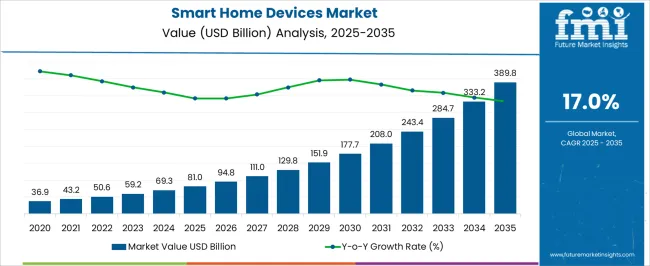

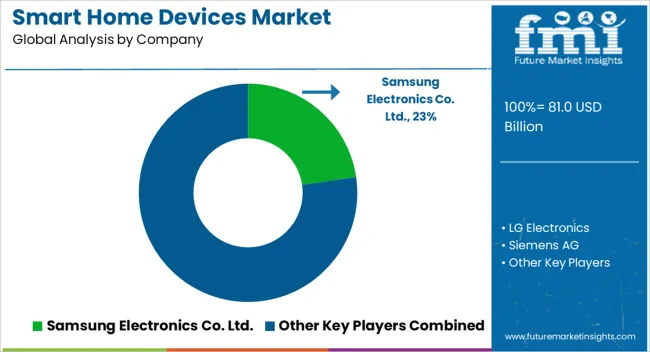

The Smart Home Devices Market is estimated to be valued at USD 81.0 billion in 2025 and is projected to reach USD 389.8 billion by 2035, registering a compound annual growth rate (CAGR) of 17.0% over the forecast period.

| Metric | Value |

|---|---|

| Smart Home Devices Market Estimated Value in (2025 E) | USD 81.0 billion |

| Smart Home Devices Market Forecast Value in (2035 F) | USD 389.8 billion |

| Forecast CAGR (2025 to 2035) | 17.0% |

The smart home devices market is experiencing robust expansion supported by rising consumer demand for convenience, safety, and energy efficiency. Growing adoption of IoT enabled solutions and increasing smartphone penetration are enhancing the accessibility and usability of connected home systems.

Integration with voice assistants and AI driven platforms is reshaping consumer interaction with smart devices, creating a seamless living environment. Government incentives promoting energy efficient appliances along with heightened consumer awareness of security solutions are accelerating adoption.

Continuous product innovation, particularly in user friendly interfaces and cross device compatibility, is further strengthening market growth. The outlook remains positive as consumers increasingly invest in connected living solutions that improve safety, reduce costs, and deliver personalized experiences.

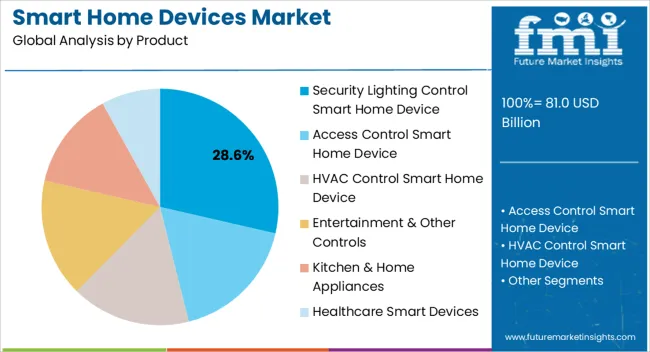

The security lighting control smart home device segment is projected to account for 28.60% of the overall market revenue by 2025 within the product category, positioning it as the leading segment. This dominance is attributed to the growing need for home safety, energy management, and remote monitoring capabilities.

These devices enable users to automate lighting systems, deter intrusions, and optimize power consumption, aligning with consumer demand for cost savings and security. Integration with mobile applications and voice controlled platforms has further expanded usage convenience.

The segment’s leadership reflects the rising trend of adopting multifunctional devices that combine security, comfort, and sustainability in residential settings.

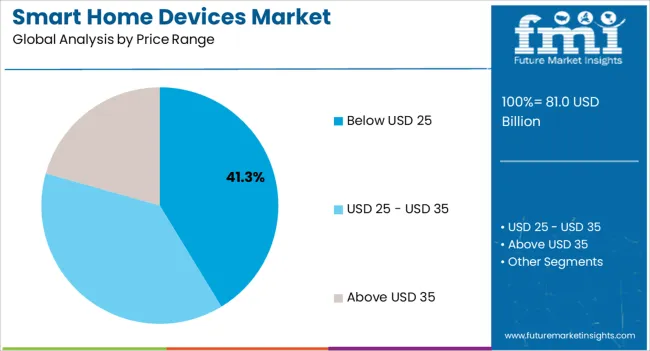

The below USD 25 price range is expected to capture 41.30% of total market revenue by 2025, making it the most prominent pricing segment. Affordability and accessibility are the key drivers supporting its dominance, as consumers increasingly prefer cost effective solutions to test and adopt smart technologies.

Low priced devices provide entry level access to smart living, encouraging widespread adoption across diverse income groups. Continuous improvements in manufacturing efficiency and component miniaturization have enabled companies to deliver affordable yet reliable products.

This trend has significantly expanded the customer base, reinforcing the below USD 25 range as the most influential pricing segment.

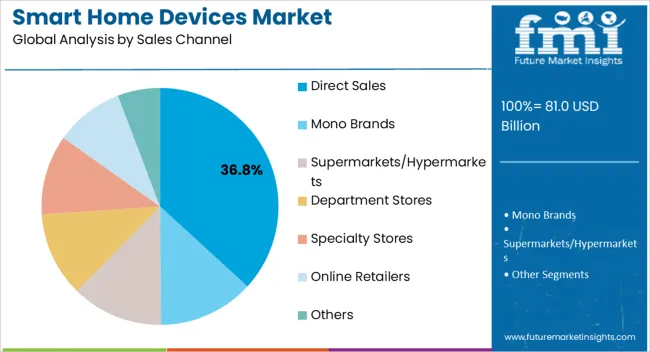

The direct sales channel segment is anticipated to hold 36.80% of the total market revenue by 2025, making it the leading distribution mode. Its prominence is driven by manufacturers’ efforts to strengthen direct engagement with customers, ensuring better product education, support, and after sales service.

Direct channels also allow brands to capture higher margins and establish stronger consumer loyalty. The expansion of brand owned retail stores and online platforms has further facilitated direct access to end users.

With growing consumer preference for authentic product sourcing and reliable customer service, the direct sales channel continues to dominate within the smart home devices market.

| Attributes | Details |

|---|---|

| Trends |

|

| Opportunities |

|

The statistics accumulated by Future Market Insights, reveal the global forum of smart home devices which has witnessed an unprecedented surge over the past few years. The key providers in the market are in conjunction with the increasing demand for smart home devices. There has been a gradual rise from a CAGR of 20.6% registered during the period of 2020 to 2025 and is likely to decrease at an adequate 17.8% in the forecast period.

Smart home devices gained popularity as more consumers recognized the benefits of home automation and connected technologies. The convenience, energy efficiency, and security features offered by these devices drove their adoption.

The range of smart home devices expanded during the historical period. It included smart speakers, thermostats, lighting systems, security cameras, door locks, appliances, and more. This diversification gave consumers wider options to make their homes smarter.

Voice-controlled smart speakers, such as Amazon Echo with Alexa and Google Home with Google Assistant, gained significant traction. These voice assistants became a central hub for controlling various smart devices, creating a seamless, hands-free user experience.

Manufacturers began focusing on integrating smart devices with existing home infrastructure, such as electrical wiring and switches, to facilitate retrofitting in older homes. This allowed homeowners to upgrade their properties without significant remodeling.

The demand for smart security devices, such as smart doorbells, security cameras, and smart locks, is rapidly increasing due to their ability to enhance home security and provide remote monitoring capabilities. As security concerns continue to rise, the market for these devices is expected to grow in the short term.

Smart home devices enable homeowners to monitor and control their energy usage, improving energy efficiency and cost savings. With growing environmental concerns and a push for sustainable living, the demand for smart thermostats, smart lighting, and energy monitoring systems is expected to increase in the mid-term.

Advances in artificial intelligence is likely to enable smart home devices to become more intelligent and adaptive. AI-powered systems can learn user preferences, automate routine tasks, and provide personalized recommendations. Integrating AI technologies is projected to drive innovation in the smart home market and create new growth avenues over the long term.

| Country | United States |

|---|---|

| HCAGR (2020 to 2025) | 20.5% |

| FCAGR (2025 to 2035) | 17.6% |

| Country | United Kingdom |

|---|---|

| HCAGR (2020 to 2025) | 19.3% |

| FCAGR (2025 to 2035) | 16.6% |

| Country | China |

|---|---|

| HCAGR (2020 to 2025) | 20% |

| FCAGR (2025 to 2035) | 17.1% |

| Country | Japan |

|---|---|

| HCAGR (2020 to 2025) | 18.7% |

| FCAGR (2025 to 2035) | 16.2% |

| Country | South Korea |

|---|---|

| HCAGR (2020 to 2025) | 18.3% |

| FCAGR (2025 to 2035) | 15.9% |

North America holds the leading share of the smart home devices market, with the United States being the lucrative market with a revenue share of 17.6%. The value of the smart home devices market in the United States is estimated to reach a high of USD 389.8 billion by the year 2035. The rising demand in the United States for energy-saving and low-carbon-emission-oriented solutions drives the global smart home market.

The United States smart home devices market has grown significantly over the past few years. The market is primarily driven by factors such as

Energy efficiency is critical to a country's economic prosperity. As a result of rising global warming and regulatory requirements, there is a growing desire to minimize energy use and carbon emissions. This aspect is expected to be the key driver of the smart home devices market growth.

Key players have introduced battery-powered security cameras with smart technology that can distinguish between a human and a vehicle. Furthermore, in the event of a mishap, the client may respond to notifications directly from the company app. This keeps the home secure, and the homeowner feels confident about the safety of their home, valuables, and themselves.

Market vendors situated in the United States have an excellent reputation for developing new items. However, the maximum companies outsourced their manufacturing activities and concentrated their engineers on design and technological advancement. In addition, despite the proliferation of devices, the country is still a long way from realizing the concept of seamlessly connected households. The market has yet to experience spectacular expansion, but well-positioned players can still produce enormous value.

The United States has a growing aging population, which presents opportunities for the adoption of smart home devices that cater to the specific needs of elderly individuals. Smart home devices that assist with healthcare monitoring, medication reminders, and home assistance are gaining traction.

Amazon's Echo devices with Alexa voice assistant have gained significant market share in the United States. Amazon continues to invest in research and development to improve its voice assistant capabilities and expand its smart home product offerings.

The United Kingdom has emerged as one of the key markets for smart home devices in Europe. With the increasing adoption of IoT technologies, the United Kingdom smart home devices market has witnessed significant growth in recent years.

Voice-controlled smart home devices have gained immense popularity in the United Kingdom. Integrating devices with voice assistants like Amazon Alexa and Google Assistant has simplified the control and management of smart home ecosystems.

The focus of the country on sustainability and energy efficiency has influenced the market. Consumers are increasingly opting for energy-saving devices such as smart thermostats, smart lighting systems, and energy monitoring solutions.

The distribution of smart home devices in the United Kingdom is primarily through online retail platforms, specialized smart home retailers, and electronic stores. Online retail platforms account for the leading share due to convenience and a wide range of product options.

Germany is a market with high potential and a significant revenue share. Key players in Germany provide a wide range of technologies designed to ensure the consistent connection of solar shades. Convenience is increased by eliminating the need to repeatedly perform tasks.

Smart heating provides optimal comfort in everyday life while saving up to 36% of energy owing to variable control choices and needs-based consumption. This is anticipated to help people live more sustainably and to make a significant contribution to climate protection, which is the primary goal of German market players.

The advanced technology provided by regional market players governs the usage of camera and browser capabilities, encrypted chat, gaming, and social media, mirroring current workplace regulations such as internal networks and work-issued devices. They assist businesses in protecting sensitive data and meeting regulatory responsibilities by minimizing unrecordable conversations and increasing the usage of currently authorized channels of communication.

The Asia Pacific currently holds a substantial share of the smart home devices market, with Japan and India as its highly profitable markets. This is attributed to the rapid use of smartphones, the internet, and other digitally enhanced equipment is likely to fuel the industry in the area. Additionally, the region now has a better standard of living and increased disposable income. Japan holds a revenue share of 16.2%, with an approximated valuation of USD 17.2 billion to reach by 2035.

Japan has one of the highly advanced and widespread internet infrastructures globally. High-speed internet connectivity enables seamless integration and connectivity of smart home devices, further driving the market growth.

Consumers in Japan have a strong preference for minimalist and sleek designs in their home appliances. Smart home devices with aesthetically pleasing designs and seamless integration into the home environment have a competitive advantage in the Japan smart home devices market.

Japanese market players have incorporated Calm Technology & Design concepts and technical competence to allow peaceful digital existence in which technology works in perfect harmony with people. They envisage future technology as one that claims to make people happier by enhancing the humanness of human life.

A key strategy of regional players is to leverage their knowledge in the parental market and compete with global corporations through open innovation. Integration with third-party services allows them to enhance their capabilities. Furthermore, their extremely versatile platform enables builders to deliver homeowners one-of-a-kind tranquil smart-home experiences.

With the increasing adoption of smart technologies and the rising disposable income of consumers, the demand for smart home devices has surged. Consumers are becoming increasingly aware of the benefits and convenience offered by smart home devices. The rising middle-class population and rapid urbanization have led to a surge in demand for connected devices that enhance home automation and security.

The government has been actively promoting the development and adoption of smart home technologies as part of its broader initiatives for smart cities and sustainable urban development. This support includes policy incentives, funding for research and development, and collaborations with industry stakeholders.

The distribution of smart home devices in China is primarily through online retail platforms such as Alibaba's Tmall, JD.com, and Xiaomi Mall. Offline retail channels such as electronics stores and home improvement stores also play a significant role in product sales.

Xiaomi is a leading player in the China smart home devices market. The company offers a wide range of smart devices under its "Mi Ecosystem" brand, including smart speakers, smart TVs, smart appliances, and smart home security systems. Xiaomi has been focusing on integrating its devices with AI and voice control technologies to enhance user experience.

India is one of the rapidly growing markets for smart home devices globally. The increasing disposable income, urbanization, and rising awareness about the benefits of smart home automation are driving market growth. The popularity of voice assistants like Amazon Alexa and Google Assistant has grown significantly in India. Consumers are increasingly using voice commands to control smart home devices.

India is a growing smart home devices market, with an adequate revenue share. Key players in India provide an innovation-driven system that really blends electrical, multimedia, and telecommunications technology into a single user-friendly smart or autonomous home solution. This smart-home automation system makes life easier by allowing you to control your music, home theatre, lights, air conditioning, and sprinklers, amongst several other things.

With the rising cost of electricity, energy management has become a key concern for consumers in India. Smart home devices that enable energy monitoring and efficient usage are in high demand. Products such as smart thermostats and smart plugs help users optimize energy consumption.

Wipro, a leading Indian technology company, has ventured into the smart home devices market with its Wipro Next brand. The company offers a range of smart lighting solutions, including bulbs, luminaires, and connected switches. Wipro's focus on innovative designs and advanced technology has positioned it as a competitive player.

Key businesses provide products and solutions that are aimed to improve lifestyles since they are tailored specifically for the end user and their environment. They advertise themselves as the top home automation devices to change an average house into an automated house, with an easy-to-understand interface and user-friendly operation.

Security is a top priority for homeowners and smart home devices offer enhanced security features. Security lighting control devices enable homeowners to automate their lighting systems, including motion sensors, timers, and remote control options. These features provide a heightened level of security by deterring potential intruders and alerting homeowners to any unusual activity.

Security lighting control devices are designed to integrate seamlessly with existing home automation systems. They can be connected to other smart devices, such as security cameras, door locks, and alarm systems. This integration allows for a comprehensive security ecosystem where different instruments work together to enhance home security.

The Smart Home Devices Market has seen a rise in do-it-yourself (DIY) installations, and security lighting control devices are well-suited for this trend. Many of these devices are user-friendly, with simple installation processes that don't require professional assistance. This accessibility has contributed to the widespread adoption of security lighting control devices among homeowners.

Online sales channels provide easy access to various smart home devices. Consumers can browse and purchase products from multiple brands and manufacturers, offering them a greater choice and convenience compared to physical retail stores.

Online platforms often offer competitive pricing due to the presence of multiple sellers, direct-to-consumer models, and the absence of intermediaries. This makes smart home devices more affordable for consumers, attracting them to online channels.

Online sales channels provide detailed product information, specifications, customer reviews, and ratings. This allows consumers to research and compare different smart home devices, enabling them to make informed purchasing decisions.

Online platforms frequently offer promotional deals, discounts, and special offers, attracting price-sensitive consumers. These sales tactics further incentivize consumers to choose online channels for their smart home device purchases.

Start-up companies are following key players to provide smart home solutions, and thus contribute to the global smart home devices market growth:

Caavo - It is a private-label brand of universal remote controllers. It provides a control center, universal remote, power supplies, and IR blasters. The control center can be used for TV controls, streaming (OTT & VOD), and gaming (consoles). The device has a centralized content library and allows users to check for recommendations from their friends. It organizes and lets users search & access all available content, both locally & on the internet.

Bond - It provides smart home solutions. The product includes Bond Bridge and Smart by Bond. The devices can be connected to the Bond Home app and can also be controlled via Alexa or Google Home.

Seven Hugs - It develops home automation solutions. It provides a remote control device that enables users to monitor/control TV, music, and lights for residential purposes. It leverages display, touch, voice, and contextual awareness via AI technology.

Aqara - It is a provider of diversified smart home products. Its offerings include wireless home automation controllers, connected switches, smart plugs, curtain controllers, smart door locks, LED bulbs, sensor modules like door and window sensors, motion sensors, temperature and humidity sensors, water leak detectors, vibration sensors, and AC controllers. It primarily caters to B2B sectors such as hotels, offices, and professional home decorators.

Key Companies Revamping the Smart Home Devices Market Space

The smart home devices market share is highly competitive owing to the involvement of several established players. Companies in the smart home industry growth frequently employ organic development techniques such as product launches and approvals. To capitalize on market growth opportunities, industry participants are focusing on expanding their presence through acquisitions, expansions, product approvals, and launches.

Recent Developments by Key Market Players

The global smart home devices market is estimated to be valued at USD 81.0 billion in 2025.

The market size for the smart home devices market is projected to reach USD 389.8 billion by 2035.

The smart home devices market is expected to grow at a 17.0% CAGR between 2025 and 2035.

The key product types in smart home devices market are security lighting control smart home device, access control smart home device, hvac control smart home device, entertainment & other controls, kitchen & home appliances and healthcare smart devices.

In terms of price range, below usd 25 segment to command 41.3% share in the smart home devices market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Wheelchair Market Forecast and Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Smart Cold Therapy Machine Market Size and Share Forecast Outlook 2025 to 2035

Smart Speaker Market Size and Share Forecast Outlook 2025 to 2035

Smart Vehicle Architecture Market Size and Share Forecast Outlook 2025 to 2035

Smart City Platforms Market Size and Share Forecast Outlook 2025 to 2035

Smart Doorbell Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Smart Welding Monitoring Solution Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Smart Behind-The-Ear Hearing Aid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA