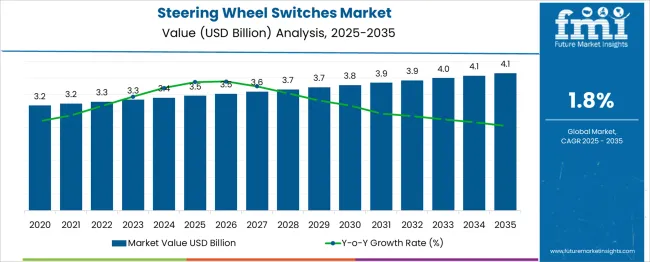

The Steering Wheel Switches Market is estimated to be valued at USD 3.5 billion in 2025 and is projected to reach USD 4.1 billion by 2035, registering a compound annual growth rate (CAGR) of 1.8% over the forecast period. The growth pattern shows an extended period of minimal expansion followed by a slight acceleration in later years. From 2025 to 2028, the market value moves from USD 3.5 billion to USD 3.6 billion, with annual increments in the range of USD 0.03-0.05 billion.

This phase indicates a high level of product penetration, limiting significant annual increases. Between 2029 and 2032, the market advances from USD 3.7 billion to USD 3.9 billion. Increments improve marginally to USD 0.07-0.1 billion per year, marking the first observable shift in the growth rate.

The period from 2033 to 2035 shows values rising from USD 4.0 billion to USD 4.1 billion, with increments stabilizing at about USD 0.05 billion annually. The breakpoint in the dataset appears between 2029 and 2030, where the annual growth rate moves from negligible to modest yet steady levels, shaping the overall decade trend of gradual but constrained expansion.

| Metric | Value |

|---|---|

| Steering Wheel Switches Market Estimated Value in (2025 E) | USD 3.5 billion |

| Steering Wheel Switches Market Forecast Value in (2035 F) | USD 4.1 billion |

| Forecast CAGR (2025 to 2035) | 1.8% |

The steering wheel switches market is viewed as a specialized yet steadily expanding category within its parent industries. It is estimated to account for about 2.2% of the global automotive interior components market, driven by the demand for integrated control systems that enhance driver convenience and safety. Within the automotive electronics sector, a share of approximately 2.9% is assessed due to the integration of infotainment, cruise control, and driver assistance functions.

In the connected and smart vehicle technology market, around 2.5% is observed reflecting the role of steering wheel controls in enabling hands on operation of digital systems. Within the premium and performance vehicle components segment, about 2.4% is evaluated as advanced switchgear becomes a differentiating feature. In the commercial vehicle interior systems market, a contribution of roughly 2.0% is calculated as fleet operators adopt multifunction steering controls.

Market growth has been influenced by the increasing integration of infotainment and driver assistance features into steering wheel designs. Innovations have focused on touch sensitive surfaces, haptic feedback systems, and customizable switch layouts to match driver preferences. Interest has been growing in multifunctional modules that combine traditional buttons with capacitive touch controls for enhanced ergonomics.

The Asia Pacific region has been observed to lead in production and adoption, supported by high vehicle manufacturing volumes, while Europe and North America maintain strong demand through premium and technology focused vehicle segments. Strategic initiatives have included collaborations between automotive OEMs and electronics suppliers to develop durable, low latency control systems with seamless connectivity to vehicle networks and advanced driver assistance systems.

The steering wheel switches market is witnessing consistent expansion, driven by the demand for enhanced in-vehicle convenience, integrated infotainment systems, and safety-centric design evolution across automotive segments. Automakers are integrating multi-functional switch modules to enable seamless user control over infotainment, cruise, and safety features without driver distraction.

Regulatory encouragement for safer driving environments and consumer demand for connected vehicle experiences are further accelerating OEM integration of advanced switch technologies. The market outlook remains strong as embedded electronics and driver-assist systems continue to evolve, creating sustained need for ergonomic and responsive switch systems.

With technological refinements in tactile feedback and smart haptic interfaces, the market is anticipated to benefit from premiumization trends across both passenger and commercial vehicle categories.

The steering wheel switches market is segmented by sales channel, product, application, and geographic regions. The sales channel of the steering wheel switches market is divided into OEM and Aftermarket. In terms of the product of the steering wheel switches market, it is classified into Push and See-saw. Based on the application of the steering wheel switches, the market is segmented into Audio controls, Infotainment controls, Cruise control, phone control, and Others. Regionally, the steering wheel switches industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

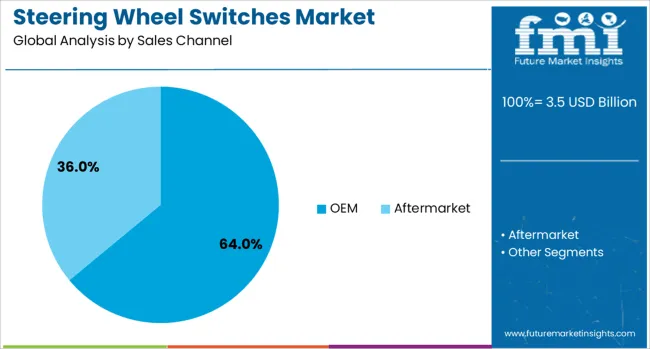

OEMs are expected to contribute 64.0% of the total revenue in the steering wheel switches market by 2025, establishing their position as the dominant sales channel. This leadership is supported by the increasing integration of factory-installed control systems in vehicles, especially across mid-range and premium models.

Automakers are prioritizing in-built, pre-tested components to enhance reliability and reduce post-sale retrofitting costs.

The growing complexity of modern steering systems, integrating infotainment, driver assistance, and communication controls, has prompted OEMs to standardize steering switch modules across models to ensure safety, compliance, and brand consistency.

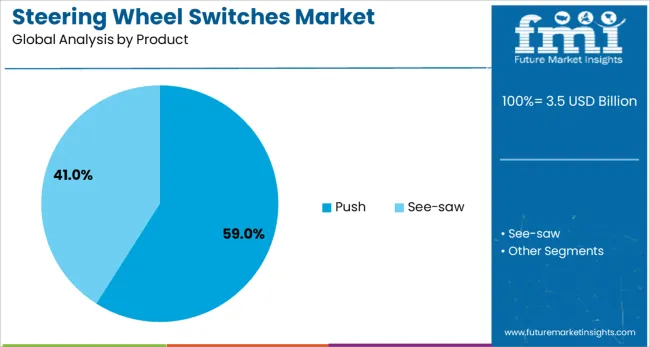

Push-type steering wheel switches are projected to hold 59.0% of the market share by 2025, making them the most widely adopted product type. Their dominance is attributed to intuitive usability, mechanical reliability, and cost-efficiency in both manufacturing and operation.

Automakers prefer push-button interfaces for functions that require tactile confirmation, such as cruise control and volume adjustment. These switches also enable clean aesthetic integration and reduce the risk of accidental input.

Enhanced by backlit options and improved haptic response, push-type designs continue to gain favor in both entry-level and high-end vehicles.

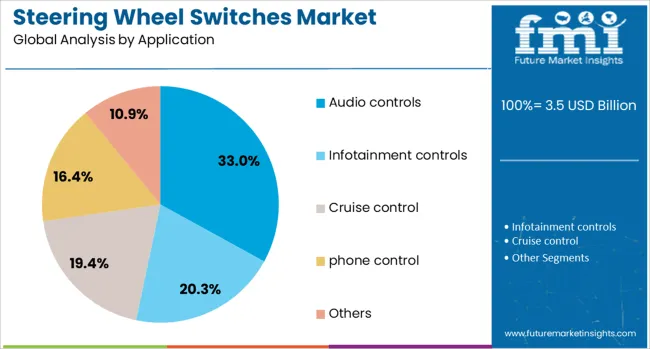

Audio control applications are expected to account for 33.0% of the market share in 2025, positioning them as the leading functional segment for steering wheel switches. This prominence is driven by increased consumer reliance on in-car entertainment systems and the demand for distraction-free audio control while driving.

With infotainment platforms becoming more complex, vehicle manufacturers are offering dedicated, easy-access controls for volume, track selection, and media source toggling.

As connected services such as streaming and voice command systems proliferate, audio-related switch modules are increasingly prioritized in both design and functionality.

The steering wheel switches market has been experiencing steady expansion, driven by the increasing integration of multifunctional controls in modern vehicles. These switches are being utilized to operate infotainment, cruise control, communication, and driver-assistance systems without diverting attention from the road. Rising vehicle electrification, enhanced safety requirements, and demand for premium driving experiences have supported growth. Advancements in tactile feedback, ergonomics, and illumination technology have improved usability. Both OEM installations and aftermarket upgrades have contributed to market adoption, making steering wheel switches an essential component in improving driver convenience and operational safety.

Continuous advancements in switch design and technology have enhanced their functionality and integration within the steering wheel. Capacitive touch interfaces, haptic feedback mechanisms, and customizable button layouts have been implemented to improve responsiveness and user comfort. Backlit and illuminated designs have been adopted to ensure visibility in all lighting conditions. Integration with voice command systems and wireless connectivity has expanded operational capabilities. Durable materials and water-resistant designs have improved longevity in varied driving environments. Such innovations have not only increased driver engagement but also enabled compliance with evolving automotive safety and ergonomic standards, reinforcing their importance in vehicle design.

Steering wheel switches have been deployed across a diverse range of vehicle categories, from economy models to luxury and performance cars. In passenger vehicles, they are used to control infotainment systems, navigation, and advanced driver-assistance functions. Commercial vehicles have adopted them to operate communication equipment, fleet management systems, and safety alerts. Electric vehicles have incorporated them to streamline controls for regenerative braking modes and energy monitoring. The growing focus on reducing driver distraction has made these switches an integral part of cockpit design. Their adaptability to varied vehicle segments has broadened market penetration globally, supporting consistent demand.

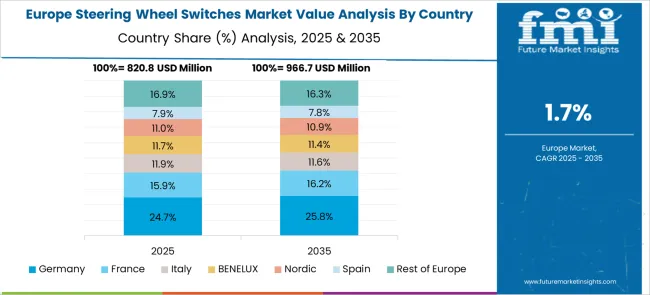

Regional market dynamics have been shaped by differing automotive production volumes, consumer preferences, and regulatory requirements. Asia-Pacific has led adoption due to high vehicle manufacturing in China, Japan, and South Korea. Europe has emphasized advanced steering wheel switch integration in line with premium vehicle production and stringent safety directives. North America has shown steady demand, driven by technology-focused consumers and the popularity of connected vehicles. Emerging markets in Latin America and the Middle East are gradually increasing adoption alongside growing automotive assembly operations. OEM collaborations with component suppliers have streamlined design customization to meet regional preferences.

The steering wheel switches market has faced certain challenges despite growing demand. Increased system complexity has led to higher manufacturing costs and longer development timelines. Compatibility issues with varied infotainment and driver-assistance platforms have required additional engineering resources. Wear and tear from frequent usage can lead to performance degradation, increasing warranty claims. Miniaturization and integration into compact steering wheel designs have posed design constraints. Additionally, the transition toward gesture control and fully voice-operated interfaces may limit long-term growth potential for physical switches. Addressing these challenges through material improvements, modular designs, and enhanced durability testing has been recognized as essential for sustaining market competitiveness.

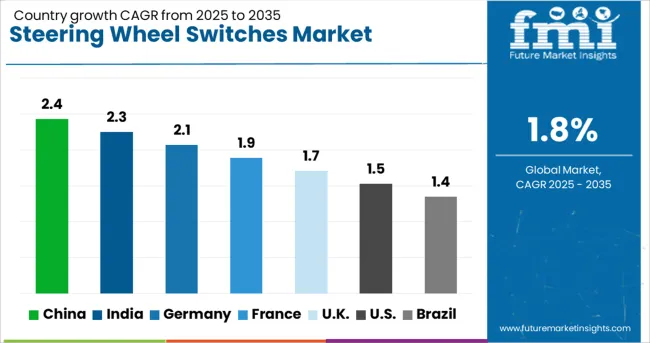

| Country | CAGR |

|---|---|

| China | 2.4% |

| India | 2.3% |

| Germany | 2.1% |

| France | 1.9% |

| UK | 1.7% |

| USA | 1.5% |

| Brazil | 1.4% |

The steering wheel switches market is expected to grow at a global CAGR of 1.8% between 2025 and 2035, driven by demand for in-vehicle control convenience, integration of advanced infotainment systems, and steady automotive production. China leads with a 2.4% CAGR, supported by large-scale vehicle manufacturing and rising adoption of multifunction steering wheels. India follows at 2.3%, fueled by increasing passenger vehicle sales and feature upgrades in mid-range models. Germany, at 2.1%, benefits from premium vehicle production and advanced automotive electronics. The UK, projected at 1.7%, sees stable demand from luxury and specialty car segments. The USA, at 1.5%, reflects a mature market with steady replacement demand. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 2.4% from 2025 to 2035, driven by rising production of passenger cars equipped with multifunctional steering wheels. Local automakers such as Geely, BYD, and SAIC are integrating advanced control switches for infotainment, driver assistance, and communication features. The shift toward connected vehicles is increasing the need for ergonomically designed and durable switch assemblies. Demand is also influenced by mid-tier vehicles adopting premium interior components.

India is expected to grow at a CAGR of 2.3% from 2025 to 2035, supported by the rising popularity of infotainment integration in compact and mid-segment vehicles. Automakers like Tata Motors and Mahindra are incorporating steering wheel switches for audio, cruise control, and hands-free calling in entry-level variants. Consumer preference for convenience features in affordable models is accelerating adoption. Partnerships between component suppliers and OEMs are ensuring compatibility with new dashboard and infotainment designs.

Germany is forecasted to grow at a CAGR of 2.1% from 2025 to 2035, driven by luxury and performance car manufacturers adopting high-precision, haptic-feedback switches. Brands such as BMW, Mercedes-Benz, and Audi are introducing touch-sensitive and backlit switch panels to enhance driver interaction. Integration with advanced driver assistance systems (ADAS) is a growing trend, particularly in high-end models. German suppliers are also focusing on durability and design customization for global exports.

The United Kingdom is anticipated to grow at a CAGR of 1.7% from 2025 to 2035, influenced by steady demand in premium and utility vehicle segments. Jaguar Land Rover and niche performance brands are fitting multifunctional steering wheel switches with customizable layouts. Increasing adoption of voice-activated functions through steering-mounted controls is gaining attention. The aftermarket segment is also benefiting from demand for retrofitted multifunction units in older models.

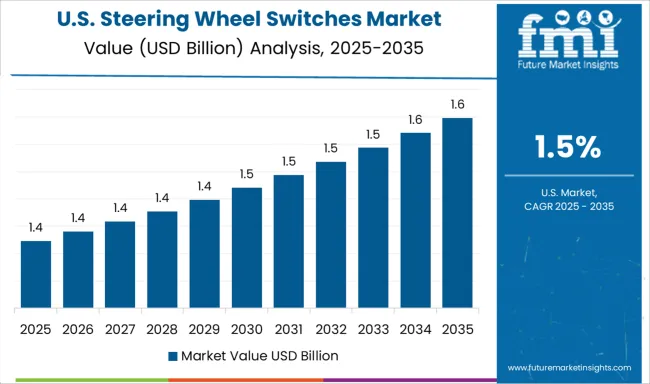

The United States is expected to grow at a CAGR of 1.5% from 2025 to 2035, driven by continued adoption in SUVs, pickup trucks, and electric vehicles. Automakers like Ford, General Motors, and Tesla are integrating steering wheel switches with advanced connectivity for navigation, media control, and driver assistance systems. Focus on improving tactile feedback and durability is guiding design innovation. The aftermarket is also strong, catering to enthusiasts upgrading interior components.

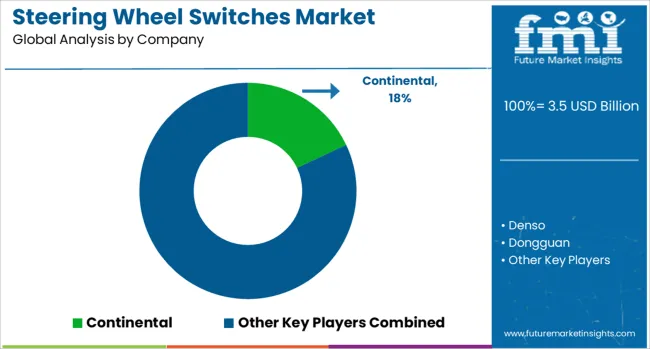

The steering wheel switches market is led by major automotive OEMs and Tier 1 suppliers producing integrated control modules that enhance driver convenience and safety. Continental and ZF Friedrichshafen supply advanced multi-function steering wheel switches for global automakers, incorporating controls for infotainment, driver assistance systems, and vehicle settings.

Denso and Valeo develop ergonomic switch modules with tactile feedback, optimized for minimal driver distraction. Panasonic Corporation provides electronic switch assemblies combining mechanical and capacitive touch inputs, targeting both premium and mass-market vehicles.

TOKAI RIKA specializes in precision switchgear and control interfaces, often customized to automaker specifications. Dongguan serves as a manufacturing hub for cost-effective switch production, supplying both domestic and export markets. Automakers such as Toyota Motor, Nissan Motor, and Hyundai Motor integrate steering wheel switch production into their broader component manufacturing capabilities, ensuring compatibility with in-house infotainment and safety systems.

Key strategies include miniaturization for integration with compact steering wheel designs, development of haptic and touch-sensitive interfaces, and alignment with evolving ADAS and connected car features. Entry barriers include strict automotive quality standards, long validation cycles, and established supplier relationships with vehicle manufacturers.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.5 Billion |

| Sales Channel | OEM and Aftermarket |

| Product | Push and See-saw |

| Application | Audio controls, Infotainment controls, Cruise control, phone control, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Continental, Denso, Dongguan, Hyundai Motor, Nissan Motor, Panasonic Corporation, TOKAI RIKA, Toyota Motor, Valeo, and ZF Friedrichshafen |

| Additional Attributes | Dollar sales by switch type and vehicle category, demand dynamics across passenger cars, light commercial vehicles, and heavy commercial vehicles, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in haptic feedback systems, capacitive touch controls, and multifunction integration with infotainment and ADAS, environmental impact of electronic component manufacturing and recycling, and emerging use cases in autonomous vehicle control interfaces, connected car ecosystems, and customizable driver experience solutions. |

The global steering wheel switches market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the steering wheel switches market is projected to reach USD 4.1 billion by 2035.

The steering wheel switches market is expected to grow at a 1.8% CAGR between 2025 and 2035.

The key product types in steering wheel switches market are oem and aftermarket.

In terms of product, push segment to command 59.0% share in the steering wheel switches market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Steering Wheel Armature Market

Boat Steering Wheels Market Size and Share Forecast Outlook 2025 to 2035

Heated Steering Wheel Market

Wheeled Bins Market Size and Share Forecast Outlook 2025 to 2035

Wheel Loader Scales Market Size and Share Forecast Outlook 2025 to 2035

Wheel Excavator Market Size and Share Forecast Outlook 2025 to 2035

Wheel Loader Market Size and Share Forecast Outlook 2025 to 2035

Wheel Balancing Market Size and Share Forecast Outlook 2025 to 2035

Wheel Aligner Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wheel Tractor Scrapers Market Size and Share Forecast Outlook 2025 to 2035

Steering Column Control Module Market Growth – Trends & Forecast 2025 to 2035

Wheeled Insulated Cooler Market Trends - Growth & Demand Forecast 2025 to 2035

Steering Stabilizers Market Growth – Trends & Forecast 2025 to 2035

Steering Column Locks Market Growth - Trends & Forecast 2025 to 2035

Competitive Breakdown of Wheeled Bin Providers

Steering Tie Rod Market Growth – Trends & Forecast 2024-2034

Germany Wheeled Bin Industry Analysis – Growth & Outlook 2024-2034

Wheelchair Market Analysis – Size, Share & Forecast 2024-2034

Steering Gear Market

Wheel studs Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA