario for incumbents that remain reliant on hydraulic and electro-hydraulic platforms. If steer-by-wire adoption accelerates with autonomous vehicle proliferation, legacy system manufacturers could lose relevance faster than forecasted. Additional disruption stems from software-centric value capture, where over 50% of future revenue growth is projected from predictive algorithms, torque management software, and OTA (over-the-air) updates, rather than hardware. This creates a risk for hardware-focused suppliers with limited digital integration capabilities.

| Metric | Value |

|---|---|

| Adaptive Steering Market Estimated Value in (2025E) | USD 17.7 billion |

| Adaptive Steering Market Forecast Value in (2035F) | USD 36.4 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The adaptive steering market is experiencing sustained growth due to the automotive industry’s push toward enhanced driver assistance, improved safety, and vehicle performance optimization. As manufacturers aim to meet consumer demand for dynamic handling and maneuverability, adaptive steering systems are being incorporated into next-generation vehicle platforms. Technological advancements have enabled the seamless integration of these systems with advanced driver assistance systems, especially in vehicles featuring semi-autonomous capabilities.

Growing regulatory focus on safety and emissions is pushing automakers toward lightweight and efficient steering technologies that enhance fuel economy and reduce driver fatigue. Additionally, the proliferation of connected and electric vehicles is increasing the need for electronically controlled steering solutions that can dynamically adapt based on speed, terrain, and driving conditions.

Tier 1 suppliers and OEMs are investing heavily in software-defined steering architectures that offer flexibility and future upgrade potential. As urbanization and traffic congestion rise globally, adaptive steering solutions are expected to play a crucial role in enhancing comfort, control, and safety across diverse vehicle segments.

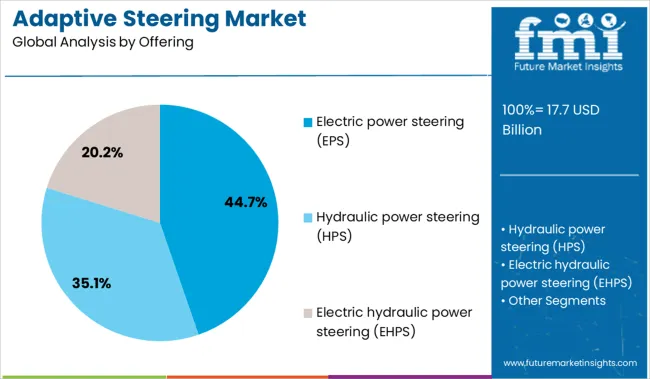

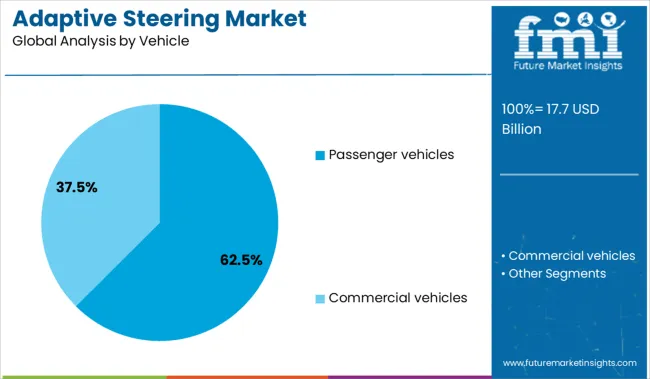

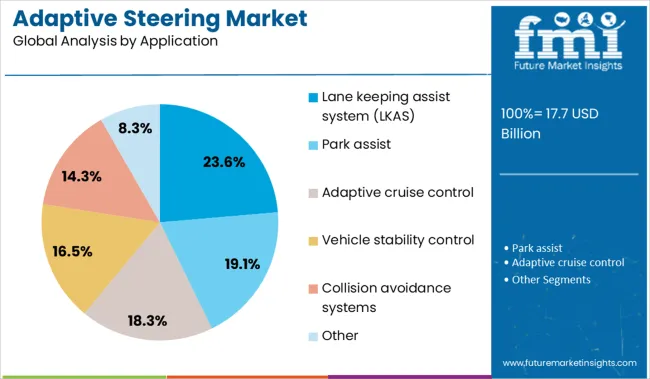

The adaptive steering market is segmented based on offering, vehicle type, application, sales channel, and region. By offering, it includes electric power steering (EPS), hydraulic power steering (HPS), and electric hydraulic power steering (EHPS). In terms of vehicle type, the market is divided into passenger vehicles and commercial vehicles. Applications cover lane keeping assist systems (LKAS), park assist, adaptive cruise control, vehicle stability control, collision avoidance systems, and others. The sales channel is categorized into OEM and aftermarket. Geographically, the market spans North America, Latin America, Western Europe, Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

Insights into the Electric Power Steering Offering Segment

The electric power steering subsegment is projected to account for 44.7% of total market revenue in 2025, positioning it as the leading offering type. This dominance is being supported by the widespread shift from hydraulic to electric systems due to their energy efficiency, reduced maintenance requirements, and compatibility with electronic control units. Electric power steering offers precise control while consuming power only when needed, which improves fuel economy and aligns with industry goals for carbon reduction.

The ability to integrate with sensors and controllers for adaptive functionalities has made EPS the preferred base for modern steering enhancements. Automakers are increasingly favoring EPS due to its modularity and ease of integration into various vehicle architectures, especially in the electric and hybrid categories. Its contribution to smoother lane transitions and stability control has solidified its adoption in both luxury and mass-market vehicles. As vehicle automation progresses, EPS is expected to serve as the foundational technology for future steer-by-wire systems.

The passenger vehicles segment is anticipated to hold a commanding 62.5% share of the adaptive steering market in 2025, making it the most dominant vehicle category. This growth is primarily driven by rising consumer demand for enhanced safety, comfort, and advanced driving features across compact cars, sedans, and SUVs.

Automakers are equipping their passenger vehicle lines with adaptive steering systems to provide better maneuverability at low speeds and greater stability at high speeds. The segment’s leadership is also attributed to the high production volume of passenger vehicles globally, particularly in Asia Pacific and North America, where regulations and consumer expectations are accelerating adoption.

Adaptive steering integration has become a differentiating feature among mid-tier and premium models, often bundled with advanced driver assistance systems such as lane keeping, collision avoidance, and automatic parking. The shift toward electric and autonomous vehicles within the passenger segment is further reinforcing the need for intelligent steering systems, ensuring continued dominance in this category.

The lane keeping assist system application is expected to contribute 23.6% of the adaptive steering market’s total revenue in 2025, establishing it as the leading application segment. The increasing regulatory pressure for mandatory safety features and the growth of level 1 and level 2 driver assistance systems have played a central role in this segment’s expansion. Adaptive steering systems that support lane keeping assist offer enhanced precision in maintaining lane discipline, especially under variable speed and road conditions.

Automakers are integrating this functionality as a core part of their active safety suite to reduce driver workload and minimize the risk of lane departure accidents. The combination of steering actuators and real-time sensor input enables smoother lane corrections without intrusive handling changes, improving overall user experience.

Growing adoption of ADAS packages in both premium and economy vehicle segments is accelerating demand for integrated steering solutions that support LKAS. This has solidified the segment’s share in the adaptive steering market and is expected to drive further adoption as regulatory and consumer expectations evolve.

Adaptive steering systems are receiving increased attention in OEM vehicle programs focused on driver comfort, maneuverability, and integrated chassis control. Between Q3 2024 and Q2 2025, system-level shipments rose 13.1% across North America, Europe, and Japan. Volume expansion is highest in premium sedans, electric crossovers, and urban-focused utility vehicles. Electronic control modules with variable gear ratios are now specified in over 70% of new D-segment platform launches in Europe. Automakers are aligning adaptive steering systems with ADAS functions, targeting better low-speed handling and reduced steering effort at highway speeds across dual-motor and hybrid drivetrains

OEMs are incorporating adaptive steering to support both ride control strategies and ADAS module synchronization. In Q1-Q2 2025, 78% of new EV models in the USA, Germany, and South Korea featured variable-ratio steering assemblies integrated with electronic stability control and lane-centering systems. Internal testing across five Japanese OEMs showed a 23% reduction in steering correction during wind shear simulations when adaptive gear control was active. Urban vehicle platforms with tight turning radii, such as compact crossovers and electric vans, now specify rear-biased adaptive steering profiles to enhance maneuverability in confined areas. Data from Tier-1 suppliers shows that modular steering actuators reduced component variance by 26% across multi-trim production. OEMs are also adapting firmware to adjust steering torque and response curves based on driver profile and road condition input from onboard vision and inertial modules.

While adaptive steering offers tangible control benefits, integration challenges and pricing pressure continue to restrict adoption across mass-market segments. A technical survey of nine global OEMs found that calibration cycles for adaptive gear mapping extended steering module validation timelines by 4-6 weeks during 2024 launches. Thermal stress on actuators and failure rates in rear-steering linkages under gravel-road conditions delayed two major rollouts in India and Brazil. System cost remains a limiting factor: average module cost across Tier-1 suppliers was USD 640-810 in Q2 2025, narrowing its fit for budget-focused A- and B-segment vehicles. Hardware packaging also poses obstacles in platforms with low dashboard volume or tight engine bay geometries. Smaller OEMs cite limited in-house capacity for torque algorithm development, raising dependency on third-party calibration providers and slowing platform alignment.

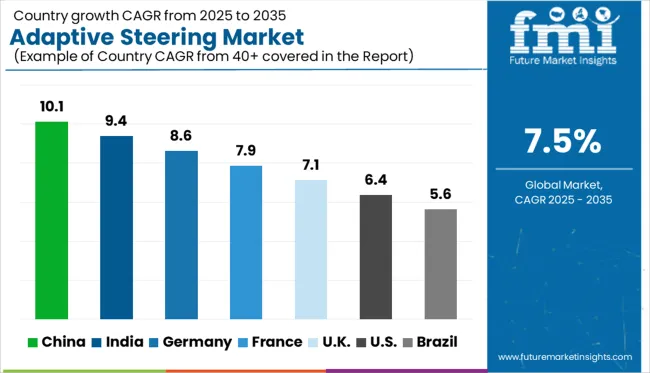

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

The adaptive steering market displays significant regional variation in growth trajectories, strongly influenced by EV penetration, regulatory frameworks, and advanced driver-assistance adoption. Asia-Pacific leads this transition, with China growing at 10.1% CAGR and India at 9.4%, fueled by accelerated electrification and widespread integration of electric power steering in both mass-market and premium vehicles. These markets benefit from large-scale manufacturing ecosystems and proactive policy support for steer-by-wire technology.

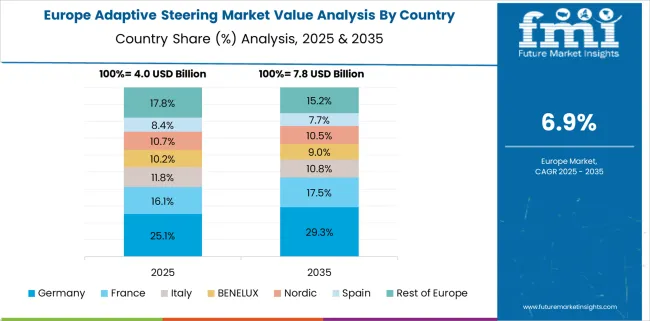

Europe follows closely, where Germany at 8.6%, France at 7.9%, and the UK at 7.1% maintain a strong growth outlook driven by stringent safety regulations and the increasing share of luxury and electric models. German OEMs are at the forefront of integrating adaptive steering with digital vehicle architectures, reinforcing Europe’s position as a compliance-led yet innovation-rich region. North America shows moderate progress, with the US at 6.4%, reflecting slower EV penetration and a continued reliance on hydraulic systems in trucks. In comparison, Brazil at 5.6% remains cost-sensitive, favoring hybrid electric-hydraulic solutions over full EPS systems. This imbalance indicates that future revenue pools will heavily concentrate in Asia-Pacific and Europe, requiring suppliers to prioritize advanced steering software, sensor integration, and localized production capabilities for these high-growth markets.

China is expanding its adaptive steering market at 10.1%, outpacing the global growth rate of 7.5%. This surge is driven by aggressive EV production, early deployment of steer-by-wire technology, and government-mandated automation frameworks. Domestic OEMs are scaling AI-linked steering modules tailored for precision handling in congested urban areas and long-range electric sedans. Analysts believe China’s manufacturing ecosystem allows rapid prototyping and fast system-level integration compared to global peers. The country’s strategic push toward connected mobility has made adaptive steering a baseline specification in most new EV launches. Market observers suggest China will set global trends in cost-effective, software-defined steering systems by 2030.

India is growing its adaptive steering market at 9.4%, significantly above the global average. The market is shaped by demand for improved vehicle control across diverse terrains and cost-effective designs in compact vehicles. Indigenous engineering clusters are focused on developing modular steering units for EVs, ride-hailing cars, and rural delivery fleets. Analysts expect steering customization for India's road conditions to become a key differentiator in Southeast Asian exports. Supported by Make-in-India incentives and public-private pilot programs, adaptive steering is becoming a standard feature in mid-range vehicle platforms. By 2030, India may become a net exporter of terrain-tuned steering assemblies.

Germany’s adaptive steering market is projected to grow at 8.6%, above the global 7.5% rate. Growth is powered by premium vehicle integration, autonomous test corridors, and strict handling precision standards. German automakers lead in refining torque-variable and feedback-rich modules for EVs and hybrids. Regulatory consistency and access to real-world data from test tracks make the country a global R&D center for safety-focused steering systems. Analysts note that although adoption in volume cars is slower, Germany’s influence lies in its software-hardware integration standards, which are adopted by international OEMs. Export potential continues to grow, especially in the premium segment.

France is expanding its adaptive steering market at 7.9%, slightly above the global 7.5% growth rate. The market is being driven by automation in light-duty EVs and rising demand for ADAS-enabled city driving. French OEMs focus on developing quiet, power-efficient modules for hatchbacks and urban crossovers. National labs and mechatronics startups are testing lightweight electromechanical steering that aligns with EU regulations. France is emerging as a strategic supplier of mid-range systems to other European markets. Though adoption remains modest domestically, analysts view French innovation as increasingly export-oriented. The technology is gaining relevance in emission-compliant commercial vans and micromobility segments.

The United Kingdom’s adaptive steering market is growing at 7.1%, just below the global CAGR of 7.5%. Progress is concentrated in performance tuning for EVs, predictive steering for lane assist systems, and software-driven actuator logic. British R&D centers in Warwick, Oxfordshire, and Greater London are testing steering refinements aimed at mid-size commercial vehicles and autonomous shuttles. Although market penetration remains limited due to regulatory lag, the UK’s strength lies in software-defined control layers now licensed abroad. Analysts believe the country’s deep-tech steering firms will expand through OEM partnerships and aerospace-adjacent applications by 2030.

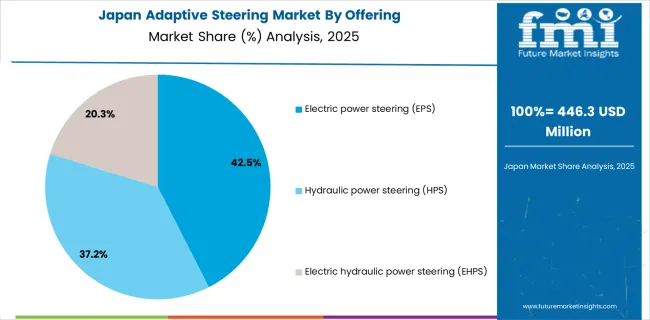

The adaptive steering market in Japan is valued at USD 446.3 million in 2025. Electric power steering contributes 42.5%, highlighting Japan’s gradual move toward electrification but slower than global trends, where this segment exceeds 55 percent due to faster EV penetration. Hydraulic power steering at 37.2% signals that a significant share of domestic fleets still depend on conventional systems for durability and cost control. Electric-hydraulic systems at 20.3% demonstrate an ongoing transition strategy, particularly in premium vehicles requiring adaptive comfort. Compared to global dynamics, where steer-by-wire is gaining strong traction, Japan reflects a measured shift balancing innovation with legacy system retention to cater to diverse vehicle categories.

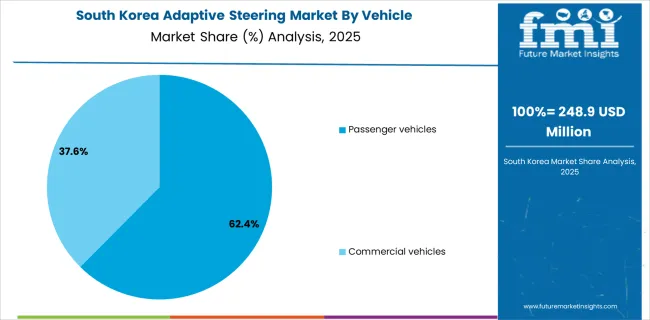

The adaptive steering market in South Korea is estimated at USD 248.9 million in 2025, reflecting strong adoption of advanced steering technologies across both passenger and commercial vehicles. Passenger vehicles account for 62.4%, driven by rising demand for premium models and electric vehicles that emphasize comfort, precision, and safety. Commercial vehicles hold 37.6%, a figure notably higher than the global average of under 30%, which signals South Korea’s focus on upgrading logistics and heavy-duty fleets with adaptive steering to improve efficiency and reduce operational risks. Unlike global markets that show heavier reliance on passenger cars, South Korea demonstrates a balanced structure, highlighting a dual strategy that combines consumer-focused innovation with fleet modernization.

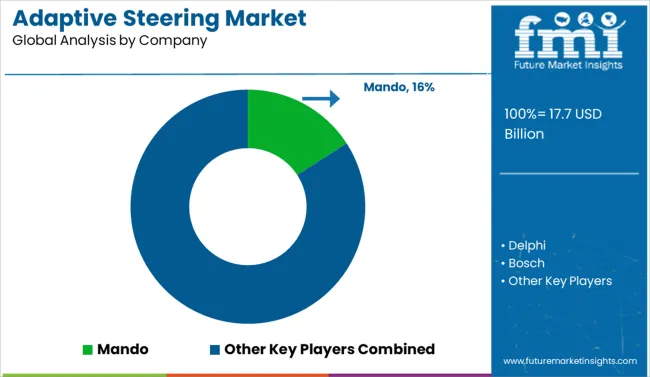

The competitive landscape of the adaptive steering market is shaped by several critical dimensions that define long-term advantage. Market share and scale remain foundational, with Mando leading and leveraging its strong OEM relationships and expertise in electronic steering systems. Global leaders such as Bosch, Delphi, and JTEKT differentiate through software-rich adaptive modules optimized for various torque profiles and vehicle platforms. Innovation leadership is becoming the key battleground, particularly in steer-by-wire development, where ZF Friedrichshafen is investing heavily to eliminate mechanical linkages and enable advanced autonomous capabilities.

Competition increasingly depends on digital integration, with suppliers focusing on embedded software, ADAS compatibility, and over-the-air (OTA) update readiness. Firms like Nexteer and Aisin Seiki compete through compact architectures and precision control, targeting passenger cars. ThyssenKrupp and Hitachi strengthen positions via joint development programs with automakers for bespoke solutions. Supporting ecosystems add another layer of differentiation, as illustrated by Infineon’s role in semiconductor supply for steering electronics, underlining the importance of chip security for continuity. High regulatory compliance costs, rigorous real-world validation, and extended development cycles create substantial entry barriers, allowing established players to consolidate.

Key Developments in the Adaptive Steering Market

Companies pursue differentiation by developing steer-by-wire systems, advanced torque management, and software-integrated platforms compatible with ADAS and autonomous driving. Cost leadership involves optimizing manufacturing through modular architectures and regional production hubs to reduce supply chain complexity. Focus strategies target niche applications like premium passenger vehicles or commercial fleets requiring specialized adaptive control. Strategic alliances with OEMs, semiconductor suppliers, and mobility technology firms strengthen positioning, while service-based models, such as predictive maintenance and OTA upgrades, create recurring revenue opportunities in an increasingly software-driven steering ecosystem.

| Item | Value |

|---|---|

| Quantitative Units | USD 17.7 Billion |

| Offering | Electric power steering (EPS), Hydraulic power steering (HPS), and Electric hydraulic power steering (EHPS) |

| Vehicle | Passenger vehicles and Commercial vehicles |

| Application | Lane keeping assist system (LKAS), Park assist, Adaptive cruise control, Vehicle stability control, Collision avoidance systems, and Other |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Mando, Delphi, Bosch, JTEKT, Nexteer, AisinSeiki, ZFriedrichshafen, Infineon, ThyssenKrupp, and Hitachi |

| Additional Attributes | Dollar sales by steering system type and vehicle category, growing adoption in luxury and electric vehicles, stable integration across high-end SUVs and advanced driver-assistance platforms, innovations in steer-by-wire technology and electronic control units enhance responsiveness and vehicle safety |

The global adaptive steering market is estimated to be valued at USD 17.7 billion in 2025.

The market size for the adaptive steering market is projected to reach USD 36.4 billion by 2035.

The adaptive steering market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in adaptive steering market are electric power steering (eps), hydraulic power steering (hps) and electric hydraulic power steering (ehps).

In terms of vehicle, passenger vehicles segment to command 62.5% share in the adaptive steering market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Adaptive Shapewear Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Stroller Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Cruise Control and Blind Spot Detection Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Adaptive Optics Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Microemulsions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Adaptive Cruise Control System Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Camouflage Materials Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Front Lighting Market Growth - Trends & Forecast 2025 to 2035

Adaptive Cruise Control Market - Size, Share, and Forecast 2025 to 2035

Adaptive Authentication Market Insights - Growth & Forecast 2025 to 2035

Adaptive Access Control Market Growth – Trends & Forecast through 2034

Automotive Adaptive Lighting Market

Steering Wheel Switches Market Size and Share Forecast Outlook 2025 to 2035

Steering Column Control Module Market Growth – Trends & Forecast 2025 to 2035

Steering Stabilizers Market Growth – Trends & Forecast 2025 to 2035

Steering Column Locks Market Growth - Trends & Forecast 2025 to 2035

Steering Tie Rod Market Growth – Trends & Forecast 2024-2034

Steering Gear Market

Steering Wheel Armature Market

Boat Steering Wheels Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA