The global market for microphones is anticipated to grow at a robust growth rate over the decade with the rise in popularity for voice-enabled smart devices, improvements in voice recognition software on the move, and fear better advanced video content on social media.

As consumers and industries alike demand better audio experiences and capabilities, microphones ubiquitous devices in everything from smartphones and smart speakers to automotive systems and professional audio equipment are in demand.

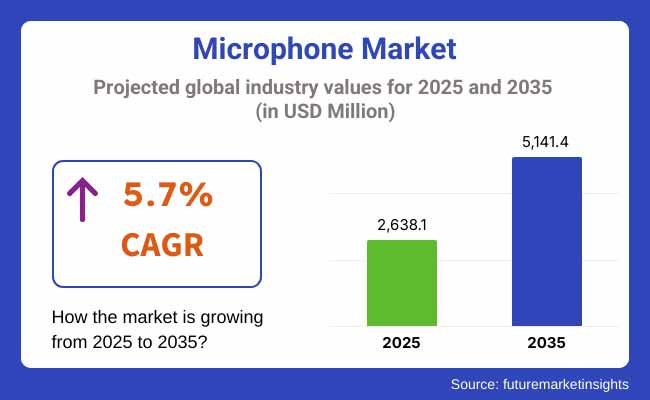

Over the forecast period (2025 to 2035), the global microphones market is estimated to reach approximately USD 5,141.4 Million by 2035, representing a CAGR of 5.7% from USD 2,638.1 Million in 2025.

The rapid penetration of smartphone and built-in microphones in automotive applications (for hands-free calling and voice commands) and growing entertainment industry are also projected to foster the long-term market growth.

The region, on the other hand, holds a high market share for the microphone, owing to an established consumer electronics industry along with a growing adoption of advanced technologies. Microphones are in particularly high demand in the United States, where they are omnipresent in smartphones, smart home and professional audio equipment. The presence of large technology companies, along with ongoing development in voice recognition and artificial intelligence, fuels market growth in this region.

The microphone market in Europe continues to flourish, driven by a focus on innovation and quality in manufacturing processes. At the leading edge, with precision engineering and high-performance audio design. The region's commitment towards environmental sustainability lends itself to a focus on recyclable materials, which makes microphones the optimal solution across the applications.

Asia Pacific is expected to be the fastest growing region with increasing industrial activities, urbanization, and capital investments in infrastructure development boosting demand. It is also because countries such as China and India have a booming economy, and they are investing a lot in manufacturing and construction which has driven the consumers and manufacturers to the microphone market.

Overall, another major factor accelerating the growth of the market for high-precision and durable microphones is the growth of the consumer electronics market in this region. The market in Asia-Pacific is also witnessing growth owing to the supportive measures encouraging local manufacturing as well as favorable government policies in the region.

Challenges: High Competition, Price Sensitivity, and Technological Integration Complexities

Consumer electronics pose a high level of price sensitivity as volume players are always looking for cost-effective solutions, leading to cut-throat competition in the microphone market. In addition, cheap manufacturers and copied products affect high-end microphone brands.

Technological integration is another factor contributing to the problem of sound quality, especially for systems that are voice-activated AI-based, automotive-related, and built into various smart gadgets, which can make it quite difficult to achieve the desired audio in such devices without interference or noise interference.

Opportunities: Growth in AI-Powered Voice Assistants, Wearable Tech, and High-Definition Audio Devices

Overall the market is experiencing growth fueled by demand for microphones in smartphones, smart speakers, automotive voice control systems and streaming devices despite headwinds. Booming adoption of voice-activated AI assistants: Amazon Alexa, Google Assistant and Siri, has also driven the need for high-sensitivity, noise-canceling and beamforming microphone technologies.

Growing use of wearables, such as smart watches, AR/VR headsets and wireless buds, is also fuelling developments in miniaturization and high-performance MEMS (Micro-Electro-Mechanical Systems) mics.

The growing popularity of podcasting, live streaming, and high-end audio recording has also created demand for studio-quality and directional microphones with better digital signal processing (DSP) capabilities. AI-based audio improvement, and AI-assisted real-time noise cancellation technologies, are significantly innovating the landscape and enhancing audio quality across multiple applications.

The microphone market boomed between 2020 and 2024 the rise of remote working, online learning, and streaming services. The increasing work-from-home trend and rising consumer engagement with virtual experiences propelled the demand for high-performance microphones in video conferencing, gaming headsets, and wireless earbuds. But the production and pricing and availability was unstable from semiconductor shortages and supply chain disruptions.

In the 2025 to 2035 timeline, AI-powered voice processing, smart noise cancellation, and edge computing for real-time audio enhancement will become increasingly integrated with each other.

Also, ultra-low-power MEMS microphones will continue to be in demand for wearable and IoT applications, as well as advancements in spatial audio for AR/VR experiences. Manufacturers of microphones will increasingly align with green technology trends, adopting sustainable and energy-efficient practices in production, and using biodegradable materials and recyclable electronic components.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with audio industry standards, digital privacy regulations, and product safety guidelines. |

| Consumer Trends | Demand for wired and wireless microphones in gaming, streaming, and conferencing applications. |

| Industry Adoption | Used primarily in consumer electronics, recording studios, and conferencing solutions. |

| Supply Chain and Sourcing | Dependence on semiconductors and rare earth materials for high-fidelity microphones. |

| Market Competition | Dominated by audio equipment manufacturers, consumer electronics brands, and telecom companies. |

| Market Growth Drivers | Increased adoption of wireless microphones, smart assistants, and streaming technologies. |

| Sustainability and Environmental Impact | Early adoption of low-power MEMS microphones and energy-efficient components. |

| Integration of Smart Technologies | Introduction of multi-microphone arrays for smart speakers and audio conferencing. |

| Advancements in Microphone Technology | Development of directional microphones and MEMS-based miniaturized sensors. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter AI-powered voice data privacy laws, environmental compliance in microphone manufacturing, and standardized voice recognition protocols. |

| Consumer Trends | Growth in AI-driven smart microphones, spatial audio solutions, and ultra-low-power MEMS microphones for wearables. |

| Industry Adoption | Expansion into autonomous vehicles, IoT-enabled voice assistants, and augmented reality (AR) applications. |

| Supply Chain and Sourcing | Shift toward sustainable sourcing, recyclable microphone components, and miniaturized MEMS sensor integration. |

| Market Competition | Entry of AI-driven microphone firms, spatial audio technology startups, and biometric voice authentication providers. |

| Market Growth Drivers | Accelerated by next-gen voice recognition, biometric audio security, and AI-enhanced noise-canceling microphones. |

| Sustainability and Environmental Impact | Large-scale shift toward eco-friendly microphone materials, recyclable sound sensors, and green manufacturing processes. |

| Integration of Smart Technologies | Expansion into AI-powered voice isolation, real-time transcription, and spatial sound enhancement for immersive experiences. |

| Advancements in Microphone Technology | Evolution toward 3D spatial audio capture, bio-acoustic microphones for healthcare, and real-time machine learning-based sound optimization. |

The USA market for microphones is expanding owing to the high demand for smart home devices, AI-powered voice assistants, and professional audio recording equipment.

Podcasting and content creation are last but not least in this growing list of sound-applying applications as the current developments in high-fidelity microphones, AI-enhanced noise suppression, etc., and last but not least MEMS based smart microphones are out there to form new platforms of remote communication. The installation of automotive voice recognition systems is so enabling market expansion as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.0% |

UK also sees steady market growth resulting from rising investment in smart homes, voice-enabled IoT devices, and AI-powered customer service applications.

With the rise in remote working and working from home, as well as the growth of virtual collaboration platforms for working with colleagues and clients online, there has been excitement around high-quality microphones for conferencing, gaming and live streaming. The evolution of the market owing to the investments in sustainable consumer electronics manufacturing is also having an impact.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.8% |

Europe’s microphone market is influenced by stringent data privacy regulations, increasing need for biometric voice authentication, and expansion in smart audio solutions by AI. Vote for the country that is leading the way in 3D sound capture technologies, AR/VR audio integration, and automotive voice recognition, or Germany, France, And Sweden. Smart home automation and wireless communication platforms are further driving the market demand.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 6.9% |

It also includes the 92M+ in number of microphones being shipped to Japan that are being used in smart wearable devices, increasing investment in artificial intelligence (AI)-enriched voice interfaces, and the high demand for high-fidelity audio systems. The demand for ultra-compact, energy-efficient microphones for IoT application is being fueled by the country's leadership in the miniaturized MEMS microphone technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.9% |

As South Korea is witnessing strong growth of consumer electronics market, quick adoption of AI powered smart assistants and increasing investments in spatial audio technology, this country is also turning into microphone market. In replacing technology the modern evolution of AR/VR headsets, wireless earbuds and AI-powered voice recognition systems is the key toward what lies ahead in microphone technology in this nation.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.0% |

Micro-electromechanical systems (MEMS) and electret microphones segments lead the microphone market as industries are continually embedding advanced audio tech into consumer electronics, professional audio devices, and industrial applications.

These components are essential in enhancing voice capture, noise cancellation, and sound clarity in smartphones, wearables, smart home devices, and communication systems.

Micro-electromechanical Systems (MEMS) Microphones Lead Market Demand as Compact and High-Fidelity Audio Solutions Gain Traction

MEMS microphones have become the dominant segment in the market, providing miniaturized form factors, high sensitivity, and increased power efficiency. MEMS devices utilize semiconductor fabrication techniques that can provide audio performance benefits over electret microphones, and are very well suited for the increasing number of digital applications.

Market penetration has been boosted by the surging need for compact, low-power microphones using MEMS technology in smart speakers, true wireless earbuds, and voice-controlled assistant devices. According to research, more than 65% of current consumer electronic gadgets employ MEMS microphones because of their accuracy, toughness, and performance.

Market expansion has been further enhanced by AI-powered voice recognition through the introduction of MEMS microphones in voice-activated AI assistants, real-time translation devices, and biometric voice authentication systems ensuring wider adaptation to smart technology ecosystem.

Further adoption has been encouraged by the addition of noise suppression algorithms, AI-optimized MEMS microphone arrays, active echo cancellation, and spatial audio processors, providing high-quality sound and improved voice command recognition.

This has optimized market growth and led to the development of advanced MEMS microphone designs with ultra-low latency, improved (SNR), and waterproof nano-coatings, which have led to superior performance in ruggedized and extreme environments.

The MEMS microphone segment has its own set of challenges despite offering advantages such as miniaturization, digital integration, and improved audio quality, which include higher manufacturing costs, susceptibility to mechanical vibrations, and complex calibration processes.

But advances in AI-driven audio algorithms, MEMS COF and multi-microphone beamforming are enhancing functionality, and MEMS-based microphones will continue to grow into new spaces.

Electret Microphones Expand as Cost-Effective and Versatile Audio Solutions Remain Relevant

Electret microphones have been widely adopted, especially by traditional audio equipment manufacturers as the industry remains in high demand for reliable, low-cost microphone solutions. The electret delivers a stable frequency response and outstanding sensitivity over MEMS microphones, so it is widely used in professional audio segments, conferencing systems, and as consumer electronics.

Increasing adoption of electret microphones across wired and wireless headsets, public address systems, and industrial communication systems can be majorly credited for the growing demand for cost-effective and long-lasting smart microphones, which in turn has propelled the growth of the global electret microphone market.

Microphones are of various types, but electret type microphones are most common (due to consistency in audio capture, more than 50% of professional and telecommunication-grade microphones use them),

The influx of studio-quality audio recording, including high-fidelity electret microphones for podcasting, broadcasting and live performances, which have aided in market growth as they guarantee sound reproduction is done to an excellent standard for professional purposes.

With the development of AI-enabled audio processing, realized through electret microphones with advanced machine-learning voice improvement processes, real-time noise suppression, and adaptive microphone gain control, adoption has received yet another mention, leading to improved sound clarity and performance.

Market growth has been optimized for hybrid microphone solutions through MEMS-electret integration for expert audio applications that make sure that the best of both analog and digital sound processing is utilized to enhance information accuracy.

However, the electret microphone segment does face challenges such as larger form factors than MEMS technology, susceptibility to long-term wear, and limited digital integration capabilities despite advantages in affordability, stability, and versatility.

Innovations in AI-powered sound processing, improved electret diaphragm durability, and hybrid MEMS-electret microphone arrays are making reliability less of an issue, facilitating them during extensive expansion in the professional and consumer audio markets.

The segments of the analog and digital MEMS microphone also serve as the key driving forces behind the expansion of the market as industries and consumers look for better sound capture, noise suppression and energy-efficient microphone solutions.

Analog MEMS Microphones Lead Market Demand as High-Fidelity Audio Capture Remains Essential

Analog MEMS microphones have become a leading segment of the market, delivering exceptional frequency response, low latency, and compatibility with established audio processing circuitry. Table of Contents Unlike digital MEMS microphones, their analog counterparts provide, upon minimum processing, direct acoustic signals that make them best suited for studio-quality sound reproduction.

The increasing need for audio justification, with analog MEMS microphones integrated in professional headsets, voice recorders, and high-end speakerphone systems, has boosted the market adoption. Research shows that over 55% of professional audio use cases rely on analog MEMS microphones due to their low distortion and natural sound reproduction.

The growing implementation of hybrid microphone technologies, such as: analog MEMS integration in smart hearing aids, automotive voice assistance, and military-grade communication headsets, has further driven the growth of the market, allowing wider utilisation in niche areas.

AI-driven audio quality improvements ensure better performance in voice-sensitive applications, with other factors such as analog MEMS microphones with dynamic frequency adjustments, active background noise cancellation, and AI-based voice pattern recognition for better results contributing to this adoption.

The continual process of the ultra-low-power analog MEMS microphones, with their improved dynamic range, lower self-noise, and better off-axis sound rejection, has further optimized the market, for more efficiency in battery-powered devices.

While analog MEMS microphone technology excels in sound fidelity, low-latency signal processing, and acoustic robustness, it also has a few drawbacks when compared to digital MEMS microphones, including limited digital connectivity, sensitivity to electromagnetic interference, and the need for additional circuitry.

Nevertheless, new developments in AI audio filters, hybrid analog-digital microphone structures, and next-generation analog-to-digital signal processing will enhance versatility meaning the analog MEMS microphone market will continue to expand.

Growth of AI-embedded and Smart Audio Applications Drives Digital MEMS Microphones

Digital MEMS microphones have found strong market integration, particularly among smart device manufacturers, as voice-activated assistants, real-time communications systems, and AI-driven sound processing gain ubiquitous functioning in the growing industry.

While analog MEMS microphones simply offer higher robustness to fatigue or motion, digital versions deliver superior noise filtering, a direct digital signal output, and next-gen beamforming.

Market adoption has been driven by the rising demand for AI-powered voice recognition, such as digital MEMS microphones in smart home speakers, automotive infotainment systems, and noise-canceling headphones.

Research has found that over 6 out of 10 next-generation consumer electronics devices have digital MEMS microphones as a result of their enhanced signal processing and lower power consumption.

The emergence of smart wearable technology, with digital MEMS microphones integrated into true wireless earbuds, fitness trackers that respond to voice commands, and AR (augmented reality) headsets, has significantly bolstered market proliferation, providing a seamless user experience with AI-based systems.

The adoption is also supported by the advancement of AI-assisted microphone arrays comprising of digital MEMS sensors that enable adaptive noise reduction, far-field voice capture & real-time directional audio processing.

Furthermore, miniaturization and product performance optimization of ultra-compact digital MEMS microphones leads to smaller chip designs, multi-mode operation in various acoustic conditions, and improved digital gain control; this is another key aspect driving the microphone MEMS market growth and enhancing compatibility with AI-driven consumer electronics.

While the digital MEMS microphone segment offers advantages in terms of enhanced digital signal processing capabilities, AI integration, and smart device compatibility, it also faces hurdles due to higher costs, complex manufacturing requirements, and the possibility of digital artifacts in sound reproduction.

Yet efficiency gains, enabled by innovations in next generation digital MEMS architectures, multi-microphone array optimization techniques, and artificial intelligence-augmented audio calibration, continue to yield benefits, and smart audio applications will continue their expansion.

The growing demand for high-performance audio capture solutions in both consumer electronics and professional recording, as well as industrial applications, drive the growth of microphone market. With the growing prominence of AI-driven voice recognition, intelligent assistants, and wearable tech, the industry continues to evolve. Market growth is driven by the progress in MEMS microphones, noise-canceling technology, and wireless connectivity.

Regardless, major industry players are competing with AI-assisted audio processing, miniaturized high-sensitivity microphones, and real-time voice enhancement solutions. The leading players are semiconductor companies, professional audio equipment manufacturers, and consumer electronics firms with innovative high precision, energy-efficient, and intelligent microphone technologies.

Market Share Analysis by Key Players & Microphone Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| Knowles Corporation | 18-22% |

| Goertek Inc. | 14-18% |

| STMicroelectronics | 12-16% |

| TDK Corporation | 8-12% |

| Infineon Technologies AG | 6-10% |

| Other Microphone Providers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Knowles Corporation | Develops AI-powered MEMS microphones, voice recognition-optimized solutions, and high-fidelity microphones for smart devices. |

| Goertek Inc. | Specializes in AI-enhanced acoustic sensors, MEMS microphones for consumer electronics, and professional-grade voice capture technology. |

| STMicroelectronics | Focuses on AI-driven microphone miniaturization, noise-canceling MEMS technology, and voice activation sensors for IoT and smart applications. |

| TDK Corporation | Provides AI-assisted MEMS microphones, wireless microphone solutions, and high-performance microphones for audio and industrial applications. |

| Infineon Technologies AG | Offers AI-powered digital microphones, ultra-low power audio processing, and real-time voice enhancement solutions. |

Key Market Insights

Knowles Corporation (18-22%)

Knowles leads in AI-powered MEMS microphone development, providing high-performance audio capture for smartphones, smart assistants, and wearable devices.

Goertek Inc. (14-18%)

Goertek specializes in MEMS microphone technology with AI-enhanced noise suppression, delivering professional and consumer-grade audio solutions.

STMicroelectronics (12-16%)

STMicroelectronics focuses on AI-driven microphone miniaturization and advanced voice recognition technology for IoT, automotive, and smart home applications.

TDK Corporation (8-12%)

TDK provides high-precision AI-assisted MEMS microphones, offering noise-canceling features and wireless connectivity for next-generation smart devices.

Infineon Technologies AG (6-10%)

Infineon integrates AI-powered digital microphones, real-time voice processing, and ultra-low power solutions for smart electronics and professional audio applications.

Other Key Players (30-40% Combined)

Several semiconductor companies, professional audio brands, and voice recognition technology providers contribute to next-generation microphone innovations, AI-powered audio processing, and real-time sound optimization. Key contributors include:

The overall market size for the microphone market was USD 2,638.1 Million in 2025.

The microphone market is expected to reach USD 5,141.4 Million in 2035.

The demand for microphones is rising due to increasing adoption in consumer electronics, advancements in voice recognition technology, and growing demand for high-quality audio in smart devices. The expansion of IoT applications and the integration of AI-driven audio processing are further driving market growth.

The top 5 countries driving the development of the microphone market are the USA, China, Japan, Germany, and South Korea.

Micro-electromechanical Systems (MEMS) and Electret Microphones are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ billion) Forecast by Region, 2017 to 2032

Table 2: Global Market Volume (Unit) Forecast by Region, 2017 to 2032

Table 3: Global Market Value (US$ billion) Forecast by MEMS Type, 2017 to 2032

Table 4: Global Market Volume (Unit) Forecast by MEMS Type, 2017 to 2032

Table 5: Global Market Value (US$ billion) Forecast by Technology, 2017 to 2032

Table 6: Global Market Volume (Unit) Forecast by Technology, 2017 to 2032

Table 7: Global Market Value (US$ billion) Forecast by Communication Technology, 2017 to 2032

Table 8: Global Market Volume (Unit) Forecast by Communication Technology, 2017 to 2032

Table 9: Global Market Value (US$ billion) Forecast by Application, 2017 to 2032

Table 10: Global Market Volume (Unit) Forecast by Application, 2017 to 2032

Table 11: North America Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 12: North America Market Volume (Unit) Forecast by Country, 2017 to 2032

Table 13: North America Market Value (US$ billion) Forecast by MEMS Type, 2017 to 2032

Table 14: North America Market Volume (Unit) Forecast by MEMS Type, 2017 to 2032

Table 15: North America Market Value (US$ billion) Forecast by Technology, 2017 to 2032

Table 16: North America Market Volume (Unit) Forecast by Technology, 2017 to 2032

Table 17: North America Market Value (US$ billion) Forecast by Communication Technology, 2017 to 2032

Table 18: North America Market Volume (Unit) Forecast by Communication Technology, 2017 to 2032

Table 19: North America Market Value (US$ billion) Forecast by Application, 2017 to 2032

Table 20: North America Market Volume (Unit) Forecast by Application, 2017 to 2032

Table 21: Latin America Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 22: Latin America Market Volume (Unit) Forecast by Country, 2017 to 2032

Table 23: Latin America Market Value (US$ billion) Forecast by MEMS Type, 2017 to 2032

Table 24: Latin America Market Volume (Unit) Forecast by MEMS Type, 2017 to 2032

Table 25: Latin America Market Value (US$ billion) Forecast by Technology, 2017 to 2032

Table 26: Latin America Market Volume (Unit) Forecast by Technology, 2017 to 2032

Table 27: Latin America Market Value (US$ billion) Forecast by Communication Technology, 2017 to 2032

Table 28: Latin America Market Volume (Unit) Forecast by Communication Technology, 2017 to 2032

Table 29: Latin America Market Value (US$ billion) Forecast by Application, 2017 to 2032

Table 30: Latin America Market Volume (Unit) Forecast by Application, 2017 to 2032

Table 31: Europe Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 32: Europe Market Volume (Unit) Forecast by Country, 2017 to 2032

Table 33: Europe Market Value (US$ billion) Forecast by MEMS Type, 2017 to 2032

Table 34: Europe Market Volume (Unit) Forecast by MEMS Type, 2017 to 2032

Table 35: Europe Market Value (US$ billion) Forecast by Technology, 2017 to 2032

Table 36: Europe Market Volume (Unit) Forecast by Technology, 2017 to 2032

Table 37: Europe Market Value (US$ billion) Forecast by Communication Technology, 2017 to 2032

Table 38: Europe Market Volume (Unit) Forecast by Communication Technology, 2017 to 2032

Table 39: Europe Market Value (US$ billion) Forecast by Application, 2017 to 2032

Table 40: Europe Market Volume (Unit) Forecast by Application, 2017 to 2032

Table 41: Asia Pacific Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 42: Asia Pacific Market Volume (Unit) Forecast by Country, 2017 to 2032

Table 43: Asia Pacific Market Value (US$ billion) Forecast by MEMS Type, 2017 to 2032

Table 44: Asia Pacific Market Volume (Unit) Forecast by MEMS Type, 2017 to 2032

Table 45: Asia Pacific Market Value (US$ billion) Forecast by Technology, 2017 to 2032

Table 46: Asia Pacific Market Volume (Unit) Forecast by Technology, 2017 to 2032

Table 47: Asia Pacific Market Value (US$ billion) Forecast by Communication Technology, 2017 to 2032

Table 48: Asia Pacific Market Volume (Unit) Forecast by Communication Technology, 2017 to 2032

Table 49: Asia Pacific Market Value (US$ billion) Forecast by Application, 2017 to 2032

Table 50: Asia Pacific Market Volume (Unit) Forecast by Application, 2017 to 2032

Table 51: Middle East and Africa Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 52: Middle East and Africa Market Volume (Unit) Forecast by Country, 2017 to 2032

Table 53: Middle East and Africa Market Value (US$ billion) Forecast by MEMS Type, 2017 to 2032

Table 54: Middle East and Africa Market Volume (Unit) Forecast by MEMS Type, 2017 to 2032

Table 55: Middle East and Africa Market Value (US$ billion) Forecast by Technology, 2017 to 2032

Table 56: Middle East and Africa Market Volume (Unit) Forecast by Technology, 2017 to 2032

Table 57: Middle East and Africa Market Value (US$ billion) Forecast by Communication Technology, 2017 to 2032

Table 58: Middle East and Africa Market Volume (Unit) Forecast by Communication Technology, 2017 to 2032

Table 59: Middle East and Africa Market Value (US$ billion) Forecast by Application, 2017 to 2032

Table 60: Middle East and Africa Market Volume (Unit) Forecast by Application, 2017 to 2032

Figure 1: Global Market Value (US$ billion) by MEMS Type, 2022 to 2032

Figure 2: Global Market Value (US$ billion) by Technology, 2022 to 2032

Figure 3: Global Market Value (US$ billion) by Communication Technology, 2022 to 2032

Figure 4: Global Market Value (US$ billion) by Application, 2022 to 2032

Figure 5: Global Market Value (US$ billion) by Region, 2022 to 2032

Figure 6: Global Market Value (US$ billion) Analysis by Region, 2017 to 2032

Figure 7: Global Market Volume (Unit) Analysis by Region, 2017 to 2032

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 10: Global Market Value (US$ billion) Analysis by MEMS Type, 2017 to 2032

Figure 11: Global Market Volume (Unit) Analysis by MEMS Type, 2017 to 2032

Figure 12: Global Market Value Share (%) and BPS Analysis by MEMS Type, 2022 to 2032

Figure 13: Global Market Y-o-Y Growth (%) Projections by MEMS Type, 2022 to 2032

Figure 14: Global Market Value (US$ billion) Analysis by Technology, 2017 to 2032

Figure 15: Global Market Volume (Unit) Analysis by Technology, 2017 to 2032

Figure 16: Global Market Value Share (%) and BPS Analysis by Technology, 2022 to 2032

Figure 17: Global Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 18: Global Market Value (US$ billion) Analysis by Communication Technology, 2017 to 2032

Figure 19: Global Market Volume (Unit) Analysis by Communication Technology, 2017 to 2032

Figure 20: Global Market Value Share (%) and BPS Analysis by Communication Technology, 2022 to 2032

Figure 21: Global Market Y-o-Y Growth (%) Projections by Communication Technology, 2022 to 2032

Figure 22: Global Market Value (US$ billion) Analysis by Application, 2017 to 2032

Figure 23: Global Market Volume (Unit) Analysis by Application, 2017 to 2032

Figure 24: Global Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 25: Global Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 26: Global Market Attractiveness by MEMS Type, 2022 to 2032

Figure 27: Global Market Attractiveness by Technology, 2022 to 2032

Figure 28: Global Market Attractiveness by Communication Technology, 2022 to 2032

Figure 29: Global Market Attractiveness by Application, 2022 to 2032

Figure 30: Global Market Attractiveness by Region, 2022 to 2032

Figure 31: North America Market Value (US$ billion) by MEMS Type, 2022 to 2032

Figure 32: North America Market Value (US$ billion) by Technology, 2022 to 2032

Figure 33: North America Market Value (US$ billion) by Communication Technology, 2022 to 2032

Figure 34: North America Market Value (US$ billion) by Application, 2022 to 2032

Figure 35: North America Market Value (US$ billion) by Country, 2022 to 2032

Figure 36: North America Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 37: North America Market Volume (Unit) Analysis by Country, 2017 to 2032

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 40: North America Market Value (US$ billion) Analysis by MEMS Type, 2017 to 2032

Figure 41: North America Market Volume (Unit) Analysis by MEMS Type, 2017 to 2032

Figure 42: North America Market Value Share (%) and BPS Analysis by MEMS Type, 2022 to 2032

Figure 43: North America Market Y-o-Y Growth (%) Projections by MEMS Type, 2022 to 2032

Figure 44: North America Market Value (US$ billion) Analysis by Technology, 2017 to 2032

Figure 45: North America Market Volume (Unit) Analysis by Technology, 2017 to 2032

Figure 46: North America Market Value Share (%) and BPS Analysis by Technology, 2022 to 2032

Figure 47: North America Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 48: North America Market Value (US$ billion) Analysis by Communication Technology, 2017 to 2032

Figure 49: North America Market Volume (Unit) Analysis by Communication Technology, 2017 to 2032

Figure 50: North America Market Value Share (%) and BPS Analysis by Communication Technology, 2022 to 2032

Figure 51: North America Market Y-o-Y Growth (%) Projections by Communication Technology, 2022 to 2032

Figure 52: North America Market Value (US$ billion) Analysis by Application, 2017 to 2032

Figure 53: North America Market Volume (Unit) Analysis by Application, 2017 to 2032

Figure 54: North America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 55: North America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 56: North America Market Attractiveness by MEMS Type, 2022 to 2032

Figure 57: North America Market Attractiveness by Technology, 2022 to 2032

Figure 58: North America Market Attractiveness by Communication Technology, 2022 to 2032

Figure 59: North America Market Attractiveness by Application, 2022 to 2032

Figure 60: North America Market Attractiveness by Country, 2022 to 2032

Figure 61: Latin America Market Value (US$ billion) by MEMS Type, 2022 to 2032

Figure 62: Latin America Market Value (US$ billion) by Technology, 2022 to 2032

Figure 63: Latin America Market Value (US$ billion) by Communication Technology, 2022 to 2032

Figure 64: Latin America Market Value (US$ billion) by Application, 2022 to 2032

Figure 65: Latin America Market Value (US$ billion) by Country, 2022 to 2032

Figure 66: Latin America Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 67: Latin America Market Volume (Unit) Analysis by Country, 2017 to 2032

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 70: Latin America Market Value (US$ billion) Analysis by MEMS Type, 2017 to 2032

Figure 71: Latin America Market Volume (Unit) Analysis by MEMS Type, 2017 to 2032

Figure 72: Latin America Market Value Share (%) and BPS Analysis by MEMS Type, 2022 to 2032

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by MEMS Type, 2022 to 2032

Figure 74: Latin America Market Value (US$ billion) Analysis by Technology, 2017 to 2032

Figure 75: Latin America Market Volume (Unit) Analysis by Technology, 2017 to 2032

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Technology, 2022 to 2032

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 78: Latin America Market Value (US$ billion) Analysis by Communication Technology, 2017 to 2032

Figure 79: Latin America Market Volume (Unit) Analysis by Communication Technology, 2017 to 2032

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Communication Technology, 2022 to 2032

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Communication Technology, 2022 to 2032

Figure 82: Latin America Market Value (US$ billion) Analysis by Application, 2017 to 2032

Figure 83: Latin America Market Volume (Unit) Analysis by Application, 2017 to 2032

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 86: Latin America Market Attractiveness by MEMS Type, 2022 to 2032

Figure 87: Latin America Market Attractiveness by Technology, 2022 to 2032

Figure 88: Latin America Market Attractiveness by Communication Technology, 2022 to 2032

Figure 89: Latin America Market Attractiveness by Application, 2022 to 2032

Figure 90: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 91: Europe Market Value (US$ billion) by MEMS Type, 2022 to 2032

Figure 92: Europe Market Value (US$ billion) by Technology, 2022 to 2032

Figure 93: Europe Market Value (US$ billion) by Communication Technology, 2022 to 2032

Figure 94: Europe Market Value (US$ billion) by Application, 2022 to 2032

Figure 95: Europe Market Value (US$ billion) by Country, 2022 to 2032

Figure 96: Europe Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 97: Europe Market Volume (Unit) Analysis by Country, 2017 to 2032

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 100: Europe Market Value (US$ billion) Analysis by MEMS Type, 2017 to 2032

Figure 101: Europe Market Volume (Unit) Analysis by MEMS Type, 2017 to 2032

Figure 102: Europe Market Value Share (%) and BPS Analysis by MEMS Type, 2022 to 2032

Figure 103: Europe Market Y-o-Y Growth (%) Projections by MEMS Type, 2022 to 2032

Figure 104: Europe Market Value (US$ billion) Analysis by Technology, 2017 to 2032

Figure 105: Europe Market Volume (Unit) Analysis by Technology, 2017 to 2032

Figure 106: Europe Market Value Share (%) and BPS Analysis by Technology, 2022 to 2032

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 108: Europe Market Value (US$ billion) Analysis by Communication Technology, 2017 to 2032

Figure 109: Europe Market Volume (Unit) Analysis by Communication Technology, 2017 to 2032

Figure 110: Europe Market Value Share (%) and BPS Analysis by Communication Technology, 2022 to 2032

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Communication Technology, 2022 to 2032

Figure 112: Europe Market Value (US$ billion) Analysis by Application, 2017 to 2032

Figure 113: Europe Market Volume (Unit) Analysis by Application, 2017 to 2032

Figure 114: Europe Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 116: Europe Market Attractiveness by MEMS Type, 2022 to 2032

Figure 117: Europe Market Attractiveness by Technology, 2022 to 2032

Figure 118: Europe Market Attractiveness by Communication Technology, 2022 to 2032

Figure 119: Europe Market Attractiveness by Application, 2022 to 2032

Figure 120: Europe Market Attractiveness by Country, 2022 to 2032

Figure 121: Asia Pacific Market Value (US$ billion) by MEMS Type, 2022 to 2032

Figure 122: Asia Pacific Market Value (US$ billion) by Technology, 2022 to 2032

Figure 123: Asia Pacific Market Value (US$ billion) by Communication Technology, 2022 to 2032

Figure 124: Asia Pacific Market Value (US$ billion) by Application, 2022 to 2032

Figure 125: Asia Pacific Market Value (US$ billion) by Country, 2022 to 2032

Figure 126: Asia Pacific Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 127: Asia Pacific Market Volume (Unit) Analysis by Country, 2017 to 2032

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 130: Asia Pacific Market Value (US$ billion) Analysis by MEMS Type, 2017 to 2032

Figure 131: Asia Pacific Market Volume (Unit) Analysis by MEMS Type, 2017 to 2032

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by MEMS Type, 2022 to 2032

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by MEMS Type, 2022 to 2032

Figure 134: Asia Pacific Market Value (US$ billion) Analysis by Technology, 2017 to 2032

Figure 135: Asia Pacific Market Volume (Unit) Analysis by Technology, 2017 to 2032

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Technology, 2022 to 2032

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 138: Asia Pacific Market Value (US$ billion) Analysis by Communication Technology, 2017 to 2032

Figure 139: Asia Pacific Market Volume (Unit) Analysis by Communication Technology, 2017 to 2032

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Communication Technology, 2022 to 2032

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Communication Technology, 2022 to 2032

Figure 142: Asia Pacific Market Value (US$ billion) Analysis by Application, 2017 to 2032

Figure 143: Asia Pacific Market Volume (Unit) Analysis by Application, 2017 to 2032

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 146: Asia Pacific Market Attractiveness by MEMS Type, 2022 to 2032

Figure 147: Asia Pacific Market Attractiveness by Technology, 2022 to 2032

Figure 148: Asia Pacific Market Attractiveness by Communication Technology, 2022 to 2032

Figure 149: Asia Pacific Market Attractiveness by Application, 2022 to 2032

Figure 150: Asia Pacific Market Attractiveness by Country, 2022 to 2032

Figure 151: Middle East and Africa Market Value (US$ billion) by MEMS Type, 2022 to 2032

Figure 152: Middle East and Africa Market Value (US$ billion) by Technology, 2022 to 2032

Figure 153: Middle East and Africa Market Value (US$ billion) by Communication Technology, 2022 to 2032

Figure 154: Middle East and Africa Market Value (US$ billion) by Application, 2022 to 2032

Figure 155: Middle East and Africa Market Value (US$ billion) by Country, 2022 to 2032

Figure 156: Middle East and Africa Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 157: Middle East and Africa Market Volume (Unit) Analysis by Country, 2017 to 2032

Figure 158: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 159: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 160: Middle East and Africa Market Value (US$ billion) Analysis by MEMS Type, 2017 to 2032

Figure 161: Middle East and Africa Market Volume (Unit) Analysis by MEMS Type, 2017 to 2032

Figure 162: Middle East and Africa Market Value Share (%) and BPS Analysis by MEMS Type, 2022 to 2032

Figure 163: Middle East and Africa Market Y-o-Y Growth (%) Projections by MEMS Type, 2022 to 2032

Figure 164: Middle East and Africa Market Value (US$ billion) Analysis by Technology, 2017 to 2032

Figure 165: Middle East and Africa Market Volume (Unit) Analysis by Technology, 2017 to 2032

Figure 166: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2022 to 2032

Figure 167: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 168: Middle East and Africa Market Value (US$ billion) Analysis by Communication Technology, 2017 to 2032

Figure 169: Middle East and Africa Market Volume (Unit) Analysis by Communication Technology, 2017 to 2032

Figure 170: Middle East and Africa Market Value Share (%) and BPS Analysis by Communication Technology, 2022 to 2032

Figure 171: Middle East and Africa Market Y-o-Y Growth (%) Projections by Communication Technology, 2022 to 2032

Figure 172: Middle East and Africa Market Value (US$ billion) Analysis by Application, 2017 to 2032

Figure 173: Middle East and Africa Market Volume (Unit) Analysis by Application, 2017 to 2032

Figure 174: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 175: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 176: Middle East and Africa Market Attractiveness by MEMS Type, 2022 to 2032

Figure 177: Middle East and Africa Market Attractiveness by Technology, 2022 to 2032

Figure 178: Middle East and Africa Market Attractiveness by Communication Technology, 2022 to 2032

Figure 179: Middle East and Africa Market Attractiveness by Application, 2022 to 2032

Figure 180: Middle East and Africa Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Car Microphone Market Size and Share Forecast Outlook 2025 to 2035

MEMS Microphones Market Size and Share Forecast Outlook 2025 to 2035

Wireless Microphone Market Report – Trends & Forecast 2018-2028

Conference Microphone Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA